Professional Documents

Culture Documents

CBDTChallanForm30 11 2022 PDF

CBDTChallanForm30 11 2022 PDF

Uploaded by

harshit gargCopyright:

Available Formats

You might also like

- Test Bank For The Developing Person Through The Life Span 8th Edition Kathleen BergerDocument36 pagesTest Bank For The Developing Person Through The Life Span 8th Edition Kathleen Bergerordainer.cerule2q8q5g100% (40)

- CBDTChallanForm01 09 2022Document1 pageCBDTChallanForm01 09 2022Aruna Kumari GorantlaNo ratings yet

- CBDTChallanForm25 06 2022Document1 pageCBDTChallanForm25 06 2022Shivaani ManoharanNo ratings yet

- CBDTChallanForm18 10 2022Document1 pageCBDTChallanForm18 10 2022gurdyal672No ratings yet

- Cyber Treasury1Document1 pageCyber Treasury1raju dholeNo ratings yet

- CBDTChallan Form 26!08!2019Document1 pageCBDTChallan Form 26!08!2019GURUDEVNo ratings yet

- Tax Payer Counterfoil: State Bank of IndiaDocument1 pageTax Payer Counterfoil: State Bank of IndiaJaydeep PrajapatiNo ratings yet

- 1680003900400IK0CEDUHY0Document1 page1680003900400IK0CEDUHY0Reshe.A.B 008 VIII BNo ratings yet

- ChallanDocument1 pageChallansoutan chakrabortyNo ratings yet

- CBDTChallanForm30 03 2020Document1 pageCBDTChallanForm30 03 2020AnujaNo ratings yet

- Tax Payer Counterfoil: State Bank of IndiaDocument1 pageTax Payer Counterfoil: State Bank of IndiaGaurav AgarwalNo ratings yet

- ChallanDocument2 pagesChallanYubaraj BhattacharyaNo ratings yet

- Challan 6Document2 pagesChallan 6mechedaadityaNo ratings yet

- Etax Cyber Receipt Challan No./Itns 281: Details of Payment Amount in Rs. 0 0 0 0 0Document1 pageEtax Cyber Receipt Challan No./Itns 281: Details of Payment Amount in Rs. 0 0 0 0 0Aryana BalanNo ratings yet

- 23022600034569FDRL ChallanReceiptDocument1 page23022600034569FDRL ChallanReceiptSayan RoyNo ratings yet

- 23032000511831KKBK ChallanReceiptDocument1 page23032000511831KKBK ChallanReceiptAjay NewareNo ratings yet

- Tax Payer Counterfoil: State Bank of IndiaDocument1 pageTax Payer Counterfoil: State Bank of IndiaRohit JhaNo ratings yet

- 23031200159123FDRL ChallanReceipt-2Document1 page23031200159123FDRL ChallanReceipt-2Mohammed FãyëzNo ratings yet

- 23032000734728CNRB ChallanReceiptDocument1 page23032000734728CNRB ChallanReceiptSubhajit SarkarNo ratings yet

- View Tax Payment Details: Reference Number: 29973328Document1 pageView Tax Payment Details: Reference Number: 29973328arjuntyagi22No ratings yet

- Gajuwaka House Tax PDFDocument1 pageGajuwaka House Tax PDFsarayu alluNo ratings yet

- Challan 2Document2 pagesChallan 2lc2023asnNo ratings yet

- Piduguralla Municipality: ReceiptDocument1 pagePiduguralla Municipality: ReceiptSHAIK AJEESNo ratings yet

- 23031200104914FDRL ChallanReceiptDocument1 page23031200104914FDRL ChallanReceiptRabbul Islam BhuyanNo ratings yet

- ChallanDocument2 pagesChallanSuman MukherjeeNo ratings yet

- ChallanDocument2 pagesChallanroshanraysarcasmNo ratings yet

- 23032000308381KKBK ChallanReceiptDocument1 page23032000308381KKBK ChallanReceipt40 dabhane MayurNo ratings yet

- 1640507351168IK0BLGYOE0Document1 page1640507351168IK0BLGYOE0Ajay VermaNo ratings yet

- CMNPM9413J PDFDocument1 pageCMNPM9413J PDFPradipta MondalNo ratings yet

- Tax Payer Counterfoil: State Bank of IndiaDocument1 pageTax Payer Counterfoil: State Bank of IndiaJITENDRA VISHVAKARMANo ratings yet

