Professional Documents

Culture Documents

Simplify FeesandCharges 20220201

Simplify FeesandCharges 20220201

Uploaded by

Cal VoGCopyright:

Available Formats

You might also like

- Nrma Business PolicyDocument104 pagesNrma Business PolicyAnon BoletusNo ratings yet

- Gap WaiverDocument2 pagesGap Waiverkyle2fitzgeraldNo ratings yet

- Car PEDG 25022021Document3 pagesCar PEDG 25022021Tsheltrim DorjiNo ratings yet

- Premium, Excess, Discounts & Helpline Benefits Guide: Motor InsuranceDocument7 pagesPremium, Excess, Discounts & Helpline Benefits Guide: Motor InsuranceAron gelbNo ratings yet

- 2023 - 07 - Terms of Business v5.9 Live Date 04.09.2023Document9 pages2023 - 07 - Terms of Business v5.9 Live Date 04.09.2023Talib HussainNo ratings yet

- Terms of BusinessDocument9 pagesTerms of Businessksenos.ukNo ratings yet

- Our Terms and ConditionsDocument23 pagesOur Terms and ConditionsU1162498No ratings yet

- Private Car Comprehensive TPFT TP - PDS - Kur - ENG - 1220Document4 pagesPrivate Car Comprehensive TPFT TP - PDS - Kur - ENG - 1220SANDY & MaxPhilus BRONo ratings yet

- Auto365 Comprehensive Premier - PDS - Kur - ENG - 1022Document4 pagesAuto365 Comprehensive Premier - PDS - Kur - ENG - 1022Kanggatharan MunusamyNo ratings yet

- Terms of BusinessDocument5 pagesTerms of BusinessmoNo ratings yet

- Lexham Insurance: - Terms of BusinessDocument4 pagesLexham Insurance: - Terms of BusinessRodrigo FernandoNo ratings yet

- Termsof Business 2018Document4 pagesTermsof Business 2018Nhung LuuNo ratings yet

- CSBMT3046Interactive VersionDocument48 pagesCSBMT3046Interactive Versionbym87853No ratings yet

- Terms of BusinessDocument4 pagesTerms of BusinessChinonso Nelse NwadeNo ratings yet

- Car Hire Policy DocumentDocument19 pagesCar Hire Policy DocumentGabor SzucsNo ratings yet

- Business Policywording A5Document82 pagesBusiness Policywording A5Evelyne MuparutsaNo ratings yet

- Collated ProductsDocument20 pagesCollated Productsamol.d.kelkarNo ratings yet

- Unit 3 InsuranceDocument29 pagesUnit 3 InsuranceNikita ShekhawatNo ratings yet

- Mastercard Guide To Benefits For Credit CardholdersDocument10 pagesMastercard Guide To Benefits For Credit CardholdersCarlos CaballolNo ratings yet

- Consumer Guide To Automobile Insurance Cau1Document27 pagesConsumer Guide To Automobile Insurance Cau1Joseph OmodoNo ratings yet

- DownloadDocument4 pagesDownloadloredanachelu61No ratings yet

- Surety Bond Cost Everything You Wanted To KnowDocument28 pagesSurety Bond Cost Everything You Wanted To Knowdoct100% (2)

- IPID - Ancillary - Motor Legal - Car, Bike - Van - 20230311205511172Document2 pagesIPID - Ancillary - Motor Legal - Car, Bike - Van - 20230311205511172Hernest GaldamezNo ratings yet

- Allianz General Insurance Company (Malaysia) BerhadDocument6 pagesAllianz General Insurance Company (Malaysia) BerhadSiti Nurazlin FariddunNo ratings yet

- Motor Insurance HandbookDocument10 pagesMotor Insurance HandbookdaramanishNo ratings yet

- Shikhar Microfinance Private Limited: Interest RateDocument3 pagesShikhar Microfinance Private Limited: Interest RatesagarNo ratings yet

- Kfs Secured Personal LoansDocument6 pagesKfs Secured Personal Loansrealtestemail1No ratings yet

- Motor Insurance Ped CurrentDocument5 pagesMotor Insurance Ped CurrentlalidawatermarkNo ratings yet

- MyECP Terms and ConditionsDocument1 pageMyECP Terms and Conditionsgoyneser1No ratings yet

- Interest Rate PolicyDocument8 pagesInterest Rate Policyraghuraman1511No ratings yet

- Lesson 10 - Strategic Thoughts For Finance and Collection FeesDocument4 pagesLesson 10 - Strategic Thoughts For Finance and Collection FeesroxanformillezaNo ratings yet

- FlyersDocument56 pagesFlyersAnh VanNo ratings yet

- Textbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterFrom EverandTextbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterNo ratings yet

