Professional Documents

Culture Documents

Hansen 1992

Hansen 1992

Uploaded by

Winalia AgwilCopyright:

Available Formats

You might also like

- SSP 512 Automated 5 Speed Manual Gearbox 0CTDocument36 pagesSSP 512 Automated 5 Speed Manual Gearbox 0CTossoski100% (3)

- Stable Convergence and Stable Limit Theorems: Erich Häusler Harald LuschgyDocument231 pagesStable Convergence and Stable Limit Theorems: Erich Häusler Harald Luschgyepidendrum2No ratings yet

- Numerical Methods for Stochastic Computations: A Spectral Method ApproachFrom EverandNumerical Methods for Stochastic Computations: A Spectral Method ApproachRating: 5 out of 5 stars5/5 (2)

- Yoga For Back PainDocument5 pagesYoga For Back PainaadityabuggascribdNo ratings yet

- GP 30 85 Fire and Gas DetectionDocument45 pagesGP 30 85 Fire and Gas Detectionsgh135586% (7)

- Brown Durbin Evans 1975Document45 pagesBrown Durbin Evans 1975Iván EstevesNo ratings yet

- Statistical Inference For Time-InhomogeneousDocument27 pagesStatistical Inference For Time-InhomogeneousScott TreloarNo ratings yet

- Weighted Quantile Regression For Longitudinal DataDocument22 pagesWeighted Quantile Regression For Longitudinal DataAgossou Alex AgbahideNo ratings yet

- Choi 2018Document13 pagesChoi 2018Agossou Alex AgbahideNo ratings yet

- Cuantil Regression in RDocument26 pagesCuantil Regression in RAratz HernandezNo ratings yet

- Bayesian Model Comparison For Time-Varying Parameter Vars With Stochastic VolatilityDocument38 pagesBayesian Model Comparison For Time-Varying Parameter Vars With Stochastic VolatilityLauraNo ratings yet

- Maximum Likelihood and Gaussian EstimationDocument35 pagesMaximum Likelihood and Gaussian EstimationBoutoubaNo ratings yet

- Ancillarity-Sufficiency Interweaving Strategy (ASIS) For Boosting MCMC Estimation of Stochastic Volatility ModelsDocument27 pagesAncillarity-Sufficiency Interweaving Strategy (ASIS) For Boosting MCMC Estimation of Stochastic Volatility ModelsjjjjNo ratings yet

- Step Stress ALT ChinaDocument11 pagesStep Stress ALT ChinaAnshul NautiyalNo ratings yet

- K. Haynes, P. Fearnhead - A - Computationally - Efficient - Nonparametric - Approach For Changepoint Detection, 2016Document32 pagesK. Haynes, P. Fearnhead - A - Computationally - Efficient - Nonparametric - Approach For Changepoint Detection, 2016CarlosRivasNo ratings yet

- Kim Shephard Chib 98Document33 pagesKim Shephard Chib 98ALVARO MIGUEL JESUS RODRIGUEZ SAENZNo ratings yet

- The Efficiency of Systematic Sampling in Stereology - ReconsideredDocument13 pagesThe Efficiency of Systematic Sampling in Stereology - ReconsideredRodrigo Felipe Toro MellaNo ratings yet

- Testing For Cross-Sectional Dependence in Panel-Data Models: 6, Number 4, Pp. 482-496Document15 pagesTesting For Cross-Sectional Dependence in Panel-Data Models: 6, Number 4, Pp. 482-496Oumaima KASSEMNo ratings yet

- TSP Cmes 41283Document25 pagesTSP Cmes 41283ranim najibNo ratings yet

- Dyncomp PreprintDocument9 pagesDyncomp PreprintAmalina SulaimanNo ratings yet

- Robust Inference: Seminar F Ur Statistik Eidgen Ossische Technische Hochschule (ETH) CH-8092 Z Urich SwitzerlandDocument33 pagesRobust Inference: Seminar F Ur Statistik Eidgen Ossische Technische Hochschule (ETH) CH-8092 Z Urich SwitzerlandMập ĐẹpNo ratings yet

- Surrogate Models For Oscillatory Systems Using Sparse Polynomial Chaos Expansions and Stochastic Time WarpingDocument45 pagesSurrogate Models For Oscillatory Systems Using Sparse Polynomial Chaos Expansions and Stochastic Time Warpingpatricia.santanareyesNo ratings yet

- Comparison - Two Biomech Measure SystemsDocument36 pagesComparison - Two Biomech Measure SystemsmtwakadNo ratings yet

- Quantile MechanicsDocument18 pagesQuantile MechanicsAgossou Alex AgbahideNo ratings yet

- Optimal Joint Detection and Estimation in Linear Models: Jianshu Chen, Yue Zhao, Andrea Goldsmith, and H. Vincent PoorDocument6 pagesOptimal Joint Detection and Estimation in Linear Models: Jianshu Chen, Yue Zhao, Andrea Goldsmith, and H. Vincent PoordoudikidNo ratings yet

- Shields Et Al RESS 15Document17 pagesShields Et Al RESS 15Meet SanghviNo ratings yet

- On Asymptotic Distribution Theory in Segmented Regression ProblemsDocument36 pagesOn Asymptotic Distribution Theory in Segmented Regression Problemscratto6384No ratings yet

- TN06 - Time Series Technical NoteDocument8 pagesTN06 - Time Series Technical NoteRIDDHI SHETTYNo ratings yet

- Econ89 GrsDocument32 pagesEcon89 GrsRdpthNo ratings yet

- Gretton - A Kernel Test For Three-Variable Interactions With Random ProcessesDocument15 pagesGretton - A Kernel Test For Three-Variable Interactions With Random ProcessesambrofosNo ratings yet

- Cleveland 1988Document16 pagesCleveland 1988Az RexNo ratings yet

- Time Series RDocument14 pagesTime Series RVarunKatyalNo ratings yet

- EconometricsDocument3 pagesEconometricssasakabNo ratings yet

- Control Engineering Practice: Mauricio G. Cea, Graham C. GoodwinDocument9 pagesControl Engineering Practice: Mauricio G. Cea, Graham C. GoodwinAaron FultonNo ratings yet

- A Unified Approach To Attractor Reconstruction: CHAOS 17, 013110 !2007"Document9 pagesA Unified Approach To Attractor Reconstruction: CHAOS 17, 013110 !2007"Son NguyenNo ratings yet

- Agresti 1992 A Survey of Exact Inference For Contingency TablesDocument24 pagesAgresti 1992 A Survey of Exact Inference For Contingency TablesagustinzarNo ratings yet

- Thu 1340 EngleDocument36 pagesThu 1340 Engleanon_154643438No ratings yet

- Akaike 1974Document8 pagesAkaike 1974pereiraomarNo ratings yet

- Cowles 96 MarkovDocument52 pagesCowles 96 MarkovMearg NgusseNo ratings yet

- MCDM SensitivityAnalysis by Triantaphyllou1Document51 pagesMCDM SensitivityAnalysis by Triantaphyllou1shilpi0208No ratings yet

- Wiley Journal of Applied Econometrics: This Content Downloaded From 128.143.23.241 On Sun, 08 May 2016 12:18:10 UTCDocument19 pagesWiley Journal of Applied Econometrics: This Content Downloaded From 128.143.23.241 On Sun, 08 May 2016 12:18:10 UTCmatcha ijoNo ratings yet

- Neurocomputing: Ratnadip AdhikariDocument12 pagesNeurocomputing: Ratnadip AdhikariReveloApraezCesarNo ratings yet

- Bickel and Levina 2004Document28 pagesBickel and Levina 2004dfaini12No ratings yet

- Does Model-Free Forecasting Really Outperform The True Model?Document5 pagesDoes Model-Free Forecasting Really Outperform The True Model?Peer TerNo ratings yet

- Co IntegrationDocument4 pagesCo IntegrationGerald HartmanNo ratings yet

- Oxford University Press The Review of Economic StudiesDocument34 pagesOxford University Press The Review of Economic StudiesMing KuangNo ratings yet

- 2011 - Information-Based Detection of Nonlinear Granger Causality in Multivariate Processes Via ADocument15 pages2011 - Information-Based Detection of Nonlinear Granger Causality in Multivariate Processes Via AVeronica JanethNo ratings yet

- Ferguson 1993Document11 pagesFerguson 1993Puspa Triani AdindaNo ratings yet

- The Top-K Tau-Path Screen For Monotone Association: Yu Et Al. 2011Document40 pagesThe Top-K Tau-Path Screen For Monotone Association: Yu Et Al. 2011Yusuf RihabeNo ratings yet

- Validation Metrics For Turbulent Plasma TransportDocument32 pagesValidation Metrics For Turbulent Plasma TransportJuan Manuel LosadaNo ratings yet

- Roger Koenker, Gilbert Bassett and Jr.1978Document19 pagesRoger Koenker, Gilbert Bassett and Jr.1978Judith Abisinia MaldonadoNo ratings yet

- Robust Standard Errors For Panel Regressions With Cross-Sectional DependenceDocument31 pagesRobust Standard Errors For Panel Regressions With Cross-Sectional DependenceCostel IonascuNo ratings yet

- Mathematics 09 00788 v3Document20 pagesMathematics 09 00788 v3muthjickuNo ratings yet

- Qu 2021Document25 pagesQu 2021Aditya GuptaNo ratings yet

- A Primer in Nonparametric EconometricsDocument88 pagesA Primer in Nonparametric EconometricsFabian GouretNo ratings yet

- Andrews 1993Document37 pagesAndrews 1993Winalia AgwilNo ratings yet

- Landau 1999 MaybeDocument2 pagesLandau 1999 MaybekeshariNo ratings yet

- 2001, Pena, PrietoDocument25 pages2001, Pena, Prietomatchman6No ratings yet

- Testing The Martingale Difference Hypothesis Using Integrated Regression FunctionsDocument17 pagesTesting The Martingale Difference Hypothesis Using Integrated Regression FunctionsVe LopiNo ratings yet

- Saville 1990Document8 pagesSaville 1990László SágiNo ratings yet

- Schmidt LawrenceDocument64 pagesSchmidt LawrenceFelipe TroncosoNo ratings yet

- Vol 5 - 4 - 3Document29 pagesVol 5 - 4 - 3Inn ArifNo ratings yet

- Bayesian Non- and Semi-parametric Methods and ApplicationsFrom EverandBayesian Non- and Semi-parametric Methods and ApplicationsRating: 3 out of 5 stars3/5 (1)

