Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

371 viewsOnett Computation Sheet

Onett Computation Sheet

Uploaded by

Breahziel ParillaThis document is a computation sheet for capital gains tax (CGT) and documentary stamp tax (DST) on the transfer of real property from Donna Dela Cruz to John Brent Villegas. It provides details of the transaction including the location of the property, area, fair market value, and selling price. It then computes the tax base, CGT of 138,295 pesos, and DST of 59,575 pesos. The total amount due is 197,870 pesos. The document provides instructions for payment and requires signatures from the ONETT team, assessment division chief, and regional director to approve the tax assessment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Test Answers For Accounts Payable 2015 - ElanceDocument14 pagesTest Answers For Accounts Payable 2015 - ElancesnezalatasNo ratings yet

- Stirling HomexDocument3 pagesStirling HomexAnne cutieNo ratings yet

- Square Pitch DeckDocument20 pagesSquare Pitch DeckAwesome Pitch Company67% (3)

- Bpi Endorsement LetterDocument1 pageBpi Endorsement LetterLawrence MangaoangNo ratings yet

- Corporate Account Customer Information Form 07-07-2014Document1 pageCorporate Account Customer Information Form 07-07-2014Jesus Inno Jaime LoretoNo ratings yet

- Cover Sheet: For Audited Financial StatementsDocument1 pageCover Sheet: For Audited Financial StatementsPamela Fayel SalazarNo ratings yet

- Baap ReaDocument17 pagesBaap ReaJasielle Leigh UlangkayaNo ratings yet

- History of PRMSDocument10 pagesHistory of PRMSSaurabh Pancholi100% (1)

- Spa For Orus 1Document1 pageSpa For Orus 1Ivy PazNo ratings yet

- (P3,300,000.00), Philippine Currency, Payable As FollowsDocument3 pages(P3,300,000.00), Philippine Currency, Payable As FollowsMPat EBarr0% (1)

- 72rr03 26anxaDocument2 pages72rr03 26anxaRenEleponioNo ratings yet

- Secretary CertificateDocument3 pagesSecretary CertificateAnnina IlasNo ratings yet

- Special Power of Attorney (Lto)Document2 pagesSpecial Power of Attorney (Lto)Joann LedesmaNo ratings yet

- Authorization LetterDocument2 pagesAuthorization LetterRea RomeroNo ratings yet

- Affidavit of Undertaking Business Permit BIDocument1 pageAffidavit of Undertaking Business Permit BIJill b.No ratings yet

- Authorization LetterDocument1 pageAuthorization LetterRoseshel BarrunNo ratings yet

- Deed of Sale of Motor VehicleDocument2 pagesDeed of Sale of Motor VehicleJuan BanaresNo ratings yet

- Spa CRUZ MayniladDocument1 pageSpa CRUZ MayniladAtty. R. PerezNo ratings yet

- Affidavit of Loss (SEnior Citizen)Document1 pageAffidavit of Loss (SEnior Citizen)Marie Jade Ebol AranetaNo ratings yet

- Sample - Amended SEC Articles, Change AddressDocument10 pagesSample - Amended SEC Articles, Change AddressJimmelyn CalejesanNo ratings yet

- Affidavit of No RentDocument1 pageAffidavit of No RentEnrryson SebastianNo ratings yet

- Draft ATSDocument1 pageDraft ATScarlomaderazoNo ratings yet

- Affidavit of Business ClosureDocument1 pageAffidavit of Business Closuretimmy_zamoraNo ratings yet

- Affidavit of ConsentDocument1 pageAffidavit of ConsentRoger L. Salvania100% (1)

- Deed of Sale of Motor Vehicle - PackmanDocument1 pageDeed of Sale of Motor Vehicle - PackmanDavid Sibbaluca MaulasNo ratings yet

- Special Power of Attorney - Bir Open CaseDocument2 pagesSpecial Power of Attorney - Bir Open CaseAral Na LangNo ratings yet

- Secretary Certificate Lost PlateDocument1 pageSecretary Certificate Lost PlateAiza VillanuevaNo ratings yet

- DRAFT - Board Resolution Closure 5 11 21Document2 pagesDRAFT - Board Resolution Closure 5 11 21Leonil Anthony S. BacayNo ratings yet

