Professional Documents

Culture Documents

SSRN Id3211745

SSRN Id3211745

Uploaded by

Cypag Asistente Rev fiscalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SSRN Id3211745

SSRN Id3211745

Uploaded by

Cypag Asistente Rev fiscalCopyright:

Available Formats

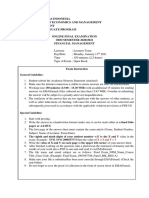

Cryptoliquidity: The Blockchain and

Monetary Stability∗

James L. Caton†

September 27, 2018

Abstract

The development of blockchain and cryptocurrency may alleviate the

economic strain associated with recession. Economic recessions tend

to be aggregate demand driven, meaning that they are caused by

fluctuations in the supply of or demand for money. Holding mone-

tary policy as solution assumes that stability must arise from outside

of the economic system. Under a policy regime that allows innova-

tions in blockchain to develop, blockchain technology may promote a

money supply that is responsive to changes in demand to hold money.

This work suggests that cryptocurrencies present an opportunity to

profitably implement rules that promote macroeconomic stability. In

particular, cryptocurrency that is asset-backed may provide a means

for cheaply attaining liquidity during a crisis.

JEL Codes: E40, E41, E42

Keywords: blockchain, cryptocurrency, endogenous money, liquidity, dise-

quilibrium

AIER Sound Money Project

Working Paper No. 2018–15

∗

I owe gratitude to Cameron Harwick for his comments on an early draft. I also bene-

fitted greatly from conversations with attendees at the Fargo Bitcoin meetings. Without

help from these individuals, this paper would not have been possible.

†

Department of Agribusiness and Applied Economics, North Dakota State University,

Fargo, ND 58102 james.caton@ndsu.edu

Electronic copy available at: https://ssrn.com/abstract=3211745

1 Introduction

In the last decade, the value and significance of blockchain technology

has gained recognition among entrepreneurs, policy makers, and academics.

What appeared to the casual observer to be simply a monetary phenomenon

has been recognized as a new means of organizing social activity, particularly

exchanges and ownership (Davidson, Filippi, and Potts 2016; Antonopou-

los 2016). Blockchain technology enables secure transactions on distributed

networks, showing potential to reduce transaction costs and transform the

structure of economic activity.

Focus has begun to shift from cryptocurrency to other uses of blockchain

technology. While this is understandable, the following argument will show

that the blockchain has only just begun to change our conception of money,

banking, and liquidity. The blockchain has potential enable a money stock

that is responsive to fluctuations in demand for money and greatly reduce the

cost of monetizing existing or future assets. This can reduce inefficiencies that

arise from aggregate-demand driven macroeconomic disequilibrium (Yeager

1956; Leijonhufvud and Clower 1981; Horwitz 2000). In the least, it may

prevent extreme macroeconomic fluctuations that are produced by erratic

macroeconomic policies, such as those observed during the Great Depression

(Glasner 1989; Hawtrey 1947; Sumner 2015a; Vedder and Galloway 1997).

Electronic copy available at: https://ssrn.com/abstract=3211745

I begin by describing money, the blockchain, and the relationship between

the two and follow by showing 1) how monetary theory informs our under-

standing of money creation through the blockchain, 2) how competitive forces

make the creation and adoption of a high-quality cryptocurrency practically

inevitable even if one cannot predict beforehand which blockchain structure

will be adopted for this purpose, and 3) how regulatory and tax policies can

either enable or inhibit these developments.

2 Money and the Blockchain

In order to discuss the relationship between money and the blockchain

requires an adequate description of both. Money is a commonly accepted

medium of exchange. It serves as an intermediate good that is typically

accepted by a community of buyers and sellers of goods. Although particular

details vary across blockchains, a blockchain can be described generally as

an accounting ledger comprised of different nodes – accounts – whose records

cannot be altered without approval of at least a majority of votes allocated to

nodes in the system. Cryptocurrency is an electronic money. It is produced

and secured on a blockchain.

2.1 Money

Although money operates fundamentally as a medium of exchange, great

benefit lies in its enabling of accounting. Money itself must necessarily have

Electronic copy available at: https://ssrn.com/abstract=3211745

been preceded by reciprocal favors through relatively small networks of social

bonds (Bourdieu 1990; Harwick 2017). Such a system does not scale as

transaction costs of developing a relationship are relatively high and the span

of affiliation is constrained as a result. Before money arises, there exists no

low-cost common numeraire – unit of account – that allow economic actors

to compare the value of goods in fine detail. Money enables this, allowing

producers of goods to compare costs and revenues and thereby evaluate their

contribution or diminishment of value in the economy and, therefore, to

their own wealth. It allows these same actors to hold their wealth in an

asset whose value is highly stable and easily saleable (Menger 1892). By

lowering transaction costs, money enables development of a broader network

of exchange by lowering the level of trust required to engage in trade (Horwitz

2008). Increases in the efficiency of exchange make society wealthier and

allows for the development of more expansive trade networks. Finally, money

enables banking. Money lowers the cost of lending since money can be lent

to investors who wish to purchase physical assets rather than lending the

physical assets themselves, a process much more costly to coordinate.

2.2 Blockchain

Like money, a blockchain is a means of accounting. Ownership of money

represents a claim to resources in an economic system in light of the prefer-

ences of agents who own each. Even without an accounting ledger, a money

of stable value enables accounting of claims to value. The blockchain is an

Electronic copy available at: https://ssrn.com/abstract=3211745

accounting ledger whose transactions are public to other nodes in the net-

work. A functional blockchain network enables convergence of every account

to a true representation of agreements in the system. This is achieved demo-

cratically. Nodes are allocated votes, perhaps on a one-to-one basis or on

a basis tied to productivity or participation in the network.1 These votes

legitimate changes in the public ledger according to whichever standard has

been adopted for the system.

The ledger allows agents to stake claim to particular assets recognized

by the blockchain. The Bitcoin blockchain allows owners to stake claim to

Bitcoins and ensures the secure transfer of these assets between exchanging

parties (Nakamoto 2008). For Bitcoin’s blockchain and many other, the

ledger of these nodes are encrypted, with miners competing to ascertain

the correct key that grants access to changed ledger for the reward of new

currency and for the greater purpose of democratically confirming the new

state of the ledger among successful mining nodes.

A blockchain may recognize a wide variety of assets. The Ethereum

blockchain, for example enables the creation of smart-contracts whose terms

are executed once the criteria of the contract are met (Ethereum White Pa-

per). Since blockchain ledgers are secure, there is no need for a third party to

intermediate the transfer of goods and funds entailed in the contract. More

1

The latter two of these mechanisms allocating voting rights concerning legitimacy of

new accounting records are referred to as “proof-of-work” and “proof-of-stake”.

Electronic copy available at: https://ssrn.com/abstract=3211745

generally, blockchains that securely and automatically manage the exchange

of assets are referred to as decentralized autonomous organizations (DAOs).

2.3 Cryptocurrency

Cryptocurrency is necessarily linked to the blockchain. In the case of Bit-

coin, it is the only alienable asset associated with the blockchain. Other

blockchains, like Ethereum, operate like Bitcoin but also allow for the regis-

tration of other assets on the blockchain. Still others enable the creation of

cryptocurrency through the tokenization of assets. Asset owners can register

their assets on the blockchain and receive, directly or indirectly, cryptocur-

rency in exchange.

The growth path of cryptocurrencies like Bitcoin are constrained by an

algorithm that determines that rate at which new currency units are made

available. With a predetermined growth path, these cryptocurrencies are un-

able to respond to changes in demand for money that accompany changes in

the rate of economic growth as well as economic crises. Blockchains that al-

low the quantity of currency created to change with demand for the currency

will improve the ability of the market to stabilize economic fluctuations.

Electronic copy available at: https://ssrn.com/abstract=3211745

3 Dynamics of Money Creation

The quantity of money under a commodity regime is determined in light of

demand for money and the elasticity of the supply of money.2 The response of

the money supply alleviates pressure that is otherwise placed on prices. For

the promotion of macroeconomic equilibrium, the case of economic recession

is of special interest. During a depression, demand for money tend to exceed

it supply, thus promoting a general fall in prices. This fall in prices may lead

to discoordination in credit markets that might be alleviated by the creation

of money and money substitutes.

Using the theoretical framework below, the role of cryptocurrency as base

money as well as near money will be considered. Near money is a catego-

rization refers to an asset with a high level of liquidity. Such assets alleviate

demand for base money during a crisis and thus serve the function of stabiliz-

ing the value of total expenditures (aggregate demand) much as the creation

of new money does.