- Book of Abtracts. 10922Document87 pagesBook of Abtracts. 10922Winalia AgwilNo ratings yet

- Andrews 1993Document37 pagesAndrews 1993Winalia AgwilNo ratings yet

- Hansen 1997Document9 pagesHansen 1997Winalia AgwilNo ratings yet

- 5basic Econometrics Chapter IVDocument9 pages5basic Econometrics Chapter IVWinalia AgwilNo ratings yet

- FIP Statement of Professional Standards (Code of Ethics)Document4 pagesFIP Statement of Professional Standards (Code of Ethics)Cesly Jewel Acosta AvilesNo ratings yet

- Estmt - 2021 10 27Document6 pagesEstmt - 2021 10 27Andrea IñiguezNo ratings yet

- Guide 5 Talking About Past PerfectDocument5 pagesGuide 5 Talking About Past PerfectgeraldineNo ratings yet

- Eppe2023 Tuto 7QDocument4 pagesEppe2023 Tuto 7QMUHAMMAD AIMAN ZAKWAN BIN ROZANINo ratings yet

- Career Transition ML & AIDocument14 pagesCareer Transition ML & AISHIVAM TRIVEDINo ratings yet

- LP PaintingDocument8 pagesLP PaintingJoselito JualoNo ratings yet

- Airon Cristobal Crim 1 D Illegal MiningDocument13 pagesAiron Cristobal Crim 1 D Illegal MiningJulius MacaballugNo ratings yet

- Pension Fund PaperDocument18 pagesPension Fund PaperRuwan DissanayakeNo ratings yet

- Report Introduction and Nursing With Maternity Premature Rupture of MembranesDocument13 pagesReport Introduction and Nursing With Maternity Premature Rupture of MembranessyaifulNo ratings yet

- Insulin Therapy Guide 2Document3 pagesInsulin Therapy Guide 2AimanRiddleNo ratings yet

- 2016 - Dairam N Et Al - Sucrose Losses Across GledhowDocument15 pages2016 - Dairam N Et Al - Sucrose Losses Across GledhowMaydolNo ratings yet

- Quantum Phase Transitions: Alexander DanielsDocument12 pagesQuantum Phase Transitions: Alexander Danielsapi-288833495No ratings yet

- Synopsis of Online Railway Reservation System: - Arham JainDocument10 pagesSynopsis of Online Railway Reservation System: - Arham JainArham JainNo ratings yet

- Health Safety Assignment 1Document21 pagesHealth Safety Assignment 1Harshvardhan VyasNo ratings yet

- Annexure G: Books: SL - No. Author Title Year PublisherDocument1 pageAnnexure G: Books: SL - No. Author Title Year PublisherPradeepa HNo ratings yet

- Items in The Classroom: Words)Document2 pagesItems in The Classroom: Words)Alan MartínezNo ratings yet

- Avamar Backup RestorationDocument4 pagesAvamar Backup RestorationLaurie BaileyNo ratings yet

- A2918 DatasheetDocument8 pagesA2918 DatasheetJayanta GhoshNo ratings yet

- Hydraulic SystemDocument23 pagesHydraulic SystemMarie Montecillo100% (1)

- Control of HVDC Transmission System Based On MMC With Three-Level Flying Capacitor SubmoduleDocument22 pagesControl of HVDC Transmission System Based On MMC With Three-Level Flying Capacitor SubmoduleAnand Parakkat Parambil100% (1)

- Sap LuwDocument6 pagesSap LuwKumaresh KararNo ratings yet

- Ar710 2 (Supply)Document329 pagesAr710 2 (Supply)xxal123xxNo ratings yet

- Spiritual DiscernmentDocument16 pagesSpiritual DiscernmentRavi KumarNo ratings yet

- Piper - Sguide Rev.070320Document289 pagesPiper - Sguide Rev.070320Francis Alberto Espinosa PerezNo ratings yet

- Sabal Bharat Sansthan ProgramDocument54 pagesSabal Bharat Sansthan ProgramapurvarayNo ratings yet

- 8Th Grade: Unit 4: Future MattersDocument8 pages8Th Grade: Unit 4: Future MattersJessi Fernandez100% (1)

- Mathematics: Quarter 2 - Module 3: The Relations Among Chords, Arcs, Central Angles and Inscribed AnglesDocument25 pagesMathematics: Quarter 2 - Module 3: The Relations Among Chords, Arcs, Central Angles and Inscribed AnglesAndreaNo ratings yet

Hansen 1992

Hansen 1992

Uploaded by

Winalia AgwilOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hansen 1992

Hansen 1992

Uploaded by

Winalia AgwilCopyright:

Available Formats

Tests for Parameter Instability in Regressions with I(1) Processes

Author(s): Bruce E. Hansen

Source: Journal of Business & Economic Statistics, Vol. 10, No. 3 (Jul., 1992), pp. 321-335

Published by: American Statistical Association

Stable URL: http://www.jstor.org/stable/1391545 .

Accessed: 21/06/2014 23:43

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at .

http://www.jstor.org/page/info/about/policies/terms.jsp

.

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of

content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms

of scholarship. For more information about JSTOR, please contact support@jstor.org.

American Statistical Association is collaborating with JSTOR to digitize, preserve and extend access to Journal

of Business &Economic Statistics.

http://www.jstor.org

This content downloaded from 62.122.76.45 on Sat, 21 Jun 2014 23:43:47 PM

All use subject to JSTOR Terms and Conditions

? 1992 AmericanStatisticalAssociation Journalof Business & EconomicStatistics,July 1992, Vol. 10, No. 3

Tests for Parameter Instability in

Regressions with 1(1) Processes

Bruce E. Hansen

Departmentof Economics,University

of Rochester,Rochester,NY 14627

Thisarticlederivesthe large-sampledistributions of Lagrangemultiplier(LM)tests forparameter

instabilityagainstseveralalternativesof interestinthe contextof cointegratedregressionmodels.

The fullymodifiedestimatorof Phillipsand Hansen is extended to cover general models with

stochastic and deterministictrends. The test statistics considered include the SupF test of

Quandt,as well as the LMtests of Nyblomand of Nabeya and Tanaka. It is found that the

asymptoticdistributionsdepend on the natureof the regressor processes-that is, if the re-

gressors are stochastic or deterministictrends. The distributionsare noticeablydifferentfrom

the distributions

whenthe dataare weaklydependent.Itis also foundthatthe lackof cointegration

is a special case of the alternativehypothesisconsidered(an unstableintercept),so the tests

proposedhere may also be viewed as a test of the nullof cointegrationagainstthe alternative

of no cointegration.The tests are appliedto three data sets-an aggregate consumptionfunc-

tion, a present value model of stock prices and dividends,and the term structureof interest

rates.

KEYWORDS: Cointegration;

Fullymodifiedestimation;Quandtstatistic;Parameterconstancy;

Structuralchange.

One potential problem with time series regression sitions were given by Nabeya and Tanaka (1988), Ny-

models is that the estimated parametersmay change blom (1989), and Hansen (1990).

over time. A formof model misspecification,parameter The precedingworks did not consider models with

nonconstancy,may have severe consequences on in- integrated regressors.This article makes such an ex-

ference if left undetected. In consequence, many ap- tension. The test statistics mentioned previously are

plied econometriciansroutinelyapply tests for param- examined here in the context of cointegratingregres-

eter change. The most commontest is the sample split sions,makinguse of the fullymodifiedestimationmethod

or Chow test (Chow 1960). This test is simpleto apply, of Phillips and Hansen (1990). The asymptoticdistri-

and the distributiontheory is well developed. The test butionsof the test statisticsare found to dependon the

is crippled,however, by the need to specifya priorithe stochasticprocessdescribingthe regressors.It emerges

timing of the (one-time) structuralchange that occurs as an importantconclusionthat it is necessaryto know

under the alternative.It is hard to see how any non- the stochasticprocessof the regressorsbefore one can

arbitrarychoice can be madeindependentlyof the data. apply the tests consideredhere.

In practice, the selection of the breakpointis chosen An additionalfinding is that, since the alternative

either with historicalevents in mindor aftertime series hypothesisof a randomwalk in the interceptis identi-

plots have been examined.This impliesthat the break- cal to no cointegration, the test statistics are tests of

point is selected conditionalon the data and therefore the null of cointegrationagainst the alternativeof no

conventionalcriticalvalues are invalid. One can only cointegration.

conclude that inferencesmay be misleading. A relatedresearcheffortby ZivotandAndrews(1992)

An alternative testing procedure was proposed by and Banerjee, Lumsdaine,and Stock (1992) developed

Quandt(1960),who suggestedspecifyingthe alternative a distributionaltheory for the test of the unit-roothy-

hypothesisas a single structuralbreakof unknowntim- pothesis employed by Perron (1989). Perron specified

ing. The difficultywith Quandt'stest is that the distri- the alternativeto be a single structuralbreakof known

butional theory was unknown until quite recently. A timing,but the aforementionedarticlesspecifythe time

distributional theoryfor this test statisticvalidfor weakly of the break as unknown.These articlesaddressa dif-

dependent regressorswas presented independentlyby ferent question (testing the unit-root hypothesis), al-

Andrews (1990), Chu (1989), and Hansen (1990). Chu though using similarmethods.

consideredas well the case of a simplelineartime trend. Section 1 sets up the structureof the model, allowing

Another testing approachhas developed in the sta- for quite generalstochasticand deterministictrendsin

tistics literaturethat specifiesthe coefficientsunderthe the regressors.This model builds on and extends the

alternativehypothesisas randomwalks. Recent expo- setup used by Phillipsand Hansen (1990) and Hansen

321

This content downloaded from 62.122.76.45 on Sat, 21 Jun 2014 23:43:47 PM

All use subject to JSTOR Terms and Conditions

322 Journalof Business & EconomicStatistics,July 1992

(1992a). Section 2 describesthe method of fully mod- hand,if a time trendis requiredin the levels regression,

ified estimationfor the model. Section 3 describesthe then x1, = k1, = k, = (1, t)' and there is no k2t. Another

test statisticsfor parameterinstability.Section 4 gives commonspecificationis that there are no trendsin the

the asymptoticdistributiontheory for the test statistics system, so k1t = kt = 1 and there is no k2t.

