Professional Documents

Culture Documents

2955136036057efd 16 - Constitutional Bodies Part - 1

2955136036057efd 16 - Constitutional Bodies Part - 1

Uploaded by

Abhinandan KhajuriaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2955136036057efd 16 - Constitutional Bodies Part - 1

2955136036057efd 16 - Constitutional Bodies Part - 1

Uploaded by

Abhinandan KhajuriaCopyright:

Available Formats

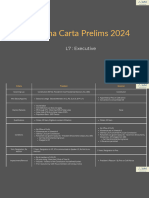

QUICK REVISION MODULE ( UPSC PRELIMS 2022) POLITY

CONSTITUTIONAL

BODIES (Part – 1)

Articles 315 Union Public Service Commission (UPSC)

to 323 State Public Service Commission (SPSC)

Article 280 Finance Commission (FC)

Article 148 Comptroller and Auditor General of India (CAG)

Article 279-A Goods and Services Tax (GST) Council

www.visionias.in Vision IAS 1

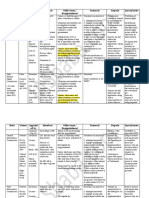

Union Public Service Commission & State Public Service Commission

UPSC UPSC

NRCH

Central recruiting agency in SHRC

Recruiting agency of the state.

India & watchdog of merit system

About Appointed by the President By Governor of the state based

based on the recommendation on the recommendations of a

of a Committee consisting of: committee consisting of the

Chairperson - The Prime Chief Minister as its head,

Minister The Home Minister Speaker of the Legislative

By

ThePresident

Leader of of India.

Opposition (L.S.) By Governor

Assembly (LA),of the state.

Appointment The Leader of Opposition (R.S.) State Home Minister and

Appointment The Speaker (L.S.) Leader of Opposition in LA.

The Deputy Chairman (R.S.) NOTE: For states having

Legislative Council, chairman

1. Chairman and other 1.Chairman and other members

and leader of opposition in the

members (Usually 9, including Note: Constitution has not

Council would also be the

Chairman) specied the strength of the

members.

Note: Constitution has not Commission and left it to the

specied the strength of the discretion of the Governor of

Composition

Commission and left it to the the state.

discretion of the President.

No qualication, except one half Same as UPSC.

m

of the members should be such

co

l.

persons who have held ofce for

ai

gm

Qualication at least 10 years under the GoI

@

23

or state government.

a1

kh

an

nd

na

hi

ab

Determined by President. Determined by Governor.

Condition of Service

6 years or until they attain age 6 years or until they attain age

of 65 years, whichever is of 62 years, whichever is

earlier. earlier.

Term of Ofce

Charged on Consolidated Entire expense of SPSC is

Fund of India (CFI) charged on the Consolidated

Salaries, allowances

Fund of State

and pensions

www.visionias.in Vision IAS 2

Re-Appointment

Chairman of UPSC Members of UPSC Chairman of SPSC Members of SPSC

(Not Eligible) (Eligible only for (Eligible only for (Eligible only for

appointment as appointment as appointment as

Chairman of UPSC Chairman of UPSC Chairman of UPSC and

or SPSC) and other SPSCs) SPSCs & menber of

UPSC)

REMOVAL of member/Chairman of UPSC or SPSC (by the President)

Manner and on grounds mentioned in On the grounds of misbehaviour:

Constitution: 1) In this case the President has to refer the

1) If he is adjudged insolvent or bankrupt, or matter to the Supreme Court for an enquiry and

2) If he occupies any other ofce of prot, or the advice tended by Supreme Court is

3) If he is unt to continue in ofce by reason binding on the President

of inrmity of mind or body.

NOTE: The Chairman and members of the SPSC can be removed only by

the President.

