Professional Documents

Culture Documents

Utility Analysis PDF

Utility Analysis PDF

Uploaded by

Letsplay GamesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Utility Analysis PDF

Utility Analysis PDF

Uploaded by

Letsplay GamesCopyright:

Available Formats

IME634: Management

Decision Analysis

Raghu Nandan Sengupta

Industrial & Management Department

Indian Institute of Technology Kanpur

IME634:MDA RNSengupta,IME Dept.,IIT 1

Kanpur,INDIA

Utility Analysis

Consider the same type of construction project is being

undertaken by more than one company, who we will

consider are the investors. Now different investors

(considering they are investing their money, time,

energy, skill, etc.) have different attributes and risk

perception for the same project

That is to say, each investor has with him/her an

opportunity set. This opportunity set is specific to that

person only.

IME634:MDA RNSengupta,IME Dept.,IIT 2

Kanpur,INDIA

Utility Analysis

Consider a shop floor manager has two

different machines, A and B, (both

doing the same operation) with

him/her. The outcomes for the two

different machines are given

IME634:MDA RNSengupta,IME Dept.,IIT 3

Kanpur,INDIA

Utility Analysis

A B

Outcome value(i) P[i] Outcome value(i) P[i]

15 1/3 20 1/3

10 1/3 12 1/3

15 1/3 8 1/3

In reality what would a person do if he or she has two outcome sets in

front of him/her.

For A we have the expected value of outcome as 13.33 and for B also

it is 13.33

IME634:MDA RNSengupta,IME Dept.,IIT 4

Kanpur,INDIA

Utility Analysis

A B

Outcome value(i) P[i] Outcome value(i) P[i]

15 ½ 20 1/3

10 ¼ 12 1/3

15 ¼ 8 1/3

Now for A we have the expected value of outcome as 13.75 and for B

it is still 13.33.

IME634:MDA RNSengupta,IME Dept.,IIT 5

Kanpur,INDIA

Utility Analysis

Outcome Team X Team Y

Wins 40 45

Draws 20 5

Losses 10 20

Case I Case II

Outcome Points Outcome Points

Win 2 Win 5

Draw 1 Draw 1

Lose 0 Lose 0

IME634:MDA RNSengupta,IME Dept.,IIT 6

Kanpur,INDIA

Utility Analysis

Case I

Team A = 100; Team B = 95, which means

A > B, i.e., A is ranked higher than B.

Case II

Team A = 220; Team B = 230, which means

B > A, i.e., B is ranked higher than A.

IME634:MDA RNSengupta,IME Dept.,IIT 7

Kanpur,INDIA

Utility Analysis

On a general nomenclature we should have

the expected value or utility given by

N (W )

E[U ] U (W )

W N (W )

W

here U(W) is the utility function which is a

function of the wealth, W, while N(W) is the

number of outcomes with respect to a certain

level of income W.

IME634:MDA RNSengupta,IME Dept.,IIT 8

Kanpur,INDIA

Utility Analysis

Remember in general utility values

cannot be negative, but many function

may give negative values.

For analysis to make the problem

simple we may consider the value to

be zero even though in actuality it is

negative.

IME634:MDA RNSengupta,IME Dept.,IIT 9

Kanpur,INDIA

Utility Analysis

Consider an example where a single individual is facing the same set of outcomes at

any instant of time but we try to analyze his/her expected value addition or utility

separately based on two different utility functions

1) U[W(1)] = W(1) +1

2) U[W(2)] = W(2)2 + W(2)

Outcome W(1) U[W(1)] P(W(1) W(2) U[W(2)] P(W(2)

15 1.5 2.5 0.15 1.5 3.75 0.15

20 2.0 3.0 0.20 2.0 6.00 0.20

25 2.5 3.5 0.25 2.5 8.75 0.25

10 3.0 4.0 0.10 3.0 12.00 0.10

5 0.5 1.5 0.05 0.5 0.75 0.05

25 5.0 6.0 0.25 5.0 30.00 0.25

Accordingly we have E[U(1)] = 3.825 and E[U(2)] = 12.69. So we can have a different

decision depending on the form of utility function we are using.

IME634:MDA RNSengupta,IME Dept.,IIT 10

Kanpur,INDIA

Utility Analysis

Now we have two different utility functions used one at a time for two different decisions

1) U[W(1)] = W(1) - 5 and

2) U[W(2)] = 2*W(2)-W(2)1.25

Outcome W U[W(1)] U[W(2)] Decision (A) Decision (B)

8 4 0 2.34 Yes No

3 5 0 2.52 No Yes

4 6 1 2.60 No Yes

6 7 2 2.61 Yes No

9 8 3 2.54 Yes No

5 9 4 2.41 No Yes

For utility function U[W(1)]

U(A,1)=0*8/(8+6+9)+2*6/(8+6+9)+3*9/(8+6+9)=1.69

U(B,1)=0*3/(3+4+5)+1*4/(3+4+5)+4*5/(3+4+5)=2.00

For utility function U[W(2)]

U(A,2)=2.34*8/(8+6+9)+2.61*6/(8+6+9)+2.54*9/(8+6+9)2.50

U(B,2)=2.52*3/(3+4+5)+2.60*4/(3+4+5)+2.41*5/(3+4+5) 2.50

IME634:MDA RNSengupta,IME Dept.,IIT 11

Kanpur,INDIA

Utility Analysis

Example # 01: A venture capitalist is considering

two possibilities of investment. The first alternative is

buying government treasury bills which cost Rs.

6,00,000. While the second alternative has three

possible outcomes, the cost of which are

Rs.10,00,000, Rs. 5,00,000 and Rs. 1,00,000

respectively. The corresponding probabilities are 0.2,

0.4 and 0.4 respectively. If we consider the power

utility function U(W)=W1/2, then the first alternative

has a utility value of Rs.776 while the second has an

expected utility value of Rs. 609. Hence the first

alternative is preferred.

IME634:MDA RNSengupta,IME Dept.,IIT 12

Kanpur,INDIA

Utility Analysis

Would the above problem give a

different answer if we used an

utility function of the form U(W)

= W1/2 + c (where c is a positive o

a negative constant)?

IME634:MDA RNSengupta,IME Dept.,IIT 13

Kanpur,INDIA

Utility Analysis

In a span of 6 days the price of a security fluctuates and a person

makes his/her transactions only at the following prices. We

assume U[P] = ln(P)

Day P U[P] Number of Outcomes Probability

1 1000 6.91 35 0.35

2 975 6.88 20 0.20

3 950 6.86 10 0.10

4 1050 6.96 15 0.15

5 925 6.83 05 0.05

6 1025 6.93 15 0.15

Expected utility is 6.91

If U[P]= P0.25, then expected utility is 33.63

IME634:MDA RNSengupta,IME Dept.,IIT 14

Kanpur,INDIA

Utility Analysis (Important properties)

General properties of utility functions

1) Non-satiation: The first restriction placed on

utility function is that it is consistent with

more being preferred to less. This means

that between two certain investments we

always take the one with the largest outcome,

i.e., U(W+1) > U(W) for all values of W.