under the null hypothesis. Section 5 discussesthe al- Some applied researchers have considered using

ternative of no cointegration.Section 6 reports three breakingtrendfunctionsin addition to the simple in-

simple applicationsof the tests. Section 7 concludes. tegerpowersof time consideredhere. Althoughin prin-

Proofs are in the Appendix. ciple it is straightforwardto define the estimatorsand

A GAUSS programthat implementsthe estimation test statisticswith these more general trend functions,

methods and test statisticsis availableon requestfrom this extension will not be consideredin this articlefor

the author. two reasons. First, the restrictionto powers of time

simplifiesthe asymptotictheory. Standardizedpowers

1. A COINTEGRATED

REGRESSIONMODEL of time converge uniformlyto limiting functions, but

We will be workingwith a fairly standardmultiple- this is not true of discontinuoustrend functions. See

regressionmodel under cointegration.The cointegrat- Zivot and Andrews(1992) for an econometricexample

ing equationsare of weak convergencewith discontinuousfunctions.Sec-

ond, breakingtrends may only make sense in a prob-

Yt = Ax, + ul,, t= 1, . . ., n,

abilitymodel if the timingand magnitudeof the break

where the process x, = (xt, x2t)' is determined by the is allowed to be random.This simplyreintroducesI(1)

equations or 1(2) components into the system that are already

capturedin system (1)-(2).

Xlt = klt The followingnuisanceparametersplay an important

H klt + Hk2t + X2t

role in the formulationof the statisticswe will be con-

x2t=

1 2 sidering.Define the matrices

n n

X2t = + (2) 1

Xt-1 U2t

l = lim - E E(uju')

Define the vectors n---,c t=l j=1

1 n t

u = ( ut U2 ); k = (kt k2t). A = lim- E E E(uju) (3)

mi m2 + P2 Pl P2 n->oc n t=l 1j=

{u} is a sequenceof mean zero randomvectors, but the partitionedin conformitywith u:

elements of kt are nonnegativeintegerpowersof time.

Note that x1, has p, elements and x2thas m2 + P2 ele- =

n12' A = All A12

ments. More specific assumptionsregardingu, and kt (21 A21 A22/

will be made in Section3. This model places the trends

When the vector ut is weakly stationary,fl is propor-

k1, directlyin the regressionequation (I will speak of tional to the spectraldensity matrixevaluated at fre-

kt as trends althoughit may contain a constant). The

trends k2tdeterminethe behaviorof the stochasticre- quency 0. It is sometimes referredto as the long-run

covariancematrix.

gressorsx2tbut are excludedfrom the regression.If kt We also define

containsa constant,we assumethat it is an element of

kit and thus enters the levels regression. n1-2 = 11, - n12,,22 21 (4)

The notation of (2) may appearconfusingat first. It

and

turns out to be especiallyconvenientfor development

of a full theory for the cointegratedregressionmodel A2+ = A21 - A2222ll'21

(1). In earlier work on cointegratedmodels, such as One may loosely call l.2 the long-runvarianceof u1,,

that of Johansen(1988), Park and Phillips(1989), and

conditional on u2,. AI represents the bias due to en-

Phillips and Hansen (1990), allowing for general de-

terministictrends was intentionallyexcluded to allow dogeneityof the regressorsafterthe fully modifiedcor-

rectiondiscussedin Section 2.

the clean developmentof a large-sampledistributional

theory. Although theoreticallyelegant, this approach ESTIMATION

2. FULLYMODIFIED

excludes many applicationsof interest.

In most applications,it seems most reasonable to The constancytests we will discuss require an esti-

specify the stochasticregressorsx2, as I(1) with a de- mate of A in (1) that has a mixturenormalasymptotic

terministictrend. In this case, kt equals a constantand distribution.Forconcreteness,we will considerthe fully

a linear time trend. If y, and x2t are deterministically modified(FM) estimatorof PhillipsandHansen(1990).

cointegrated,using the terminologyof Ogaki and Park Alternative estimatorswith the same asymptoticdis-

(1990), then the levels regressionneed only contain a tribution include the maximum likelihood estimator

constant, so x,t = kit = 1 and k2t = t. On the other (MLE) of Johansen(1988) or the "leads and lags" es-

This content downloaded from 62.122.76.45 on Sat, 21 Jun 2014 23:43:47 PM

All use subject to JSTOR Terms and Conditions

Hansen:TestforInstability

with1(1)Processes 323

timator of Saikkonen (1991) and Stock and Watson In most applications,it appears that the choice of

(1991). (See PhillipsandLoretan[1991]for an informa- kernel is much less importantthan the choice of band-

tive review.) width parameter.For currentconsistencyproofs (see

Hansen 1992b), it is required that M - ooat some rate

2.1 Estimation of Covariance Parameters slower than sample size. This, however, does not pro-

The semiparametricmethod of Phillipsand Hansen vide a useful guide for the selection of the bandwidth

(1990) is a two-step estimator in which the first step parameterin a particularapplication.In a recentarticle,

estimates the covarianceparametersQ1.2 and A1I de- Andrews(1991)providedsome usefulguidelines(based

fined in (4). Our suggestion is to use a prewhitened on the minimizationof asymptotic truncated mean

kernel estimator with the plug-in bandwidthrecom- squarederror) to their selection. He recommendeda

mended by Andrewsand Monahan(in press). We out- plug-inbandwidthestimator.For the Bartlett, Parzen,

line the procedurein this subsection. and QS kernels, the choices are

First, estimate (1) by ordinaryleast squares (OLS), Bartlett: M = 1.1147(c()n)l/3

yielding the parameterestimates A and the residuals

u1, = Yt - Axt. Second, estimate (2) by OLS in differ- Parzen: M = 2.6614(a(2)n)l/5

ences: Ax2, = lAk1,t + I2Ak2t + u2t, yielding the re- QS: M- = 1.3221(a(2)n)15,

siduals u2t.Set u = (uAl,u2t).

The covariancematricesfl and A could be estimated where a(1) and a(2) are obtainedfrom approximating

directlyfrom the residualsut via a kernel. In most ap- parametricmodels. A particularlyattractivechoice sug-

plications,the cointegratingresidualsu1,have a signif- gestedby Andrewsis univariate(autoregressive)AR(1)

icant degree of serial correlation. In this event, the models for each element, eat (a = 1, . . ., p) of e,. Let

kernel estimate will be highly biased, unless a large (pa,6-2) denote the autoregressive and innovation vari-

bandwidthparameteris used, whichincreasesthe vari- ance estimatesfor the ath element. Then

ance of the estimator.In suchcases, an estimatorbased P A P

W2 Ca

on prewhiteningis often preferablein moderatesample i(5(1)

=.4PaOa

--

tawi a1 (1 - a)6( + Pa)2 1 (1 - Pa)

sizes.We suggestusinga (vectorautoregressive) VAR(1),

althougha higher order VAR could also be used. We and

first fit a VAR to the residualsut: ut = ia,_- + et. A p 2 2

/

kernel estimatoris then appliedto the whitenedresid- a^ Pa4a

(2)

uals et. These take the form () = (1 a- p)8 a ( - Pa)

n

I

The use of a plug-inbandwidthparameterhas several

- e t

e tjt

w(jlM) E

n t=j+l

advantages.First, it removes the arbitrarinessassoci-

j=o

ated with the choice of bandwidth.Many applied re-

and searchershave been frustratedwith the semiparametric

n n branchof the unit-rootliteraturebecause the test out-

e = fie

~ w(jlM)-

w(j/M) et_jet , comes sometimesdepend on the choice of bandwidth.

j=-n n t=j+l e et'

Second, simulationresults of Park and Ogaki (1991)

demonstratedthat its use can dramaticallyimprovethe

where w(.) is a weight function (or kernel) that yields

mean squared error of semiparametricestimates of

positive semi-definiteestimates and M is a bandwidth

cointegratingrelationships.

parameter.The estimatorQe can be seen as a scaled

estimate of the spectraldensityof e, (when e, is covari-

ance stationary)and has its origin in the literatureon 2.2 Estimation of the Regression Parameters

spectraldensityestimation,whichdates backto Parzen

Partition A and ft as A and fi, set il1.2 =l -

(1957).

The covarianceparameterestimates of interest can i12i2'f1i21 and A2 = A21 - fikP2lh21 and define

be obtained by recoloring: Q = (I - <)-l'e(I - the transformed dependent variable y+ = y -

)- 1 and A = (I - )-Ae(I - <)-1 - (I

- li"2j2l12t. The FM estimatorof A is then given by

A)--1j , where t = (1/n) Z=1it^;.

These estimatesrequirea choice of kernel and band- A+ y;- .

(0 A1i'))) (xt;)

t=1

width parameter.Any kernel that yields positive semi- t=l

definiteestimatescanbe used.Theseincludethe Bartlett, Associated with these parameterestimates are the

Parzen, and quadraticspectral(QS) kernels. Andrews residualsau = y+ - A +x,. One interestingfeatureof

(1991) recommendedthe QS kernel, which takes the the FM estimates that will be importantfor our later

form

developmentsis that

n

1

w(x) = 122(sin(6(rx/5) - cos(6rx/5)) x

w()=127T2X26=rx5 n t=i w21

This content downloaded from 62.122.76.45 on Sat, 21 Jun 2014 23:43:47 PM

All use subject to JSTOR Terms and Conditions

324 Journalof Business&Economic

Statistics,July1992

althoughin OLS regressionthe sum of the productsof martingaledifferencesis 0: Ho: 62 = 0. One alternative

the regressorsand residualsis identically0. Thus the hypothesis is H3 : 82 > 0, G, = (fi.2 0 V,,)-l; tln E

scores of the problemare the variables 9C,with test statistic

1

S, = (XtU -

(5)

MeanF =

nY tlne

F, where n* = >

tln 3

1.

(21))

which satisfy Sn=1 , = 0.

The final alternativeis H4: 62 > 0, Gt = (f1.2 ?

