Professional Documents

Culture Documents

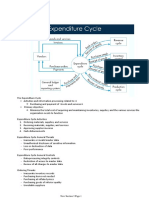

Pre-Numbered Documents, Special Journals, Subsidiary Ledgers

Pre-Numbered Documents, Special Journals, Subsidiary Ledgers

Uploaded by

DANIELLE TORRANCE ESPIRITUCopyright:

Available Formats

You might also like

- Tourism Unit 2 IADocument21 pagesTourism Unit 2 IADelmar Nixon75% (4)

- Dakota Office ProductssDocument17 pagesDakota Office ProductssSuzan Bakleh100% (5)

- Internal Control InventoryDocument13 pagesInternal Control Inventoryabbyplexx100% (3)

- Auditing The Revenue CycleDocument30 pagesAuditing The Revenue Cycleasdfghjkl100% (1)

- Accounts Payable Sox TestingDocument2 pagesAccounts Payable Sox TestingStephen JonesNo ratings yet

- Zara Consumer BackgroundDocument5 pagesZara Consumer BackgroundAmisha Singh100% (2)

- Chapter 4 ReviewerDocument10 pagesChapter 4 ReviewerItsme ColladoNo ratings yet

- M 12 - 13 Expenditure CycleDocument50 pagesM 12 - 13 Expenditure CycleJevan MarcelNo ratings yet

- Expenditure Cycle Risks and Internal ControlsDocument12 pagesExpenditure Cycle Risks and Internal ControlsKatie Barnes67% (6)

- Chapter 5 Purchases and Cash DisbursementDocument6 pagesChapter 5 Purchases and Cash Disbursementangelie mendozaNo ratings yet

- Pertemuan 4Document46 pagesPertemuan 4narutouzumaki785No ratings yet

- Auditing The Revenue CycleDocument9 pagesAuditing The Revenue CycleWendelyn TutorNo ratings yet

- The Expenditure Cycle Part 1Document42 pagesThe Expenditure Cycle Part 1CenNo ratings yet

- Internal Control Procedures Chapter 4Document32 pagesInternal Control Procedures Chapter 4lukeNo ratings yet

- The Expenditure Cycle: Part I: Purchases and Cash Disbursements ProceduresDocument40 pagesThe Expenditure Cycle: Part I: Purchases and Cash Disbursements ProceduresstudentresearchonlyNo ratings yet

- Accounting Information System Report-2Document45 pagesAccounting Information System Report-2Rana Chrisabel G. TaguinotNo ratings yet

- Ais903 Hall 2007 Ch04 The Revenue CycleDocument16 pagesAis903 Hall 2007 Ch04 The Revenue CyclewichupinunoNo ratings yet

- Expenditure SubsystemDocument30 pagesExpenditure SubsystemChristian AribasNo ratings yet

- The Expenditure CycleDocument8 pagesThe Expenditure Cyclemoknetone100% (1)

- Chapter 4 The Revenue CycleDocument9 pagesChapter 4 The Revenue Cycleangelie mendozaNo ratings yet

- Chapter 10Document43 pagesChapter 10Wendelyn TutorNo ratings yet

- The Revenue Cycle: Group 1Document43 pagesThe Revenue Cycle: Group 1Ratih PratiwiNo ratings yet

- Frauds in BankDocument18 pagesFrauds in BankSaroj Kumar0% (1)

- Controlling Information SystemDocument19 pagesControlling Information SystemSarah Mae Del RosarioNo ratings yet

- Ais ReviewerDocument6 pagesAis ReviewerAlliyah NasuenNo ratings yet

- CH 04Document44 pagesCH 04Junaid MalicNo ratings yet

- Group3 Disbursement CycleDocument26 pagesGroup3 Disbursement CyclegelaNo ratings yet

- Acquisiation and Payment CycleDocument48 pagesAcquisiation and Payment CycleDwidarNo ratings yet

- Specific Aspects of Auditing in A Computer Based EnvironmentDocument9 pagesSpecific Aspects of Auditing in A Computer Based EnvironmentCacatian, Joanna Mae M.No ratings yet

- Overview of Business ProcessesDocument9 pagesOverview of Business ProcessesNoha KhaledNo ratings yet

- Overview of Business ProcessesDocument8 pagesOverview of Business ProcessesJanica BerbaNo ratings yet

