Professional Documents

Culture Documents

Kesmore Corporation

Kesmore Corporation

Uploaded by

AyeshaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kesmore Corporation

Kesmore Corporation

Uploaded by

AyeshaCopyright:

Available Formats

UV7000

t

Jun. 18, 2015

os

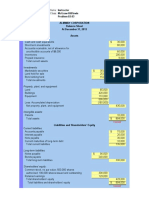

Kesmore Corporation

rP

Kesmore Corporation’s balance sheet as of December 31, 2014, and December 31, 2013, and information

pertaining to its 2014 activities are presented below.

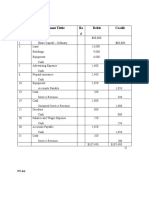

December 31,

Assets 2014 2013

yo

Cash $15,000 $90,000

Short-term investments 200,000 –

Accounts receivable (net) 590,000 440,000

Inventory 600,000 615,000

Long-term investments 310,000 390,000

Property, plant, and equipment (gross) 1,800,000 1,100,000

Accumulated depreciation (500,000) (500,000)

op

Property, plant, and equipment (net) 1,300,000 600,000

Goodwill 95,000 105,000

Total assets $3,110,000 $2,240,000

Liabilities and Stockholders’ Equity

Accounts payable $900,000 $850,000

tC

Short-term debt 190,000 –

Common stock 1,155,000 975,000

Retained earnings 865,000 415,000

Total liabilities and stockholders’ equity $3,110,000 $2,240,000

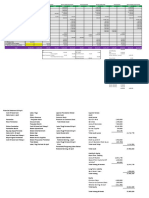

Information relating to 2014 activities:

No

Net income was $800,000.

Equipment costing $450,000 and having a book value of $200,000 was sold for $200,000.

A long-term investment was sold for $150,000. There were no other transactions affecting long-term

investments in 2013.

Depreciation expense was $250,000.

Required

Do

Prepare a statement of cash flows for 2014 using the indirect method.

This exercise was prepared by Luann J. Lynch, Almand R. Coleman Professor of Business Administration, and Mary Margaret Frank, Associate Professor

of Business Administration. Copyright 2015 by the University of Virginia Darden School Foundation, Charlottesville, VA. All rights reserved. To order

copies, send an e-mail to sales@dardenbusinesspublishing.com. No part of this publication may be reproduced, stored in a retrieval system, used in a spreadsheet, or

transmitted in any form or by any means—electronic, mechanical, photocopying, recording, or otherwise—without the permission of the Darden School Foundation.

This document is authorized for educator review use only by Syed Shah, National University of Modern Languages until December 2015. Copying or posting is an infringement of copyright.

Permissions@hbsp.harvard.edu or 617.783.7860

You might also like

- Earn $1,100 Per Week Through Risk Free Arbitrage BettingDocument19 pagesEarn $1,100 Per Week Through Risk Free Arbitrage Bettingsnpatel171100% (1)

- Offshore Wind Farm ProjectDocument39 pagesOffshore Wind Farm ProjectAlireza Aleali89% (9)

- F7 (FR) Workbook (Mix)Document6 pagesF7 (FR) Workbook (Mix)Aye Myat ThawtarNo ratings yet

- Bharat Chemical CaseDocument5 pagesBharat Chemical CaseambitiousfirkinNo ratings yet

- Project Report On Sublimation PrintingDocument5 pagesProject Report On Sublimation PrintingGanpati Gallery100% (1)

- EngineeringeconomyanswerssssDocument13 pagesEngineeringeconomyanswerssssMalik MalikNo ratings yet

- FM1 ActivityDocument4 pagesFM1 ActivityChieMae Benson Quinto100% (1)

- TESLA-financial Statement 2016-2020Document18 pagesTESLA-financial Statement 2016-2020XienaNo ratings yet

- Inteli ChildDocument41 pagesInteli ChildSILANo ratings yet

- Designing Substantive ProceduresDocument9 pagesDesigning Substantive ProceduresCamille CaringalNo ratings yet

- Assignement 01Document6 pagesAssignement 01Abdul SamiNo ratings yet

- Case Study - BCVE and Preacquistion EntriesDocument3 pagesCase Study - BCVE and Preacquistion EntriesHuỳnh Minh Gia HàoNo ratings yet

- Statement of Change in Working Capital & Inflows/Outflows of Working CapitalDocument5 pagesStatement of Change in Working Capital & Inflows/Outflows of Working CapitalChandani DesaiNo ratings yet

- Chapter: Common Size, Comparative and Trend AnalysisDocument6 pagesChapter: Common Size, Comparative and Trend Analysiseldridatech pvt ltdNo ratings yet

- Accts Imp QnsDocument4 pagesAccts Imp QnsnishabilochiNo ratings yet

- AsasassaDocument3 pagesAsasassaIden PratamaNo ratings yet

- Prorata ExerciceDocument3 pagesProrata ExerciceNjakanarivo Christian RajaonaNo ratings yet