Thus dU(W)/dW > 0

IME634:MDA RNSengupta,IME Dept.,IIT 15

Kanpur,INDIA

Utility Analysis (Important properties)

2) If we consider the investors or the

decision makers perception of absolute

risk, then we have the concept/property

of (i) risk aversion, (ii) risk neutrality

and (iii) risk seeking. Let us consider

an example now

IME634:MDA RNSengupta,IME Dept.,IIT 16

Kanpur,INDIA

Utility Analysis (Important properties)

Invest Prob Do not invest Prob

2 ½ 1 1

0 ½

Price for investing is 1 and it is a fair gamble,

in the sense its value is exactly equal to the

decision of not investing

IME634:MDA RNSengupta,IME Dept.,IIT 17

Kanpur,INDIA

Utility Analysis (Important properties)

Thus

U(I1)*P(I1) + U(I2)*P(I2) < U(DI)*1

risk averse

U(I1)*P(I1) + U(I2)*P(I2) = U(DI)*1

risk neutral

U(I1)*P(I1) + U(I2)*P(I2) > U(DI)*1

risk seeker

IME634:MDA RNSengupta,IME Dept.,IIT 18

Kanpur,INDIA

Utility Analysis (Important properties)

Another characteristic by which to classify a

risk averse, risk neutral and risk seeker person

is

d2U(W)/dW2 = U(W) < 0 risk averse

d2U(W)/dW2 = U(W) = 0 risk neutral

d2U(W)/dW2 = U(W) > 0 risk seeker

IME634:MDA RNSengupta,IME Dept.,IIT 19

Kanpur,INDIA

Utility Analysis (Important properties)

Utility curves

U (W )

IME634:MDA RNSengupta,IME Dept.,IIT 20

Kanpur,INDIA

Utility Analysis and Marginal Utility

Marginal Utility Function

Marginal utility function looks like a concave

function risk averse

Marginal utility function looks neither like a

concave nor like a convex function risk

neutral

Marginal utility function looks like a convex

function risk seeker

IME634:MDA RNSengupta,IME Dept.,IIT 21

Kanpur,INDIA

Utility Analysis and Marginal Utility

Marginal Utility Rate

Marginal utility rate is increasing at a

decreasing rate risk averse

Marginal utility rate is increasing at a constant

rate risk neutral

Marginal utility rate is increasing at a

increasing rate risk seeker

IME634:MDA RNSengupta,IME Dept.,IIT 22

Kanpur,INDIA

Utility Analysis and Marginal Utility

Risk avoider

U (W )

W1 W1 1 W1 2

W

IME634:MDA RNSengupta,IME Dept.,IIT 23

Kanpur,INDIA

Utility Analysis and Marginal Utility

Risk neutral

U (W )

W1 W1 1 W1 2 W

IME634:MDA RNSengupta,IME Dept.,IIT 24

Kanpur,INDIA

Utility Analysis and Marginal Utility

Risk seeker

U (W )

W1 W1 1 W1 2 W

IME634:MDA RNSengupta,IME Dept.,IIT 25

Kanpur,INDIA

Utility Analysis and Marginal Utility

Few other important concepts

Condition Definition Implication

Risk aversion Reject a U(W) < 0

fair gamble

Risk neutrality Indifference to U(W) = 0

a fair gamble

Risk seeking Select a U(W) > 0

fair gamble

IME634:MDA RNSengupta,IME Dept.,IIT 26

Kanpur,INDIA

Utility Analysis

(Other concepts, i.e., A(W))

3) Absolute risk aversion property of utility

function where by absolute risk aversion we

mean

A(W) = - [d2U(W)/dW2]/[dU(W)/dW]

= - U(W)/U(W)

IME634:MDA RNSengupta,IME Dept.,IIT 27

Kanpur,INDIA

Utility Analysis

(Other concepts, i.e., A(W))

• Assume an investor has wealth of amount W and a

security with an outcome represented by Z, which is a

random variable.

• Assume Z is a fair gamble, such that E[Z] = 0 and V[Z]

= 2Z and the utility function is U(W).

• If WC is the wealth such that we can write this as a

decision process having two chooses, i.e.,

Choice A Choice B

W+Z WC

IME634:MDA RNSengupta,IME Dept.,IIT 28

Kanpur,INDIA

Utility Analysis

(Other concepts, i.e., A(W))

• Now if the person is indifferent between decision/choice

A and decision/choice B, then we must have E[A] =

E[B], i.e., E[U(W+Z)] = E[U(WC)] = U(WC)*1

• The person is willing to give maximum of (W – WC) to

avoid risk, i.e., the absolute risk (say ) = (W- WC).

• Expanding U(W+Z) in a Taylors series around W and

we would get the answer.

Assignment # 01: This is an assignment and for the

proof check any good book in economics or game theory

which has utility as a part of it

IME634:MDA RNSengupta,IME Dept.,IIT 29

Kanpur,INDIA

Utility Analysis

(Other concepts, i.e., A(W))

For the three different types of persons

Decreasing absolute risk aversion

A(W) = dA(W)/d(W) < 0

Constant absolute risk aversion

A(W) = dA(W)/d(W) = 0

Increasing absolute risk aversion

A(W) = dA(W)/d(W) > 0

IME634:MDA RNSengupta,IME Dept.,IIT 30

Kanpur,INDIA

Utility Analysis

(Other concepts, i.e., A(W))

Condition Definition Property

1) Decreasing As wealth A(W) < 0

absolute risk increases the amount

aversion held in risk assets

increases

2) Constant As wealth A(W) = 0

absolute risk increases the amount

aversion held in risk assets

remains the same

3) Increasing As wealth A(W) > 0

absolute risk increases the amount

aversion held in risk assets

decreases

IME634:MDA RNSengupta,IME Dept.,IIT 31

Kanpur,INDIA

Utility Analysis

(Other concepts, i.e., R(W))

4) Relative risk aversion property of utility

function where by relative risk aversion we

mean

R(W) = - W * [d2U(W)/dW2]/[dU(W)/dW]

= - W * U(W)/U(W)

IME634:MDA RNSengupta,IME Dept.,IIT 32

Kanpur,INDIA

Utility Analysis

(Other concepts, i.e., R(W))

• Consider the same example as the previous

prove but now with /= (W- WC)/W, which is

the per cent of money the person will give up in

order to avoid the gamble and E[Z]=1.

• Z represented the outcome per rupee invested.

• Therefore for W invested we obtain W*Z

amount of money. On the other hand we have a

sure investment of WC.

IME634:MDA RNSengupta,IME Dept.,IIT 33

Kanpur,INDIA

Utility Analysis

(Other concepts, i.e., R(W))

• For the investor to be indifferent between the two

decision processes we must have: E[U(W*Z)] =

E[U(WC)]

• Consider now E(U(W*Z)] and expanding it in a

Taylors series around W and we would get our

result

Assignment # 02: This is an assignment and for

the proof check any good book in economics or

game theory which has utility as a part of it

IME634:MDA RNSengupta,IME Dept.,IIT 34

Kanpur,INDIA

Utility Analysis

(Other concepts, i.e., R(W))

For the three different types of persons

Decreasing relative risk aversion

R(W) = dR(W)/dW < 0

Constant relative risk aversion

R(W) = dR(W)/dW = 0

Increasing relative risk aversion

R(W) = dR(W)/dW > 0

IME634:MDA RNSengupta,IME Dept.,IIT 35

Kanpur,INDIA

Utility Analysis

(Other concepts, i.e., R(W))

Condition Definition Property

1) Decreasing As wealth increases R(W) < 0

relative risk the % held in risky

aversion assets increases

2) Constant As wealth increases R(W) = 0

relative risk the % held in risky

aversion assets remains the

same

3) Increasing As wealth increases R(W) > 0

relative risk the % held in risky

aversion assets decreases

IME634:MDA RNSengupta,IME Dept.,IIT 36

Kanpur,INDIA

Examples of Utility Functions

Quadratic: U(W) = W – b*W2

Then:

A(W)=4*b2/(1- 2*b*W)2

R(W)=2*b/(1- 2*b*W)2

Hence we use this utility function for people

with

(i) increasing absolute risk aversion

(ii) increasing relative risk aversion

IME634:MDA RNSengupta,IME Dept.,IIT 37

Kanpur,INDIA

Examples of Utility Functions

W W-b*W^2 A(W) A'(W) R(W) R'(W)

