Professional Documents

Culture Documents

GSTR - 3B: Made by - Youngster Ctpa

GSTR - 3B: Made by - Youngster Ctpa

Uploaded by

Rohan SakiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GSTR - 3B: Made by - Youngster Ctpa

GSTR - 3B: Made by - Youngster Ctpa

Uploaded by

Rohan SakiCopyright:

Available Formats

0

GSTR - 3B

Name: JAGDISH KUMAR HIRALAL FINANCIAL YEAR 2022-2023

Address: 47/2 PARSI MOHALLA CHAWANI

QTR / MONTH JAN-MARCH

GSTIN: Last Date

Registerd Email ID jagdish_saki@yahoo.com

Registerd Mobile Number 9425351768

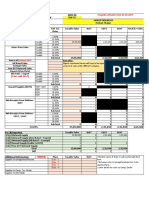

3.1 OUTWARD SUPPLY DETAIL

S. Basic Value Basic Value IGST CGST SGST CESS Total

DESCRIPTION

No. (1)(MP) (2)(OMP) (3) (4) (5) (6) (7)=( 1 to 6)

3.1 OUTWARD TAXABLE SUPPLY

1 Tax Free supply 808983 0 808983

2 Exempted supply 0 0 0

3 EXPORT / SEZ 0 0 0 0

4 Other Outward Supply (Other than 1, 2, 3)

a 0.25% 0 0 0 0 0 0

b 3% 0 0 0 0 0 0 0

c 5% 0 0 0 0 0 0 0

d 12% 0 0 0 0 0 0 0

e 18% 0 0 0 0 0 0 0

f 28% 0 0 0 0 0 0 0

A TOTAL 0 0 0 0 0 0

5 Inward Supply (RCM) 9(3,4) URP

a 0.25% 0 0 0 0 0 0 0

b 3% 0 0 0 0 0 0 0

c 5% 0 0 0 0 0 0 0

d 12% 0 0 0 0 0 0 0

e 18% 0 0 0 0 0 0 0

f 28% 0 0 0 0 0 0 0

B TOTAL 808983 0 0 0 0 0 808983

Non GST SUPPLY

6 Petroleum Crude, Petrol, Diesel, Natural Gas, Aviation 0 0 0

Turbine Fuel, Liquor

7 TOTAL (A+B) 0 0 0 0 0 0 0

MADE BY - YOUNGSTER CTPA

3.2 INTERSTATE SUPPLLIES Place of Supply(state name) Total Taxable Value Amount of IGST

8 Unregistered Persons 0 0

9 Composition taxable Persons 0 0

10 UIN Holders 0 0

11 TOTAL 0 0

* Total Taxable Supply = Value of Invoices+ Debit Notes - Value of Credit Note + Value of Advances Received - Value of advance adjusted

against invoices.

4 ELIGIBLE ITC ON PURCHASES

INWARD TAXABLE SUPPLY

S. Basic Value Basic Value IGST CGST SGST CESS Total

DESCRIPTION

No. (1)(MP) (2)(OMP) (3) (4) (5) (6) (7)=(1 TO 6)

(A) ITC Avaliable (Full OR Part)

