Professional Documents

Culture Documents

Far270 CT - Q - April2022 PDF

Far270 CT - Q - April2022 PDF

Uploaded by

NUR QAMARINAOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Far270 CT - Q - April2022 PDF

Far270 CT - Q - April2022 PDF

Uploaded by

NUR QAMARINACopyright:

Available Formats

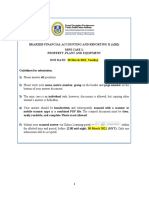

CONFIDENTIAL 1 AC/APR 2022/FAR270

UNIVERSITI TEKNOLOGI MARA

COMMON TEST

COURSE : FINANCIAL ACCOUNTING 4

COURSE CODE : FAR270

EXAMINATION : APRIL 2022

TIME : 1 HOUR 30 MINUTES

INSTRUCTIONS TO CANDIDATES

1. This question paper consists of TWO questions.

2. Answer the question in your own Answer Paper.

3. Write your FULL NAME, STUDENT ID and GROUP on top of the first page of your answer.

4. Please scan your answer and combine it into one single PDF file before submit.

5. Please rename your file with your FULL NAME_STUDENT ID_GROUP

6. Answer ALL questions in English.

DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO

This examination paper consists of 5 pages

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 2 AC/APR 2022/FAR270

QUESTION 1

A. i. Sofiya is a new account clerk in Lovely Shawl Bhd. She only learned how to

prepare account during her secondary school. With her limited knowledge in

preparing account, she is afraid that she might recorded the asset transaction

wrongly.

She had shown you a list of expenses incurred during the acquisition of a cutting

machine. The machine was imported from Japan. She is unsure on how to

account for each of the expenses incurred.

You are advised to help her in this matter.

Required:

Identify whether the following expenses incurred can be capitalised or expense

off in accordance with MFRS 116 Property, Plant and Equipment.

1. Transportation cost from Japan to Malaysia

2. Duty import

3. Legal fees

4. Estimated repairing cost for each year

5. Employee training costs

(5 marks)

ii. Venture Bhd is a company involves in creating advertisement. Most of the

advertisements are made using a specialized computer with custom made

software.

On 1 July 2021, the company acquired a high- technology computer to deal with

high demand of technical and creativeness in the advertisement. The following

costs are related to the new computer:

RM

Computer 7,000

External hard disc 450

Custom made software 3,500

High tech speaker 2,450

Installation and testing 700

Transportation cost 200

Training cost 1,500

Maintenance cost (monthly) 150

It is the policy of Venture Bhd to depreciate its property, plant and equipment

based on the period of ownership over 5 years. The company adopts cost model

for its property, plant and equipment to measure its subsequent measurement.

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 3 AC/APR 2022/FAR270

Required:

Calculate the initial cost of new computer on 1 July 2021.

(5 marks)

B. Menegak Bhd involves in making a sambal ngosek. The product is highly demanded in

the market at present. All units are sold out whenever it is available in the market. Thus,

the production of sambal ngosek becomes so intensive that the machine is fully utilized

every day. As at 1 July 2021, the company has in its account, machinery costing

RM2,700,000 with accumulated depreciation of RM1,350,000. In order to meet its

current demands, the company has been advised to buy a special component replacing

the existing component so that it will increase the output of the production and extend

the life of the machine.

The cost of the old component that need to be replaced is RM300,000, which was

bought on 1 July 2016. Meanwhile, the cost of the new component is RM500,000. This

replacement will take place on 1 July 2021.

It is the policy of the company to charge depreciation on straight line method using the

monthly basis. Depreciation rates for machinery is 10%. The company adopts cost

model for its subsequent measurement and the financial year end is on 30 June every

year.

Required:

i. Compute the carrying amount of the machinery as at 1 J u l y 2021 after the

replacement of the old component took place.

(4 marks)

ii. Prepare the journal entries for the transactions.

(4 marks)

C. Brilliant Vision Bhd, a successful company in a business selling stylish and branded

sunglasses acquired a building in Pahang at a cost of RM15,000,000 on 5 January

2018. It is the policy of the company to depreciate its building using the straight line

method on yearly basis. The estimated useful life of the building is 30 years.

The company also has a piece of land in Terengganu. This land had cost the company

RM3,000,000. The land was bought on 1 January 2018.