- Authorization LetterDocument1 pageAuthorization LetterHonney AgbisitNo ratings yet

- AMLA Annex C - BlankDocument1 pageAMLA Annex C - BlankCGCruz100% (1)

- CMPRS Form2 - Secretarys Certificate CMPRS Oct 17 2017Document2 pagesCMPRS Form2 - Secretarys Certificate CMPRS Oct 17 2017Lariyl de VeraNo ratings yet

- SITC - AUTHORIZATION LETTER FORMAT (Final)Document1 pageSITC - AUTHORIZATION LETTER FORMAT (Final)Riz Shiel Manipis0% (1)

- Secretary's CertificateDocument1 pageSecretary's CertificateJil MacasaetNo ratings yet

- Branch Office Expression of Interest For Amnesty of Fines and Penalties at SECDocument2 pagesBranch Office Expression of Interest For Amnesty of Fines and Penalties at SECcsb1683100% (1)

- Affidavit of UndertakingDocument1 pageAffidavit of UndertakingLM REYES LAW OFFICESNo ratings yet

- Special Power of Attorney For Case Monitoring SystemDocument1 pageSpecial Power of Attorney For Case Monitoring SystemMary Joy SumapidNo ratings yet

- Bir Ruling Da 192-08Document2 pagesBir Ruling Da 192-08norliza albutraNo ratings yet

- Sworn Statement-Bir - Loose LeafDocument1 pageSworn Statement-Bir - Loose LeafEkeena LimNo ratings yet

- QC Hall SPECIAL POWER OF ATTORNEY (12212)Document1 pageQC Hall SPECIAL POWER OF ATTORNEY (12212)Melo MagnoNo ratings yet

- Deed of Undertaking CoopCorp 7april2022Document3 pagesDeed of Undertaking CoopCorp 7april2022El pueblo TransportNo ratings yet

- BIR Ruling No. 253-16Document4 pagesBIR Ruling No. 253-16john allen MarillaNo ratings yet

- Secretary's Cert - SampleDocument1 pageSecretary's Cert - SampleCuki IsbusyNo ratings yet

- Deed of Absolute SaleDocument2 pagesDeed of Absolute SaleHenna Capao100% (1)

- Transmittal List: NO. Particulars RemarksDocument1 pageTransmittal List: NO. Particulars RemarksJulius Candelario Felizardo100% (1)

- RDO No. 44 - Taguig-Pateros4850195872301349928Document428 pagesRDO No. 44 - Taguig-Pateros4850195872301349928Karla Katigbak100% (1)

- SPADocument1 pageSPAPaul CasajeNo ratings yet

- Affidavit of Loss Bir Books of AccountsDocument15 pagesAffidavit of Loss Bir Books of AccountsMary gil Mariano100% (1)

- Secretary-Certificate LetterDocument2 pagesSecretary-Certificate Letterteresa bautistaNo ratings yet

- Sample Loss ORCRDocument1 pageSample Loss ORCRCharm Tan-CalzadoNo ratings yet

- CertificateDocument1 pageCertificateFrancis Basa CasimNo ratings yet

- Letter PRADocument2 pagesLetter PRARaysunArellanoNo ratings yet

- Deed of Absolute Sale Blank 5Document2 pagesDeed of Absolute Sale Blank 5Jenny T Manzo100% (1)

- DOAS TemplateDocument2 pagesDOAS Templatemailguzman100% (1)

- Petition For Dropping LTFRBDocument3 pagesPetition For Dropping LTFRBMegan Camille SanchezNo ratings yet

- Deed of Donation Rizal WestDocument5 pagesDeed of Donation Rizal WestMarga CastilloNo ratings yet

- Affidavit of RemittanceDocument1 pageAffidavit of RemittancenbmantillaNo ratings yet

- China Banking Corporation Bir E-Fps Payment Manual: May 2011 V 6.0Document48 pagesChina Banking Corporation Bir E-Fps Payment Manual: May 2011 V 6.0KyonNo ratings yet

- 1906 January 2018 ENCS FinalDocument1 page1906 January 2018 ENCS FinalShane Shane100% (4)

- ANNEX B Undertaking - Corp.Document1 pageANNEX B Undertaking - Corp.cynthia r. monjardin100% (1)