- Tax Payer Counterfoil: State Bank of IndiaDocument1 pageTax Payer Counterfoil: State Bank of IndiaInspiring IndiaNo ratings yet

- ChallanDocument2 pagesChallansalarschoolparaNo ratings yet

- ChallanDocument2 pagesChallanAshutosh ThakurNo ratings yet

- Direct Taxes 639034001021902385Document1 pageDirect Taxes 639034001021902385Raghava KruthiventiNo ratings yet

- Tax Invoice: Description Taxable Value SGST at 9% CGST at 9% TotalDocument1 pageTax Invoice: Description Taxable Value SGST at 9% CGST at 9% TotalCSNo ratings yet

- Challan 3Document2 pagesChallan 3kuntaldash8961No ratings yet

- PB10FZ7959 FASTag Statement 1704050735511Document2 pagesPB10FZ7959 FASTag Statement 1704050735511dps_1976No ratings yet

- ChallanDocument2 pagesChallanroshanraysarcasmNo ratings yet

- Tax Payer Counterfoil: State Bank of IndiaDocument1 pageTax Payer Counterfoil: State Bank of IndiaPradipta MondalNo ratings yet

- 23033000488148FDRL ChallanReceiptDocument1 page23033000488148FDRL ChallanReceiptVibhash Kumar GabelNo ratings yet

- Devleena ESS PROF TX EChallanDocument2 pagesDevleena ESS PROF TX EChallanABHINEET KRISHNA VARSHNEYNo ratings yet

- ChallanDocument2 pagesChallanSanidev MishraNo ratings yet

- Statement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceDocument1 pageStatement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceAnant GadakhNo ratings yet

- 1619760530149IK0BCLCSH8Document1 page1619760530149IK0BCLCSH8radhika bhattarNo ratings yet

- 23033000976144KKBK ChallanReceiptDocument1 page23033000976144KKBK ChallanReceiptgaaya 3onlineNo ratings yet

- Income Tax Department: Challan ReceiptDocument1 pageIncome Tax Department: Challan ReceiptRajesh Patel-1No ratings yet

- TDS ChalanDocument1 pageTDS ChalanRAKHAL BAIRAGINo ratings yet

- Tax Payer Counterfoil: State Bank of IndiaDocument1 pageTax Payer Counterfoil: State Bank of IndiaGaurav AgarwalNo ratings yet

- Tax Payer Counterfoil: State Bank of IndiaDocument1 pageTax Payer Counterfoil: State Bank of IndiaKumar MNo ratings yet

- Tax Payer Counterfoil: State Bank of IndiaDocument1 pageTax Payer Counterfoil: State Bank of Indiadeepam aroraNo ratings yet

- Challan 545Document2 pagesChallan 545SUVASISH MANDALNo ratings yet

- 1663920910508IK0BXAEUQ2Document1 page1663920910508IK0BXAEUQ2kiran.m KumarNo ratings yet

- Ramani TaxDocument1 pageRamani TaxRAAZ3727No ratings yet

- 23032501220471CNRB ChallanReceiptDocument1 page23032501220471CNRB ChallanReceiptAshutosh GuptaNo ratings yet

- Guntur Municipal Corporation: ReceiptDocument1 pageGuntur Municipal Corporation: ReceiptAnuradha DoppalapudiNo ratings yet

- Tax 3Document1 pageTax 3prasad gujjulaNo ratings yet

- 1661246944592IK0BVWLPV4Document1 page1661246944592IK0BVWLPV4balakrishnak eceNo ratings yet

- ChallanDocument2 pagesChallanSani SardarNo ratings yet

- ChallanDocument2 pagesChallansubhaworksample1992No ratings yet

- GSTIN: 29AACCF1132H2ZX CIN: U67190MH2012PTC337657 Pan: Aaccf1132H State Code: 29Document1 pageGSTIN: 29AACCF1132H2ZX CIN: U67190MH2012PTC337657 Pan: Aaccf1132H State Code: 29Nipun sharmaNo ratings yet

- Gift CertificatesDocument1 pageGift CertificatesJames CarterNo ratings yet

- Guidelines For The Regulation of Insurance Brokers in Nigeria ZERO DRAFT 27.06.2018Document90 pagesGuidelines For The Regulation of Insurance Brokers in Nigeria ZERO DRAFT 27.06.2018Gabriel EtimNo ratings yet

- Activity Procter & Gamble (P&G) Balogo, Aljean Kaye S. Bsbaom601ADocument3 pagesActivity Procter & Gamble (P&G) Balogo, Aljean Kaye S. Bsbaom601AOragon LatosaNo ratings yet

