Professional Documents

Culture Documents

Multiplying The Inventory at Retail by The Ratio of Cost To

Multiplying The Inventory at Retail by The Ratio of Cost To

Uploaded by

Max0 ratings0% found this document useful (0 votes)

7 views2 pagesThis document discusses calculating cost of goods sold using the retail method. It provides an example where beginning inventory, purchases, and goods available for sale are given at cost and retail prices. The ratio of cost to retail price is calculated as 62%. Ending inventory and cost of goods sold are then estimated using this ratio and the net sales figure. The document notes that while the actual cost percentage may vary between items, it is assumed the weighted average cost percentage of inventory is the same as for total goods available for sale. It cautions that different gross profit rates for different inventory classes require separate calculations.

Original Description:

Original Title

multiplying the inventory at retail by the ratio of cost to

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses calculating cost of goods sold using the retail method. It provides an example where beginning inventory, purchases, and goods available for sale are given at cost and retail prices. The ratio of cost to retail price is calculated as 62%. Ending inventory and cost of goods sold are then estimated using this ratio and the net sales figure. The document notes that while the actual cost percentage may vary between items, it is assumed the weighted average cost percentage of inventory is the same as for total goods available for sale. It cautions that different gross profit rates for different inventory classes require separate calculations.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views2 pagesMultiplying The Inventory at Retail by The Ratio of Cost To

Multiplying The Inventory at Retail by The Ratio of Cost To

Uploaded by

MaxThis document discusses calculating cost of goods sold using the retail method. It provides an example where beginning inventory, purchases, and goods available for sale are given at cost and retail prices. The ratio of cost to retail price is calculated as 62%. Ending inventory and cost of goods sold are then estimated using this ratio and the net sales figure. The document notes that while the actual cost percentage may vary between items, it is assumed the weighted average cost percentage of inventory is the same as for total goods available for sale. It cautions that different gross profit rates for different inventory classes require separate calculations.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

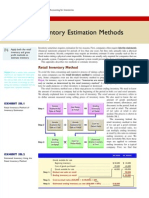

multiplying the inventory at retail by the ratio of cost to

selling (retail) price for the goods available for sale, also

the estimate of cost of goods sold is calculated by

multiplying the net sales at retail by the ratio of cost to

retail price or by deducting the ending inventory at

estimated cost from the cost of goods available for sale,

these estimate appears as follows:

Exhibit 9

Cost Retail

Beginning inventory, Jan 1 L.E 19,400 L.E 36,000

Purchases in January (net) 42,600 64,000

Goods available for sale L.E 62,000 L.E 100,000

Ratio of cost to retail price : = 62%

(-)

Sales in January (net) 70,000

Ending inventory, January 31. at retail (-) 30,000

Ending inventory, January 31, at estimated cost (

L. E 30000 x 62%)

L.E 18,600

Cost of goods sold or ( 70000 x 62% ) 43,400

L.E. 62000

L.E. 10000

Chapter Four: Inventories and the cost of goods sold

194

In terms of the percent of cost to selling price, the

mix of the items in the ending inventory is assumed to be

the same as the entire stock of merchandise available for

sale. In Exhibit 9 for example, it is unlikely that the retail

price of every item was composed of exactly 62% cost and

38% gross profit. It is assumed, however, that the weighted

average of the cost percentages of the merchandise in the

inventory (L.E 30000) is the same as in the merchandise

available for sale (L.E 100000). When the inventory is

made up of different classes of merchandise with very

different gross profit rates, the cost percentages and the

inventory should be developed for each class of inventory.

One of the major advantages of the retail method is

that it provides inventory figures for use in preparing

monthly or quarterly statements. Department stores and

similar merchandisers usually determine gross profit and

operating, income each month but take a physical inventory

only once a year. A comparison of the estimated ending

inventory with the physical ending inventory, both at retail

You might also like

- Unit 1 Cost-Volume - Profit Analysis (Cvp-Analysis) : Contribution Margin Versus Gross MarginDocument13 pagesUnit 1 Cost-Volume - Profit Analysis (Cvp-Analysis) : Contribution Margin Versus Gross MarginNigussie BerhanuNo ratings yet

- Math PracticeDocument3 pagesMath Practiceakmal_07No ratings yet

- Retail Inventory MethodDocument5 pagesRetail Inventory MethodEllaine CabalNo ratings yet

