Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

8 viewsSS Illustrative Example Ita

SS Illustrative Example Ita

Uploaded by

sharifah nurshahira sakinaThis document provides an example calculation of investment tax allowances (ITA) for a company over three years (2020-2022). It shows the qualifying capital expenditures, calculation of ITA at 60% of expenditures, the statutory business income each year, utilization of ITA to reduce taxable income, and the carry forward of any unused ITA to future years. The total ITA available over the three years amounts to RM2.7 million.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision Questionskelvinmunashenyamutumba100% (1)

- REVISED SS CT FAR270 May 2021 With ExplanationDocument4 pagesREVISED SS CT FAR270 May 2021 With Explanationsharifah nurshahira sakinaNo ratings yet

- Chapter-04 Completing The Accounting Cycle (Maths)Document9 pagesChapter-04 Completing The Accounting Cycle (Maths)ShifatNo ratings yet

- Example1 - Investment IncentiveDocument6 pagesExample1 - Investment IncentiveRaudhatun Nisa'No ratings yet

- Solution Illustrative Example PSDocument1 pageSolution Illustrative Example PSsharifah nurshahira sakinaNo ratings yet

- Tutorial 2 (3) 3 (E)Document2 pagesTutorial 2 (3) 3 (E)Shan JeefNo ratings yet

- T2 Revised Ans. (PS & ITA)Document8 pagesT2 Revised Ans. (PS & ITA)alvinmono.718No ratings yet

- T3 Ans. (RA)Document6 pagesT3 Ans. (RA)KY LawNo ratings yet

- T2 Ans. (PS & ITA)Document8 pagesT2 Ans. (PS & ITA)KY LawNo ratings yet

- CF Assignment 1 06102022 091143pmDocument1 pageCF Assignment 1 06102022 091143pmhadsem78No ratings yet

- SS June 2022Document1 pageSS June 2022ALIESYA FARHANA ALI HUSSAIN GHAZALINo ratings yet

- Acc106 Assignment 2 Tie Beauty Enterprise FinalDocument15 pagesAcc106 Assignment 2 Tie Beauty Enterprise Finalnur anisNo ratings yet

- Book2 (1) 2Document5 pagesBook2 (1) 2Alfonsus William BudiNo ratings yet

- Tutorial 7 A - Tax IncentivesDocument4 pagesTutorial 7 A - Tax IncentivesKEAN WAI NGNo ratings yet

- Flexible BudgetDocument4 pagesFlexible BudgetSeli Fitria Rahma DiantikaNo ratings yet

- Expenditures Rupees Income RupeesDocument7 pagesExpenditures Rupees Income Rupeessaima saeedNo ratings yet

- Financial Accounting Ifrs 4e Solution Ch04Document50 pagesFinancial Accounting Ifrs 4e Solution Ch04蔡宜欣No ratings yet

- Answer Tax317 Scheme July 2022Document10 pagesAnswer Tax317 Scheme July 2022Kirei RoseNo ratings yet

- Lecture 2 Answer1 1564205815261Document18 pagesLecture 2 Answer1 1564205815261Trinesh BhargavaNo ratings yet

- 18 Dec 2020 ADocument8 pages18 Dec 2020 AYIN LING CHOYNo ratings yet

- Assignment 1Document9 pagesAssignment 1Seemab KanwalNo ratings yet

- SCF With DODocument3 pagesSCF With DOMuhammad Asif KhanNo ratings yet

- Question 5: Ias 7 Statements of Cash FlowsDocument4 pagesQuestion 5: Ias 7 Statements of Cash FlowsShiza ArifNo ratings yet

- Tutorial 2 Question 4 - ITA Year: BIZ UnabsorbedDocument12 pagesTutorial 2 Question 4 - ITA Year: BIZ UnabsorbedSDASDNo ratings yet

- 3rd Quarter 2021Document19 pages3rd Quarter 2021sakib9949No ratings yet

- Financial Plan AtstyleDocument4 pagesFinancial Plan AtstyleM.ShahnamNo ratings yet

- IndexDocument29 pagesIndexBình QuốcNo ratings yet

- Mid Sem Part 1Document9 pagesMid Sem Part 1Razanna HanimNo ratings yet

- 2016-2017 2017-2018 2018-2019 All Values in INR ThousandsDocument18 pages2016-2017 2017-2018 2018-2019 All Values in INR ThousandsSomlina MukherjeeNo ratings yet