Roles & Responsibilties (UPSC + SPSC)

Recruitment Advisory Joint Recruitment Annual Report Jurisdiction of

m

co

1) UPSC - (All Function UPSC assists states President and UPSC and SPSC

l.

ai

India Services & Advices center (if requested by Governor present can also be

gm

@

Central Services) and state two or more states annual report to in extended by the

23

2) SPSC (State government in to do so) in the Parliament and Parliament and the

a1

kh

Services) promotion and framing and State legislature state legislature

an

disciplinary matters operating schemes respectively. respectively.

nd

na

of joint

hi

ab

recruitment for

any service.

FINANCE COMMISSION

Article 280

Constituted by the President of India every fth year or at such earlier time, as he considers

necessary.

Composition

Chairperson and four other members to be appointed by the President.

www.visionias.in Vision IAS 3

Qualication

The Constitution authorizes the Parliament to determine the qualications. Parliament enacted

Finance Commission act 1951accordingly, the Parliament has specied following qualications:

(i) Chairman - should be a person having experience in public affairs

(ii) Other four members should be selected from amongst the following:

1. A judge of high court or one qualied to be appointed as one.

2. A person who has specialized knowledge of nance and accounts of the government.

3. A person who has wide experience in nancial matters and in administration.

4. A person who has special knowledge of economics.

Term

They hold ofce for such period as specied by the President.

Reappointment

They are also eligible for reappointment.

FŎÖ ŐPǾŎÕÕÑǾMŌŇ ĖÞŇÒPŎǾĠÑŌÑǾMÕŎŅHŌŇÒM(CAG)

m

co

Functions

l.

ai

gm

Finance commission is required to make recommendations to the President on following matters:

@

23

1.Distribution of the net proceeds of taxes to be shared between the Centre and the states, and

a1

the allocation between the states of the respective shares of taxes.

kh

an

2.Principles that should govern the grants-in-aid (Article 275) to the states by Centre out of

nd

Consolidated Fund of India (CFI).

na

hi

3.Measures needed to augment the Consolidated Fund of a state to supplement the resources of the

ab

Panchayats and the municipalities in the state on the basis of recommendations made by the

State Finance Commission.

4.Any other matter referred to it by the President in the interests of sound nance.

Other Function

The Commission submits its report to the President which is laid before both the Houses of the

Parliament along with an explanatory memorandum as to the action taken on its recommendations.

NOTE: Recommendations made by the Finance Commission are only of advisory nature

and hence are not binding on the government. However, as a convention, its recommendations

are accepted by the government.

www.visionias.in Vision IAS 4

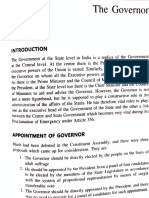

Comptroller and Auditor General of India (CAG)

Article

Article 148

There shall be an independent ofce of CAG appointed by the President by warrant under his hand

and seal.

Facts

1) Head of Indian Audit and Accounts department.

2) Guardian of public purse.

3) One of the bulwarks of the democratic system in India (others Supreme Court, election commission

and UPSC).

65

6

Term

Six years or up to age of 65 years, whichever is earlier.

Removal

Same manner and grounds as a judge of the Supreme Court of India:

m

Manner: He can be removed by the President on the basis of a resolution passed to that effect by

co

l.

both the Houses of Parliament with special majority.

ai

gm

Grounds: Either of proved misbehaviour or incapacity.

@

NOTE: He doesn't hold ofce during the pleasure of the President, though he is appointed by the

23

a1

President

kh

an

nd

na

hi

ab

Service Conditions

Determined by Parliament.

Reappointment

Not eligible for further ofce under both central as well as state government after he ceases to

hold his ofce.

Expense

Entire expense including the salaries, allowances and pensions of the CAG and persons serving in

that ofce is charged on the Consolidated Fund of India.

www.visionias.in Vision IAS 5

Article

Power and functions (Article 149)

Constitution empowers Parliament to prescribe the duties and powers. Accordingly, the

Parliament enacted the CAG's (Duties, Powers and conditions of service) Act, 1971:

1) AUDITING:

a) Accounts related to all expenditure from the consolidated fund, contingency fund and public

account of India of central, state UTs govt.

b) Receipts and expenditure of the centre and each state.

c) Accounts of any authority when requested by President or Governor.

d) Receipts and expenditure of the following:

I. All bodies and authorities substantially nanced from the Central or state revenues;

ii. Government companies; and

iii. Other corporations and bodies, when so required by related laws.

