Professional Documents

Culture Documents

Logo-Policy-document-LIC-s-Bima-Jyoti-dt-24122021 5

Logo-Policy-document-LIC-s-Bima-Jyoti-dt-24122021 5

Uploaded by

Cyril Pilligrin0 ratings0% found this document useful (0 votes)

9 views1 pageThis document defines 31 key terms used in the policy document, including:

- Age, which is the age at commencement except for ages 0 which is 90 days.

- Annualized Premium, which excludes taxes, riders, and loadings.

- Base Policy, which refers to basic benefits excluding riders.

- Beneficiary, who is entitled to receive policy benefits and can be the proposer, life assured, assignee, nominee, or legal representatives.

- Date of Commencement, which is the start date of the policy.

- Life Assured, whose life the insurance cover has been accepted for.

- Nomination, which is the process of nominating beneficiaries and must follow Section

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document defines 31 key terms used in the policy document, including:

- Age, which is the age at commencement except for ages 0 which is 90 days.

- Annualized Premium, which excludes taxes, riders, and loadings.

- Base Policy, which refers to basic benefits excluding riders.

- Beneficiary, who is entitled to receive policy benefits and can be the proposer, life assured, assignee, nominee, or legal representatives.

- Date of Commencement, which is the start date of the policy.

- Life Assured, whose life the insurance cover has been accepted for.

- Nomination, which is the process of nominating beneficiaries and must follow Section

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

9 views1 pageLogo-Policy-document-LIC-s-Bima-Jyoti-dt-24122021 5

Logo-Policy-document-LIC-s-Bima-Jyoti-dt-24122021 5

Uploaded by

Cyril PilligrinThis document defines 31 key terms used in the policy document, including:

- Age, which is the age at commencement except for ages 0 which is 90 days.

- Annualized Premium, which excludes taxes, riders, and loadings.

- Base Policy, which refers to basic benefits excluding riders.

- Beneficiary, who is entitled to receive policy benefits and can be the proposer, life assured, assignee, nominee, or legal representatives.

- Date of Commencement, which is the start date of the policy.

- Life Assured, whose life the insurance cover has been accepted for.

- Nomination, which is the process of nominating beneficiaries and must follow Section

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

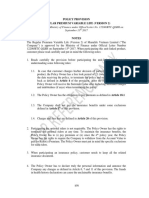

PART – B: DEFINITIONS

The definitions of terms/words used in the Policy Document are as under:

1. Age is the age nearer birthday of the Life Assured at the time of the commencement of the policy except for age 0year for

which the age is 90 days completed.

2. Appointee is the person to whom the proceeds/benefits secured under the Policy are payable if the benefit becomes

payable to the nominee and nominee is minor as on the date of claim payment.

3. Annualized Premium shall be the premium amount payable in a year chosen by the policyholder excluding the taxes, rider

premiums, underwriting extra premiums and loadings for modal premiums, if any.

4. Assignee is the person to whom the rights and benefits are transferred by virtue of an Assignment.

5. Assignment is the process of transferring the rights and benefits to an “Assignee”. Assignment should be in accordance

with the provisions of Section 38 of the Insurance Act, 1938 as amended from time to time.

6. Base Policy is that part of the Policy referring to basic benefit (benefits referred to in this Policy Document excluding

benefits covered under Rider(s), if opted for).

7. Basic Sum Assured means the amount specified in the Schedule as opted by the Policyholder at the time of taking the

policy.

8. Beneficiary/ Claimant means the person(s)/entity who is/are entitled to receive benefits under this Policy. The Beneficiary

to whom benefits are payable is the Proposer or Life Assured or his Assignee under Section 38 of the Insurance Act, 1938,

as amended from time to time or Nominee(s) under Section 39 of the Insurance Act, 1938, as amended from time to time or

proved Executors or Administrators or other Legal Representatives who should take out representation to his/ her Estate or

limited to the moneys payable under this Policy from any Court of any State or Territory of the Union of India, as

applicable.

9. Continued Insurability is the determination of insurability of Life Assured/Proposer on revival of policy with rider(s) if

opted for, to the satisfaction of the Corporation based on the information, documents and reports that are already available

and any additional information in this regard if and as may be required in accordance with the Underwriting Policy of the

Corporation at the time of revival.

10. Corporation means the Life Insurance Corporation of India established under Section 3 of the LIC Act, 1956.

11. Date of commencement of policy is the start date of this Policy.

12. Date of commencement of risk is the date on which the Corporation accepts the risk for insurance (cover) as evidenced in

the Schedule of the policy.