2.00 3.00 -0.25 0.06 -0.50 -0.13

3.00 5.25 -0.20 0.04 -0.60 -0.08

4.00 8.00 -0.17 0.03 -0.67 -0.06

5.00 11.25 -0.14 0.02 -0.71 -0.04

6.00 15.00 -0.13 0.02 -0.75 -0.03

7.00 19.25 -0.11 0.01 -0.78 -0.02

8.00 24.00 -0.10 0.01 -0.80 -0.02

9.00 29.25 -0.09 0.01 -0.82 -0.02

10.00 35.00 -0.08 0.01 -0.83 -0.01

11.00 41.25 -0.08 0.01 -0.85 -0.01

IME634:MDA RNSengupta,IME Dept.,IIT 38

Kanpur,INDIA

Examples of Utility Functions

IME634:MDA RNSengupta,IME Dept.,IIT 39

Kanpur,INDIA

Examples of Utility Functions

Logarithmic: U(W) = ln(W)

Then:

A(W) = - 1/W2

R(W) = 0

We use this utility function for people with

(i) decreasing absolute risk aversion

(ii) constant relative risk aversion

IME634:MDA RNSengupta,IME Dept.,IIT 40

Kanpur,INDIA

Examples of Utility Functions

W ln(W) A(W) A'(W) R(W) R'(W)

1.00 0.00 -1.00 -1.00 -1.00 0.00

2.00 0.69 -0.50 -0.25 -1.00 0.00

3.00 1.10 -0.33 -0.11 -1.00 0.00

4.00 1.39 -0.25 -0.06 -1.00 0.00

5.00 1.61 -0.20 -0.04 -1.00 0.00

6.00 1.79 -0.17 -0.03 -1.00 0.00

7.00 1.95 -0.14 -0.02 -1.00 0.00

8.00 2.08 -0.13 -0.02 -1.00 0.00

9.00 2.20 -0.11 -0.01 -1.00 0.00

10.00 2.30 -0.10 -0.01 -1.00 0.00

IME634:MDA RNSengupta,IME Dept.,IIT 41

Kanpur,INDIA

Examples of Utility Functions

U(W)=ln(W)

2.50

2.00

1.50

1.00 U(W)

U(W)

A(W)

0.50

A'(W)

0.00 R(W)

.00 2.0

0 0

3.0 4.0

0 0

5.0 6.0

0

7.0

0 0 0

8.0 9.0 10.0

0 R'(W)

-0.50 1

-1.00

-1.50

W

IME634:MDA RNSengupta,IME Dept.,IIT 42

Kanpur,INDIA

Examples of Utility Functions

Exponential: U(W) = - e-aW

Then:

A(W) = 0

R(W) = a

We use this utility function for people with

(i) constant absolute risk aversion

(ii) increasing relative risk aversion

IME634:MDA RNSengupta,IME Dept.,IIT 43

Kanpur,INDIA

Examples of Utility Functions

W U(W) A(W) A'(W) R(W) R'(W)

2.00 -1.65 -0.25 0.00 0.50 0.25

3.00 -2.12 -0.25 0.00 0.75 0.25

4.00 -2.72 -0.25 0.00 1.00 0.25

5.00 -3.49 -0.25 0.00 1.25 0.25

6.00 -4.48 -0.25 0.00 1.50 0.25

7.00 -5.75 -0.25 0.00 1.75 0.25

8.00 -7.39 -0.25 0.00 2.00 0.25

9.00 -9.49 -0.25 0.00 2.25 0.25

10.00 -12.18 -0.25 0.00 2.50 0.25

11.00 -15.64 -0.25 0.00 2.75 0.25

IME634:MDA RNSengupta,IME Dept.,IIT 44

Kanpur,INDIA

Examples of Utility Functions

U(W)=-exp(-a*W)

5.00

0.00

2.00 3.00 4.00 5.00 6.00 7.00 8.00 9.00 10.00 11.00 U(W)

-5.00 A(W)

U(W)

A'(W)

-10.00 R(W)

R'(W)

-15.00

-20.00

W

IME634:MDA RNSengupta,IME Dept.,IIT 45

Kanpur,INDIA

Examples of Utility Functions

Power: U(W) = c*Wc

Then:

A(W) = (c-1)/W2

R(W) = 0.

We use this utility function for people with

(i) decreasing absolute risk aversion

(ii) constant relative risk aversion

IME634:MDA RNSengupta,IME Dept.,IIT 46

Kanpur,INDIA

Examples of Utility Functions

W U(W) A(W) A'(W) R(W) R'(W)

2.00 0.30 0.38 -0.19 -0.75 0.00

3.00 0.33 0.25 -0.08 -0.75 0.00

4.00 0.35 0.19 -0.05 -0.75 0.00

5.00 0.37 0.15 -0.03 -0.75 0.00

6.00 0.39 0.13 -0.02 -0.75 0.00

7.00 0.41 0.11 -0.02 -0.75 0.00

8.00 0.42 0.09 -0.01 -0.75 0.00

9.00 0.43 0.08 -0.01 -0.75 0.00

10.00 0.44 0.08 -0.01 -0.75 0.00

11.00 0.46 0.07 -0.01 -0.75 0.00

IME634:MDA RNSengupta,IME Dept.,IIT 47

Kanpur,INDIA

Examples of Utility Functions

U(W)=cW^c

0.60

0.40

0.20

U(W)

0.00

A(W)

U(W)

2.00 3.00 4.00 5.00 6.00 7.00 8.00 9.00 10.00 11.00

-0.20 A'(W)

-0.40 R(W)

R'(W)

-0.60

-0.80

-1.00

W

IME634:MDA RNSengupta,IME Dept.,IIT 48

Kanpur,INDIA

Utility Function (An Example)

Example # 02:Suppose U(W) = W1/4 and we are required to

find the properties of this utility function and also draw the

utility function graph.

Now

IME634:MDA RNSengupta,IME Dept.,IIT 49

Kanpur,INDIA

Utility Function (An Example)

Let us find absolute risk aversion and relative risk aversion

properties of this particular utility function.

IME634:MDA RNSengupta,IME Dept.,IIT 50

Kanpur,INDIA

Utility Function (An Example)

Now from the two equations we easily see that:

1. We have decreasing absolute risk aversion property,

i.e., as the amount of wealth (W) increases the

amount held in risky assets also increases.

2. We have constant relative risk aversion property,

i.e., as the amount of wealth (W) increases the %

held in risky assets remains the same.

IME634:MDA RNSengupta,IME Dept.,IIT 51

Kanpur,INDIA

Utility Function (An Example)

Now the U(W) looks like as shown in the graph.

IME634:MDA RNSengupta,IME Dept.,IIT 52

Kanpur,INDIA

Utility Analysis

The actual value of expected utility is of no

use, except when comparing with other

alternatives. Hence we use an important

concept of certainty equivalent, which is the

amount of certain wealth (risk free) that has

the utility level exactly equal to this expected

utility value.

We define U(C) = E[U(W)], where C is the

certainty value

IME634:MDA RNSengupta,IME Dept.,IIT 53

Kanpur,INDIA

Utility Analysis

How is this value of certainty equivalent (C)

useful

Suppose that we have a decision process with a

set of outcomes, their probabilities and the

corresponding utility values. In case we want to

compare this decision process we can find the

certainty equivalent so that comparison is easier.

To find the exact form of the utility function for a

person who is not clear about the form of utility

function he/she uses.

