Professional Documents

Culture Documents

Operating (Revenue) Expenses & Losses Brief Description:: Suresh G. Lalwani - Managerial Accounting Page 1 of 1

Operating (Revenue) Expenses & Losses Brief Description:: Suresh G. Lalwani - Managerial Accounting Page 1 of 1

Uploaded by

akanksha chauhanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Operating (Revenue) Expenses & Losses Brief Description:: Suresh G. Lalwani - Managerial Accounting Page 1 of 1

Operating (Revenue) Expenses & Losses Brief Description:: Suresh G. Lalwani - Managerial Accounting Page 1 of 1

Uploaded by

akanksha chauhanCopyright:

Available Formats

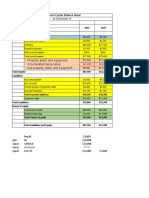

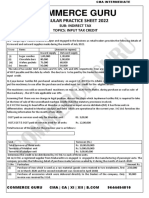

CLASSIC UPHOLSTERY SHOP - PLEASE ANALYZE TRANSACTIONS SEQUENTIALLY AS THEY APPEAR IN STORY. PLEASE USE TRANSACTION NO.

0 FOR CAPITAL INFUSION

ASSET OPERATING OWNERS' EQUITY

INCOME

(CASH & OTHER (REVENUE) BRIEF (EXTERNAL) or NET WORTH or BRIEF BRIEF

TRANSACTION DETAILS: BRIEF DESCRIPTION: (REVENUE)

BANK ASSETS EXPENSES & DESCRIPTION: LIABILITIES CAPITAL or DESCRIPTION: DESCRIPTION:

& GAINS

BALANCE) LOSSES COMMON STOCK

0 Capital Infusion $ 16,000 Cash / Bank increases $ 16,000 Capital (Owner's Equity)

1 Advertising (Consumers) -$ 6,000 Cash / Bank reduces $ 2,000 Expensed

$ 4,000 Capitalized (Deferred Revenue Exp)

2 Advert. (Int. Decorators) -$ 3,000 Cash / Bank reduces $ 1,000 Expensed

$ 2,000 Capitalized (Deferred Revenue Exp)

3A Indl. Sewing machine $ 4,000 Fixed Asset goes up

-$ 4,000 Cash / Bank reduces

3B Other tools & equipment $ 3,000 Fixed Asset goes up

-$ 3,000 Cash / Bank reduces

4 Cash Sales $ 80,000 Cash / Bank increases 80000 Cash Sales

5 Receivables $ 2,500 Current Asset goes up 2500 Credit Sales

6 Purchase of 'Upholstery Fabric' -$ 40,000 Cash / Bank reduces

$ 40,000 Current Asset goes up

7 Purchase of 'Other Supplies' -$ 10,000 Cash / Bank reduces

$ 10,000 Current Asset goes up

8 Wages (Part time assistant) -$ 9,500 Cash / Bank reduces $ 9,500 Wage Expense

9 Rent -$ 4,800 Cash / Bank reduces $ 4,800 Rent Expense

10 Insurance $ 1,600 Capitalized (Curr. Asset) $ 1,600 Ins. Expense

-$ 3,200 Cash / Bank reduces

11 Utilities -$ 2,500 Cash / Bank reduces $ 2,500 Utilities Expense

12 Miscellaneous Expenses -$ 1,700 Cash / Bank reduces $ 1,700 Misc. Expense

13 Payales for Utilities $ ,320 Utilities Expense 320 Utility Exps. Payable

14 COGS (Upholstery Fabric) -$ 26,000 Inventory reduces $ 26,000 COGS Expense

15 COGS (Other Supplies) -$ 7,700 Inventory reduces $ 7,700 COGS Expense

16 Depreciation (Sewing Machine) -$ ,800 BV of Fixed Asset reduces $ ,800 Deprn. Expense

17 Depreciation (Tools & Equipmt) -$ 1,000 BV of Fixed Asset reduces $ 1,000 Deprn. Expense

18 Tax $ 4,716 Tax Expense 4716 Provision for Tax

$ 63,636 TOTAL OPERATING (REVENUE) EXPS.