3.1 Money and Macroeconomic Disequilibrium

Macroeconomic disequilibrium arises when there is a discrepancy between

the value of total expenditures and the aggregate value of goods and services

that are available for sale and which would be sold in macroeconomic equilib-

rium. For the sake of analytical simplicity, let us assume that there is some

2

The foundations of the analysis below are presented in the appendix.

Electronic copy available at: https://ssrn.com/abstract=3211745

level of growth of real income in the long-run.3 This value anchors analysis,

allowing for the description of macroeconomic equilibrium, and therefore,

macroeconomic disequilibrium. Anlaysis begin again with the equation of

exchange. Real level of economic growth in the long-run is defined as y0 .

The value of the other variables at any time are defined by the subscript t.

At any time, we define the macroeconomy by:

Mt Vt = Pt yt (1)

The function can be rearranged to isolate yt :

Mt Vt

yt = (2)

Pt

In equilibrium the observed value of real income is equal to the value that is

sustainable in the long-run:

yt = y0 (3)

yt can be replaced with its equivalent in terms of Mt , Vt , and Pt and rear-

range to restate the equation of exchange in terms of aggregate supply and

aggregate demand:

Mt Vt = Pt y0 (4)

3

Long-run is defined as the state that will be reach absent exogenous shocks to the

model. It is not a reference to a particular or even a potential range of time.

Electronic copy available at: https://ssrn.com/abstract=3211745

Macroeconomic disequilibrium is defined as any case where not all available

goods are sold or where more goods are produced than is economically sus-

tainable in the long-run. In disequilibrium:

yt 6= y0 (5)

And therefore:

Mt Vt 6= Pt y0 (6)

In order for the market to clear, the classical macroeconomic model (see

Snowdon and Vane 2005; Clower and Leijonhufvud 1981) demands that the

price level adjust to offset the discrepancy between Mt Vt and Pt y0 .

3.2 Economic Recession

The case of economic recession is of prime interest to the cryptocurrency

markets and merits further description. The National Bureau of Economic

Research defines a recession:

a significant decline in economic activity spread across the economy,

lasting more than a few months, normally visible in real GDP, real

income, employment, industrial production, and wholesale-retail sales.

(2008)

This situation where there remain unsold goods is described as:

y0 − yt > 0 (7)

Electronic copy available at: https://ssrn.com/abstract=3211745

There exists an excess supply of goods whose real value is equal to the dif-

ference between y0 and yt .

For the purpose of describing economic recession, Equation 7 requires fur-

ther elaboration. A recession occurs when there is a significant and sustained

discrepancy between y0 and yt . Given agent preferences to hold money in

the long-run, which is autonomous, there does not exist enough money for

these goods to be sold at the current price level, Pt . The price level must

fall. If the price level falls, the value of money increases and producers of the

commodity that serves as money may increase profits by providing a greater

quantity of the good to the market. Thus, increases in real cash balances

tend to translate to changes in M in the long-run.

Since yt can be described in terms of Mt , Vt , and Pt , a recession may also

be described as occurring when the nominal value of total expenditures is less

than the value of available goods at price level Pt , such that prices cannot

quickly adjust to offset this equilibrium:

Mt Vt < Pt y0 (8)

Not all goods available for sale are purchased in this case so that there exists

an excess supply of non-money goods where, Pt yt , the nominal value of goods

purchased is less than Pt y0 , the nominal value required to purchase all goods

at price level Pt .

Electronic copy available at: https://ssrn.com/abstract=3211745

By identity, this means that there exists an excess demand for money where

the quantity of money in circulation is less than the quantity demanded at

price Pt given available supply of non-money goods y0 :

Pt y 0

Mt < (9)

Vt

1

Substitute kt for Vt

:

Mt < Pt y0 kt (10)

Read left to right, this states that the existing stock of money is less than

quantity of money demanded as defined by a combination of transaction

demand for money, Pt y0 , and portfolio demand for money, kt . In the case of

an aggregate demand driven recession, the existing money stock is insufficient

to purchase all goods available for sale in light of the preference of the average

agent to hold money. If Equation 10 is divided by the price level (as in

equation 5A), either M must increase or P fall for all goods to be sold, thus

allowing yt to rise to the level y0 .

4 Monetary Rules in Economics

Discussion of the role of crypto currencies as money and in promoting

macroeconomic stability can be informed work on monetary rules intended

to constrain central bank decision-making. Rules governing the expansion of

10

Electronic copy available at: https://ssrn.com/abstract=3211745

the money stock with intent to offset shocks to money and credit markets

hold prominent place in discussions of macroeconomic theory. A good mon-

etary rule must consider the role of money in contributing to and alleviating

macroeconomic disequilibrium. Some popular rules promoted for constrain-

ing central bank decision-making include Milton Friedman’s k-percent rule

(Salter 2014), John Taylor’s “Taylor rule” (Taylor 1993; Woodford 2001),

and nominal income targeting (Sumner 2014; 2015b). Broadly, each of these

rules attempt to maintain a non-negative, if not positive, rate of inflation.

The idea being that a negative inflation rate is correlated with positive de-

mand for money not offset by monetary growth (Equation 10). The k-percent

rule targets a positive and constant growth rate of the money stock. The

Taylor attempts to offset discrepancies between target and actual inflation

rates, real interest rates, and rates of growth of real income. Nominal income

targeting follows most closely the above presentation. It attempts to offset

changes in portfolio demand for money (i.e., velocity) in order to maintain a

targeted growth rate of nominal income.

A different sort of rule would require that a nation’s currency be backed

by tangible assets, as under the gold standard. The history of money en-

tails the selection of assets that are used as money and the development of

instruments backed by those assets, the most significant such case being the

gold standard. Paper currency represented claims to gold and tended to be

created by private competitors, though in many cases, particularly in the

11

Electronic copy available at: https://ssrn.com/abstract=3211745

19th and early 20th centuries, government notes backed by gold reserves at

the central bank circulated as money (Hawtrey 1947). Under such standards,

the backing of legal tender with gold served as the monetary rule, though

the ratio of this backing was not always strictly defined or enforced. In the

U.S. colonies, it was not uncommon for state notes to be backed by tobacco

(Rothbard 2002).4

While each of these proposals, if consistently implemented, might produce

superior results to a discretionary regime, the gulf between theory and prac-

tice is quite significant. For an executive at a central bank, his or her job

seems to oppose the simple operation of a rule (White 2010). Otherwise, a

well-chosen rule could essentially replace the head of a central bank. The job

of the central banker would be to watch the system evolve according to the

monetary rule.

Since changes in the quantity of a cryptocurrency are necessarily rule-constrained,

4

The idea of an asset-backed, national currency did not die with the gold standard. In

1943, having been disillusioned by the failure an international gold standard managed by

poorly coordinated central banks, F. A. Hayek wrote, “A Commodity Reserve Currency”

where he detailed the functioning of a commodity backed reserve currency whose operation

would be subject to a rule structure. Hayek’s article followed the suggestion of Benjamin

Graham (1937) and Frank D. Graham (1942), which both followed a proposal “by the

Dutch economist, Professor J. Goudrian, in a pamphlet, How to Stop Deflation (London,

1932).” Hayek’s proposal argued that monetary authorities employ a basket of commodities

as reserves. This authority would target the price of the basket, such that when the basket

is below the target price, the monetary authority increases its holdings of commodities in

the basket through purchase enabled by an expansion of the money stock. When the price

of the basket is above the target, the monetary authority sells its holdings of the basket

of commodities. With a basket of commodities that is sufficiently broad, this would allow

the relative prices of these commodities to fluctuate while overall demand for the basket

is sustained. Consistent with our discussion of regulation of the money stock, changes in

the quantity of money under such standards are governed by rules.

12

Electronic copy available at: https://ssrn.com/abstract=3211745

they are well-suited for the adoption of rules that promote macroeconomic

stability. Political concerns hold less influence over a rule’s selection and

implementation for cryptocurrency. The expansion of each cryptocurrency is

subject to unique protocol. Unlike the rules discussed in monetary theory, the

rules governing the expansion of cryptocurrency are not necessarily aimed at

promoting macroeconomic stability. Rather, they are aimed at maintaining

scarcity of the money stock and predictability of its expansion.

4.1 Monetary Rules for Cryptocurrencies

Next we consider the mechanisms governing the growth of Bitcoin, Ripple’s

XRP, and cyrptocurrencies like ATLANT that are generated through the

registration and tokenization of assets on a blockchain. The key feature

of a good monetary rule is that it adjusts the quantity of money in light

of changes in demand for it. It is not necessary that the monetary rule

perfectly or automatically offset changes in demand for money. It is sufficient

that actors in the market can profit from offsetting the shortfall in aggregate

demand at a given price level. A cryptocurrency that enables creation of

currency to adjust to changes in demand for money will create value for

parties demanding new money and exploit value creation potentiated by a

surge of demand for currency.