- Affidavit Certification of Gross SalesDocument1 pageAffidavit Certification of Gross SalesJan Bajar100% (1)

- Infosheet For New ID Applicant (OSD-PICD)Document1 pageInfosheet For New ID Applicant (OSD-PICD)zab04148114No ratings yet

- Application For The New Penalty Condonation Program On Mandatory Monthly Savings (MS) RemittancesDocument2 pagesApplication For The New Penalty Condonation Program On Mandatory Monthly Savings (MS) RemittancesCrizetteTarcena50% (2)

- Rmo15 03anxb PDFDocument1 pageRmo15 03anxb PDFAM CruzNo ratings yet

- ONETT For Sale of Real Property Classified As Ordinary AssetDocument1 pageONETT For Sale of Real Property Classified As Ordinary Assetd-fbuser-49417072No ratings yet

- ConstellationsDocument37 pagesConstellationsBreahziel ParillaNo ratings yet

- Converse of BPTDocument21 pagesConverse of BPTBreahziel ParillaNo ratings yet

- Add A SubheadingDocument2 pagesAdd A SubheadingBreahziel ParillaNo ratings yet

- Brown and White Scrapbook Elegant Company Profile PresentationDocument14 pagesBrown and White Scrapbook Elegant Company Profile PresentationBreahziel ParillaNo ratings yet

- Pag-Ibig Loyalty Card Plus Account Holder'S Contact Details Change Request FormDocument1 pagePag-Ibig Loyalty Card Plus Account Holder'S Contact Details Change Request FormBreahziel ParillaNo ratings yet

- Pagibig ListDocument1 pagePagibig ListBreahziel ParillaNo ratings yet

- Pag-Ibig Loyalty Card Plus Account Holder'S Contact Details Change Request FormDocument2 pagesPag-Ibig Loyalty Card Plus Account Holder'S Contact Details Change Request FormBreahziel ParillaNo ratings yet

- Chapter 4 Market Equlibrium PDFDocument12 pagesChapter 4 Market Equlibrium PDFAiman DanielNo ratings yet

- Generation and Screening of Ideas ProjectDocument17 pagesGeneration and Screening of Ideas ProjectCharu ModiNo ratings yet

- TpaDocument40 pagesTpadeepankarkatNo ratings yet

- IMT Assignments For All SubjectsDocument170 pagesIMT Assignments For All SubjectsSUNSHINE TEAHOUSENo ratings yet

- Iffco-Tokio General Insurance Co. LTD: Corporate Identification Number (CIN) U74899DL2000PLC107621, IRDA Reg. No. 106Document2 pagesIffco-Tokio General Insurance Co. LTD: Corporate Identification Number (CIN) U74899DL2000PLC107621, IRDA Reg. No. 106Michael KrishnaNo ratings yet

- Emotion Drives Investor DecisionsDocument1 pageEmotion Drives Investor DecisionsTori PatrickNo ratings yet

- AvianCorp Fall 2013Document2 pagesAvianCorp Fall 2013braveusmanNo ratings yet

- Visitor No: 2621224 Dated: 23:jul:2014: Answ ErDocument1 pageVisitor No: 2621224 Dated: 23:jul:2014: Answ ErChandanMatoliaNo ratings yet

- Managerial Level Ias - 8 Financial Accounting: From The Desk of Ghulam Mustafa (FCMA), M.A. EconomicsDocument4 pagesManagerial Level Ias - 8 Financial Accounting: From The Desk of Ghulam Mustafa (FCMA), M.A. EconomicsSundus HussainNo ratings yet

- Dissertation Topics On Financial CrisisDocument6 pagesDissertation Topics On Financial CrisisWebsiteThatWillWriteAPaperForYouSingapore100% (1)

- SFM NotesDocument15 pagesSFM NotesAakash JohnsNo ratings yet

- N. Whitehall 2024 Proposed BudgetDocument12 pagesN. Whitehall 2024 Proposed BudgetLVNewsdotcomNo ratings yet

- The Mock SBR Sept 19 Q PDFDocument6 pagesThe Mock SBR Sept 19 Q PDFEhsanulNo ratings yet

- BPI US Equity Feeder Fund Latest DisclosureDocument3 pagesBPI US Equity Feeder Fund Latest DisclosureJelor GallegoNo ratings yet