$ 18,864 PROFIT AFTER TAX (PAT)

$ 82,500 $ 82,500 TOTAL INCOME

Suresh G. Lalwani - Managerial Accounting Page 1 of 1

You might also like

- 704Document5 pages704Bhoomi GhariwalaNo ratings yet

- BE20230819Document6 pagesBE20230819Margie IgnacioNo ratings yet

- Set 1 MID TERM TEST ECO162 MAC23-1Document8 pagesSet 1 MID TERM TEST ECO162 MAC23-1Nurus Sahirah67% (3)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

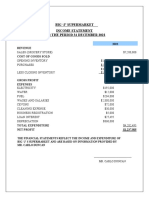

- Big 'J'S Supermarket Income Statement 2022Document2 pagesBig 'J'S Supermarket Income Statement 2022Stephen Francis100% (1)

- Jennys FroyoDocument16 pagesJennys FroyoKailash Kumar100% (2)

- New Heritage Doll CompanyDocument5 pagesNew Heritage Doll CompanyChris ChanonaNo ratings yet

- 704Document3 pages704Bhoomi GhariwalaNo ratings yet

- Saracenic Education: SaracensDocument3 pagesSaracenic Education: SaracensGelo San DiegoNo ratings yet

- Assignment 123Document2 pagesAssignment 123shivrajsidhu20No ratings yet

- Date Account Titles & Explanation Debit Credit: A. Prepare EntriesDocument4 pagesDate Account Titles & Explanation Debit Credit: A. Prepare Entriesyogi fetriansyahNo ratings yet

- Alrich Farms CaseDocument1 pageAlrich Farms CaseKanishka KartikeyaNo ratings yet

- The Garden Spot: Year One: Financial Statements and AnalysisDocument4 pagesThe Garden Spot: Year One: Financial Statements and AnalysisMayank TiwariNo ratings yet

- I. Cases Case 12-16: Tully Corporation 30-Nov-10Document5 pagesI. Cases Case 12-16: Tully Corporation 30-Nov-10Tio SuyantoNo ratings yet

- Salma Barkah - Dasar Akuntansi - Latihan E2-9 & E2-10Document6 pagesSalma Barkah - Dasar Akuntansi - Latihan E2-9 & E2-10Salma BarkahNo ratings yet

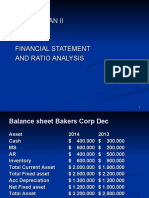

- Chapter 3 - Analysis and Interpretation of Financial StatementsDocument21 pagesChapter 3 - Analysis and Interpretation of Financial StatementsFahad Asghar100% (1)

- Pa 1Document4 pagesPa 1Aditya DzikirNo ratings yet

- Sample Nightclub Business PlanDocument23 pagesSample Nightclub Business PlansubhanNo ratings yet

- Nomor 1: Gain From Bargain Purchase $ - 9,000Document3 pagesNomor 1: Gain From Bargain Purchase $ - 9,000Sherlin KhuNo ratings yet

- Case 1 Format IdeaDocument5 pagesCase 1 Format IdeaMarina StraderNo ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- Working CapitalDocument6 pagesWorking CapitalElizabeth Sanabria AriasNo ratings yet

- Tugas AuditDocument7 pagesTugas AuditRirin SumalindaNo ratings yet

- PDF 3 PDFDocument2 pagesPDF 3 PDFPatricia RodriguesNo ratings yet

- Property, Plant, Equipment: Abbey Corporation Statement of Financial Position DECEMBER 31,2015 AssetDocument4 pagesProperty, Plant, Equipment: Abbey Corporation Statement of Financial Position DECEMBER 31,2015 AssetAstri KaruniaNo ratings yet

- Tugas MK11Document2 pagesTugas MK11Nan BaeeeNo ratings yet

- Financial Plan:: The Following Sections Will Outline Important Financial InformationDocument17 pagesFinancial Plan:: The Following Sections Will Outline Important Financial InformationAyesha KanwalNo ratings yet

- QBE Fijis Key Disclosure Statement For The Financial Year Ended 2022Document2 pagesQBE Fijis Key Disclosure Statement For The Financial Year Ended 2022Navinesh NandNo ratings yet

- Bab-2 MK2018Document15 pagesBab-2 MK2018CalistaNo ratings yet

- Fath Abdul Azis - A031211044Document6 pagesFath Abdul Azis - A031211044Fath Abdul AzisNo ratings yet

- Principles of Accounting: Name: Muhammad Hasnain Shakir Enrolment No: 01-111192-145 Section: BBA4 - 2ADocument3 pagesPrinciples of Accounting: Name: Muhammad Hasnain Shakir Enrolment No: 01-111192-145 Section: BBA4 - 2AOsman Bin SaifNo ratings yet

- Book 1Document45 pagesBook 1ZULFA SYAMNo ratings yet

- Sharp Screen Films, Inc., Is Developing Its Annual Financial Statements Cash FlowDocument4 pagesSharp Screen Films, Inc., Is Developing Its Annual Financial Statements Cash FlowKailash KumarNo ratings yet