13

Electronic copy available at: https://ssrn.com/abstract=3211745

4.1.1 Bitcoin5

Bitcoin was the first cryptocurrency to market. Its maximum quantity

was prestated. Nearly 21 million bitcoin will be released through a process

of mining, with the final bitcoin being mined in 2040.6 A block as added to

Bitcoin’s blockchain each time a miner solves the hash associated with the

block. Bitcoin are released with each block mined. A new block is mined

every ten minutes. The new block contains a record of every new transaction

that has occurred since the creation of the previous block.

The blockchain itself is a series of blocks that contain a history of trans-

actions. Each block is identified by a hash that links to the block’s key. The

hash is generated algorithmically with a pseudo-random number generator.

A correct hash is discovered by competing miners. Bitcoin are released every

time a miner generates the correct hash. To account for improvements in

processing power associated with Moore’s law, the hashes become increas-

ingly difficult to solve as the rate at which blocks are mined increases above

the long-run rate stipulated by bitcoin protocol.

The protocol for increase in the quantity of bitcoin has features similar to

the k-percent rule. Although the quantity of bitcoin does not increase by

some percent, it does grow at a constant rate in terms of units of bitcoin.

5

For discussion of Bitcoin protocol, see Antonopoulos (2014)

6

GitHub: https://github.com/bitcoin/bitcoin/blob/08a7316c144f9f2516db8fa62400893f4358c5ae/src/amount.h

(Accessed June 5, 2018)

14

Electronic copy available at: https://ssrn.com/abstract=3211745

This rate, changes over time. It started as 50 bitcoin per block and is halved

every 4 years until all bitcoin have been issued. The current rate of release is

12.5 bitcoin per block. Miners also receive a fee for each block mined.. Once

all Bitcoin are released, successful miners will receive only the fee for the

service of de-encrypting and confirming the record of transactions recorded

in each block.

4.1.2 Ripple’s XRP

Ripple’s currency, XRP, is unique compared to many cryptocurrencies.

XRP are not mined. Rather, a fixed number of XRP have already been

created. Currently there are just over 39 billion XRP in circulation while

there actually exist 100 billion XRP. Of the over 60 billion remaining XRP,

the vast majority will be released systematically. According to Ripple CEO

David Schwartz:

The escrow consists of independent on ledger escrows that release a total

of one billion XRP each month over the next 55 months. This provides an

upper limit on the amount of new XRP that can be brought into circulation.

The amount of XRP actually released into circulation will likely be much less

than this. Any additional XRP leftover each month will be placed into a new

escrow to release in the first month in which no escrow currently releases.

(Schwartz 2017)

15

Electronic copy available at: https://ssrn.com/abstract=3211745

If the full 1 billion XRP are released each month, this would initially

amount to a monthly expansion rate of over 2.5% with the final monthly re-

lease amounting to a monthly rate of just over 1%. Once all XRP have been

released, stock of XRP will actually begin to shrink. With every transaction,

a small quantity of XRP, 0.00001, is destroyed.7 This transaction cost is

intended to prevent any user from overloading the network with transaction

requests. At this rate, there will be no XRP left in existence after 10 quin-

tillion transactions. Many expect that those in control of validator nodes on

the blockchain, which have voting rights, will vote to change the transaction

fees if this becomes prohibitive to adoption (XRP Ledger Documentation:

Fee Voting).8

4.1.3 Asset Backed Cryptocurrencies

Cryptocurrency protocol can require that cryptocurrency be backed by as-

sets registered on the blockchain. Asset-backed cryptocurrencies operate in

two ways. They either trade on a blockchain that is tied directly to assets,

but with the creation of coins being linked to an initial coin offering rather

than assets themselves. Kodak’s KODAKCoin will operate in this manner.

Although it is yet to launch, KODAKOne users will pay to use photos up-

loaded on the platform. KOKDAKOne recently signed an agreement that will

allow several sports arenas to participate in the system (Kim 2018). Another

7

XRP Ledger Documentation. “Transaction Cost.” Accessed June 5, 2018:

https://developers.ripple.com/transaction-cost.html

8

XRP Ledger Documentation. “Fee Voting.” Accessed June 5, 2018:

https://developers.ripple.com/fee-voting.html

16

Electronic copy available at: https://ssrn.com/abstract=3211745

cryptocurrency of this variety, ATLANT, allows users to use cryptocurrency

to buy claims to real estate. Investors gain voting rights over management

of real estate and a claim to future revenues earned by the asset. The value

of cryptocurrencies such as these can be thought of as representing at least

the value of the assets registered on the blockchain.

The second type of asset backed cryptocurrencies are generated by the

registration of assets on the blockchain. A number of gold backed cryptocur-

rencies have taken on just this strategy. Many of these create one coin for

every unit of gold that is registered on the blockchain. Thus, the instruments

operate as an asset backed ETF. Royal Mint Gold (RMG), developed and

managed by the United Kingdom’s Royal Mint, offers sells gold that is held

securely and may even be delivered on request.9 The Royal Mint plans to

register RMG on exchanges so that it can be traded for other currency.

Cryptocurrencies, such as RMG, which require an asset to offset the cryp-

tocurrency, offer the benefit that assets can be monetized at low cost. For

cryptocurrencies that are backed by non-liquid assets, such as real estate,

this serves to make the money stock much more responsive to changes in

demand. Reminiscent of early bank notes, asset backed cryptocurrencies are

highly liquid securities that can even be used directly in exchange.

9

The Royal Mint: https://www.royalmint.com/invest/bullion/digital-gold/ (Accessed

June 10, 2018)

17

Electronic copy available at: https://ssrn.com/abstract=3211745

5 Near-moneys, Liquidity, and Demand for

Money

It is not necessary that any cryptocurrencies be broadly adopted as money

in order for these to serve a stabilizing service. A crypto currency might

have stable demand in niche markets – e.g., exchanges on the “deep web”

(Hardy and Norgaard 2016; Norgaard, Walbert, and Hardy 2018), KO-

DAKOne’s platform, or in nations that have an unstable monetary regime

(The Economist, April 3, 2018). To this extent, the crypto currency will be

able to alleviate some of the burden to purchase goods that would otherwise

be borne by the commonly accepted medium of exchange. Even if this is not

the case, cryptocurrency may play a role in alleviating demand for money as

a near money: a highly liquid store of value. If a cryptocurrency is accepted

broadly by investors, it may be employed as a means to liquidity and a hedge

in the face of market instability. The following reviews the concept of liquid-

ity and near moneys and then consider the usefulness of crypto currencies in

this respect.

Money may exist as base money or as substitutes for base money like de-

posit accounts or other highly liquid assets. Standard analysis describes the

creation of credit money and near-moneys in terms of higher level monetary

aggregates (M1 , M2 , etc. . . ). In this case one may think of cryptocurrencies

as supplementing the existing stock of money. It is useful to think of the de-

18

Electronic copy available at: https://ssrn.com/abstract=3211745

velopment of cryptocurrency markets as a response to an increase in demand

for currency that neutralizes the price level effect of that increase in demand.

While cryptocurrency functions as money among relatively small networks,

major positions in cryptocurrency currently tend to be speculative (Luther

and White 2014; Baur et al., 2018). Despite significance of speculation in the

early life of cryptocurrencies, Bitcoin and other cryptocurrencies might also

be used as a hedge against other financial instruments and indices (Dyhrberg

2016). Even if cryptocurrencies do not become accepted by all actors in an

economy, the asset class can meet demands for liquidity.

The quickness with which these money substitutes can be created makes

cryptocurrency a valuable asset for those seeking liquidity. As the quantity

of substitutes for base money increases, the velocity of base money also in-

creases. This is significant for the mitigation of short-run disequilibrium. A

long tradition of research in macroeconomics recognizes the significance of

liquidity costs in affecting the value of financial instruments (Keynes 1930;

Glasner 1989, 144; Hicks 1989, 55-79; White 1999, 14) and liquidity shortage

driving crisis dynamics (Keynes 1936; Diamond and Dybvig 1983; Yeager

1956, 444-446).

