Professional Documents

Culture Documents

Technical Report 8th September 2011

Technical Report 8th September 2011

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Technical Report 8th September 2011

Technical Report 8th September 2011

Uploaded by

Angel BrokingCopyright:

Available Formats

Technical Research | September 08, 2011

Daily Technical Report

Sensex (17065) / Nifty (5125)

Markets opened with an upside gap and traded with positive bias throughout the day to close well above 17000 / 5100 mark. On the sector front, Realty, Power and Capital Goods counters were among the major gainers. The advance decline ratio was in favor of advancing counters (A=1938 D=913). (Source www.bseindia.com)

Exhibit 1: Sensex Daily Chart

Formation

We are witnessing a positive crossover in ADX (9) indicator on the Daily chart.

Trading strategy:

Indices opened well above 20 Days EMA and traded with a strong optimism throughout the session. As mentioned in our previous report, a positive up move was witnessed after sustaining above Tuesdays high of 16895 / 5073. Subsequently, indices tested resistance level of 17100 / 5150 during the session and corrected marginally from the days high. We are now observing a positive crossover in ADX (9) indicator which indicates possibility of a further up move if indices break yesterdays high of 17157 / 5155. In this case, they are likely to test 17250 17350 / 5200 5230 levels. On the downside, 16900 16760 / 5065 5030 levels may act as support in coming trading sessions.

Source: Falcon

For Private Circulation Only |

Technical Research | September 08, 2011

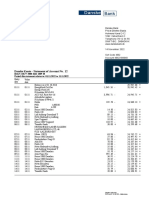

Daily Pivot Levels For Nifty 50 Stocks

SCRIPS SENSEX NIFTY ACC AMBUJACEM AXISBANK BAJAJ-AUTO BHARTIARTL BHEL BPCL CAIRN CIPLA DLF DRREDDY GAIL HCLTECH HDFC HDFCBANK HEROMOTOCO HINDALCO HINDUNILVR ICICIBANK IDFC INFY ITC JINDALSTEL JPASSOCIAT KOTAKBANK LT M&M MARUTI NTPC ONGC PNB POWERGRID RANBAXY RCOM RELCAPITAL RELIANCE RELINFRA RPOWER SAIL SBIN SESAGOA SIEMENS STER SUNPHARMA SUZLON TATAMOTORS TATAPOWER TATASTEEL TCS WIPRO S2 16,813 5,040 996 134 1,127 1,607 394 1,735 659 272 273 194 1,450 418 390 652 467 2,113 151 316 882 110 2,244 197 534 66 455 1,623 761 1,073 160 259 919 95 468 84 418 814 462 82 115 1,958 227 851 132 481 40 741 989 490 1,010 324 S1 16,939 5,082 1,031 141 1,135 1,624 398 1,763 666 275 278 199 1,461 422 398 660 477 2,143 155 318 889 113 2,268 199 549 69 462 1,652 773 1,100 164 261 936 96 477 86 423 824 470 83 118 1,993 230 859 134 487 41 755 1,014 494 1,021 327 PIVOT 17,048 5,118 1,055 145 1,147 1,648 402 1,781 671 279 281 203 1,475 428 404 665 484 2,165 159 320 898 115 2,291 201 559 70 466 1,673 792 1,120 166 262 952 97 485 89 430 834 477 85 121 2,018 235 866 136 492 41 768 1,033 499 1,035 329 R1 17,174 5,161 1,091 152 1,155 1,665 406 1,809 678 282 287 208 1,487 433 413 673 494 2,195 164 323 906 118 2,315 203 574 73 473 1,701 804 1,146 170 264 969 98 495 91 435 843 485 87 124 2,053 238 873 139 498 42 782 1,058 503 1,046 332 R2 17,283 5,197 1,115 156 1,167 1,689 410 1,827 684 286 290 213 1,500 438 419 679 501 2,217 168 325 914 120 2,338 205 584 75 477 1,722 823 1,166 172 266 984 99 503 94 442 853 492 89 126 2,077 243 880 141 503 42 794 1,077 508 1,060 334

Technical Research Team

For Private Circulation Only |

Technical Research | September 08, 2011 Technical Report

RESEARCH TEAM

Shardul Kulkarni Sameet Chavan Sacchitanand Uttekar Mehul Kothari Ankur Lakhotia Head - Technicals Technical Analyst Technical Analyst Technical Analyst Technical Analyst