IME634:MDA RNSengupta,IME Dept.,IIT 54

Kanpur,INDIA

Utility Analysis

Example # 03: Suppose you face two options. Under

option # 1 you toss a coin and if head comes you win

Rs. 10, while if tail appears you win Rs. 0. Under

option # 2 you get an amount of Rs. M. Also assume

that your utility function is of the form U(W) = W –

0.04*W2. It means that after you win any amount the

utility you get from the amount you won.

For the first option the expected utility value would be

Rs. 3, while the second option has an expected utility of

Rs. M – 0.04*M2. To find the certainty equivalent we

should have U(M) = M – 0.04*M2 = 3. Thus M = 3.49,

i.e., C = 3.49, as U(3.49) = E[U(W)]

IME634:MDA RNSengupta,IME Dept.,IIT 55

Kanpur,INDIA

Utility Analysis

The above example illustrates that you would be

indifferent between option # 1 and option # 2.

Now suppose if you face a different situation

where you have option # 1 as before but a

different option # 2 where you get Rs. 5. Then

obviously you would choose option # 2 here, as

U(5) = (5 - 0.04*52) = 4 > 3.49.

For the venture capital problem the certainty

value for the option # 2 is Rs. 370881, as

U(370881) = (370881)0.5 = 609

IME634:MDA RNSengupta,IME Dept.,IIT 56

Kanpur,INDIA

Utility Analysis

A risk averse person will select a

equivalent certain event rather than the

gamble

A risk neutral person will be indifferent

between the equivalent certain event and

the gamble

A risk seeking person will select the

gamble rather than the equivalent certain

event

IME634:MDA RNSengupta,IME Dept.,IIT 57

Kanpur,INDIA

Utility Analysis

A B

Expected Value

IME634:MDA RNSengupta,IME Dept.,IIT 58

Kanpur,INDIA

Utility Analysis

• A and B are wealth values, i.e., values of W. Also for

ease of our analysis we consider that U(W)=W.

• Form a lottery such that it has an outcome of A with

probability p and the other outcome is B with a

probability (1-p).

• Change the values of p and ask the investor how much

certain wealth (C) he/she will have in place of the

lottery. Thus C varies with p.

• Now the expected value of lottery is {p*A+(1-p)*B}. A

risk averse person will have C < {p*A+(1-p)*B}.

• Plot the values of C and you already have the expected

values of the lottery.

IME634:MDA RNSengupta,IME Dept.,IIT 59

Kanpur,INDIA

Utility Analysis

• How would you find the explicit form of the utility

function of a person. Suppose you know that it is of the

form U(W) = - e –aW.

• You ask the person that given a lottery which has a 50-50

chance of winning Rs. 1,000,000 or Rs. 4,00,000. In order

to buy this lottery what was he/she willing to pay.

• Suppose the answer is Rs. 5,00,000 (say for example),

then it means that the person is indifferent between a

certain equivalent amount of Rs. 5,00,000 and the lottery

(which is a fair gamble).

• Hence: 1*(- e-500000*a)= 0.5*(-e-1000000*a) + 0.5*(-e-400000*a).

• Solving through iteration process we can find a.

IME634:MDA RNSengupta,IME Dept.,IIT 60

Kanpur,INDIA

Utility Analysis (Axioms)

Axioms of utility functions

1) An investor can always say whether A = B, A > B or A <

B

2) If A > B and B > C, then A > C

3) Consider X = Y. Then assume we combine with X with

another decision Z, such that X is with P(X) = p and Z is

with P(Z) =1-p. On the same lines we have the same

decision Z with Y, such that Y is with P(Y) = p and Z is

with P(Z) = 1-p. The X+Z = Y+Z

4) For every gamble there is a certainty equivalent such

that a person is indifferent between the gamble and the

certainty equivalent

IME634:MDA RNSengupta,IME Dept.,IIT 61

Kanpur,INDIA

Comparison of MV and Utility Analysis

Comparison between mean-variance and utility function

The utility function used is (U(W)=W-bW2), which is quadratic

Consider we have three assets and the prices are as follows

No A B C R(A) R(B) R(C) P(i)

1 100 105 80 --- --- --- 1/5

2 110 115 90 1.10 1.09 1.13 1/5

3 115 120 95 1.05 1.04 1.06 1/5

4 120 125 105 1.04 1.04 1.11 1/5

5 125 130 130 1.04 1.04 1.24 1/5

IME634:MDA RNSengupta,IME Dept.,IIT 62

Kanpur,INDIA

Comparison of MV and Utility Analysis

Then:

R A 1.06 ; RB 1.05; RC 1.14

A 0.025 ; B 0.022; C 0.052

W A 114 ;WB 119;WC 100

If risk less interest (in terms of total return) is 0.5, then using mean-

variance analysis we rank the assets as

B RB R f / B 25.0 A RA R f / A 22.4

CRC R f / C 12.3

Using quadratic utility function U(W) = W – b*W2, with b = -0.002 we

rank the assets as

B [U(B) = 90.68] > A [U(A) = 88.01] > C [U(C) = 80.00]

IME634:MDA RNSengupta,IME Dept.,IIT 63

Kanpur,INDIA

Comparison of MV and Utility Analysis

Consider the following example with two different sets of outcomes. The

utility function is U[W] = W2 + W

Outcome Outcome W U[W] P(W)

Scenario 1 Scenario 2

15 20 1.5 3.75 (15+20)/212

20 12 2.0 6.00 (20+12)/212

25 25 2.5 8.75 (25+25)/212

10 17 3.0 12.00 (10+17)212

5 8 3.5 15.75 (5+8)/212

25 30 4.0 20.00 (25+30)/212

Accordingly we have to calculate the expected utility value

IME634:MDA RNSengupta,IME Dept.,IIT 64

Kanpur,INDIA

Decisions and Utility Analysis

Deterministic vs Probabilistic

b1

h1

w1

1 h1 0

p1 w2

p2

p3 w3

h4 b4

p4

w4

1 h4 0

IME634:MDA RNSengupta,IME Dept.,IIT 65

Kanpur,INDIA

Decisions and Utility Analysis

People have other criteria for

investment/project/portfolio solutions

and they are

Geometric mean return

Safety first criteria

Stochastic dominance

Analysis in terms of characteristics of

the return distribution

IME634:MDA RNSengupta,IME Dept.,IIT 66

Kanpur,INDIA

Decisions and Utility Analysis

Geometric mean return

For the selection process we consider

the maximum GM has:

The highest probability of reaching or

exceeding any given wealth level in the

shortest possible time.

The highest probability of exceeding

any given wealth level over any given

period of time

IME634:MDA RNSengupta,IME Dept.,IIT 67

Kanpur,INDIA

Decisions and Utility Analysis

Ri,j = ith possible return on the jth portfolio.

p1, j pn, j

RG , j (1 R1, j ) ...... (1 Rn, j ) 1

pi,j = probability of ith outcome for jth

portfolio.

Then choose the maximum of the GM values

IME634:MDA RNSengupta,IME Dept.,IIT 68

Kanpur,INDIA

Decisions and Utility Analysis

Example # 04: Consider we have the following

combinations of assets A, B and C in the following ratios

(weights) to form a portfolio P. The returns are 10, 20, 30

respectively.