- CABINAS FocusNotes PrelimDocument7 pagesCABINAS FocusNotes PrelimJoshua CabinasNo ratings yet

- Accounting Information Systems: Moscove, Simkin & BagranoffDocument26 pagesAccounting Information Systems: Moscove, Simkin & BagranoffJessa WongNo ratings yet

- The Expenditure Cycle: Part I: Purchases and Cash Disbursements ProceduresDocument24 pagesThe Expenditure Cycle: Part I: Purchases and Cash Disbursements ProceduresNAVISTA DITA FAIRUZINo ratings yet

- CH13 and 14: November 29, 2022 3:26 PMDocument6 pagesCH13 and 14: November 29, 2022 3:26 PMdre thegreatNo ratings yet

- Chapter 4 The Revenue Cycle SummaryDocument6 pagesChapter 4 The Revenue Cycle SummaryAngela Erish CastroNo ratings yet

- AIS Chapter 2Document28 pagesAIS Chapter 2Shopno ChuraNo ratings yet

- Chapter 5 Expenditure Cycle Part 1Document33 pagesChapter 5 Expenditure Cycle Part 1KRIS ANNE SAMUDIO100% (1)

- Summary Note of Assurance - Chap 5 - 7Document8 pagesSummary Note of Assurance - Chap 5 - 7Đông VyNo ratings yet

- ReviewerDocument5 pagesReviewerRegine San JuanNo ratings yet

- Acctsys 101022 1Document3 pagesAcctsys 101022 1Charine Joy Rosales VillaverNo ratings yet

- CHAPTER 4 SUMMARY (The Revenue Cycle)Document6 pagesCHAPTER 4 SUMMARY (The Revenue Cycle)Janica GaynorNo ratings yet

- 3accounting Information SystemsDocument22 pages3accounting Information SystemsAirish Justine MacalintalNo ratings yet

- Purpose of Internal ControlDocument50 pagesPurpose of Internal ControlTHATONo ratings yet

- Point-Of-Sale (POS) SystemDocument17 pagesPoint-Of-Sale (POS) SystemBalestramon100% (2)

- Chapter 4 - Review Questions Accounting Information SystemDocument2 pagesChapter 4 - Review Questions Accounting Information SystemBeny MoldogoNo ratings yet

- Internal ControlDocument4 pagesInternal ControlFe VhieNo ratings yet

- Chapter 07 The Revenue CycleDocument22 pagesChapter 07 The Revenue CycleClaire Denisse AilesNo ratings yet

- Auditing The Revenue CycleDocument7 pagesAuditing The Revenue CycleYoite MiharuNo ratings yet

- Discussion Question:: 1. What Documents Constitute The AP Packet? What Evidence Does Each Document Provide?Document4 pagesDiscussion Question:: 1. What Documents Constitute The AP Packet? What Evidence Does Each Document Provide?Rizza L. MacarandanNo ratings yet

- Accounts Payable Sox TestingDocument2 pagesAccounts Payable Sox TestingStephen JonesNo ratings yet

- Aa-Threat and Control For Each CycleDocument9 pagesAa-Threat and Control For Each CycleKucing Brow Brow100% (1)

- Audit - System Audit - CIS Audit - IT AuditDocument5 pagesAudit - System Audit - CIS Audit - IT AuditBHAVYAN AGARWALNo ratings yet

- Transaction Cycles and Internal ControlsDocument16 pagesTransaction Cycles and Internal ControlsPreyNo ratings yet

- Liu Ais CH 2Document36 pagesLiu Ais CH 2hassan nassereddineNo ratings yet

- Introduction To Transaction ProcessingDocument16 pagesIntroduction To Transaction ProcessingneffhbaculodmzNo ratings yet

- The Expenditure Cycle Part 1: Purchases and Cash Disbursements ProceduresDocument41 pagesThe Expenditure Cycle Part 1: Purchases and Cash Disbursements ProceduresGlazerie Quijano GalabinNo ratings yet

- Chapter 5Document41 pagesChapter 5Gemma RetesNo ratings yet

- 9) Chapter 8 (Internal Control System)Document42 pages9) Chapter 8 (Internal Control System)azone accounts & audit firmNo ratings yet