For any Queries, Suggestions and Feedback kindly mail to mehul.kothari@angelbroking.com Research Team: 022-3935 7600 Website: www.angelbroking.com

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions. Opinion expressed is our current opinion as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true and are for general guidance only. While every effort is made to ensure the accuracy and completeness of information contained, the company takes no guarantee and assumes no liability for any errors or omissions of the information. No one can use the information as the basis for any claim, demand or cause of action. Recipients of this material should rely on their own investigations and take their own professional advice. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain transactions - futures, options and other derivatives as well as non-investment grade securities - involve substantial risks and are not suitable for all investors. Reports based on technical analysis centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals and as such, may not match with a report on a company's fundamentals. We do not undertake to advise you as to any change of our views expressed in this document. While we would endeavor to update the information herein on a reasonable basis, Angel Broking, its subsidiaries and associated companies, their directors and employees are under no obligation to update or keep the information current. Also there may be regulatory, compliance, or other reasons that may prevent Angel Broking and affiliates from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Angel Broking Limited and affiliates, including the analyst who has issued this report, may, on the date of this report, and from time to time, have long or short positions in, and buy or sell the securities of the companies mentioned herein or engage in any other transaction involving such securities and earn brokerage or compensation or act as advisor or have other potential conflict of interest with respect to company/ies mentioned herein or inconsistent with any recommendation and related information and opinions. Angel Broking Limited and affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Sebi Registration No : INB 010996539

For Private Circulation Only |

You might also like

- Crim HW1 DigestDocument12 pagesCrim HW1 Digestzealous9carrotNo ratings yet

- Lyon Capital Group - CisDocument3 pagesLyon Capital Group - Cismincho4104100% (1)

- BLM Lesson - Grade 5 PDFDocument5 pagesBLM Lesson - Grade 5 PDFAlex PfeifferNo ratings yet

- Technical Report 2nd September 2011Document3 pagesTechnical Report 2nd September 2011Angel BrokingNo ratings yet

- Technical Report 30th September 2011Document3 pagesTechnical Report 30th September 2011Angel BrokingNo ratings yet

- Technical Report 15th September 2011Document3 pagesTechnical Report 15th September 2011Angel BrokingNo ratings yet

- Technical Report 11th August 2011Document3 pagesTechnical Report 11th August 2011Angel BrokingNo ratings yet

- Technical Report 18th August 2011Document3 pagesTechnical Report 18th August 2011Angel BrokingNo ratings yet

- Technical Report 25th August 2011Document3 pagesTechnical Report 25th August 2011Angel BrokingNo ratings yet

- Technical Report 19th August 2011Document3 pagesTechnical Report 19th August 2011Angel BrokingNo ratings yet

- Technical Report 20th September 2011Document3 pagesTechnical Report 20th September 2011Angel BrokingNo ratings yet

- Technical Report 7th September 2011Document3 pagesTechnical Report 7th September 2011Angel BrokingNo ratings yet

- Technical Report 9th September 2011Document3 pagesTechnical Report 9th September 2011Angel BrokingNo ratings yet

- Technical Report 27th September 2011Document3 pagesTechnical Report 27th September 2011Angel BrokingNo ratings yet

- Technical Report 21st September 2011Document3 pagesTechnical Report 21st September 2011Angel BrokingNo ratings yet

- Technical Report 24th August 2011Document3 pagesTechnical Report 24th August 2011Angel BrokingNo ratings yet

- Technical Report 6th September 2011Document3 pagesTechnical Report 6th September 2011Angel BrokingNo ratings yet

- Technical Report 26th August 2011Document3 pagesTechnical Report 26th August 2011Angel BrokingNo ratings yet

- Technical Report 5th October 2011Document3 pagesTechnical Report 5th October 2011Angel BrokingNo ratings yet

- Technical Report 17th August 2011Document3 pagesTechnical Report 17th August 2011Angel BrokingNo ratings yet

- Technical Report 27th December 2011Document5 pagesTechnical Report 27th December 2011Angel BrokingNo ratings yet

- Technical Report 13th September 2011Document3 pagesTechnical Report 13th September 2011Angel BrokingNo ratings yet

- Technical Report 14th September 2011Document3 pagesTechnical Report 14th September 2011Angel BrokingNo ratings yet

- Technical Report 16th September 2011Document3 pagesTechnical Report 16th September 2011Angel BrokingNo ratings yet

