Professional Documents

Culture Documents

Case Study Team 12

Case Study Team 12

Uploaded by

Vidya Hegde KavitasphurtiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Study Team 12

Case Study Team 12

Uploaded by

Vidya Hegde KavitasphurtiCopyright:

Available Formats

Financial Management - Assignment

Team No. : 12

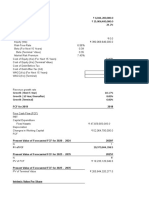

Case A

Name Ramesh

Age 45

Present Bank Balance 600000

Work till 60

Present salary 400000

Growth rate 12%

Time Period 15%

Rate 10%(7%+13%/2)

1.Value of investments at the age of 60 years

Cashflow 500000

N 15

rate 10%

Present Value ₹ 41,83,343.73

2. The value of 1000000 after 15 years

N 15

Rate 10%

FV 100000

PV ₹ 8,36,668.75

At the age of 60 he should have ₹ 50,20,012.47

How much should Ramesh save each year for the next 15 years?

Rate 10%

PV 600000

FV ₹ 50,20,012.47

PMT ₹ 79,114.49

How much money would he need when he reaches the age of 60 to meet this specific need?

200000 withdrawal for charitable cause

N 3

Rate 10%

PMT 200000

FV 0

PV ₹ 5,47,107.44

How much cash we should have at 60

N 13

Rate 10%

PMT 0

FV 547107.44

PV ₹ 1,58,477.54

Case B

Monthly Payment for MBA 1st Year Expenditure ₹ 19,205.25

Monthly Payment for MBA 2nd Year Expenditure ₹ 22,129.76

Compounding Quarterly Payment Monthly (Gradual) Annuity Calculations

Current MBA 1st Year Expenditure ₹ 20,00,000.00

Current MBA 2nd Year Expenditure ₹ 25,00,000.00

Years to MBA 1st Year 10

Years to MBA 2nd Year 11

MBA Expense Growth Rate 5%

Nominal Interest Rate 8%

Compounding per Year 4

Monthly Payments per year 12

Effective Monthly Rate 0.66%

Monthly Payment for MBA 1st Year Expenditure ₹ 19,205.25

Answer (i) Monthly Payment for MBA 2nd Year Expenditure ₹ 22,129.76

Amount Required for Jasleen Wedding ₹ 3,00,00,000.00

Years to wedding 20

Answer (ii) Amount needed for fixed deposit ₹ 61,53,291.84

Annual expenditure after 10 years ₹ 12,00,000.00

Years for Fixed deposit 10

Annuity Interest Rate 10%

Inflation Rate 5%

Amount needed after 10 years ₹ 81,10,828.58

Answer (iii) Monthly Annuity ₹ 58,095.75

You might also like

- Group Case 3 - It's Better Late Than NeverDocument8 pagesGroup Case 3 - It's Better Late Than NeverHannahPojaFeria0% (1)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- 30 Questions: MGT 303 Pricing Money Market Instruments IIDocument28 pages30 Questions: MGT 303 Pricing Money Market Instruments IIFelixNo ratings yet

- Safal Niveshak Mastermind Free ChaptersDocument31 pagesSafal Niveshak Mastermind Free Chaptersthisispraveen100% (2)

- Professional Personal ChefDocument225 pagesProfessional Personal ChefPaulo Castelhano100% (10)

- Business Applications of Measure of Central TendencyDocument2 pagesBusiness Applications of Measure of Central TendencyVidya Hegde Kavitasphurti100% (2)

- VivendiDocument32 pagesVivendiSowmiya KangeyaniNo ratings yet

- Types of Risk Systematic and Unsystematic Risk in FinanceDocument8 pagesTypes of Risk Systematic and Unsystematic Risk in FinanceKrishna Prince M M100% (1)

- Assignment 01 FMDocument8 pagesAssignment 01 FMChinky JaiswalNo ratings yet

- Cia FMDocument5 pagesCia FMYASHASWI 20212166No ratings yet

- Time ValueDocument29 pagesTime ValueAditya BapnaNo ratings yet

- FIN545 Time ValueDocument19 pagesFIN545 Time ValuemayankNo ratings yet

- NMHYDWM072Document18 pagesNMHYDWM072SHAWKATMANZOORNo ratings yet

- PGPM 2021 Time Value Problem SetDocument20 pagesPGPM 2021 Time Value Problem SetPRONOY ROYNo ratings yet

- FM301 CaseDocument23 pagesFM301 CaseSIDDHART BHANSALINo ratings yet

- CFPDocument5 pagesCFPHARSHITA DEVNANINo ratings yet

- SBR 1 Group 2Document6 pagesSBR 1 Group 2Ankit JindalNo ratings yet

- Ba 540 (HW1) Osuid 934268766Document6 pagesBa 540 (HW1) Osuid 934268766MariaNo ratings yet

- BA 540 (Homework-1)Document6 pagesBA 540 (Homework-1)MariaNo ratings yet

- Ans 1 Future Value of Annuity ProblemDocument4 pagesAns 1 Future Value of Annuity ProblemParth Hemant PurandareNo ratings yet

- HEMANT PracticeDocument24 pagesHEMANT Practicegoel.animesh105No ratings yet

- Current Value of Portfolio 0 Monthly SIP Amount 10000 Rate (%) 14% Period of Investment (In Years) 20 Type (Begin - 1, End - 0) 1Document10 pagesCurrent Value of Portfolio 0 Monthly SIP Amount 10000 Rate (%) 14% Period of Investment (In Years) 20 Type (Begin - 1, End - 0) 1Subhana NasimNo ratings yet

- Finance Exam ToolkitDocument14 pagesFinance Exam ToolkitAshish PatwardhanNo ratings yet

- NMHYDWM004Document31 pagesNMHYDWM004SHAWKATMANZOORNo ratings yet

- Account ADocument7 pagesAccount ADr. VinothNo ratings yet

- Interest Rate (Pa) : 0.08 Compound Periods: 4 Number of Years: 5Document5 pagesInterest Rate (Pa) : 0.08 Compound Periods: 4 Number of Years: 5SGNo ratings yet

- ExcelDocument4 pagesExcelTrần Thị Diễm QuỳnhNo ratings yet

- Present Value Basics - StudentDocument22 pagesPresent Value Basics - Studentsaumil shahNo ratings yet

- IBS Session 1 With SolutionDocument16 pagesIBS Session 1 With SolutionMOHD SHARIQUE ZAMANo ratings yet

- HandoutsDocument32 pagesHandoutsShiba ShankarNo ratings yet

- FPWM ClassesDocument14 pagesFPWM Classesshashank dhruvNo ratings yet

- Final SumsDocument12 pagesFinal SumsMaryNo ratings yet

- Time Value of Money in Excel - Workshop 1: Name: Name: Name: NameDocument16 pagesTime Value of Money in Excel - Workshop 1: Name: Name: Name: NameFranco GuaragnaNo ratings yet

- Question Set TVMDocument17 pagesQuestion Set TVMAnju VijayNo ratings yet

- Project Report: OF Luxus InnDocument28 pagesProject Report: OF Luxus InnTanmay RakshitNo ratings yet

- WPC Assignment - FM CaseDocument6 pagesWPC Assignment - FM CaseAhmed AliNo ratings yet

- Time Value of Money FV Solution (1 Solution)Document6 pagesTime Value of Money FV Solution (1 Solution)Manroop SinghNo ratings yet

- Session 10 Finance Formula Cheat SheetDocument16 pagesSession 10 Finance Formula Cheat Sheetpayal mittalNo ratings yet

- Net Present Value MethodDocument3 pagesNet Present Value Methodmaha SriNo ratings yet

- The Time Value of MoneyDocument58 pagesThe Time Value of MoneyvijayluckeyNo ratings yet

- IMP QuestionsDocument3 pagesIMP Questionsed21b014No ratings yet

- Asset v1 IMF+FMAx+2T2017+Type@Asset+Block@M0 Assessments Activity v2Document12 pagesAsset v1 IMF+FMAx+2T2017+Type@Asset+Block@M0 Assessments Activity v2Nguyễn Trần Thuỳ LinhNo ratings yet

- W6Exercises 180318amparoDocument5 pagesW6Exercises 180318amparoJosephAmparoNo ratings yet

- Example Future Value of Ordinary Simple AnnuityDocument12 pagesExample Future Value of Ordinary Simple AnnuityFashion EleganceNo ratings yet

- Solutions To Problems - Chapter 6 Mortgages: Additional Concepts, Analysis, and ApplicationsDocument11 pagesSolutions To Problems - Chapter 6 Mortgages: Additional Concepts, Analysis, and ApplicationsJonnabeth BondeNo ratings yet

- The Correct Answer Is: 4731Document21 pagesThe Correct Answer Is: 4731nishiNo ratings yet

- I Am Planning To Buy A Car in Next 5 Years. I Would Require 40 Lakh Rupees For The SameDocument3 pagesI Am Planning To Buy A Car in Next 5 Years. I Would Require 40 Lakh Rupees For The SameKameshNo ratings yet