- Textbook of Urgent Care Management: Chapter 13, Financial ManagementFrom EverandTextbook of Urgent Care Management: Chapter 13, Financial ManagementNo ratings yet

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 4.5 out of 5 stars4.5/5 (2)

- The Art and Science of Auditing: Principles, Practices, and InsightsFrom EverandThe Art and Science of Auditing: Principles, Practices, and InsightsNo ratings yet

- Projman (Ca51029)Document17 pagesProjman (Ca51029)DANIELLE TORRANCE ESPIRITUNo ratings yet

- AIS Reviewer 5Document2 pagesAIS Reviewer 5DANIELLE TORRANCE ESPIRITUNo ratings yet

- 11 12 PDFDocument2 pages11 12 PDFDANIELLE TORRANCE ESPIRITUNo ratings yet

- 1 2 PDFDocument2 pages1 2 PDFDANIELLE TORRANCE ESPIRITUNo ratings yet

- Far 1ST Term NotesDocument28 pagesFar 1ST Term NotesDANIELLE TORRANCE ESPIRITUNo ratings yet

- Grading System (Refer To Course Plan) Forms of Business Sole ProprietorshipDocument24 pagesGrading System (Refer To Course Plan) Forms of Business Sole ProprietorshipDANIELLE TORRANCE ESPIRITUNo ratings yet

- Und - Self 1st Term NotesDocument46 pagesUnd - Self 1st Term NotesDANIELLE TORRANCE ESPIRITUNo ratings yet

- Read-Ph 1st Term NotesDocument3 pagesRead-Ph 1st Term NotesDANIELLE TORRANCE ESPIRITUNo ratings yet

- Path-Fit 1ST Term NotesDocument2 pagesPath-Fit 1ST Term NotesDANIELLE TORRANCE ESPIRITUNo ratings yet

- Man-Sci 1st Term NotesDocument11 pagesMan-Sci 1st Term NotesDANIELLE TORRANCE ESPIRITUNo ratings yet

- Ele Imhpssdp 1ST Term NotesDocument7 pagesEle Imhpssdp 1ST Term NotesDANIELLE TORRANCE ESPIRITUNo ratings yet

- Freshmen Orientation PPT AY21 22 For Distribution To StudentsDocument78 pagesFreshmen Orientation PPT AY21 22 For Distribution To StudentsDANIELLE TORRANCE ESPIRITUNo ratings yet

- Man-Econ 1ST Term NotesDocument4 pagesMan-Econ 1ST Term NotesDANIELLE TORRANCE ESPIRITUNo ratings yet

- Readings in Philippine History o o oDocument3 pagesReadings in Philippine History o o oDANIELLE TORRANCE ESPIRITUNo ratings yet

- Innovation in Credit Card and Debit Card Business by Indian BanksDocument21 pagesInnovation in Credit Card and Debit Card Business by Indian BanksProf S P GargNo ratings yet

- Drghafoorkazi,+1386 Article+Text 6216 1 6 20200612Document8 pagesDrghafoorkazi,+1386 Article+Text 6216 1 6 20200612Ahsan ButtNo ratings yet

- The Business Vision and Mission: Chapter TwoDocument31 pagesThe Business Vision and Mission: Chapter TwoSteffanie SantiagoNo ratings yet

- 4.share of Heart-Mind and MarketDocument16 pages4.share of Heart-Mind and MarketKavitha prabhakaranNo ratings yet

- Marketing Management PDFDocument30 pagesMarketing Management PDFElena BadeaNo ratings yet

- BY Rajashekara D A: 1VA19MBA25Document9 pagesBY Rajashekara D A: 1VA19MBA25Leelesh GNo ratings yet

- Online EarningsDocument3 pagesOnline EarningsafzalalibahttiNo ratings yet

- Unit 7Document18 pagesUnit 7Oluwaseun EmmaNo ratings yet

- Inbound Logistics Performance For AutoZoneDocument2 pagesInbound Logistics Performance For AutoZoneMartha GlNo ratings yet

- Chapter President Manual Upated Juy 28 - 21Document23 pagesChapter President Manual Upated Juy 28 - 21Faisal OmarNo ratings yet

- Connect Platform - Executive SummaryDocument14 pagesConnect Platform - Executive SummaryAndrei SorokinNo ratings yet