- Acc311 2021 2Document4 pagesAcc311 2021 2hoghidan1No ratings yet

- Answer To Sample Question 2Document3 pagesAnswer To Sample Question 2Farid AbbasovNo ratings yet

- ANS - 1 (A, B, C)Document5 pagesANS - 1 (A, B, C)Nazir AhmadNo ratings yet

- Gates - Almonte & Balierbare - Sheet1Document1 pageGates - Almonte & Balierbare - Sheet1Kherss Ann Joy EspinosaNo ratings yet

- Hyper Star Traders Income Statement As of Dec 31, 2009: Net SalesDocument6 pagesHyper Star Traders Income Statement As of Dec 31, 2009: Net SalesomairpkNo ratings yet

- Tugas 4 Dasar AkuntansiDocument15 pagesTugas 4 Dasar AkuntansiSamuel PurbaNo ratings yet

- Soal NirlabaDocument1 pageSoal NirlabaIntan FaricaNo ratings yet

- Statement of CFDocument1 pageStatement of CFnr1520122No ratings yet

- Business Combination Stock AcquisitionDocument2 pagesBusiness Combination Stock AcquisitionTEOPE, EMERLIZA DE CASTRONo ratings yet

- Statement of Financial Position As at 31st March 2015Document52 pagesStatement of Financial Position As at 31st March 2015Shameel IrshadNo ratings yet

- Cash Flow - HandoutDocument3 pagesCash Flow - HandoutMichelle ManuelNo ratings yet

- Accounting 50 IMP QUESDocument94 pagesAccounting 50 IMP QUESVijayasri KumaravelNo ratings yet

- EE Practice Qs Foreign Currency - AnswersDocument6 pagesEE Practice Qs Foreign Currency - AnswersTham Ru JieNo ratings yet

- 2ND Year QualiDocument4 pages2ND Year QualiMark Domingo MendozaNo ratings yet

- Classroom Exercises 1 - Statement of Financial Position and Comprehensive IncomeDocument2 pagesClassroom Exercises 1 - Statement of Financial Position and Comprehensive IncomeBianca JovenNo ratings yet

- Jane Christine SolutionDocument7 pagesJane Christine Solutionckbeom0No ratings yet

- KJA SabrinaDocument1 pageKJA SabrinaKha ShynTaNo ratings yet

- Chapter 5 Amalgamtion of Companies HandoutsDocument7 pagesChapter 5 Amalgamtion of Companies Handoutsvikax90927No ratings yet

- Ak - 111219Document3 pagesAk - 111219lisa filiNo ratings yet

- Study Unit Eight Activity Measures and FinancingDocument15 pagesStudy Unit Eight Activity Measures and FinancingPaul LteifNo ratings yet

- 2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 2 (Part 2)Document5 pages2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 2 (Part 2)Renee WongNo ratings yet

- BUS 285 F23 Practice Questions in WordDocument6 pagesBUS 285 F23 Practice Questions in WordLê AnhNo ratings yet

- MA - Vertical Statement Question BankDocument18 pagesMA - Vertical Statement Question Bankmanav.vakhariaNo ratings yet

- Presentation of Properly Classified FSDocument9 pagesPresentation of Properly Classified FSpapa1No ratings yet

- Accounting 1 (Chapter 9)Document3 pagesAccounting 1 (Chapter 9)CPAREVIEW100% (2)

- Q5 Vikings LimitedDocument2 pagesQ5 Vikings Limitedamosmalusi5No ratings yet

- Mac Trading Company Comparative Balance Sheet For The Year Ended December 20CY 20CY 20PYDocument8 pagesMac Trading Company Comparative Balance Sheet For The Year Ended December 20CY 20CY 20PYJoymee BigorniaNo ratings yet

- Full Download PDF of Solution Manual For Financial & Managerial Accounting 15th by Warren All ChapterDocument73 pagesFull Download PDF of Solution Manual For Financial & Managerial Accounting 15th by Warren All Chapterpolikjellys100% (6)

- Chapter 5-Prob. 1Document7 pagesChapter 5-Prob. 1Rajah CalicaNo ratings yet

- BA 205 AnswerDocument5 pagesBA 205 AnswerAnhar Polo CanacanNo ratings yet

- Audit of Financial Statements Part 2Document2 pagesAudit of Financial Statements Part 2Brit NeyNo ratings yet

- Illustrative Financial StatementsDocument36 pagesIllustrative Financial Statementsasif_qayyum_1No ratings yet

- Balance Sheet and Income Statement (2016-2020)Document20 pagesBalance Sheet and Income Statement (2016-2020)XienaNo ratings yet

- FABM 2 Peer TutorialDocument3 pagesFABM 2 Peer TutorialIrish LudoviceNo ratings yet

- Bracknell Cash Flow QuestionDocument3 pagesBracknell Cash Flow Questionsanjay blakeNo ratings yet

- Chapter 3 - Excel SolutionsDocument8 pagesChapter 3 - Excel SolutionsHalt DougNo ratings yet