Mnn)-1, with test statistic

3. TESTS FOR PARAMETER INSTABILITY

Hansen (1990) outlined a general theory of testing Lc = tr{Mnn1 E St? S)}.

for parameterinstabilityin econometricmodels. The

test statisticscan be derivedas Lagrangemultiplier(LM)

The F,, test (fixed t) is computationallysimple, cor-

tests in correctlyspecifiedlikelihoodproblems.In this

section, we describethese test statisticsin the context respondingto the classical Chow test or sample split

test. The test statisticis computationallyequivalentto

of fully modifiedestimationof cointegratedregression

models. estimatingA1 andA2 on the two subsamplesandtesting

their equivalenceusing a Wald test, usingthe variance

We can modify(1) to incorporatepossibleparameter

estimatefor the full-sampleestimates.Thiscanbe easily

instabilityby allowingA to depend on time: seen if we consider the special case of least squares

Yt = A,xt + u,. (1)' estimation on a single equation (ml = 1). Then note

that

For all of the tests, the null hypothesisis that the coef-

ficientA, in (1)' is constant,althoughthe tests differin

the treatmentof alternativehypotheses. Mnt Snt = (E XiXi Xii

The first two tests model At is obeyinga single struc-

tural break at time t, where 1 < t < n: = ( xx) I - (- xix ) xA = A, - A;

Ai = A1, i < t

that is, the score from the first part of the sample,

= A2, i>t. evaluatedat the estimate from the full sample, is pro-

The null hypothesisis Ho: A1 = A2. For the first test, portionalto the difference between the estimates ob-

the timing of the structuralbreak is known under the tainedfromjust the firstpartof the sampleand the full

alternativeH : A1 + A2, t known.A test for Hoagainst sample.It follows(witha little algebra)thatourstatistic

H1 is given by the statistic Fntis essentiallyequivalent to the Wald statistic that

tests the equivalenceof At and A. The only difference

Fn = vec(Snt)' (Q1.20 Vnt)-vec(Snt ) arises due to the choice of the varianceestimates.It is

= tr{SntVntl,SntL1},

well knownthatthisWaldstatisticis algebraicallyequiv-

alent to the classic Chow statistic, which is based on

where the differencebetweenthe estimatesobtainedfromthe

t two subsamples.For example,see SnowandIm (1991).

Sn = S i, (6) The distributionaltheory developed for this test

i=1

(asymptoticchi-squared)is only valid when t can be

chosenindependentlyof the sample.Thisis a restrictive

Vnt = Mnt- MntMnnl'Mn, (7)

assumptionin practiceand may be valid only when t is

and chosen in an arbitraryway, such as t = n/2. In this

t event, the test mighthave low power againstmany al-

Mnt = xiX'. (8) ternativesof interest.

i=l The SupF test dates back to Quandt(1960). Several

For the secondtest, the timingof the structuralbreak recentworkshave exploredthe distributionaltheoryin

is treatedas unknown:H2 : A1 4 A2, [tin] E -, where severalcontexts-those of Andrews(1990),Chu (1989),

5- is some compact subset of (0, 1), and [.] denotes and Hansen (1990). The only difficultyin implemen-

tation is the choice of the region S-. As pointedout by

"integerpart." This test statisticis simply

Anderson and Darling (1952) and emphasizedby An-

SupF = sup Fnt. drews (1990), the region 2- must not include the end-

tln E-

points 0 and 1; otherwisethe test statisticwill diverge

The thirdand fourthtests model the parameterA, as to infinityalmostsurely.The fix suggestedby Andrews

a martingale process: A, = A,_1 + E,; E(E,t-- 1) = 0, is to select T-= [.15, .85]. Although a reasonableap-

E(E,E') = 82G,. In this context, the null hypothesis can proach,this introducesan element of arbitrarinessthat

be written as the constraintthat the variance of the dilutes the appeal of the test.

This content downloaded from 62.122.76.45 on Sat, 21 Jun 2014 23:43:47 PM

All use subject to JSTOR Terms and Conditions

Hansen:TestforInstability

with1(1)Processes 325

The MeanF test statistic is derived from a different 7. k, = (1, t, t2, . . ., tP)', p = pi + P2 - 1; and

hypothesis structure but is seen to be simply the average 8. M51n = 0(1).

Fnt test. Although in principle the averaging can include

For the random sequence {ut, the assumptions im-

all values of r for which Fn,can be computed, in practice

some trimming will be required (since F,, will not be pose weak dependence through fairly mild conditions

on the strong mixing coefficients. The moment condi-

defined over all t). Thus the arbitrariness associated

tions are only slightly stronger than square integrability.

with the SupF test is not completely avoided. For the

- Assumption 5 implies that the elements of xt are not

remainder of the article, we set = [.15, .85] as for

the SupF test. mutually cointegrated, that x2tdoes not contain a lagged

The Lc test has a long history in statistical theory, dependent variable, and that xt and the error u1, are

not multicointegrated (see Granger and Lee 1990). As-

although it has not been fully understood until quite

sumption 6 says that the vector k2 plays a role in the

recently. It was first proposed by Gardner (1969) as a

asymptotic behavior of x2t. Assumption 7 restricts the

Bayes test for structural change. It was later indepen- vector kt to integer powers of time.

dently proposed by Pagan and Tanaka (1981), Nyblom Set Yt = jt=l uj. Our assumptions are sufficient for

and Makelainen (1983), and King (1987). These works

the following results:

all concerned tests on a single coefficient in a Gaussian

linear regression model. First attempts at a large-sample

=

distributional theory were made by Nyblom and Make- (1/Vn)Y,,[nr] > B(r) BM(Q); (9)

lainen (1983), Nabeya and Tanaka (1988), and Ley-

[nr] rf

bourne and McCabe (1989). A fairly complete theory

(l/n) YVtu+l > J0 Bdb' + rA; (10)

for maximum likelihood was given by Nyblom (1989) t=l

and was extended to general econometric estimators by

and

Hansen (1990). It has the advantage that it is much

easier to compute than the SupF and MeanF tests and A --- 1A'

, --> n. (11)

requires no decisions for trimming, hence excluding any Here and elsewhere, ">" denotes weak convergence

form of arbitrariness.

of the associated probability measures with respect to

The three proposed tests-SupF, MeanF, and Lc-

the uniform metric, and BM(fl) denotes a Brownian

are all tests of the same null hypothesis but differ in

motion with covariance matrix f. The invariance prin-

their choice of alternative hypothesis. In practice, all

of the tests will tend to have power in similar directions, ciple (9) was shown by Herrndorf (1984). Convergence

to the matrix stochastic integral (10) was shown by Han-

so the choice may be made on the computationalgrounds

sen (1992c). Consistent covariance parameter estima-

that Lc is much easier to calculate. But the appropriate

tion (11) was shown by Hansen (1992b).

test statistic for a particular application should also de-

We need to find a sequence of weight matrices that

pend on the purpose of the test. If the desire is to will appropriately standardize the regressors x, and the

discover whether there was a swift shift in regime, then

estimates A +. We adopt a method from Hansen (1992a).

the SupF test is appropriate. On the other hand, if one

Set n = diag(l, n- , n-2, .. n-P) and k(r) = (1,

is simply interested in testing whether or not the spec-

r, r2, . . ., rP)'. Thus

ified model is a good model that captures a stable re-

lationship, the notion of martingale parameters is more 8nk[nr]

-> k(r) as n - oc (12)

appropriate, since it captures the notion of an unstable

model that gradually shifts over time. If the likelihood uniformly in r. Partition 8, = diag(8n,, 82n) and k(r) =

of parameter variation is relatively constant throughout (k1(r), k2(r))' in conformity with k.

the sample, then the Lc statisticis the appropriatechoice. Equation (2) specifies that the stochastic regressors

x2t are driven by the processes k1,, k2t, and xt. Since k1,

is also in the levels regression, least squares will project

4. DISTRIBUTIONALTHEORY x2, orthogonal to k1,, leaving only k2tand x4. We would

like to isolate the effects of the stochastic trends from

The assumptions we require for the asymptotic dis-

the deterministic trends. Construct an (m2 + P2) x m2

tribution theory are summarized in the following. Let

matrix HI in the null space of I2. The matrix II will

{a,} denote the a-mixing (strong-mixing) coefficients

for {u,}. then annihilate the remaining deterministic component

k2t from x2t. Now define the weight matrix for x2t,

Assumptions. For some q > 3 > 5/2,

1. E(u,) = 0; =2n

2n

( 2J2(n

2 -1 1tf2

)112I)-1 2

\

1/2 )

\(1l/V)(n2*'22n2I)

2. am are of size -ql3/[2(q - /3)];

3. sup,-l EUtlq < o0; and the weight matrix for xt,

4. H as defined in (3) exists with finite elements;

5. H22 > 0 and H1.2 > 0; 8ln 2nO

r = -(

6. rank(I2) = P2; Fn F2nl r2J .

This content downloaded from 62.122.76.45 on Sat, 21 Jun 2014 23:43:47 PM

All use subject to JSTOR Terms and Conditions

326 Journalof Business & EconomicStatistics,July 1992

To see that this is a good choice for weightingmatrix, We are now in a position to analyze the asymptotic

note that distributionof these processes.

r =

-= 8nklt

+ X2t)

Theorem 2.

rnxt = Vr2(I2k2t

/ 1nklt \

rrnsn(T)SS*(T)11.2,

(a) ~nFrSn(r)

(a) 1r)2

32nk2t + 32n(I2II2) II2x2 1, (13)

-

(1I/v i)(rl 'f1

k(1/x/~)(II2 2

f22II2) 11/2fI* X

12 X2t] (b) Fn(r) > F(T)on rE

T ;

so by (9) and (12), where S*(r) = S(T) - M(r)M(1)-1S(1), S(T) =

/kl(r) fO5XdW,F(r) = tr(S*(T)'V(T)-1S*(r)),and W1 =

= k2(r) = X(r), say, (14)

B1/2B. BM(Iml), independent of X.

rnX[nr]

W2(r) The process S*(T) is a tied-downversionof the pro-

cess S(r), whichis a continuoustime martingale.Con-

where W2(r) = (11'122112)-/2I* 'B(r) - BM(Im2). ditional on 9; = 0 - r - 1), the sigma field

-r(X(r):

SincefoXX' > 0 for all T> 0 (PhillipsandHansen1990,

generatedby the processX(r), both are Gaussianpro-

lemma A.2), F, is an appropriateweightingmatrixfor cesses. Theirconditionalcovariancefunctionsare given,

the processx,. Equation (14) says that x, is asymptoti- for r1 < T2:

cally dominatedby the trend processeskl(r) and k2(r)

and an m2-dimensionalstochastictrend (W2). E(vec(S(Tr)vec(S(T2))'j!~) = Im2 M(r1)

The test statisticsof Section3 are functionsof partial = Im20 (M(rT)

E(vec(S*(rO))vec(S*(T2))'1;)

samplesums.It willbe convenientto expressthese sums

as functionsof the space [0, 1]. Specifically,define - M(r)M(1)-'M(T2)).