- Ifp Ut 6BDocument26 pagesIfp Ut 6BnishiNo ratings yet

- Managerial Economics - Practice 2Document9 pagesManagerial Economics - Practice 2nhidiepnguyet08112004No ratings yet

- Deferred AnnuityDocument1 pageDeferred Annuityjaine ylevrebNo ratings yet

- Deferred AnnuityDocument1 pageDeferred Annuityjaine ylevrebNo ratings yet

- Week 2 Assignment FNCE UCWDocument14 pagesWeek 2 Assignment FNCE UCWamyna abhavaniNo ratings yet

- Finance New 1Document5 pagesFinance New 1KashémNo ratings yet

- Capital Budgeting-2Document48 pagesCapital Budgeting-2Adarsh Singh RathoreNo ratings yet

- F Bond Valuation Workings in Class and Solutions 1sGM0gfKLuDocument34 pagesF Bond Valuation Workings in Class and Solutions 1sGM0gfKLudffdf fdfgNo ratings yet

- Financial Literacy and Other PresentationsDocument13 pagesFinancial Literacy and Other PresentationsMax MaxaNo ratings yet

- (DP Period) : Bank Financing (Drawdown 30 Days After 1st 10% DP)Document4 pages(DP Period) : Bank Financing (Drawdown 30 Days After 1st 10% DP)Rose AnnNo ratings yet

- Iar 2Document112 pagesIar 2David Roderick PirihNo ratings yet

- Class Problems Chapter 6 - Haryo IndraDocument3 pagesClass Problems Chapter 6 - Haryo IndraHaryo HartoyoNo ratings yet

- Project Activity 1Document14 pagesProject Activity 1Maria Camila Fuentes ReyesNo ratings yet

- Time ValueDocument24 pagesTime ValueAditya BapnaNo ratings yet

- Ba540 HW1Document3 pagesBa540 HW1MariaNo ratings yet

- CiplaDocument9 pagesCiplaShivam GoelNo ratings yet

- PERMALINO - Learning Activity 20. Capital Budgeting TechniquesDocument2 pagesPERMALINO - Learning Activity 20. Capital Budgeting TechniquesAra Joyce PermalinoNo ratings yet

- Time Value of Money Q. & Ans. For Practical (Financial Literacy)Document8 pagesTime Value of Money Q. & Ans. For Practical (Financial Literacy)ishubhy111No ratings yet

- UntitledDocument475 pagesUntitledVidya Hegde KavitasphurtiNo ratings yet

- Japan's Ageing SocietyDocument10 pagesJapan's Ageing SocietyVidya Hegde KavitasphurtiNo ratings yet

- Israel Macro Economic GDP, Inflation and Financial System Phase 1Document9 pagesIsrael Macro Economic GDP, Inflation and Financial System Phase 1Vidya Hegde KavitasphurtiNo ratings yet

- Even SEMESTER TimDocument1 pageEven SEMESTER TimVidya Hegde KavitasphurtiNo ratings yet

- Chapter-6 The Role of Financial Institutions in Ssi Development-An OverviewDocument94 pagesChapter-6 The Role of Financial Institutions in Ssi Development-An OverviewVidya Hegde KavitasphurtiNo ratings yet

- Visvesvaraya Technological University: Belagavi - 590 018, Karnataka State, INDIADocument1 pageVisvesvaraya Technological University: Belagavi - 590 018, Karnataka State, INDIAVidya Hegde KavitasphurtiNo ratings yet

- Calender'sDocument3 pagesCalender'sVidya Hegde KavitasphurtiNo ratings yet

- Mergers Acquisition and Corporate Restructuring PDFDocument15 pagesMergers Acquisition and Corporate Restructuring PDFVidya Hegde KavitasphurtiNo ratings yet

- Keywords: Social Cost Benefit Analysis-UNIDO Approach, Coal Plant, Hydro Plant, PowerDocument22 pagesKeywords: Social Cost Benefit Analysis-UNIDO Approach, Coal Plant, Hydro Plant, PowerVidya Hegde KavitasphurtiNo ratings yet

- Watershed Development Programmes in KarnatakaDocument31 pagesWatershed Development Programmes in KarnatakaVidya Hegde KavitasphurtiNo ratings yet

- Data Analytics in Human Resource A Case Study and Critical Review PDFDocument9 pagesData Analytics in Human Resource A Case Study and Critical Review PDFVidya Hegde Kavitasphurti100% (1)

- 06-Bhagavathavu - 10 Skanda-A PDFDocument423 pages06-Bhagavathavu - 10 Skanda-A PDFVidya Hegde KavitasphurtiNo ratings yet

- Strategic Management & Strategic Planning ProcessDocument23 pagesStrategic Management & Strategic Planning ProcessVidya Hegde KavitasphurtiNo ratings yet