It is tempting to think of an increase in financial instruments as represent-

ing an increase in the money stock. We differentiate between base money

and broader moneys. Base money is MB and the total money stock, which

includes broader moneys is MT . These can be weighted according to liquidity

19

Electronic copy available at: https://ssrn.com/abstract=3211745

as in the case of Divisia (Barnett, Offenbacher, and Spindt 1984) such that

the contribution of a financial instrument to the overall money stock is some

fraction of it’s market value. The base money stock and total money stock

are both subject to different velocities: VB and VT .

The velocity of the base, or equivalently, portfolio demand for base money

is itself a function of the credit stock. An net increase in the credit stock tends

negatively influences demand for base money. Money that is not base money

is itself a substitute for base money. Thus, a shift in money holdings from

base money to non-base money is equivalent to a shifting of demand away

from base money. Financial markets tend to respond to such a demand by

creation of new instruments. Assuming that the base is static, an increase

in the quantity (MT − MB ) translates directly to an increase in VB and,

equivalently, a fall in kB .

Deposit and money market accounts along with highly liquid securities

like U.S. treasury notes service demand for liquidity. It is not uncommon for

interest rates on highly liquid instruments to become depressed preceding a

recession (Chinn and Kucko 2015; Longstaff 2001). This occurred during the

Great Recession with the rate of return on U.S. Treasuries beginning a steep

decline more than 6 months before the last recession.10 This represented a

10

Erdogan, et al., (2015) note:

The use of a US government yield curve arguably makes sense for pre-

dicting crises or recessions because it is forward looking and implicitly

20

Electronic copy available at: https://ssrn.com/abstract=3211745

swift reversal in the yield curve inversion that had preceded this and most

other recessions (Estrella and Trubin 2006, 4). While intervention in this

overnight lending market explains the near-zero rates that followed the re-

cession, the initial fall was a response of an increased demand for liquidity

(Erdogan, et al., 2015). There was a similar rise in the price of commodities

in the face of volatility as the move to electronic trading has greatly increased

investor exposure to commodity backed instruments (Irwin and Sanders 2011;

2012; Gilbert 2010). The quantity of these contracts are highly sensitive to

increases in demand for them.

Assets that serve as a store of value and are also a low cost means to

accessing money can help alleviate a fall in demand for money. The existence

of near-moneys, money-like assets, may offset autonomous changes in demand

to hold money. The cost of holding money is the gain foregone by not holding

other assets (Friedman 1956). For example, the holding of money in a savings

account yields a small amount of interest with very low cost in terms of loss

projects future risk-free interest rates, in the context of a highly liquid

and informationally efficient market. . . Lower forward interest rates

indicate current market expectations of falling future short-term in-

terest rates. This in turn could reflect lower expected inflation premia

or, more relevant to the topic at hand, lower expected real interest

rates (or lower required risk-free real returns) associated with a slack

economic environment, or both. A closely related interpretation is

that government securities provide a haven from prospective credit

problems in the event of a recession, causing the prices of treasuries

to rise as investors flee risk, accepting low or even negative interest

rates as the price of safety. (408)

21

Electronic copy available at: https://ssrn.com/abstract=3211745

of liquidity. One can leave their money in a checking account and treat funds

in the account as being available for expenditure. While it is appropriate to

treat funds in a deposit accounts or invested in near-moneys as money, it is

useful for our purpose this analysis to treat a these instruments as alleviating

portfolio demand for base money or, equivalently, increasing the velocity of

base money.

5.1 Demand for Money and Supply of Cryptocurrency

Although cryptocurrencies are not credit money, they can operate accord-

ing to the same dynamics as the financial instruments discussed above. With

the appropriate monetary rules, they can even be more effective than stan-

dard financial markets in responding to increases in demand for currency,

especially during a crisis.

During an economic crisis, demand to hold money increases such that not

all available goods can be sold (Equations 7-10). Cryptocurrencies that can

increase the money stock during a crisis serve can both increase their adoption

and stabilize aggregate demand purely through market mechanisms. Given

the rules that are reviewed above, the most promising in this respect are

asset backed currencies. While the particular details of any cryptocurrency

protocol differ, these currencies can promote monetary expansion to the ex-

tent that assets can be registered on a blockchain and, presumably, there

exist no competing claim for the portion of the assets value that is converted

22

Electronic copy available at: https://ssrn.com/abstract=3211745

to cryptocurrency. If there exists no need to repay the claim against the

asset, the conversion of the asset’s value into cryptocurrency amounts to an

interest free loan.

6 Competition, Entrepreneurship, and the Blockchain

It’s tough to make predictions, especially about the future. - Yogi

Bera

Cryptocurrency can serve as a substitute for legal tender, either through

networks that use them directly or as near moneys that can provide low-cost

access to legal tender. This claim pertains to the potential of cryptocur-

rencies, not the current state of cryptocurrencies. Two things remain to be

discovered. 1) Which cryptocurrencies structures will bring the most value

to cryptocurrency users. 2) What effect will the regulatory environment have

on the development and application of blockchain technology?

6.1 Entrepreneurial Discovery and the Blockchain

The explosion in the variety of blockchain technlogy is an ideal example

of combinatorial creativity (Potts 2000; Koppl, et al., 2015). Different net-

work structure, encryption technology, asset classes, protocol for creation

and release of cryptocurrency, and so forth. This makes prediction of which

cryptocurrencies will be successful exceedingly difficult. While the analysis

23

Electronic copy available at: https://ssrn.com/abstract=3211745

suggests asset-backed crypto currencies can promote macroeconomic equilib-

rium during a crisis, the success of a given blockchain and cryptocurrency is

dependent upon many other factors. Which manifestation of blockchain tech-

nology will benefit users well enough to gain widespread adoption remains

an open question.

Innovation gains widespread adoption as entrepreneurs lower the cost of

providing technology and make that technology accessible to the user. For

example, Steve Jobs provided just this with the development of relatively

cheap desktop computers with graphical user interfaces (Isaacson 2011). Bill

Gates accomplished a similar feat by concentrating on dramatically reduc-

ing costs of operating systems and easy to use programs with widespread

applicability like Microsoft Word and Excel. The choice of the appropriate

product and the cost-efficient means of providing that product is no small

task. It requires a willingness to experiment, fail, and, ultimately, to learn

(Kirzner 1973; Harford 2011). Competition in markets tend to produce the

lowest cost strategies.

The role of the entrepreneur is to overcome uncertainty and bear the cost

of doing so (Knight 1921; Foss and Klein 2012). It is to learn in the broadest

sense of the word. Entrepreneurship In his classic article, “Uncertainty, Evo-

lution, and Economic Theory”, Alchian (1950) reasons that economic agents

need not be perfectly knowledgeable and, in fact, cannot know beforehand

the solutions that the market will generate. Competitive processes, through

24

Electronic copy available at: https://ssrn.com/abstract=3211745

a process competition and selection, generate outcomes that are highly func-

tional, if not perfectly efficient (Caton 2017).

Blockchain technology is already disrupting banking as the Ripple network

has greatly reduced the costs of transactions, especially cross border transac-

tions (Arnold 2018). Over 100 banks have adopted the Ripple Network. Even

SWIFT, the dominant player in this market, has begun to make changes to a

model that had remained unchanged for decades. Unlike Bitcoin’s blockchain

and many others, Ripple’s blockchain does not require making the task of

miner’s increasingly difficult as processing speed improves. Instead, changes

in Ripple’s ledger depend upon and 80% consensus amongst nodes on the

same server. This democratic structure allows for low computational costs

while still maintaining the security of the ledger.

Blockchain technology is developing in precisely this fashion. Companies

have quickly begun to integrate blockchain technology into their operations.

Kodak’s use of blockchain to secure rights over photographs and create a

market for their purchase certainly counts as one such innovation. Louis

Dreyfus Company recently executed the first transaction in agriculture that

uses blockchain technology to reduce “time spent on processing documents

and data from hours to minutes (Louis Dreyfus Company 2018).” Examples

exist of blockchain application exist and are emerging in many areas, includ-

ing supply chain management, contracts, and healthcare (The Enterprisers

Project, July 2 2018; Berg et al., 2018).

25

Electronic copy available at: https://ssrn.com/abstract=3211745

Even applications of blockchain that are not in the field of finance or do

not need to explicitly include cryptocurrency might benefit from the inclusion

of cryptocurrency. A blockchain that manages a supply chain, for example,

might create cryptocurrency linked to assets produced in it and thereby limit

price volatility as well as distortions in relative prices. Co-movements among

the prices of inputs and outputs would be offset by similar fluctuations in

the value of the cryptocurrency. The potential for an industry currency has

been recognized in the marijuana industry, a grey market where legal bar-

riers prevent banks and financial firms from trading directly with producers

(Meyers 2018).