- Royal Sundaram General InsuranceDocument22 pagesRoyal Sundaram General InsuranceVinayak BhardwajNo ratings yet

- Financial Insurance & Guarantee Risk SheetDocument6 pagesFinancial Insurance & Guarantee Risk SheetMartin PittNo ratings yet

- Asra 040722Document10 pagesAsra 040722hifayeg383No ratings yet

- Insurance & Risk ManagementDocument8 pagesInsurance & Risk ManagementJASONM22No ratings yet

- 3Document15 pages3gech95465195No ratings yet

- Overview of Premium Financed Life InsuranceDocument17 pagesOverview of Premium Financed Life InsuranceProvada Insurance Services100% (1)

- sanction_letter 4Document2 pagessanction_letter 4anawinjoepichappillyNo ratings yet

- Pricecalculator 2000Document1 pagePricecalculator 2000api-102440078No ratings yet

- Financial Services GuideDocument2 pagesFinancial Services GuideJohan Sebastian Sandoval OssaNo ratings yet

- Sompo Motor Insurance (Private Car Comprehensive Policy) : Product Disclosure SheetDocument6 pagesSompo Motor Insurance (Private Car Comprehensive Policy) : Product Disclosure SheetMuhammad Shamaran AbdullahNo ratings yet

- CAA Insurance Automobile Guidebook FinalDocument14 pagesCAA Insurance Automobile Guidebook FinalbobNo ratings yet

- A Practical Guide To Insurance Broker Compensation and Potential Conflicts PDFDocument7 pagesA Practical Guide To Insurance Broker Compensation and Potential Conflicts PDFNooni Rinyaphat100% (1)

- The Certificate Examination in Investment-Linked Life Insurance (CEILI) Summary Slides (English)Document118 pagesThe Certificate Examination in Investment-Linked Life Insurance (CEILI) Summary Slides (English)JunHong ChenNo ratings yet

- MSIG Motor Plus Insurance BrochureDocument24 pagesMSIG Motor Plus Insurance BrochureTai AndyNo ratings yet

- CH 6 Insurance Company Operations PDFDocument22 pagesCH 6 Insurance Company Operations PDFMonika RehmanNo ratings yet

- Wellness Health - Protection Terms of Business 07.22 v2Document3 pagesWellness Health - Protection Terms of Business 07.22 v2CharlesNo ratings yet

- Dayinsure Terms of Business: Mara House, Tarporley Business Centre, Nantwich Road, Tarporley, Cheshire CW6 9UYDocument2 pagesDayinsure Terms of Business: Mara House, Tarporley Business Centre, Nantwich Road, Tarporley, Cheshire CW6 9UYQasim IsmailNo ratings yet

- Auto-Mobile InsuranceDocument12 pagesAuto-Mobile InsuranceH-Sam PatoliNo ratings yet

- Open A New Private Browser TabDocument1 pageOpen A New Private Browser Tabkamot12835No ratings yet

- Insurance Terms and Definitions 2Document5 pagesInsurance Terms and Definitions 2Tsegaye TadesseNo ratings yet

- Forbes Life InvaderDocument19 pagesForbes Life Invaderapi-270707231No ratings yet

- Policy PLATINUM EUDocument19 pagesPolicy PLATINUM EUmeNo ratings yet

- Commercial Premium Financing: Exit StrategiesDocument3 pagesCommercial Premium Financing: Exit StrategiesKevin WheelerNo ratings yet

- Synopsis: Submitted in The Partial Fulfillment of Requireent For The Award of The Degree ofDocument21 pagesSynopsis: Submitted in The Partial Fulfillment of Requireent For The Award of The Degree ofsakaray mohana vidyaNo ratings yet

- NotesDocument10 pagesNotesgimgiNo ratings yet

- Life-Related Finaning SecuritizationsDocument5 pagesLife-Related Finaning SecuritizationsbillNo ratings yet

Simplify FeesandCharges 20220201

Simplify FeesandCharges 20220201

Uploaded by

Cal VoGOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Simplify FeesandCharges 20220201

Simplify FeesandCharges 20220201

Uploaded by

Cal VoGCopyright:

Available Formats

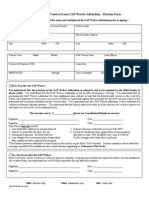

Fees and Charges

SCHEDULE OF STANDARD FEES AND CHARGES APPLIED TO CONSUMER CONTRACTS

All finance approvals are subject to lender credit criteria

and responsible lending requirements.

Terms and interest rates offered will depend on your own individual or company circumstances and the security (Motor

Vehicle) being purchased.