- AMALGAMATIONDocument20 pagesAMALGAMATIONabhisheksoni_scribdNo ratings yet

- UV0806 North Mountain Nursery, Inc - Statement of Cahs FlowDocument3 pagesUV0806 North Mountain Nursery, Inc - Statement of Cahs Flowpaocvl892No ratings yet

- By of 3,750: AccountDocument6 pagesBy of 3,750: AccountAravind ShekharNo ratings yet

- 5th Year Pre-Final ExamDocument3 pages5th Year Pre-Final ExamJoshua UmaliNo ratings yet

- QUICKDocument8 pagesQUICKnissaNo ratings yet

- Financial Projections: Horsing Around Balance Sheet As at Jan, 2021Document4 pagesFinancial Projections: Horsing Around Balance Sheet As at Jan, 2021Royden StephensNo ratings yet

- Sadecki Corporation Balance Sheets Dec-31 Assets 2014 2013Document9 pagesSadecki Corporation Balance Sheets Dec-31 Assets 2014 2013mohitgaba19No ratings yet

- Cash Flow StatementDocument3 pagesCash Flow StatementanupsuchakNo ratings yet

- Cash Flows From OperatingDocument1 pageCash Flows From OperatingAnonymous poFC3Q7uejNo ratings yet

- 7 SynthesisDocument5 pages7 SynthesisCristine Jane Granaderos OppusNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- 2Document11 pages2Erik JNo ratings yet

- Bank Management Koch 8th Edition Solutions ManualDocument8 pagesBank Management Koch 8th Edition Solutions Manualmeghantaylorxzfyijkotm100% (54)

- Francisco Vs TRBDocument3 pagesFrancisco Vs TRBFranz KafkaNo ratings yet

- أنواع العقاراتchapter 2Document5 pagesأنواع العقاراتchapter 2loaza abdoNo ratings yet

- Strategy Evaluation ProcessDocument38 pagesStrategy Evaluation ProcessIshtiaq Ahmed0% (1)

- Financial Accounting MCQs - Senior Auditor Bs-16Document34 pagesFinancial Accounting MCQs - Senior Auditor Bs-16Faizan Ch0% (1)

- Basic Accounting EquationDocument17 pagesBasic Accounting EquationArienaya100% (1)

- Interest Rate Swaps and Currency SwapsDocument21 pagesInterest Rate Swaps and Currency SwapsDhananjay SinghalNo ratings yet

- 11symp DekempanaerDocument58 pages11symp DekempanaerStuart BroodNo ratings yet

- ? Management Approach. Chief Operating Decision Maker: Pfrs 8 Q&ADocument8 pages? Management Approach. Chief Operating Decision Maker: Pfrs 8 Q&ALALALA LULULUNo ratings yet

- CCAP BrochureDocument12 pagesCCAP BrochureradheymohanupadhayayNo ratings yet

- Practice Worksheet Solutions - IBFDocument13 pagesPractice Worksheet Solutions - IBFsusheel kumarNo ratings yet

- 2E. Investment Decisions: E.1. Capital Budgeting Process 3 E.2. Capital Investment Analysis Methods 13Document30 pages2E. Investment Decisions: E.1. Capital Budgeting Process 3 E.2. Capital Investment Analysis Methods 13Karan GoelNo ratings yet

- Millions of Fake Accounts That Drowning and Burying Wells FargoDocument67 pagesMillions of Fake Accounts That Drowning and Burying Wells Fargothe1uploaderNo ratings yet

- Accounting Principles Canadian Volume II 7th Edition Weygandt Solutions Manual Full Chapter PDFDocument67 pagesAccounting Principles Canadian Volume II 7th Edition Weygandt Solutions Manual Full Chapter PDFEdwardBishopacsy100% (19)

- Real Estate & REIT Modeling: Course Outline: What Others Are Saying About Our Modeling Courses..Document19 pagesReal Estate & REIT Modeling: Course Outline: What Others Are Saying About Our Modeling Courses..asdNo ratings yet

- Research Paper On Term Structure of Interest RatesDocument7 pagesResearch Paper On Term Structure of Interest RatesafdtrzkhwNo ratings yet

- Agricultural Transformation in NepalDocument39 pagesAgricultural Transformation in NepalChandan SapkotaNo ratings yet

- Aro Granite ReportDocument7 pagesAro Granite ReportsiddharthgrgNo ratings yet

- Aggregate Demand and SupplyDocument41 pagesAggregate Demand and SupplySonali JainNo ratings yet

- Aim Higher Helping Investors Move From Ambition To Action With ESG Investment ApproachesDocument16 pagesAim Higher Helping Investors Move From Ambition To Action With ESG Investment ApproachesAnkit SinghalNo ratings yet

- AFIN 253 Quiz 2Document8 pagesAFIN 253 Quiz 2garytrollingtonNo ratings yet

- 10M SMALL CAP ExcelDocument1 page10M SMALL CAP ExcelPatel Vishal M.No ratings yet

- IfmmmDocument6 pagesIfmmmJagadees ReddyNo ratings yet