Professional Documents

Culture Documents

2 Workshop Solution 3

2 Workshop Solution 3

Uploaded by

Travelling UKOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2 Workshop Solution 3

2 Workshop Solution 3

Uploaded by

Travelling UKCopyright:

Available Formats

Learning Activity 3 solution

a) £

Total Sales (370 + 666 + 1,199 + 2,158) 4,393

Less: Production costs (222 + 400 + 719 + 1,295) (2,636)

Less: Total depreciation (290 x 4) (1,160)

Total profit 597

Average annual profit (597/4) 149

Average investment: (1,200 + 40)/2 620

ARR = 149/620 x 100% = 24.0%

b) £ £

Initial investment (time 0) (1,200) (1,200)

Net cash inflow (year 1)(370 - 222) 148 (1,052)

Net cash inflow (year 2)(666 - 400) 266 (786)

Net cash inflow (year 3)(1,199 - 719) 480 (306)

Net cash inflow (year 4)(2,158 - 1,295) 863 557

Realisation of assets (time 4) 40 597

If net cash inflows occur evenly through the year then payback will occur in 4 th

month of year 4(306/863). Payback is therefore, 3 years 4 months.

c)

ARR of the project is above the hurdle rate of 18% so the project should be

considered further. The company should not rely solely on non-discounted

techniques for appraising projects as these ignore the time value of money.

Environment factors should also be considered, such as building in an area of

outstanding natural beauty and also the health effects of toxic gases.

You might also like

- Assignment 2. Estimating Adidas' Equity ValueDocument4 pagesAssignment 2. Estimating Adidas' Equity Valuefasihullah1995No ratings yet

- Write Your Answer For Part A HereDocument9 pagesWrite Your Answer For Part A HereMATHEW JACOBNo ratings yet

- Answers: Operating Income Changes in Net Operating AssetsDocument6 pagesAnswers: Operating Income Changes in Net Operating AssetsNawarathna KumariNo ratings yet

- Instructor: Võ H NG Đ C Group Members:: T Khánh LinhDocument20 pagesInstructor: Võ H NG Đ C Group Members:: T Khánh LinhMai Trần100% (1)

- ACF214 Principles of Finance: Workshop Solutions 2017-2018Document11 pagesACF214 Principles of Finance: Workshop Solutions 2017-2018Syed Ahmer Hasnain JafferiNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Management Accounting Level 3/series 4 2008 (3024)Document14 pagesManagement Accounting Level 3/series 4 2008 (3024)Hein Linn Kyaw50% (2)

- Ceres Gardening ProjectDocument5 pagesCeres Gardening Projectritwika.sagnikNo ratings yet

- AnswersDocument7 pagesAnswersNirmal ShresthaNo ratings yet

- Answer Test Group No.2-K27ktDocument2 pagesAnswer Test Group No.2-K27ktThư ThưNo ratings yet

- CFAP 4 Winter 2023Document15 pagesCFAP 4 Winter 2023MuhammadNaumanNo ratings yet

- F 2 Nov 09 Specimen AnswersDocument9 pagesF 2 Nov 09 Specimen AnswersRobert MunyaradziNo ratings yet

- 3.EF232. FIM IL II Solution CMA September 2022 Exam.Document5 pages3.EF232. FIM IL II Solution CMA September 2022 Exam.nobiNo ratings yet

- Fund Raising Financials 2020 (Updated)Document24 pagesFund Raising Financials 2020 (Updated)Abhishek SinghNo ratings yet

- Accounting/Series 4 2007 (Code3001)Document17 pagesAccounting/Series 4 2007 (Code3001)Hein Linn Kyaw100% (2)

- Management Accounting Level 3/series 2 2008 (Code 3024)Document14 pagesManagement Accounting Level 3/series 2 2008 (Code 3024)Hein Linn Kyaw67% (3)

- Icahn - Earnings Presentation (9.30.20) VfinalDocument21 pagesIcahn - Earnings Presentation (9.30.20) VfinalMiguel RamosNo ratings yet

- AnswersDocument5 pagesAnswersduong duongNo ratings yet

- Revision AnswersDocument27 pagesRevision Answersi.minkovaNo ratings yet

- 9706 Y16 SM 2Document12 pages9706 Y16 SM 2Wi Mae RiNo ratings yet

- Lec 2 After Mid TermDocument11 pagesLec 2 After Mid TermsherygafaarNo ratings yet

- LixingcunDocument10 pagesLixingcunMeghna JhupseeNo ratings yet

- Accounting (IAS) /series 4 2007 (Code3901)Document17 pagesAccounting (IAS) /series 4 2007 (Code3901)Hein Linn Kyaw0% (1)

- Earnings Results: The 3rd Quarter Ended December 31, 2023Document32 pagesEarnings Results: The 3rd Quarter Ended December 31, 2023MV ShoesNo ratings yet

- 03 2151101 FikaDocument28 pages03 2151101 Fikarafi putraNo ratings yet

- Ans. Corporate Finance Part 2Document17 pagesAns. Corporate Finance Part 2HashimRazaNo ratings yet