- Lecture 1 - 2Document70 pagesLecture 1 - 2premsuwaatiiNo ratings yet

- Chapter7-Stock Price Behavior & Market EfficiencyDocument9 pagesChapter7-Stock Price Behavior & Market Efficiencytconn8276No ratings yet

- XLBC FactsDocument24 pagesXLBC FactsMutimbaNo ratings yet

- Leverage: Navin Khandelwal FCA, DISADocument41 pagesLeverage: Navin Khandelwal FCA, DISAsaiNo ratings yet

- Databook Planning CommissionDocument292 pagesDatabook Planning CommissionSandeep KotaNo ratings yet

- FM 100 Cash Flow AnalysisDocument31 pagesFM 100 Cash Flow AnalysisChaiiNo ratings yet

- Sir. Shabir Ahmad Tariq Aziz: Supervised byDocument52 pagesSir. Shabir Ahmad Tariq Aziz: Supervised byMohib Ullah YousafzaiNo ratings yet

- Dwnload Full Business and Professional Ethics For Directors Executives Accountants 8th Edition Brooks Test Bank PDFDocument36 pagesDwnload Full Business and Professional Ethics For Directors Executives Accountants 8th Edition Brooks Test Bank PDFmetiers2155100% (21)

- Chapter 13.Document6 pagesChapter 13.perdana findaNo ratings yet

- 201741795654bhakti Gems DPDocument245 pages201741795654bhakti Gems DPmanugeorgeNo ratings yet

- Case Study Finding WACC For A Project BoltaDocument1 pageCase Study Finding WACC For A Project BoltaebeNo ratings yet

- Initial Report October 22Th, 2007: Analyst: Victor Sula, PHDDocument20 pagesInitial Report October 22Th, 2007: Analyst: Victor Sula, PHDbeacon-docsNo ratings yet

Onett Computation Sheet

Onett Computation Sheet

Uploaded by

Breahziel Parilla0 ratings0% found this document useful (0 votes)

371 views1 pageThis document is a computation sheet for capital gains tax (CGT) and documentary stamp tax (DST) on the transfer of real property from Donna Dela Cruz to John Brent Villegas. It provides details of the transaction including the location of the property, area, fair market value, and selling price. It then computes the tax base, CGT of 138,295 pesos, and DST of 59,575 pesos. The total amount due is 197,870 pesos. The document provides instructions for payment and requires signatures from the ONETT team, assessment division chief, and regional director to approve the tax assessment.

Original Description:

Original Title

onett computation sheet (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is a computation sheet for capital gains tax (CGT) and documentary stamp tax (DST) on the transfer of real property from Donna Dela Cruz to John Brent Villegas. It provides details of the transaction including the location of the property, area, fair market value, and selling price. It then computes the tax base, CGT of 138,295 pesos, and DST of 59,575 pesos. The total amount due is 197,870 pesos. The document provides instructions for payment and requires signatures from the ONETT team, assessment division chief, and regional director to approve the tax assessment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

371 views1 pageOnett Computation Sheet

Onett Computation Sheet

Uploaded by

Breahziel ParillaThis document is a computation sheet for capital gains tax (CGT) and documentary stamp tax (DST) on the transfer of real property from Donna Dela Cruz to John Brent Villegas. It provides details of the transaction including the location of the property, area, fair market value, and selling price. It then computes the tax base, CGT of 138,295 pesos, and DST of 59,575 pesos. The total amount due is 197,870 pesos. The document provides instructions for payment and requires signatures from the ONETT team, assessment division chief, and regional director to approve the tax assessment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

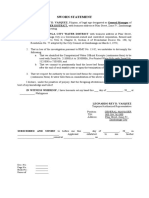

"Annex B"

ONETT COMPUTATION SHEET

CAPITAL GAINS TAX ( CGT) and DOCUMENTARY STAMP TAX (DST)

FOR ONEROUS TRANSFER OF REAL PROPERTY CLASSIFIED AS CAPITAL ASSET (BOTH TAXABLE AND EXEMPT)

NAME OF SELLER/S: DONNA DELA CRUZ ADDRESS: TIN:

NAME OF BUYER/S: JOHN BRENT VILLEGAS ADDRESS: TIN:

