Professional Documents

Culture Documents

Question #2

Question #2

Uploaded by

Leslie Castillo0 ratings0% found this document useful (0 votes)

23 views2 pagesMarks Manufacturing Company began the period with $100,000 in materials inventory, $370,000 in work in process, and $60,000 in finished goods. During the period, the company purchased $872,000 of materials, incurred $22,000 in delivery charges, used $565,000 of direct labor and $900,000 of materials for production. They also incurred various manufacturing costs totaling $324,000 and transferred $2,035,000 of completed goods from work in process to finished goods. Sales were $2,600,000 and ending finished goods were $93,000. The company's gross margin was 23% of sales.

Original Description:

Original Title

question #2

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMarks Manufacturing Company began the period with $100,000 in materials inventory, $370,000 in work in process, and $60,000 in finished goods. During the period, the company purchased $872,000 of materials, incurred $22,000 in delivery charges, used $565,000 of direct labor and $900,000 of materials for production. They also incurred various manufacturing costs totaling $324,000 and transferred $2,035,000 of completed goods from work in process to finished goods. Sales were $2,600,000 and ending finished goods were $93,000. The company's gross margin was 23% of sales.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

23 views2 pagesQuestion #2

Question #2

Uploaded by

Leslie CastilloMarks Manufacturing Company began the period with $100,000 in materials inventory, $370,000 in work in process, and $60,000 in finished goods. During the period, the company purchased $872,000 of materials, incurred $22,000 in delivery charges, used $565,000 of direct labor and $900,000 of materials for production. They also incurred various manufacturing costs totaling $324,000 and transferred $2,035,000 of completed goods from work in process to finished goods. Sales were $2,600,000 and ending finished goods were $93,000. The company's gross margin was 23% of sales.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 2

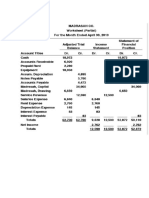

Marks Manufacturing Company has the following beginning balances:

Materials inventory $100,000

Work in process $370,000

Finished Goods $ 60,000

During the period, the following occurred:

1. Purchased for cash $872,000 worth of raw materials. Delivery charges on these

materials equaled $22,000.

2. Used $565,000 worth of direct labor in the production process.

3. Used $900,000 worth of material in the production process.

4. The following costs were incurred:

Indirect labor $27,000

Factory supplies used 46,000

Property taxes and insurance 14,000

Depreciation -factory 54,000

Factory –utilities 147,000

Depreciation – manufacturing 46,000

Selling and administrative 28,000

5. Transferred $2,035,000 worth of work in process inventory to finished goods

inventory.

6. Sales were $2,600,000.

7. The ending balance in finished goods inventory was $93,000.

Required:

a. Calculate the Ending Materials and Work in Process Inventory balances.

b. What was Marks Manufacturing’s gross margin during the period?

a. Ending inventory balances are:

Materials Work in Finished

Inventory Process Goods

Beginning balance............................................................................................................................................

100,000 370,000 60,000

(1) Purchases..........................................................................................................................................................

872,000

Delivery charge................................................................................................................................................

22,000

(2) Direct labor......................................................................................................................................................

565,000

(3) Materials transfer.............................................................................................................................................

900,000

(4) Indirect labor....................................................................................................................................................

27,000

Factory supplies...............................................................................................................................................

46,000

Depreciation–factory........................................................................................................................................

54,000

Factory utilities................................................................................................................................................

147,000

Depreciation–Mfg............................................................................................................................................

46,000

Property taxes...................................................................................................................................................

(5) Finished goods–transfers..................................................................................................................................

Cost of goods sold............................................................................................................................................

Ending balance.................................................................................................................................................

b. Gross margin was 23 percent.

Sales.................................................................................................................................................................

Cost of goods sold............................................................................................................................................

Gross margin....................................................................................................................................................

You might also like

- ACC 206 Incomplete Manufacturing Costs Expenses and Selling Data For Two Different Cases Are As FDocument3 pagesACC 206 Incomplete Manufacturing Costs Expenses and Selling Data For Two Different Cases Are As FebadbaddevNo ratings yet

- Chap02 Rev. FI5 Ex 2Document18 pagesChap02 Rev. FI5 Ex 2Khate KDb100% (1)

- 20210213174013D3066 - Soal Cost System and Cost AccumulationDocument6 pages20210213174013D3066 - Soal Cost System and Cost AccumulationLydia limNo ratings yet

- Answer: Cost Flow Equation: BB + TI TO + EB Computer Chips: $600,000 + $1,600,000 $1,800,000 + EBDocument8 pagesAnswer: Cost Flow Equation: BB + TI TO + EB Computer Chips: $600,000 + $1,600,000 $1,800,000 + EBkmarisseeNo ratings yet

- Accounting ExerciseDocument6 pagesAccounting Exercisenourhan hegazyNo ratings yet

- Job Costing QuestionsDocument5 pagesJob Costing Questionsfaith olaNo ratings yet

- 15 Nov. PGPDocument11 pages15 Nov. PGPtanvi gargNo ratings yet

- Problem Set B: Total Manufacturing Costs and The Costs Assigned To Each JobDocument17 pagesProblem Set B: Total Manufacturing Costs and The Costs Assigned To Each JobenzoNo ratings yet

- Cost Accounting EntriesDocument4 pagesCost Accounting EntriesSibgha100% (1)

- C5 (Problems) - Cost Accounting by CarterDocument7 pagesC5 (Problems) - Cost Accounting by CarterAkiNo ratings yet

- Additonal ProblemsDocument8 pagesAdditonal ProblemsMohammed Al ArmaliNo ratings yet

- Process Costing Test Bank SOLUTION PDFDocument7 pagesProcess Costing Test Bank SOLUTION PDFAshNor RandyNo ratings yet

- Hilton CH 2 Select SolutionsDocument12 pagesHilton CH 2 Select SolutionsUmair AliNo ratings yet

- Budgeted - Cogm & CogsDocument3 pagesBudgeted - Cogm & CogsHassan TariqNo ratings yet

- Selected Tutorial Solutions CHPT 1-5Document22 pagesSelected Tutorial Solutions CHPT 1-5Silo KetenilagiNo ratings yet

- Chapter 1 2 SolutionsDocument10 pagesChapter 1 2 SolutionsShiv AchariNo ratings yet

- Solution To Chapter 2 E2 24,2 30, P2 40, 2 37 E2 32,28 (1 3 Parts) P2 43,2 54Document7 pagesSolution To Chapter 2 E2 24,2 30, P2 40, 2 37 E2 32,28 (1 3 Parts) P2 43,2 54ReilpeterNo ratings yet

- Problem 2Document18 pagesProblem 2HaideBrocalesNo ratings yet

- Module 4 Homework Answer KeyDocument9 pagesModule 4 Homework Answer KeyMrinmay kunduNo ratings yet

- Homework Lec4Document9 pagesHomework Lec4Tran Do QuynNo ratings yet

- Predetermined Overhead Rates - ProblemsDocument2 pagesPredetermined Overhead Rates - ProblemsShaina Jean PiezonNo ratings yet

- Managerial Accounting: Process CostingDocument12 pagesManagerial Accounting: Process Costingahmad bsoulNo ratings yet

- Materials Inventory P148,200 ? Work-in-Process Inventory 33,000 ? Finished Goods Inventory .. 166,000 P143,200 Cost of Goods Sold 263,400Document3 pagesMaterials Inventory P148,200 ? Work-in-Process Inventory 33,000 ? Finished Goods Inventory .. 166,000 P143,200 Cost of Goods Sold 263,400NinaNo ratings yet

- BM6023 S1 22 23 Week 2 AnswersDocument4 pagesBM6023 S1 22 23 Week 2 AnswersTemmyChangNo ratings yet

- Problem 2-39 & 2-41Document3 pagesProblem 2-39 & 2-41Yanwar A MerhanNo ratings yet

- Cost ManagementDocument5 pagesCost ManagementSohag KhanNo ratings yet

- Chapter 2 Example ProblemsDocument16 pagesChapter 2 Example ProblemsSolomon LegeseNo ratings yet

- 1Document3 pages1Sunshine Vee0% (1)

- Assignment - ABC CostingDocument2 pagesAssignment - ABC Costingjoneth.duenasNo ratings yet

- Exercise CH 2Document17 pagesExercise CH 2UserNo ratings yet

- CA2 Valenko CompanyDocument1 pageCA2 Valenko CompanyArshia EmamiNo ratings yet

- Cornerstones of Cost Management Hansen 3rd Edition Solutions ManualDocument36 pagesCornerstones of Cost Management Hansen 3rd Edition Solutions Manualmiscallcallipee462q100% (50)

- 1 DoneDocument9 pages1 DoneНикита ШтефанюкNo ratings yet

- AKM 1 Bab 3Document5 pagesAKM 1 Bab 3alesha nindyaNo ratings yet

- Ch3 - Batch - Exercises and SolutionDocument9 pagesCh3 - Batch - Exercises and Solution黃群睿No ratings yet

- 5204 Solutions For Problems 2-17, 2-22, 2-26 (12th Ed)Document7 pages5204 Solutions For Problems 2-17, 2-22, 2-26 (12th Ed)assignmentsbysinghNo ratings yet

- CH 3Document12 pagesCH 3Firas HamadNo ratings yet

- Soal Cost System and Cost AccumulationDocument5 pagesSoal Cost System and Cost AccumulationSugata S100% (1)

- Solutions To Self-Study QuestionsDocument47 pagesSolutions To Self-Study QuestionsChristina ZhangNo ratings yet

- The Company Reported The Following Information For The Year Ending Work in ProcessDocument1 pageThe Company Reported The Following Information For The Year Ending Work in ProcessMuhammad ShahidNo ratings yet

- ABC Manufacturing Entity Sole Trader Has Provided You With TheDocument1 pageABC Manufacturing Entity Sole Trader Has Provided You With TheMiroslav GegoskiNo ratings yet

- Hilton CH 15 Select SolutionsDocument11 pagesHilton CH 15 Select SolutionsPiyushSharmaNo ratings yet

- Cost System and Cost Accumulation - Kelompok 6Document9 pagesCost System and Cost Accumulation - Kelompok 6JessicaTheLazy PlayerNo ratings yet

- Questions and AnswersDocument13 pagesQuestions and Answerss3ki0No ratings yet

- Chapter 20 ElesaiDocument3 pagesChapter 20 ElesaiSandi PrasetyaNo ratings yet

- Overhead Costing QuestionsDocument5 pagesOverhead Costing Questionsfaith olaNo ratings yet

- Lecture 6.1-General Cost Classifications (Problem 1)Document3 pagesLecture 6.1-General Cost Classifications (Problem 1)Nazmul-Hassan Sumon100% (4)

- Additional Aspects of Product Costing Systems: Changes From Eleventh EditionDocument21 pagesAdditional Aspects of Product Costing Systems: Changes From Eleventh EditionAlka NarayanNo ratings yet

- Faith Job Costing ProblemsDocument10 pagesFaith Job Costing Problemsfaith olaNo ratings yet

- Waqar AssignmentDocument2 pagesWaqar AssignmentIrza KhanNo ratings yet

- Popquizch4Au11 182nlk8Document3 pagesPopquizch4Au11 182nlk8PrincessNo ratings yet

- Flexible BudgetDocument3 pagesFlexible BudgetGregorian JerahmeelNo ratings yet

- D) Underapplied Overhead of $3,500.: AMIS 4310 Job CostingDocument5 pagesD) Underapplied Overhead of $3,500.: AMIS 4310 Job CostingDaniella Mae ElipNo ratings yet

- Ashley LTD Is A Manufacturing Firm The Bookkeeper Supplies YouDocument1 pageAshley LTD Is A Manufacturing Firm The Bookkeeper Supplies YouMiroslav GegoskiNo ratings yet

- Cost Accounting and Control Assignment #1Document3 pagesCost Accounting and Control Assignment #1カリン カリンNo ratings yet

- Job Order Costing QuizDocument5 pagesJob Order Costing Quizxenoyew100% (1)

- Problem 2-24: © The Mcgraw-Hill Companies, Inc., 2010. All Rights Reserved. Solutions Manual, Chapter 2 51Document2 pagesProblem 2-24: © The Mcgraw-Hill Companies, Inc., 2010. All Rights Reserved. Solutions Manual, Chapter 2 51Rizky Wahyu FebriyantoNo ratings yet

- 2011-03-12 230922 GarciaDocument4 pages2011-03-12 230922 GarciaJonathan OrrNo ratings yet

- P 13-9A - SolutionDocument1 pageP 13-9A - SolutionMichelle GraciaNo ratings yet

- Announcement of Tuition Fee Increase SY 2022 2023 - MergedDocument8 pagesAnnouncement of Tuition Fee Increase SY 2022 2023 - MergedLeslie CastilloNo ratings yet

- MBA FAQs - FinalDocument4 pagesMBA FAQs - FinalLeslie CastilloNo ratings yet

- Banana Leaf Catering FSDocument2 pagesBanana Leaf Catering FSLeslie CastilloNo ratings yet

- Solstice Cosmetics: Dare To Be Brighter Than The SunDocument2 pagesSolstice Cosmetics: Dare To Be Brighter Than The SunLeslie CastilloNo ratings yet

- Key Differences Between Prose and PoetryDocument4 pagesKey Differences Between Prose and PoetryLeslie CastilloNo ratings yet