13. Date of issuance of policy is a date when a proposal after underwriting is accepted as a policy and this contract gets

effected.

14. Date of Maturity means the date specified in the Schedule on which the Policy Term is completed.

15. Date of Vesting shall be the policy anniversary date coinciding with or immediately following the completion of 18 years

of age. On such vesting date, this policy shall be deemed to be a contract between the Corporation and the Life Assured.

The Life Assured shall become the absolute owner of the policy and the proposer or his estate shall cease to have any right

or interest therein.

16. Death Benefit means the benefit, which is payable on death, as specified in Condition 1.A of Part C of this Policy

Document.

17. Discharge form is the form to be filled by policyholder/claimant to claim the maturity / surrender / death benefit under the

policy.

18. Due Date means a fixed date on which the policy premium is due and payable by the policyholder.

19. Endorsement means conditions attached/ affixed to this Policy incorporating any amendments or modifications agreed to

or issued by the Corporation.

20. Extra premium means a charge, due to underwriting decision, for any additional risk not provided for, in minimum

contract premium.

21. Foreclosure is an action of closing the policy due to default in payment of outstanding loan and / or loan interest on due

date when the outstanding loan amount along with interest is to exceed the surrender value.

22. Free Look Period is the period of 15 days (30 days in case of electronic policies and policies obtained through distance

mode (online)) from the date of receipt of the Policy Document by the Policyholder (wherever electronic policy is issued,

the Free Look Period shall be reckoned from the date of issuance of electronic policy) to review the terms and conditions of

this policy and where the Policyholder disagrees with any of those terms and conditions, he/ she has the option to return

this policy as detailed in Condition 7 of Part D of this Policy Document.

23. Grace period is the time granted by the insurer from the due date for the payment of premium, without any penalty or late

fee, during which time the policy is considered to be in-force with the risk cover without any interruption as per the terms

and conditions of the Policy.

24. Guaranteed Surrender Value is the minimum guaranteed amount of Surrender Value payable to the policyholder on

surrender of the policy.

25. In-force policy means a policy in which all the due premiums have been paid and the premiums are not outstanding

beyond grace period.

26. IRDAI means Insurance Regulatory and Development Authority of India earlier called as Insurance Regulatory and

Development Authority (IRDA).

27. Lapse is the status of the Policy when due premium is not paid within the grace period.

28. Life Assured is the person on whose life the insurance cover has been accepted.

29. Loan is the interest bearing repayable amount granted by the Corporation against the surrender value payable to the

policyholder.

30. Maturity Benefit means the benefit, which is payable on maturity as specified in Condition1B of Part C of this Policy

Document.

31. Material information is the information already known to the Policyholder/Life Assured/Proposer at the time of obtaining

a policy which has a bearing on underwriting of the proposal /Policy submitted.

32. Minor is a person who has not completed 18 years of age.

33. Nomination is the process of nominating a person(s) who is (are) named as “Nominee(s)” in the proposal form or

subsequently included/ changed by an endorsement. Nomination should be in accordance with provisions of Section 39 of

LIC’s Bima Jyoti (UIN 512N339V02) Page 5 of 17

You might also like

- Annexure 1 To Circular 254Document13 pagesAnnexure 1 To Circular 254rahul4u88No ratings yet

- T&C GCLI Final 138N017V01Document9 pagesT&C GCLI Final 138N017V01raviNo ratings yet

- PolicyDocument48 pagesPolicyPushpendra KushwahaNo ratings yet

- ICICI Pru Guaranteed Pension Plan Flexi Annexure V Benefit Enhancer 24june2022Document8 pagesICICI Pru Guaranteed Pension Plan Flexi Annexure V Benefit Enhancer 24june2022Prashant A UNo ratings yet

- Sales Brochure LIC GCLIDocument5 pagesSales Brochure LIC GCLIRKNo ratings yet

- Exide Life Freedom Plan (U24) (Uin 114l046v01)Document27 pagesExide Life Freedom Plan (U24) (Uin 114l046v01)Sachin KuttaNo ratings yet

- Futuregeneralipearlsguarantee 133n047v01Document18 pagesFuturegeneralipearlsguarantee 133n047v01Dinesh nawaleNo ratings yet

- Life Stay Smart Plan BrochureDocument2 pagesLife Stay Smart Plan BrochureBadi SudhakaranNo ratings yet

- Bharti AXA Policy Document Elite AdvantageDocument16 pagesBharti AXA Policy Document Elite AdvantageRutik PicturesNo ratings yet

- Loan Secure Sales Policy DocumentDocument15 pagesLoan Secure Sales Policy Documentakshayguin1997No ratings yet

- Policy Bond of GCLIDocument15 pagesPolicy Bond of GCLIDARSHAN ROYGAGANo ratings yet

- HDFC Click2protect Plus BrochureDocument8 pagesHDFC Click2protect Plus Brochurethirudan29No ratings yet

- Exide Life Powering Life Limited Payment Endowment Plan (Elr) (Uin 114n010v01)Document7 pagesExide Life Powering Life Limited Payment Endowment Plan (Elr) (Uin 114n010v01)Navpreet Singh RandhawaNo ratings yet

- ULK ManulifeDocument31 pagesULK ManulifeLong NguyenNo ratings yet

- EN Appendix - Protection Plan (UL039)Document8 pagesEN Appendix - Protection Plan (UL039)Dai HungNo ratings yet

- Bharti AXA Policy Bond Secure IncomeDocument10 pagesBharti AXA Policy Bond Secure IncomeOsham JumaniNo ratings yet

- EN Appendix - Saving Plan (UL038)Document8 pagesEN Appendix - Saving Plan (UL038)Dai HungNo ratings yet

- Standard Policy Provisions: 1. DefinitionsDocument4 pagesStandard Policy Provisions: 1. DefinitionsskvskvskvskvNo ratings yet

- Standard Policy Provisions: 1. DefinitionsDocument4 pagesStandard Policy Provisions: 1. DefinitionsskvskvskvskvNo ratings yet

- Bharti AXA Life Guaranteed Income PlanDocument14 pagesBharti AXA Life Guaranteed Income PlanSuresh DhanasekarNo ratings yet

- Benefits On DeathDocument16 pagesBenefits On DeathnaitikNo ratings yet

- Space For Name and Address of Policyholder Space For Address and E-Mail Id of Micro Insurance UnitDocument13 pagesSpace For Name and Address of Policyholder Space For Address and E-Mail Id of Micro Insurance Unitjagdish patidarNo ratings yet

- (A Non-Linked, Non-Participating Health Insurance Plan) Part - ADocument12 pages(A Non-Linked, Non-Participating Health Insurance Plan) Part - AsagarkanzarkarNo ratings yet

- Master Policy Bond SPGIDocument17 pagesMaster Policy Bond SPGIDARSHAN ROYGAGANo ratings yet

- Fortune Guarantee Pension Policy Document1Document34 pagesFortune Guarantee Pension Policy Document1karamatNo ratings yet

- Life Insurance in India - 3Document7 pagesLife Insurance in India - 3Himansu S MNo ratings yet

- Bharti AXA Policy Document Elite AdvantageDocument13 pagesBharti AXA Policy Document Elite AdvantageManojChowdaryNo ratings yet

- Sec 38 39 47Document3 pagesSec 38 39 47ayan mohantyNo ratings yet

- Policy Forms and Variable ContractsDocument74 pagesPolicy Forms and Variable ContractsKelvin CulajaráNo ratings yet

- Kotak Complete Cover Group PlanDocument7 pagesKotak Complete Cover Group PlanGens GeorgeNo ratings yet

- Bharti AXA Policy Document Elite AdvantageDocument12 pagesBharti AXA Policy Document Elite AdvantageSandeepNayakNo ratings yet

- Tata AIA Life Fortune Guarantee Plus TandC (UIN 110N158V07)Document21 pagesTata AIA Life Fortune Guarantee Plus TandC (UIN 110N158V07)Arul DayanandNo ratings yet

- A. Section 38 - Assignment and Transfer of Insurance PoliciesDocument6 pagesA. Section 38 - Assignment and Transfer of Insurance PoliciesradhakrishnaNo ratings yet

- Devices For Ascertaining and Controlling Risk and LossDocument12 pagesDevices For Ascertaining and Controlling Risk and LossShash BernardezNo ratings yet

- Life InsuranceDocument23 pagesLife InsuranceSruthi RavindranNo ratings yet

- Insurance Regulatory and Development AuthorityDocument31 pagesInsurance Regulatory and Development AuthorityAishwarya MRNo ratings yet

