Professional Documents

Culture Documents

21.2 - Notes WK 7 - Asset Disposal

21.2 - Notes WK 7 - Asset Disposal

Uploaded by

Denzel RasodiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

21.2 - Notes WK 7 - Asset Disposal

21.2 - Notes WK 7 - Asset Disposal

Uploaded by

Denzel RasodiCopyright:

Available Formats

GRADE 11 LESSON

21

FIXED ASSETS

DISPOSAL OF FIXED ASSETS

WORKSHEET 5

CONCEPTS

ASSET DISPOSAL - Why does a business dispose of a fixed asset?

The business disposes of a fixed asset for several reasons:

The existing equipment has become old

Vehicles may have been involved in accidents

Damage to assets and therefore the business cannot use it anymore

Asset is out-of-date

ASSET DISPOSAL - How does a business dispose of a fixed asset?

Sell for cash – Bank

Sell on credit – Debtors control

Owner can take the asset for personal use – Drawings

Asset can be given as a donation – Donations

Vehicle can be traded in for a new one – Creditors control

Asset can be damaged and an insurance claim can be lodged.

The asset can be scrapped.

21 Accounting Grade 11 - CAPS 1

STEPS TO FOLLOW

Account Account

Steps Transaction debit credit

1 Depreciation Calculate the current Depreciation Accumulated

depreciation depreciation

(If applicable)

2 Accumulated Calculate the total Accumulated Asset disposal

depreciation accumulated depreciation

depreciation at date of

disposal

(balance beginning of the

year + depreciation up to

date of sale as calculated

in number 1).

3 Cost price Transfer the cost price of Asset disposal Asset account

the asset (e.g. Vehicle

account)

4 Disposal of asset Transfer the disposal

(selling price) Sell for cash Bank Asset disposal

Sell on credit Debtors control Asset disposal

Taken by owner Drawings Asset disposal

Donated Donations Asset disposal

5 Calculate Profit / loss Transfer the profit/ loss

3. Cost R20 000 Transfer profit Asset disposal Profit on sale

2. Acc dep (15 000) of asset

Book value 5 000

4. Selling price (4 000) Transfer loss Loss on sale of Asset disposal

5. Loss 1 000 asset

The Asset Disposal account is a nominal account which is opened

specifically for the disposal (selling) of this asset.

After it is closed off, it will not be used anymore.

ASSET DISPOSAL - WHEN?

DISPOSAL OF ASSETS

In the beginning of the year At the end of the year During the year

21 Accounting Grade 11 - CAPS 2

WORKSHEET 6

DISPOSAL OF FIXED ASSETS IN BEGINNING OF THE YEAR

EXAMPLE 3

INFORMATION

On 1 March 2010 (beginning of financial year) ABC Traders sold a typewriter to B. Baloy for

R200 cash to A Adams.

The original price of the typewriter was R300 and the accumulated depreciation

amounted to R100.

REQUIRED

Record the disposal of the asset as follows: Look at the date of sale

Journalise the transactions If sold in beginning of the year, no

Post to the General Ledger depreciation is calculated

Look at the date of sale

If sold in beginning of the year,

ANSWER no depreciation is calculated

STEPS

1 depreciation R 0 (no depreciation calculated when sold at the beginning of year)

2 transfer acc dep R100

3 transfer cost R300

4 sell R200

5 profit/loss

Cost R300

less acc. dep. (R100)

book value R200

sold for (R200)

profit/loss R 0 .

GENERAL JOURNAL OF ABC TRADERS

Debit Credit

Accumulated depreciation on equipment 100

Asset disposal 100

Transfer accumulated depreciation

Asset disposal 300

Equipment 300

Transfer equipment at cast price

21 Accounting Grade 11 - CAPS 3

CASH RECEIPTS JOURNAL OF ABC TRADERS FOR MARCH 2010

Sundry Accounts

Doc. D Details Fol Bank

Amount Details

1 A Adams 200 200 Asset disposal

Crescent Welfare 4 750 4 750 Donation

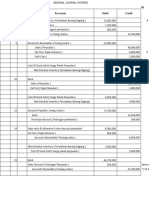

GENERAL LEDGER OF ABC TRADERS

EQUIPMENT

Mar 1 Balance b/d 3 600 Mar 1 Asset disposal 300

ACCUMULATED DEPRECIATION ON EQUIPMENT

Mar 1 Asset disposal 100 MAR 1 Balance b/d 800

BANK

Mar 1 Asset disposal 200

ASSET DISPOSAL

Mar 1 Equipment 300 Mar 1 Accumulated 100

depreciation on

equipment

Bank 200

300 300

Both totals must be the same

21 Accounting Grade 11 - CAPS 4

Look at the date of sale

ACTIVITY 9 If sold in beginning of the year, no

depreciation is calculated

INFORMATION

On 1 March 2015 ABC Traders sold an old vehicle on credit to XYZ for R18 000. The cost

price was R36 000 and was purchased on 1 March 2002.

Depreciation is calculated at 20% per annum on the diminishing balance method.

Accumulated depreciation was R17 568 on 28 February 2015.

REQUIRED

Record the disposal of the asset as follows:

Journalise the transactions

Post to the General Ledger

ANSWER

GENERAL JOURNAL OF ABC TRADERS FOR FEBRUARY 2015

Debit Credit

21 Accounting Grade 11 - CAPS 5

GENERAL LEDGER OF ABC TRADERS

VEHICLES

Mar 1 Balance b/d 380 600

ACCUMULATED DEPRECIATION ON VEHICLES

Mar 1 Balance b/d 18 500

DEBTORS CONTROL

Mar 1 Balance b/d 218 500

ASSET DISPOSAL

LOSS ON SALE OF ASSETS

21 Accounting Grade 11 - CAPS 6

ANSWERS LESSON

21

ACTIVITY 9

STEPS

1 depreciation R 0 (no depreciation calculated when sold at the beginning of year)

2 transfer accum dep R17 568

3 transfer cost R36 00

4 sell R18 000

5 profit/loss

Cost R36 000

less acc. dep. (R17 568)

book value R18 432

sold for (R18 000)

loss R 432 .

GENERAL JOURNAL OF ABC TRADERS

Debit Credit

Accumulated depreciation on vehicles 17 568

Asset disposal 17 568

Transfer accumulated depreciation

Asset disposal 36 000

Vehicles 36 000

Transfer equipment at cast price

Debtors control / XYZ 18 000

Asset disposal 18 000

Transfer selling price of vehicle sold

Asset disposal 432

Loss on sale of asset 432

Loss on sale of vehicle

21 Accounting Grade 11 - CAPS 7

GENERAL LEDGER OF ABC TRADERS

VEHICLES

Mar 1 Balance b/d 380 600 Mar 1 Asset disposal 36 000

ACCUMULATED DEPRECIATION ON VEHICLES

Mar 1 Asset disposal 17 568 Mar 1 Balance b/d 18 500

DEBTORS CONTROL

Mar 1 Balance b/d 218 500

Asset disposal 18 000

ASSET DISPOSAL

Mar 1 Equipment 36 000 Mar 1 Accumulated 17 568

depreciation on

vehicles

Debtors control 18 000

Loss on sale of 432

asset

36 000 36 000

LOSS ON SALE OF ASSETS

Mar 1 Asset disposal 432

21 Accounting Grade 11 - CAPS 8

You might also like

- Tugas 3 - ELRISKA TIFFANI - 142200111Document3 pagesTugas 3 - ELRISKA TIFFANI - 142200111Elriska Tiffani100% (1)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Acc 2021 GR 11 T1 Week 4 Asset Disposal ENGDocument7 pagesAcc 2021 GR 11 T1 Week 4 Asset Disposal ENGziyandamadlolo07No ratings yet

- TUTORIAL AccDocument12 pagesTUTORIAL Accizzat ikramNo ratings yet

- Accounting Equation & Accounting Classification: Prepared By: Nurul Hassanah Binti HamzahDocument12 pagesAccounting Equation & Accounting Classification: Prepared By: Nurul Hassanah Binti HamzahNur Amira NadiaNo ratings yet

- Accounting 2 (FMI) 2024 DR - Mohiy Samy LectureDocument18 pagesAccounting 2 (FMI) 2024 DR - Mohiy Samy LectureAmr HassanNo ratings yet

- Chapter - 7 Departmental Accounting: Mark-Up Accounting Journal EntriesDocument17 pagesChapter - 7 Departmental Accounting: Mark-Up Accounting Journal EntriesAyush AcharyaNo ratings yet

- Monthly Test October 2019: AccountingDocument7 pagesMonthly Test October 2019: AccountingMohamed MubarakNo ratings yet

- MIT2 96F12 Lec05Document43 pagesMIT2 96F12 Lec05BishwoNo ratings yet

- 2 96 Finacial 04Document55 pages2 96 Finacial 04earespNo ratings yet

- DEMO - Financial AnalysisDocument35 pagesDEMO - Financial AnalysisshielaNo ratings yet

- Chapter 5 Depreciation of Non-Current Assets ChineseDocument6 pagesChapter 5 Depreciation of Non-Current Assets ChineseFung Shan CheungNo ratings yet

- 3 Asset Diposal MGDocument10 pages3 Asset Diposal MGSweetness MakaLuthando LeocardiaNo ratings yet

- Journal Entries & LedgerDocument16 pagesJournal Entries & LedgerdelgadojudithNo ratings yet

- Assignment 1 AFSDocument14 pagesAssignment 1 AFSSimra SalmanNo ratings yet

- Final Accounts: Presented by Manmeet Kaur (110069) Payal Motwani (110072)Document28 pagesFinal Accounts: Presented by Manmeet Kaur (110069) Payal Motwani (110072)Payal Motwani100% (1)

- MintooDocument446 pagesMintooSHIVAM GUPTANo ratings yet

- Civic CompanyDocument5 pagesCivic CompanyJyasmine Aura V. AgustinNo ratings yet

- 008 Types of Major AccountsDocument52 pages008 Types of Major AccountsJames CasisonNo ratings yet

- Lecture 03Document108 pagesLecture 03Masood AliNo ratings yet

- Financial Statements Part BDocument29 pagesFinancial Statements Part Bhaleemafaizann2008No ratings yet

- Nov 17 2022 Accounting 2 SFP KeyDocument3 pagesNov 17 2022 Accounting 2 SFP KeyJayvee Dela CruzNo ratings yet

- DepreciationDocument8 pagesDepreciationDubai SheikhNo ratings yet

- Introduction To Financial Accounting: Page 1 of 7 Dure Nayab19-May-10-4:27:26 PMDocument7 pagesIntroduction To Financial Accounting: Page 1 of 7 Dure Nayab19-May-10-4:27:26 PMSalman AliNo ratings yet

- FAR 04 ReceivablesDocument10 pagesFAR 04 ReceivablesRoseNo ratings yet

- Learning Unit 3Document12 pagesLearning Unit 3prim2698No ratings yet

- Chapter 2 SolutionsDocument15 pagesChapter 2 SolutionsKashif IshaqNo ratings yet

- Acc GR 10 Mid QP 2022-3Document7 pagesAcc GR 10 Mid QP 2022-3LegobjeNo ratings yet

- Lesson 2 - Statement of Financial PositionDocument39 pagesLesson 2 - Statement of Financial Positiondenise andalocNo ratings yet

- Journal, Ledger Trial BalanceDocument15 pagesJournal, Ledger Trial BalanceOmar Galal100% (1)

- Lect 11c Depreciation-Disposals (Part 3)Document17 pagesLect 11c Depreciation-Disposals (Part 3)11Co sarahNo ratings yet

- Financial Statements With Adjustments: Submitted To:-Ms. Palak Bajaj Submitted By:-Chirag VermaDocument15 pagesFinancial Statements With Adjustments: Submitted To:-Ms. Palak Bajaj Submitted By:-Chirag VermaChiragNo ratings yet

