Professional Documents

Culture Documents

Annex 830355500000272

Annex 830355500000272

Uploaded by

raj sanganiCopyright:

Available Formats

You might also like

- Best EIN Verification Letter 05 - BackupDocument2 pagesBest EIN Verification Letter 05 - BackupYooo100% (1)

- EIN and Biz RegistrationDocument2 pagesEIN and Biz RegistrationmaufunctNo ratings yet

- 2018-09-05 DOC Re EIN Confirmation (DSJ Real Estate Holdings)Document2 pages2018-09-05 DOC Re EIN Confirmation (DSJ Real Estate Holdings)Doo Soo KimNo ratings yet

- Sue's Market (83-2020164) - EIN RegistrationDocument2 pagesSue's Market (83-2020164) - EIN RegistrationDoo Soo Kim100% (1)

- Classification Election. See Form 8832 and Its Instructions For Additional InformationDocument3 pagesClassification Election. See Form 8832 and Its Instructions For Additional InformationSamuel RodriguezNo ratings yet

- CP575Notice 1605020544606Document2 pagesCP575Notice 1605020544606SMOOVE STOP PLAYIN RECORDSNo ratings yet

- Locate Real Estate LLC EinDocument2 pagesLocate Real Estate LLC Einapi-32562269No ratings yet

- UAC2021 HandbookDocument71 pagesUAC2021 Handbookaldo serena sandresNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- Annex 582729700036153Document1 pageAnnex 582729700036153venkatNo ratings yet

- Rajesh Annex-259579700022090Document1 pageRajesh Annex-259579700022090sona singhNo ratings yet

- Annex - 071469700651425Document1 pageAnnex - 071469700651425KALYAN KUMARNo ratings yet

- Annex 603869700012681Document1 pageAnnex 603869700012681ULTIMA SERVICESNo ratings yet

- Annex 030409710286616Document1 pageAnnex 030409710286616sameer pashaNo ratings yet

- Income Tax Pan Services Unit: ACKNOWLEDGEMENT NO.881035292293111Document1 pageIncome Tax Pan Services Unit: ACKNOWLEDGEMENT NO.881035292293111MSEB WalujNo ratings yet

- Income Tax Pan Services Unit: ACKNOWLEDGEMENT NO.881036279775761Document1 pageIncome Tax Pan Services Unit: ACKNOWLEDGEMENT NO.881036279775761surinderNo ratings yet

- Income Tax Pan Services Unit: ACKNOWLEDGEMENT NO.845739700001221Document1 pageIncome Tax Pan Services Unit: ACKNOWLEDGEMENT NO.845739700001221SameerNo ratings yet

- Annex 205919700005773Document1 pageAnnex 205919700005773Brisk VpnNo ratings yet

- Annex 881038200955301Document1 pageAnnex 881038200955301cads vjaNo ratings yet

- Annex 033779700803822Document1 pageAnnex 033779700803822Sayed ShoiabNo ratings yet

- Income Tax Pan Services Unit: ACKNOWLEDGEMENT NO.091019703743452Document1 pageIncome Tax Pan Services Unit: ACKNOWLEDGEMENT NO.091019703743452Sumanth RNo ratings yet

- Income Tax Pan Services Unit: Reference: Our Letter Ref - No. TIN/PAN/CR-II/N-8810552613810721171 Dated 11-SEP-2021Document3 pagesIncome Tax Pan Services Unit: Reference: Our Letter Ref - No. TIN/PAN/CR-II/N-8810552613810721171 Dated 11-SEP-2021Rashid KhanNo ratings yet

- Annex 290419700148093Document1 pageAnnex 290419700148093itoriyaonlinecenterirctcNo ratings yet

- Annex 717329700375352Document1 pageAnnex 717329700375352niharxerox180No ratings yet

- Annex 882039274666970Document1 pageAnnex 882039274666970sandeep.soniNo ratings yet

- Pan RejectDocument1 pagePan RejectRaja RajNo ratings yet

- Annex 881130211969615Document1 pageAnnex 881130211969615saleem shaikhNo ratings yet

- Annex 010109703338232Document1 pageAnnex 010109703338232Sahil RajputNo ratings yet

- Annex 882038275424342Document1 pageAnnex 882038275424342Shree Nath Transport Co.No ratings yet

- Income Tax Pan Services Unit: (Managed by NSDL E-Governance Infrastructure Limited)Document2 pagesIncome Tax Pan Services Unit: (Managed by NSDL E-Governance Infrastructure Limited)Moinuddin AnsariNo ratings yet