DATE OF TRANSACTION: 2/20/23 DUE DATE (CGT): 3/20/23 DUE DATE (DST): 3/5/23

Tax Fair Market Tax Base

OCT/TCT ZV/ Zonal Value Selling Price

Declaration LOCATION CLASS. AREA Value (FMV) (ZV/FMV/SP whichever is

CCT No. No. (TD) sq. m. (ZV) (SP)

per TD higher)

2016011868 F-023-23581 COMMONWEALTH HEIGHTS RR 52.65 20,000 1,263,600.00 315,900.00 950,000.00 2,529,500.00

D-023-23780 RR 462,500.00 462,500.00

TOTAL 1,726,100.00 778,400.00 950,000.00 2,529,5003.00

COMPUTATION DETAILS: PER AUDIT PER REVIEW

1. CAPITAL GAINS TAX

TAX DUE

Legal basis: Sections 24(D)(1), 25(A)(3) & 27(D)(5)

P 2,529,500.00 x 6.0% P 138,295.00 P

(Tax Base)

LESS: Tax Paid per Return, if a return was filed -----------------------------------------------------

CGT STILL DUE / (OVERPAYMENT) ------------------------------------------------------------------------- P P

Add: 25% Surcharge P

Interest ( to )

Compromise Penalty

TOTAL AMOUNT STILL DUE ON CGT -------------------------------------------------------------------------- P 138,295.00 P

2. DOCUMENTARY STAMP TAX

TAX DUE

Legal basis: Section 196 (CTRP) NIRC

P 2,529,500.00 x P15.00 for every P1,000.00 or a fraction thereof P 59,575.00 P

(Tax Base)

LESS: Tax Paid per Return, if a return was filed -----------------------------------------------------

DST STILL DUE / (OVERPAYMENT) ------------------------------------------------------------------------- P P

Add: 25% Surcharge P

Interest ( to )

Compromise Penalty

TOTAL AMOUNT STILL DUE ON DST -------------------------------------------------------------------------- P 59,575.00 P

TOTAL AMOUNT OF Nos. 1 & 2 ----------------------------------------------------------------------------- P 197,870.00 P

Remarks:

To be accomplished by ONETT Team. Payment Verified by: To be accomplished upon review.

Computed by: Reviewed by:

ONETT Officer ONETT Member/ Collection Section Chief, Assessment Div.

(Signature Over Printed Name) OR No. Tax Type Date of Payment (Signature Over Printed Name)

Approved by: Approved by:

Head, ONETT Team Regional Director

(Signature Over Printed Name) (Signature Over Printed Name)

Reference:

The BIR is not precluded from assessing and collecting any deficiency internal revenue tax(es) that maybe found from the taxpayer after examination or review.

CONFORME:

TAXPAYER/AUTHORIZED REPRESENTATIVE Telephone No. Date

(Signature Over Printed Name)

Instruction: Prepare in duplicate and ascertain that ONETT Computation Sheet is signed by Head ONETT Team before release to taxpayer.

Please attach additional sheet, if necessary.

You might also like

- Test Answers For Accounts Payable 2015 - ElanceDocument14 pagesTest Answers For Accounts Payable 2015 - ElancesnezalatasNo ratings yet

- Stirling HomexDocument3 pagesStirling HomexAnne cutieNo ratings yet

- Square Pitch DeckDocument20 pagesSquare Pitch DeckAwesome Pitch Company67% (3)

- Bpi Endorsement LetterDocument1 pageBpi Endorsement LetterLawrence MangaoangNo ratings yet

- Corporate Account Customer Information Form 07-07-2014Document1 pageCorporate Account Customer Information Form 07-07-2014Jesus Inno Jaime LoretoNo ratings yet

- Cover Sheet: For Audited Financial StatementsDocument1 pageCover Sheet: For Audited Financial StatementsPamela Fayel SalazarNo ratings yet

- Baap ReaDocument17 pagesBaap ReaJasielle Leigh UlangkayaNo ratings yet

- History of PRMSDocument10 pagesHistory of PRMSSaurabh Pancholi100% (1)

- Spa For Orus 1Document1 pageSpa For Orus 1Ivy PazNo ratings yet

- (P3,300,000.00), Philippine Currency, Payable As FollowsDocument3 pages(P3,300,000.00), Philippine Currency, Payable As FollowsMPat EBarr0% (1)

