Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

52 viewsIFRS 4 Vs IFRS 17

IFRS 4 Vs IFRS 17

Uploaded by

Cristel TannaganIFRS 4 has inconsistencies that prevent fair comparisons of insurance companies and between insurance and non-insurance companies. IFRS 17 provides consistent accounting requirements to improve comparability. It requires insurance contracts to be measured based on current estimates and market information rather than outdated assumptions or the value of investment portfolios. IFRS 17 also improves transparency by providing more granular disclosures and separating insurance and financial results. The standard aims to provide more relevant and accurate information to investors about the value generated by insurance contracts over time.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- 2Document2 pages2noneofyourbusinessNo ratings yet

- Introduction To IFRS 17 May2021 LIMA MoGDocument35 pagesIntroduction To IFRS 17 May2021 LIMA MoGRahul IyerNo ratings yet

- IFRB 2023 06 Implications of IFRS 17 For Non InsurersDocument10 pagesIFRB 2023 06 Implications of IFRS 17 For Non InsurersSkymoonNo ratings yet

- Supervisory Implications of IFRS 17 Insurance Contracts - Executive SummaryDocument3 pagesSupervisory Implications of IFRS 17 Insurance Contracts - Executive SummaryЙоанна ЗNo ratings yet

- SummaryDocument3 pagesSummaryMaitet CarandangNo ratings yet

- Demystifying IFRS 17 Mahasen Kunapuli & ShrenikBaidDocument43 pagesDemystifying IFRS 17 Mahasen Kunapuli & ShrenikBaidWubneh AlemuNo ratings yet

- Knowledge Base Care Ifrs 17 (LRC)Document33 pagesKnowledge Base Care Ifrs 17 (LRC)grace sijabatNo ratings yet

- IFRS 4 Insurance ContractDocument24 pagesIFRS 4 Insurance ContractSalmanNo ratings yet

- AP Newsletter Q4 2018 PDFDocument28 pagesAP Newsletter Q4 2018 PDFMuhammad SheikhNo ratings yet

- IFRS 17 Level of Aggregation - Background Briefing Paper FinalDocument19 pagesIFRS 17 Level of Aggregation - Background Briefing Paper FinalEmmanuelNo ratings yet

- Ifrs InsDocument15 pagesIfrs InsMOORTHYNo ratings yet

- IFRS 17 - Profit Profiles Under IFRS 4 and IFRS 17 - 20190717 PDFDocument3 pagesIFRS 17 - Profit Profiles Under IFRS 4 and IFRS 17 - 20190717 PDFkhedidja attiaNo ratings yet

- AC511Document3 pagesAC511Kimkim EdilloNo ratings yet

- Ey Good Insurance General Model Paa Nov 2020Document99 pagesEy Good Insurance General Model Paa Nov 2020Arlinda MartinajNo ratings yet

- Accounting Standards Saudi Arabia InsuranceDocument8 pagesAccounting Standards Saudi Arabia InsurancecateNo ratings yet

- Afar.3416 Insurance ContractsDocument3 pagesAfar.3416 Insurance ContractsBennett GiftNo ratings yet

- Insurance ContractsDocument1 pageInsurance ContractsRicababeNo ratings yet

- GX Ifrs17 What Does It Mean For YouDocument12 pagesGX Ifrs17 What Does It Mean For YouZaid KamalNo ratings yet

- Summary of Ifrs 4Document3 pagesSummary of Ifrs 4Woodliness McMahon100% (2)

- Ifrs 4 - 2005Document89 pagesIfrs 4 - 2005jon_cpaNo ratings yet

- IFRS17 Considerations Health InsurersDocument4 pagesIFRS17 Considerations Health Insurersjester lawNo ratings yet

- PFRS 4 Insurance ContractsDocument16 pagesPFRS 4 Insurance ContractseiraNo ratings yet