[ni]

The distributionaltheoryfor the limitprocessof S('r)

Mn(r) = Mnln = Z XXi is analogousto the distributionaltheory that arises in

modelswithouttrends;for example,see Nyblom(1989)

and V"(r) = Vn[n = Mn(r) - Mn(r)Mn(1)-lMn(r). or Hansen (1990). In models withouttrends, we find

We can now findthe function-spacedistributionallimits

of these randomfunctionals.

n Sn(T) -= B*(r) = B(r) - (M)M-1B(l)

Theorem1.

= B(T) - TB(1),

(a) lrnMn()r)' M(T)= XX';

a Brownianbridge. In this expression,M > 0 is a con-

stant matrix. The difference between this result and

(b) - rnVn(T)rn> V(T)= M(T) - M(T)M(1)-'M(T); Theorem 2 arises because, in models without trends,

samplecovariancematricesconvergeto constantmatri-

ces. In modelswithstochastictrends,samplecovariance

(c) irnx tu'j XdBl +r A2) matricesare randomvariablesthat change over time.

where ui = ul - ii1u2,;

Thus the expressionfor S*(r) depends on the matrix

processM(r), representingthe samplecovariancestruc-

ture of the regressors.

(d) Vnr 21P (A

.( We can now give expressionsfor the asymptoticdis-

tributionof the test statisticsfrom Section 3.

+- A)rI

(e) Vn-(A dB.2X'' xx , Theorem3.

where B1.2 BM(fi1.2) is independent of X(r), and (a) F-*d i, b = (1 + p + m2)mi;

A21 = (I'22n) -21/2I'2 A21-

(b) supF -d su F(T);

All of the test statisticsconsideredin Section 3 were

functionsof the stochasticprocessSnt.Threeof the tests

were also functionsof the process Fnt.It will be con- (c) MeanF-d f F(r)dr;

venient to write these also as functionals on [0, 1].

Define

Inr] (d) Lc -->

Jd tr(S*(T)'M()- lS*(Tr)).

= =

Sn(T) Sn[n] E Si

i=1 The asymptoticdistributionof the standardF test is

chi-squared.This test, however, as suggested earlier,

Fn(r) = Fn[nr.

has limitedapplicabilitydue to the restrictivenatureof

= vec(Sn(T)) '(V11.2 ) Vgn(T))

-vec(S(T)). the alternativehypothesisinvolved. The other test sta-

This content downloaded from 62.122.76.45 on Sat, 21 Jun 2014 23:43:47 PM

All use subject to JSTOR Terms and Conditions

Hansen:Test for Instabilitywith 1(1)Processes 327

tisticsare nonstandardand dependon the natureof the a3), we can easily generate approximateasymptoticp

trends in X (i.e., p, ml, and m2). values automaticallyin the course of calculatingthe

Theorem 3 shows that it is importantto know the statistic.

trend propertiesof the regressorsbefore a parameter To calculate the parameters,I evaluated 38 upper

constancy test can be mounted. Since the asymptotic percentilesfrom the Monte Carlo distributions,from

distributionsonly depend on a few parameters,appro- .20 to .015 in steps of .005. Then I regressedthe per-

priate critical values can be tabulated. If X contains centiles on a third-orderpolynomial in the associate

only deterministictrends, then analytic methods are criticalvalues. For all cases, the fit was very good over

available. Nabeya and Tanaka (1988) derived the this region. Experimentationwith extendingup to the

asymptoticdistributionof Lc for x, = k, (in our nota- .010 percentile indicateda worsened fit, so it was not

tion) and iid errors u1. In this case, they have found done. The estimatedparametersare reportedin Table

expressionsfor the characteristicfunctionof the limiting 1. On their own, they are not interesting. But when

distribution.Theirmethoddoes not immediatelyextend incorporatedinto a computerprogram,they reducethe

to stochastic trends, so here I resort to simulation need to use tables. The polynomials should only be

methods. viewed as approximationsthat can produce p values

The asymptotic distributionsare approximatedby over the region[.20, .015].Thisis not a majorhandicap,

draws from samples of size 1,000 using iid normal since a p value below .20 is rarelytermed"significant."

pseudorandomnumbers. The calculationswere made The distributionaltheory of this section is asymp-

in GAUSS386 using its random-numbergenerator. totic. An investigationof the behaviorof the test sta-

Criticalvaluesfor the three tests are tabulatedin Tables tisticsin finite sampleswas undertakenby Gregoryand

1, 2, and 3 for the single equation setting (ml = 1). Nason (1991). These authorsassessed the testing pro-

The tables includep = 0, 1, 2 and m2 = 0, 1, 2, 3, 4. ceduresdescribedin this articleby applyingthe tests in

For m2 = 0, 1, 2, 25,000 replicationswere made. For the context of a linear-quadraticmodel. Their Monte

m2 = 3, 4, 10,000replicationswere made. The critical Carlodesigninvolvedsamplesizes of 100,200, and500.

values are noticeablydifferentfrom those for the case They found that the tests exhibitedvery little size dis-

of weakly dependent data. (For the supF statistic,see tortionin these samples.They also found that the tests

Andrews [1990, table 1]; for the MeanF and Lc statis- had good power againstsimple structuralbreaksat the

tics, see Hansen [1990, table 1]. first,second,andthirdquarterof the sample.The power

The criticalvalues of Table 1 are useful but require of the tests depended on a cost-of-adjustmentparam-

applied researchersto frequentlylook up tables when eter, which induces serial correlationinto the cointe-

making computations.It is more convenient to have gratingerror. As the degree of serialcorrelationin the

computer packages produce p values along with test errorincreases,the powerdecreases.Thisis not entirely

statistics.What we want is a functionp value = p(x), surprising,because a highly seriallycorrelatederroris

which maps an observedtest statisticx into the appro- close to a randomwalk, whichis equivalentto a random

priatevalue in the range[0, 1]. Thisis of specialinterest walk in the intercept.The abilityof the test to discrim-

when the p value falls into the range [0, .2]. Suppose inate between these two cases breaks down, and the

that we can well approximatethe functionp(x) by a power falls. Overall, Gregoryand Nason's study casts

low-order polynomial: p(x) - aO+ alx + a2x2 + a3x3. a favorable light on the finite-sampleperformanceof

Then if we can obtain the parametersa = (ao, a1, a2, the test statisticsadvocatedhere.

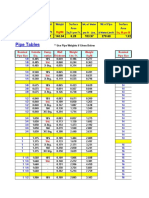

Table 1. AsymptoticCriticalValuesfor SupF

Significancelevel p-value coefficients

m2 p 1% 5% 10% ao a, a2 a3

0 1 16.4 12.9 11.2 1.954 - .373 .0245 -.00055

0 2 20.0 15.8 14.1 2.487 -.400 .0219 - .00041

1 0 16.2 12.4 10.6 1.960 -.350 .0213 -.00044

1 1 19.0 15.2 13.4 2.666 -.424 .0230 -.00043

1 2 22.0 17.8 15.9 3.480 -.505 .0250 -.00042

2 0 18.6 14.8 13.0 3.182 - .491 .0258 - .00046

2 1 21.4 17.3 15.3 3.652 -.511 .0243 -.00039

2 2 23.9 19.7 17.7 4.003 - .508 .0219 - .00032

3 0 21.0 17.2 15.3 2.882 -.403 .0193 -.00031

3 1 23.9 19.3 17.3 3.248 - .397 .0163 - .00023

3 2 26.0 21.4 19.4 4.488 -.523 .0206 -.00027

4 0 23.6 19.0 17.1 3.522 - .449 .0194 - .00028

4 1 25.2 21.2 19.1 4.030 -.472 .0187 -.00025

4 2 28.0 23.2 21.0 5.341 -.594 .0224 -.00029

NOTE: These tablesareforthe singleequationmodel(ml = 1). Criticalvaluesare calculatedby MonteCarlosimulationusingsamples

of size 1,000. 25,000 replicationswere made form2 = 0, 1, 2. 10,000 replicationswere made form2 = 3, 4.

This content downloaded from 62.122.76.45 on Sat, 21 Jun 2014 23:43:47 PM

All use subject to JSTOR Terms and Conditions

328 Journalof Business & EconomicStatistics,July 1992

Table2. AsymptoticCriticalValuesfor MeanF

Significancelevel p-value coefficients

m2 p 1% 5% 10% ao a, a2 a3

0 1 6.83 4.48 3.73 1.080 -.511 .0843 -.00478

0 2 8.85 6.22 5.11 1.595 -.613 .0818 -.00374

1 0 6.78 4.57 3.73 1.008 -.470 .0773 -.00438

1 1 8.61 6.22 5.20 1.386 -.501 .0629 -.00271

1 2 10.4 7.76 6.50 1.641 -.479 .0479 -.00163

2 0 8.50 6.17 5.18 1.477 -.557 .0729 -.00326

2 1 10.3 7.69 6.58 1.818 - .556 .0607 - .00223

2 2 11.9 9.12 7.88 2.121 -.550 .0489 -.00148

3 0 10.1 7.68 6.66 1.448 - .397 .0370 -.00117

3 1 12.0 9.21 7.89 2.22 - .580 .0520 - .00159

3 2 13.4 10.4 9.15 2.640 -.609 .0480 -.00128

4 0 11.7 9.08 7.87 2.162 -.563 .0505 -.00154

4 1 13.3 10.6 9.28 2.440 -.551 .0426 -.00113

4 2 15.0 11.9 10.4 3.287 -.702 .0512 -.00127

NOTE: See Note to Table 1.

