Professional Documents

Culture Documents

FM (6th) Dec2018 PDF

FM (6th) Dec2018 PDF

Uploaded by

AxuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FM (6th) Dec2018 PDF

FM (6th) Dec2018 PDF

Uploaded by

AxuCopyright:

Available Formats

23329 23329 23329 23329 23329 23329 23329 23329 23329

23329 Roll No.

23329 23329 23329 23329 23329 Total23329

No. of Pages

23329 : 02 23329

Total No. of Questions : 07

B.Com (2013 to 2017 Batch) (Sem.–6)

23329 23329 23329 23329 23329 23329 23329 23329 23329

FINANCIAL MANAGEMENT

Subject Code : BCOP-603

Paper ID : [A2260]

23329 23329 23329 23329 23329 23329 23329 23329 23329

Time : 3 Hrs. Max. Marks : 60

INSTRUCTION TO CANDIDATES :

23329 23329 23329 23329 23329 23329 23329 23329 23329

1. SECTION-A is COMPULSORY consisting of TEN questions carrying T WO marks

each.

2. SECTION-B contains SIX questions carrying T EN marks each and a student has

to attempt any FOUR questions.

23329 23329 23329 23329 23329 23329 23329 23329 23329

m

23329 23329 23329 23329 SECTION-A

23329 23329 23329 23329 23329

1. Write short notes on the following :

o

23329 23329

i. 23329

Payback 23329

period method .r c23329 23329 23329 23329 23329

ii.

p e

Weighted average cost of capital

m

pa o

.r c

23329 23329 23329 23329 23329 23329 23329 23329 23329

br

iii. EBIT EPS Analysis

23329 23329

iv. Investment decision

23329 23329 23329

p e

23329 23329 23329 23329

v. Permanent working capital

p a

23329 23329 vi. Financial

23329 leverage23329 23329

br 23329 23329 23329 23329

vii. Aging Schedule of Receivables

23329 23329 23329 23329 23329 23329 23329 23329 23329

viii. Assumptions of EOQ

ix. Financial Plan

23329 23329 23329 23329 23329 23329 23329 23329 23329

x. Time value of money

23329 23329 23329 23329 23329 23329 23329 23329 23329

1 | M- 71028 (S3)-761

23329 23329 23329 23329 23329 23329 23329 23329 23329

23329 23329 23329 23329 23329 23329 23329 23329 23329

23329 23329 23329 23329 23329 23329 23329 23329 23329

SECTION-B

23329 23329 23329 23329 23329 23329 23329 23329 23329

2. What is financial management all about? How financial decision making involves risk

return trade off? How is the goal of wealth maximization a better operative criterion than

23329 23329 profit maximization?

23329 23329 23329 23329 23329 23329 23329

3. What are the various facets of working capital management? How the working capital

requirements are determined?

23329 23329 23329 23329 23329 23329 23329 23329 23329

4. What is capital budgeting and what are its important steps? Compare and contrast NPV vs.

IRR as method of appraising capital investments? Which method is better and why?

23329 23329 23329 23329 23329 23329 23329 23329 23329

5. What do you understand by cost of capital? How the cost of various sources of finance is

calculated?

23329 23329

6. Critically23329 23329

explain the MM approach to23329 23329

capital structure. 23329

Explain with 23329

suitable examples the 23329

arbitrage process of MM approach on capital structure.

7. What are23329

the various factors

23329 to be kept in mind while23329

framing dividend

23329 policy?

23329 23329 23329

o m 23329 23329

23329 23329 23329 23329

.r c

23329 23329 23329 23329 23329

p e m

pa o

.r c

23329 23329 23329 23329 23329 23329 23329 23329 23329

23329 23329 23329

br 23329 23329

p e

23329 23329 23329 23329

p a

23329 23329 23329 23329 23329

br 23329 23329 23329 23329

23329 23329 23329 23329 23329 23329 23329 23329 23329

23329 23329 23329 23329 23329 23329 23329 23329 23329

23329 23329 23329 23329 23329 23329 23329 23329 23329

2 | M- 71028 (S3)-761

23329 23329 23329 23329 23329 23329 23329 23329 23329

23329 23329 23329 23329 23329 23329 23329 23329 23329

You might also like

- Sylvia Gregorio Case StudyDocument10 pagesSylvia Gregorio Case StudyJoyleen Cervantes100% (2)