12 Import of Goods /Services * 0 0 0 0

a 0.25% 0 0.00 0 0.00

b 3% 0 0 0 0

c 5% 0 0 0 0

d 12% 0 0 0 0

e 18% 0 0 0 0

f 28% 0 0 0 0

Inward supplies Liable to reverse charge

13 0 0 0 0 0 0 0

(RCM) **

14 Inward supplies from ISD 0 0 0 0 0 0 0

15 All Other ITC (INTRA / INTER)

a 0.25% 0 0 0 0 0 0 0

b 3% 0 0 0 0 0 0 0

c 5% 0 0 0 0 0 0 0

d 12% 0 0 0 0 0 0 0

e 18% 0 0 0 0 0 0 0

f 28% 0 0 0 0 0 0 0

g Other ITC (Other than 15(a to g)) 0 0 0 0 0 0 0

16 TOTAL 0 0 0.00 0 0 0 0

(B) ITC Reversed

17 As per Rule 42 (Tax free + Taxable) 0.00 0 0 0.00 0.00 0 0

18 As per Rule 43 (Capital Goods) 0 0 0 0 0 0 0.00

19 Other 0 0 0 0 0 0 0.00

20 TOTAL 0.00 0 0 0.00 0.00 0 0

(C) Net ITC Available A - B 0 0 0 0 0 0 0

(D) Ineligible ITC

21 As per Section 17(5) *** 0 0 0 0 0 0 0.00

22 Other 0 0 0 0 0 0 0.00

23 TOTAL ITC CAN BE AVAIL 0 0 0 0 0 0 0

* ONLY OUT OF INDIA PURCHASES/SERVICES *** S. 17(5) LIST ARE ENCLOSED HEREWITH

** REVERSE CHARGE MECHANISIM LIST (RCM)

Value of Exempted, Nil Rated, and Non-

5 LOCAL (WITHIN MP) INTERSTATE (OUT OF MP)

GST Inward Supplies

24 Exempted Inward 769193 0

25 Nil rated Inward 0 0

26 Inward from Composition Person 0 0

27 Non - GST Supply 0 0 PETROL/DIESEL

28 TOTAL 769193 0

MADE BY - YOUNGSTER CTPA

You might also like

- Group 3 Country - Attractiveness - SpreadsheetDocument8 pagesGroup 3 Country - Attractiveness - Spreadsheetbruno ahosseyNo ratings yet

- Amway Profit CalculatorDocument3 pagesAmway Profit CalculatormohanpyNo ratings yet

- Health Insurance Off The GridDocument163 pagesHealth Insurance Off The GridDaryl Kulak100% (4)

- 1Document2 pages1Your MaterialsNo ratings yet

- Program Summary Report 2018 10/8/2018Document6 pagesProgram Summary Report 2018 10/8/2018Jeff NixonNo ratings yet

- Hasil Aasesmen 1Document1 pageHasil Aasesmen 1Mila SafanaNo ratings yet

- Equity Portfolio TemplateDocument6 pagesEquity Portfolio TemplatePpNo ratings yet

- FORM 3 2022 ScoresheetDocument35 pagesFORM 3 2022 Scoresheetrawaida_hayaniNo ratings yet

- 2020 Indikator Mutu IPSG 6B Patien Resiko JatuhDocument17 pages2020 Indikator Mutu IPSG 6B Patien Resiko JatuhLeny NopiyantiNo ratings yet

- Nishant Thakur GSTR3B Feb22Document3 pagesNishant Thakur GSTR3B Feb22VIDHI SINGHNo ratings yet

- State FY21-22 Budget Presentation FormatDocument18 pagesState FY21-22 Budget Presentation FormatVivek Vishal GiriNo ratings yet

- KPI S Planta IH SULLANA 2020Document7 pagesKPI S Planta IH SULLANA 2020Emilio GarciaNo ratings yet

- Model Cerere InstantaDocument49 pagesModel Cerere InstantaDiaconu FlorinNo ratings yet

- My StockDocument7 pagesMy Stockgemi nuramdhianiNo ratings yet

- The GM New Vehicle Tire WarrantyDocument12 pagesThe GM New Vehicle Tire WarrantyfghdNo ratings yet

- Project Tracker TemplateDocument9 pagesProject Tracker TemplateKarla Moya ZuñigaNo ratings yet

- Daftar Tingkat Kebutuhan Tenaga Perawat Ruang Perawatan Rsud NgimbangDocument17 pagesDaftar Tingkat Kebutuhan Tenaga Perawat Ruang Perawatan Rsud NgimbangNGIMBANGNo ratings yet

- Tính điểm thi GPADocument12 pagesTính điểm thi GPANalinthone NiNo ratings yet

- Nivel Socioeconomico: PacientesDocument3 pagesNivel Socioeconomico: PacientesAlexander Araujo TerronesNo ratings yet

- NPV Irr PracticeDocument3 pagesNPV Irr PracticeNazar FaridNo ratings yet

- Payment Certificate With Advance Payment Fidic Rules 14.2 A, BDocument3 pagesPayment Certificate With Advance Payment Fidic Rules 14.2 A, BSalama ShurrabNo ratings yet