5. A TEST OF COINTEGRATION

AGAINST ventionallydefined, fall into the set of alternativescon-

NO COINTEGRATION sidered by the specificationtests consideredhere?

For simplicity,rewriteModel (1) as

Many applied econometriciansbelieve that it is im-

portant that an econometricmodel be able to survive Yt = A1 + A2X2t + ut; (15)

statisticaltests of the assumptionsunderlyingthatmodel. that is, assume that k1t is simply a constant. Assume

In the case of estimatinga cointegratingrelationship, that y, and x2, are not cointegrated.This is equivalent

a naturalhypothesisto test is thatof cointegrationitself. to the statementthat the error u, is 1(1). Now we can

In contrast, most cointegrationtests, such as those of

decompose ut as ut = W, + v,, where W, is a random

Engle and Granger(1987), Stock and Watson (1988), walk (AWtis white noise) and vt is stationary.Thus

Johansen(1988), and Phillipsand Ouliaris(1990), take

Equation(15) can be writtenas

the null to be no cointegration.The one notable ex-

ception is the spuriousregressortest of Park, Ouliaris, Yt = Alt + A2x2t + vt, (16)

and Choi (1988). where A1t = A1 + Wt. Equation (16) is a special case

The specificationtests developed in Section 3 are of (1)', which is our model of cointegrationwith non-

clearlytests of the model of cointegrationproposedby stationarycoefficients.Specifically,we can see that no

Granger(1981) and developed by Engle and Granger cointegrationis equivalent to one coefficient, the in-

(1987). It is, of course, possible to generalizethe def- tercept, followinga randomwalk. This is a specialcase

inition of cointegrationto allow a nonstationarylinear of the alternativehypothesisfor which the Lc statistic

relationshipbetween the variables,but this would be a is an LM test statistic.We concludethat Lc is a test of

radicaldeparturefrom the idea Grangeroriginallyput the null of cointegrationagainst the alternativeof no

forward. But does the model of no cointegration, con- cointegration.

Table3. AsymptoticCriticalValuesfor Lc

Significancelevel p-value coefficients

m2 p 1% 5% 10% ao a, a2 a3

0 1 .723 .468 .361 .927 -3.536 4.771 -2.225

0 2 .758 .480 .382 1.120 -3.644 4.155 -1.628

1 0 .898 .575 .450 .769 -3.432 5.471 -3.041

1 1 .959 .623 .497 .996 -3.493 4.311 -1.834

1 2 .999 .654 .520 1.171 -3.421 3.507 -1.240

2 0 1.03 .690 .556 .855 -3.829 6.085 -3.342

2 1 1.13 .778 .625 1.074 -3.658 4.358 - 1.778

2 2 1.19 .814 .666 1.263 -3.511 3.404 -1.133

3 0 1.18 .834 .680 1.247 -3.393 3.235 -1.066

3 1 1.29 .901 .752 1.430 -3.623 3.185 -.959

3 2 1.33 .954 .793 1.496 -3.636 3.075 -.894

4 0 1.31 .934 .780 1.451 -3.515 2.942 -.841

4 1 1.45 1.03 .866 1.694 -3.835 2.992 -.795

4 2 1.51 1.10 .922 1.726 -3.729 2.792 -.716

NOTE: See Note to Table 1.

This content downloaded from 62.122.76.45 on Sat, 21 Jun 2014 23:43:47 PM

All use subject to JSTOR Terms and Conditions

Hansen:Test for Instabilitywith 1(1)Processes 329

The SupF and MeanF statistics are not specifically nomics. In a recent article, Campbell (1987) showed

targetedfor the alternativeof random-walkcoefficients, that a strict infinite-horizonpermanent-incomemodel

but they will have asymptoticpower againstthis alter- yields a cointegratingrelationshipbetween aggregate

native as well. consumption and aggregate disposable income. We

Interestingly,there is a connectionbetweenthe SupF can now test the constancyof this cointegratingrela-

test, the MeanFtest, and the spuriousregressortest of tionship.

Park et al. (1988). For each t, F,, is the F test for the The data, from Blinder and Deaton (1985), are sea-

significanceof sample-splitslope dummies.In the ter- sonallyadjustedaggregatequarterlyU.S. consumption

minology of Park et al. (1988), these are "spurious and total disposable income (DI,) in real per capita

trends."By the same argumentused by these authors, units, for the period 1953:2-1984:4. Campbell esti-

each F,, statisticis consistentagainstthe alternativeof mated the equation for both total consumption(TC,)

no cointegration.Therefore, the SupF and MeanFsta- and nondurablesand servicesconsumption(NDS,). In

tistics will be also. the following regressions,a constantand a time trend

There is another intuitive concept linking no coin- were included:

tegrationand parameterinstability.Under the null of

cointegration,regressioncoefficientestimatesconverge TCt = -113 + -1.02t + .982DIt

uniformlyin differentparts of the sample space to the (194) (1.83) (.088)

cointegratingrelationship.Under the alternativeof no M = .89

cointegration,however, the regressionestimates con-

verge to randomvariables,whichwill take on different SupF = 12.3 (.15)

values in different samples. See Phillips (1986). Thus MeanF = 6.2 (.05)

sequential parameterestimates will display apparent

.51

parameterinstability.This simple observationimplies Lc= (.09);

an importantmessage. Rejectionof the null of constant

parametersdoes not implythe particularalternativethe NDS, = 518 + 2.96t + .526DIt

test was designed to detect. There are many possibili- (103) (.97) (.047)

ties. If the SupF test rejects, for example, it would be

AM= .97

quite inappropriateto conclude (on this piece of evi-

dence alone) that there were two cointegratingregimes, SupF = 8.7 (>.20)

which shifted at a particularpoint in the sample. The

MeanF = 3.0

only statisticallyjustifiedconclusionis that the standard (>.20)

model of cointegration,includingits implicit assump- Lc = .14 (>.20).

tion of long-runstabilityof the cointegratingrelation-

ship, is rejected by the data. First, examine the fully modified estimates. It ap-

6. APPLICATIONS pears that the correctionsare having an importantef-

fect. The OLS estimates of the first equation, for ex-

We now apply this testing method to three applica- ample, yield a coefficientfor disposableincome of .85

tions. In each example, the fully modified estimation ratherthan the economicallymore plausible .98. Note

method is used. The covarianceparametersare esti- that the estimatedbandwidthparameterfor both equa-

matedusing a QS kernelon residualsprewhitenedwith tions is less than 1, indicatingthat nearlyall of the serial

a VAR(1). (All of the reportedregressionswere also correlationin the residualswas capturedby the pre-

estimated using the Parzen and Bartlett kernels, and whiteningprocedure.

the results were nearly identical.) The bandwidthpa- The tests when applied to the first equation do not

rameterwas selectedaccordingto the recommendations yield clear results, with p values rangingfrom .05 to

of Andrews (1991), using univariateAR(1) approxi- .15. Although the evidence suggeststhat the relation-

mating models. In all regressionsreported, the esti- ship may indeed be unstable, the data are not suffi-

mates and standarderrors are the fully modified esti- ciently informativeto be able to reject the null of sta-

mates of Phillips and Hansen (1990). The estimated bility. On the other hand, the second equation (for

plug-in bandwidthparameter(M) is reported. All of nondurablesand services consumption)does not sug-

the SupF and MeanF statisticsare calculatedusing the gest instabilityat all, since none of the test statisticsare

trimmingregion [.15, .85]. The constancytest statistics significantat the 20% level. These results (for both

are reported along with their asymptoticp values (in equations)are robustto the choiceof kernelandwhether

parentheses), which are calculated according to the the equationsare estimatedafter taking logarithms.

method of Section 4. It is informativeto visuallyexaminethe sequence of

F statisticsfor structuralchange.Figures1 and2 display

6.1 Aggregate Consumption Function these sequences for each regression, along with 5%

The notion of an aggregaterelationshipbetweencon- criticalvalues for its largest value (SupF), its average

sumptionand income has a long history in macroeco- value (MeanF), and for a fixed known breakpoint.

This content downloaded from 62.122.76.45 on Sat, 21 Jun 2014 23:43:47 PM

All use subject to JSTOR Terms and Conditions

330 Journalof Business & EconomicStatistics,July 1992

I I I I I I I I I I I

4-1

0

U)

Ll-

C0

0 ? ? ? ? ?

1958 1962 1966 1970 1974 1978 1982

Figure 1. Total Consumption, 1953-1984: - , F Statistic Sequence; --, 5% Critical, SupF;...... 5% Critical, MeanF; ---, 5% Critical,

KnownBreak.

6.2 Present-Value Model

1871-1986, they found evidence to support this claim.

Campbell and Shiller (1987) argued that a standard In a later series of articles, Campbell and Shiller (1988a,b)

rational-expectations model of asset markets implies argued for a logarithmic approximation that implicitly

that real stock prices and dividends should be cointe- assumes that the logarithms of the price and dividend

grated. Using price (P,) and (D,) indexes for the period indexes are cointegrated. Using their data, we can test

OD

T- I II I I _I I I I I

' I

C0

0

v--

0

4-J

U) 00

d-..,

0 I I I I I

1958 1962 1966 1970 1974 1978 1982

Figure 2. NDS Consumption, 1953-1984: - , F Statistic Sequence; --, 5% Critical, SupF;...... 5% Critical, MeanF; ---, 5% Critical,

KnownBreak.

This content downloaded from 62.122.76.45 on Sat, 21 Jun 2014 23:43:47 PM

All use subject to JSTOR Terms and Conditions

Hansen:Test for Instabilitywith1(1)Processes 331

the stabilityof each specification: be unity, but the point estimate is significantlyabove

this value. The SupFand MeanFtests statisticssuggests

P, = -.15 + 32.1D,

that the relationshipis not stable. The plot of the se-

(.06) (3.5) quence of F statisticsis displayedin Figure4.

A = .78 Thisevidencesuggeststhatstockpricesanddividends

are indeed cointegrated,but the logarithmicapproxi-

SupF = 6.9 (>.20) mationused by Campbelland Shiller(1988a,b)may be

MeanF = 3.3 (.14) misspecified.

