Professional Documents

Culture Documents

Financial Statements Q - Student

Financial Statements Q - Student

Uploaded by

Sun PujunOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Statements Q - Student

Financial Statements Q - Student

Uploaded by

Sun PujunCopyright:

Available Formats

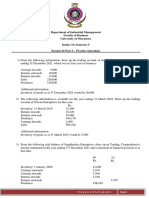

Financial Statements (including adjustments)

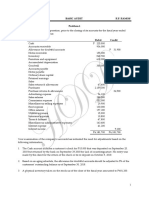

Mr Chai has been trading for some years as a wine merchant. The following list of balances has

been extracted from his ledger as at 30 April 2017, the end of his most recent financial year.

RM

Capital 83,887

Sales 259,870

Trade creditors 19,840

Returns out 13,407

Provision for doubtful debts 512

Discounts allowed 2,306

Discounts received 1,750

Purchases 135,680

Returns inwards 5,624

Carriage outwards 4,562

Drawings 18,440

Carriage inwards 11,830

Rent, rates and insurance 25,973

Heating and lighting 11,010

Postage, stationery and telephone 2,410

Advertising 5,980

Salaries and wages 38,521

Bad debts 2,008

Cash in hand 534

Cash at bank 4,440

Stock as at 1 May 2016 15,654

Trade debtors 24,500

Fixtures and fittings – at cost 120,740

Provision for depreciation on fixtures 63,020

and fittings – as at 30 April 2017

Depreciation 12,074

The following additional information as at 30 April 2017 is available:

(a) Stock at the close of business was valued at RM17,750.

(b) Insurances have been prepaid by RM1,120.

(c) Heating and lighting is accrued by RM1,360.

(d) Rates have been prepaid by RM5,435.

(e) The provision for doubtful debts is to be adjusted so that it is 3% of trade debtors.

Required:

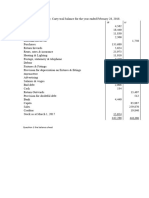

Prepare Mr Chai’s trading and profit and loss account for the year ended 30 April 2017 and a

balance sheet as at that date.

You might also like

- Introduction To AccountingDocument180 pagesIntroduction To Accountingmuzamilmf5No ratings yet

- Level 1 MockDocument33 pagesLevel 1 MockMuhammad Ahmed100% (3)

- 4.0 Curly KaleDocument2 pages4.0 Curly KaleAkik HasanNo ratings yet

- Feb Case Analysis 4Document3 pagesFeb Case Analysis 4Kote GagnidzeNo ratings yet

- INCOMPLETEDocument13 pagesINCOMPLETEOwen Bawlor ManozNo ratings yet

- Accounting Revision QuestionsDocument8 pagesAccounting Revision QuestionsFranswa MateteNo ratings yet

- Review Questions Volume 1 - Chapter 7Document3 pagesReview Questions Volume 1 - Chapter 7YelenochkaNo ratings yet

- Research Analyst Notes - NoRestrictionDocument33 pagesResearch Analyst Notes - NoRestrictionMayank Gupta67% (3)

- Test 1 (QP)Document2 pagesTest 1 (QP)Bushra AsgharNo ratings yet

- Assignment MBA 1003Document34 pagesAssignment MBA 1003KAWongCy100% (1)

- Accounting Questions PracticesDocument2 pagesAccounting Questions PracticesSusanna Ng50% (2)

- Ac108 May2017Document5 pagesAc108 May2017Sahid Afrid AnwahNo ratings yet

- Question 3-FSDocument1 pageQuestion 3-FSRax-Nguajandja KapuireNo ratings yet

- Tutorial AdjustmentDocument13 pagesTutorial AdjustmentnoorhanaNo ratings yet

- Frankwood 361-361Document1 pageFrankwood 361-361saiimbutt525No ratings yet

- Quiz 1 AccountingDocument2 pagesQuiz 1 AccountingNayab ShamsiNo ratings yet

- Single & Double EntryDocument9 pagesSingle & Double EntryJoel VargheseNo ratings yet

- Accounting Fundamentals - PWS - 7Document11 pagesAccounting Fundamentals - PWS - 7Meet PatelNo ratings yet

- Assessment MerchandisingDocument2 pagesAssessment MerchandisingPauline BiancaNo ratings yet

- Accounting Week13 Lec01 & Lec02 NotesDocument3 pagesAccounting Week13 Lec01 & Lec02 NotesABUBAKAR FawadNo ratings yet

- Compre Audit Cieloflawless Q PDFDocument3 pagesCompre Audit Cieloflawless Q PDFCarina Mae Valdez ValenciaNo ratings yet

- Revision Paper Semester Examination 2023 JulyDocument4 pagesRevision Paper Semester Examination 2023 JulydinishiappuhamyNo ratings yet

- PracticeDocument1 pagePracticeNana CatNo ratings yet

- HKMA David Li Kwok Po College S4 Business, Accounting and Financial Studies Accounting Classwork 1Document4 pagesHKMA David Li Kwok Po College S4 Business, Accounting and Financial Studies Accounting Classwork 1Cho VinceNo ratings yet

- Financial Statements - Lesson 02 (Part 2) QuestionsDocument3 pagesFinancial Statements - Lesson 02 (Part 2) QuestionsNirmal JayakodyNo ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Financial ReportingDocument11 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Financial ReportingNarendra KumarNo ratings yet

- Revision Questions For Progressive Check - Suggested Solutions 2Document5 pagesRevision Questions For Progressive Check - Suggested Solutions 2Grace Ting Jia JiaNo ratings yet

- ACP314 Competency PracticeDocument1 pageACP314 Competency PracticeJastine Rose CañeteNo ratings yet

- Trial Balance and Final Accounts ProblemsDocument6 pagesTrial Balance and Final Accounts Problemsbhanu.chandu100% (1)

- M2 Academy - Income StatementsDocument2 pagesM2 Academy - Income StatementsDesire Mthungameli DubeNo ratings yet

- Resit Examinations For 2004 - 2005 / Semester 2: Module: Financial AccountingDocument6 pagesResit Examinations For 2004 - 2005 / Semester 2: Module: Financial AccountingBasilio MaliwangaNo ratings yet

- Question 1 Trail BalanceDocument1 pageQuestion 1 Trail Balancehamsmith1876No ratings yet

- M SamiDocument5 pagesM SamiMah rukh M.yaqoobNo ratings yet

- Balance Sheet As On 1-4-2012: Liabilities RS Assets RSDocument2 pagesBalance Sheet As On 1-4-2012: Liabilities RS Assets RSL.D TECHNICAL POINTNo ratings yet

- Ingenuity International School and College Baridhara, Gulshan, Dhaka. MCT-4 Sub: Accounting Class-Std - VIIIDocument2 pagesIngenuity International School and College Baridhara, Gulshan, Dhaka. MCT-4 Sub: Accounting Class-Std - VIIINayna Sharmin100% (1)

- Igcse - Final AccountsDocument4 pagesIgcse - Final AccountsMUSTHARI KHANNo ratings yet

- Last Term RevisionDocument2 pagesLast Term RevisionNgoc Huỳnh HyNo ratings yet

- Final Accounts AssignemntDocument7 pagesFinal Accounts Assignemntamruthavarshini2765No ratings yet

- Tutorial 7 QADocument4 pagesTutorial 7 QAJin HueyNo ratings yet

- Unit 2Document15 pagesUnit 2neharajt06061No ratings yet

- P&LAC Exercises PracticeDocument5 pagesP&LAC Exercises PracticeDilfaraz KalawatNo ratings yet

- Final Accounts QuesDocument2 pagesFinal Accounts QuesJiller GgNo ratings yet

- The Following Trial Balance Have Been Taken Out From The Books of XYZ As On 31st DecemberDocument3 pagesThe Following Trial Balance Have Been Taken Out From The Books of XYZ As On 31st DecemberyogeshNo ratings yet

- Financial Statements (Basic)Document7 pagesFinancial Statements (Basic)Mohamed MubarakNo ratings yet

- Financial Statement - Yr 10Document1 pageFinancial Statement - Yr 10MUSTHARI KHANNo ratings yet

- Financial Statements of NonDocument3 pagesFinancial Statements of NonYashi GuptaNo ratings yet

- Completing The Accounting Cycle - Merchandising YtDocument1 pageCompleting The Accounting Cycle - Merchandising YtGoogle UserNo ratings yet

- DocumentDocument2 pagesDocumentShivaansh VatsNo ratings yet

- ISSo FPDocument6 pagesISSo FPabbeangedesireNo ratings yet

- Accounts Assignment Class 11 CandE 20220111131012374Document5 pagesAccounts Assignment Class 11 CandE 20220111131012374Jithu EmmanuelNo ratings yet

- Final Account ProblemDocument22 pagesFinal Account ProblemAbhijeet Anand100% (1)

- Tutorial 5 6 UECH1104Document3 pagesTutorial 5 6 UECH1104Putri Nurin Hasnida HassanNo ratings yet

- Financial Statement Assignment 1Document3 pagesFinancial Statement Assignment 1tahasafdari772No ratings yet

- 2017 S2 (final) (尊孔)Document5 pages2017 S2 (final) (尊孔)Khor Xing TienNo ratings yet

- 5 FINANCIAL ACCOUNTING I PaperDocument5 pages5 FINANCIAL ACCOUNTING I PaperRhys SinclairNo ratings yet

- Biweekly 3.1 - QDocument3 pagesBiweekly 3.1 - QVilma Tayum100% (1)

- Additional Class Tutorial Basic Sopl SofpDocument2 pagesAdditional Class Tutorial Basic Sopl Sofpazra balqisNo ratings yet

- Balances of Different Ledger Accounts Amount (RS)Document2 pagesBalances of Different Ledger Accounts Amount (RS)Ashish ChandraNo ratings yet