- Shivagami Gugan: Cover StoryDocument4 pagesShivagami Gugan: Cover StoryShivagami GuganNo ratings yet

- ESG and Investment EfficiencyDocument18 pagesESG and Investment EfficiencyPriyanka AggarwalNo ratings yet

- Mumbai Home Buying Guide - Wint WealthDocument21 pagesMumbai Home Buying Guide - Wint Wealthankit.jadhav263No ratings yet

- Lecture Note - Cost ConceptDocument23 pagesLecture Note - Cost ConceptPHƯƠNG HOÀNG HOÀINo ratings yet

- Assignment BPME3013Document3 pagesAssignment BPME3013Luthfiah HidayahNo ratings yet

- Firewall Audit Checklist IT-QuestionnairesDocument55 pagesFirewall Audit Checklist IT-Questionnairessashi100% (1)

- Info General of Moldova CorectDocument9 pagesInfo General of Moldova CorectJeka MkNo ratings yet

- Unity InteriorDocument5 pagesUnity InteriorfaaltuidNo ratings yet

- A Study On Impact of Startup Ecosystem On Student Innovations Bhavin U. Pandya Krupa MehtaDocument10 pagesA Study On Impact of Startup Ecosystem On Student Innovations Bhavin U. Pandya Krupa MehtaDiwya Bharathi V I MBANo ratings yet

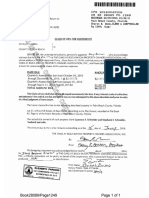

- Oaks AT Boca Raton HOA Lien V SchneiderDocument1 pageOaks AT Boca Raton HOA Lien V Schneiderlarry-612445No ratings yet

- Project Management 3 Problems Assignment 2015Document7 pagesProject Management 3 Problems Assignment 2015DoreenNo ratings yet

- Compensation OTBI Best Practices HQDocument13 pagesCompensation OTBI Best Practices HQRahh SlNo ratings yet

- DNV GL ETO 2018 Main Report Sept 1Document324 pagesDNV GL ETO 2018 Main Report Sept 1Sergio AymiNo ratings yet

- Quiz 2brand ElementsDocument1 pageQuiz 2brand ElementsFizza HassanNo ratings yet

- Chap 002Document121 pagesChap 002Selena SevvinNo ratings yet

- Bank ReconciliationDocument11 pagesBank ReconciliationRONALD SSEKYANZINo ratings yet

- Credit and Collection Wk1 2 StudDocument39 pagesCredit and Collection Wk1 2 StudAhyessa GetesNo ratings yet

- Roles and Challenges of Specialized BanksDocument12 pagesRoles and Challenges of Specialized BanksSadman SafayetNo ratings yet

- Eco AssignmentDocument6 pagesEco Assignmentshashwat shuklaNo ratings yet

- December 2020Document145 pagesDecember 2020Ajay BulusuNo ratings yet

- Marketing Jeans Case StudyDocument6 pagesMarketing Jeans Case StudySimran VishwakarmaNo ratings yet

- Nimp 20303Document196 pagesNimp 20303Peter TayNo ratings yet

- Chapter 2Document42 pagesChapter 2Marco RegunayanNo ratings yet

- Tax Drills Weeks 1-7 & DiagnosticDocument119 pagesTax Drills Weeks 1-7 & DiagnosticMitch MinglanaNo ratings yet

- Case Study 278 PDF FreeDocument6 pagesCase Study 278 PDF Freewaqas farooqNo ratings yet

- Nonprofit VsDocument3 pagesNonprofit VsRoschelle MiguelNo ratings yet

CBDTChallanForm30 11 2022 PDF

CBDTChallanForm30 11 2022 PDF

Uploaded by

harshit gargOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CBDTChallanForm30 11 2022 PDF

CBDTChallanForm30 11 2022 PDF

Uploaded by

harshit gargCopyright:

Available Formats

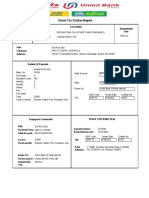

Direct Tax Challan Report

Tax Details

CHALLAN Assessment

NO./ITNS 280 Tax Applicable (0021)INCOME-TAX (OTHER THAN COMPANIES) Year

Type of Payment (800) TDS on Sale of Property (Form 26QB) 2022-23

PAN AYTPK4374Q

Full Name RAKXXX XUMAR

Address 5548000,14012022,BKWPM0703R,BI6108023,GAUTAM BUDDHA NAGAR,UP,201307

Details Of Payment

Amount (in Rs Only)

Basic Tax 120114 Debit Account 428502010271328

Surcharge 0

Education Cess 0

Interest 0 Date 30112022

Penalty 0

Others 0 Drawn On Union Bank of India Internet

Fee

Fee Under BSR Code Tender Date Challan No.