- Working PaperDocument7 pagesWorking PaperWinnie LaraNo ratings yet

- Financial Accounting Ifrs 4e Chapter 4 SolutionDocument50 pagesFinancial Accounting Ifrs 4e Chapter 4 SolutionSana SoomroNo ratings yet

- October 27 - Special DeductionsDocument3 pagesOctober 27 - Special DeductionsDarius DelacruzNo ratings yet

- BU51009 (5BA) - Assessed Coursework - EBT 2019-20Document2 pagesBU51009 (5BA) - Assessed Coursework - EBT 2019-20Sravya MagantiNo ratings yet

- Afar 05aDocument3 pagesAfar 05aJhekka FerrerNo ratings yet

- Solution Key To Problem Set 2Document6 pagesSolution Key To Problem Set 2Ayush RaiNo ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced TaxationDocument10 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced TaxationNarendra KumarNo ratings yet

- I Fitness Venture StandaloneDocument15 pagesI Fitness Venture StandaloneThe keyboard PlayerNo ratings yet

- CAC1201201008 Financial Accounting 1BDocument6 pagesCAC1201201008 Financial Accounting 1Bnyasha gundaniNo ratings yet

- Class Discussion On Ratios 28022023Document2 pagesClass Discussion On Ratios 28022023lil telNo ratings yet

- Illustration For Financial Analysis Using RatioDocument2 pagesIllustration For Financial Analysis Using RatioamahaktNo ratings yet

- Tutorial 2 (2) 1 (D)Document1 pageTutorial 2 (2) 1 (D)Shan JeefNo ratings yet

- Paw and Saw DownstreamDocument3 pagesPaw and Saw DownstreamLorie Roncal JimenezNo ratings yet

- Bangladesh IFRS Project Extended Question - SanganaDocument13 pagesBangladesh IFRS Project Extended Question - SanganaShakhawatNo ratings yet

- Chapter 7 Up StreamDocument14 pagesChapter 7 Up StreamAditya Agung SatrioNo ratings yet

- Apple RatiosDocument19 pagesApple RatiosJims Leñar CezarNo ratings yet

- Financial Template GuidelineDocument9 pagesFinancial Template GuidelineAmzar SaniNo ratings yet

- UE MC 2023-2024 Exercíse 9 B2 Solution1Document1 pageUE MC 2023-2024 Exercíse 9 B2 Solution1Sami El YadiniNo ratings yet

- Tutorial 8Document6 pagesTutorial 8WEI QUAN LEENo ratings yet

- Financial Plan OkDocument7 pagesFinancial Plan OkSYED ARSALANNo ratings yet

- Intercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Document31 pagesIntercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Abegail LibreaNo ratings yet

- StoqnamadruateDocument4 pagesStoqnamadruateDela cruz, Hainrich (Hain)No ratings yet

- Aminah Quiz Answer Done by Abdullah Narejo-The Great.Document10 pagesAminah Quiz Answer Done by Abdullah Narejo-The Great.Abdullah NarejoNo ratings yet

- Mid Sem RevisionDocument4 pagesMid Sem Revisionannissofea2708No ratings yet

- Anandam Case AnalysisDocument5 pagesAnandam Case AnalysisVini ShethNo ratings yet

- Ifrs 8+ias36+ias24 - ExcercisesDocument12 pagesIfrs 8+ias36+ias24 - ExcercisesLEEN hashemNo ratings yet

- FAC 2602 - 2023 - S1 - Assessment 4 SolutionDocument13 pagesFAC 2602 - 2023 - S1 - Assessment 4 SolutionlennoxhaniNo ratings yet

- Seminar 09 Calculating NCInt Simple Example ColourDocument2 pagesSeminar 09 Calculating NCInt Simple Example Colour金鑫No ratings yet

- A4 PalacioDocument3 pagesA4 PalacioPinky DaisiesNo ratings yet

- Book 11Document4 pagesBook 11Actg SolmanNo ratings yet

- Chap 18 - Revenue RecognitionDocument11 pagesChap 18 - Revenue RecognitionResnika TanNo ratings yet

- Codification of Statements on Auditing Standards: Numbers 122 to 133, January 2018From EverandCodification of Statements on Auditing Standards: Numbers 122 to 133, January 2018No ratings yet

- SS - TEST FAR270 - NOV 2022 Set 2 StudentDocument5 pagesSS - TEST FAR270 - NOV 2022 Set 2 Studentsharifah nurshahira sakinaNo ratings yet