- ACC311 November 2018Document5 pagesACC311 November 2018Sunday NgbokiNo ratings yet

- Grade 10 Provincial Case Study QP 2023Document5 pagesGrade 10 Provincial Case Study QP 2023kwazy dlaminiNo ratings yet

- Suggested Answer CAP II June 2017rDocument104 pagesSuggested Answer CAP II June 2017rBAZINGANo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- ACC1201 Assignment Jan 2023Document3 pagesACC1201 Assignment Jan 2023Sun PujunNo ratings yet

- Adjusting EntriesDocument1 pageAdjusting EntriesSun PujunNo ratings yet

- Additional Question - L4Document1 pageAdditional Question - L4Sun PujunNo ratings yet

- ASSDocument5 pagesASSSun PujunNo ratings yet

- Organizational Plan:: Form of OwnershipDocument3 pagesOrganizational Plan:: Form of OwnershiphibaNo ratings yet

- Economic Problems of Pakistan and Their Solutions: Hafiz DabeerDocument45 pagesEconomic Problems of Pakistan and Their Solutions: Hafiz DabeerSajid Ali MaharNo ratings yet

- Sage 50 Payroll Year End GuideDocument43 pagesSage 50 Payroll Year End GuidemirzabasithNo ratings yet

- Nationalisation of BankDocument17 pagesNationalisation of Banklavanyasundar7No ratings yet

- Major Accounts: Kelvin Jay S. Sapla, LPT, CTTDocument10 pagesMajor Accounts: Kelvin Jay S. Sapla, LPT, CTTKelvin Jay Sebastian SaplaNo ratings yet

- Ching AgcaoiliDocument39 pagesChing AgcaoiliAlj SolemnNo ratings yet

- Form 26QB: Income Tax DepartmentDocument3 pagesForm 26QB: Income Tax DepartmentAnand JaiswalNo ratings yet

- Special Exam - AllDocument5 pagesSpecial Exam - AllRegie AlbeldaNo ratings yet

- Marketing Management - CarvelDocument14 pagesMarketing Management - CarvelyusnazaNo ratings yet

- Mas 02 - Variable Absorption Costing & BudgetingDocument11 pagesMas 02 - Variable Absorption Costing & BudgetingCriane DomineusNo ratings yet

- Finance Department Analysis of Dabur LimitedDocument15 pagesFinance Department Analysis of Dabur LimitedradhikaNo ratings yet

- Avenue Supermarts LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument8 pagesAvenue Supermarts LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Financial Statements, Taxes, and Cash FlowDocument46 pagesFinancial Statements, Taxes, and Cash FlowgagafikNo ratings yet

- Mas 2605Document6 pagesMas 2605John Philip CastroNo ratings yet

- Audited Financial Statements - ATRAM AsiaPlus Equity FundDocument29 pagesAudited Financial Statements - ATRAM AsiaPlus Equity FundKnivesNo ratings yet

- Manajemen Keuangan-Modul 2Document59 pagesManajemen Keuangan-Modul 2Rian syaeful anwarNo ratings yet

- Vergara, Gian Bianca F. BSAT-4A Recitation: Compensation IncomeDocument4 pagesVergara, Gian Bianca F. BSAT-4A Recitation: Compensation Incomelena cpaNo ratings yet

- Types of Risk in International BusinessDocument9 pagesTypes of Risk in International BusinessBappa P M BaruaNo ratings yet

- The Most Used Revenue Management KPI's For HotelsDocument5 pagesThe Most Used Revenue Management KPI's For Hotelsjakamgeroev.netNo ratings yet

- Public Finance Mcqs by Geek: A. B. C. DDocument11 pagesPublic Finance Mcqs by Geek: A. B. C. DIbrahimGorgage100% (1)

- Form 16: Ibm Daksh Business Process Services Pvt. LTDDocument5 pagesForm 16: Ibm Daksh Business Process Services Pvt. LTDmadan mehtaNo ratings yet

- Canara Bank 1 Floor, Gulmohar Building, Central Area, IIT Bombay, Powai Campus, Mumbai - 400076, IndiaDocument3 pagesCanara Bank 1 Floor, Gulmohar Building, Central Area, IIT Bombay, Powai Campus, Mumbai - 400076, IndiaDesikanNo ratings yet

- Assignment On PrivatisationDocument12 pagesAssignment On Privatisationbahubali50% (8)

- 90 03 Q Income Tax On CorporationDocument14 pages90 03 Q Income Tax On CorporationRhoshelle Beleganio100% (1)

- The Steel Index Webinar Slides DownloadDocument32 pagesThe Steel Index Webinar Slides DownloadMoez MoezNo ratings yet

- Strategies in Action: Strategic Management: Concepts & Cases 13 Edition Fred DavidDocument17 pagesStrategies in Action: Strategic Management: Concepts & Cases 13 Edition Fred DavidChris Nicole LaigueNo ratings yet

- Ahmed Dan Hamdan 2015Document24 pagesAhmed Dan Hamdan 2015Raihan RamadhaniNo ratings yet