Total 120114 CIN 0290179 30112022 21901

Total (in words) Rupees One Lakh Twenty Thousand

One Hundred and Fourteen only

Taxpayers Counterfoil SPACE FOR BANK SEAL

PAN AYTPK4374Q

Received From : RAKXXX XUMAR Payment Status : Success

Bank Reference No : 514146082

Debit Account : 428502010271328

BSR Code Tender Date Challan No.

For Rs : 120114 CIN 0290179 30112022 21901

Rs (in words): Rupees One Lakh Twenty Thousand

One Hundred and Fourteen only

Bank 2, 66/80 , Mumbai Samachar Marg, Post Bag

Address : No. 253&518, Fort, Mumbai -400023

Drwan On : Union Bank of India Internet

On Account of : CHALLAN NO./ITNS 280

Assessment 2022-23

Year

You might also like

- Test Bank For The Developing Person Through The Life Span 8th Edition Kathleen BergerDocument36 pagesTest Bank For The Developing Person Through The Life Span 8th Edition Kathleen Bergerordainer.cerule2q8q5g100% (40)

- CBDTChallanForm01 09 2022Document1 pageCBDTChallanForm01 09 2022Aruna Kumari GorantlaNo ratings yet

- CBDTChallanForm25 06 2022Document1 pageCBDTChallanForm25 06 2022Shivaani ManoharanNo ratings yet

- CBDTChallanForm18 10 2022Document1 pageCBDTChallanForm18 10 2022gurdyal672No ratings yet

- Cyber Treasury1Document1 pageCyber Treasury1raju dholeNo ratings yet

- CBDTChallan Form 26!08!2019Document1 pageCBDTChallan Form 26!08!2019GURUDEVNo ratings yet

- Tax Payer Counterfoil: State Bank of IndiaDocument1 pageTax Payer Counterfoil: State Bank of IndiaJaydeep PrajapatiNo ratings yet

- 1680003900400IK0CEDUHY0Document1 page1680003900400IK0CEDUHY0Reshe.A.B 008 VIII BNo ratings yet

- ChallanDocument1 pageChallansoutan chakrabortyNo ratings yet

- CBDTChallanForm30 03 2020Document1 pageCBDTChallanForm30 03 2020AnujaNo ratings yet

- Tax Payer Counterfoil: State Bank of IndiaDocument1 pageTax Payer Counterfoil: State Bank of IndiaGaurav AgarwalNo ratings yet

- ChallanDocument2 pagesChallanYubaraj BhattacharyaNo ratings yet

- Challan 6Document2 pagesChallan 6mechedaadityaNo ratings yet

- Etax Cyber Receipt Challan No./Itns 281: Details of Payment Amount in Rs. 0 0 0 0 0Document1 pageEtax Cyber Receipt Challan No./Itns 281: Details of Payment Amount in Rs. 0 0 0 0 0Aryana BalanNo ratings yet

- 23022600034569FDRL ChallanReceiptDocument1 page23022600034569FDRL ChallanReceiptSayan RoyNo ratings yet

- 23032000511831KKBK ChallanReceiptDocument1 page23032000511831KKBK ChallanReceiptAjay NewareNo ratings yet

- Tax Payer Counterfoil: State Bank of IndiaDocument1 pageTax Payer Counterfoil: State Bank of IndiaRohit JhaNo ratings yet

- 23031200159123FDRL ChallanReceipt-2Document1 page23031200159123FDRL ChallanReceipt-2Mohammed FãyëzNo ratings yet

- 23032000734728CNRB ChallanReceiptDocument1 page23032000734728CNRB ChallanReceiptSubhajit SarkarNo ratings yet

- View Tax Payment Details: Reference Number: 29973328Document1 pageView Tax Payment Details: Reference Number: 29973328arjuntyagi22No ratings yet

- Gajuwaka House Tax PDFDocument1 pageGajuwaka House Tax PDFsarayu alluNo ratings yet

- Challan 2Document2 pagesChallan 2lc2023asnNo ratings yet

- Piduguralla Municipality: ReceiptDocument1 pagePiduguralla Municipality: ReceiptSHAIK AJEESNo ratings yet