On 31 December 2019, the fair value of the building was determined to be

RM19,330,000, while the fair value of the land was RM2,800,000.

On 31 December 2021, the fair value of the land and building was RM5,000,000 and

RM22,000,000 respectively.

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 4 AC/APR 2022/FAR270

The company adopts revaluation model for its property, plant and equipment. The

revaluation will be done on every two years of ownership. The transfer on revaluation

will only be made in full upon disposal. The company prepares its financial statement on

31 December every year.

Required:

i. Determine whether it is a surplus or deficit on revaluation of building on 31

December 2021 (round up the figure to the nearest RM).

(2 marks)

ii. Explain the accounting treatment for the revaluation of land on 31 December 2021.

(4 marks)

iii. Prepare journal entries on revaluation of land and building for the year ended 31

December 2021.

(6 marks)

D. On 1 January 2021, Sesuci Bhd have the following assets:

Cost (RM) Accumulated Depreciation (RM)

Land 1,000,000 Nil

Building 3,000,000 750,000

On 1 March 2021, the company purchased a delivery van for delivering its product to

customers. The company paid RM150,000 for the van.

The company has been planning to move its operation to another state in the country.

In order to fulfill this plan, it has decided to sell some of its assets which are the land

and building. This is to cover the cost of acquiring new assets at the new place.

On 1 June 2021, the whole land was disposed off at RM2,000,000. Meanwhile, part of

the building which cost RM1,200,000 had been sold for RM3,500,000. The land and

building were purchased on 1 January 2016.

It is the policy of the company to adopt the cost model to account for its property, plant

and equipment. The building is depreciated for 5% using the straight line method based

on a monthly basis. The delivery van is depreciated over its estimated useful life of 10

years with residual value of RM15,000 on a yearly basis.

Required:

Construct a schedule to show the movement of property, plant and equipment for the

year end 31 December 2021.

(5 marks)

(Total: 35 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 5 AC/APR 2022/FAR270

QUESTION 2

A. LeeMang Properties Bhd has submitted a list of its properties (land and building) in Selangor

and Negeri Sembilan to you so that you can advise them whether the respective land and

buildings would be recognised as Investment Property according to MFRS 140 Investment

Property.

i. 20 acres of land in Selangor in which 80% is used for its operating activities and the

balance is rented out to outsiders under finance lease.

ii. A ten-storey building in Negeri Sembilan, whereby the whole building is leased out to

its subsidiary.

iii. A 25-storey building in Selangor, whereby two floors are used for office administration

and business purposes and the balance is rented out to outsiders under an operating

lease. The whole building cannot be sold separately.

iv. A piece of land in Negeri Sembilan, whereby 95% of it is rented out to outsiders under

operating lease and the balance is used as a site for its transportation facilities. The

company cannot account the portions separately.

v. A three-storey building in Negeri Sembilan is used as a warehouse for its inventory.

Required:

Identify whether the above properties would qualify as Investment Property according to the

definition of MFRS 140 Investment Property.

(5 marks)

B. LongTong Bhd acquired a mega shopping mall on 1 July 2011, which was rented out to

various other organisations under operating lease arrangements. The shopping mall has an

estimated life of 30 years and was measured at fair value. The trial balance as at 31

December 2020 showed the fair value of the shopping mall was RM8,000,000. The

company also provides the security and maintenance services at a total cost of

RM2,000,000 per year to their tenants. On 1 July 2021, this company converted the mall to

office purpose due to company’s rapid expansion program that demand in more office

space. On this date, the fair value of the building was determined to be RM10,000,000. The

company adopted the revaluation model for its owner occupied building and its depreciation

is calculated based on monthly basis. The fair value of the building on 31 December 2021

was RM12,000,000.

Required:

a. Prepare a Statement of Profit or Loss (extract) for the year ended 31 December 2021 and

Statement of Financial Position (extract) as at 31 December 2021.