7 Cryptocurrencies and Public Policy

Given the variety of cryptocurrencies due to the broad application of

blockchain technology, it is possible that the massive expansion of liquid-

ity provided by cryptocurrencies may themselves promote macroeconomic

stability. Still, the ability to create new units of money or near-moneys for

low cost during a crisis seem a most promising solution who implications

deserve working out. Whatever set of solutions may be efficient, economic

improvements provided by blockchain technology and cryptocurrency may

be obstructed by regulatory policies (Kirzner 1997). Next will consider in-

efficiencies that arise due the categorical treatment of blockchain technology

by regulating and taxing authorities.

26

Electronic copy available at: https://ssrn.com/abstract=3211745

7.1 Securities Regulation

Cryptocurrencies represent an area of ambiguity for regulators, partly due

to uncertainty concerning the nature and development of the asset (Fillippi

2014). At the present time, the U.S. Securities and Exchange Commission’s

website advises that “ICOs, based on specific facts, may be securities of-

ferings, and fall under the SEC’s jurisdiction of enforcing federal securities

law.” A recent announcement, while not officially binding, has provided the

market with some expectations concerning the legal status of cryptocurren-

cies. William Hinman, the Direct of the Division of Corporate Finance at

the Securities and Exchange Commission advised that ether, the cryptocur-

rency used on the Ethereum network, should not be regulated like stocks

and bonds (Matsakis 2018). Investments in initial coin offerings (ICOs), the

first sale of cryptocurrencies, may still be subject to regulation as officials

claim that initial investments are made with an expected return. There is

some irony in this reasoning as economic theory suggests that all investments

are made with an expected return and that agents economize on holdings of

money, money-like assets, and other physical assets in light of expected re-

turns (Friedman 1956). Limits set by regulatory agencies are looming as

cryptocurrencies linked to assets and assets linked to cryptocurrencies are

facing fierce resistance from the SEC (Pisani 2018). Although a Bitcoin fu-

tures market is in operation, the SEC has refused to approve a Bitcoin ETF.

To the extent that the SEC limits expansion in these markets, so too will the

liquidity provided by these new instruments be limited.

27

Electronic copy available at: https://ssrn.com/abstract=3211745

7.2 Capital Gains Tax

Whether due to conscious preference or evolutionary selection, agents who

economize on asset holdings according to expected return per dollar invested

will tend to invest less in an asset as transaction costs required for dealing in

the asset increase. The remarkable fall in transaction costs over the last few

decades has resulted in a massive expansion of liquidity in financial markets.

One cost is difficult, if not impossible, to avoid: capital gains taxes. Where

there exist differentials in tax treatment in light of asset class or realization

of loss, there also exist noticeable differences in investor behavior. Investors

attempt to minimize these costs. This takes on many forms as cryptocurren-

cies are inheriting a problem that has beset financial markets for as long as

financial assets have been taxed and regulated.

Fiscal policy in the form of the tax code can create disjunctions in finan-

cial markets. Investors may demand a premium for stocks acquired in an

acquisition in order to offset losses that will be incurred by a capital gains

tax (Ayers, Lefanowicz, and Robinson 2003). More commonly, investors in

the U.S. tend to sell stocks that have incurred a loss during the year in De-

cember. The tax code incentivizes this as investors can write off losses from

these sales and pay less in taxes as a result (Blouin, Raedy, Shackelford 2003;

Mello, Ferris, and Hwang 2003; Jin 2006). Other financial instruments that

provide more liquidity to the market, like ETFs, are subject to similar tax

treatment.

28

Electronic copy available at: https://ssrn.com/abstract=3211745

By the same logic, the development of and investment in cryptocurren-

cies will impacted by tax policy. Currently in the U.S., cryptocurrencies are

subject to the capital gains tax. This is true for every transaction, whether

cryptocurrencies are trade for other cryptocurrencies or they are sold for dol-

lars. Failure to register such transactions on tax documents are subject to

“a penalty of $50 to $250 per unreported transaction (Burton and Michel

2017).” Either paying the tax or risking payment of penalty for unregistered

transactions makes using cryptocurrency as money an especially costly prac-

tice.

The Australian government has been heralded as a leader in blockchain

technology (Pollock, April 15, 2018). According to the Australian tax code,

those who acquire cryptocurrency with the intent to use it in transactions are

not subject to capital gains tax. Ambiguity between investors and those who

primarily transact in a cryptocurrency, and therefore are long-term hold-

ers, will need to be confronted. The code also treats those who trade be-

tween cryptocurrencies subject to capital gains tax, thus not ameliorating

the liquidity constraints that these instruments might offset. Despite this,

the transformation of Australia’s legal framework is encouraging relative to

the response of other governments and may set precedent for policy makers.

Regulation and taxation may, by no intention of policy makers, inhibit

the development of markets that can promote macroeconomic stability. No

matter how useful a technology, its full potential may not be realized if there

29

Electronic copy available at: https://ssrn.com/abstract=3211745

exists inefficient regulatory and tax frameworks. If existing codes in indus-

trialized countries do not allow room for development of these instruments,

potential for these technologies might be realized in areas where government

are least prepared or able to regulate them.

8 Conclusion

To review, the potential of cryptocurrency is vast and, therefore, cannot

be fully described ex ante. Macroeconomic theory provides us insight into

a niche that cryptocurrencies might fill. Monetary instability that is often

associated with economic depression might be offset by the adoption of cryp-

tocurrencies, especially if those cryptocurrencies adopted allow for expansion

of the money stock for those willing to pay for new units of currency during

an economic crisis. Markets that allow for widespread competition enable

the discovery and implementation of these uses so long as regulation does

not prevent this.

The blockchain shows potential to monetize illiquid assets; both those

existing and those scheduled to exist in the future. If the full potential of

blockchain and cryptocurrency is to be realized, the ability of this technology

to monetize assets and thus offset macroeconomic instability must not be

prohibited by inefficiency-inducing regulations and tax policies.

30

Electronic copy available at: https://ssrn.com/abstract=3211745

A Appendix

The dynamics of money creation illustrate that the quantity of money,

when determined by the market, is determined by demand for money. For

the sake of clarity, we will only consider commodity base money with the

parallel that cryptocurrency is a “synthetic commodity” (Selgin 2015).

A.1 Supply of and Demand for Money

Money, as the commonly accepted medium of exchange, is unique among

goods in that it is the common unit of account of non-money goods. The price

of money is whatever one is willing to trade for it. Given the variety of money

prices that exist across markets, money’s price is conveniently approximated

as the inverse of the average price of non-money goods (i.e., the price level).

Thus, the average price of money, PM , relates to the price level P as:

1

PM = (1A)

P

The average price of money is the inverse of the price level. As the price of

money goes up, the price level goes down and vice versa.

Supply and demand for money work much as supply and demand for other

goods. However, since money represents half of every exchange, we find that

demand for money is a function of demand for other goods in addition to

demand to hold money over a given period of time. The demand function

31

Electronic copy available at: https://ssrn.com/abstract=3211745

for money is implied by the equation of exchange:

MV = P y (2A)

In its elementary form, the equation equates aggregate demand, total expen-

ditures, with aggregate supply, the value of marketable non-money goods in

the economy. In the long-run , all goods available for sale will be purchased.

The product of the existing stock of money (M ) and the average rate at

which each dollar is spent (V ) is equal to the real value of goods (y) adjusted

for changes in the price level (P ).

The equation can be rewritten such that the existing stock, or supply, of

money is a function of the remaining variables P ,y and V , which together

comprise the total demand for money.

Py

M= (3A)

V

1

V

can be rewritten as k, portfolio demand for money which is the average

portion of one’s money holdings that he or she withholds from expenditure.

The other form of demand for money, transactions demand, is represented

by P y, the product of the price level and stock of real goods. The supply of

money is a function of demand to spend money and demand to hold money

32

Electronic copy available at: https://ssrn.com/abstract=3211745

on reserve:

M = P yk (4A)

This description of money demand must be nuanced further given the long-

run endogeneity of the price level. The price level is a function of the money

stock in the long run (Friedman 1970) as portfolio demand tends to be stable

over long periods of time. Even if portfolio demand for money is not perfectly

stable, the velocity of the effective base tends to move much more slowly than

the money stock. In a commodity money economy, the price level is mean

reverting (Mazumder and Wood 2013; White 1999) with the rate of growth

of the nominal money stock tending to match the real rate of growth in the

long-run.