- Manajemen Keuangan: Chapter 6: Making Capital Investment DecisionDocument9 pagesManajemen Keuangan: Chapter 6: Making Capital Investment Decision21. Syafira Indi KhoirunisaNo ratings yet

- Capital Plastic 2021Document78 pagesCapital Plastic 2021JanosNo ratings yet

- T4 June 07 AnsDocument6 pagesT4 June 07 AnssmhgilaniNo ratings yet

- SFM Book 3 Merger Mutual and TheoryDocument380 pagesSFM Book 3 Merger Mutual and TheorySagar singlaNo ratings yet

- The download Solution Manual for Corporate Financial Management 5th Edition by Glen Arnold ISBN 0273758837 9780273758839 full chapter new 2024Document29 pagesThe download Solution Manual for Corporate Financial Management 5th Edition by Glen Arnold ISBN 0273758837 9780273758839 full chapter new 2024gusanusaiora100% (13)

- Budgeting, Capital Structure, and Working Capital ManagementDocument11 pagesBudgeting, Capital Structure, and Working Capital Managementritu paudelNo ratings yet

- 2019 LBG q1 Ims CombinedDocument19 pages2019 LBG q1 Ims CombinedsaxobobNo ratings yet

- Interim Management StatementDocument10 pagesInterim Management StatementsaxobobNo ratings yet

- 14-Combining Financial Statements-Sept. 30, 07-Fin Com-ADocument4 pages14-Combining Financial Statements-Sept. 30, 07-Fin Com-ACOASTNo ratings yet

- c38fn2 - Revision Handout (2018)Document6 pagesc38fn2 - Revision Handout (2018)Syaimma Syed AliNo ratings yet

- F6uk 2013 Jun ADocument10 pagesF6uk 2013 Jun ADaniel B Boy NkrumahNo ratings yet

- ACCT500 (16) Answers To Seminar 6Document5 pagesACCT500 (16) Answers To Seminar 6rashid rahmanzada100% (1)

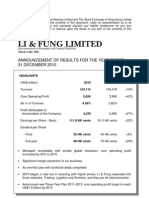

- Announcement of Results For The Year Ended 31 DECEMBER 2010: (Incorporated in Bermuda With Limited Liability)Document25 pagesAnnouncement of Results For The Year Ended 31 DECEMBER 2010: (Incorporated in Bermuda With Limited Liability)shiyeegohNo ratings yet

- Blackstone 1 Q 20 Earnings Press ReleaseDocument40 pagesBlackstone 1 Q 20 Earnings Press ReleaseZerohedgeNo ratings yet

- Reviewer MactwoDocument17 pagesReviewer MactwoJessa Iloso PerezNo ratings yet

- Sri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 30 September 2019Document14 pagesSri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 30 September 2019Nilupul BasnayakeNo ratings yet

- 2010 Second Quarter N Half Yr ResultsDocument33 pages2010 Second Quarter N Half Yr ResultsmandikiniNo ratings yet

- Presented To:-: Ms. Khushboo SherwaniDocument19 pagesPresented To:-: Ms. Khushboo SherwaniArchit Goel100% (1)

- Hayleys Surpasses Rs 100 BN Turnover in 1HFY18/19Document18 pagesHayleys Surpasses Rs 100 BN Turnover in 1HFY18/19Janitha DissanayakeNo ratings yet

- Complete Task - Buderim GingerDocument9 pagesComplete Task - Buderim GingerOne OrgNo ratings yet

- Accounting Grade 11 Revision Solutions Term 2 - 2024Document16 pagesAccounting Grade 11 Revision Solutions Term 2 - 2024Ongeziwe BokiNo ratings yet

- AnswersDocument11 pagesAnswerscatcat1122No ratings yet

- F9 - IPRO - Mock 1 - AnswersDocument12 pagesF9 - IPRO - Mock 1 - AnswersOlivier MNo ratings yet

- Capital Budgeting Cash Flows: Solutions To ProblemsDocument20 pagesCapital Budgeting Cash Flows: Solutions To ProblemsRau MohdNo ratings yet

- Capital Budget TemplateDocument1 pageCapital Budget TemplaterajvakNo ratings yet

- A Report On Financial Analysis of Next PLC 3Document11 pagesA Report On Financial Analysis of Next PLC 3Hamza AminNo ratings yet

- FSA - Class 15 - 13 October 2023 - RevSess2 - ExDocument15 pagesFSA - Class 15 - 13 October 2023 - RevSess2 - Exmhmdgholami0939No ratings yet

- Accounting IAS Model Answers Series 3 2006 Old SyllabusDocument20 pagesAccounting IAS Model Answers Series 3 2006 Old SyllabusAung Zaw HtweNo ratings yet

- MABALAZADocument4 pagesMABALAZAMahasa R HajiiNo ratings yet

- Final Exam Answer Scheme A141Document9 pagesFinal Exam Answer Scheme A141Hooi CheeNo ratings yet

- Managerial Economics (Chapter 14)Document28 pagesManagerial Economics (Chapter 14)api-3703724100% (1)

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet