Professional Documents

Culture Documents

IV FM Capital Budgeting Techniques Dr. Nagesh Parashar

IV FM Capital Budgeting Techniques Dr. Nagesh Parashar

Uploaded by

Ritesh KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IV FM Capital Budgeting Techniques Dr. Nagesh Parashar

IV FM Capital Budgeting Techniques Dr. Nagesh Parashar

Uploaded by

Ritesh KumarCopyright:

Available Formats

Financial Management/Capital Budgeting Techniques

A business unit is often faced with the problem of selection between two projects or the buy vs

make choice. Due to the limitation of fund, a business unit has to choose between different

projects/investments. Capital budgeting techniques help in making such decisions.

What is Capital Budgeting?

Capital budgeting is a method of judging investments and huge expenses in order to obtain the

best returns on money invested.

Capital budgeting is combination of two words ‘capital’ and ‘budgeting.’ In this regard capital

expenditure is the disbursement of funds for large expenditures like purchasing fixed assets like

machinery, equipment, repairs to fixed assets or equipment, research and development,

expansion etc. Budgeting is setting limit for projects to ensure maximum profitability.

With capital budgeting techniques a business evaluates potential major projects or investments.

Erection of a new plant or a big investment tangible proposals are examples of projects that

would require capital budgeting before they are sanctioned or rejected.

Capital budgeting process is also known as investment appraisal.

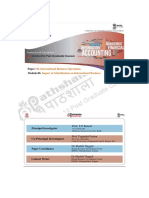

Capital Budgeting Techniques

To assist a business unit in selection of the best investment projects there are various

techniques available, these techniques are:

Capital

Bugeting

Techniques

Non

Discounted

Discounted

Techniques

Techniques

Acoounting Discounted

Pay Back Net Present Profitability Internal Rate

Rate of Pay Back

Period value Index of Return

Return Period

Dr. Nagesh Parashar, S.S. in Commerce, Vikram University, Ujjain Page 1

Financial Management/Capital Budgeting Techniques

In non discount techniques time value of money is not considered, in discounted techniques time

value of money is considered. As per the time value of money concept the money in the present

is valuable more than the same sum of money to be received in the future. This is true because

money that we have right now can be invested and earn a return, that will create a large amount

of money in the future. There is the additional risk with future money that the future money may

never actually be received, for few reasons. The time value of money is the greater benefit of

receiving money in present rather than an identical sum in future. It is based on time preference.

The time value of money shows the reason why interest is paid or earned: interest on a bank

deposit or debt, balance the depositor or lender for the time value of money.

Non Discounted Techniques

Payback Period Method: Pay back period is the period required to recover initial cash outlay .

As the name suggests, this method gives the period in which the proposed project will generate

cash to recover the initial investment. It purely stresses on the cash inflows, economic life of the

project and the investment made in the project.

Pay Back Period= Cash Outlay (Investment)/Annual Cash Inflow

Accounting Rate of Return Method (ARR): This method helps to rectify the disadvantages of

the payback period method. It works on the base that any project having ARR higher than the

minimum rate set by the management will be considered and those below the set rate are

rejected.

ARR= (Average Profit/Average Investment)*100

Discounted Cash Flow Techniques

The discounted cash flow method calculates the cash inflow and outflow through the life of

an asset. These cash flows are then discounted through a discounting factor. The discounted cash

inflows and outflows are then compared.

Discounted Pay Back Period: In this method, cash flows are discounted through discount factor.

Remaining will be same as traditional method.

Net present Value (NPV) Method: The net present value is arrived by taking the difference

between the present value of cash inflows and the present value of cash outflows over a period of

time. The projects with a positive NPV will be considered. In case there are multiple projects, the

proposal with a higher NPV will be selected.

NPV=PVB-PVC

where,

PVB = Present value of Inflows PVC = Present value of Outflows

Dr. Nagesh Parashar, S.S. in Commerce, Vikram University, Ujjain Page 2

Financial Management/Capital Budgeting Techniques

Internal Rate of Return (IRR): This is expressed as the rate at which the net present value of

the investment is zero. The discounted cash inflows is equal to the discounted cash outflow. This

method considers time value of money. This method gives a rate of interest at which funds

invested in the project could be repaid out of the cash inflows. IRR is the rate at which the NPV

becomes zero. The project with higher IRR is generally selected.

Profitability Index (PI): It is the ratio of the present value of future cash inflows, at the certain

rate of return to the initial cash outflow of the investment.

PI= PV of cash inflows/Initial cash outlay

All projects with PI > 1.0 is accepted.

Alternatively PI=NPV(benefits)/NPV(Costs)

Importance of Capital Budgeting

1) Involvement of Risk: Capital expenditures projects are long term investments which involve

more financial risks. That is why capital budgeting is needed.

2) Heavy and irreversible investments : Capital expenditure once made can not be reversed .

Cash outflow is huge so adequate planning with capital budgeting techniques is a pre-

requisite.

3) Benefits in Long Run : Capital budgeting cuts the costs as well as gets changes in the

profitability of the company. It helps keep away from over or under investments. Adequate

planning and analysis of the proposed plan helps in the long run.

Other Importance/Significance of Capital Budgeting

Capital budgeting is a necessary tool in financial management, Capital budgeting

offers a wide scope for financial managers to judge different projects in terms of their feasibility

to be taken up for investments, It helps in revealing the risk and uncertainty of different projects,

It helps in keeping a limit on over or under investments.

Conclusion: According to the definition of Charles T. Hrongreen, “Capital Budgeting is a

long-term planning for making and financing proposed capital outlays.” One can conclude that

capital budgeting is the effort to establish the future.

--------------------------------------ThankYou………………………………………

Dr. Nagesh Parashar, S.S. in Commerce, Vikram University, Ujjain Page 3

You might also like

- The Ultimate Guide To Master Supply and Demand in ForexDocument28 pagesThe Ultimate Guide To Master Supply and Demand in ForexT51328295% (20)

- Economic Globalization Poverty and InequalityDocument29 pagesEconomic Globalization Poverty and InequalityEmmanuel Garcia100% (3)

- BUAD 839 ASSIGNMENT (Group F)Document4 pagesBUAD 839 ASSIGNMENT (Group F)Yemi Jonathan OlusholaNo ratings yet

- Assignment - Capital BudgetingDocument9 pagesAssignment - Capital BudgetingSahid KarimbanakkalNo ratings yet

- HPC LPG Intl Time Charter Party 05 03 2013Document30 pagesHPC LPG Intl Time Charter Party 05 03 2013Sumeet Sud100% (1)

- Dr. Sandeep Malu Associate Professor SVIM, IndoreDocument14 pagesDr. Sandeep Malu Associate Professor SVIM, Indorechaterji_aNo ratings yet

- Dr. Sandeep Malu Associate Professor SVIM, IndoreDocument14 pagesDr. Sandeep Malu Associate Professor SVIM, Indorechaterji_aNo ratings yet

- Year, Financial Management: Capital BudgetingDocument9 pagesYear, Financial Management: Capital BudgetingPooja KansalNo ratings yet

- Evaluation of Capital Budgeting TechniquesDocument36 pagesEvaluation of Capital Budgeting TechniquesAshish GoelNo ratings yet

- Investment Evaluation CriteriaDocument15 pagesInvestment Evaluation Criteriainq33108No ratings yet

- Capital BudgetingDocument20 pagesCapital Budgetingmansi dhimanNo ratings yet

- Capitalbudgeting 1227282768304644 8Document27 pagesCapitalbudgeting 1227282768304644 8Sumi LatheefNo ratings yet

- Capital Budgeing ReviewDocument20 pagesCapital Budgeing ReviewBalakrishna ChakaliNo ratings yet

- Capital BudgetingDocument6 pagesCapital BudgetingKhushbu PriyadarshniNo ratings yet

- Project. Capital BudgetingDocument8 pagesProject. Capital BudgetingGm InwatiNo ratings yet

- CAPITAL BUDGETING LECTURE NOTES MAY 22 - DodomaDocument5 pagesCAPITAL BUDGETING LECTURE NOTES MAY 22 - DodomachabeNo ratings yet

- Capital Budgeting: Exclusive ProjectsDocument6 pagesCapital Budgeting: Exclusive ProjectsMethon BaskNo ratings yet

- Capital BudgetingDocument14 pagesCapital BudgetingD Y Patil Institute of MCA and MBANo ratings yet

- Evaluation of Capital BudgetingDocument24 pagesEvaluation of Capital BudgetingGayathri GopiramnathNo ratings yet

- Capital Budgeting PPTDocument12 pagesCapital Budgeting PPTshyamNo ratings yet

- Capital Budgeting AssignmentDocument6 pagesCapital Budgeting AssignmentAdnan SethiNo ratings yet

- Vinay ProjectDocument55 pagesVinay ProjectD Priyanka100% (1)

- Capital BudgetingDocument17 pagesCapital BudgetingAditya SinghNo ratings yet

- Capital Investment Decisions: Chapte RDocument95 pagesCapital Investment Decisions: Chapte RMohammad Salim HossainNo ratings yet

- Final ProjectDocument65 pagesFinal ProjectD PriyankaNo ratings yet

- Presentation On: Capital BudgetingDocument23 pagesPresentation On: Capital Budgetingakhil_247No ratings yet

- Time Value of MoneyDocument4 pagesTime Value of MoneyShradha KapseNo ratings yet

- Capital Budgeting - 2Document45 pagesCapital Budgeting - 2chloemhae.ogayreNo ratings yet

- Capital Budgeting: - Vinamra NayakDocument14 pagesCapital Budgeting: - Vinamra NayakhridzenrichingNo ratings yet

- Techniques of Investment AnalysisDocument32 pagesTechniques of Investment AnalysisPranjal Verma0% (1)

- Capital Budgeting NotesDocument6 pagesCapital Budgeting NotesAlyssa Hallasgo-Lopez AtabeloNo ratings yet

- International Capital Burgeting AssignmentDocument18 pagesInternational Capital Burgeting AssignmentHitesh Kumar100% (1)

- Multinational Capital BudgetingDocument26 pagesMultinational Capital BudgetingDishaNo ratings yet

- Assignment On FaseelDocument6 pagesAssignment On FaseelAbdul KhanNo ratings yet

- Definition of Capital BudgetingDocument6 pagesDefinition of Capital Budgetingkaram deenNo ratings yet

- Topic VII Capital Budgeting TechniquesDocument16 pagesTopic VII Capital Budgeting TechniquesSeph AgetroNo ratings yet

- Finance Test 1 NotesDocument7 pagesFinance Test 1 NotesnathanaelzeidanNo ratings yet

- Capital Budgeting TechniquesDocument26 pagesCapital Budgeting TechniquesMahima GirdharNo ratings yet

- Capital Budgeting On Dinner KariDocument3 pagesCapital Budgeting On Dinner KariVashu KatiyarNo ratings yet

- Business Finance Investment Decision: Lecturer: Hibak A. NouhDocument21 pagesBusiness Finance Investment Decision: Lecturer: Hibak A. NouhHibaaq AxmedNo ratings yet

- Capital BudgetingDocument16 pagesCapital BudgetingNikhil BapnaNo ratings yet

- Process of Capital Budgeting: #1 - To Identify Investment OpportunitiesDocument9 pagesProcess of Capital Budgeting: #1 - To Identify Investment Opportunitiesshanza munawerNo ratings yet

- Capitalbudgeting 1227282768304644 8Document27 pagesCapitalbudgeting 1227282768304644 8durgesh dhumalNo ratings yet

- Capital Budgeting MethodsDocument13 pagesCapital Budgeting MethodsAmit SinghNo ratings yet