- 爱企查Document1 page爱企查王强No ratings yet

- Guru ShreeDocument1 pageGuru ShreeNiyati MakwanaNo ratings yet

- FormatDocument72 pagesFormatVish PatilNo ratings yet

- Borang PENTAKSIRAN PENUH ENGLISHDocument23 pagesBorang PENTAKSIRAN PENUH ENGLISHJamunaCinyoraNo ratings yet

- Expected CGPA and Percentage ConverterDocument4 pagesExpected CGPA and Percentage ConverterVishal SairamNo ratings yet

- General Basement BoqDocument82 pagesGeneral Basement BoqMuarleedharan RajanNo ratings yet

- Summary Progrees Report FormatDocument8 pagesSummary Progrees Report FormatChobwe Stephano KanyinjiNo ratings yet

- Analisis Item Form 1-3 TEMPLATEDocument5 pagesAnalisis Item Form 1-3 TEMPLATEAnnie ChengNo ratings yet

- January 2012 Projected Units For Awarding (Site Max. Unit Recommendation) ER GB-RHDocument5 pagesJanuary 2012 Projected Units For Awarding (Site Max. Unit Recommendation) ER GB-RHJuryl ZacariasNo ratings yet

- HC Autogenerate Menengah Atas (Panitia)Document23 pagesHC Autogenerate Menengah Atas (Panitia)Chaa2003No ratings yet

- Bangladesh Budget Insight - FY'21Document21 pagesBangladesh Budget Insight - FY'21Muhammad NasirNo ratings yet

- X Y Nudo GLH: CoordenadasDocument23 pagesX Y Nudo GLH: CoordenadasHenry Blandon PentecostalNo ratings yet

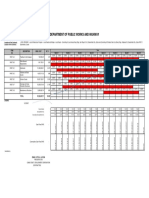

- Department of Public Works and Highway: Contract I.D. Location of The Contract: Location of The ContractDocument1 pageDepartment of Public Works and Highway: Contract I.D. Location of The Contract: Location of The ContractAdrian Louie Laganzo AquinoNo ratings yet

- Monthly Accident Report JAN - DEC 2018Document2 pagesMonthly Accident Report JAN - DEC 2018PetrusNo ratings yet

- Unspec Sumatera TGL 26062024 New 1Document14 pagesUnspec Sumatera TGL 26062024 New 1Rs kN (RskN)No ratings yet

- Daily Report @own ProjectDocument6 pagesDaily Report @own Projectsamir ranjan dhalNo ratings yet

- Queues ReportDocument6 pagesQueues Reportofek VakninNo ratings yet

- Asphalt Surfaced Roads and Parking Lots Condition Survey Data Sheet For Sample UnitDocument45 pagesAsphalt Surfaced Roads and Parking Lots Condition Survey Data Sheet For Sample UnitRicardo Enrique MorenoNo ratings yet

- Istiqomah Ibadah: Select A Period To Highlight at Right. A Legend Describing The Charting FollowsDocument4 pagesIstiqomah Ibadah: Select A Period To Highlight at Right. A Legend Describing The Charting FollowsSyeipto DarlinsyahNo ratings yet

- DADGAD - My Wintergreen 1Document2 pagesDADGAD - My Wintergreen 1Peter HeijnenNo ratings yet

- SUBEXLTD - Investor Presentation - 01-Feb-22 - TickertapeDocument37 pagesSUBEXLTD - Investor Presentation - 01-Feb-22 - TickertapeleoharshadNo ratings yet

- Design Tender21092007Document13 pagesDesign Tender21092007saurabhjerps231221No ratings yet

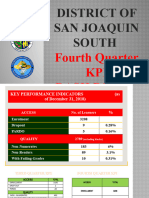

- 4 KPI Final Presentation 2019Document25 pages4 KPI Final Presentation 2019Vicky SongcuyaNo ratings yet

- TCL So Good Food-Routing 03-28 21 - 04Document162 pagesTCL So Good Food-Routing 03-28 21 - 04Syahari Jayadi SaputraNo ratings yet