- 23031200104914FDRL ChallanReceiptDocument1 page23031200104914FDRL ChallanReceiptRabbul Islam BhuyanNo ratings yet

- ChallanDocument2 pagesChallanSuman MukherjeeNo ratings yet

- ChallanDocument2 pagesChallanroshanraysarcasmNo ratings yet

- 23032000308381KKBK ChallanReceiptDocument1 page23032000308381KKBK ChallanReceipt40 dabhane MayurNo ratings yet

- 1640507351168IK0BLGYOE0Document1 page1640507351168IK0BLGYOE0Ajay VermaNo ratings yet

- CMNPM9413J PDFDocument1 pageCMNPM9413J PDFPradipta MondalNo ratings yet

- Tax Payer Counterfoil: State Bank of IndiaDocument1 pageTax Payer Counterfoil: State Bank of IndiaJITENDRA VISHVAKARMANo ratings yet

- Tax Payer Counterfoil: State Bank of IndiaDocument1 pageTax Payer Counterfoil: State Bank of IndiaInspiring IndiaNo ratings yet

- ChallanDocument2 pagesChallansalarschoolparaNo ratings yet

- ChallanDocument2 pagesChallanAshutosh ThakurNo ratings yet

- Direct Taxes 639034001021902385Document1 pageDirect Taxes 639034001021902385Raghava KruthiventiNo ratings yet

- Tax Invoice: Description Taxable Value SGST at 9% CGST at 9% TotalDocument1 pageTax Invoice: Description Taxable Value SGST at 9% CGST at 9% TotalCSNo ratings yet

- Challan 3Document2 pagesChallan 3kuntaldash8961No ratings yet

- PB10FZ7959 FASTag Statement 1704050735511Document2 pagesPB10FZ7959 FASTag Statement 1704050735511dps_1976No ratings yet

- ChallanDocument2 pagesChallanroshanraysarcasmNo ratings yet

- Tax Payer Counterfoil: State Bank of IndiaDocument1 pageTax Payer Counterfoil: State Bank of IndiaPradipta MondalNo ratings yet

- 23033000488148FDRL ChallanReceiptDocument1 page23033000488148FDRL ChallanReceiptVibhash Kumar GabelNo ratings yet

- Devleena ESS PROF TX EChallanDocument2 pagesDevleena ESS PROF TX EChallanABHINEET KRISHNA VARSHNEYNo ratings yet

- ChallanDocument2 pagesChallanSanidev MishraNo ratings yet

- Statement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceDocument1 pageStatement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceAnant GadakhNo ratings yet

- 1619760530149IK0BCLCSH8Document1 page1619760530149IK0BCLCSH8radhika bhattarNo ratings yet

- 23033000976144KKBK ChallanReceiptDocument1 page23033000976144KKBK ChallanReceiptgaaya 3onlineNo ratings yet

- Income Tax Department: Challan ReceiptDocument1 pageIncome Tax Department: Challan ReceiptRajesh Patel-1No ratings yet

- TDS ChalanDocument1 pageTDS ChalanRAKHAL BAIRAGINo ratings yet

- Tax Payer Counterfoil: State Bank of IndiaDocument1 pageTax Payer Counterfoil: State Bank of IndiaGaurav AgarwalNo ratings yet

- Tax Payer Counterfoil: State Bank of IndiaDocument1 pageTax Payer Counterfoil: State Bank of IndiaKumar MNo ratings yet

- Tax Payer Counterfoil: State Bank of IndiaDocument1 pageTax Payer Counterfoil: State Bank of Indiadeepam aroraNo ratings yet

- Challan 545Document2 pagesChallan 545SUVASISH MANDALNo ratings yet

- 1663920910508IK0BXAEUQ2Document1 page1663920910508IK0BXAEUQ2kiran.m KumarNo ratings yet

- Ramani TaxDocument1 pageRamani TaxRAAZ3727No ratings yet

- 23032501220471CNRB ChallanReceiptDocument1 page23032501220471CNRB ChallanReceiptAshutosh GuptaNo ratings yet

- Guntur Municipal Corporation: ReceiptDocument1 pageGuntur Municipal Corporation: ReceiptAnuradha DoppalapudiNo ratings yet

- Tax 3Document1 pageTax 3prasad gujjulaNo ratings yet

- 1661246944592IK0BVWLPV4Document1 page1661246944592IK0BVWLPV4balakrishnak eceNo ratings yet