- 72rr03 26anxaDocument2 pages72rr03 26anxaRenEleponioNo ratings yet

- Secretary CertificateDocument3 pagesSecretary CertificateAnnina IlasNo ratings yet

- Special Power of Attorney (Lto)Document2 pagesSpecial Power of Attorney (Lto)Joann LedesmaNo ratings yet

- Authorization LetterDocument2 pagesAuthorization LetterRea RomeroNo ratings yet

- Affidavit of Undertaking Business Permit BIDocument1 pageAffidavit of Undertaking Business Permit BIJill b.No ratings yet

- Authorization LetterDocument1 pageAuthorization LetterRoseshel BarrunNo ratings yet

- Deed of Sale of Motor VehicleDocument2 pagesDeed of Sale of Motor VehicleJuan BanaresNo ratings yet

- Spa CRUZ MayniladDocument1 pageSpa CRUZ MayniladAtty. R. PerezNo ratings yet

- Affidavit of Loss (SEnior Citizen)Document1 pageAffidavit of Loss (SEnior Citizen)Marie Jade Ebol AranetaNo ratings yet

- Sample - Amended SEC Articles, Change AddressDocument10 pagesSample - Amended SEC Articles, Change AddressJimmelyn CalejesanNo ratings yet

- Affidavit of No RentDocument1 pageAffidavit of No RentEnrryson SebastianNo ratings yet

- Draft ATSDocument1 pageDraft ATScarlomaderazoNo ratings yet

- Affidavit of Business ClosureDocument1 pageAffidavit of Business Closuretimmy_zamoraNo ratings yet

- Affidavit of ConsentDocument1 pageAffidavit of ConsentRoger L. Salvania100% (1)

- Deed of Sale of Motor Vehicle - PackmanDocument1 pageDeed of Sale of Motor Vehicle - PackmanDavid Sibbaluca MaulasNo ratings yet

- Special Power of Attorney - Bir Open CaseDocument2 pagesSpecial Power of Attorney - Bir Open CaseAral Na LangNo ratings yet

- Secretary Certificate Lost PlateDocument1 pageSecretary Certificate Lost PlateAiza VillanuevaNo ratings yet

- DRAFT - Board Resolution Closure 5 11 21Document2 pagesDRAFT - Board Resolution Closure 5 11 21Leonil Anthony S. BacayNo ratings yet

- Authorization LetterDocument1 pageAuthorization LetterHonney AgbisitNo ratings yet

- AMLA Annex C - BlankDocument1 pageAMLA Annex C - BlankCGCruz100% (1)

- CMPRS Form2 - Secretarys Certificate CMPRS Oct 17 2017Document2 pagesCMPRS Form2 - Secretarys Certificate CMPRS Oct 17 2017Lariyl de VeraNo ratings yet

- SITC - AUTHORIZATION LETTER FORMAT (Final)Document1 pageSITC - AUTHORIZATION LETTER FORMAT (Final)Riz Shiel Manipis0% (1)

- Secretary's CertificateDocument1 pageSecretary's CertificateJil MacasaetNo ratings yet

- Branch Office Expression of Interest For Amnesty of Fines and Penalties at SECDocument2 pagesBranch Office Expression of Interest For Amnesty of Fines and Penalties at SECcsb1683100% (1)

- Affidavit of UndertakingDocument1 pageAffidavit of UndertakingLM REYES LAW OFFICESNo ratings yet

- Special Power of Attorney For Case Monitoring SystemDocument1 pageSpecial Power of Attorney For Case Monitoring SystemMary Joy SumapidNo ratings yet

- Bir Ruling Da 192-08Document2 pagesBir Ruling Da 192-08norliza albutraNo ratings yet

- Sworn Statement-Bir - Loose LeafDocument1 pageSworn Statement-Bir - Loose LeafEkeena LimNo ratings yet

- QC Hall SPECIAL POWER OF ATTORNEY (12212)Document1 pageQC Hall SPECIAL POWER OF ATTORNEY (12212)Melo MagnoNo ratings yet

- Deed of Undertaking CoopCorp 7april2022Document3 pagesDeed of Undertaking CoopCorp 7april2022El pueblo TransportNo ratings yet