Repayment terms offered range between 12 and 60 months for motor vehicles (up to 72 months for marine).

Lender fees and charges, terms and conditions will apply, and we will discuss these with you once we can establish your

objectives and which lender best suits your needs.

Simplify charges a service fee, commonly referred to as an origination, introducer or broker fee. This fee can vary

between $ 0.00 and $ 995, and is included in your loan structure/repayments. The fee charged relates to the provision of

our specialised services in assisting you in obtaining the right solutions to meet your needs and objectives, in obtaining

motor vehicle finance and insurance. If you do not enter into the credit contract you will not be charged.

Simplify is responsible for administering insurance policies on behalf of Autosure. An administration fee of $ 75 is

charged by Simplify, to cover expenses related to the additional administrative costs of changing or cancelling an

insurance policy outside of the cooling off period. This fee will be deducted from the prorata reimbursement, where the

policy is eligible for one.

You might also like

- Nrma Business PolicyDocument104 pagesNrma Business PolicyAnon BoletusNo ratings yet

- Gap WaiverDocument2 pagesGap Waiverkyle2fitzgeraldNo ratings yet

- Car PEDG 25022021Document3 pagesCar PEDG 25022021Tsheltrim DorjiNo ratings yet

- Premium, Excess, Discounts & Helpline Benefits Guide: Motor InsuranceDocument7 pagesPremium, Excess, Discounts & Helpline Benefits Guide: Motor InsuranceAron gelbNo ratings yet

- 2023 - 07 - Terms of Business v5.9 Live Date 04.09.2023Document9 pages2023 - 07 - Terms of Business v5.9 Live Date 04.09.2023Talib HussainNo ratings yet

- Terms of BusinessDocument9 pagesTerms of Businessksenos.ukNo ratings yet

- Our Terms and ConditionsDocument23 pagesOur Terms and ConditionsU1162498No ratings yet

- Private Car Comprehensive TPFT TP - PDS - Kur - ENG - 1220Document4 pagesPrivate Car Comprehensive TPFT TP - PDS - Kur - ENG - 1220SANDY & MaxPhilus BRONo ratings yet

- Auto365 Comprehensive Premier - PDS - Kur - ENG - 1022Document4 pagesAuto365 Comprehensive Premier - PDS - Kur - ENG - 1022Kanggatharan MunusamyNo ratings yet

- Terms of BusinessDocument5 pagesTerms of BusinessmoNo ratings yet

- Lexham Insurance: - Terms of BusinessDocument4 pagesLexham Insurance: - Terms of BusinessRodrigo FernandoNo ratings yet

- Termsof Business 2018Document4 pagesTermsof Business 2018Nhung LuuNo ratings yet

- CSBMT3046Interactive VersionDocument48 pagesCSBMT3046Interactive Versionbym87853No ratings yet

- Terms of BusinessDocument4 pagesTerms of BusinessChinonso Nelse NwadeNo ratings yet

- Car Hire Policy DocumentDocument19 pagesCar Hire Policy DocumentGabor SzucsNo ratings yet

- Business Policywording A5Document82 pagesBusiness Policywording A5Evelyne MuparutsaNo ratings yet

- Collated ProductsDocument20 pagesCollated Productsamol.d.kelkarNo ratings yet

- Unit 3 InsuranceDocument29 pagesUnit 3 InsuranceNikita ShekhawatNo ratings yet

- Mastercard Guide To Benefits For Credit CardholdersDocument10 pagesMastercard Guide To Benefits For Credit CardholdersCarlos CaballolNo ratings yet

- Consumer Guide To Automobile Insurance Cau1Document27 pagesConsumer Guide To Automobile Insurance Cau1Joseph OmodoNo ratings yet

- DownloadDocument4 pagesDownloadloredanachelu61No ratings yet

- Surety Bond Cost Everything You Wanted To KnowDocument28 pagesSurety Bond Cost Everything You Wanted To Knowdoct100% (2)

- IPID - Ancillary - Motor Legal - Car, Bike - Van - 20230311205511172Document2 pagesIPID - Ancillary - Motor Legal - Car, Bike - Van - 20230311205511172Hernest GaldamezNo ratings yet

- Allianz General Insurance Company (Malaysia) BerhadDocument6 pagesAllianz General Insurance Company (Malaysia) BerhadSiti Nurazlin FariddunNo ratings yet

- Motor Insurance HandbookDocument10 pagesMotor Insurance HandbookdaramanishNo ratings yet

- Shikhar Microfinance Private Limited: Interest RateDocument3 pagesShikhar Microfinance Private Limited: Interest RatesagarNo ratings yet