- Capital Budgeting 55Document54 pagesCapital Budgeting 55Hitesh Jain0% (1)

- RABARA - Capital ManagementDocument2 pagesRABARA - Capital Managementjhon rayNo ratings yet

- Techniques of Capital BudgetingDocument2 pagesTechniques of Capital BudgetingLJBernardoNo ratings yet

- Discounted Cash FlowsDocument4 pagesDiscounted Cash FlowsRohit BajpaiNo ratings yet

- Investment Appraisal TechniquesDocument6 pagesInvestment Appraisal TechniquesERICK MLINGWANo ratings yet

- Engineering Economics Unit 4Document44 pagesEngineering Economics Unit 4smnavaneethakrishnan.murugesanNo ratings yet

- Long Term Investment Decision Making ("Capital Budgeting" An Approach)Document47 pagesLong Term Investment Decision Making ("Capital Budgeting" An Approach)samadhanNo ratings yet

- Bba FM Notes Unit IiiDocument7 pagesBba FM Notes Unit IiiSunita SehgalNo ratings yet

- Capital BudgetingDocument10 pagesCapital BudgetingAnkit SathyaNo ratings yet

- Capital BudgetingDocument22 pagesCapital BudgetingRajatNo ratings yet

- Methods of Economic AnalysisDocument17 pagesMethods of Economic Analysiseddula ganeshNo ratings yet

- Investment Appraisal: Qs 435 Construction ECONOMICS IIDocument38 pagesInvestment Appraisal: Qs 435 Construction ECONOMICS IIGithu RobertNo ratings yet

- Capital BudgetingDocument2 pagesCapital BudgetingMuhammad Akmal HossainNo ratings yet

- Capital Budgeting: Mrs Smita DayalDocument23 pagesCapital Budgeting: Mrs Smita Dayalkaran katariaNo ratings yet

- Capital Budgeting Techniques: Prof. Nidhi BandaruDocument28 pagesCapital Budgeting Techniques: Prof. Nidhi Bandaruhashmi4a4No ratings yet

- Unit 3: Capital Budgeting: Techniques & ImportanceDocument17 pagesUnit 3: Capital Budgeting: Techniques & ImportanceRahul kumarNo ratings yet

- Discounted Cash Flow Demystified: A Comprehensive Guide to DCF BudgetingFrom EverandDiscounted Cash Flow Demystified: A Comprehensive Guide to DCF BudgetingNo ratings yet

- Decoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisFrom EverandDecoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisNo ratings yet

- Ashutosh Jha PDFDocument1 pageAshutosh Jha PDFRitesh KumarNo ratings yet

- UNIT-1 Time Value of MoneyDocument16 pagesUNIT-1 Time Value of MoneyRitesh KumarNo ratings yet

- FM DC Lecture 5 Capital Budgeting PDFDocument7 pagesFM DC Lecture 5 Capital Budgeting PDFRitesh KumarNo ratings yet

- Corporate Ethics, Governance and Social Responsibility of BusinessDocument21 pagesCorporate Ethics, Governance and Social Responsibility of BusinessRitesh KumarNo ratings yet

- Business AnalyticsDocument12 pagesBusiness AnalyticsRitesh KumarNo ratings yet

- Ace M - 4 PDFDocument2 pagesAce M - 4 PDFRitesh KumarNo ratings yet

- IT Applications To Business: Bachelor of Business AdministrationDocument41 pagesIT Applications To Business: Bachelor of Business AdministrationRitesh KumarNo ratings yet

- TESLA Final Report1 PDFDocument67 pagesTESLA Final Report1 PDFRitesh KumarNo ratings yet

- Summer Internship ReportDocument66 pagesSummer Internship ReportRitesh KumarNo ratings yet

- ROHIT JINDAL FINAL WORK - Rohit JindalDocument42 pagesROHIT JINDAL FINAL WORK - Rohit JindalRitesh KumarNo ratings yet

- BBA Ecommerce HTML FILEDocument21 pagesBBA Ecommerce HTML FILERitesh KumarNo ratings yet