- Fund Flow - RevisedDocument11 pagesFund Flow - RevisedModhish NothumanNo ratings yet

- 18.2 - Notes WK 6 - Asset DisposalDocument8 pages18.2 - Notes WK 6 - Asset DisposalDenzel RasodiNo ratings yet

- Mark Scheme For Form 6 MockDocument7 pagesMark Scheme For Form 6 Mockkya.pNo ratings yet

- Provision For DepreciationDocument10 pagesProvision For DepreciationAsh InuNo ratings yet

- Paper 16Document75 pagesPaper 16Komal yadavNo ratings yet

- Assignment 1 FMDocument4 pagesAssignment 1 FMmnegiuk07No ratings yet

- Journal and Ledger With List of Accounts PDFDocument2 pagesJournal and Ledger With List of Accounts PDFJen RossNo ratings yet

- Level 1&2 Text Book V2 - Batch 2Document91 pagesLevel 1&2 Text Book V2 - Batch 2Banyar Thiha ZawNo ratings yet

- Statement of Financial Position (SFP) : TNHS Main - SHS - Accountancy, Business and ManagementDocument10 pagesStatement of Financial Position (SFP) : TNHS Main - SHS - Accountancy, Business and ManagementPedana RañolaNo ratings yet

- Answers To Lecture 1Document10 pagesAnswers To Lecture 1Mohamed ZaitoonNo ratings yet

- Jawaban Jurnal Umum P Dagang (11 Desember 2023)Document4 pagesJawaban Jurnal Umum P Dagang (11 Desember 2023)230210018No ratings yet

- Diagram 1.1: (Book of Original Entry) Office Equipment XXXX Cash XXXX Accounts Payable XXXXDocument14 pagesDiagram 1.1: (Book of Original Entry) Office Equipment XXXX Cash XXXX Accounts Payable XXXXEfi of the IsleNo ratings yet

- Act Day 1-3Document45 pagesAct Day 1-3Joyce Anne GarduqueNo ratings yet

- 62e49cfs (Module3)Document12 pages62e49cfs (Module3)kumaranil_1983No ratings yet

- Accounting TestDocument4 pagesAccounting Testefrata AlemNo ratings yet

- Week 1 - DepreciationDocument8 pagesWeek 1 - DepreciationTeresa ManNo ratings yet

- Accounting Grade 12 Term 2 Week 4 - 2020Document7 pagesAccounting Grade 12 Term 2 Week 4 - 2020Samishka GovenderNo ratings yet

- Topic 2 Accounting Equation and StatementsDocument47 pagesTopic 2 Accounting Equation and StatementsNurul AfiqahNo ratings yet

- Analisa Ratio Keuangan LatihansoalDocument4 pagesAnalisa Ratio Keuangan Latihansoalxiao yung12No ratings yet

- Asset Life Cycle What Is The Journal Entry When You Capitalize The Asset When It Is Ready To UseDocument7 pagesAsset Life Cycle What Is The Journal Entry When You Capitalize The Asset When It Is Ready To UseRajesh VarmaNo ratings yet

- Accounting CycleDocument15 pagesAccounting CycleDeligateaux MalaysiaNo ratings yet

- Practice Handout of Ias 36: Example 1Document5 pagesPractice Handout of Ias 36: Example 1noor ul anumNo ratings yet

- 25 Question PaperDocument4 pages25 Question PaperPacific Tiger0% (1)

- Lcci LV I TextDocument65 pagesLcci LV I TextPyin Nyar AungNo ratings yet

- Accounts Heads & Balance SheetDocument19 pagesAccounts Heads & Balance SheetAshraf HussainNo ratings yet

- Adjustment ProcessDocument19 pagesAdjustment ProcessDarwin Dionisio ClementeNo ratings yet

- Topic3 S Balance SheetDocument10 pagesTopic3 S Balance SheetWei ZhangNo ratings yet

- 7.90 Closing Process Jan SDocument21 pages7.90 Closing Process Jan SaraseliNo ratings yet