- Argentina (CB & Impact of Religion On Business Practices)Document2 pagesArgentina (CB & Impact of Religion On Business Practices)Abhay TegtaNo ratings yet

- D-2 Startup Costing of BusinessDocument10 pagesD-2 Startup Costing of BusinessNaveed KhaliqNo ratings yet

- Case Study-Azz FoodsDocument11 pagesCase Study-Azz FoodsAli HussainNo ratings yet

- Office Administration Research PaperDocument6 pagesOffice Administration Research PaperaflbskroiNo ratings yet

- Barriers To Entering An Industry: Entry Barriers and The Other 4 Porter Competitive ForcesDocument11 pagesBarriers To Entering An Industry: Entry Barriers and The Other 4 Porter Competitive ForcesFasi RaoNo ratings yet

- Alishba Internship ReportDocument48 pagesAlishba Internship ReportAlishba NadeemNo ratings yet

- Cheap Totally In-Demand: and For BeingDocument7 pagesCheap Totally In-Demand: and For Beingmotilal oswalNo ratings yet

- PDF Managing International Business in China 2Nd Edition Xiaowen Tian Ebook Full ChapterDocument53 pagesPDF Managing International Business in China 2Nd Edition Xiaowen Tian Ebook Full Chapterrichard.keller167100% (4)

- Emc Social Media InfluencerDocument5 pagesEmc Social Media InfluencerShreya ShriniwasNo ratings yet

- Mahindra Mahindra Limited Vs DCIT ITAT MumbaiDocument59 pagesMahindra Mahindra Limited Vs DCIT ITAT MumbaiVinod TanwaniNo ratings yet

- 0 - Haibali Water Taps LTDDocument4 pages0 - Haibali Water Taps LTDMahdi SuhadNo ratings yet

- ASSIGNMENT Air Cargo WahajDocument3 pagesASSIGNMENT Air Cargo WahajwahajNo ratings yet

- Vidit Sareen: ProfessionalDocument3 pagesVidit Sareen: ProfessionalAnshumali MishraNo ratings yet

- Master Thesis Erasmus University RotterdamDocument8 pagesMaster Thesis Erasmus University RotterdamSuzanne Simmons100% (2)

- Company A Competitive Efforts Company B Competitive Efforts Company C Competitive Efforts North AmericaDocument12 pagesCompany A Competitive Efforts Company B Competitive Efforts Company C Competitive Efforts North AmericaThảo Nguyễn PhươngNo ratings yet

- Apparel Merchandising Assingnment 1Document21 pagesApparel Merchandising Assingnment 1Neha Shrivastava100% (1)

Pre-Numbered Documents, Special Journals, Subsidiary Ledgers

Pre-Numbered Documents, Special Journals, Subsidiary Ledgers

Uploaded by

DANIELLE TORRANCE ESPIRITUOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pre-Numbered Documents, Special Journals, Subsidiary Ledgers

Pre-Numbered Documents, Special Journals, Subsidiary Ledgers

Uploaded by

DANIELLE TORRANCE ESPIRITUCopyright:

Available Formats

• Inaccurately recording transactions in journals and accounts.

– Physical controls include transaction authorization, accounting records,

pre-numbered documents, special journals, subsidiary ledgers,

general ledger control accounts, files and independent verification:

• Shipping department reconciles goods being shipped against

packing slip to ensure customer is receiving correct items and

quantity.

• Billing function reconciles original sales order with shipping notice

to ensure bills are correct and sales are recorded properly.

• GL function reconciles journal vouchers and summary reports

prepared independently in different functional areas before posting

to control accounts.

– IT controls include automated postings and file backups.

• Misappropriation of cash receipts and inventory.

– Physical controls include transaction authorization, supervision (especially

in the mail room), access controls and segregation of duties:

• Cash receipts function should be separate from the AR function.

• Cash receipts clerk should not have access to GL cash.

• Personnel with physical custody of inventory should not update

records.

– IT controls include multilevel security.

• Unauthorized access to accounting records and reports.

– Motives include attempt to create a fraud, data theft and malicious acts.

– Physical controls include access controls and segregation of duties such

that the perpetration of a fraud requires collusion.

– IT controls include passwords and multilevel security.

Physical Systems: Multilevel Security

• Employs programmed techniques that permit simultaneous access to a central

system by many users with different access privileges.

– Users are prevented from obtaining information for which they lack

authorization.

• Two common multilevel security methods:

– Access control list (ACL) method assigns privileges directly to

individuals which is burdensome in large organizations.

– Role-based access control (RBAC) creates standard tasks called

roles that are assigned specific privileges.

• Once a role is created, individuals are assigned to it.

• Easy to add or delete roles as job responsibilities change.

Physical Systems: Point-of-Sale (POS) Systems

• POS systems used extensively in retail establishments.

– Customers pick items from shelves and take them to a cashier.

• Clerk scans the Universal product code (UPC) of items.

– Price and description retrieved from inventory file.

– Inventory levels are updated and reordered as needed.

• System automatically calculates taxes, discounts and total.

– Non-cash payments are approved via online connection.

• At shift end, money and receipts reconciled to the internal cash register tape with

cash over and shorts accounts for.

• Cash receipts clerk prepares deposit slip for total daily cash receipts and batch

program posts entry to the GL.

Physical Systems: POS Control Issues

• Authorization:

– Clerk should match customer signature with credit card.

• Supervision:

– Surveillance cameras and floor security help prevent shoplifting and

employee theft.

• Access Control:

– Separate cash drawers, locked showcases and magnetic tags attached to

merchandise help control theft.

• Accounting records:

– Only supervisors should access internal cash register tapes.

• Independent verification:

– Cash drawers should be reconciled to internal register tapes.

Physical Systems: Reengineering

• Electronic data interchange (EDI) expedites transactions.

– Customer’s computer automatically orders inventory as needed.

– Seller processes order with little or no human involvement.

– Binding terms specified in a trading partner agreement.

– Control problems include ensuring only valid transactions are processed

and that accounting records are not compromised.

• Doing business on the Internet involves both business-to-business (B2B) and

business-to-consumer (B2C) transactions.

– Opens the door to thousands of business partners without formal trading

agreements.

– Risks include threats from computer hackers, viruses and transaction

fraud.

You might also like

- Tourism Unit 2 IADocument21 pagesTourism Unit 2 IADelmar Nixon75% (4)

- Dakota Office ProductssDocument17 pagesDakota Office ProductssSuzan Bakleh100% (5)

- Internal Control InventoryDocument13 pagesInternal Control Inventoryabbyplexx100% (3)

- Auditing The Revenue CycleDocument30 pagesAuditing The Revenue Cycleasdfghjkl100% (1)

- Accounts Payable Sox TestingDocument2 pagesAccounts Payable Sox TestingStephen JonesNo ratings yet

- Zara Consumer BackgroundDocument5 pagesZara Consumer BackgroundAmisha Singh100% (2)

- Chapter 4 ReviewerDocument10 pagesChapter 4 ReviewerItsme ColladoNo ratings yet

- M 12 - 13 Expenditure CycleDocument50 pagesM 12 - 13 Expenditure CycleJevan MarcelNo ratings yet

- Expenditure Cycle Risks and Internal ControlsDocument12 pagesExpenditure Cycle Risks and Internal ControlsKatie Barnes67% (6)

- Chapter 5 Purchases and Cash DisbursementDocument6 pagesChapter 5 Purchases and Cash Disbursementangelie mendozaNo ratings yet

- Pertemuan 4Document46 pagesPertemuan 4narutouzumaki785No ratings yet

- Auditing The Revenue CycleDocument9 pagesAuditing The Revenue CycleWendelyn TutorNo ratings yet

- The Expenditure Cycle Part 1Document42 pagesThe Expenditure Cycle Part 1CenNo ratings yet

- Internal Control Procedures Chapter 4Document32 pagesInternal Control Procedures Chapter 4lukeNo ratings yet

- The Expenditure Cycle: Part I: Purchases and Cash Disbursements ProceduresDocument40 pagesThe Expenditure Cycle: Part I: Purchases and Cash Disbursements ProceduresstudentresearchonlyNo ratings yet

- Accounting Information System Report-2Document45 pagesAccounting Information System Report-2Rana Chrisabel G. TaguinotNo ratings yet

- Ais903 Hall 2007 Ch04 The Revenue CycleDocument16 pagesAis903 Hall 2007 Ch04 The Revenue CyclewichupinunoNo ratings yet

- Expenditure SubsystemDocument30 pagesExpenditure SubsystemChristian AribasNo ratings yet

- The Expenditure CycleDocument8 pagesThe Expenditure Cyclemoknetone100% (1)

- Chapter 4 The Revenue CycleDocument9 pagesChapter 4 The Revenue Cycleangelie mendozaNo ratings yet

- Chapter 10Document43 pagesChapter 10Wendelyn TutorNo ratings yet

- The Revenue Cycle: Group 1Document43 pagesThe Revenue Cycle: Group 1Ratih PratiwiNo ratings yet

- Frauds in BankDocument18 pagesFrauds in BankSaroj Kumar0% (1)

- Controlling Information SystemDocument19 pagesControlling Information SystemSarah Mae Del RosarioNo ratings yet

- Ais ReviewerDocument6 pagesAis ReviewerAlliyah NasuenNo ratings yet

- CH 04Document44 pagesCH 04Junaid MalicNo ratings yet

- Group3 Disbursement CycleDocument26 pagesGroup3 Disbursement CyclegelaNo ratings yet

- Acquisiation and Payment CycleDocument48 pagesAcquisiation and Payment CycleDwidarNo ratings yet

- Specific Aspects of Auditing in A Computer Based EnvironmentDocument9 pagesSpecific Aspects of Auditing in A Computer Based EnvironmentCacatian, Joanna Mae M.No ratings yet

- Overview of Business ProcessesDocument9 pagesOverview of Business ProcessesNoha KhaledNo ratings yet

- Overview of Business ProcessesDocument8 pagesOverview of Business ProcessesJanica BerbaNo ratings yet

- CABINAS FocusNotes PrelimDocument7 pagesCABINAS FocusNotes PrelimJoshua CabinasNo ratings yet

- Accounting Information Systems: Moscove, Simkin & BagranoffDocument26 pagesAccounting Information Systems: Moscove, Simkin & BagranoffJessa WongNo ratings yet

- The Expenditure Cycle: Part I: Purchases and Cash Disbursements ProceduresDocument24 pagesThe Expenditure Cycle: Part I: Purchases and Cash Disbursements ProceduresNAVISTA DITA FAIRUZINo ratings yet

- CH13 and 14: November 29, 2022 3:26 PMDocument6 pagesCH13 and 14: November 29, 2022 3:26 PMdre thegreatNo ratings yet

- Chapter 4 The Revenue Cycle SummaryDocument6 pagesChapter 4 The Revenue Cycle SummaryAngela Erish CastroNo ratings yet

- AIS Chapter 2Document28 pagesAIS Chapter 2Shopno ChuraNo ratings yet

- Chapter 5 Expenditure Cycle Part 1Document33 pagesChapter 5 Expenditure Cycle Part 1KRIS ANNE SAMUDIO100% (1)

- Summary Note of Assurance - Chap 5 - 7Document8 pagesSummary Note of Assurance - Chap 5 - 7Đông VyNo ratings yet

- ReviewerDocument5 pagesReviewerRegine San JuanNo ratings yet

- Acctsys 101022 1Document3 pagesAcctsys 101022 1Charine Joy Rosales VillaverNo ratings yet

- CHAPTER 4 SUMMARY (The Revenue Cycle)Document6 pagesCHAPTER 4 SUMMARY (The Revenue Cycle)Janica GaynorNo ratings yet

- 3accounting Information SystemsDocument22 pages3accounting Information SystemsAirish Justine MacalintalNo ratings yet

- Purpose of Internal ControlDocument50 pagesPurpose of Internal ControlTHATONo ratings yet

- Point-Of-Sale (POS) SystemDocument17 pagesPoint-Of-Sale (POS) SystemBalestramon100% (2)

- Chapter 4 - Review Questions Accounting Information SystemDocument2 pagesChapter 4 - Review Questions Accounting Information SystemBeny MoldogoNo ratings yet

- Internal ControlDocument4 pagesInternal ControlFe VhieNo ratings yet

- Chapter 07 The Revenue CycleDocument22 pagesChapter 07 The Revenue CycleClaire Denisse AilesNo ratings yet

- Auditing The Revenue CycleDocument7 pagesAuditing The Revenue CycleYoite MiharuNo ratings yet