- Summer Intership ReportDocument69 pagesSummer Intership ReportRitesh KumarNo ratings yet

- E-Commerce: Bachelor of Business AdministrationDocument21 pagesE-Commerce: Bachelor of Business AdministrationRitesh KumarNo ratings yet

- Ifrs9 New Insurance Standard Ifrs4 ApproachesDocument21 pagesIfrs9 New Insurance Standard Ifrs4 ApproachesErnestNo ratings yet

- Financial Investment EXERCISE-1Document16 pagesFinancial Investment EXERCISE-1Quynh NguyenNo ratings yet

- Jane Jacobs: Urban DesignDocument12 pagesJane Jacobs: Urban DesignRini Sebastian0% (1)

- Haut Lac Postion PaperDocument4 pagesHaut Lac Postion Paperbm9gvfxj6hNo ratings yet

- FINA 410 Exercises NOV PDFDocument7 pagesFINA 410 Exercises NOV PDFDrSwati BhargavaNo ratings yet

- Work Sheet SARTHAK GOELDocument24 pagesWork Sheet SARTHAK GOELSarthak GoelNo ratings yet

- Planned Economy - WikipediaDocument93 pagesPlanned Economy - Wikipediamzingayengwenya9No ratings yet

- Method Statement - Relocate Street LightingDocument6 pagesMethod Statement - Relocate Street Lightingahmad.nazareeNo ratings yet

- Market Leader Test 2Document2 pagesMarket Leader Test 2Deniss De AnissNo ratings yet

- Bhoomi ReportsDocument44 pagesBhoomi ReportsGANESH KUNJAPPA POOJARINo ratings yet

- actInThreeVolumesManualOfConventionEn PDFDocument499 pagesactInThreeVolumesManualOfConventionEn PDFD BrownNo ratings yet

- Rbi Gives Nbfcs Room To Hold On To Realty Hopes: Telegram T.Me/IndiaepapersDocument14 pagesRbi Gives Nbfcs Room To Hold On To Realty Hopes: Telegram T.Me/Indiaepapersaashmeen25No ratings yet

- Capitalism+and+Socialism+ +RRLDocument23 pagesCapitalism+and+Socialism+ +RRLKathleen LouiseNo ratings yet

- Absolute and Comparative AdvantageDocument8 pagesAbsolute and Comparative AdvantageMuzna AijazNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource Wasjennifer roslinNo ratings yet

- Resolution To Award - Foot - WalkDocument2 pagesResolution To Award - Foot - WalkBarangay LumbiaNo ratings yet

- Case Study On Exchange Rate RiskDocument2 pagesCase Study On Exchange Rate RiskUbaid DarNo ratings yet

- Atienza RRLDocument8 pagesAtienza RRLMae Anne Yabut Roque-CunananNo ratings yet

- 6-Impact of Globalisation On IBDocument16 pages6-Impact of Globalisation On IBMohit RanaNo ratings yet

- Online Challan FormDocument1 pageOnline Challan FormRaja UmairNo ratings yet

- 9 THDocument6 pages9 THPraveen DubeyNo ratings yet

- Lse 3in 2021Document156 pagesLse 3in 2021gaja babaNo ratings yet

- ECO121 - Test 01 - Individual Assignment 01 - Fall2023 1Document6 pagesECO121 - Test 01 - Individual Assignment 01 - Fall2023 1Diệp TrịnhNo ratings yet

- Factoring & Forfaiting: Junior Level Presentation Compiled by V.V.S. RaoDocument21 pagesFactoring & Forfaiting: Junior Level Presentation Compiled by V.V.S. RaoVvs RaoNo ratings yet

- 5 6244486808881595360Document14 pages5 6244486808881595360aIDa100% (1)

- Cost of Capital QuestionsDocument18 pagesCost of Capital QuestionsRonmaty VixNo ratings yet

- Money Vocabulary British English TeacherDocument8 pagesMoney Vocabulary British English TeachereniolatobiNo ratings yet