- Financial DecisionDocument5 pagesFinancial DecisionJoshua MahNo ratings yet

- Chintia Novrianti 3c Lat 12 RevDocument6 pagesChintia Novrianti 3c Lat 12 RevShintia NovriantiNo ratings yet

- Oktay Urcan: Financial Accounting: Advanced TopicsDocument39 pagesOktay Urcan: Financial Accounting: Advanced TopicsRishap JindalNo ratings yet

- Johnson - Cassandra - AC556 Assignment Unit 6Document9 pagesJohnson - Cassandra - AC556 Assignment Unit 6ctp4950_552446766No ratings yet

- 39062781-Furniture-Business-Plan EditDocument20 pages39062781-Furniture-Business-Plan EditBerihu GirmayNo ratings yet

- Chapter 1 - Analyze TransactionDocument1 pageChapter 1 - Analyze TransactionLê Nguyễn Anh ThưNo ratings yet

- The Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekDocument4 pagesThe Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekKailash KumarNo ratings yet

- Furniture Business Plan EditDocument19 pagesFurniture Business Plan EditBerihu GirmayNo ratings yet

- Financial Plan:: The Following Sections Will Outline Important Financial InformationDocument17 pagesFinancial Plan:: The Following Sections Will Outline Important Financial InformationpalwashaNo ratings yet

- Hisyam Ramadhan 2201751543: 90% Parent Share 10% NCI Share 100% Total ValueDocument2 pagesHisyam Ramadhan 2201751543: 90% Parent Share 10% NCI Share 100% Total ValueYuda Fadhil CuyNo ratings yet

- Balance Sheet As of March 2003: Jl. Gunung Lingai Gg. Berkat Blok. AADocument1 pageBalance Sheet As of March 2003: Jl. Gunung Lingai Gg. Berkat Blok. AARiski Nack OutsiderNo ratings yet

- Cash FlowDocument35 pagesCash FlowsiriusNo ratings yet

- Excercises Chapter 4Document5 pagesExcercises Chapter 4Mar ChahinNo ratings yet

- 3-14-11 AZOP 2011 CGA Organization BudgetDocument2 pages3-14-11 AZOP 2011 CGA Organization BudgetElizabeth VenableNo ratings yet

- Financial Management 2Document22 pagesFinancial Management 2Win BerAngelNo ratings yet

- Accounting Question-With AnswerDocument5 pagesAccounting Question-With AnswerApanar OoNo ratings yet

- Balance Sheet Onondaga Oswego County ChapterDocument9 pagesBalance Sheet Onondaga Oswego County ChapterNelson ParkNo ratings yet

- Group 2 - FRA Assignment PDFDocument29 pagesGroup 2 - FRA Assignment PDFarsheenchughNo ratings yet

- Accounting SADocument30 pagesAccounting SAmagardiwakar11No ratings yet

- CH.2 HWDocument11 pagesCH.2 HWSally PhungNo ratings yet

- Pasta Centre Business PlanDocument15 pagesPasta Centre Business PlanZoya KhanNo ratings yet

- 6 DesemberDocument8 pages6 DesemberKezia N. ApriliaNo ratings yet

- Question:-: Solution:-Computation of The Classified Year End Balance SheetDocument4 pagesQuestion:-: Solution:-Computation of The Classified Year End Balance SheetShadowmaster LegendNo ratings yet

- 1.8 Interactive Balance SheetDocument13 pages1.8 Interactive Balance SheetChristian LeejohnNo ratings yet

- Remi DadaDocument1 pageRemi DadaaderemidadaNo ratings yet

- 417 Assignment #1Document26 pages417 Assignment #1Gloria GuanNo ratings yet

- PT 1 (Alemany)Document5 pagesPT 1 (Alemany)Thrisha AlemanyNo ratings yet

- Financial Management Assignment 1Document3 pagesFinancial Management Assignment 12K22DMBA67 kushankNo ratings yet

- Statement of Change in Working Capital & Inflows/Outflows of Working CapitalDocument5 pagesStatement of Change in Working Capital & Inflows/Outflows of Working CapitalChandani DesaiNo ratings yet

- Practice For Quiz #3 Solutions For StudentsDocument10 pagesPractice For Quiz #3 Solutions For Studentssylstria.mcNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- PAT (Carried To BS) 49.60: Financial Accounting - A Managerial Orientation - GW-1 Page 3 of 4Document1 pagePAT (Carried To BS) 49.60: Financial Accounting - A Managerial Orientation - GW-1 Page 3 of 4akanksha chauhanNo ratings yet