(5 marks)

b. Explain the accounting treatment in relation to the above scenario as at 1 July 2021 and

31 December 2021.

(5 marks)

(Total: 15 marks)

END OF QUESTION PAPER

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

You might also like

- 4a. Maf201 Fa - Jul2021 - Q Set1Document9 pages4a. Maf201 Fa - Jul2021 - Q Set1Natasha GabrielNo ratings yet

- MC 1-PPE (Students) - A202Document5 pagesMC 1-PPE (Students) - A202lim qsNo ratings yet

- CT Far270 Dec21Document5 pagesCT Far270 Dec212022624622No ratings yet

- Q - Test Far270 Nov 2022 PDFDocument5 pagesQ - Test Far270 Nov 2022 PDFNUR QAMARINANo ratings yet

- Universiti Teknologi Mara Common Test: Confidential 1 AC/MAY 2021/FAR270Document4 pagesUniversiti Teknologi Mara Common Test: Confidential 1 AC/MAY 2021/FAR270Lampard AimanNo ratings yet

- Far270 - Q Test May 2023Document5 pagesFar270 - Q Test May 20232022896776No ratings yet

- Far570 Q Test December 2022Document4 pagesFar570 Q Test December 2022fareen faridNo ratings yet

- UntitledDocument3 pagesUntitledCarylChooNo ratings yet

- Far570 Q Set 1Document8 pagesFar570 Q Set 1NURUL NAZAHANNIE MOHAMAD NAJIBNo ratings yet

- Common Test Nov 2022Document5 pagesCommon Test Nov 20222024916967No ratings yet

- Universiti Teknologi Mara Final Assessment: Confidential 1 AC/FEB 2022/FAR570Document7 pagesUniversiti Teknologi Mara Final Assessment: Confidential 1 AC/FEB 2022/FAR570NURUL NAZAHANNIE MOHAMAD NAJIBNo ratings yet

- Far270 February 22 FaDocument8 pagesFar270 February 22 FarumaisyaNo ratings yet

- FAR210 - Feb 2022 - QDocument8 pagesFAR210 - Feb 2022 - Qqh2mtyprq8No ratings yet

- Far160 Pyq Feb2023Document8 pagesFar160 Pyq Feb2023nazzyusoffNo ratings yet

- Faculty - Accountancy - 2022 - Session 1 - Diploma - Far160Document8 pagesFaculty - Accountancy - 2022 - Session 1 - Diploma - Far160Irzam ZairyNo ratings yet

- Maf201 - Fa Feb2022 - QuestionDocument7 pagesMaf201 - Fa Feb2022 - Questiondatu mohd aslamNo ratings yet

- Far570 SoalanDocument7 pagesFar570 SoalanNURUL NAZAHANNIE MOHAMAD NAJIBNo ratings yet

- Mid-Term Test Tax517 June 2022Document8 pagesMid-Term Test Tax517 June 2022FeahRafeah KikiNo ratings yet

- Aspire BHDDocument1 pageAspire BHDHazoriah RejabNo ratings yet

- Faculty - Accountancy - 2022 - Session 1 - Diploma - Far210Document8 pagesFaculty - Accountancy - 2022 - Session 1 - Diploma - Far210Bil hutNo ratings yet

- Universiti Teknologi Mara Common Test 1: Confidential 1 AC/JAN 2017/FAR320Document5 pagesUniversiti Teknologi Mara Common Test 1: Confidential 1 AC/JAN 2017/FAR320NURAISHA AIDA ATANNo ratings yet

- Project Paper Far410 Dec2023-Uitm KagDocument3 pagesProject Paper Far410 Dec2023-Uitm KagAtiqah FazlyNo ratings yet

- CT May 2021Document5 pagesCT May 2021Star Wind Flower SunNo ratings yet

- Maf151 July 2021Document9 pagesMaf151 July 2021FATIN BATRISYIA MOHD FAZILNo ratings yet

- Tax517 Test June 2022Document5 pagesTax517 Test June 2022Marlina RashidNo ratings yet

- Module 5 - PpsDocument4 pagesModule 5 - PpsMIGUEL JOSHUA VILLANUEVANo ratings yet

- Faculty Accountancy 2022 Session 1 - Degree Far510Document13 pagesFaculty Accountancy 2022 Session 1 - Degree Far510Wahida AmalinNo ratings yet

- AUD02 - 10 - Audit of Other Assests - Illustrative ProblemsDocument3 pagesAUD02 - 10 - Audit of Other Assests - Illustrative ProblemsRenelyn FiloteoNo ratings yet

- CT Far160 Dec2022 QDocument4 pagesCT Far160 Dec2022 QSiti Nurul AtiqahNo ratings yet