To account for the possibility of a changing price level, we describe the level

of real cash balances by accounting for changes in the price level. We rewrite

to isolate the two factors driving demand for money in a system where the

money stock is not a choice variable for policy makers :

M

= yk (5A)

P

The supply of real cash balances is a function of real income and portfolio

demand for money, both of which are determined by autonomous factors.

This value can increase either by a change in the money stock, (M), or by

33

Electronic copy available at: https://ssrn.com/abstract=3211745

a change in the price level (P). Initially, a change in demand for money will

lead to a change in the price level, therefore impacting the price of money in

the inverse direction. Changes in the price level exert a real balance effect;

the real value of money holdings moves inversely with changes in the price

level (Patinkin 1989). This may promote macroeconomic equilibrium if the

change does not lead to structural effects such as imbalances in credit markets

that lead to systemic effects, as was the case during the great depression and

the most recent crisis in 2008.

If the supply of money is not perfectly inelastic, the quantity of money

responds to changes in demand for it through changes or expected changes

in the average price of goods. The change in the price level will reverse to the

extent that the quantity of money produced changes in the opposite direction.

If the price level under a commodity standard is truly mean reverting, then

entirety of falls in P will reversed by increases in M.

We are interested in the effect of a fall in the price level and its effect on

the money stock as deflations are commonly associated with dislocations in

credit markets and falls in productivity. The supply of real cash balances is a

function of demand for money to purchase real goods and portfolio demand

for money. Increases in demand for money exert a negative force on the

price level, which is an increase in the value of money. Under a commodity

money regime with an upward sloping supply curve, the nominal money stock

will increase as either quantity of real goods or demand to hold money (k)

34

Electronic copy available at: https://ssrn.com/abstract=3211745

increases.

35

Electronic copy available at: https://ssrn.com/abstract=3211745

References

Journal Articles

Alchian, A. (1950). Uncertainty, Evolution, and Economic Theory. Journal

of Political Economy Vol. 58, 211-21.

Antonopoulos, A. M. (2014). Mastering Bitcoin: Programming the Open

Blockchain, 2nd Edition. Sebastapol, CA: O’Reilly.

Antonopoulos, A. M. (2016). The Internet of Money, Volume One. Merkle

Bloom LLC.

Ayers, B. C., C. E. Lefanowicz, and J. R. Robinson. (2003). “Shareholder

Taxes in Acquisition Premiums: The Effect of Capital Gains Taxation.”

The Journal of Finance Vol. 58, 2783-2801.

Barnett, W. A., E. K. Offenbacher, and P. A. Spindt (1984). “The New

Divisia Monetary Aggregates.” Journal of Political Economy Vol. 92,

1049-1085.

Baur, D. G., Hong, K., and A. D. Lee (2018). “Bitcoin: Medium of Exchange

or Speculative Assets?” Journal of International Financial Markets, In-

stitutions, Money Vol. 54, 177-189.

Berg, C., S. Davidson, and J. Potts (June 2018). “Supply Chains on Blockchains.”

APEC Currents, Accessed June 9, 2018: http://cryptoeconomics.com.au/2018/06/supply-

chains-on-blockchains/

Blouin, J. L., J. S. Raedy, and D. A. Shackelford (2003). “Capital Gains

Taxes and Equity Trading: Empirical Evidence.” Journal of Accounting

Research Vol. 41, 611-651.

Bourdieu, P. (1990). The Logic of Practice. Stanford, CA: Stanford Univer-

sity Press.

Burton, D. R. and N. J. Michel (2017). “Removing Tax Barriers to Compet-

itive Currencies” The Heritage Foundation Issue Brief 4761: 1-5.

Caton, J. (2017). “Entrepreneurship, Search Costs, and Ecological Rational-

ity in an Agent-based Model.” Review of Austrian Economics Vol. 30:

http://link.springer.com/article/10.1007/s11138-016-0351-2

Chinn, M. and K. Kucko (2015). “The Predictive Power of the Yield Curve

Across Countries and Time.” International Finance Vol. 18, 129-156.

Clower, R. and A. Leijonhufvud. (1981). “Say’s Principles: What it Means

and Doesn’t Mean” in Information and Coordination. New York: Oxford

University Press.

Davidson, S., P. Filippi, and J. Potts (2016). “Economics of Blockchain.”

Proceedings of Public Choice Conference: https://hal.archives-ouvertes.fr/hal-

36

Electronic copy available at: https://ssrn.com/abstract=3211745

01382002/document

Diamond, D. W. and P. H. Dybvig (1983). “Bank Runs, Deposit Insurance,

and Liquidity.” The Journal of Political Economy Vol. 91, 401-419.

D’Mello, R., S. P. Ferris, and C. Y. Hwang (2003). “The Tax-loss Selling

Hypothesis, Market Liquidity, and Price Pressure around the Turn-of-

the-Year.” Journal of Financial Markets Vol. 6, 73-98.

Dyhrberg, A. H. (2016). “Hedging Capabilities of Bitcoin. Is it the Virtual

Gold?” Finance Research Letters Vol. 16, 139-144.

Erdogan, O., P. Bennett, and C. Ozyildirim. (2015). “Recession Prediction

Using Yield Curve and Stock Market Liquidity Deviation Measures.” Re-

view of Finance Vol. 19, 407-422.

Estrella, A. and M. R Trubin (2006). “The Yield Curve as a Leading Indica-

tor: Some Practical Issues.” Federal Reserve Bank of New York: Current

Issues in Economics and Finance Vol. 12, 1-7.

Ethereum White Paper: A Next-Generation Smart Contract and Decentral-

ized Application Platform: https://github.com/ethereum/wiki/wiki/White-

Paper

Fillippi, P. (2014). “Bitcoin: A Regulator Nightmare to a Libertarian Dream.”

Internet Policy Review Vol. 3: https://policyreview.info/articles/analysis/

bitcoin-regulatory-nightmare-libertarian-dream

Freidman, M. (1956). “The Quantity Theory: A Restatement.” In Milton

Friedman (ed.,) Studies in the Quantity Theory of Money. Chicago: Uni-

versity of Chicago.

Friedman, M. (1970). “A Theoretical Framework for Monetary Analysis.”

Journal of Political Economy Vol. 78, 193-238.

Gilbert, C. L. (2010). “Speculative Influences on Commodity Futures Prices

2006-2008.”UNCTAD Discussion Papers 197: http://www.unctad.org/en/

docs/osgdp20101 en.pdf

Glasner, D. (1989). Free Banking and Monetary Reform. Cambridge, U.K.:

Cambridge University Press.

Goudrian, J. (1932). How to Stop Deflation. London: Search Publishing.

Graham, B. (1937). Storage and Stability. New York: McGraw Hill.

Graham, F. D. (1942). Social Goals and Economic Institutions. Princeton,

NJ: Princeton University Press.

Harford, Tim. (2011). Adapt: Why Success Always Starts with Failure.

New York: Picador.

Hardy, A. and J. Norgaard (2016). “Reputation in the Internet Black Mar-

ket: An Empirical and Theoretical Analysis.” Journal of Institutional

37

Electronic copy available at: https://ssrn.com/abstract=3211745

Economics Vol. 12, 515-539.

Harwick, C. (2017). “Money and Its Institutional Substitutes: the Role of

Exchange in Human Cooperation.” Journal of Institutional Economics

Vol. 14, 689-714.

Hawtrey, R. G. (1947). The Gold Standard in Theory and Practice. London:

Longmans, Green, and Co.

Hayek, F. A. (1943). “A Commodity Reserve Currency.” The Economic

Journal Vol. 53, 176-184.

Hicks, J. R. (1989). A Market Theory of Money. Oxford: Oxford University

Press. Horwitz, S. (2000). Microfoundations and Macroeconomics: An

Austrian Perspective. New York: Routledge.

Horwitz, S. 2008. “Monetary Calculation and the Extension of Social Coop-

eration into Anonymity.” Journal of Private Enterprise Vol. 23, 81-93.

Irwin, S. H. and D. R. Sanders (2011). Applied Economic Perspectives and

Policy Vol. 33, 1-31.

Irwin, S. H. and D. R. Sanders (2012). “Financialization and Structural

Change in Commodity Futures Markets.” Journal of Agricultural and

Applied Economics Vol. 44, 371-396.

Jin, L. (2006). “Capital Gains Tax Overhang and Price Pressure.” The

Journal of Finance Vol. 61, 1399-1431.

Keynes, J. M. (1930). Treatise on Money. London: Macmillan.

Keynes, J. M. (1936). The General Theory of Employment, Interest, and

Money.

Kirzner, I. (1973). Competition and Entrepreneurship. Chicago: University

of Chicago Press.