- Financial Position and Performance in IFRS 17: Scandinavian Actuarial JournalDocument28 pagesFinancial Position and Performance in IFRS 17: Scandinavian Actuarial JournalUncle TeaNo ratings yet

- IFRS 17 Insurance Contracts - SummaryDocument8 pagesIFRS 17 Insurance Contracts - SummaryEltonNo ratings yet

- Yardimci Ufrs Rehberi PDFDocument39 pagesYardimci Ufrs Rehberi PDFEhli HibreNo ratings yet

- ADVANCE ASSIGNMENT FinalDocument17 pagesADVANCE ASSIGNMENT Finalaklilu shiferawNo ratings yet

- OBA Advisors LTDDocument7 pagesOBA Advisors LTDWALTA ETHIOPIA S. C.No ratings yet

- Ap2b Amendments To Ifrs 17Document11 pagesAp2b Amendments To Ifrs 17Ioanna ZlatevaNo ratings yet

- IFRS 4 Insurance ContractsDocument5 pagesIFRS 4 Insurance Contractstikki0219No ratings yet

- HO 7 - Other Special TopicsDocument16 pagesHO 7 - Other Special TopicsMaureen Kaye PaloNo ratings yet

- Ifrs 17 Insurance ContractsDocument144 pagesIfrs 17 Insurance Contractsace zero100% (1)

- 29 September: Accounting Developments NewsletterDocument4 pages29 September: Accounting Developments Newslettershaharhr1No ratings yet

- In The Spotlight: IFRS 17 Affects More Than Just Insurance CompaniesDocument14 pagesIn The Spotlight: IFRS 17 Affects More Than Just Insurance Companiesgir botNo ratings yet

- Audit DraftDocument11 pagesAudit DraftIvy Rose ZafraNo ratings yet

- Report Petrol Pump 2Document4 pagesReport Petrol Pump 2upendrasingh88No ratings yet

- 18 Ifrs 17Document14 pages18 Ifrs 17DM BuenconsejoNo ratings yet

- hu-seven-reasons-to-focus-IFR S17Document7 pageshu-seven-reasons-to-focus-IFR S17Zaid KamalNo ratings yet

- Summary On Ifrs and Ias StandardsDocument14 pagesSummary On Ifrs and Ias StandardsAlexNo ratings yet

- Summary of IFRS 4Document4 pagesSummary of IFRS 4Juanito TanamorNo ratings yet

- 1b. IFRS 17 - Insurance - Contracts - As - Amended - in - June - 2020 - An - Illustration - PWCDocument156 pages1b. IFRS 17 - Insurance - Contracts - As - Amended - in - June - 2020 - An - Illustration - PWCctprimaNo ratings yet

- 2b. Ey-Good-Life-Insurance-Pd-Oct-2018 - EYDocument99 pages2b. Ey-Good-Life-Insurance-Pd-Oct-2018 - EYctprimaNo ratings yet

- Ifrs 17 Project SummaryDocument16 pagesIfrs 17 Project Summarymarhadi100% (1)

- IFRS 7 Financial Instruments: Disclosures: Second EditionDocument36 pagesIFRS 7 Financial Instruments: Disclosures: Second EditionkradventoNo ratings yet

- Afar Quizzer - Insurance Contracts (Ifrs 17)Document5 pagesAfar Quizzer - Insurance Contracts (Ifrs 17)Ralph Adian Tolentino100% (1)

- IFRS 17 Simplified Case Study PDFDocument18 pagesIFRS 17 Simplified Case Study PDFAnonymous H1l0FwNYPS0% (1)

- Serhat Yanik - Evaluation of IFRS 17 For Insurance CompaniesDocument3 pagesSerhat Yanik - Evaluation of IFRS 17 For Insurance CompaniesMufid SupriyantoNo ratings yet

- Bridging The GAAP - IFRS 17 and LDTIDocument5 pagesBridging The GAAP - IFRS 17 and LDTImikfrancisNo ratings yet