Lc = .30 (>.20);

6.3 Term Structure of Interest Rates

ln(P,) = 4.44 + 1.33 ln(D,) The theory of the term structureof interest rates

(.51) (.12) suggests that, if interest rates can be characterizedas

M = 1.07 1(1) processes,then they shouldbe cointegrated.Stock

and Watson (1988), for example, tested for cointegra-

SupF = 11.7 (.06) tion amongthree postwarU.S. interestratesand found

MeanF = 5.1 evidence of two cointegratingvectors (i.e., only one

(.03)

commontrend). They used monthlydata fromJanuary

Lc = .35 (.18). 1960to August 1979, presumablyto exclude a possible

regime shift in the term structuredue to the change in

The levels equation yields estimates very close to the FederalReserve'soperatingproceduresin 1979.We

those fromOLS (whichgivesa slope coefficientof 31.1). now test the hypothesisthat these relationshipsare sta-

Thiscorrespondsto a long-runreal-interestrateof 3.1%, ble over the entire period from January1960to March

which, as noted by Campbelland Shiller (1987), is be- 1990. We use the same series-the federal funds rate

low the sample mean returnof 8.2%. The relationship (FF), the 90-daytreasury-billrate (TB3), and the one-

appearsvery stable, however, with no significanttest year treasury-billrate (TB12)-and obtainedthe series

statistics. The plot of the sequence of F statistics is from the Citibasedata base.

displayedin Figure3. We report the results of two fully modified regres-

The logarithmicspecification does not perform as sions, TB3 on TB12 and TB3 on FF (the regressionof

well. The modelpredictsthatthe slope coefficientshould TB12 on FF yields resultsvery similarto the regression

00 -

0

I.s._

1880 1900 1920 1940 1960 1980

Figure 3. Stock Prices and Dividends, 1871-1986: , F Statistic Sequence; --, 5% Critical, SupF;...... 5% Critical MeanF; ---, 5%

Critical,KnownBreak.

This content downloaded from 62.122.76.45 on Sat, 21 Jun 2014 23:43:47 PM

All use subject to JSTOR Terms and Conditions

332 Journalof Business&Economic

Statistics,July1992

in

1-

0

1880 1900 1920 1940 1960 1980

Figure 4. Logged Stock Prices and Dividends, 1871-1986: -- , F Statistic Sequence; --, 5% Critical SupF;...... 5% Critical, MeanF;

---, 5% Critical, Known Break.

of TB3 on FF): to have affected the relationship between the federal-

funds rate and the treasury-bill rates but not the rela-

TB3, = -.62 + 1.06TB12,

tionship between the treasury-bill rates of different

(.22) (.03) maturities.

M = 2.54

7. CONCLUSION

SupF = 3.6 (>.20) As shown by example in Section 6, in some appli-

MeanF = 1.6 (>.20) cations the three test statistics (SupF, MeanF, and Lc)

.21 may appear to be in conflict. There is no reason why

Lc= (>.20); all three tests should reject (or not reject) at a particular

TB3, = .49 + .83FF, level of significance in a particular sample. The tests

are looking in different directions and will have more

(.14) (.02) power against some alternatives than others. All of the

M = 2.51 tests, however, will have asymptotic power against the

same set of alternatives. The possibility of conflicting

SupF = 22.8 (.01) test statistics is not new to applied economists. There

MeanF = 8.4 (.01) are many tests for heteroscedasticity, for unit roots, for

cointegration, and so forth. The same care needs to be

Lc = .45 (.06). exercised in the present context. Calculation of all three

Over the entire period, it appears that the two treasury- test statistics seems the most judicious suggestion at this

bill rates are cointegrated with a stable relationship, time.

with a near-unity slope coefficient. This is strong sup- The tests were describedhere usingthe Phillips-Hansen

port for the theory of the term structure. In contrast, fully modified estimator. This is not the only possibility.

the relationship of the treasury-bill rate with the federal- It is quite straightforward to calculate the test statistics

funds rate appears unstable, with the SupF and MeanF for other asymptotically efficient estimates of cointe-

statistics highly significant. Figures 5 and 6 display the grating vectors, such as the MLE due to Johansen (1988)

sequences of F statistics for the two regressions. The or the "leads and lags" estimator of Saikkonen (1991)

sequence for the second regression crosses the 5% SupF and Stock and Watson (1991). Since the estimators are

critical value several times, achieving its maximal value asymptotically equivalent, the test statistics would have

approximately in 1980. This supports the conjecture the same asymptotic distributions as those tabulated in

that the change in the Federal Reserve's operating pro- this article. It is quite likely, however, that the asymp-

cedures altered the relationship between some interest totic proofs would be more difficult.

rates. It is interesting that this regime shift only appears This article only discussed joint tests on all of the

This content downloaded from 62.122.76.45 on Sat, 21 Jun 2014 23:43:47 PM

All use subject to JSTOR Terms and Conditions

Hansen:Test for Instabilitywith 1(1)Processes 333

00

4-

LL

0 -

0 I I I I I.

1960 1964 1968 1972 1976 1980 1984

Figure 5. Three-Monthand One-YearTreasury-BillRates, 1960-1990: , F Statistic Sequence; --, 5% CriticalSupF; ....... 5%

Critical MeanF; ---, 5% Critical, Known Break.

regression parameters in a cointegrating regression. It Adrian Pagan, Jim Stock, the associate editor, the ref-

should be possible to extend these results to tests on a eree, and seminar participants at the University of

subset of the parameters as well. This will be left to Rochester, Indiana University, and UCLA for helpful

future research. discussions and comments on earlier drafts. This research

was supported by the National Science Foundation.

ACKNOWLEDGMENTS APPENDIX: PROOFS OF THE THEOREMS

An earlier version of this article was entitled "Testing Proof of Theorem 1

for Structural Change of Unknown Form in Models

With Non-stationary Regressors." My thanks go to Don (a) The finite-dimensional result is immediate from

Andrews, Bill Brown, David Hendry, Peter Phillips, (14). Weak convergence follows from the continuous

0-

Co

Ic

U- r _

0

1960 1964 1968 1972 1976 1980 1984

and Federal Funds Rates, 1960-1990: --

Figure 6. Three-MonthTreasury-Bill , F StatisticSequence; --, 5% Critical,SupF; .....

5% Critical, MeanF; ---, 5% Critical, Known Break.

This content downloaded from 62.122.76.45 on Sat, 21 Jun 2014 23:43:47 PM

All use subject to JSTOR Terms and Conditions

334 Journalof Business & EconomicStatistics,July 1992

mapping theorem (see Billingsley 1968, p. 30) since + r(

XdB, T

M(r) is a continuousfunctionof r and X(.). a l 2 )

*21/

(b) This follows from part (a) and continuity.

(c) By (13) and theorem 4.1 of Hansen (1992c), - r X(f xx)\ XdB.-20- (

( nn 1

1 l-n-

RV f22 fl2 op)u+ = S(T)fl12 - M(T)M(1)- S(1)I'1.2

=

,nnCnx,ul'

1 '2 2t It

n"i

= S*(r)fi.2

f/ kdB.2

by Theorem 1 and the continuousmappingtheorem.

f

(lnf2n* 2 nr (frB2dB2 + tA+y (b)

Fn(T) = tr{Sn(T)'Vn(T)-'S(Tr)l21}

= tr{ S(T)'( rnvn(),T) , rsT)1}

J;WdB2+A

By (11),A

~\W2(d)

(d) By (11), > tr{lS2ST*(r)'

V(T)-S*(T)ll'.2ln.2 }

= tr{S*(T)'V(T)-lS*(T)}.

-

r2nA2+1 = | -1/2 2 (A21 - &22f221 21l) Proofof Theorem3

l(2*' 2\2 /2*)

Part(a) followsfromTheorem2 (b) and the fact that

0O conditional on 9x, for any r E ST,vec(S*(T)) = N(0,

II(n*' 1i22n 1/2

1.2 ( V(r)), and therefore

n1/

F(T)l -- X2b

=(2?) Since this distributionis independentof 9, it is the

unconditionaldistributionas well.

(e) Part (b) follows from Theorem2(b) and the contin-

n (A+ - A)F-1 = - V (OA+')rF uous mappingtheorem.

( 1v 1 lti2xr'

Part (c) follows from Theorem2(b), the continuous

mapping theorem and the fact that fyF(r)dr is well

-

(-12122

-

,121-22) n I 2t,Xt) defined.

Part (d) follows from Theorem l(a), Theorem2(a),

and (11).

\n x xn

[ReceivedJanuary1991. RevisedJanuary1992.]

=> dB ,.2X' + (0 A+')

REFERENCES

(OA,))(1 ) Anderson,T. W., and Darling,D. A. (1952), "AsymptoticTheory

of Certain 'Goodness of Fit' CriteriaBased on StochasticPro-

cesses," TheAnnals of Mathematical Statistics,23, 193-212.

- f dB2X'(f xx') Andrews, D. W. K. (1990), "Tests for ParameterInstabilityand

StructuralChange With Unknown Change Point," Discussion

Paper 943, Yale University,Cowles Foundationfor Researchin

by parts (a), (c), and (d), and (11). Economics.

and AutocorrelationConsistent

(1991), "Heteroskedasticity

Proof of Theorem 2 CovarianceMatrixEstimation,"Econometrica,59, 817-858.

Andrews,D. W. K., and Monahan,J. C. (in press), "An Improved

(a)

Ilnr Heteroskedasticityand AutocorrelationConsistent Covariance

1 1 Inl1 1 MatrixEstimator,"Econometrica,60.

-r,sn(r) = - rn St ,- r, alt

Banerjee,A., Lumsdaine,R. L., andStock,J. H. (1992),"Recursive

=

n- 7n tt = N/n 1=1 \ (A21))

andSequentialTestsof the Unit Root andTrendBreakHypothesis

1 [n'" Theory and InternationalEvidence. Journalof Business& Eco-

nomic Statistics,10, 271-287.

I , t= Billingsley, P. (1968), Convergenceof ProbabilityMeasures,New

York: John Wiley.

n t=l Blinder, A. A., and Deaton, A. S. (1985) "The Time Series Con-

sumptionFunctionRevisited,"BrookingsPaperson EconomicAc-

[n_] o0 tivity,465-511.