- Management Accounting: Roll No. Total No. of Pages: 02 Total No. of Questions: 07 - 5)Document2 pagesManagement Accounting: Roll No. Total No. of Pages: 02 Total No. of Questions: 07 - 5)sumanNo ratings yet

- FM (4th) May2019Document2 pagesFM (4th) May2019DISHU GUPTANo ratings yet

- HRM (3rd) May2019Document2 pagesHRM (3rd) May2019arunabh googiNo ratings yet

- Corporate Strategies: Instructions To CandidatesDocument2 pagesCorporate Strategies: Instructions To CandidatesRitik KaliaNo ratings yet

- POM (6th) May2018 PDFDocument2 pagesPOM (6th) May2018 PDFAnjali BhardwajNo ratings yet

- Production and Operations ManagementDocument2 pagesProduction and Operations ManagementTobalynti TiewsohNo ratings yet

- ED (6th) May2018Document2 pagesED (6th) May2018GovindaGowdaNo ratings yet

- ED (6th) May2019Document2 pagesED (6th) May2019GovindaGowdaNo ratings yet

- Cost Accounting-I: Instruction To CandidatesDocument2 pagesCost Accounting-I: Instruction To CandidatesKr Ish NaNo ratings yet

- Industrial Relations and Labour Laws: Instructions To CandidatesDocument2 pagesIndustrial Relations and Labour Laws: Instructions To CandidatesPriyanshi JhaNo ratings yet

- SPM (7th&8th) May2018Document2 pagesSPM (7th&8th) May2018Shubham rajputNo ratings yet

- Punjab Technical University: Management of Financial ServicesDocument2 pagesPunjab Technical University: Management of Financial ServicesMehak 731No ratings yet

- WT (6th) May2019Document2 pagesWT (6th) May2019Harnoor 420No ratings yet

- Accounting For Management: Instruction To CandidatesDocument2 pagesAccounting For Management: Instruction To CandidatesvikramvsuNo ratings yet

- CA (2nd) May2019Document2 pagesCA (2nd) May2019JahangirNo ratings yet

- ME (2nd) May2019 PDFDocument2 pagesME (2nd) May2019 PDFKavita sharmaNo ratings yet

- Jntuk 2 1 Mefa Nov 2017 Q PDocument5 pagesJntuk 2 1 Mefa Nov 2017 Q PsaiNo ratings yet

- SPM (7th 8th) May2019Document2 pagesSPM (7th 8th) May2019Shubham rajputNo ratings yet

- Financial Management: M-71204 Page 1 of 2Document2 pagesFinancial Management: M-71204 Page 1 of 2Siddharth Singh TomarNo ratings yet

- PPM (1st) May2019Document2 pagesPPM (1st) May2019Ankit SinghNo ratings yet

- PP (6th) May2019Document2 pagesPP (6th) May2019sakibhussain036No ratings yet

- IIM (6th) May2022Document2 pagesIIM (6th) May2022RAJEEV SHABOTRANo ratings yet

- Strategic Financial Management: Roll No. Total No. of Pages: 2 Total No. of Questions: 07Document2 pagesStrategic Financial Management: Roll No. Total No. of Pages: 2 Total No. of Questions: 07Abhishek ChaturvediNo ratings yet

- Cost Accounting-Ii: Instruction To CandidatesDocument2 pagesCost Accounting-Ii: Instruction To CandidatessumanNo ratings yet

- Principles of Management: Instruction To CandidatesDocument2 pagesPrinciples of Management: Instruction To CandidatesKartik KumarNo ratings yet

- BA (1st) May2019Document2 pagesBA (1st) May2019sg8rxyfvgxNo ratings yet

- Bba 4 Sem Financial Management 77425 Dec 2022Document3 pagesBba 4 Sem Financial Management 77425 Dec 2022Mehak SandhuNo ratings yet

- ME (2nd) May2018Document2 pagesME (2nd) May2018Shruti BansalNo ratings yet

- CAD CAM (5th) May2018 PDFDocument2 pagesCAD CAM (5th) May2018 PDFAnjaiah MadarapuNo ratings yet