- Icsaz IfrsDocument12 pagesIcsaz IfrsVictor GezanaNo ratings yet

- Ifrs 4 - Insurance Contract: Presented by - Harshal Thombare 27Document10 pagesIfrs 4 - Insurance Contract: Presented by - Harshal Thombare 27hthombare25No ratings yet

- Using Solvency II To Implement IFRSDocument40 pagesUsing Solvency II To Implement IFRSМансур ШарафутдиновNo ratings yet

- If Rs 4 PractitionersDocument78 pagesIf Rs 4 PractitionersAnup KumarNo ratings yet

- Chapter 22Document51 pagesChapter 22Sia DLSLNo ratings yet

- CFAS-ReportDocument3 pagesCFAS-Reportramirezmarctimothy28No ratings yet

- IFRS 17 Insurance Contracts Why Annual Cohorts 1588124015Document6 pagesIFRS 17 Insurance Contracts Why Annual Cohorts 1588124015Grace MoraesNo ratings yet

- Ifrs 17 Impact On Non Insurance EntitiesDocument8 pagesIfrs 17 Impact On Non Insurance EntitiesMohammad IslamNo ratings yet

- File 1 - Overview IFRS 17Document30 pagesFile 1 - Overview IFRS 17mcahya82No ratings yet

- 2-Behar Ifrs17-An Actuarial ChallengeDocument26 pages2-Behar Ifrs17-An Actuarial Challengesuba bNo ratings yet

- IFRS 9, The Impact To Financial Institutions More So Insurance Companies. Evidence From Leading Global Insurance ProvidersDocument4 pagesIFRS 9, The Impact To Financial Institutions More So Insurance Companies. Evidence From Leading Global Insurance Providerspatrick olaleNo ratings yet

- Summary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingFrom EverandSummary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingNo ratings yet

- 4ps - Q'sDocument2 pages4ps - Q'sCristel TannaganNo ratings yet

- Data Interpretation - EditedDocument25 pagesData Interpretation - EditedCristel TannaganNo ratings yet

- 4.4. Marital Status of The Household HeadDocument6 pages4.4. Marital Status of The Household HeadCristel TannaganNo ratings yet

- Chapter 15 - Audit TheoryDocument45 pagesChapter 15 - Audit TheoryCristel TannaganNo ratings yet

- Auditing and Assurance Services: Seventeenth EditionDocument41 pagesAuditing and Assurance Services: Seventeenth EditionCristel TannaganNo ratings yet

- Relationship Between Respondents' Marital Status and Their Spending PracticesDocument16 pagesRelationship Between Respondents' Marital Status and Their Spending PracticesCristel TannaganNo ratings yet

- 4PS DataDocument12 pages4PS DataCristel TannaganNo ratings yet

- Wrantech Co. (Inventory Sheet - Ria)Document28 pagesWrantech Co. (Inventory Sheet - Ria)Cristel TannaganNo ratings yet

- UntitledDocument5 pagesUntitledCristel TannaganNo ratings yet

- UntitledDocument5 pagesUntitledCristel TannaganNo ratings yet

- Final Examination Government AccountingDocument6 pagesFinal Examination Government AccountingCristel TannaganNo ratings yet

- Chapter 1 - GOV'T ACCOUNTINGDocument11 pagesChapter 1 - GOV'T ACCOUNTINGCristel TannaganNo ratings yet

- Unified Accounts Code StructureDocument5 pagesUnified Accounts Code StructureCristel TannaganNo ratings yet

- ABC - Final Exam: RequiredDocument17 pagesABC - Final Exam: RequiredCristel TannaganNo ratings yet

- Accounting Certification & Training Institute: Application FormDocument1 pageAccounting Certification & Training Institute: Application FormCristel TannaganNo ratings yet

- AST Final Examination: RequiredDocument21 pagesAST Final Examination: RequiredCristel TannaganNo ratings yet

- Tqs Finals Operations-AuditDocument46 pagesTqs Finals Operations-AuditCristel TannaganNo ratings yet