Kirzner, I. (1997). Entrepreneurial Discovery and the Competitive Market

Process: An Austrian Approach. Journal of Economic Literature Vol.

35, 60-85.

Koppl, R., Kauffman, S., Felin, T. Longo, G. (2015). Economics for a

Creative World. Journal of Institutional Economics Vol. 11, 1-31.

Longstaff, F. A. (2004). “The Flight-to-Liquidity Premium in U.S. Treasury

Bond Prices.” The Journal of Business Vol. 77, 511-526.

Luther, W. J. and L. H. White (2014). “Can Bitcoin Become a Major Cur-

rency?” George Mason University, Department of Economic, Working

Paper No. 14-17.

Mazumder, S. and J. H. Wood (2013). “The Great Deflation of 1929-33: It

(Almost) Had to Happen.” The Economic History Review 66: 156-177.

38

Electronic copy available at: https://ssrn.com/abstract=3211745

Menger, C. (1892). “On the Origins of Money.” The Economic Journal Vol.

2, 239-55. National Bureau of Economic Research (2008). “The NBER’s

Recession Dating Procedure.”: http://www.nber.org/cycles/jan2003.html

Nakamoto, S. (2008). “Bitcoin: A Peer-to-Peer Electronic Cash System.”:

https://bitcoin.org/bitcoin.pdf

Norgaard, J., H. J. Walbert, and A. Hardy. (2018). “Shadow Markets and Hi-

erarchies: Comparing and Modeling Networks in the Dark Net.” Journal

of Institutional Economics: https://doi.org/10.1017/S1744137417000613

Patinkin, D. (1989). Money, Interest, and Prices: An Integration of Monetary

and Value Theory. Harper and Row.

Potts, J. (2000). A New Evolutionary Microeconomics. Edward Elgar Pub-

lishing.

Rothbard, M. (2002). A History of Money and Banking in the United States:

The Colonial Era to World War II. Auburn, AL: Ludwig von Mises In-

stitute.

Salter, A. (2014). “An Introduction to Monetary Policy Rules.” Mercatus

Working Paper: https://www.mercatus.org/system/files/Salter-Monetary-

PolicyRules.pdf

Selgin, G. (2015). “Synthetic Commodity Money.” Journal of Financial Sta-

bility Vol. 17, 92-99.

Snowdon, B. and H. R. Vane (2005). Macroeconomics: Its Origins, Develop-

ment and Current State. Northampton, MA: Edward Elgar Publishing.

Sumner, S. B. (2014). “Nominal GDP Targeting: A Simple Rule to Improve

Fed Performance.” Cato Journal Vol. 34, 315-337.

Sumner, S. B. (2015a). The Midas Paradox: Financial Markets, Government

Policy Shocks, and the Great Depression. Oakland, CA: Independent

Institute.

Sumner, S. B. (2015b). “Nominal GDP Futures Targeting.” Journal of Fi-

nancial Stability Vol. 17, 65-75.

Taylor, J. B. (1993). “Discretion Versus Policy Rules in Practice.” Carnegie-

Rochester Conference Series on Public Policy Vol. 39, 195-214.

Vedder, R. and L. Galloway (1997). Out-of-Work: Unemployment and Gov-

ernment in Twentieth-Century America. Oakland, CA: Independent In-

stitute.

White, L. H. (1999). The Theory of Monetary Institutions. Oxford: Black-

well Publishers.

White, L. H. (2010). “The Rule of Law or the Rule of Central Bankers?”

Cato Journal Vol. 30, 451-463.

39

Electronic copy available at: https://ssrn.com/abstract=3211745

White, L. H. (2015). “The Merits and Feasibility of Returning to a Com-

modity Standard.” Journal of Financial Stability Vol. 17, 59-64.

Woodford, M. (2001). “The Taylor Rule and Optimal Monetary Policy.” The

American Economic Review Vol. 91, 232-237.

Yeager, L. B. (1956). “A Cash-balance Interpretation of Depression.” South-

ern Economic Journal Vol. 22: 438-447.

New Articles and Websites

Arnold, Martin (2018), “Ripple and Swift Slug it Out Over Cross Border Pay-

ments”, Financial Times, 5 June: https://www.ft.com/content/631af8cc-

47cc-11e8-8c77-ff51caedcde6 (Accessed June 8, 2018)

Australian Taxation Office. “Tax Treatment of Crypto-currencies in Aus-

tralia – Specifically Bitcoin.” Accessed June 9, 2018: https://www.ato.gov.au/

General/Gen/Tax-treatment-of-crypto-currencies-in-Australia —specifically-

bitcoin/?page=2Transacting with cryptocurrency

Casey, Kevin (2018), “Blockchain in Action: 5 Interesting Examples”, The

Enterprisers Project, 2 July: https://enterprisersproject.com/article/2018/7/

blockchain-action-5-interesting-examples (Accessed July 9, 2018)

Kim, Christine (2018), “KODAKCoin Inks Arena Partnership to Store NBA,

NHL Photos”, CoinDesk, 11 June: https://www.coindesk.com/kodakcoin-

inks-arena-partnership-store-nba-nhl-photos/

Louis Dreyfus Company (2018), “Louis Dreyfus Company, ING, Societe

Generale and ABN Amro Complete the First Agricultural Commodity

Trade Through Blockchain”: https://www.ldc.com/global/en/investors-

media/press-releases/press-release-2018/louis-dreyfus-company-ing-societe-

generale-and-abn-amro-complete-first-agricultural-commodity-trade-through-

blockchain/ (Accessed June 9, 2018)

Matsakis, Louise (2018), “Rest Easy, Cryptocurrency Fans: Ether and Bit-

coin Aren’t Securities”, Wired. 14 June: https://www.wired.com/story/sec-

ether-bitcoin-not-securities/ (Accessed July 10, 2018)

Meyers, Nick (2018), “Weed Money: Cryptocurrency May be the Key to Un-

locking Bank Vaults for the Cannabis Industry”, Phoenix News Times, 29

June: https://www.phoenixnewtimes.com/news/weed-money-cryptocurrency-

banking-cannabis-industry-10566055/ (Accessed July 8, 2018)

Pisani, Bob (2018), “Bitcoin and Ether are not Securities, but some Initial

Coin Offerings May Be, SEC Official Says”, CNBC, 14 June: https://www.cnbc.com

/2018/06/14/bitcoin-and-ethereum-are-not-securities-but -some-cryptocurrencies-

may-be-sec-official-says.html (Accessed July 10, 2018)

40

Electronic copy available at: https://ssrn.com/abstract=3211745

Pollock, Darryn (2018), “How Australia is Becoming a Cryptocurrency Con-

tinent: Markets, Regulation, and Plans”, CoinTelegraph, 15 April: https://

cointelegraph.com/news/how-australia-is-becoming-a-cryptocurrency-continent-

markets-regulations-and-plans (Accessed July 9, 2018)

Schwartz, David (2017), “An Explanation of Ripple’s XRP Escrow.” 15

December: https://ripple.com/dev-blog/explanation-ripples-xrp-escrow/

(Accessed June 5, 2018)

The Economist (2008), “Why are Venezuelans Mining so Much Bitcoin?” 3

April: https://www.economist.com/the-economist-explains/2018/04/03/why-

are-venezuelans-mining-so-much-bitcoin (Accessed July 8, 2018)

41

Electronic copy available at: https://ssrn.com/abstract=3211745

You might also like

- Investment Appraisal Report (Individual Report)Document10 pagesInvestment Appraisal Report (Individual Report)Eric AwinoNo ratings yet

- Facility Management Business PlanDocument51 pagesFacility Management Business PlanJoseph QuillNo ratings yet

- Aml CFT QuestionsDocument9 pagesAml CFT QuestionsWalter Agbons100% (3)

- Stellar CBDC WhitepaperDocument30 pagesStellar CBDC WhitepaperJuan Luis ClaureNo ratings yet

- J 7 IJAL 2019 1 Kkartikeya14 Gmailcom 20200509 000011Document14 pagesJ 7 IJAL 2019 1 Kkartikeya14 Gmailcom 20200509 000011kumar kartikeyaNo ratings yet

- Creating A Decentralised Payment Network: A Study of BitcoinDocument57 pagesCreating A Decentralised Payment Network: A Study of BitcoinCoinometrics100% (1)

- Cryptoliquidity: The Blockchain and Monetary StabilityDocument42 pagesCryptoliquidity: The Blockchain and Monetary StabilityIguaNo ratings yet

- Finance For EntrepreneursDocument17 pagesFinance For EntrepreneursAnza FatimaNo ratings yet