- Activity 2 Basis PeriodDocument1 pageActivity 2 Basis Periodsharifah nurshahira sakinaNo ratings yet

- SS CT 1 FAR270 Sem MAC2022 StudentDocument4 pagesSS CT 1 FAR270 Sem MAC2022 Studentsharifah nurshahira sakinaNo ratings yet

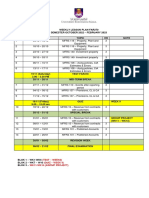

- 0 - Far270 - Weekly Lesson Plan - Oct 2022 PDFDocument2 pages0 - Far270 - Weekly Lesson Plan - Oct 2022 PDFsharifah nurshahira sakinaNo ratings yet

- Format YA 2022Document2 pagesFormat YA 2022sharifah nurshahira sakinaNo ratings yet

- Solution Illustrative Example PSDocument1 pageSolution Illustrative Example PSsharifah nurshahira sakinaNo ratings yet

- Tax317 Ctmay2022Document10 pagesTax317 Ctmay2022sharifah nurshahira sakinaNo ratings yet

- TAX317 TEST Q Dec2021Document10 pagesTAX317 TEST Q Dec2021sharifah nurshahira sakinaNo ratings yet

SS Illustrative Example Ita

SS Illustrative Example Ita

Uploaded by

sharifah nurshahira sakina0 ratings0% found this document useful (0 votes)

8 views1 pageThis document provides an example calculation of investment tax allowances (ITA) for a company over three years (2020-2022). It shows the qualifying capital expenditures, calculation of ITA at 60% of expenditures, the statutory business income each year, utilization of ITA to reduce taxable income, and the carry forward of any unused ITA to future years. The total ITA available over the three years amounts to RM2.7 million.

Original Description:

ILLUSTRATION

Original Title

SS ILLUSTRATIVE EXAMPLE ITA (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an example calculation of investment tax allowances (ITA) for a company over three years (2020-2022). It shows the qualifying capital expenditures, calculation of ITA at 60% of expenditures, the statutory business income each year, utilization of ITA to reduce taxable income, and the carry forward of any unused ITA to future years. The total ITA available over the three years amounts to RM2.7 million.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

8 views1 pageSS Illustrative Example Ita

SS Illustrative Example Ita

Uploaded by

sharifah nurshahira sakinaThis document provides an example calculation of investment tax allowances (ITA) for a company over three years (2020-2022). It shows the qualifying capital expenditures, calculation of ITA at 60% of expenditures, the statutory business income each year, utilization of ITA to reduce taxable income, and the carry forward of any unused ITA to future years. The total ITA available over the three years amounts to RM2.7 million.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

SS ILLUSTRATIVE EXAMPLE ITA

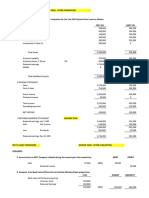

SOLUTION COMPREHENSIVE EXAMPLE: INVESTMENT TAX ALLOWANCES

Calculate the chargeable income and exempt income account available for the year of

assessment 2020 to 2022.

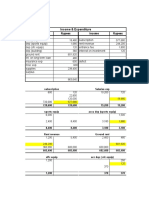

2020 2021 2022 Total

ITA Working

Qualifying capital expenditure (QCE)

Factory building 2,000 -

Plant and machinery 900 800

Total QCE 2,900 800

ITA@ 60% QCE 1,740 480

RM’000 RM’000 RM’000 RM’000

Statutory Business Income (SBI) 2,000 3,300 4,500

Less: ITA utilised (Refer ITA working) (1,400) (820) (480)

SBI after exemption 600 2,480 4,020

ITA b/f Nil 340 -

Add: CY ITA: 60% QCE 1,740 480 480

Total ITA Available 1,740 820 480

Less: Utilised during the year (restricted to (1,400) (820) (480)

70% SBI)

ITA c/f 340 Nil Nil

70% of SBI 1,400 2,310 3,150

Amount credited to EIA 1,400 820 480 2,700

You might also like

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision Questionskelvinmunashenyamutumba100% (1)

- REVISED SS CT FAR270 May 2021 With ExplanationDocument4 pagesREVISED SS CT FAR270 May 2021 With Explanationsharifah nurshahira sakinaNo ratings yet

- Chapter-04 Completing The Accounting Cycle (Maths)Document9 pagesChapter-04 Completing The Accounting Cycle (Maths)ShifatNo ratings yet

- Example1 - Investment IncentiveDocument6 pagesExample1 - Investment IncentiveRaudhatun Nisa'No ratings yet