- SE Gov ActgDocument16 pagesSE Gov ActgCristel TannaganNo ratings yet

- Operations AuditingDocument2 pagesOperations AuditingCristel TannaganNo ratings yet

- BookkeepingDocument14 pagesBookkeepingCristel TannaganNo ratings yet

- Financial MarketsDocument5 pagesFinancial MarketsCristel TannaganNo ratings yet

- Ways On How To Reduce PovertyDocument4 pagesWays On How To Reduce PovertyCristel TannaganNo ratings yet

- NovemberDocument1 pageNovemberCristel TannaganNo ratings yet

- Answer: CDocument1 pageAnswer: CCristel TannaganNo ratings yet

- Report - Audit in CisDocument5 pagesReport - Audit in CisCristel TannaganNo ratings yet

- Module 9 Electronic Commerce E Commerce IndustryDocument12 pagesModule 9 Electronic Commerce E Commerce IndustryCristel TannaganNo ratings yet

- Business Combination and ConsolidationDocument21 pagesBusiness Combination and ConsolidationCristel TannaganNo ratings yet

- Economic Globalization and Sustainable DevelopmentDocument30 pagesEconomic Globalization and Sustainable DevelopmentCristel TannaganNo ratings yet

- 3 Audit ReportDocument50 pages3 Audit ReportCristel TannaganNo ratings yet

IFRS 4 Vs IFRS 17

IFRS 4 Vs IFRS 17

Uploaded by

Cristel Tannagan0 ratings0% found this document useful (0 votes)

52 views3 pagesIFRS 4 has inconsistencies that prevent fair comparisons of insurance companies and between insurance and non-insurance companies. IFRS 17 provides consistent accounting requirements to improve comparability. It requires insurance contracts to be measured based on current estimates and market information rather than outdated assumptions or the value of investment portfolios. IFRS 17 also improves transparency by providing more granular disclosures and separating insurance and financial results. The standard aims to provide more relevant and accurate information to investors about the value generated by insurance contracts over time.

Original Description:

Original Title

IFRS 4 vs IFRS 17.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIFRS 4 has inconsistencies that prevent fair comparisons of insurance companies and between insurance and non-insurance companies. IFRS 17 provides consistent accounting requirements to improve comparability. It requires insurance contracts to be measured based on current estimates and market information rather than outdated assumptions or the value of investment portfolios. IFRS 17 also improves transparency by providing more granular disclosures and separating insurance and financial results. The standard aims to provide more relevant and accurate information to investors about the value generated by insurance contracts over time.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

52 views3 pagesIFRS 4 Vs IFRS 17

IFRS 4 Vs IFRS 17

Uploaded by

Cristel TannaganIFRS 4 has inconsistencies that prevent fair comparisons of insurance companies and between insurance and non-insurance companies. IFRS 17 provides consistent accounting requirements to improve comparability. It requires insurance contracts to be measured based on current estimates and market information rather than outdated assumptions or the value of investment portfolios. IFRS 17 also improves transparency by providing more granular disclosures and separating insurance and financial results. The standard aims to provide more relevant and accurate information to investors about the value generated by insurance contracts over time.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

IFRS 4 vs IFRS 17

The purpose of establishing IFRS standards is to create a common

accounting language so that businesses and accounts can be understood and

compared between companies and between countries. The disclosure of

insurance contracts is covered by IFRS 4, but IFRS 4 has too many inconsistencies

to allow for fair comparisons between insurance companies and comparisons of

an insurance company to a non-insurance company, necessitating the use of IFRS

17. This provides a foundation for evaluating the impact of insurance contracts on

the entity's financial position, financial performance, and cash flows by those who

utilize financial statements.

IFRS 4 Main Issues

There were few changes made to the current insurance accounting

methods because IFRS 4 was only intended to be an interim standard when it was

implemented in 2004. With various accounting practices, insurance companies

might still compare identical insurance contracts. These practices developed

based on insurance contracts in a particular country, which also led to a

divergence between the accounting models used by the insurance business and

IFRS standards employed by other industries. As a result, there are few

opportunities for comparisons between the insurance and non-insurance sectors.