- Test Categ Color Change MacroDocument1 pageTest Categ Color Change MacroDMurray3No ratings yet

- This Work Is Licensed Under The Creative Commons Attribution-Noncommercial 3.0 Singapore LicenseDocument24 pagesThis Work Is Licensed Under The Creative Commons Attribution-Noncommercial 3.0 Singapore LicenseFrancesco ZucchettoNo ratings yet

- Plantilla MantenimientoDocument26 pagesPlantilla MantenimientoAaron AltamiranoNo ratings yet

- Bulan: 400,000 Tanggal Saldo % Target ProfitDocument5 pagesBulan: 400,000 Tanggal Saldo % Target ProfitUria Pampang WitoNo ratings yet

- Queues ReportDocument6 pagesQueues Reportofek VakninNo ratings yet

- Sunflower - Paddy Sun (Edited by Tùng A.G. Jul 21, 2012)Document13 pagesSunflower - Paddy Sun (Edited by Tùng A.G. Jul 21, 2012)The PlaysZNo ratings yet

- Unspec Sumatera TGL 30062024 NewDocument14 pagesUnspec Sumatera TGL 30062024 NewRs kN (RskN)No ratings yet

- Credit NoteDocument1 pageCredit NoteShaik NoorshaNo ratings yet

- Irr ChartDocument2 pagesIrr ChartajeetpatelNo ratings yet

- Laporan Icd 10Document4 pagesLaporan Icd 10farishiltNo ratings yet

- Amanjeet General Store: HSN Product Name Pack Case Rate Net Amt S.N Unit SCH CD M.R.P. Taxable Free AmountDocument1 pageAmanjeet General Store: HSN Product Name Pack Case Rate Net Amt S.N Unit SCH CD M.R.P. Taxable Free Amountali warsiNo ratings yet

- Latihan IRR Dan NPV: Tahun Ke 0 1 2 3 4 5 6 7Document14 pagesLatihan IRR Dan NPV: Tahun Ke 0 1 2 3 4 5 6 7Samuel WuNo ratings yet

- TCL So Good Food-Routing 03-28 21 - 04Document162 pagesTCL So Good Food-Routing 03-28 21 - 04Syahari Jayadi SaputraNo ratings yet

- Queues ReportDocument6 pagesQueues Reportofek VakninNo ratings yet

- Technical TradingDocument31 pagesTechnical TradingJonathan SpeessenNo ratings yet

- C++ Exception Handling: AdvantageDocument7 pagesC++ Exception Handling: AdvantageRohan SakiNo ratings yet

- C++ Oops Concepts: Oops (Object Oriented Programming System)Document16 pagesC++ Oops Concepts: Oops (Object Oriented Programming System)Rohan SakiNo ratings yet

- Advantage of C++ InheritanceDocument5 pagesAdvantage of C++ InheritanceRohan SakiNo ratings yet

- InternshipDocument2 pagesInternshipRohan SakiNo ratings yet

- Business To Consumer (B2CL) : Sales ListDocument237 pagesBusiness To Consumer (B2CL) : Sales ListRohan SakiNo ratings yet

- UntitledDocument1 pageUntitledRohan SakiNo ratings yet

- PPVFR Act 2001Document4 pagesPPVFR Act 2001Rohan SakiNo ratings yet

- CNADocument2 pagesCNARohan SakiNo ratings yet

- Banking Law Crash Course LLBDocument109 pagesBanking Law Crash Course LLBRohan SakiNo ratings yet

- Assessment LLB 5 SEM Reg. - Ex - AtktDocument4 pagesAssessment LLB 5 SEM Reg. - Ex - AtktRohan SakiNo ratings yet

- NUST Business School: ECO 215 Fundamentals of Econometrics Assignment 2Document11 pagesNUST Business School: ECO 215 Fundamentals of Econometrics Assignment 2Asadullah SherNo ratings yet

- Industrial Training at Traco Cables Company Limited: Cochin University College of Engineering KUTTANADU-637215Document30 pagesIndustrial Training at Traco Cables Company Limited: Cochin University College of Engineering KUTTANADU-637215Vimal SudhakaranNo ratings yet