- Kfs Secured Personal LoansDocument6 pagesKfs Secured Personal Loansrealtestemail1No ratings yet

- Motor Insurance Ped CurrentDocument5 pagesMotor Insurance Ped CurrentlalidawatermarkNo ratings yet

- MyECP Terms and ConditionsDocument1 pageMyECP Terms and Conditionsgoyneser1No ratings yet

- Interest Rate PolicyDocument8 pagesInterest Rate Policyraghuraman1511No ratings yet

- Lesson 10 - Strategic Thoughts For Finance and Collection FeesDocument4 pagesLesson 10 - Strategic Thoughts For Finance and Collection FeesroxanformillezaNo ratings yet

- FlyersDocument56 pagesFlyersAnh VanNo ratings yet

- Textbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterFrom EverandTextbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterNo ratings yet

- Royal Sundaram General InsuranceDocument22 pagesRoyal Sundaram General InsuranceVinayak BhardwajNo ratings yet

- Financial Insurance & Guarantee Risk SheetDocument6 pagesFinancial Insurance & Guarantee Risk SheetMartin PittNo ratings yet

- Asra 040722Document10 pagesAsra 040722hifayeg383No ratings yet

- Insurance & Risk ManagementDocument8 pagesInsurance & Risk ManagementJASONM22No ratings yet

- 3Document15 pages3gech95465195No ratings yet

- Overview of Premium Financed Life InsuranceDocument17 pagesOverview of Premium Financed Life InsuranceProvada Insurance Services100% (1)

- sanction_letter 4Document2 pagessanction_letter 4anawinjoepichappillyNo ratings yet

- Pricecalculator 2000Document1 pagePricecalculator 2000api-102440078No ratings yet

- Financial Services GuideDocument2 pagesFinancial Services GuideJohan Sebastian Sandoval OssaNo ratings yet

- Sompo Motor Insurance (Private Car Comprehensive Policy) : Product Disclosure SheetDocument6 pagesSompo Motor Insurance (Private Car Comprehensive Policy) : Product Disclosure SheetMuhammad Shamaran AbdullahNo ratings yet

- CAA Insurance Automobile Guidebook FinalDocument14 pagesCAA Insurance Automobile Guidebook FinalbobNo ratings yet

- A Practical Guide To Insurance Broker Compensation and Potential Conflicts PDFDocument7 pagesA Practical Guide To Insurance Broker Compensation and Potential Conflicts PDFNooni Rinyaphat100% (1)

- The Certificate Examination in Investment-Linked Life Insurance (CEILI) Summary Slides (English)Document118 pagesThe Certificate Examination in Investment-Linked Life Insurance (CEILI) Summary Slides (English)JunHong ChenNo ratings yet

- MSIG Motor Plus Insurance BrochureDocument24 pagesMSIG Motor Plus Insurance BrochureTai AndyNo ratings yet

- CH 6 Insurance Company Operations PDFDocument22 pagesCH 6 Insurance Company Operations PDFMonika RehmanNo ratings yet

- Wellness Health - Protection Terms of Business 07.22 v2Document3 pagesWellness Health - Protection Terms of Business 07.22 v2CharlesNo ratings yet

- Dayinsure Terms of Business: Mara House, Tarporley Business Centre, Nantwich Road, Tarporley, Cheshire CW6 9UYDocument2 pagesDayinsure Terms of Business: Mara House, Tarporley Business Centre, Nantwich Road, Tarporley, Cheshire CW6 9UYQasim IsmailNo ratings yet

- Auto-Mobile InsuranceDocument12 pagesAuto-Mobile InsuranceH-Sam PatoliNo ratings yet

- Open A New Private Browser TabDocument1 pageOpen A New Private Browser Tabkamot12835No ratings yet

- Insurance Terms and Definitions 2Document5 pagesInsurance Terms and Definitions 2Tsegaye TadesseNo ratings yet

- Forbes Life InvaderDocument19 pagesForbes Life Invaderapi-270707231No ratings yet

- Policy PLATINUM EUDocument19 pagesPolicy PLATINUM EUmeNo ratings yet

- Commercial Premium Financing: Exit StrategiesDocument3 pagesCommercial Premium Financing: Exit StrategiesKevin WheelerNo ratings yet

- Synopsis: Submitted in The Partial Fulfillment of Requireent For The Award of The Degree ofDocument21 pagesSynopsis: Submitted in The Partial Fulfillment of Requireent For The Award of The Degree ofsakaray mohana vidyaNo ratings yet

- NotesDocument10 pagesNotesgimgiNo ratings yet

- Life-Related Finaning SecuritizationsDocument5 pagesLife-Related Finaning SecuritizationsbillNo ratings yet