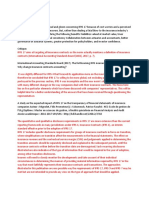

Existing Issues vs. how IFRS 17 improves accounting

Existing issues IFRS 17 requirements

Treatment varies depending on the type Companies will apply consistent accounting

of contract and entity interpretation. for all insurance contracts.

Extremely outdated estimates, including Estimates updated to reflect

those for long-term contract discounts current market-based information

Some companies measure insurance Companies will measure their insurance

contracts based on the value of their contracts based only on the obligations

investment portfolios created by these contracts

Some companies do not consider the time Companies will reflect the time value of

value of money when measuring liabilities money in estimated payments to settle

for claims. incurred claims.

Some multinational companies A multinational company will measure

consolidate their subsidiaries using insurance contracts consistently within the

different accounting policies for the same group, making it easier to compare results

type of insurance contracts written in by product and geographical area.

different countries.

Revenue includes premium and may Revenue excludes any investment

include an investment component component and represents the reduction of

the liabilities held as the entity provides

insurance service and respective risk is

released.

Reinsurance is calculated on a net basis Reinsurance is calculated separately

Disclosures help users understand Disclosures are more detailed and granular

amounts in the insurer’s financial

statements

Why does IFRS 17 replace IFRS 4?

The most recent accounting standard that addresses how an entity should

account for insurance contracts, and which addresses the identified drawbacks of

IFRS 4 (relevance, comparability, and transparency)

Comparability of insurers

Under IFRS 4, insurers could report insurance contracts using a

variety of practices and, in consolidated financial reports, could

consolidate that variety of practices. IFRS 17 will introduce a

consistent framework for reporting insurance contracts. IFRS 4

allowed inconsistency with other industries, including the reporting

of deposits as revenue and, in some jurisdictions, the reporting of life

insurance revenue on a cash basis. Under IFRS 17, revenue is

intended to reflect services provided in the same way as other

industries.

Transparency and quality of investor information

The objective of the new standard is to provide investors with better

knowledge about insurance contracts and the value that each insurer

generates. IFRS 17 accomplishes this, according to the IASB, by:

Combining current measurement of future cash flows with the

recognition of profit over the period that services are provided

under the contract.

Presenting insurance service results (including presentation of

insurance revenue) separately from insurance finance income or

expenses.

Requiring an entity to make an accounting policy choice of whether

to recognize all insurance finance income or expenses in profit or

loss or to recognize some of that income or expenses in other

comprehensive income.

Relevance

In many IFRS 4 implementations, outdated or locked-in assumptions

will be replaced by periodically updated current assumptions in IFRS 17.

IFRS 17 will accurately reflect the value of options and guarantees,

which was not always the case with IFRS 4 implementations. Discount

rates will take into account the IFRS 17 insurance contract liabilities

rather than the underlying assets. Overall, it is anticipated that IFRS 17

will more accurately reflect economic reality and the underlying

financial status and performance of insurance contracts.

You might also like

- 2Document2 pages2noneofyourbusinessNo ratings yet

- Introduction To IFRS 17 May2021 LIMA MoGDocument35 pagesIntroduction To IFRS 17 May2021 LIMA MoGRahul IyerNo ratings yet

- IFRB 2023 06 Implications of IFRS 17 For Non InsurersDocument10 pagesIFRB 2023 06 Implications of IFRS 17 For Non InsurersSkymoonNo ratings yet

- Supervisory Implications of IFRS 17 Insurance Contracts - Executive SummaryDocument3 pagesSupervisory Implications of IFRS 17 Insurance Contracts - Executive SummaryЙоанна ЗNo ratings yet