A B C

1 0.20 0.20 0.60

2 1/3 1/3 1/3

3 0.25 0.25 0.50

• RP,1 = (1+0.10)0.20*(1+0.20)0.20*(1+0.30)0.60 – 1 = 0.237

• RP,2 = (1+0.10)1/3*(1+0.20)1/3*(1+0.30)1/3 – 1 = 0.197

• RP,3 = (1+0.10)0.25*(1+0.20)0.25*(1+0.30)0.50 – 1 = 0.222

Note: Hence choose scenario # 1

IME634:MDA RNSengupta,IME Dept.,IIT 69

Kanpur,INDIA

Decisions and Utility Analysis

Maximizing GM return is equivalent to

maximizing the expected value of log

utility function

Projects/Investment/Portfolios that

maximize the GM return are also mean-

variance efficient if returns are log-

normally distributed

IME634:MDA RNSengupta,IME Dept.,IIT 70

Kanpur,INDIA

Decisions and Utility Analysis

Safety first principle

Under safety first principle the basic

tenet is that the decision maker is unable

or unwilling to consider the utility

theorem for making his/her decision

process

Under this methodology people make

their decision placing more importance

to bad outcomes

IME634:MDA RNSengupta,IME Dept.,IIT 71

Kanpur,INDIA

Decisions and Utility Analysis

(Concepts)

Safety first principles (rules)

Min Pr[RP<RL]

Max RL

Max RP

IME634:MDA RNSengupta,IME Dept.,IIT 72

Kanpur,INDIA

Decisions and Utility Analysis

(Concepts)

If returns are normally distributed then the optimal

portfolio would be the one where RL was the maximum

number of SD away from the mean

Let us consider an example for Min P[Rp < RL].

Remember we consider the returns are normally

distributed and the suffix P denotes the portfolio while

RL means a fixed level of return (5).

A B C

RP 10 14 17

P 5 4 8

Diff from 5% -1*A -2.25* B -1.5*C

IME634:MDA RNSengupta,IME Dept.,IIT 73

Kanpur,INDIA

Decisions and Utility Analysis

(Concepts)

2 * A 2 * B

RL RA RB

IME634:MDA RNSengupta,IME Dept.,IIT 74

Kanpur,INDIA

Decisions and Utility Analysis

(Concepts)

In order to determine how many SDs, RL

lies below the mean we calculate RL minus

the mean return divided by the SD. Thus

we have

RL RP RP RL

min max

P P

RP RF

This is equivalent to max

P

IME634:MDA RNSengupta,IME Dept.,IIT 75

Kanpur,INDIA

Decisions and Utility Analysis

(Concepts)

Even though for our example we have

simplified our assumption by considering

only normal distribution, but this would

hold for any distributions having first and

second moments.

IME634:MDA RNSengupta,IME Dept.,IIT 76

Kanpur,INDIA

Decisions and Utility Analysis

(Concepts)

According to Tchebychev (Chebyshev)

inequality for any random variable X, such

that E(X) and V(X) exists, then

X EX 1 RP RP 1

Pr t 2 Pr K 2

V X t

P K

IME634:MDA RNSengupta,IME Dept.,IIT 77

Kanpur,INDIA

Decisions and Utility Analysis

(Concepts)

As we are interested in lower limit hence

we simply it and have

RP RP 1

Pr K 2

P K

RP RP RL RP P2

Pr

RL RP

2

P P

IME634:MDA RNSengupta,IME Dept.,IIT 78

Kanpur,INDIA

Decisions and Utility Analysis

(Concepts)

The right hand side of the inequality is is

exactly equal to the decision process # 1

under safety first principle we have

considered previously

RP RP RL RP P2

Pr

RL RP

2

P P

PrRP RL

IME634:MDA RNSengupta,IME Dept.,IIT 79

Kanpur,INDIA

Decisions and Utility Analysis

(Concepts)

For the second criterion we have

max RL

s.t.: Pr(RP < RL)

We are given (say 0.05), then we should

have

RP RP RL RP

Pr 0.05

P P

IME634:MDA RNSengupta,IME Dept.,IIT 80

Kanpur,INDIA

Decisions and Utility Analysis

(Concepts)

`

0.05

z RB

IME634:MDA RNSengupta,IME Dept.,IIT 81

Kanpur,INDIA

Decisions and Utility Analysis

(Concepts)

RP P*

RL , 4

R L ,3

RL , 2

RL ,1

P

IME634:MDA RNSengupta,IME Dept.,IIT 82

Kanpur,INDIA

Decisions and Utility Analysis

(Concepts)

The criterion is max RP such that

Pr(RP RL) = , here is predertermined

depending on the investors own

constraints. Thus with the condition we

have RP RL z * P

IME634:MDA RNSengupta,IME Dept.,IIT 83

Kanpur,INDIA

Decisions and Utility Analysis

(Concepts)

A2

RP A1

B2

B1

RL

P

IME634:MDA RNSengupta,IME Dept.,IIT 84

Kanpur,INDIA

Safety First Principle (Example)

Example # 05: Considering we have projects A, B,

C and D and we need to rank them using the

concept of safety first principle. The information is

as follows

IME634:MDA RNSengupta,IME Dept.,IIT 85

Kanpur,INDIA

Safety First Principle (Example)

As per safety first principle we have: min {RP,jRL}

where: (i) i = 1, 2,….., m, (number of projects) and (ii)

j = 1, 2,….., n (number of jobs/activities/financial

decisions in each project).

Thus:

IME634:MDA RNSengupta,IME Dept.,IIT 86

Kanpur,INDIA

Safety First Principle (Example)

IME634:MDA RNSengupta,IME Dept.,IIT 87

Kanpur,INDIA

Stochastic Dominance

• First-order stochastic dominance

• Second-order stochastic

dominance

• Third-order stochastic

dominance

IME634:MDA RNSengupta,IME Dept.,IIT 88

Kanpur,INDIA

First Order Stochastic (FOS)

Dominance

• A lottery F dominates G then the

decision maker prefers F to G

regardless of what U(W) is, as long as

it is

– Weakly increasing (i.e., U(Wi) U(Wj),

where Wi Wj)

IME634:MDA RNSengupta,IME Dept.,IIT 89

Kanpur,INDIA

FOS Dominance (contd…)

• F dominates G iff

• Simply stated it means that every

individual with increasing utility

function prefers FW to GW regardless

of his/her risk preferences.

IME634:MDA RNSengupta,IME Dept.,IIT 90

Kanpur,INDIA

FOS Dominance (contd…)

First-order stochastic dominance

• F dominates G iff FW(W)GW(W)

• This definition requires that FW gives

more wealth than GW realization by

realization.

IME634:MDA RNSengupta,IME Dept.,IIT 91

Kanpur,INDIA

Second Order Stochastic (SOS)

Dominance

• A lottery F dominates G if the decision

maker prefers F to G as long as he/she

is

– Risk averse

– U(W) is weakly increasing (i.e., U(Wi)

U(Wj), where Wi Wj)

IME634:MDA RNSengupta,IME Dept.,IIT 92

Kanpur,INDIA

Loss Functions

In the course of a statistical estimation

problem, observations (collectively, the

sample) pertaining to a data set are regarded

as realizations of a random element (X) with

which is associated a probability law P

Usually, P is specified by the cumulative

distribution function (d.f.) of X, namely, F(x)

= P(X x), xR=(-, )

Generally, F is not completely known, and we

are usually interested in drawing statistical

conclusion about the parameters, = (F)

which are functionals of the d.f. F

IME634:MDA RNSengupta,IME Dept.,IIT 93

Kanpur,INDIA

Loss Functions (contd…)

In a parametric model, the assumed functional

form of F may involve some unknown

algebraic constant(s), which are interpreted as

the parameters, e.g., in the normal d.f., the

algebraic constants are themselves the mean

() and the variance (2)

The objective in point estimation is to utilize

the information in the given set (X1,….., Xn)

of sample observations (random variables) to

choose a suitable statistic Tn = T(X1, X2,..…,

Xn) such that Tn estimates (parameter) in a

meaningful way

IME634:MDA RNSengupta,IME Dept.,IIT 94

Kanpur,INDIA

Loss Functions (contd…)

Imposing consistency and unbiasedness does

not always lead to a unique estimator of

A good idea is to locate an optimal estimator

within the class of consistent (and possibly,

unbiased) estimators

One idea is to choose a nonnegative metric

L(Tn , ) defined for all , where varies over

(the parameter space) while Tn varies over

(the sample space, which is usually a subset of

Rn, the n-dimensional Euclidean space)

IME634:MDA RNSengupta,IME Dept.,IIT 95

Kanpur,INDIA

Squared Error Loss (SEL) Function

• The loss function is of the form L(Tn , ) =

(Tn - )2 and looks like as give below

L()

Squared Error Loss function

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 96

Kanpur,INDIA

SEL Function (contd…)

Most widely used loss function and is used in estimation

problems when unbiased estimators of are considered, since

the risk, R(Tn , ) ( = E[L (Tn , )] = E[(Tn - )2]) is the mean

square error (MSE) of Tn, which reduces to the variance of Tn

subject to unbiasedness

The corresponding optimal estimator, if it exists, is called the

minimum variance unbiased (MVU) estimator

Another reason for the popularity of SEL is due to its

relationship to the classical least square theory. Also, for most

analyses SEL makes calculation relatively straight forward.