- BIR Ruling No. 253-16Document4 pagesBIR Ruling No. 253-16john allen MarillaNo ratings yet

- Secretary's Cert - SampleDocument1 pageSecretary's Cert - SampleCuki IsbusyNo ratings yet

- Deed of Absolute SaleDocument2 pagesDeed of Absolute SaleHenna Capao100% (1)

- Transmittal List: NO. Particulars RemarksDocument1 pageTransmittal List: NO. Particulars RemarksJulius Candelario Felizardo100% (1)

- RDO No. 44 - Taguig-Pateros4850195872301349928Document428 pagesRDO No. 44 - Taguig-Pateros4850195872301349928Karla Katigbak100% (1)

- SPADocument1 pageSPAPaul CasajeNo ratings yet

- Affidavit of Loss Bir Books of AccountsDocument15 pagesAffidavit of Loss Bir Books of AccountsMary gil Mariano100% (1)

- Secretary-Certificate LetterDocument2 pagesSecretary-Certificate Letterteresa bautistaNo ratings yet

- Sample Loss ORCRDocument1 pageSample Loss ORCRCharm Tan-CalzadoNo ratings yet

- CertificateDocument1 pageCertificateFrancis Basa CasimNo ratings yet

- Letter PRADocument2 pagesLetter PRARaysunArellanoNo ratings yet

- Deed of Absolute Sale Blank 5Document2 pagesDeed of Absolute Sale Blank 5Jenny T Manzo100% (1)

- DOAS TemplateDocument2 pagesDOAS Templatemailguzman100% (1)

- Petition For Dropping LTFRBDocument3 pagesPetition For Dropping LTFRBMegan Camille SanchezNo ratings yet

- Deed of Donation Rizal WestDocument5 pagesDeed of Donation Rizal WestMarga CastilloNo ratings yet

- Affidavit of RemittanceDocument1 pageAffidavit of RemittancenbmantillaNo ratings yet

- China Banking Corporation Bir E-Fps Payment Manual: May 2011 V 6.0Document48 pagesChina Banking Corporation Bir E-Fps Payment Manual: May 2011 V 6.0KyonNo ratings yet

- 1906 January 2018 ENCS FinalDocument1 page1906 January 2018 ENCS FinalShane Shane100% (4)

- ANNEX B Undertaking - Corp.Document1 pageANNEX B Undertaking - Corp.cynthia r. monjardin100% (1)

- Affidavit Certification of Gross SalesDocument1 pageAffidavit Certification of Gross SalesJan Bajar100% (1)

- Infosheet For New ID Applicant (OSD-PICD)Document1 pageInfosheet For New ID Applicant (OSD-PICD)zab04148114No ratings yet

- Application For The New Penalty Condonation Program On Mandatory Monthly Savings (MS) RemittancesDocument2 pagesApplication For The New Penalty Condonation Program On Mandatory Monthly Savings (MS) RemittancesCrizetteTarcena50% (2)

- Rmo15 03anxb PDFDocument1 pageRmo15 03anxb PDFAM CruzNo ratings yet

- ONETT For Sale of Real Property Classified As Ordinary AssetDocument1 pageONETT For Sale of Real Property Classified As Ordinary Assetd-fbuser-49417072No ratings yet

- ConstellationsDocument37 pagesConstellationsBreahziel ParillaNo ratings yet

- Converse of BPTDocument21 pagesConverse of BPTBreahziel ParillaNo ratings yet

- Add A SubheadingDocument2 pagesAdd A SubheadingBreahziel ParillaNo ratings yet

- Brown and White Scrapbook Elegant Company Profile PresentationDocument14 pagesBrown and White Scrapbook Elegant Company Profile PresentationBreahziel ParillaNo ratings yet

- Pag-Ibig Loyalty Card Plus Account Holder'S Contact Details Change Request FormDocument1 pagePag-Ibig Loyalty Card Plus Account Holder'S Contact Details Change Request FormBreahziel ParillaNo ratings yet

- Pagibig ListDocument1 pagePagibig ListBreahziel ParillaNo ratings yet

- Pag-Ibig Loyalty Card Plus Account Holder'S Contact Details Change Request FormDocument2 pagesPag-Ibig Loyalty Card Plus Account Holder'S Contact Details Change Request FormBreahziel ParillaNo ratings yet