2) Advises the President regarding standards in which the account shall be kept.

3) Ascertains and certies net proceeds of any tax or duty and his certicate is nal.

4) Compiles and maintains the account of state government.

5) He acts as friend, philosopher, and guide to the Public Accounts Committee.

6) The CAG submits three audit reports to the President on:

a. Appropriation accounts,

b. Audit report on nance account, and

c. Audit report on public undertakings.

Similarly, CAG submits his audit reports of state accounts to the Governor, who place them before

the State legislature.

m

co

Limitations

l.

ai

gm

1) In practice CAG is fullling only the role of an Auditor General and not of a Comptroller.

@

2) It is just recommendatory in nature.

23

a1

3) When CAG asks for information from various departments, there is a considerable delay and there

kh

an

is no mechanism for CAG to enforce its at.

nd

4) Due to the lack of clarity in the CAG Act, there are no boundaries dened for a CAG audit.

na

hi

5) No power with respect to secret service expenditure

ab

www.visionias.in Vision IAS 6

GST Council

Mission

Evolving by a process of wider consultation a good & service tax structure with is information

technology driven & uses friendly

Vision

To establish highest standard of cooperative federalism in the functioning of GST council, which the

rst constitutional federal body vested with powers to take all major decision relating to GST

Article

Article 279-A

It is a constitutional body for making recommendations to Union & State Govt. on issues related to

GST. Constituted by the Presidential order after 60 days of enactment of GST Act

Composition

m

Chairperson - Union Finance Minister

co

Members:

l.

ai

gm

1) Union Minister of State in charge of Revenue or Finance as vice-chairpersion

@

2) Minister in charge of Finance or Taxation or any other Minister nominated by each State Government

23

a1

kh

an

nd

na

hi

ab

GOODS AND SE VICES

Quorum TAX COUNCIL

One-half of total number of Members of GST Council.

Decision Making

Every decision of the council has to be taken by a majority of not less than three-fourth of the

weighted votes of the members present & voting.

Weightage of Votes of:

1) Central government - one-third of the total votes cast.

2) All the state governments together - two-thirds of the total votes cast.

www.visionias.in Vision IAS 7

Functions:

The GST Council shall make recommendations to the Union and the States on:

1) The taxes, cesses and surcharges levied by the Union, the States and the local bodies which

may be subsumed in the GST.

2) The goods and services that may be subjected to, or exempted from the goods and services tax.

3) Model GST Laws, principles of levy, apportionment of GST levied on supplies in the course of inter-

state trade or commerce under article 269A and the principles that govern the place of supply.

4) Threshold limit of turnover below which goods and services may be exempted from GST.

5) The rates including oor rates with bands of GST.

6) Any special rate or rates for a specied period, to raise additional resources during any natural

calamity or disaster.

7) Special provision with respect to the some States like Arunachal Pradesh, Assam, Manipur,

Meghalaya, Mizoram, etc.

8) Any other matter relating to GST as the Council may decide.

9) GST Council shall recommend the date on which the GST will be levied on crude petroleum,

high speed diesel, motor spirit, natural gas and aviation turbine fuel.

m

co

l.

ai

gm

@

23

a1

kh

an

nd

na

hi

ab

www.visionias.in Vision IAS 8

You might also like

- Constitutional & Non Constitutional BodiesDocument6 pagesConstitutional & Non Constitutional Bodiesbakwas he60% (5)

- Constitutional Bodies - National IAS AcademyDocument18 pagesConstitutional Bodies - National IAS AcademyVenkatesh MallelaNo ratings yet

- Constitutional BodiesDocument5 pagesConstitutional BodiesTushar SanwareyNo ratings yet

- 123 Success in Prelims 2023 SIP Today's Class Advance PPT atDocument64 pages123 Success in Prelims 2023 SIP Today's Class Advance PPT atBhargav RajNo ratings yet

- 29591360360f05a9 20 - Non Constitutional Bodies Part - 2Document9 pages29591360360f05a9 20 - Non Constitutional Bodies Part - 2Abhinandan KhajuriaNo ratings yet

- Urg 2Document9 pagesUrg 2Tushar SanwareyNo ratings yet

- UnderStand UPSC PolityDocument34 pagesUnderStand UPSC PolityShweta KolewadNo ratings yet

- 5 PolityDocument5 pages5 PolitymanmeetNo ratings yet

- Constitutional Bodies PDFDocument13 pagesConstitutional Bodies PDFVip TopNo ratings yet

- Constitutional Body NotesDocument14 pagesConstitutional Body NotespaviliongmatNo ratings yet

- Constitutional and Non Constitutional BodiesDocument3 pagesConstitutional and Non Constitutional BodiesAnubhav SrivastavaNo ratings yet

- Final - Constitutional BodiesDocument10 pagesFinal - Constitutional Bodiesvaibhavbhargav15No ratings yet

- Final - Constitutional Bodies (V)Document5 pagesFinal - Constitutional Bodies (V)tpkhh8g5bjNo ratings yet

- L12 Bodies MC Prelims 2024 1 Lyst9202Document9 pagesL12 Bodies MC Prelims 2024 1 Lyst9202jankitkhareNo ratings yet

- One Pager Pdfresizer - Com-Pdf-ResizeDocument2 pagesOne Pager Pdfresizer - Com-Pdf-Resize29sfw4rvjmNo ratings yet

- 2 GS-2Document19 pages2 GS-2Rajat Kumar SinghNo ratings yet

- Non Constitutional BodiesDocument10 pagesNon Constitutional BodiesMadhu MadhuNo ratings yet

- Constitutional Non Constitutional Bodies English 92Document29 pagesConstitutional Non Constitutional Bodies English 92ravi kumarNo ratings yet

- Constitutional Satutory and Execcutive BodiesDocument21 pagesConstitutional Satutory and Execcutive BodiesMadhu Mugili MNo ratings yet

- L7 Executive - MC - Prelims - 2024 - 1 - Lyst9440Document7 pagesL7 Executive - MC - Prelims - 2024 - 1 - Lyst9440jankitkhareNo ratings yet

- Body Nature Appoint Ed by Members Office Term / Reappointment Removal Reports Special NotesDocument4 pagesBody Nature Appoint Ed by Members Office Term / Reappointment Removal Reports Special NotesPrynkaNo ratings yet

- Constitutional Bodies PDF in English - pdf-55Document3 pagesConstitutional Bodies PDF in English - pdf-55tanyagoswami11No ratings yet

- Polity 18 Governor Polity PDFDocument25 pagesPolity 18 Governor Polity PDFGaurav KumarNo ratings yet

- CA Primer NewDocument15 pagesCA Primer NewGia DirectoNo ratings yet

- State Public Service CommissionDocument5 pagesState Public Service CommissionAbhishek yadavNo ratings yet

- Polity - Constitutional BodiesDocument3 pagesPolity - Constitutional BodiesAkshayJhaNo ratings yet

- Standing Committee of The NPC of ChinaDocument4 pagesStanding Committee of The NPC of ChinaKhurram JuttNo ratings yet

- Follow UPSCINFOGRAPHICS in Yoda & Telegram: Who Is President of India?Document5 pagesFollow UPSCINFOGRAPHICS in Yoda & Telegram: Who Is President of India?Pooja AgarwalNo ratings yet

- Constitutional BodiesDocument3 pagesConstitutional BodiesTanu YadavNo ratings yet

- Constitutional BodiesDocument6 pagesConstitutional BodiesYuvina JancyNo ratings yet