- Managerial Economics: Instruction To CandidatesDocument2 pagesManagerial Economics: Instruction To CandidatesNihal MalviyaNo ratings yet

- MAD (6th) May2022Document2 pagesMAD (6th) May2022Mahnoor SiddiquiNo ratings yet

- Time: 3 Hours Max. Marks: 70Document2 pagesTime: 3 Hours Max. Marks: 70Saidinesh SurineniNo ratings yet

- Sec-B2 2022Document3 pagesSec-B2 2022Sanchari DasNo ratings yet

- Mfs (Mba) (4th) May2012Document2 pagesMfs (Mba) (4th) May2012Mehak 731No ratings yet

- Financial Management: Instruction To CandidatesDocument2 pagesFinancial Management: Instruction To CandidatesRishi MitraNo ratings yet

- FMP (2nd) May2016Document1 pageFMP (2nd) May2016Vandana AhujaNo ratings yet

- Data Base Management SystemDocument3 pagesData Base Management SystemSahil Sharma 734No ratings yet

- WWW - Manares U L Ts - Co.InDocument5 pagesWWW - Manares U L Ts - Co.InRashmi SharmaNo ratings yet

- CC (6th) May201989Document2 pagesCC (6th) May201989Harnoor 420No ratings yet

- Indian Financial SystemDocument2 pagesIndian Financial SystemgetfitonlineytNo ratings yet

- WT (6th) May2018Document2 pagesWT (6th) May2018Harnoor 420No ratings yet

- 53 Elective1 Advanced Financial Management Fresh CBCS 2016 17 and OnwardsDocument3 pages53 Elective1 Advanced Financial Management Fresh CBCS 2016 17 and OnwardsLaya NeeleshNo ratings yet

- R L F C: Ptudelhi - Vice@yahoo - Co.in Regional Learning & Facilitation Cent ReDocument71 pagesR L F C: Ptudelhi - Vice@yahoo - Co.in Regional Learning & Facilitation Cent Rerakhi962No ratings yet

- Income Tax - I: Roll No. Total No. of Pages: 02 Total No. of Questions: 07 - 5)Document2 pagesIncome Tax - I: Roll No. Total No. of Pages: 02 Total No. of Questions: 07 - 5)Radha RaniNo ratings yet

- SAPM (3rd) May2019Document2 pagesSAPM (3rd) May2019Kajal HeerNo ratings yet

- BOM (1st) May2018Document2 pagesBOM (1st) May2018ananya singhNo ratings yet

- CA (3rd) May2019Document3 pagesCA (3rd) May2019Arshan BhullarNo ratings yet

- Business Environment: M-72063 Page 1 of 2Document2 pagesBusiness Environment: M-72063 Page 1 of 2piyush kumarNo ratings yet

- DWM (5th) May2019Document2 pagesDWM (5th) May2019Navdeep KhubberNo ratings yet

- ME (1st) May2018Document2 pagesME (1st) May2018Deep InNo ratings yet

- Dr. Ambedkar Institute of Technology, Bangalore - 560 056Document3 pagesDr. Ambedkar Institute of Technology, Bangalore - 560 0561DA18EE013Gagana B.RNo ratings yet

- GIT (7th 8th) May2019Document2 pagesGIT (7th 8th) May2019DinekarNo ratings yet

- HRM (7th&8th) May2018Document2 pagesHRM (7th&8th) May2018Mir AzharNo ratings yet

- AI (6th) May2022Document2 pagesAI (6th) May2022Armaan SinghNo ratings yet

- Consumer Behaviour PDFDocument2 pagesConsumer Behaviour PDFAditya RajNo ratings yet

- C (1st) May2019Document2 pagesC (1st) May2019tushar jainNo ratings yet

- C (1st) May2019Document2 pagesC (1st) May2019Yuvraj KochharNo ratings yet

- MM (3rd) May2019Document2 pagesMM (3rd) May2019nehakalra2455No ratings yet

- CC (7th&8th) May2018Document2 pagesCC (7th&8th) May2018Abhi GiriNo ratings yet

- Reliance Communication Internship Report by Vikas DubeyDocument55 pagesReliance Communication Internship Report by Vikas DubeyDushyant TiwariNo ratings yet