- ChallanDocument2 pagesChallanSani SardarNo ratings yet

- ChallanDocument2 pagesChallansubhaworksample1992No ratings yet

- GSTIN: 29AACCF1132H2ZX CIN: U67190MH2012PTC337657 Pan: Aaccf1132H State Code: 29Document1 pageGSTIN: 29AACCF1132H2ZX CIN: U67190MH2012PTC337657 Pan: Aaccf1132H State Code: 29Nipun sharmaNo ratings yet

- Gift CertificatesDocument1 pageGift CertificatesJames CarterNo ratings yet

- Guidelines For The Regulation of Insurance Brokers in Nigeria ZERO DRAFT 27.06.2018Document90 pagesGuidelines For The Regulation of Insurance Brokers in Nigeria ZERO DRAFT 27.06.2018Gabriel EtimNo ratings yet

- Activity Procter & Gamble (P&G) Balogo, Aljean Kaye S. Bsbaom601ADocument3 pagesActivity Procter & Gamble (P&G) Balogo, Aljean Kaye S. Bsbaom601AOragon LatosaNo ratings yet

- Shivagami Gugan: Cover StoryDocument4 pagesShivagami Gugan: Cover StoryShivagami GuganNo ratings yet

- ESG and Investment EfficiencyDocument18 pagesESG and Investment EfficiencyPriyanka AggarwalNo ratings yet

- Mumbai Home Buying Guide - Wint WealthDocument21 pagesMumbai Home Buying Guide - Wint Wealthankit.jadhav263No ratings yet

- Lecture Note - Cost ConceptDocument23 pagesLecture Note - Cost ConceptPHƯƠNG HOÀNG HOÀINo ratings yet

- Assignment BPME3013Document3 pagesAssignment BPME3013Luthfiah HidayahNo ratings yet

- Firewall Audit Checklist IT-QuestionnairesDocument55 pagesFirewall Audit Checklist IT-Questionnairessashi100% (1)

- Info General of Moldova CorectDocument9 pagesInfo General of Moldova CorectJeka MkNo ratings yet

- Unity InteriorDocument5 pagesUnity InteriorfaaltuidNo ratings yet

- A Study On Impact of Startup Ecosystem On Student Innovations Bhavin U. Pandya Krupa MehtaDocument10 pagesA Study On Impact of Startup Ecosystem On Student Innovations Bhavin U. Pandya Krupa MehtaDiwya Bharathi V I MBANo ratings yet

- Oaks AT Boca Raton HOA Lien V SchneiderDocument1 pageOaks AT Boca Raton HOA Lien V Schneiderlarry-612445No ratings yet

- Project Management 3 Problems Assignment 2015Document7 pagesProject Management 3 Problems Assignment 2015DoreenNo ratings yet

- Compensation OTBI Best Practices HQDocument13 pagesCompensation OTBI Best Practices HQRahh SlNo ratings yet

- DNV GL ETO 2018 Main Report Sept 1Document324 pagesDNV GL ETO 2018 Main Report Sept 1Sergio AymiNo ratings yet

- Quiz 2brand ElementsDocument1 pageQuiz 2brand ElementsFizza HassanNo ratings yet

- Chap 002Document121 pagesChap 002Selena SevvinNo ratings yet

- Bank ReconciliationDocument11 pagesBank ReconciliationRONALD SSEKYANZINo ratings yet

- Credit and Collection Wk1 2 StudDocument39 pagesCredit and Collection Wk1 2 StudAhyessa GetesNo ratings yet

- Roles and Challenges of Specialized BanksDocument12 pagesRoles and Challenges of Specialized BanksSadman SafayetNo ratings yet

- Eco AssignmentDocument6 pagesEco Assignmentshashwat shuklaNo ratings yet

- December 2020Document145 pagesDecember 2020Ajay BulusuNo ratings yet

- Marketing Jeans Case StudyDocument6 pagesMarketing Jeans Case StudySimran VishwakarmaNo ratings yet

- Nimp 20303Document196 pagesNimp 20303Peter TayNo ratings yet

- Chapter 2Document42 pagesChapter 2Marco RegunayanNo ratings yet

- Tax Drills Weeks 1-7 & DiagnosticDocument119 pagesTax Drills Weeks 1-7 & DiagnosticMitch MinglanaNo ratings yet

- Case Study 278 PDF FreeDocument6 pagesCase Study 278 PDF Freewaqas farooqNo ratings yet

- Nonprofit VsDocument3 pagesNonprofit VsRoschelle MiguelNo ratings yet