- Technical Report 23rd December 2011Document5 pagesTechnical Report 23rd December 2011Angel BrokingNo ratings yet

- Technical Report 23rd September 2011Document3 pagesTechnical Report 23rd September 2011Angel BrokingNo ratings yet

- Technical Report 4th October 2011Document3 pagesTechnical Report 4th October 2011Angel BrokingNo ratings yet

- Technical Report 11th January 2012Document5 pagesTechnical Report 11th January 2012Angel BrokingNo ratings yet

- Technical Report 2nd August 2011Document3 pagesTechnical Report 2nd August 2011Angel BrokingNo ratings yet

- Technical Report 23rd August 2011Document3 pagesTechnical Report 23rd August 2011Angel BrokingNo ratings yet

- Technical Report 25th April 2012Document5 pagesTechnical Report 25th April 2012Angel BrokingNo ratings yet

- Technical Report 26th April 2012Document5 pagesTechnical Report 26th April 2012Angel BrokingNo ratings yet

- Technical Report 25th January 2012Document5 pagesTechnical Report 25th January 2012Angel BrokingNo ratings yet

- Technical Report 20th July 2011Document3 pagesTechnical Report 20th July 2011Angel BrokingNo ratings yet

- Technical Report 27th April 2012Document5 pagesTechnical Report 27th April 2012Angel BrokingNo ratings yet

- Technical Report 8th December 2011Document5 pagesTechnical Report 8th December 2011Angel BrokingNo ratings yet

- Technical Report 17th January 2012Document5 pagesTechnical Report 17th January 2012Angel BrokingNo ratings yet

- Technical Report 28th September 2011Document3 pagesTechnical Report 28th September 2011Angel BrokingNo ratings yet

- Technical Report 13th March 2012Document5 pagesTechnical Report 13th March 2012Angel BrokingNo ratings yet

- Technical Report 23rd November 2011Document5 pagesTechnical Report 23rd November 2011Angel BrokingNo ratings yet

- Technical Report 19th March 2012Document5 pagesTechnical Report 19th March 2012Angel BrokingNo ratings yet

- Technical Report 29th December 2011Document5 pagesTechnical Report 29th December 2011Angel BrokingNo ratings yet

- Technical Report 3 RD August 2011Document3 pagesTechnical Report 3 RD August 2011Angel BrokingNo ratings yet

- Technical Report 29th August 2011Document3 pagesTechnical Report 29th August 2011Angel BrokingNo ratings yet

- Technical Report 1st February 2012Document5 pagesTechnical Report 1st February 2012Angel BrokingNo ratings yet

- Technical Report 3rd October 2011Document3 pagesTechnical Report 3rd October 2011Angel BrokingNo ratings yet

- Technical Report 1st March 2012Document5 pagesTechnical Report 1st March 2012Angel BrokingNo ratings yet

- Technical Report 22nd September 2011Document3 pagesTechnical Report 22nd September 2011Angel BrokingNo ratings yet

- Technical Report 9th March 2012Document5 pagesTechnical Report 9th March 2012Angel BrokingNo ratings yet

- Technical Report 2nd November 2011Document5 pagesTechnical Report 2nd November 2011Angel BrokingNo ratings yet

- Technical Report 31st January 2012Document5 pagesTechnical Report 31st January 2012Angel BrokingNo ratings yet

- Technical Report 22nd August 2011Document3 pagesTechnical Report 22nd August 2011Angel BrokingNo ratings yet

- Technical Report 19th September 2011Document3 pagesTechnical Report 19th September 2011Angel BrokingNo ratings yet

- Technical Report 15th March 2012Document5 pagesTechnical Report 15th March 2012Angel BrokingNo ratings yet

- Technical Report 16th February 2012Document5 pagesTechnical Report 16th February 2012Angel BrokingNo ratings yet

- Technical Report 27th January 2012Document5 pagesTechnical Report 27th January 2012Angel BrokingNo ratings yet

- Technical Report 28th March 2012Document5 pagesTechnical Report 28th March 2012Angel BrokingNo ratings yet

- Technical Report 14th March 2012Document5 pagesTechnical Report 14th March 2012Angel BrokingNo ratings yet

- Technical Report 3rd November 2011Document5 pagesTechnical Report 3rd November 2011Angel BrokingNo ratings yet

- Technical Report 12th January 2012Document5 pagesTechnical Report 12th January 2012Angel BrokingNo ratings yet