- (Torts) Perez vs. PomarDocument4 pages(Torts) Perez vs. PomarFaye Cience Bohol100% (1)

- BCI Moves Plea Urging SC To Direct Govt To Provide Interest-Free Loans Up To Rs 3 Lakhs Each For Lawyers in Need Due To COVID-19Document36 pagesBCI Moves Plea Urging SC To Direct Govt To Provide Interest-Free Loans Up To Rs 3 Lakhs Each For Lawyers in Need Due To COVID-19JAGDISH GIANCHANDANINo ratings yet

- People Vs SendaydiegoDocument22 pagesPeople Vs SendaydiegoryuseiNo ratings yet

- Kel IV ReportDocument18 pagesKel IV ReportAnoopAsokan0% (1)

- Classification of MSME in IndiaDocument7 pagesClassification of MSME in Indiaaishu patilNo ratings yet

- Tubacex Group 131Document20 pagesTubacex Group 131Khobeb MuslimNo ratings yet

- 0LB - Unilever's Lifebuoy Assignment (A&b) - WrittenDocument3 pages0LB - Unilever's Lifebuoy Assignment (A&b) - WrittenMonil Chheda100% (1)

- PAT 2 Obligations of Partners Among ThemselvesDocument132 pagesPAT 2 Obligations of Partners Among ThemselvesPamela Nicole ManaloNo ratings yet

- S2A F Datasheet en GBDocument4 pagesS2A F Datasheet en GBAzhar AliNo ratings yet

- ISPS Code - A Measure To Enhance The Security of Ships and Port FacilitiesDocument11 pagesISPS Code - A Measure To Enhance The Security of Ships and Port FacilitiesGiorgi KandelakiNo ratings yet

- Jntuk MT Feb 2016 - 2Document15 pagesJntuk MT Feb 2016 - 2MhappyCuNo ratings yet

- BANAT V COMELEC G.R. No. 179271 April 21, 2009Document2 pagesBANAT V COMELEC G.R. No. 179271 April 21, 2009abethzkyyyyNo ratings yet

- Ariesogeo BR Nse Ae - 0Document2 pagesAriesogeo BR Nse Ae - 0Martine OneNo ratings yet

- Wine Marketing PlanDocument17 pagesWine Marketing PlanAdib M Basbous100% (2)

- Video Production TimelineDocument1 pageVideo Production TimelineLeisuread 2No ratings yet

- Doing Business in IndiaDocument20 pagesDoing Business in IndiarasheedNo ratings yet

- United States v. Syed Ali Abrar, 58 F.3d 43, 2d Cir. (1995)Document7 pagesUnited States v. Syed Ali Abrar, 58 F.3d 43, 2d Cir. (1995)Scribd Government DocsNo ratings yet

- Surface Defects in Steel ProductsDocument41 pagesSurface Defects in Steel ProductsShilaj PNo ratings yet

- Law On Treaties Group 4Document51 pagesLaw On Treaties Group 4Seyre Eser ArymNo ratings yet

- Tenggara Backgrounder 2023 Jun 09 1 sPNFol6RDocument20 pagesTenggara Backgrounder 2023 Jun 09 1 sPNFol6RAlisa Syakila MaharaniNo ratings yet

- Limpiador de Serpetin Alkifoam Parker Virgina - MsdsDocument2 pagesLimpiador de Serpetin Alkifoam Parker Virgina - MsdsJessikAraceltyNo ratings yet

- EE 341 Lab 4Document8 pagesEE 341 Lab 4EmilyNo ratings yet

- Embedded Systems Design Flow Using Altera's FPGA Development Board (DE2-115 T-Pad)Document107 pagesEmbedded Systems Design Flow Using Altera's FPGA Development Board (DE2-115 T-Pad)john smithNo ratings yet

- RPU12W0C Restore Wage Types After UpgradDocument5 pagesRPU12W0C Restore Wage Types After Upgradyeison baqueroNo ratings yet

- Vinyl Ester Epovia Data SheetDocument32 pagesVinyl Ester Epovia Data SheetAmjad MehmoodNo ratings yet