- Break Even AnalysisDocument4 pagesBreak Even Analysissatavahan_yNo ratings yet

- (At) 01 - Preface, Framework, EtcDocument8 pages(At) 01 - Preface, Framework, EtcCykee Hanna Quizo LumongsodNo ratings yet

- CVP AnalysisDocument3 pagesCVP AnalysisEjaz KhanNo ratings yet

- Management Accounting Individual AssignmentDocument10 pagesManagement Accounting Individual AssignmentendalNo ratings yet

- Cost Volume Profit Analysis For Paper 10Document6 pagesCost Volume Profit Analysis For Paper 10Zaira Anees100% (1)

- 2666Document3 pages2666MaxNo ratings yet

- Unit 2Document30 pagesUnit 2yebegashet100% (1)

- Unit 2: Inventories: Special Valuation Methods 2.0 Aims and ObjectivesDocument17 pagesUnit 2: Inventories: Special Valuation Methods 2.0 Aims and ObjectivesNesru SirajNo ratings yet

- Inventory LastDocument27 pagesInventory LastNigus AyeleNo ratings yet

- Assign Acc2Document5 pagesAssign Acc2Abule MogesNo ratings yet

- Inventory EstimationDocument4 pagesInventory EstimationShy Ng0% (1)

- Sales Mix VarianceDocument6 pagesSales Mix Variance'Qy Qizwa Andini'No ratings yet

- CVP Analysis F5 NotesDocument7 pagesCVP Analysis F5 NotesSiddiqua Kashif100% (1)

- CVP AnalysisDocument30 pagesCVP AnalysisBinyam Ayele100% (1)

- Inventory Accounting and ValuationDocument4 pagesInventory Accounting and ValuationFathi Salem Mohammed Abdullah100% (1)

- Accounting Excercises 2Document13 pagesAccounting Excercises 2Abdallah HassanNo ratings yet

- Retail Math'Sppt1Document40 pagesRetail Math'Sppt1nataraj105100% (9)

- Intercompany Profit Transactions - Inventories: Transactions Within The Affiliated GroupDocument60 pagesIntercompany Profit Transactions - Inventories: Transactions Within The Affiliated GroupPhil MO JoeNo ratings yet

- Mas 04 - CVP AnalysisDocument7 pagesMas 04 - CVP AnalysisCarl Angelo LopezNo ratings yet

- Lecture 1-2 Marginal Vs Absoption CostingDocument23 pagesLecture 1-2 Marginal Vs Absoption CostingAfzal AhmedNo ratings yet

- Commission and Other Selling CostsDocument2 pagesCommission and Other Selling CostsMaxNo ratings yet

- ACCT 340 - Ch9Notes - Withanswers-2Document5 pagesACCT 340 - Ch9Notes - Withanswers-2Alex MorrisonNo ratings yet

- Accounting English IIDocument14 pagesAccounting English IIJaprax LailyasNo ratings yet

- Managerial Accounting Exam CHDocument17 pagesManagerial Accounting Exam CH808kailuaNo ratings yet

- QuantiDocument18 pagesQuantiJoyceNo ratings yet

- ACC F3 Inventory Lecture NotesDocument17 pagesACC F3 Inventory Lecture NotesAbdullah ZakariyyaNo ratings yet

- Inventory Records CHA 1Document10 pagesInventory Records CHA 1cherinetNo ratings yet

- 12 - Lower of Cost and Net Realizable ValueDocument26 pages12 - Lower of Cost and Net Realizable Valuelheamaecayabyab4No ratings yet

- Cost VolumeDocument2 pagesCost VolumeChristieJoyCaballesParadelaNo ratings yet

- Methods of Estimating InventoryDocument46 pagesMethods of Estimating Inventoryone formanyNo ratings yet

- Man Acc Qs 1Document6 pagesMan Acc Qs 1Tehniat Zafar0% (1)

- Câu 32 Trong Hình Tao Gửi Sai Nên Ai Làm Phần Đó Nhớ Sửa LạiDocument11 pagesCâu 32 Trong Hình Tao Gửi Sai Nên Ai Làm Phần Đó Nhớ Sửa LạiNhu Le ThaoNo ratings yet