Vn r2A21J Campbell,J. Y. (1987), "Does SavingAnticipateDecliningLabor

This content downloaded from 62.122.76.45 on Sat, 21 Jun 2014 23:43:47 PM

All use subject to JSTOR Terms and Conditions

Hansen:Test for Instabilitywith 1(1)Processes 335

Income?An AlternativeTest of the PermanentIncome Hypoth- Nyblom, J. (1989), "Testingfor the Constancyof ParametersOver

esis," Econometrica,55, 1249-1273. Time," Journalof the AmericanStatisticalAssociation,84, 223-

Campbell,J. Y., and Shiller,R. J. (1987), "CointegrationandTests 230.

of PresentValueModels,"Journalof PoliticalEconomy,95, 1062- Nyblom, J., and Makelainen,T. (1983), "Comparisonsof Tests for

1088. the Presence of Random Walk Coefficientsin a Simple Linear

(1988a), "Stock Prices, Earningand Expected Dividends," Model,"Journalof the AmericanStatisticalAssociation,84, 856-

TheJournalof Finance,43, 661-676. 864.

(1988b),"The Dividend-PriceRatio and Expectationsof Fu- Ogaki, M., and Park, J. Y. (1990), "A CointegrationApproachto

tureDividendsandDiscountFactors,"Reviewof FinancialStudies, EstimatingPreferenceParameters,"Paper236, RochesterCenter

1, 195-228. for EconomicResearch.

Chow, G. C. (1960), "Testsof EqualityBetweenSets of Coefficients Pagan,A. R., andTanaka,K. (1981), "A FurtherTest for Assessing

in Two LinearRegressions,"Econometrica,28, 591-605. the Stabilityof RegressionCoefficients,"unpublishedmanuscript.

Chu, C.-S. J. (1989), "New Tests for ParameterConstancyin Sta- Park,J. Y., andOgaki,M. (1991),"Inferencein CointegratedModels

tionaryandNonstationaryRegressionModels,"unpublishedman- UsingVAR Prewhiteningto EstimateShortrunDynamics,"Work-

uscript,Universityof Californiaat SanDiego, Dept. of Economics. ing Paper281, RochesterCenterfor EconomicResearch.

Engle, R. F., and Granger,C. W. J. (1987), "Co-integrationand Park,J. Y., Ouliaris,S., and Choi, B. (1988), "A New Approachto

Error-correction: Representation,EstimationandTesting,"Econ- Testing for a Unit Root," mimeo, Cornell University,Dept. of

ometrica,55, 251-276. Economics.

Gardner,L. A., Jr. (1969), "On DetectingChangesin the Mean of Park, J. Y., and Phillips,P. C. B. (1989), "StatisticalInferencein

NormalVariates,"TheAnnalsof Mathematical Statistics,40, 116- RegressionsWithIntegratedProcesses,Part1," EconometricThe-

126. ory, 4, 468-497.

Granger,C. W. J. (1981), "Some Propertiesof Time Series Data Parzen, E. (1957), "On ConsistentEstimatesof the Spectrumof a

and Their Use in EconometricModel Specification,"Journalof StationaryTime Series,"TheAnnalsof Mathematical Statistics,28,

Econometrics,16, 121-130. 329-348.

Granger,C. W. J., and Lee, T.-H. (1990), "Multicointegration," Perron,P. (1989), "The Great Crash,the Oil Price Shock, and the

Advancesin Econometrics,8, 71-84. Unit Root Hypothesis,"Econometrica,57, 1361-1401.

Gregory,A. W., and Nason, J. M. (1991), "Testingfor Structural Phillips, P. C. B. (1986), "UnderstandingSpuriousRegressionsin

Breaks in CointegratedRelationships,"unpublishedmanuscript, Econometrics,"Journalof Econometrics,33, 311-340.

Queen's University,Dept. of Economics. Phillips,P. C. B., and Hansen, B. E. (1990), "StatisticalInference

Hansen, B. E. (1990), "LagrangeMultiplierTests for Parameter in InstrumentalVariablesRegressionWithI(1) Processes,"Review

Instabilityin Non-linearModels," unpublishedmanuscript,Uni- of EconomicStudies,57, 99-125.

versityof Rochester,Dept. of Economics. Phillips, P. C. B., and Loretan, M. (1991), "EstimatingLong-run

(in press a), "EfficientEstimationand Testing of Cointe- EconomicEquilibria,"Reviewof EconomicStudies,58, 407-436.

gratingVectorsin the Presenceof DeterministicTrends,"Journal Phillips,P. C. B., and Ouliaris,S. (1990), "AsymptoticProperties

of Econometrics,52. of Residual Based Tests for Cointegration,"Econometrica,58,

(in press b), "ConsistentCovarianceMatrixEstimationfor 165-193.

DependentHeterogeneousProcesses,"Econometrica,60. Quandt,R. (1960), "Testsof the HypothesisThat a LinearRegres-

(in press c), "Convergenceto StochasticIntegralsfor De- sion SystemObeysTwo SeparateRegimes,"Journalof theAmer-

pendentHeterogeneousProcesses,"EconometricTheory,8. ican StatisticalAssociation,55, 324-30.

Herrndorf,N. (1984), "A FunctionalCentral Limit Theorem for Saikkonen,P. (1991), "AsymptoticallyEfficientEstimationof Coin-

WeaklyDependentSequencesof RandomVariables,"TheAnnals tegratingRegressions,"EconometricTheory,7, 1-21.

of Probability,12, 829-839. Snow, M. S., and Im, E. I. (1991), "The Equivalenceof Two Test

Johansen,S. (1988), "StatisticalAnalysisof CointegrationVectors," Statisticsfor Testing the Constancyof RegressionCoefficients,"

Journalof EconomicDynamicsand Control,12, 231-254. EconometricTheory,7, 419-420.

King, M. L. (1987), "An AlternativeTest for RegressionCoefficient Stock, J. H., and Watson, M. W. (1988), "Testingfor Common

Stability,"TheReviewof Economicsand Statistics,69, 379-381. Trends,"Journalof theAmericanStatisticalAssociation,83, 1097-

Leybourne,S. L., and McCabe, B. P. M. (1989), "On the Distri- 1107.

bution of Some Test Statisticsfor CoefficientConstancy,"Bio- (1991),"A SimpleEstimatorof Cointegrating Vectorsin Higher

metrika,76, 169-177. OrderIntegratedSystems,"unpublishedmanucript.

Nabeya, S., and Tanaka,K. (1988), "AsymptoticTheoryof a Test Zivot, E., andAndrews,D. W. K. (1992), "FurtherEvidenceon the

for the Constancyof RegressionCoefficientsAgainstthe Random GreatCrash,the Oil-PriceShock,andthe Unit-RootHypothesis,"

Walk Alternative,"TheAnnals of Statistics,16, 218-235. Journalof Business& EconomicStatistics,10, 251-270.

This content downloaded from 62.122.76.45 on Sat, 21 Jun 2014 23:43:47 PM

All use subject to JSTOR Terms and Conditions

You might also like

- SSP 512 Automated 5 Speed Manual Gearbox 0CTDocument36 pagesSSP 512 Automated 5 Speed Manual Gearbox 0CTossoski100% (3)

- Stable Convergence and Stable Limit Theorems: Erich Häusler Harald LuschgyDocument231 pagesStable Convergence and Stable Limit Theorems: Erich Häusler Harald Luschgyepidendrum2No ratings yet

- Numerical Methods for Stochastic Computations: A Spectral Method ApproachFrom EverandNumerical Methods for Stochastic Computations: A Spectral Method ApproachRating: 5 out of 5 stars5/5 (2)

- Yoga For Back PainDocument5 pagesYoga For Back PainaadityabuggascribdNo ratings yet

- GP 30 85 Fire and Gas DetectionDocument45 pagesGP 30 85 Fire and Gas Detectionsgh135586% (7)

- Brown Durbin Evans 1975Document45 pagesBrown Durbin Evans 1975Iván EstevesNo ratings yet

- Statistical Inference For Time-InhomogeneousDocument27 pagesStatistical Inference For Time-InhomogeneousScott TreloarNo ratings yet

- Weighted Quantile Regression For Longitudinal DataDocument22 pagesWeighted Quantile Regression For Longitudinal DataAgossou Alex AgbahideNo ratings yet

- Choi 2018Document13 pagesChoi 2018Agossou Alex AgbahideNo ratings yet

- Cuantil Regression in RDocument26 pagesCuantil Regression in RAratz HernandezNo ratings yet

- Bayesian Model Comparison For Time-Varying Parameter Vars With Stochastic VolatilityDocument38 pagesBayesian Model Comparison For Time-Varying Parameter Vars With Stochastic VolatilityLauraNo ratings yet

- Maximum Likelihood and Gaussian EstimationDocument35 pagesMaximum Likelihood and Gaussian EstimationBoutoubaNo ratings yet

- Ancillarity-Sufficiency Interweaving Strategy (ASIS) For Boosting MCMC Estimation of Stochastic Volatility ModelsDocument27 pagesAncillarity-Sufficiency Interweaving Strategy (ASIS) For Boosting MCMC Estimation of Stochastic Volatility ModelsjjjjNo ratings yet

- Step Stress ALT ChinaDocument11 pagesStep Stress ALT ChinaAnshul NautiyalNo ratings yet

- K. Haynes, P. Fearnhead - A - Computationally - Efficient - Nonparametric - Approach For Changepoint Detection, 2016Document32 pagesK. Haynes, P. Fearnhead - A - Computationally - Efficient - Nonparametric - Approach For Changepoint Detection, 2016CarlosRivasNo ratings yet

- Kim Shephard Chib 98Document33 pagesKim Shephard Chib 98ALVARO MIGUEL JESUS RODRIGUEZ SAENZNo ratings yet

- The Efficiency of Systematic Sampling in Stereology - ReconsideredDocument13 pagesThe Efficiency of Systematic Sampling in Stereology - ReconsideredRodrigo Felipe Toro MellaNo ratings yet

- Testing For Cross-Sectional Dependence in Panel-Data Models: 6, Number 4, Pp. 482-496Document15 pagesTesting For Cross-Sectional Dependence in Panel-Data Models: 6, Number 4, Pp. 482-496Oumaima KASSEMNo ratings yet