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 97

Kanpur,INDIA

Weighted SEL Function

A generalization of SEL, which is of

interest, is L( , Tn) = w()( - Tn)2 and it is

termed as the weighted squared error loss

which has the attractive feature of allowing

the squared error, to be weighted by a

function of , which may be useful for many

practical problems.

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 98

Kanpur,INDIA

Quadratic Loss Function

If =(1,…,n) is a vector estimated

by T=(T1,…,Tn) and Q is (nXp)

positive definite matrix, then,

L(,T)=(-T)/Q(-T) is called a

quadratic loss function

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 99

Kanpur,INDIA

Linear Loss Function

• When the utility function is

approximately linear the loss

function will tend to be linear in

nature which is of the form,

• L( - Tn) = K1( - Tn) if ( - Tn) 0

= K2(Tn - ) if ( - Tn) < 0

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 100

Kanpur,INDIA

Absolute Error Loss Function

• The constants K1 and K2 are to be chosen to

reflect the relative importance of

overestimation and underestimation. In

general, these constants are different

• When they are equal, the equivalent loss

function is of the form L( , Tn) = | - Tn|,

which is called absolute error loss

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 101

Kanpur,INDIA

Absolute Error Loss Function

(contd…)

L()=L(Tn,)

=(Tn-)

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 102

Kanpur,INDIA

Absolute Error Loss Function

(contd…)

• The optimal estimator for this absolute

error loss function, if it exists, is called

the minimum mean absolute error

estimator

• If K1 and K2 are themselves functions of

, then the loss function is termed as the

weighted linear loss function

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 103

Kanpur,INDIA

Weighted Absolute Error Loss Function

L()=L(Tn,)

=(Tn,)

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 104

Kanpur,INDIA

Weighted Absolute Error Loss

Function (contd…)

L()=L(Tn,)

=(Tn,)

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 105

Kanpur,INDIA

0-1 Loss Function

• This is of the form

L( , Tn) = 1, if |Tn - | > ,

= 0, otherwise

for 0 < < 1

• Here risk is P(|Tn - | > )

• This refers to the large deviation probability, and the

optimality of an estimator Tn is interpreted in terms of

minimization of this probability or in terms of the fastest

rate of decline (with n) of this probability

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 106

Kanpur,INDIA

Balanced Loss Function

The BLF, (Zellner (1994)), reflects both

goodness of fit (lack of bias) and precision of

estimation

A balanced loss function (BLF) is of the form

L(Tn,)=w{g(Tn)-g()}T{g(Tn)-g()} + (1-w) (Tn-

)T(Tn-)

with 0≤w≤1

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 107

Kanpur,INDIA

Balanced Loss Function (contd…)

The first term represents the goodness of fit

while the second represents the precision of

estimation, which is also, termed as

accuracy

The second term as originally used by

Zellner (1994) considers it in its quadratic

form or the squared error term

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 108

Kanpur,INDIA

Balanced Loss Function (contd…)

The least square estimation reflects

goodness of fit consideration whereas the

use of quadratic loss function involves a sole

emphasis on precision of estimation

Depending on the problem this term can be

modified as lin-lin, mod etc.

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 109

Kanpur,INDIA

Linear Exponential (LINEX) Loss

Function

The fact the overestimation and

underestimation of may be of unequal

consequence has not been properly or

adequately emphasized in any of the above

loss functions

Varian (1975) first employs such a loss

function in real-estate assessment

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 110

Kanpur,INDIA

LINEX Loss Function (contd…)

A loss function, which takes care of this, is the

linear exponential loss function (LINEX), (Zellner

(1986)), which is an asymmetric convex loss

function and is given by

L()=L(Tn,)=b[exp{a(Tn-)} - a(Tn-) -1]

a determines the shape of the loss function

b > 0 serves to scale the loss function

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 111

Kanpur,INDIA

LINEX Loss Function (contd…)

When a > 0, the convex loss increases almost

linearly for negative error =(Tn-), and

almost exponential for positive error =(Tn-),

therefore, overestimation is of more serious

concern than underestimation

When a < 0, the linear-exponential increases

are interchanged, whereby underestimation

becomes more serious than overestimation

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 112

Kanpur,INDIA

LINEX Loss Function (contd…) (a > 0)

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 113

Kanpur,INDIA

LINEX Loss Function (contd…) (a < 0)

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 114

Kanpur,INDIA

LINEX Loss Function: Example # 01

Consider a company plans to launch a new

product, say a refrigerator in the consumer

market

Also suppose that similar products from

different manufacturers already exist in the

market

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 115

Kanpur,INDIA

LINEX Loss Function: Example # 01

(contd…)

Then the company is expected to give some

warranty for the particular product, i.e., the

refrigerator, to its customers in order to sell the

product

Now if the value of this warranty is more than

the average time of failure for the product, then

the aforesaid mentioned company needs to

replace the damaged products it sells, or face

litigation charges

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 116

Kanpur,INDIA

LINEX Loss Function: Example # 01

(contd…)

On the other if the warranty period is less

than the average failure time of similar

products available in the market, then the

company losses the market share to its

rivals, as naturally, customers are willing to

buy the refrigerator from the competitors

who assure a higher warranty period

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 117

Kanpur,INDIA

LINEX Loss Function: Example # 01

(contd…)

Under such a situation it is definitely advisable

to estimate the warranty life time using an

asymmetric loss

What values of a one should use would then

depend on the level of importance our company

places on overestimation versus

underestimation, i.e., the cost of litigation

versus the cost of a loss in the market share of

the company

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 118

Kanpur,INDIA

LINEX Loss Function: Example # 02

As a second example, assume a civil

engineer is building a dam and he/she is

interested in finding the height of the dam

which is being built

If due to some error the height is estimated

to be greater than the actual value then the

cost the engineer incurs are mainly due to

material and labour

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 119

Kanpur,INDIA

LINEX Loss Function: Example # 02

(contd…)

On the other hand, if the estimated height is

less than what it should be, then the

consequences can be disastrous in terms of an

environmental impact, which in monetary

terms can be very high

So it is logical to use a value of a < 0 in such

situations such that underestimation is

penalized more than over estimation

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 120

Kanpur,INDIA

LINEX Loss Function: Example # 03

Finally to illustrate the significance of over

estimation when compared with

underestimation let us consider a different

real life example

Consider an electrical company

manufactures vacuum circuit

breakers/interrupters, which are used as a

fuse in high voltage system

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 121

Kanpur,INDIA

LINEX Loss Function: Example # 03

(contd…)

As for any product these circuit

breakers have a working life and it

is of utmost importance that this

value is estimated as accurately as

possible

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 122

Kanpur,INDIA

LINEX Loss Function: Example # 03

(contd…)