- National Testing Agency (NTA) UGC-NET RESULT December, 2018: Click HereDocument1 pageNational Testing Agency (NTA) UGC-NET RESULT December, 2018: Click HereVidya Hegde KavitasphurtiNo ratings yet

- Managerial Economics: Geetika, Piyali Ghosh & Purbaroy ChoudhuryDocument3 pagesManagerial Economics: Geetika, Piyali Ghosh & Purbaroy ChoudhuryVidya Hegde KavitasphurtiNo ratings yet

- A Study On The Impact of Dividend Announcement On Stock PriceDocument9 pagesA Study On The Impact of Dividend Announcement On Stock PriceVidya Hegde KavitasphurtiNo ratings yet

- Strategic Brand ManagementDocument3 pagesStrategic Brand ManagementVidya Hegde KavitasphurtiNo ratings yet

- GlossaryDocument340 pagesGlossaryaryo_wbNo ratings yet

- Article On APMCsDocument2 pagesArticle On APMCsEnamul HaqueNo ratings yet

- Derivative+Market - Recent Trends ND Development, Future .Document25 pagesDerivative+Market - Recent Trends ND Development, Future .KARISHMAAT86% (7)

- Anf 5A Application Form For Epcg Authorisation IssueDocument6 pagesAnf 5A Application Form For Epcg Authorisation IssueBaljeet SinghNo ratings yet

- EM5 UNIT 3 INTEREST FORMULAS & RATES Part 2Document7 pagesEM5 UNIT 3 INTEREST FORMULAS & RATES Part 2MOBILEE CANCERERNo ratings yet

- KFC - Marketing ManagementDocument6 pagesKFC - Marketing ManagementJepSebadoNo ratings yet

- The Jap YenDocument13 pagesThe Jap YenRadhika KashyapNo ratings yet

- ACC 1202 INTRODUCTION TO ACCOUNTING II Open Book PTDocument3 pagesACC 1202 INTRODUCTION TO ACCOUNTING II Open Book PTChallieBoss100% (1)

- Cma QuizDocument2 pagesCma QuizKurt SoriaoNo ratings yet

- Chapter 11 331-339Document9 pagesChapter 11 331-339Anthon AqNo ratings yet

- Small Midcap Engineering DayDocument7 pagesSmall Midcap Engineering Daybhavesh32No ratings yet

- How Your SDCERS Benefits Are Affected by Returning To Work After You RetireDocument10 pagesHow Your SDCERS Benefits Are Affected by Returning To Work After You Retireapi-201256435No ratings yet

- MBA 511 (2) - Financial Management - Dr. Sumon DasDocument6 pagesMBA 511 (2) - Financial Management - Dr. Sumon DasdelowerNo ratings yet

- Rikkee Sbi3Document52 pagesRikkee Sbi3JaiHanumankiNo ratings yet

- Islami BankDocument36 pagesIslami Bankmoin06No ratings yet

- Primary DealersDocument3 pagesPrimary DealersJestin JosephNo ratings yet

- Syndicated LoansDocument12 pagesSyndicated LoansPriyanka AgarwalNo ratings yet

- Financials of PAFDocument26 pagesFinancials of PAFAbhishek PandaNo ratings yet

- Global Trust Bank NOW!! Oriental Bank OF COMMERCE?????Document28 pagesGlobal Trust Bank NOW!! Oriental Bank OF COMMERCE?????Vignesh HollaNo ratings yet

- Apprenticeships To Change The WorldDocument36 pagesApprenticeships To Change The WorldKhawaja SohailNo ratings yet

- Backus Valuation ExcelDocument28 pagesBackus Valuation ExcelAdrian MontoyaNo ratings yet

- Abn Amro Bank - Company ProfileDocument20 pagesAbn Amro Bank - Company ProfileSurpreet Singh PaviNo ratings yet

- Exam 1 MCDocument489 pagesExam 1 MCDesmanto HermanNo ratings yet

- Project Management & Its Applications MBCQ-724D FinalDocument310 pagesProject Management & Its Applications MBCQ-724D FinalamppoalNo ratings yet

- Group 14: Meet Mehta Umang Kumar Ayushi Jaiswal Ayon DasDocument18 pagesGroup 14: Meet Mehta Umang Kumar Ayushi Jaiswal Ayon DasUmang KNo ratings yet

- Ma. Elaisa G. Baugbog XI-Tokyo: English For Academic and Professional PurposesDocument1 pageMa. Elaisa G. Baugbog XI-Tokyo: English For Academic and Professional PurposesMaria Elaisa BaugbogNo ratings yet