- (NCC-Sem-5: RegulationDocument5 pages(NCC-Sem-5: RegulationPalak GuptaNo ratings yet

- Non Constitutional Bodies National IAS AcademyDocument15 pagesNon Constitutional Bodies National IAS AcademyTanu YadavNo ratings yet

- Bodies Polity 1Document1 pageBodies Polity 1AMIT PANDEYNo ratings yet

- National Commissions - SC, ST & OBC - 2Document3 pagesNational Commissions - SC, ST & OBC - 2Govind TripathiNo ratings yet

- 109 Constitutional Law Paper - IIDocument97 pages109 Constitutional Law Paper - IIbhatt.net.inNo ratings yet

- KGP-04 Polity Hand OutDocument7 pagesKGP-04 Polity Hand Outgamerbhaiya369No ratings yet

- Markmap 4Document1 pageMarkmap 4Muhammed ValayathNo ratings yet

- Constitutional and Non Constitutional BodiesDocument1 pageConstitutional and Non Constitutional Bodiesanandtiwariat787No ratings yet

- 7.public Service CommissionsDocument7 pages7.public Service CommissionsPOOJALASHMI V M 0099No ratings yet

- Polity Notes Manuj Jindal AIR 53Document250 pagesPolity Notes Manuj Jindal AIR 53rishiNo ratings yet

- Document 1Document7 pagesDocument 145satishNo ratings yet

- Non Constitutional BodiesDocument3 pagesNon Constitutional Bodiesbishal123456No ratings yet

- Constitutional BodiesDocument2 pagesConstitutional BodiesGaurav NaharNo ratings yet

- GovernorDocument9 pagesGovernorSuyash BhosaleNo ratings yet

- President & GovernorDocument18 pagesPresident & GovernorSandeep NehraNo ratings yet

- Union ExecutiveDocument11 pagesUnion ExecutiveJanet RoyNo ratings yet

- Constitutional BodiesDocument5 pagesConstitutional BodiesNaziaNo ratings yet

- Test 1 - 927 - 2017Document22 pagesTest 1 - 927 - 2017Ved Prakash MarvahNo ratings yet

- President and GovernorDocument13 pagesPresident and GovernorVinay PanditNo ratings yet

- The ParliamentDocument10 pagesThe ParliamentYogita AhlawatNo ratings yet

- Executive 094729Document3 pagesExecutive 094729Alano S. LimgasNo ratings yet

- Polity Notes For PrelimsDocument90 pagesPolity Notes For PrelimsVivekanand sahooNo ratings yet

- Consumer Protection Act 1986Document6 pagesConsumer Protection Act 1986Ramesh patilNo ratings yet

- Indian PolityDocument1 pageIndian Polityashraya2207No ratings yet

- U.P.S.C. and S.P.S.C. & INDIAN CONSTITUTIONDocument10 pagesU.P.S.C. and S.P.S.C. & INDIAN CONSTITUTIONPOOJALASHMI V M 0099No ratings yet

- Screenshot 2024-03-13 at 8.26.07 PMDocument2 pagesScreenshot 2024-03-13 at 8.26.07 PMAayushi chauhanNo ratings yet

- By Ankit Bajad SirDocument47 pagesBy Ankit Bajad SirMonalisha PattraNo ratings yet

- Constitutional and Non Constitutional Bodies - pdf-18Document7 pagesConstitutional and Non Constitutional Bodies - pdf-18Sushobhan MazumdarNo ratings yet

- Consumer Redressal AgenciesDocument9 pagesConsumer Redressal Agenciessamsun009No ratings yet

- Biodiversity IIDocument33 pagesBiodiversity IIAbhinandan KhajuriaNo ratings yet

- 294713603605becb-8 Parliament-Part 3Document7 pages294713603605becb-8 Parliament-Part 3Abhinandan KhajuriaNo ratings yet

- 29591360360f05a9 20 - Non Constitutional Bodies Part - 2Document9 pages29591360360f05a9 20 - Non Constitutional Bodies Part - 2Abhinandan KhajuriaNo ratings yet