- I. Match The Words With DefinitionsDocument3 pagesI. Match The Words With DefinitionsZaklina DonevskaNo ratings yet

- Management Games Andrews Industry 24Document9 pagesManagement Games Andrews Industry 24Rahul ChauhanNo ratings yet

- FS2 Le5Document2 pagesFS2 Le5Jorebell W. QuiminoNo ratings yet

- Purchasing and Supply Management 16th Edition Johnson Test BankDocument23 pagesPurchasing and Supply Management 16th Edition Johnson Test BankAnitaCareyfemy100% (41)

- Electricity WorksheetDocument4 pagesElectricity WorksheetSawyerNo ratings yet

- Caneda vs. CADocument3 pagesCaneda vs. CAAnnalie FranciscoNo ratings yet

- Personal Trading BehaviourDocument5 pagesPersonal Trading Behaviourapi-3739065No ratings yet

- History of HockeyDocument11 pagesHistory of HockeyLes LeynesNo ratings yet

- Cold Rooms Amp Insulated Panels TSSCDocument32 pagesCold Rooms Amp Insulated Panels TSSCZar KhariNo ratings yet

- UPCAT Pointers Science A. Chemistry C. Earth Science and AstronomyDocument2 pagesUPCAT Pointers Science A. Chemistry C. Earth Science and AstronomyJulia OrdonaNo ratings yet

- ManualDocument278 pagesManualAnnn SoooNo ratings yet

- Certificate of Participation: Republic of The PhilippinesDocument2 pagesCertificate of Participation: Republic of The PhilippinesYuri PamaranNo ratings yet

- Study of CRM at IBM An IT GiantDocument4 pagesStudy of CRM at IBM An IT GiantDarrick AroraNo ratings yet

- Mechanical Engineering Design CADDocument33 pagesMechanical Engineering Design CADمحمد عبداللهNo ratings yet

- Ipcc Law Case Studies 2Document12 pagesIpcc Law Case Studies 2Vaibhav MaheshwariNo ratings yet

- North Jersey Jewish Standard, April 17, 2015Document64 pagesNorth Jersey Jewish Standard, April 17, 2015New Jersey Jewish StandardNo ratings yet

- Ada Blackjack Answers (11-09-2021)Document4 pagesAda Blackjack Answers (11-09-2021)Blob BlobbyNo ratings yet

- Sec5a4 Abs AsrDocument94 pagesSec5a4 Abs AsrTadas PNo ratings yet

- Design of A Material Handling Equipment: Belt Conveyor System For Crushed Limestone Using 3 Roll IdlersDocument10 pagesDesign of A Material Handling Equipment: Belt Conveyor System For Crushed Limestone Using 3 Roll IdlersJake OkuyeNo ratings yet

- Scrambled MerchandisingDocument12 pagesScrambled MerchandisingNisha ChauhanNo ratings yet

- Customer NeedsDocument4 pagesCustomer Needstuan anh nguyenNo ratings yet

- 3 Grade: Unit of Study 1 Elements of Drama-Script Quarter 1 Key Concepts: SkillsDocument4 pages3 Grade: Unit of Study 1 Elements of Drama-Script Quarter 1 Key Concepts: SkillsSheila Mae Cordero TabuenaNo ratings yet

- Chapter 1 EnterprenureshipDocument16 pagesChapter 1 EnterprenureshipKavita RawatNo ratings yet

- Lead Generation GuideDocument82 pagesLead Generation GuidePepe El FritangasNo ratings yet

- Redacted PresentmentDocument11 pagesRedacted PresentmentWTXL ABC27No ratings yet

- WCCP Proxy ConfigurationDocument7 pagesWCCP Proxy ConfigurationMd Ariful IslamNo ratings yet

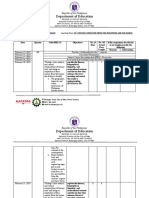

- MSAT-BOW-Template - Budget-of-Work-Matatag - Docx 21STDocument15 pagesMSAT-BOW-Template - Budget-of-Work-Matatag - Docx 21STmoanaNo ratings yet

- Wearable Technologies: Scott Mcgregor President & Ceo, Broadcom CorporationDocument23 pagesWearable Technologies: Scott Mcgregor President & Ceo, Broadcom CorporationRavi PilgarNo ratings yet