- Discussion Question:: 1. What Documents Constitute The AP Packet? What Evidence Does Each Document Provide?Document4 pagesDiscussion Question:: 1. What Documents Constitute The AP Packet? What Evidence Does Each Document Provide?Rizza L. MacarandanNo ratings yet

- Accounts Payable Sox TestingDocument2 pagesAccounts Payable Sox TestingStephen JonesNo ratings yet

- Aa-Threat and Control For Each CycleDocument9 pagesAa-Threat and Control For Each CycleKucing Brow Brow100% (1)

- Audit - System Audit - CIS Audit - IT AuditDocument5 pagesAudit - System Audit - CIS Audit - IT AuditBHAVYAN AGARWALNo ratings yet

- Transaction Cycles and Internal ControlsDocument16 pagesTransaction Cycles and Internal ControlsPreyNo ratings yet

- Liu Ais CH 2Document36 pagesLiu Ais CH 2hassan nassereddineNo ratings yet

- Introduction To Transaction ProcessingDocument16 pagesIntroduction To Transaction ProcessingneffhbaculodmzNo ratings yet

- The Expenditure Cycle Part 1: Purchases and Cash Disbursements ProceduresDocument41 pagesThe Expenditure Cycle Part 1: Purchases and Cash Disbursements ProceduresGlazerie Quijano GalabinNo ratings yet

- Chapter 5Document41 pagesChapter 5Gemma RetesNo ratings yet

- 9) Chapter 8 (Internal Control System)Document42 pages9) Chapter 8 (Internal Control System)azone accounts & audit firmNo ratings yet

- Textbook of Urgent Care Management: Chapter 13, Financial ManagementFrom EverandTextbook of Urgent Care Management: Chapter 13, Financial ManagementNo ratings yet

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 4.5 out of 5 stars4.5/5 (2)

- The Art and Science of Auditing: Principles, Practices, and InsightsFrom EverandThe Art and Science of Auditing: Principles, Practices, and InsightsNo ratings yet

- Projman (Ca51029)Document17 pagesProjman (Ca51029)DANIELLE TORRANCE ESPIRITUNo ratings yet

- AIS Reviewer 5Document2 pagesAIS Reviewer 5DANIELLE TORRANCE ESPIRITUNo ratings yet

- 11 12 PDFDocument2 pages11 12 PDFDANIELLE TORRANCE ESPIRITUNo ratings yet

- 1 2 PDFDocument2 pages1 2 PDFDANIELLE TORRANCE ESPIRITUNo ratings yet

- Far 1ST Term NotesDocument28 pagesFar 1ST Term NotesDANIELLE TORRANCE ESPIRITUNo ratings yet

- Grading System (Refer To Course Plan) Forms of Business Sole ProprietorshipDocument24 pagesGrading System (Refer To Course Plan) Forms of Business Sole ProprietorshipDANIELLE TORRANCE ESPIRITUNo ratings yet

- Und - Self 1st Term NotesDocument46 pagesUnd - Self 1st Term NotesDANIELLE TORRANCE ESPIRITUNo ratings yet

- Read-Ph 1st Term NotesDocument3 pagesRead-Ph 1st Term NotesDANIELLE TORRANCE ESPIRITUNo ratings yet

- Path-Fit 1ST Term NotesDocument2 pagesPath-Fit 1ST Term NotesDANIELLE TORRANCE ESPIRITUNo ratings yet

- Man-Sci 1st Term NotesDocument11 pagesMan-Sci 1st Term NotesDANIELLE TORRANCE ESPIRITUNo ratings yet

- Ele Imhpssdp 1ST Term NotesDocument7 pagesEle Imhpssdp 1ST Term NotesDANIELLE TORRANCE ESPIRITUNo ratings yet

- Freshmen Orientation PPT AY21 22 For Distribution To StudentsDocument78 pagesFreshmen Orientation PPT AY21 22 For Distribution To StudentsDANIELLE TORRANCE ESPIRITUNo ratings yet

- Man-Econ 1ST Term NotesDocument4 pagesMan-Econ 1ST Term NotesDANIELLE TORRANCE ESPIRITUNo ratings yet