- Daily Technical Report: FormationDocument5 pagesDaily Technical Report: FormationAngel BrokingNo ratings yet

- Stock Fundamental Analysis Mastery: Unlocking Company Stock Financials for Profitable TradingFrom EverandStock Fundamental Analysis Mastery: Unlocking Company Stock Financials for Profitable TradingNo ratings yet

- The Power of Charts: Using Technical Analysis to Predict Stock Price MovementsFrom EverandThe Power of Charts: Using Technical Analysis to Predict Stock Price MovementsNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- PDF of PPT - Roman - Ulama Ki Pairvi Mein Hamara Manhaj - Strong Foundation CourseDocument78 pagesPDF of PPT - Roman - Ulama Ki Pairvi Mein Hamara Manhaj - Strong Foundation Courseamer sohailNo ratings yet

- Hse Plan - Rev-1Document81 pagesHse Plan - Rev-1srirambaskyNo ratings yet

- Position Paper Salupare Ervin DDocument3 pagesPosition Paper Salupare Ervin DErvin SalupareNo ratings yet

- G.R. No. 72244Document2 pagesG.R. No. 72244Name ToomNo ratings yet

- Dehymuls® LE: General CharacterisationDocument2 pagesDehymuls® LE: General CharacterisationNizar KiliNo ratings yet

- NRIA Summary C D Order 6-21-2022Document63 pagesNRIA Summary C D Order 6-21-2022RSNo ratings yet

- Kjs Handbook 03Document50 pagesKjs Handbook 03Alfian Syaiful HaqNo ratings yet

- 2903Document5 pages2903iso9002No ratings yet

- YALE YELSeries - YJL680-2-2002 PDFDocument34 pagesYALE YELSeries - YJL680-2-2002 PDFJuan Carlos NúñezNo ratings yet

- DsddsdsdsdsDocument7 pagesDsddsdsdsdsLemuel Jay MananapNo ratings yet

- Document 28 PDF - RemovedDocument1 pageDocument 28 PDF - RemovedalysNo ratings yet

- Jos C.N. Raadschelders, Theo A.J. Toonen, Frits M. Van Der Meer - The Civil Service in The 21st Century - Comparative Perspectives (2007) PDFDocument332 pagesJos C.N. Raadschelders, Theo A.J. Toonen, Frits M. Van Der Meer - The Civil Service in The 21st Century - Comparative Perspectives (2007) PDFAnderson Tavares100% (1)

- CSEC POA MCQ SamplepagesDocument3 pagesCSEC POA MCQ SamplepagesnatalieNo ratings yet

- Doctrine of Implication DigestsDocument12 pagesDoctrine of Implication DigestsHannah TolentinoNo ratings yet

- Child Protection PolicyDocument19 pagesChild Protection PolicyMaestra EvangelineNo ratings yet

- Gun ControlDocument11 pagesGun ControlDarshan PandyaNo ratings yet

- Social Securityfor Unorganized Workersin IndiaDocument10 pagesSocial Securityfor Unorganized Workersin IndiaJaya VardhiniNo ratings yet

- Chapter 4 Parity Conditions in InternatiDocument21 pagesChapter 4 Parity Conditions in Internatigalan nationNo ratings yet

- Notice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsDocument1 pageNotice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsJustia.comNo ratings yet

- Payment Step-By-Step: ZilingoDocument1 pagePayment Step-By-Step: ZilingoEKNo ratings yet

- Submission PleadingDocument30 pagesSubmission PleadingdivyavishalNo ratings yet

- Kenya Methodist University: Advanced Financial Accounting (Accf 433)Document9 pagesKenya Methodist University: Advanced Financial Accounting (Accf 433)Alice WairimuNo ratings yet

- eWTO M8 R1 EDocument41 pageseWTO M8 R1 EhichichicNo ratings yet

- Telebap v. ComelecDocument23 pagesTelebap v. Comelectweezy24No ratings yet

- Man With A Dream Reading Comprehension Exercises Tests - 24600Document3 pagesMan With A Dream Reading Comprehension Exercises Tests - 24600JChris Troidz RomeroNo ratings yet

- Why I Left The Institutional Church For The Organic Expression of JesusDocument3 pagesWhy I Left The Institutional Church For The Organic Expression of JesusGregory Valentine100% (1)

- KPI ReferenceDocument60 pagesKPI ReferenceKAMALI82No ratings yet