- Project Report: Dataset Used-Financial Analysis DatasetDocument3 pagesProject Report: Dataset Used-Financial Analysis Datasetmr.m0rn9ngst4rNo ratings yet

- Equilibrium in Short Run:: Marginal Revenue, Organizations Would Incur Losses, As Shown in Figure-3Document3 pagesEquilibrium in Short Run:: Marginal Revenue, Organizations Would Incur Losses, As Shown in Figure-3Akshay TeleNo ratings yet

- Intercompany Sale of InventoryDocument35 pagesIntercompany Sale of InventoryAudrey LouelleNo ratings yet

- 2016030f4150712chap 8 AssignmentDocument3 pages2016030f4150712chap 8 AssignmentReynante Dap-ogNo ratings yet

- Daily Management of Store OperationsDocument12 pagesDaily Management of Store OperationsDeepak KanojiaNo ratings yet

- Marketing Metrics - Chapter 3Document28 pagesMarketing Metrics - Chapter 3Hoang Yen NhiNo ratings yet

- Special Inventory Valuation Methods 4.1. Valuation at Lower of Cost or Market (LCM)Document6 pagesSpecial Inventory Valuation Methods 4.1. Valuation at Lower of Cost or Market (LCM)ashegemedeNo ratings yet

- Week 08 - 02 - Module 19 - Accounting For InventoriesDocument17 pagesWeek 08 - 02 - Module 19 - Accounting For Inventories지마리No ratings yet

- Accounting For InventoriesDocument29 pagesAccounting For InventoriesLakachew GetasewNo ratings yet

- Cost 2 ch4Document7 pagesCost 2 ch4Eid AwilNo ratings yet

- Kieso 15e SGV1 Ch09Document30 pagesKieso 15e SGV1 Ch09anilegna99No ratings yet

- AccountingDocument6 pagesAccountingVanessa Plata Jumao-asNo ratings yet

- Ch. 1 CVP Re RevDocument20 pagesCh. 1 CVP Re Revsolomon adamuNo ratings yet

- Sales VarianceDocument22 pagesSales VarianceTejitu AdebaNo ratings yet

- Inventory Turn Over RatioDocument2 pagesInventory Turn Over RatioRavi ShankarNo ratings yet

- Costing Principles: Absorption and Marginal CostingDocument4 pagesCosting Principles: Absorption and Marginal CostingPaul AmenyawuNo ratings yet

- Cost Volume Profit Analysis: F. M. KapepisoDocument19 pagesCost Volume Profit Analysis: F. M. KapepisosimsonNo ratings yet

- Break Even Point: Oleh Sugeng Wahyudi Prof - DR.HDocument18 pagesBreak Even Point: Oleh Sugeng Wahyudi Prof - DR.HPutri Andira SafitriNo ratings yet

- 1 ++Marginal+CostingDocument71 pages1 ++Marginal+CostingB GANAPATHYNo ratings yet

- Ac102 ch7Document22 pagesAc102 ch7Mohammed OsmanNo ratings yet

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- Lessors of Shopping Centers & Retail Stores Revenues World Summary: Market Values & Financials by CountryFrom EverandLessors of Shopping Centers & Retail Stores Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Flight Training Revenues World Summary: Market Values & Financials by CountryFrom EverandFlight Training Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Flowmeters World Summary: Market Values & Financials by CountryFrom EverandFlowmeters World Summary: Market Values & Financials by CountryNo ratings yet

- PricesDocument2 pagesPricesMaxNo ratings yet

- Rather Than at The End of The PeriodDocument3 pagesRather Than at The End of The PeriodMaxNo ratings yet

- Commission and Other Selling CostsDocument2 pagesCommission and Other Selling CostsMaxNo ratings yet

- Into The Computer and StoredDocument2 pagesInto The Computer and StoredMaxNo ratings yet

- 6658795Document2 pages6658795MaxNo ratings yet

- Chapter FourDocument3 pagesChapter FourMaxNo ratings yet

- 4 6032580247847702277Document5 pages4 6032580247847702277MaxNo ratings yet

- 2666Document3 pages2666MaxNo ratings yet

- PriceDocument2 pagesPriceMaxNo ratings yet

- محاضرة 2 قانون دك محمد عبد الظاهر PDFDocument6 pagesمحاضرة 2 قانون دك محمد عبد الظاهر PDFMaxNo ratings yet