- Suresh G. Lalwani - Managerial Accounting Page 1 of 1Document1 pageSuresh G. Lalwani - Managerial Accounting Page 1 of 1akanksha chauhanNo ratings yet

- Suresh G. Lalwani - Managerial Accounting Page 1 of 1Document1 pageSuresh G. Lalwani - Managerial Accounting Page 1 of 1akanksha chauhanNo ratings yet

- Hiring and Employer Branding (Campus Connect) : Please Clearly Mention Any Assumptions You May Have Made For The DatasetDocument1 pageHiring and Employer Branding (Campus Connect) : Please Clearly Mention Any Assumptions You May Have Made For The Datasetakanksha chauhanNo ratings yet

- Exam Revision - 5 & 6 SolDocument7 pagesExam Revision - 5 & 6 SolNguyễn Minh ĐứcNo ratings yet

- Environmental Economics Canadian 4th Edition Field Test Bank Full Chapter PDFDocument42 pagesEnvironmental Economics Canadian 4th Edition Field Test Bank Full Chapter PDFchristabeldienj30da100% (14)

- Finacc Quiz 2 PDF FreeDocument11 pagesFinacc Quiz 2 PDF FreeGuinevereNo ratings yet

- SnapEx Deck V1.016964Document20 pagesSnapEx Deck V1.016964Trần Đỗ Trung MỹNo ratings yet

- The Power of Mercantile CityDocument8 pagesThe Power of Mercantile CityChan DarareaksmeyNo ratings yet

- Expenditure Cycle: Purchasing and DisbursementDocument18 pagesExpenditure Cycle: Purchasing and DisbursementWenah TupasNo ratings yet

- Flexible Exchange RatesDocument14 pagesFlexible Exchange Ratestapan mistryNo ratings yet

- Banking LawDocument22 pagesBanking LawRASHIKA TRIVEDINo ratings yet

- Merchandising 105 Answer Key PeriodicDocument38 pagesMerchandising 105 Answer Key PeriodicPrincess Heart MacadatNo ratings yet

- BANKINGDocument15 pagesBANKINGHoneylyn V. ChavitNo ratings yet

- T4 Exercises QuestDocument11 pagesT4 Exercises QuestXin XiuNo ratings yet

- All You Need To Know About The Forex Trading MarketDocument2 pagesAll You Need To Know About The Forex Trading Marketahmed bakryNo ratings yet

- Aani FluorotechDocument8 pagesAani FluorotechDinesh NNo ratings yet

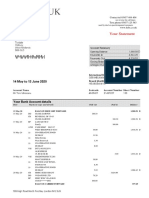

- Your Statement: Account SummaryDocument7 pagesYour Statement: Account SummaryToni MirosanuNo ratings yet

- The Comparative Economic Impact of Travel Tourism PDFDocument44 pagesThe Comparative Economic Impact of Travel Tourism PDFkenanpa7590No ratings yet

- BNPLDocument1 pageBNPLRISHAV RAJ GUPTANo ratings yet

- 50 Sow Unit Piggery Business Plan Financials - USDDocument15 pages50 Sow Unit Piggery Business Plan Financials - USDonward marumuraNo ratings yet

- Caiib - Abm - Sample QuestionsDocument2 pagesCaiib - Abm - Sample QuestionsPradyumnanbharadwaj PradiNo ratings yet

- International Trade in BangladehDocument5 pagesInternational Trade in BangladehRatul MahmudNo ratings yet

- Practicesheet - Input Tax CreditDocument5 pagesPracticesheet - Input Tax CreditHemmu sahuNo ratings yet

- NML Serie 44 Indonesia Maritime HotspotDocument108 pagesNML Serie 44 Indonesia Maritime Hotspotabdul malik al fatahNo ratings yet

- Questions Journal, Ledger & TBDocument9 pagesQuestions Journal, Ledger & TBHarsh GhaiNo ratings yet

- An Introduction To Trade and Environment in The WTODocument4 pagesAn Introduction To Trade and Environment in The WTOgouricuj100% (1)

- I - Functions of MoneyDocument38 pagesI - Functions of MoneyVISHVESH JUNEJANo ratings yet

- FIN 072 - Period 1 Quiz 1Document2 pagesFIN 072 - Period 1 Quiz 1Asdfg HjklNo ratings yet

- Discounted Cash FlowsDocument4 pagesDiscounted Cash FlowsRohit BajpaiNo ratings yet