- SummaryDocument3 pagesSummaryMaitet CarandangNo ratings yet

- Demystifying IFRS 17 Mahasen Kunapuli & ShrenikBaidDocument43 pagesDemystifying IFRS 17 Mahasen Kunapuli & ShrenikBaidWubneh AlemuNo ratings yet

- Knowledge Base Care Ifrs 17 (LRC)Document33 pagesKnowledge Base Care Ifrs 17 (LRC)grace sijabatNo ratings yet

- IFRS 4 Insurance ContractDocument24 pagesIFRS 4 Insurance ContractSalmanNo ratings yet

- AP Newsletter Q4 2018 PDFDocument28 pagesAP Newsletter Q4 2018 PDFMuhammad SheikhNo ratings yet

- IFRS 17 Level of Aggregation - Background Briefing Paper FinalDocument19 pagesIFRS 17 Level of Aggregation - Background Briefing Paper FinalEmmanuelNo ratings yet

- Ifrs InsDocument15 pagesIfrs InsMOORTHYNo ratings yet

- IFRS 17 - Profit Profiles Under IFRS 4 and IFRS 17 - 20190717 PDFDocument3 pagesIFRS 17 - Profit Profiles Under IFRS 4 and IFRS 17 - 20190717 PDFkhedidja attiaNo ratings yet

- AC511Document3 pagesAC511Kimkim EdilloNo ratings yet

- Ey Good Insurance General Model Paa Nov 2020Document99 pagesEy Good Insurance General Model Paa Nov 2020Arlinda MartinajNo ratings yet

- Accounting Standards Saudi Arabia InsuranceDocument8 pagesAccounting Standards Saudi Arabia InsurancecateNo ratings yet

- Afar.3416 Insurance ContractsDocument3 pagesAfar.3416 Insurance ContractsBennett GiftNo ratings yet

- Insurance ContractsDocument1 pageInsurance ContractsRicababeNo ratings yet

- GX Ifrs17 What Does It Mean For YouDocument12 pagesGX Ifrs17 What Does It Mean For YouZaid KamalNo ratings yet

- Summary of Ifrs 4Document3 pagesSummary of Ifrs 4Woodliness McMahon100% (2)

- Ifrs 4 - 2005Document89 pagesIfrs 4 - 2005jon_cpaNo ratings yet

- IFRS17 Considerations Health InsurersDocument4 pagesIFRS17 Considerations Health Insurersjester lawNo ratings yet

- PFRS 4 Insurance ContractsDocument16 pagesPFRS 4 Insurance ContractseiraNo ratings yet

- Financial Position and Performance in IFRS 17: Scandinavian Actuarial JournalDocument28 pagesFinancial Position and Performance in IFRS 17: Scandinavian Actuarial JournalUncle TeaNo ratings yet

- IFRS 17 Insurance Contracts - SummaryDocument8 pagesIFRS 17 Insurance Contracts - SummaryEltonNo ratings yet

- Yardimci Ufrs Rehberi PDFDocument39 pagesYardimci Ufrs Rehberi PDFEhli HibreNo ratings yet

- ADVANCE ASSIGNMENT FinalDocument17 pagesADVANCE ASSIGNMENT Finalaklilu shiferawNo ratings yet

- OBA Advisors LTDDocument7 pagesOBA Advisors LTDWALTA ETHIOPIA S. C.No ratings yet

- Ap2b Amendments To Ifrs 17Document11 pagesAp2b Amendments To Ifrs 17Ioanna ZlatevaNo ratings yet

- IFRS 4 Insurance ContractsDocument5 pagesIFRS 4 Insurance Contractstikki0219No ratings yet

- HO 7 - Other Special TopicsDocument16 pagesHO 7 - Other Special TopicsMaureen Kaye PaloNo ratings yet

- Ifrs 17 Insurance ContractsDocument144 pagesIfrs 17 Insurance Contractsace zero100% (1)

- 29 September: Accounting Developments NewsletterDocument4 pages29 September: Accounting Developments Newslettershaharhr1No ratings yet