- Annex 055840100375124Document2 pagesAnnex 055840100375124Siddhi PatilNo ratings yet

- Annex 881037244760002Document1 pageAnnex 881037244760002Shamim AkhtarNo ratings yet

- Form 1 EnglishDocument2 pagesForm 1 Englishashish yadavNo ratings yet

- Income Tax Pan Services Unit: (Managed by National Securities Depository Limited)Document2 pagesIncome Tax Pan Services Unit: (Managed by National Securities Depository Limited)MalliMurthyNo ratings yet

- 881053278006296Document2 pages881053278006296Sameer MittalNo ratings yet

- Application For Filing Information Returns Electronically: (Rev. 6-2007) (Please Type Print inDocument2 pagesApplication For Filing Information Returns Electronically: (Rev. 6-2007) (Please Type Print inIRSNo ratings yet

- NSDLDocument13 pagesNSDLSrini VasanNo ratings yet

- A Nine-Digit Number That Is Assigned by The IRS and Used To Identify Taxpayers in A Business EntityDocument3 pagesA Nine-Digit Number That Is Assigned by The IRS and Used To Identify Taxpayers in A Business EntityJeff ArthurNo ratings yet

- Ein Verification Letter 05Document2 pagesEin Verification Letter 05tontiw63No ratings yet

- Classification Election. See Form 8832 and Its Instructions For Additional InformationDocument3 pagesClassification Election. See Form 8832 and Its Instructions For Additional Informationдиковець пашаNo ratings yet

- eTAX Acco Unt: Application For Opening An eTAX Account by New User With No Tax F Ile in IRDDocument1 pageeTAX Acco Unt: Application For Opening An eTAX Account by New User With No Tax F Ile in IRDKendra CuiNo ratings yet

- Acknowledgment For Request For New PAN Card or - and Changes or Correction in PAN Data (881030205408706)Document1 pageAcknowledgment For Request For New PAN Card or - and Changes or Correction in PAN Data (881030205408706)kapilchandanNo ratings yet

- N PanDocument2 pagesN PanMonika BansalNo ratings yet

- Annex 106179700020354Document2 pagesAnnex 106179700020354Santosh Yadav0% (1)

- Corporation. The LLC Will Be Treated As A Corporation As of The Effective Date of The SDocument2 pagesCorporation. The LLC Will Be Treated As A Corporation As of The Effective Date of The SVõ Quốc CôngNo ratings yet

- (Registration Wing) Form For Capturing Details of Parent's Name & Communication DetailsDocument1 page(Registration Wing) Form For Capturing Details of Parent's Name & Communication DetailsVinesh NairNo ratings yet

- Tanya David EINDocument2 pagesTanya David EINsaniapayoneerebayNo ratings yet

- FileToShare 1Document2 pagesFileToShare 1mnszaidiNo ratings yet

- Income Tax Pan Services Unit: (Managed by NSDL E-Governance Infrastructure Limited)Document2 pagesIncome Tax Pan Services Unit: (Managed by NSDL E-Governance Infrastructure Limited)maheshNo ratings yet

- Annexure HDocument1 pageAnnexure HHMMSPNo ratings yet

- Request For Public Inspection or Copy of Exempt or Political Organization IRS FormDocument2 pagesRequest For Public Inspection or Copy of Exempt or Political Organization IRS FormIRS100% (1)

- Ir 6104Document1 pageIr 6104Kit ChuNo ratings yet

- US Internal Revenue Service: f8878 - 2004Document2 pagesUS Internal Revenue Service: f8878 - 2004IRSNo ratings yet

- Indian Oil Corporation Limited: Application Form (Personal & Confidential)Document1 pageIndian Oil Corporation Limited: Application Form (Personal & Confidential)Sairam SaiNo ratings yet

- IncomeeDocument2 pagesIncomeeRtl GdsNo ratings yet

- Approved Ein - FS Ventures Inc PDF Irs Tax Forms Internal Revenue ServiceDocument1 pageApproved Ein - FS Ventures Inc PDF Irs Tax Forms Internal Revenue Serviceharwelldustin837No ratings yet

- RTI Filing ProcedureDocument8 pagesRTI Filing ProcedureErRajivAmieNo ratings yet

- Ein Macon Homes and Construction, LLCDocument2 pagesEin Macon Homes and Construction, LLCminhdang03062017No ratings yet