- Complete ChemistryDocument60 pagesComplete ChemistryAbhinandan KhajuriaNo ratings yet

- Classroom 0 Biodiversity QuestionsDocument11 pagesClassroom 0 Biodiversity QuestionsAbhinandan KhajuriaNo ratings yet

- Mineral Resources in IndiaDocument9 pagesMineral Resources in IndiaAbhinandan KhajuriaNo ratings yet

- Hindu College Gazette - August September Issue-1Document91 pagesHindu College Gazette - August September Issue-1Abhinandan KhajuriaNo ratings yet

- Cds - Journey Live Class - Chemistry NotesDocument19 pagesCds - Journey Live Class - Chemistry NotesAbhinandan KhajuriaNo ratings yet

- Document (TrueScanner) 2022-11-13 6.16.4Document2 pagesDocument (TrueScanner) 2022-11-13 6.16.4Abhinandan KhajuriaNo ratings yet

- December Current AffairsDocument55 pagesDecember Current AffairsAbhinandan KhajuriaNo ratings yet

- e-EPIC MBD0059683Document1 pagee-EPIC MBD0059683Abhinandan KhajuriaNo ratings yet

- Complete PhysicsDocument54 pagesComplete PhysicsAbhinandan KhajuriaNo ratings yet

- Malus LawDocument9 pagesMalus LawAbhinandan KhajuriaNo ratings yet

- PlasmaDocument9 pagesPlasmaAbhinandan KhajuriaNo ratings yet

- CDS Current Affairs 1Document51 pagesCDS Current Affairs 1Abhinandan KhajuriaNo ratings yet

- 100 Current Affairs For CDS and NDA 1Document100 pages100 Current Affairs For CDS and NDA 1Abhinandan KhajuriaNo ratings yet

- Exp-1 Boltzmann ConstantDocument7 pagesExp-1 Boltzmann ConstantAbhinandan KhajuriaNo ratings yet

- 978f3-Mains-Mini-Test Geography 1 2184 e 2023Document2 pages978f3-Mains-Mini-Test Geography 1 2184 e 2023Abhinandan KhajuriaNo ratings yet

- Effects of EarthquakeDocument7 pagesEffects of EarthquakeAbhinandan KhajuriaNo ratings yet

- Ultrasonic GratingDocument6 pagesUltrasonic GratingAbhinandan KhajuriaNo ratings yet

- IvcDocument1 pageIvcAbhinandan KhajuriaNo ratings yet

- Law of Three Stages - Sociology LearnersDocument3 pagesLaw of Three Stages - Sociology LearnersAbhinandan KhajuriaNo ratings yet

- Joshi 1981Document32 pagesJoshi 1981Abhinandan KhajuriaNo ratings yet

- 291313603601cbdf 1 - Ancient India - Architecture and SculptureDocument23 pages291313603601cbdf 1 - Ancient India - Architecture and SculptureAbhinandan KhajuriaNo ratings yet

- 10.4324 9780203714560 PreviewpdfDocument35 pages10.4324 9780203714560 PreviewpdfAbhinandan KhajuriaNo ratings yet

- Conducting MediumDocument4 pagesConducting MediumAbhinandan KhajuriaNo ratings yet

- Indias Internal Security Challenges 2021 - IB ACIO 2 TIER 2 ExamDocument6 pagesIndias Internal Security Challenges 2021 - IB ACIO 2 TIER 2 ExamAbhinandan KhajuriaNo ratings yet

- Indias CYBER Security Challenges 2021 - IB ACIO 2 TIER 2 ExamDocument4 pagesIndias CYBER Security Challenges 2021 - IB ACIO 2 TIER 2 ExamAbhinandan KhajuriaNo ratings yet

- Akshay Ramanlal Desai - Introduction To Rural Sociology in India. 4Document262 pagesAkshay Ramanlal Desai - Introduction To Rural Sociology in India. 4Abhinandan KhajuriaNo ratings yet