In case they are underestimated

than what its value is in reality,

then the consequences is just labour

and man hour loss in terms of

production stoppage time

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 123

Kanpur,INDIA

LINEX Loss Function: Example # 03

(contd…)

On the other hand if the working life of the

circuit breaker is over estimated than the actual

figure, then it would definitely signify an

exponential form of loss in monetary terms due

to an accident or major break down of

machineries

So, for these categories of practical estimation

problems we always consider a > 0

IME634:MDA Raghu N. SENGUPTA,IME Dept.,IIT 124

Kanpur,INDIA

You might also like

- Hackerrank TestDocument3 pagesHackerrank Testswapnil0% (7)

- ISOM4520 Sample Midterm Examination SolutionDocument10 pagesISOM4520 Sample Midterm Examination SolutionAlessia YangNo ratings yet

- Faculty of Science and Technology OPENBOOK EXAM: COM 123 Numerical Analysis and ComputationDocument5 pagesFaculty of Science and Technology OPENBOOK EXAM: COM 123 Numerical Analysis and ComputationJoshBarack TshinemuNo ratings yet

- Data Interpretation Guide For All Competitive and Admission ExamsFrom EverandData Interpretation Guide For All Competitive and Admission ExamsRating: 2.5 out of 5 stars2.5/5 (6)

- Paper Boat Beverage Branding Delightful Nostalgia PDFDocument15 pagesPaper Boat Beverage Branding Delightful Nostalgia PDFNitin JoyNo ratings yet

- Establishing StarBucksDocument27 pagesEstablishing StarBucksVijendra KumarNo ratings yet

- VLFM Utility TheoryDocument91 pagesVLFM Utility TheoryAnandbabu RadhakrishnanNo ratings yet

- IME621 TAMCDM Slides 05 VIKORDocument38 pagesIME621 TAMCDM Slides 05 VIKORPriyanshu NainNo ratings yet

- SEE1002 Introduction To Computing For Energy and EnvironmentDocument5 pagesSEE1002 Introduction To Computing For Energy and EnvironmentMing Lim ChanNo ratings yet

- S. K. Patel Institute of Management and Computer Studies Production and Operations Management (CC 206) Mid Term ExaminationDocument3 pagesS. K. Patel Institute of Management and Computer Studies Production and Operations Management (CC 206) Mid Term ExaminationParnika JhaNo ratings yet

- IGNOU BCA Assignment Semester - IVDocument21 pagesIGNOU BCA Assignment Semester - IVAnonNo ratings yet

- Lecture 6. Chapter 7Document22 pagesLecture 6. Chapter 7I.. IshaNo ratings yet

- Statistics AssignmentDocument8 pagesStatistics AssignmentPheakdeyNo ratings yet

- QAM-III - Mukesh Mehlawat (F, G, H, I)Document3 pagesQAM-III - Mukesh Mehlawat (F, G, H, I)206Ishu GuptaNo ratings yet

- Data Analysis & Decision Making - III - Unit 5 - Week 2 (Incomplete)Document3 pagesData Analysis & Decision Making - III - Unit 5 - Week 2 (Incomplete)kaif.ahmed.0210No ratings yet

- PL2-sol NewDocument4 pagesPL2-sol NewFadhil Akmal FakhriNo ratings yet

- SFM QBDocument8 pagesSFM QBSrikanth BheemsettiNo ratings yet

- Sample Paper 4 - ANSWERSDocument11 pagesSample Paper 4 - ANSWERSWei ZheNo ratings yet

- Solution One Problem of Productivity, Decision Tree and Break-Even AnalysisDocument5 pagesSolution One Problem of Productivity, Decision Tree and Break-Even AnalysisNoor AlamNo ratings yet

- GATE Mechanical Engineering 2014 Solved Paper - 3Document19 pagesGATE Mechanical Engineering 2014 Solved Paper - 3aksasinghNo ratings yet

- MBA-I 414 Statistics For ManagementDocument2 pagesMBA-I 414 Statistics For ManagementArchana RNo ratings yet

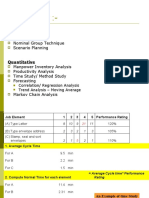

- Some Tools:-: Job Analysis Delphi Method Nominal Group Technique Scenario PlanningDocument19 pagesSome Tools:-: Job Analysis Delphi Method Nominal Group Technique Scenario PlanningMoidin AfsanNo ratings yet

- Question Bank - OPMDocument17 pagesQuestion Bank - OPMRavi Kiran SunkaraNo ratings yet

- InfyTQ Daily Test Questions On 19th Feb 2020Document14 pagesInfyTQ Daily Test Questions On 19th Feb 2020Phani PNo ratings yet

- AY 2021 - E210 - Practice QuestionsDocument21 pagesAY 2021 - E210 - Practice QuestionsMj SNo ratings yet

- Anil Kumar Jaiswal (MBA Dissertation/Project) - 2010 (Bad Debts Reduction in EBU Segment)Document109 pagesAnil Kumar Jaiswal (MBA Dissertation/Project) - 2010 (Bad Debts Reduction in EBU Segment)Anil Arjun JaiswalNo ratings yet

- MM Zg533 Ec-2r First Sem 2014-2015Document2 pagesMM Zg533 Ec-2r First Sem 2014-2015MukeshSharmaNo ratings yet

- All Exams-For IIMRDocument73 pagesAll Exams-For IIMRahujadeepti2581No ratings yet

- Class 9 Computer Applications (Finals 20-21)Document5 pagesClass 9 Computer Applications (Finals 20-21)Aditya PandeyNo ratings yet

- BE Mock Test QuestionsDocument2 pagesBE Mock Test QuestionsCalonneFrNo ratings yet

- MA5120 Final Paper 2023Document4 pagesMA5120 Final Paper 2023Lahiru KariyawasamNo ratings yet

- Assignment 2 - Variables and DatatypesDocument6 pagesAssignment 2 - Variables and DatatypesHasanul MahiNo ratings yet

- Amity University HaryanaDocument3 pagesAmity University Haryananidhi malikNo ratings yet

- Practical Task 4Document8 pagesPractical Task 4perhik.ruNo ratings yet

- Application of Runge - Kutta Method To Population EquationsDocument8 pagesApplication of Runge - Kutta Method To Population EquationsIJRASETPublicationsNo ratings yet

- Mba 2 Sem 15mng201 Business Research Methods 2017Document3 pagesMba 2 Sem 15mng201 Business Research Methods 2017Rajesh Kumar NayakNo ratings yet

- Semester One Final Examinations 2020 ECON7350Document10 pagesSemester One Final Examinations 2020 ECON7350im.shanluNo ratings yet

- Sessional II Spring 2015Document7 pagesSessional II Spring 2015Jannat NasirNo ratings yet

- ECN 702 Final Examination Question PaperDocument6 pagesECN 702 Final Examination Question PaperZoheel AL ZiyadNo ratings yet

- MGT4304 - Operation Management PDFDocument5 pagesMGT4304 - Operation Management PDFSanduni Lakshani100% (1)

- GS200 First ExamDocument7 pagesGS200 First ExamMohmed Al NajarNo ratings yet

- BS Assignment 2 - Group 8Document7 pagesBS Assignment 2 - Group 8NivedhikaNo ratings yet

- Business Analytics: Team 7Document7 pagesBusiness Analytics: Team 7Anantha KumarNo ratings yet

- 2K16-SE-071 (ESE File)Document16 pages2K16-SE-071 (ESE File)Sahil BhasinNo ratings yet

- Cambridge Ordinary LevelDocument16 pagesCambridge Ordinary LevelAayan AhmadNo ratings yet