- Chapter 4 Market Equlibrium PDFDocument12 pagesChapter 4 Market Equlibrium PDFAiman DanielNo ratings yet

- Generation and Screening of Ideas ProjectDocument17 pagesGeneration and Screening of Ideas ProjectCharu ModiNo ratings yet

- TpaDocument40 pagesTpadeepankarkatNo ratings yet

- IMT Assignments For All SubjectsDocument170 pagesIMT Assignments For All SubjectsSUNSHINE TEAHOUSENo ratings yet

- Iffco-Tokio General Insurance Co. LTD: Corporate Identification Number (CIN) U74899DL2000PLC107621, IRDA Reg. No. 106Document2 pagesIffco-Tokio General Insurance Co. LTD: Corporate Identification Number (CIN) U74899DL2000PLC107621, IRDA Reg. No. 106Michael KrishnaNo ratings yet

- Emotion Drives Investor DecisionsDocument1 pageEmotion Drives Investor DecisionsTori PatrickNo ratings yet

- AvianCorp Fall 2013Document2 pagesAvianCorp Fall 2013braveusmanNo ratings yet

- Visitor No: 2621224 Dated: 23:jul:2014: Answ ErDocument1 pageVisitor No: 2621224 Dated: 23:jul:2014: Answ ErChandanMatoliaNo ratings yet

- Managerial Level Ias - 8 Financial Accounting: From The Desk of Ghulam Mustafa (FCMA), M.A. EconomicsDocument4 pagesManagerial Level Ias - 8 Financial Accounting: From The Desk of Ghulam Mustafa (FCMA), M.A. EconomicsSundus HussainNo ratings yet

- Dissertation Topics On Financial CrisisDocument6 pagesDissertation Topics On Financial CrisisWebsiteThatWillWriteAPaperForYouSingapore100% (1)

- SFM NotesDocument15 pagesSFM NotesAakash JohnsNo ratings yet

- N. Whitehall 2024 Proposed BudgetDocument12 pagesN. Whitehall 2024 Proposed BudgetLVNewsdotcomNo ratings yet

- The Mock SBR Sept 19 Q PDFDocument6 pagesThe Mock SBR Sept 19 Q PDFEhsanulNo ratings yet

- BPI US Equity Feeder Fund Latest DisclosureDocument3 pagesBPI US Equity Feeder Fund Latest DisclosureJelor GallegoNo ratings yet

- Lecture 1 - 2Document70 pagesLecture 1 - 2premsuwaatiiNo ratings yet

- Chapter7-Stock Price Behavior & Market EfficiencyDocument9 pagesChapter7-Stock Price Behavior & Market Efficiencytconn8276No ratings yet

- XLBC FactsDocument24 pagesXLBC FactsMutimbaNo ratings yet

- Leverage: Navin Khandelwal FCA, DISADocument41 pagesLeverage: Navin Khandelwal FCA, DISAsaiNo ratings yet

- Databook Planning CommissionDocument292 pagesDatabook Planning CommissionSandeep KotaNo ratings yet

- FM 100 Cash Flow AnalysisDocument31 pagesFM 100 Cash Flow AnalysisChaiiNo ratings yet

- Sir. Shabir Ahmad Tariq Aziz: Supervised byDocument52 pagesSir. Shabir Ahmad Tariq Aziz: Supervised byMohib Ullah YousafzaiNo ratings yet

- Dwnload Full Business and Professional Ethics For Directors Executives Accountants 8th Edition Brooks Test Bank PDFDocument36 pagesDwnload Full Business and Professional Ethics For Directors Executives Accountants 8th Edition Brooks Test Bank PDFmetiers2155100% (21)

- Chapter 13.Document6 pagesChapter 13.perdana findaNo ratings yet

- 201741795654bhakti Gems DPDocument245 pages201741795654bhakti Gems DPmanugeorgeNo ratings yet

- Case Study Finding WACC For A Project BoltaDocument1 pageCase Study Finding WACC For A Project BoltaebeNo ratings yet

- Initial Report October 22Th, 2007: Analyst: Victor Sula, PHDDocument20 pagesInitial Report October 22Th, 2007: Analyst: Victor Sula, PHDbeacon-docsNo ratings yet