- Readings in Philippine History o o oDocument3 pagesReadings in Philippine History o o oDANIELLE TORRANCE ESPIRITUNo ratings yet

- Innovation in Credit Card and Debit Card Business by Indian BanksDocument21 pagesInnovation in Credit Card and Debit Card Business by Indian BanksProf S P GargNo ratings yet

- Drghafoorkazi,+1386 Article+Text 6216 1 6 20200612Document8 pagesDrghafoorkazi,+1386 Article+Text 6216 1 6 20200612Ahsan ButtNo ratings yet

- The Business Vision and Mission: Chapter TwoDocument31 pagesThe Business Vision and Mission: Chapter TwoSteffanie SantiagoNo ratings yet

- 4.share of Heart-Mind and MarketDocument16 pages4.share of Heart-Mind and MarketKavitha prabhakaranNo ratings yet

- Marketing Management PDFDocument30 pagesMarketing Management PDFElena BadeaNo ratings yet

- BY Rajashekara D A: 1VA19MBA25Document9 pagesBY Rajashekara D A: 1VA19MBA25Leelesh GNo ratings yet

- Online EarningsDocument3 pagesOnline EarningsafzalalibahttiNo ratings yet

- Unit 7Document18 pagesUnit 7Oluwaseun EmmaNo ratings yet

- Inbound Logistics Performance For AutoZoneDocument2 pagesInbound Logistics Performance For AutoZoneMartha GlNo ratings yet

- Chapter President Manual Upated Juy 28 - 21Document23 pagesChapter President Manual Upated Juy 28 - 21Faisal OmarNo ratings yet

- Connect Platform - Executive SummaryDocument14 pagesConnect Platform - Executive SummaryAndrei SorokinNo ratings yet

- Argentina (CB & Impact of Religion On Business Practices)Document2 pagesArgentina (CB & Impact of Religion On Business Practices)Abhay TegtaNo ratings yet

- D-2 Startup Costing of BusinessDocument10 pagesD-2 Startup Costing of BusinessNaveed KhaliqNo ratings yet

- Case Study-Azz FoodsDocument11 pagesCase Study-Azz FoodsAli HussainNo ratings yet

- Office Administration Research PaperDocument6 pagesOffice Administration Research PaperaflbskroiNo ratings yet

- Barriers To Entering An Industry: Entry Barriers and The Other 4 Porter Competitive ForcesDocument11 pagesBarriers To Entering An Industry: Entry Barriers and The Other 4 Porter Competitive ForcesFasi RaoNo ratings yet

- Alishba Internship ReportDocument48 pagesAlishba Internship ReportAlishba NadeemNo ratings yet

- Cheap Totally In-Demand: and For BeingDocument7 pagesCheap Totally In-Demand: and For Beingmotilal oswalNo ratings yet

- PDF Managing International Business in China 2Nd Edition Xiaowen Tian Ebook Full ChapterDocument53 pagesPDF Managing International Business in China 2Nd Edition Xiaowen Tian Ebook Full Chapterrichard.keller167100% (4)

- Emc Social Media InfluencerDocument5 pagesEmc Social Media InfluencerShreya ShriniwasNo ratings yet

- Mahindra Mahindra Limited Vs DCIT ITAT MumbaiDocument59 pagesMahindra Mahindra Limited Vs DCIT ITAT MumbaiVinod TanwaniNo ratings yet

- 0 - Haibali Water Taps LTDDocument4 pages0 - Haibali Water Taps LTDMahdi SuhadNo ratings yet

- ASSIGNMENT Air Cargo WahajDocument3 pagesASSIGNMENT Air Cargo WahajwahajNo ratings yet

- Vidit Sareen: ProfessionalDocument3 pagesVidit Sareen: ProfessionalAnshumali MishraNo ratings yet

- Master Thesis Erasmus University RotterdamDocument8 pagesMaster Thesis Erasmus University RotterdamSuzanne Simmons100% (2)

- Company A Competitive Efforts Company B Competitive Efforts Company C Competitive Efforts North AmericaDocument12 pagesCompany A Competitive Efforts Company B Competitive Efforts Company C Competitive Efforts North AmericaThảo Nguyễn PhươngNo ratings yet

- Apparel Merchandising Assingnment 1Document21 pagesApparel Merchandising Assingnment 1Neha Shrivastava100% (1)