- Mid-Term Exam Spring 2021 PRINTABLE VERSION UpdatedDocument8 pagesMid-Term Exam Spring 2021 PRINTABLE VERSION UpdatedHani FloraNo ratings yet

- IandF - CS1A - 202304 - Examiner ReportDocument13 pagesIandF - CS1A - 202304 - Examiner ReportPoorva ShindeNo ratings yet

- 03 Motion of A Freely Falling Body Lab WorkDocument7 pages03 Motion of A Freely Falling Body Lab Workkaramict8No ratings yet

- Statistical Data Analysis Full ProjectDocument22 pagesStatistical Data Analysis Full ProjectashNo ratings yet

- Mangesh Software Testing Lab ManualDocument24 pagesMangesh Software Testing Lab ManualAvinash VadNo ratings yet

- Make-Up Test) - NOV - 2022Document3 pagesMake-Up Test) - NOV - 2022Zibusiso NcubeNo ratings yet

- IME634: Management Decision AnalysisDocument82 pagesIME634: Management Decision AnalysisBeHappy2106No ratings yet

- OODJ - Miniproject Report - TemplateDocument7 pagesOODJ - Miniproject Report - TemplateDeepa ANo ratings yet

- Entrepreneur Decision Making Process and Application of Linear Programming TechniqueDocument5 pagesEntrepreneur Decision Making Process and Application of Linear Programming Techniquereehammostafa77No ratings yet

- Msom 821Document4 pagesMsom 821Cheruiyot EmmanuelNo ratings yet

- ECON1C2Document2 pagesECON1C2chris castelaryNo ratings yet

- Itp Lab 5 - 20tliiDocument9 pagesItp Lab 5 - 20tliiBisma pari MemonNo ratings yet

- Drowsiness Detection Based On Eye Shape MeasurementDocument5 pagesDrowsiness Detection Based On Eye Shape MeasurementShubham JainNo ratings yet

- Adaptive.Signal.Processing.LabDocument5 pagesAdaptive.Signal.Processing.Labaiman.naouil.etu22No ratings yet

- HW3Document19 pagesHW3rogervalen5049No ratings yet

- Algorithm Analysis: CS F211: Data Structures and Algorithms Dr. Swati AgarwalDocument17 pagesAlgorithm Analysis: CS F211: Data Structures and Algorithms Dr. Swati AgarwalShikhar SahayNo ratings yet

- Let's Practise: Maths Workbook Coursebook 6From EverandLet's Practise: Maths Workbook Coursebook 6No ratings yet

- Assignment 1Document1 pageAssignment 1Letsplay GamesNo ratings yet

- Topsis PDFDocument31 pagesTopsis PDFLetsplay GamesNo ratings yet

- Averaging Techniques PDFDocument61 pagesAveraging Techniques PDFLetsplay GamesNo ratings yet

- IME634: Management Decision AnalysisDocument15 pagesIME634: Management Decision AnalysisLetsplay GamesNo ratings yet

- Object Recognition Can Drive Motion Perception: Scientific CorrespondenceDocument2 pagesObject Recognition Can Drive Motion Perception: Scientific CorrespondenceLetsplay GamesNo ratings yet

- Perceiving Surfaces Oriented in Depth From Palmer PDFDocument110 pagesPerceiving Surfaces Oriented in Depth From Palmer PDFLetsplay GamesNo ratings yet

- Visual Perception From Visual ScienceDocument21 pagesVisual Perception From Visual ScienceLetsplay GamesNo ratings yet

- Prim Week 11 20Document69 pagesPrim Week 11 20Allick Fitzgerald Nanton Jr.No ratings yet

- Johns 10e Irm ch15Document24 pagesJohns 10e Irm ch15Jacob WeiseNo ratings yet

- DABURDocument21 pagesDABURyatin rajputNo ratings yet

- Financial Ratio Analysis-LiquidityDocument30 pagesFinancial Ratio Analysis-LiquidityZybel RosalesNo ratings yet

- Assignment On Motivational Practice in ACI Bangladesh LTDDocument31 pagesAssignment On Motivational Practice in ACI Bangladesh LTDtowsif_mpay100% (1)

- Computers in Human Behavior: Mar Gómez, Carmen Lopez, Arturo Molina TDocument11 pagesComputers in Human Behavior: Mar Gómez, Carmen Lopez, Arturo Molina TTheFounders AgencyNo ratings yet

- 1F - INTRO SUSTAINABILITY Management Models by Fons TrompenaarsDocument46 pages1F - INTRO SUSTAINABILITY Management Models by Fons Trompenaarsfgha100% (1)

- Contract Agreement - ArmchairsDocument2 pagesContract Agreement - ArmchairsGee EssyuNo ratings yet

- Muhammad Aiman Bin Mohd Azri ID 20050142 Sec 4 (A)Document10 pagesMuhammad Aiman Bin Mohd Azri ID 20050142 Sec 4 (A)Aiman AzriNo ratings yet

- Laying Grounds For InternationalizationDocument2 pagesLaying Grounds For Internationalizationkristine contrerasNo ratings yet

- Universiti Teknologi Mara Final Examination: This Online Test Paper Consists of 5 Printed PagesDocument5 pagesUniversiti Teknologi Mara Final Examination: This Online Test Paper Consists of 5 Printed PagesAfiqKhalidNo ratings yet

- II.C.7 Temic Automotive v. Temic Automotive Phils. Employees Union, December 23, 2009Document4 pagesII.C.7 Temic Automotive v. Temic Automotive Phils. Employees Union, December 23, 2009Jin AghamNo ratings yet

- Campus Activewear Marketing Management ProjectDocument12 pagesCampus Activewear Marketing Management Projectscreener0991No ratings yet

- Assaignment Int MKT (Azmol 193046067)Document16 pagesAssaignment Int MKT (Azmol 193046067)Azmol bdNo ratings yet

- Case Study - C.A OsasunaDocument2 pagesCase Study - C.A OsasunajlaniadogriNo ratings yet

- Entr CH 1Document7 pagesEntr CH 184kaveri8650% (2)

- Mergers Acquisitions and Corporate Restructuring-IIDocument57 pagesMergers Acquisitions and Corporate Restructuring-IIPRAO600583% (6)

- Impact of BIM Implementation On Architectural PracticeDocument12 pagesImpact of BIM Implementation On Architectural PracticeEduardo BernardinoNo ratings yet

- IHC Super Tax JudgmentDocument42 pagesIHC Super Tax JudgmentHussain Afzal100% (1)

- Fabm Week 11 20fabm 121 Week 11 20Document3 pagesFabm Week 11 20fabm 121 Week 11 20Criscel SantiagoNo ratings yet

- GPTADocument20 pagesGPTAJam AlbanoNo ratings yet

- Laporan Tahunan 2019 6 - IdDocument268 pagesLaporan Tahunan 2019 6 - IdmeylanNo ratings yet

- Assessment Task 1.1Document13 pagesAssessment Task 1.1Fahad AhmadNo ratings yet

- CHAPTER 10 - Questions and ProblemsDocument12 pagesCHAPTER 10 - Questions and ProblemsMrinmay kunduNo ratings yet

- Asset Management at Central Banks and Monetary Authorities New Practices in Managing International Foreign Exchange Reserves Jacob BjorheimDocument43 pagesAsset Management at Central Banks and Monetary Authorities New Practices in Managing International Foreign Exchange Reserves Jacob Bjorheimyvette.gonzalez261100% (11)

- WSP Reporting and Investigation PolicyDocument9 pagesWSP Reporting and Investigation PolicyroshanrajasNo ratings yet

- Co Working SpacesDocument6 pagesCo Working SpacesArshad UllahNo ratings yet

- Types of Production ProcessDocument24 pagesTypes of Production ProcessPRIYANK89% (18)