- Blockchain Analysis of The Bitcoin MarketDocument55 pagesBlockchain Analysis of The Bitcoin MarketRuslanNo ratings yet

- Bank of Canada Staff Working Paper :document de Travail Du Personnel 2018 - 34 Incentive Compatibility On The Blockchainswp2018-34Document19 pagesBank of Canada Staff Working Paper :document de Travail Du Personnel 2018 - 34 Incentive Compatibility On The Blockchainswp2018-34CrowdfundInsiderNo ratings yet

- Some Simple Economics of The BlockchainDocument30 pagesSome Simple Economics of The BlockchainCrowdfundInsiderNo ratings yet

- Giudici2020 Article CryptocurrenciesMarketAnalysisDocument18 pagesGiudici2020 Article CryptocurrenciesMarketAnalysisGeysa Pratama EriatNo ratings yet

- M A Thesis Anon PDFDocument41 pagesM A Thesis Anon PDFMitchell WRNo ratings yet

- Cryptocurrencies Market AnalysisDocument18 pagesCryptocurrencies Market AnalysisSana BraiekNo ratings yet

- The Economicsof Cryptocurrencies 2Document17 pagesThe Economicsof Cryptocurrencies 2chastomsNo ratings yet

- Cryptocurrency and Blockchains in Emerging Economies: Social and Political ContextDocument8 pagesCryptocurrency and Blockchains in Emerging Economies: Social and Political ContexthametNo ratings yet

- The Impact of Cryptocurrencies On DeveloDocument8 pagesThe Impact of Cryptocurrencies On DeveloesthereliaweNo ratings yet

- Blockchain Disruption and Smart Contracts: Booth School of Business, University of ChicagoDocument48 pagesBlockchain Disruption and Smart Contracts: Booth School of Business, University of ChicagoAlexander DisraeliNo ratings yet

- A Regulatory Framework For CryptocurrencyDocument27 pagesA Regulatory Framework For CryptocurrencyFarha Khan NazNo ratings yet

- BNCoin White Paper (English) 200124Document20 pagesBNCoin White Paper (English) 200124dra arbyNo ratings yet

- Paper 6Document10 pagesPaper 6Dr-Shakir UllahNo ratings yet

- Mitigating Blockchain Fork AttacksDocument24 pagesMitigating Blockchain Fork AttacksshamanjrNo ratings yet

- BCT Unit 1Document27 pagesBCT Unit 1Ishika MudeNo ratings yet

- Briefing Paper-Introduction To Blockchain TechnologyDocument10 pagesBriefing Paper-Introduction To Blockchain Technologyreavthy99999No ratings yet

- Stellar CBDC WhitepaperDocument24 pagesStellar CBDC WhitepaperLucas GabrielNo ratings yet

- 7 Ways Blockchain Technology Could Disrupt The Post-Trade Ecosystem. Kynetix White Paper. Written by - Paul Smyth, CEODocument10 pages7 Ways Blockchain Technology Could Disrupt The Post-Trade Ecosystem. Kynetix White Paper. Written by - Paul Smyth, CEOChild TraffickingNo ratings yet

- Final Assignment - Crypto 23Document9 pagesFinal Assignment - Crypto 23Vinessen SevatheanNo ratings yet

- Basics of CryptocurrencyDocument3 pagesBasics of Cryptocurrencyndestiny811No ratings yet

- Karels, Racole (Cryptocurrencies and The Economy) Capstone 201718Document21 pagesKarels, Racole (Cryptocurrencies and The Economy) Capstone 201718saquibkazi55No ratings yet

- CBDCs and Tokenization (2022)Document48 pagesCBDCs and Tokenization (2022)Ghali LaraquiNo ratings yet

- Blockchain and Central Banks Legal and R PDFDocument34 pagesBlockchain and Central Banks Legal and R PDFsymopNo ratings yet

- Evolution of CryptoassetsDocument12 pagesEvolution of CryptoassetsSadia RahmanNo ratings yet

- Blockchain A New Era For BusinessDocument20 pagesBlockchain A New Era For Businesskalyan.dasNo ratings yet

- Blockchain For Fragile States, The Good, The Bad and The UglyDocument8 pagesBlockchain For Fragile States, The Good, The Bad and The UglyCristhian J Mendoza VillanuevaNo ratings yet

- Blockchain and It Fintech ApplicationsDocument5 pagesBlockchain and It Fintech ApplicationsBlaahhhNo ratings yet

- Cryptocurrency 2018: When The Law Catches Up With Game-Changing Technology - Stay Informed - K&L GatDocument4 pagesCryptocurrency 2018: When The Law Catches Up With Game-Changing Technology - Stay Informed - K&L GatChristos FloridisNo ratings yet

- A New Digital Age in Finance Blockchain and Smart ContractsDocument14 pagesA New Digital Age in Finance Blockchain and Smart Contractsamr.mans95No ratings yet

- Chapter II: Review of Related Literature and StudiesDocument9 pagesChapter II: Review of Related Literature and StudiesJamesAnthonyNo ratings yet

- Block ChainDocument33 pagesBlock ChainJohn6754No ratings yet

- Economic Impacts of BlockchainDocument7 pagesEconomic Impacts of BlockchainMatthew KlierNo ratings yet

- The Dark Side of Cryptocurrency - Tushar ShahaniDocument25 pagesThe Dark Side of Cryptocurrency - Tushar ShahaniTushar ShahaniNo ratings yet

- CryptoDocument37 pagesCryptoHARSH GAIKWAD100% (1)

- 30 Day ContentDocument34 pages30 Day ContenthapiankhatonNo ratings yet

- Blockchain Application On Financial Sector in The FutureDocument12 pagesBlockchain Application On Financial Sector in The FutureVincent RinaldyNo ratings yet

- Blockchain Technology: Mastering the Digital Ledger RevolutionFrom EverandBlockchain Technology: Mastering the Digital Ledger RevolutionNo ratings yet

- Analytics in Accounting, Finance and EconomicsDocument11 pagesAnalytics in Accounting, Finance and EconomicsNeel paulNo ratings yet

- Blockchain Technology PaperDocument17 pagesBlockchain Technology Paperkotte.pandurangareddyNo ratings yet

- Market structure of cryptoasset exchanges_Introduction, challenges and emerging trendsDocument30 pagesMarket structure of cryptoasset exchanges_Introduction, challenges and emerging trendsfelixniefeiusNo ratings yet

- The Blockchain and Islamic Finance PDFDocument3 pagesThe Blockchain and Islamic Finance PDFyashvardhan Singh MoreNo ratings yet

- The Crypto Revolution: A Guide to Building Wealth with CryptocurrenciesFrom EverandThe Crypto Revolution: A Guide to Building Wealth with CryptocurrenciesNo ratings yet

- Modern Banking Ledgers Through Blockchain TechnologiesDocument33 pagesModern Banking Ledgers Through Blockchain TechnologiesAlejandro HurtadoNo ratings yet

- Topic: Cryptocurrency: HistoryDocument14 pagesTopic: Cryptocurrency: HistoryVindhya ShankerNo ratings yet

- The Bad and The Ugly BlockchainDocument8 pagesThe Bad and The Ugly BlockchainSam TaylorNo ratings yet

- The Rise of Blockchain Technology and Its Potential For Improving The Quality of Accounting InformationDocument7 pagesThe Rise of Blockchain Technology and Its Potential For Improving The Quality of Accounting InformationMohamed MelouahNo ratings yet

- USB CryptocurrencyDocument18 pagesUSB CryptocurrencytabNo ratings yet

- J RGNUL Student Research Review Kkartikeya14 Gmailcom 20200508 235403Document18 pagesJ RGNUL Student Research Review Kkartikeya14 Gmailcom 20200508 235403kumar kartikeyaNo ratings yet

- Blockchain ReportDocument13 pagesBlockchain ReportAnish Ani100% (1)

- Amity School of Engineering & Technology Noida, Uttar PradeshDocument16 pagesAmity School of Engineering & Technology Noida, Uttar PradeshUjjwal BhatnagarNo ratings yet

- Future of Bitcoinsa StudyDocument12 pagesFuture of Bitcoinsa StudySho AibNo ratings yet

- Some Simple Economics of BlockchainDocument39 pagesSome Simple Economics of BlockchainVijay KumarNo ratings yet

- العملات الافتراضية - تقارير بنك التوسيات الدولى BISDocument6 pagesالعملات الافتراضية - تقارير بنك التوسيات الدولى BISWael HassanNo ratings yet

- Block Chain TechnologyDocument6 pagesBlock Chain TechnologyjarameliNo ratings yet