- In The Spotlight: IFRS 17 Affects More Than Just Insurance CompaniesDocument14 pagesIn The Spotlight: IFRS 17 Affects More Than Just Insurance Companiesgir botNo ratings yet

- Audit DraftDocument11 pagesAudit DraftIvy Rose ZafraNo ratings yet

- Report Petrol Pump 2Document4 pagesReport Petrol Pump 2upendrasingh88No ratings yet

- 18 Ifrs 17Document14 pages18 Ifrs 17DM BuenconsejoNo ratings yet

- hu-seven-reasons-to-focus-IFR S17Document7 pageshu-seven-reasons-to-focus-IFR S17Zaid KamalNo ratings yet

- Summary On Ifrs and Ias StandardsDocument14 pagesSummary On Ifrs and Ias StandardsAlexNo ratings yet

- Summary of IFRS 4Document4 pagesSummary of IFRS 4Juanito TanamorNo ratings yet

- 1b. IFRS 17 - Insurance - Contracts - As - Amended - in - June - 2020 - An - Illustration - PWCDocument156 pages1b. IFRS 17 - Insurance - Contracts - As - Amended - in - June - 2020 - An - Illustration - PWCctprimaNo ratings yet

- 2b. Ey-Good-Life-Insurance-Pd-Oct-2018 - EYDocument99 pages2b. Ey-Good-Life-Insurance-Pd-Oct-2018 - EYctprimaNo ratings yet

- Ifrs 17 Project SummaryDocument16 pagesIfrs 17 Project Summarymarhadi100% (1)

- IFRS 7 Financial Instruments: Disclosures: Second EditionDocument36 pagesIFRS 7 Financial Instruments: Disclosures: Second EditionkradventoNo ratings yet

- Afar Quizzer - Insurance Contracts (Ifrs 17)Document5 pagesAfar Quizzer - Insurance Contracts (Ifrs 17)Ralph Adian Tolentino100% (1)

- IFRS 17 Simplified Case Study PDFDocument18 pagesIFRS 17 Simplified Case Study PDFAnonymous H1l0FwNYPS0% (1)

- Serhat Yanik - Evaluation of IFRS 17 For Insurance CompaniesDocument3 pagesSerhat Yanik - Evaluation of IFRS 17 For Insurance CompaniesMufid SupriyantoNo ratings yet

- Bridging The GAAP - IFRS 17 and LDTIDocument5 pagesBridging The GAAP - IFRS 17 and LDTImikfrancisNo ratings yet

- Icsaz IfrsDocument12 pagesIcsaz IfrsVictor GezanaNo ratings yet

- Ifrs 4 - Insurance Contract: Presented by - Harshal Thombare 27Document10 pagesIfrs 4 - Insurance Contract: Presented by - Harshal Thombare 27hthombare25No ratings yet

- Using Solvency II To Implement IFRSDocument40 pagesUsing Solvency II To Implement IFRSМансур ШарафутдиновNo ratings yet

- If Rs 4 PractitionersDocument78 pagesIf Rs 4 PractitionersAnup KumarNo ratings yet

- Chapter 22Document51 pagesChapter 22Sia DLSLNo ratings yet

- CFAS-ReportDocument3 pagesCFAS-Reportramirezmarctimothy28No ratings yet

- IFRS 17 Insurance Contracts Why Annual Cohorts 1588124015Document6 pagesIFRS 17 Insurance Contracts Why Annual Cohorts 1588124015Grace MoraesNo ratings yet

- Ifrs 17 Impact On Non Insurance EntitiesDocument8 pagesIfrs 17 Impact On Non Insurance EntitiesMohammad IslamNo ratings yet

- File 1 - Overview IFRS 17Document30 pagesFile 1 - Overview IFRS 17mcahya82No ratings yet

- 2-Behar Ifrs17-An Actuarial ChallengeDocument26 pages2-Behar Ifrs17-An Actuarial Challengesuba bNo ratings yet