- Far270 Q Feb2021 FaDocument9 pagesFar270 Q Feb2021 Fa2024786333No ratings yet

- Common Test May 2023Document4 pagesCommon Test May 20232024916967No ratings yet

- FAR570 - Q - August 2021Document7 pagesFAR570 - Q - August 2021NURUL NAZAHANNIE MOHAMAD NAJIBNo ratings yet

- CT Maf201 May2022 - QDocument5 pagesCT Maf201 May2022 - Qdatu mohd aslamNo ratings yet

- 2020 Mar - 2020 July - QDocument11 pages2020 Mar - 2020 July - Qnur hazirahNo ratings yet

- Assignment/ TugasanDocument7 pagesAssignment/ TugasanFauziah Mustafa100% (1)

- A221 MC 10 - StudentDocument8 pagesA221 MC 10 - StudentNajihah RazakNo ratings yet

- MC9 - Hire Purchase A202 - StudentDocument3 pagesMC9 - Hire Purchase A202 - Studentlim qs0% (1)

- TAX517 2023 Feb QDocument15 pagesTAX517 2023 Feb QNik Fatehah NajwaNo ratings yet

- Shacsbsc1103 Part I EdaranDocument5 pagesShacsbsc1103 Part I EdaranCAROLINE ABRAHAMNo ratings yet

- A232 MC 3 Int Assets - Questions-1Document5 pagesA232 MC 3 Int Assets - Questions-1nur amiraNo ratings yet

- A221 MC 3 - StudentDocument5 pagesA221 MC 3 - StudentNajihah RazakNo ratings yet

- Bcom Y3 Acc3 12 August 2021 s1Document4 pagesBcom Y3 Acc3 12 August 2021 s1Ntokozo Siphiwo Collin DlaminiNo ratings yet

- Revision FfarDocument6 pagesRevision Ffarleejw2810No ratings yet

- Cuac208 Tutorial QuestionsDocument25 pagesCuac208 Tutorial QuestionsSamuel BureNo ratings yet

- Financial Accounting and Reporting IFRS March 2023 ExamDocument9 pagesFinancial Accounting and Reporting IFRS March 2023 Examrwinchella2803No ratings yet

- Far670 - Q - Feb 2021Document5 pagesFar670 - Q - Feb 2021AMIRA BINTI AMRANNo ratings yet

- Universiti Teknologi Mara Final Assessment: Confidential 1 AC/FEB 2022/FAR560Document7 pagesUniversiti Teknologi Mara Final Assessment: Confidential 1 AC/FEB 2022/FAR560NURUL IRA SHAFINAZ ARMENNo ratings yet

- Jan22 QQ PDFDocument5 pagesJan22 QQ PDFSYAZWINA SUHAILINo ratings yet

- Tax 467 Common Test July 2022 PDFDocument5 pagesTax 467 Common Test July 2022 PDFkhaiNo ratings yet

- November 2022 - QSDocument3 pagesNovember 2022 - QSfareen faridNo ratings yet

- Tutorial Investment PropertyDocument3 pagesTutorial Investment Property2022696728No ratings yet

- Comment Test 2Document6 pagesComment Test 2AirasNo ratings yet

- Ctnov22 - Maf201 QDocument5 pagesCtnov22 - Maf201 QAinin SofiyaNo ratings yet

- MC 3 Int Assets - Students - A202Document4 pagesMC 3 Int Assets - Students - A202lim qsNo ratings yet

- 2021 AugDocument8 pages2021 AugmustardNo ratings yet

- Assessment (QP)Document2 pagesAssessment (QP)hasan ihtishamNo ratings yet

- Universiti Teknologi MaraDocument5 pagesUniversiti Teknologi Mararaihana abdulkarimNo ratings yet

- Maf201 Test 2 Jan 2022 QDocument5 pagesMaf201 Test 2 Jan 2022 Qediza adhaNo ratings yet

- Maf151 Common Test 2022nov - QDocument6 pagesMaf151 Common Test 2022nov - QArissa NashaliaNo ratings yet

- Innovative Infrastructure Financing through Value Capture in IndonesiaFrom EverandInnovative Infrastructure Financing through Value Capture in IndonesiaRating: 5 out of 5 stars5/5 (1)