- Solution Illustrative Example PSDocument1 pageSolution Illustrative Example PSsharifah nurshahira sakinaNo ratings yet

- Tutorial 2 (3) 3 (E)Document2 pagesTutorial 2 (3) 3 (E)Shan JeefNo ratings yet

- T2 Revised Ans. (PS & ITA)Document8 pagesT2 Revised Ans. (PS & ITA)alvinmono.718No ratings yet

- T3 Ans. (RA)Document6 pagesT3 Ans. (RA)KY LawNo ratings yet

- T2 Ans. (PS & ITA)Document8 pagesT2 Ans. (PS & ITA)KY LawNo ratings yet

- CF Assignment 1 06102022 091143pmDocument1 pageCF Assignment 1 06102022 091143pmhadsem78No ratings yet

- SS June 2022Document1 pageSS June 2022ALIESYA FARHANA ALI HUSSAIN GHAZALINo ratings yet

- Acc106 Assignment 2 Tie Beauty Enterprise FinalDocument15 pagesAcc106 Assignment 2 Tie Beauty Enterprise Finalnur anisNo ratings yet

- Book2 (1) 2Document5 pagesBook2 (1) 2Alfonsus William BudiNo ratings yet

- Tutorial 7 A - Tax IncentivesDocument4 pagesTutorial 7 A - Tax IncentivesKEAN WAI NGNo ratings yet

- Flexible BudgetDocument4 pagesFlexible BudgetSeli Fitria Rahma DiantikaNo ratings yet

- Expenditures Rupees Income RupeesDocument7 pagesExpenditures Rupees Income Rupeessaima saeedNo ratings yet

- Financial Accounting Ifrs 4e Solution Ch04Document50 pagesFinancial Accounting Ifrs 4e Solution Ch04蔡宜欣No ratings yet

- Answer Tax317 Scheme July 2022Document10 pagesAnswer Tax317 Scheme July 2022Kirei RoseNo ratings yet

- Lecture 2 Answer1 1564205815261Document18 pagesLecture 2 Answer1 1564205815261Trinesh BhargavaNo ratings yet

- 18 Dec 2020 ADocument8 pages18 Dec 2020 AYIN LING CHOYNo ratings yet

- Assignment 1Document9 pagesAssignment 1Seemab KanwalNo ratings yet

- SCF With DODocument3 pagesSCF With DOMuhammad Asif KhanNo ratings yet

- Question 5: Ias 7 Statements of Cash FlowsDocument4 pagesQuestion 5: Ias 7 Statements of Cash FlowsShiza ArifNo ratings yet

- Tutorial 2 Question 4 - ITA Year: BIZ UnabsorbedDocument12 pagesTutorial 2 Question 4 - ITA Year: BIZ UnabsorbedSDASDNo ratings yet

- 3rd Quarter 2021Document19 pages3rd Quarter 2021sakib9949No ratings yet

- Financial Plan AtstyleDocument4 pagesFinancial Plan AtstyleM.ShahnamNo ratings yet

- IndexDocument29 pagesIndexBình QuốcNo ratings yet

- Mid Sem Part 1Document9 pagesMid Sem Part 1Razanna HanimNo ratings yet

- 2016-2017 2017-2018 2018-2019 All Values in INR ThousandsDocument18 pages2016-2017 2017-2018 2018-2019 All Values in INR ThousandsSomlina MukherjeeNo ratings yet

- Working PaperDocument7 pagesWorking PaperWinnie LaraNo ratings yet

- Financial Accounting Ifrs 4e Chapter 4 SolutionDocument50 pagesFinancial Accounting Ifrs 4e Chapter 4 SolutionSana SoomroNo ratings yet

- October 27 - Special DeductionsDocument3 pagesOctober 27 - Special DeductionsDarius DelacruzNo ratings yet

- BU51009 (5BA) - Assessed Coursework - EBT 2019-20Document2 pagesBU51009 (5BA) - Assessed Coursework - EBT 2019-20Sravya MagantiNo ratings yet

- Afar 05aDocument3 pagesAfar 05aJhekka FerrerNo ratings yet

- Solution Key To Problem Set 2Document6 pagesSolution Key To Problem Set 2Ayush RaiNo ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced TaxationDocument10 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced TaxationNarendra KumarNo ratings yet

- I Fitness Venture StandaloneDocument15 pagesI Fitness Venture StandaloneThe keyboard PlayerNo ratings yet