- IFRS 9, The Impact To Financial Institutions More So Insurance Companies. Evidence From Leading Global Insurance ProvidersDocument4 pagesIFRS 9, The Impact To Financial Institutions More So Insurance Companies. Evidence From Leading Global Insurance Providerspatrick olaleNo ratings yet

- Summary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingFrom EverandSummary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingNo ratings yet

- 4ps - Q'sDocument2 pages4ps - Q'sCristel TannaganNo ratings yet

- Data Interpretation - EditedDocument25 pagesData Interpretation - EditedCristel TannaganNo ratings yet

- 4.4. Marital Status of The Household HeadDocument6 pages4.4. Marital Status of The Household HeadCristel TannaganNo ratings yet

- Chapter 15 - Audit TheoryDocument45 pagesChapter 15 - Audit TheoryCristel TannaganNo ratings yet

- Auditing and Assurance Services: Seventeenth EditionDocument41 pagesAuditing and Assurance Services: Seventeenth EditionCristel TannaganNo ratings yet

- Relationship Between Respondents' Marital Status and Their Spending PracticesDocument16 pagesRelationship Between Respondents' Marital Status and Their Spending PracticesCristel TannaganNo ratings yet

- 4PS DataDocument12 pages4PS DataCristel TannaganNo ratings yet

- Wrantech Co. (Inventory Sheet - Ria)Document28 pagesWrantech Co. (Inventory Sheet - Ria)Cristel TannaganNo ratings yet

- UntitledDocument5 pagesUntitledCristel TannaganNo ratings yet

- UntitledDocument5 pagesUntitledCristel TannaganNo ratings yet

- Final Examination Government AccountingDocument6 pagesFinal Examination Government AccountingCristel TannaganNo ratings yet

- Chapter 1 - GOV'T ACCOUNTINGDocument11 pagesChapter 1 - GOV'T ACCOUNTINGCristel TannaganNo ratings yet

- Unified Accounts Code StructureDocument5 pagesUnified Accounts Code StructureCristel TannaganNo ratings yet

- ABC - Final Exam: RequiredDocument17 pagesABC - Final Exam: RequiredCristel TannaganNo ratings yet

- Accounting Certification & Training Institute: Application FormDocument1 pageAccounting Certification & Training Institute: Application FormCristel TannaganNo ratings yet

- AST Final Examination: RequiredDocument21 pagesAST Final Examination: RequiredCristel TannaganNo ratings yet

- Tqs Finals Operations-AuditDocument46 pagesTqs Finals Operations-AuditCristel TannaganNo ratings yet

- SE Gov ActgDocument16 pagesSE Gov ActgCristel TannaganNo ratings yet

- Operations AuditingDocument2 pagesOperations AuditingCristel TannaganNo ratings yet

- BookkeepingDocument14 pagesBookkeepingCristel TannaganNo ratings yet

- Financial MarketsDocument5 pagesFinancial MarketsCristel TannaganNo ratings yet

- Ways On How To Reduce PovertyDocument4 pagesWays On How To Reduce PovertyCristel TannaganNo ratings yet

- NovemberDocument1 pageNovemberCristel TannaganNo ratings yet

- Answer: CDocument1 pageAnswer: CCristel TannaganNo ratings yet

- Report - Audit in CisDocument5 pagesReport - Audit in CisCristel TannaganNo ratings yet

- Module 9 Electronic Commerce E Commerce IndustryDocument12 pagesModule 9 Electronic Commerce E Commerce IndustryCristel TannaganNo ratings yet

- Business Combination and ConsolidationDocument21 pagesBusiness Combination and ConsolidationCristel TannaganNo ratings yet

- Economic Globalization and Sustainable DevelopmentDocument30 pagesEconomic Globalization and Sustainable DevelopmentCristel TannaganNo ratings yet

- 3 Audit ReportDocument50 pages3 Audit ReportCristel TannaganNo ratings yet