- Form N3 DDO Registration NORDocument2 pagesForm N3 DDO Registration NORYogi173No ratings yet

- RTI SatishDocument2 pagesRTI SatishtechviserNo ratings yet

- RTI Application Form DateDocument1 pageRTI Application Form DateurkabitaNo ratings yet

- Innovación de Ciclo RapidoDocument10 pagesInnovación de Ciclo RapidoJuan David Ramirez SalazarNo ratings yet

- Roto 101 - Operator Best Practices Training: TechnologyDocument2 pagesRoto 101 - Operator Best Practices Training: TechnologyQuý Đình Mai MaiNo ratings yet

- MSE 617 - Team B - Final ReportDocument17 pagesMSE 617 - Team B - Final ReporthshNo ratings yet

- SHS-Applied (Entrepreneurship) Activity Sheet Quarter 1 - Competency 3.1 The Marketing MixDocument17 pagesSHS-Applied (Entrepreneurship) Activity Sheet Quarter 1 - Competency 3.1 The Marketing Mixblue archerNo ratings yet

- Ohs-Pr-09-26-F01 Initial Incident Notification 26.1 (2022)Document2 pagesOhs-Pr-09-26-F01 Initial Incident Notification 26.1 (2022)Shafie ZubierNo ratings yet

- MARKETING FUNDAMENTALsDocument12 pagesMARKETING FUNDAMENTALsAhsanNo ratings yet

- Sustainability DigitalizationDocument10 pagesSustainability Digitalizationpennynii21No ratings yet

- Ibm Gatt and WtoDocument14 pagesIbm Gatt and Wto6038 Mugilan kNo ratings yet

- Signature of Student: Date: Signature of Guide/ Supervisor Date: Seal: Name: Name: Email ID: DesignationDocument1 pageSignature of Student: Date: Signature of Guide/ Supervisor Date: Seal: Name: Name: Email ID: DesignationzahooorbhatNo ratings yet

- Tax 1 PrimerDocument113 pagesTax 1 PrimerPatrice De CastroNo ratings yet

- Genpact - AVP Operations JDDocument6 pagesGenpact - AVP Operations JDUmang Mathur100% (1)

- Revised MBA Syllabus - 2021 OnwardsDocument238 pagesRevised MBA Syllabus - 2021 OnwardsChetan BariyaNo ratings yet

- Cambridge IGCSE: Economics For Examination From 2020Document16 pagesCambridge IGCSE: Economics For Examination From 2020Mohammed ZakeeNo ratings yet

- Analyzing Relationship Between India VIX and Stock Market Volatility PDFDocument13 pagesAnalyzing Relationship Between India VIX and Stock Market Volatility PDFJyotesh SinghNo ratings yet

- 005 - 1965 - Law Relating To TaxationDocument15 pages005 - 1965 - Law Relating To TaxationSubhayan BoralNo ratings yet

- C1 Week 1 QuizDocument12 pagesC1 Week 1 QuizShabaan HossainNo ratings yet

- Sustainable Supply Chain Maturity ModelDocument11 pagesSustainable Supply Chain Maturity ModelbusinellicNo ratings yet

- OFRwp 22 04 - Central Bank Digital CurrencyDocument40 pagesOFRwp 22 04 - Central Bank Digital CurrencyocnixenNo ratings yet

- Supporting Reading Material 1Document4 pagesSupporting Reading Material 1QueenieCatubagDomingoNo ratings yet

- Unit I Fundamentals of DesignDocument8 pagesUnit I Fundamentals of DesignChaitanya YengeNo ratings yet

- Internship JD (Full) 90 DaysDocument73 pagesInternship JD (Full) 90 Daysparika khannaNo ratings yet

- Business Mathematics Learning KitDocument15 pagesBusiness Mathematics Learning KitKeith ReyesNo ratings yet

- Warehouse Law QuizDocument8 pagesWarehouse Law QuizJohana ReyesNo ratings yet

- Sub Order Labels E0c2d77c 9794 43cf Ad24 F7f6cb15a739Document60 pagesSub Order Labels E0c2d77c 9794 43cf Ad24 F7f6cb15a739Giri KanyakumariNo ratings yet

- ITSAC RFO 445 AwardListDocument16 pagesITSAC RFO 445 AwardListPon KamaleshNo ratings yet

- Letter of Interest Model MINUTA DE LOI - END SELLERDocument3 pagesLetter of Interest Model MINUTA DE LOI - END SELLERSilvia FagáNo ratings yet

- Instant Download Health Assessment and Physical Examination 5th Edition Estes Test Bank PDF Full ChapterDocument32 pagesInstant Download Health Assessment and Physical Examination 5th Edition Estes Test Bank PDF Full Chaptersaintdomembossmdzfj100% (14)

- Single's Bakery: Sta. Rosa, Abulug, CagayanDocument3 pagesSingle's Bakery: Sta. Rosa, Abulug, CagayanImee Claire PacisNo ratings yet

- Marketing Department of BritanniaDocument6 pagesMarketing Department of BritanniaradhikaNo ratings yet

Annex 830355500000272

Annex 830355500000272

Uploaded by

raj sanganiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annex 830355500000272

Annex 830355500000272

Uploaded by

raj sanganiCopyright:

Available Formats

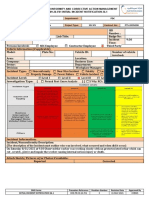

INCOME TAX PAN SERVICES UNIT

(Managed By NSDL e-Governance Infrastructure Limited)

5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8,

Model Colony, Near Deep Bungalow Chowk, Pune - 411 016.

Ref.No.TIN/PAN/CR-/83035550000027202 Date: 08-MAR-2023

Shri KALU SINGH

CORNER OF JAVAHAR ROAD JIBRISH VIDEO

AXARDHAM COMPLEX UPLETA

RAJKOT Gujarat 360490

Dear Sir/Madam,

Subject : Discrepancy in the documents received for PAN application

1. This has reference to documents received in connection with your request for New PAN card and/or changes/correction in PAN data for PAN COJPK2879E made vide

acknowledgement no. 830355500000272. Following discrepancies are observed between details provided in application and details available with Income Tax Department

(ITD).

Particular As per Application As per ITD's Database Discrepancy in documents submitted

Father's Name DEVI SINGH ACHAL ASALA SINGH Father's name change from ASALA SINGH to DEVI SINGH ACHAL

SINGH SINGH has not been specified in AADHAR Card issued by the

Unique Identification Authority of India provided by you (Please refer

list 1)

2. Please submit the below specified documents (with details as per application) to clear the above mentioned discrepancy (ies).

Father's Name

( any one of the following - List 1 )

Public notification in official gazette or clarification for

change in father name along with relevant proof of

Identity of applicant having father name as desired.

3. Please note your PAN application will be processed only on receipt of documents as explained above.

4. If we do not receive documents as mentioned above within 30 days, then your application will be filed and no further action will be taken.

5. Information relating to all PAN Services of ITD can be obtained by making a phone call to Aaykar Sampark Kendra (1800-180-1961) or TIN-Call Centre (020-27218080)

or from the website: www.incometaxindia.gov.in or www.tin-nsdl.com

(This being a computer-generated letter,no signature is required) Income Tax Department

Caution : Income Tax Department does not send e-mails regarding refunds and does not seek any taxpayer information like user name, password, details of ATM, bank accounts,

credit cards, etc. Taxpayers are advised not to part with such information on the basis of emails.

To be sent to NSDL along with documents RETURN-SLIP

ACKNOWLEDGEMENT NO.830355500000272

Please indicate how you want your application to be processed by putting tick in appropriate boxes.

A. Reprint PAN card with ITD data, no change required: [ ]

B. For following fields, details available with Income Tax Department is / are correct and should not be changed (ignore application data):

[ ] Name [ ] Father's Name [ ] DOB

C. For following fields, details available with Income Tax Department is / are incorrect and should be changed:

[ ] Name [ ] Father's Name [ ] DOB (provide documents to support changes as described overleaf)

List of Documents attached: (1)_____________(2)___________(3)___________(4)____________

Name of Applicant: Shri KALU SINGH

Signature of Applicant: _______________

You might also like

- Best EIN Verification Letter 05 - BackupDocument2 pagesBest EIN Verification Letter 05 - BackupYooo100% (1)

- EIN and Biz RegistrationDocument2 pagesEIN and Biz RegistrationmaufunctNo ratings yet

- 2018-09-05 DOC Re EIN Confirmation (DSJ Real Estate Holdings)Document2 pages2018-09-05 DOC Re EIN Confirmation (DSJ Real Estate Holdings)Doo Soo KimNo ratings yet

- Sue's Market (83-2020164) - EIN RegistrationDocument2 pagesSue's Market (83-2020164) - EIN RegistrationDoo Soo Kim100% (1)

- Classification Election. See Form 8832 and Its Instructions For Additional InformationDocument3 pagesClassification Election. See Form 8832 and Its Instructions For Additional InformationSamuel RodriguezNo ratings yet

- CP575Notice 1605020544606Document2 pagesCP575Notice 1605020544606SMOOVE STOP PLAYIN RECORDSNo ratings yet

- Locate Real Estate LLC EinDocument2 pagesLocate Real Estate LLC Einapi-32562269No ratings yet

- UAC2021 HandbookDocument71 pagesUAC2021 Handbookaldo serena sandresNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- Annex 582729700036153Document1 pageAnnex 582729700036153venkatNo ratings yet

- Rajesh Annex-259579700022090Document1 pageRajesh Annex-259579700022090sona singhNo ratings yet

- Annex - 071469700651425Document1 pageAnnex - 071469700651425KALYAN KUMARNo ratings yet

- Annex 603869700012681Document1 pageAnnex 603869700012681ULTIMA SERVICESNo ratings yet

- Annex 030409710286616Document1 pageAnnex 030409710286616sameer pashaNo ratings yet

- Income Tax Pan Services Unit: ACKNOWLEDGEMENT NO.881035292293111Document1 pageIncome Tax Pan Services Unit: ACKNOWLEDGEMENT NO.881035292293111MSEB WalujNo ratings yet

- Income Tax Pan Services Unit: ACKNOWLEDGEMENT NO.881036279775761Document1 pageIncome Tax Pan Services Unit: ACKNOWLEDGEMENT NO.881036279775761surinderNo ratings yet

- Income Tax Pan Services Unit: ACKNOWLEDGEMENT NO.845739700001221Document1 pageIncome Tax Pan Services Unit: ACKNOWLEDGEMENT NO.845739700001221SameerNo ratings yet

- Annex 205919700005773Document1 pageAnnex 205919700005773Brisk VpnNo ratings yet

- Annex 881038200955301Document1 pageAnnex 881038200955301cads vjaNo ratings yet

- Annex 033779700803822Document1 pageAnnex 033779700803822Sayed ShoiabNo ratings yet

- Income Tax Pan Services Unit: ACKNOWLEDGEMENT NO.091019703743452Document1 pageIncome Tax Pan Services Unit: ACKNOWLEDGEMENT NO.091019703743452Sumanth RNo ratings yet

- Income Tax Pan Services Unit: Reference: Our Letter Ref - No. TIN/PAN/CR-II/N-8810552613810721171 Dated 11-SEP-2021Document3 pagesIncome Tax Pan Services Unit: Reference: Our Letter Ref - No. TIN/PAN/CR-II/N-8810552613810721171 Dated 11-SEP-2021Rashid KhanNo ratings yet

- Annex 290419700148093Document1 pageAnnex 290419700148093itoriyaonlinecenterirctcNo ratings yet

- Annex 717329700375352Document1 pageAnnex 717329700375352niharxerox180No ratings yet

- Annex 882039274666970Document1 pageAnnex 882039274666970sandeep.soniNo ratings yet

- Pan RejectDocument1 pagePan RejectRaja RajNo ratings yet

- Annex 881130211969615Document1 pageAnnex 881130211969615saleem shaikhNo ratings yet

- Annex 010109703338232Document1 pageAnnex 010109703338232Sahil RajputNo ratings yet

- Annex 882038275424342Document1 pageAnnex 882038275424342Shree Nath Transport Co.No ratings yet

- Income Tax Pan Services Unit: (Managed by NSDL E-Governance Infrastructure Limited)Document2 pagesIncome Tax Pan Services Unit: (Managed by NSDL E-Governance Infrastructure Limited)Moinuddin AnsariNo ratings yet

- Annex 055840100375124Document2 pagesAnnex 055840100375124Siddhi PatilNo ratings yet

- Annex 881037244760002Document1 pageAnnex 881037244760002Shamim AkhtarNo ratings yet

- Form 1 EnglishDocument2 pagesForm 1 Englishashish yadavNo ratings yet

- Income Tax Pan Services Unit: (Managed by National Securities Depository Limited)Document2 pagesIncome Tax Pan Services Unit: (Managed by National Securities Depository Limited)MalliMurthyNo ratings yet

- 881053278006296Document2 pages881053278006296Sameer MittalNo ratings yet

- Application For Filing Information Returns Electronically: (Rev. 6-2007) (Please Type Print inDocument2 pagesApplication For Filing Information Returns Electronically: (Rev. 6-2007) (Please Type Print inIRSNo ratings yet

- NSDLDocument13 pagesNSDLSrini VasanNo ratings yet

- A Nine-Digit Number That Is Assigned by The IRS and Used To Identify Taxpayers in A Business EntityDocument3 pagesA Nine-Digit Number That Is Assigned by The IRS and Used To Identify Taxpayers in A Business EntityJeff ArthurNo ratings yet

- Ein Verification Letter 05Document2 pagesEin Verification Letter 05tontiw63No ratings yet

- Classification Election. See Form 8832 and Its Instructions For Additional InformationDocument3 pagesClassification Election. See Form 8832 and Its Instructions For Additional Informationдиковець пашаNo ratings yet

- eTAX Acco Unt: Application For Opening An eTAX Account by New User With No Tax F Ile in IRDDocument1 pageeTAX Acco Unt: Application For Opening An eTAX Account by New User With No Tax F Ile in IRDKendra CuiNo ratings yet

- Acknowledgment For Request For New PAN Card or - and Changes or Correction in PAN Data (881030205408706)Document1 pageAcknowledgment For Request For New PAN Card or - and Changes or Correction in PAN Data (881030205408706)kapilchandanNo ratings yet

- N PanDocument2 pagesN PanMonika BansalNo ratings yet

- Annex 106179700020354Document2 pagesAnnex 106179700020354Santosh Yadav0% (1)

- Corporation. The LLC Will Be Treated As A Corporation As of The Effective Date of The SDocument2 pagesCorporation. The LLC Will Be Treated As A Corporation As of The Effective Date of The SVõ Quốc CôngNo ratings yet

- (Registration Wing) Form For Capturing Details of Parent's Name & Communication DetailsDocument1 page(Registration Wing) Form For Capturing Details of Parent's Name & Communication DetailsVinesh NairNo ratings yet

- Tanya David EINDocument2 pagesTanya David EINsaniapayoneerebayNo ratings yet

- FileToShare 1Document2 pagesFileToShare 1mnszaidiNo ratings yet

- Income Tax Pan Services Unit: (Managed by NSDL E-Governance Infrastructure Limited)Document2 pagesIncome Tax Pan Services Unit: (Managed by NSDL E-Governance Infrastructure Limited)maheshNo ratings yet

- Annexure HDocument1 pageAnnexure HHMMSPNo ratings yet

- Request For Public Inspection or Copy of Exempt or Political Organization IRS FormDocument2 pagesRequest For Public Inspection or Copy of Exempt or Political Organization IRS FormIRS100% (1)

- Ir 6104Document1 pageIr 6104Kit ChuNo ratings yet

- US Internal Revenue Service: f8878 - 2004Document2 pagesUS Internal Revenue Service: f8878 - 2004IRSNo ratings yet

- Indian Oil Corporation Limited: Application Form (Personal & Confidential)Document1 pageIndian Oil Corporation Limited: Application Form (Personal & Confidential)Sairam SaiNo ratings yet

- IncomeeDocument2 pagesIncomeeRtl GdsNo ratings yet

- Approved Ein - FS Ventures Inc PDF Irs Tax Forms Internal Revenue ServiceDocument1 pageApproved Ein - FS Ventures Inc PDF Irs Tax Forms Internal Revenue Serviceharwelldustin837No ratings yet

- RTI Filing ProcedureDocument8 pagesRTI Filing ProcedureErRajivAmieNo ratings yet

- Ein Macon Homes and Construction, LLCDocument2 pagesEin Macon Homes and Construction, LLCminhdang03062017No ratings yet

- Form N3 DDO Registration NORDocument2 pagesForm N3 DDO Registration NORYogi173No ratings yet

- RTI SatishDocument2 pagesRTI SatishtechviserNo ratings yet

- RTI Application Form DateDocument1 pageRTI Application Form DateurkabitaNo ratings yet

- Innovación de Ciclo RapidoDocument10 pagesInnovación de Ciclo RapidoJuan David Ramirez SalazarNo ratings yet

- Roto 101 - Operator Best Practices Training: TechnologyDocument2 pagesRoto 101 - Operator Best Practices Training: TechnologyQuý Đình Mai MaiNo ratings yet

- MSE 617 - Team B - Final ReportDocument17 pagesMSE 617 - Team B - Final ReporthshNo ratings yet

- SHS-Applied (Entrepreneurship) Activity Sheet Quarter 1 - Competency 3.1 The Marketing MixDocument17 pagesSHS-Applied (Entrepreneurship) Activity Sheet Quarter 1 - Competency 3.1 The Marketing Mixblue archerNo ratings yet

- Ohs-Pr-09-26-F01 Initial Incident Notification 26.1 (2022)Document2 pagesOhs-Pr-09-26-F01 Initial Incident Notification 26.1 (2022)Shafie ZubierNo ratings yet

- MARKETING FUNDAMENTALsDocument12 pagesMARKETING FUNDAMENTALsAhsanNo ratings yet

- Sustainability DigitalizationDocument10 pagesSustainability Digitalizationpennynii21No ratings yet

- Ibm Gatt and WtoDocument14 pagesIbm Gatt and Wto6038 Mugilan kNo ratings yet

- Signature of Student: Date: Signature of Guide/ Supervisor Date: Seal: Name: Name: Email ID: DesignationDocument1 pageSignature of Student: Date: Signature of Guide/ Supervisor Date: Seal: Name: Name: Email ID: DesignationzahooorbhatNo ratings yet

- Tax 1 PrimerDocument113 pagesTax 1 PrimerPatrice De CastroNo ratings yet

- Genpact - AVP Operations JDDocument6 pagesGenpact - AVP Operations JDUmang Mathur100% (1)

- Revised MBA Syllabus - 2021 OnwardsDocument238 pagesRevised MBA Syllabus - 2021 OnwardsChetan BariyaNo ratings yet

- Cambridge IGCSE: Economics For Examination From 2020Document16 pagesCambridge IGCSE: Economics For Examination From 2020Mohammed ZakeeNo ratings yet

- Analyzing Relationship Between India VIX and Stock Market Volatility PDFDocument13 pagesAnalyzing Relationship Between India VIX and Stock Market Volatility PDFJyotesh SinghNo ratings yet

- 005 - 1965 - Law Relating To TaxationDocument15 pages005 - 1965 - Law Relating To TaxationSubhayan BoralNo ratings yet

- C1 Week 1 QuizDocument12 pagesC1 Week 1 QuizShabaan HossainNo ratings yet

- Sustainable Supply Chain Maturity ModelDocument11 pagesSustainable Supply Chain Maturity ModelbusinellicNo ratings yet

- OFRwp 22 04 - Central Bank Digital CurrencyDocument40 pagesOFRwp 22 04 - Central Bank Digital CurrencyocnixenNo ratings yet

- Supporting Reading Material 1Document4 pagesSupporting Reading Material 1QueenieCatubagDomingoNo ratings yet

- Unit I Fundamentals of DesignDocument8 pagesUnit I Fundamentals of DesignChaitanya YengeNo ratings yet

- Internship JD (Full) 90 DaysDocument73 pagesInternship JD (Full) 90 Daysparika khannaNo ratings yet

- Business Mathematics Learning KitDocument15 pagesBusiness Mathematics Learning KitKeith ReyesNo ratings yet

- Warehouse Law QuizDocument8 pagesWarehouse Law QuizJohana ReyesNo ratings yet

- Sub Order Labels E0c2d77c 9794 43cf Ad24 F7f6cb15a739Document60 pagesSub Order Labels E0c2d77c 9794 43cf Ad24 F7f6cb15a739Giri KanyakumariNo ratings yet

- ITSAC RFO 445 AwardListDocument16 pagesITSAC RFO 445 AwardListPon KamaleshNo ratings yet

- Letter of Interest Model MINUTA DE LOI - END SELLERDocument3 pagesLetter of Interest Model MINUTA DE LOI - END SELLERSilvia FagáNo ratings yet

- Instant Download Health Assessment and Physical Examination 5th Edition Estes Test Bank PDF Full ChapterDocument32 pagesInstant Download Health Assessment and Physical Examination 5th Edition Estes Test Bank PDF Full Chaptersaintdomembossmdzfj100% (14)

- Single's Bakery: Sta. Rosa, Abulug, CagayanDocument3 pagesSingle's Bakery: Sta. Rosa, Abulug, CagayanImee Claire PacisNo ratings yet

- Marketing Department of BritanniaDocument6 pagesMarketing Department of BritanniaradhikaNo ratings yet