- CAC1201201008 Financial Accounting 1BDocument6 pagesCAC1201201008 Financial Accounting 1Bnyasha gundaniNo ratings yet

- Class Discussion On Ratios 28022023Document2 pagesClass Discussion On Ratios 28022023lil telNo ratings yet

- Illustration For Financial Analysis Using RatioDocument2 pagesIllustration For Financial Analysis Using RatioamahaktNo ratings yet

- Tutorial 2 (2) 1 (D)Document1 pageTutorial 2 (2) 1 (D)Shan JeefNo ratings yet

- Paw and Saw DownstreamDocument3 pagesPaw and Saw DownstreamLorie Roncal JimenezNo ratings yet

- Bangladesh IFRS Project Extended Question - SanganaDocument13 pagesBangladesh IFRS Project Extended Question - SanganaShakhawatNo ratings yet

- Chapter 7 Up StreamDocument14 pagesChapter 7 Up StreamAditya Agung SatrioNo ratings yet

- Apple RatiosDocument19 pagesApple RatiosJims Leñar CezarNo ratings yet

- Financial Template GuidelineDocument9 pagesFinancial Template GuidelineAmzar SaniNo ratings yet

- UE MC 2023-2024 Exercíse 9 B2 Solution1Document1 pageUE MC 2023-2024 Exercíse 9 B2 Solution1Sami El YadiniNo ratings yet

- Tutorial 8Document6 pagesTutorial 8WEI QUAN LEENo ratings yet

- Financial Plan OkDocument7 pagesFinancial Plan OkSYED ARSALANNo ratings yet

- Intercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Document31 pagesIntercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Abegail LibreaNo ratings yet

- StoqnamadruateDocument4 pagesStoqnamadruateDela cruz, Hainrich (Hain)No ratings yet

- Aminah Quiz Answer Done by Abdullah Narejo-The Great.Document10 pagesAminah Quiz Answer Done by Abdullah Narejo-The Great.Abdullah NarejoNo ratings yet

- Mid Sem RevisionDocument4 pagesMid Sem Revisionannissofea2708No ratings yet

- Anandam Case AnalysisDocument5 pagesAnandam Case AnalysisVini ShethNo ratings yet

- Ifrs 8+ias36+ias24 - ExcercisesDocument12 pagesIfrs 8+ias36+ias24 - ExcercisesLEEN hashemNo ratings yet

- FAC 2602 - 2023 - S1 - Assessment 4 SolutionDocument13 pagesFAC 2602 - 2023 - S1 - Assessment 4 SolutionlennoxhaniNo ratings yet

- Seminar 09 Calculating NCInt Simple Example ColourDocument2 pagesSeminar 09 Calculating NCInt Simple Example Colour金鑫No ratings yet

- A4 PalacioDocument3 pagesA4 PalacioPinky DaisiesNo ratings yet

- Book 11Document4 pagesBook 11Actg SolmanNo ratings yet

- Chap 18 - Revenue RecognitionDocument11 pagesChap 18 - Revenue RecognitionResnika TanNo ratings yet

- Codification of Statements on Auditing Standards: Numbers 122 to 133, January 2018From EverandCodification of Statements on Auditing Standards: Numbers 122 to 133, January 2018No ratings yet

- SS - TEST FAR270 - NOV 2022 Set 2 StudentDocument5 pagesSS - TEST FAR270 - NOV 2022 Set 2 Studentsharifah nurshahira sakinaNo ratings yet

- Activity 2 Basis PeriodDocument1 pageActivity 2 Basis Periodsharifah nurshahira sakinaNo ratings yet

- SS CT 1 FAR270 Sem MAC2022 StudentDocument4 pagesSS CT 1 FAR270 Sem MAC2022 Studentsharifah nurshahira sakinaNo ratings yet

- 0 - Far270 - Weekly Lesson Plan - Oct 2022 PDFDocument2 pages0 - Far270 - Weekly Lesson Plan - Oct 2022 PDFsharifah nurshahira sakinaNo ratings yet

- Format YA 2022Document2 pagesFormat YA 2022sharifah nurshahira sakinaNo ratings yet

- Solution Illustrative Example PSDocument1 pageSolution Illustrative Example PSsharifah nurshahira sakinaNo ratings yet

- Tax317 Ctmay2022Document10 pagesTax317 Ctmay2022sharifah nurshahira sakinaNo ratings yet

- TAX317 TEST Q Dec2021Document10 pagesTAX317 TEST Q Dec2021sharifah nurshahira sakinaNo ratings yet