- IFLI Guaranteed Wealth Plan Policy Document - V7.0 Dated - 27th April 2020Document20 pagesIFLI Guaranteed Wealth Plan Policy Document - V7.0 Dated - 27th April 2020Sales DiscountNo ratings yet

- Individual Permanent Total Disability Policy: Pioneer Insurance & Surety CorporationDocument6 pagesIndividual Permanent Total Disability Policy: Pioneer Insurance & Surety CorporationIrene AnastasiaNo ratings yet

- Tata AIA Life Insurance Sampoorna Raksha Supreme (UIN 110N160V03) TandCDocument32 pagesTata AIA Life Insurance Sampoorna Raksha Supreme (UIN 110N160V03) TandCPradeep KshatriyaNo ratings yet

- Bharti AXA Life Premier Protect Home ShieldDocument20 pagesBharti AXA Life Premier Protect Home ShieldAsepNo ratings yet

- Policy Document - LIC S Fortune PlusDocument12 pagesPolicy Document - LIC S Fortune Plussharma65367No ratings yet

- Kotak Endowment PlanDocument2 pagesKotak Endowment PlanMichael GreenNo ratings yet

- Tata AIA Life Insurance Smart Sampoorna Raksha TandCDocument31 pagesTata AIA Life Insurance Smart Sampoorna Raksha TandCAnkit Maheshwari /WealthMitra/Delhi/Dwarka/No ratings yet

- Tata AIA Life Guaranteed Return Insurance Plan (UIN 20110N152V10) TandCDocument106 pagesTata AIA Life Guaranteed Return Insurance Plan (UIN 20110N152V10) TandCsaurabh chaudhariNo ratings yet

- ILife TCDocument3 pagesILife TClavanyadNo ratings yet

- Sahara NidhiDocument4 pagesSahara NidhiAyush DubeyNo ratings yet

- Reliance Child PlanDocument44 pagesReliance Child PlanNilesh PatilNo ratings yet

- Policy DocumentDocument12 pagesPolicy DocumentdjborseNo ratings yet

- Policy Doc LIC S New Jeevan Mangal V04Document15 pagesPolicy Doc LIC S New Jeevan Mangal V04mathvresh MathNo ratings yet

- Ko Tak Preferred Term PlanDocument7 pagesKo Tak Preferred Term PlanvtanmaynNo ratings yet

- Life Insurance Claims & COPRA 1986Document34 pagesLife Insurance Claims & COPRA 1986Samhitha KandlakuntaNo ratings yet

- Irda Protection of Policyholders Interests RegulationsDocument7 pagesIrda Protection of Policyholders Interests RegulationsSrikanth DubbakuNo ratings yet

- 20BAL094 - Contract AnalysisDocument24 pages20BAL094 - Contract AnalysisSrajan DixitNo ratings yet

- Exide Life New Fulfilling Life Anticipated Whole Life Plan (Fla) (Uin 114n024v01)Document11 pagesExide Life New Fulfilling Life Anticipated Whole Life Plan (Fla) (Uin 114n024v01)satheeskumar VikramasingarajNo ratings yet

- Insurance Act, 2010: Submitted To: Golam RamijDocument10 pagesInsurance Act, 2010: Submitted To: Golam RamijAshraful IslamNo ratings yet

- Max Life Group Credit Life Secure Policy Document v1Document19 pagesMax Life Group Credit Life Secure Policy Document v1Amit VermaNo ratings yet

- Tata AIA Life Insurance Sampoorna Raksha Supreme TC 110N160V02Document54 pagesTata AIA Life Insurance Sampoorna Raksha Supreme TC 110N160V02Aman GuptaNo ratings yet

- w3 - Contract Provisions in Life InsuranceDocument31 pagesw3 - Contract Provisions in Life InsuranceNur AliaNo ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- E5Document1 pageE5Cyril PilligrinNo ratings yet

- E4Document1 pageE4Cyril PilligrinNo ratings yet

- PDFDocument313 pagesPDFCyril PilligrinNo ratings yet

- Logo-Policy-document-LIC-s-Bima-Jyoti-dt-24122021 1Document1 pageLogo-Policy-document-LIC-s-Bima-Jyoti-dt-24122021 1Cyril PilligrinNo ratings yet

- Dhan Varsha Sales BrochureDocument12 pagesDhan Varsha Sales BrochureCyril PilligrinNo ratings yet

- Employment Notification For Non-Teaching Group ' A' Positions PDFDocument6 pagesEmployment Notification For Non-Teaching Group ' A' Positions PDFCyril PilligrinNo ratings yet