Professional Documents

Culture Documents

Example 1

Example 1

Uploaded by

Krisha Teves0 ratings0% found this document useful (0 votes)

9 views3 pagesCompany A saw sales increase from $800,000 in year 1 to $1,000,000 in year 2 while operating expenses rose from $450,000 to $550,000. The document then calculates the company's degree of operating leverage (DOL) for the two years. It finds the DOL is 1.14, indicating profits are more sensitive to sales changes than operating costs.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCompany A saw sales increase from $800,000 in year 1 to $1,000,000 in year 2 while operating expenses rose from $450,000 to $550,000. The document then calculates the company's degree of operating leverage (DOL) for the two years. It finds the DOL is 1.14, indicating profits are more sensitive to sales changes than operating costs.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

9 views3 pagesExample 1

Example 1

Uploaded by

Krisha TevesCompany A saw sales increase from $800,000 in year 1 to $1,000,000 in year 2 while operating expenses rose from $450,000 to $550,000. The document then calculates the company's degree of operating leverage (DOL) for the two years. It finds the DOL is 1.14, indicating profits are more sensitive to sales changes than operating costs.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

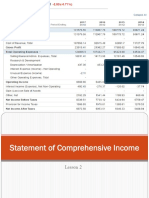

Example 1

Company A, which has clocked sales of $800,000 in year one,

which further increased to $1,000,000 in year two. In year one,

the operating expenses stood at $450,000, while in year two, the

same went up to $550,000. Determine the DOL for Company A.

Use the following data for the calculation of the Degree of Operating

Leverage.

Particulars Year 1 Year 2

Sales Php 800,000 Php 1,000,000

Operating Expense Php 450,000 Php 550,000

EBIT in year 1

EBIT in year 1 = sales in yr 1 – operating expense in year 1

= Php 800,000 – 450,000

= 350,000

EBIT in year 2

EBIT in year 2 = Sales in year 2 – Operating expense in year 2

= ₱1,000,000 – ₱550,000

= ₱450,000

Change in EBIT

Change in EBIT = EBIT in year 2 – EBIT in year 1

= ₱450,000 – ₱350,000

= ₱100,000

Percentage Change in EBIT

Percentage change in EBIT = Change in EBIT / EBIT in year 1 * 100%

= ₱100,000 / ₱350,000 * 100%

= 28.57%

Change in Sales

Change in sales = Sales in year 2 – Sales in year 1

= ₱1,000,000 – ₱800,000

= ₱200,000

Percentage Change in Sales

Percentage change in sales = Change in sales / Sales in year 1 * 100%

= ₱200,000 / ₱800,000 * 100%

= 25.00%

Calculation of Degree of Operating Leverage will be

DOL Formula = Percentage change in EBIT / Percentage change in

sales

DOL Formula= 28.57% / 25.00%

= 1.14

Therefore, the DOL of Company A is 1.14.

You might also like

- FINAN204-21A - Tutorial 3 Week 3Document14 pagesFINAN204-21A - Tutorial 3 Week 3Danae YangNo ratings yet

- 4995628Document5 pages4995628mohitgaba19100% (1)

- Ukff3083 Financial Statement AnalysisDocument4 pagesUkff3083 Financial Statement AnalysisChong Jk100% (1)

- C11 - PAS 8 Accounting Policies, Estimate and ErrorsDocument10 pagesC11 - PAS 8 Accounting Policies, Estimate and ErrorsAllaine Elfa100% (2)

- MAS-14 FS Analaysis With EFN (Letran)Document6 pagesMAS-14 FS Analaysis With EFN (Letran)Gio PacayraNo ratings yet

- COMEX1 TAX REVIEW Canvas-1Document18 pagesCOMEX1 TAX REVIEW Canvas-1LhowellaAquinoNo ratings yet

- Financial Management - Operating Leverage vs. Financial Leverage - MBA 2019-21 - Sem-IIDocument27 pagesFinancial Management - Operating Leverage vs. Financial Leverage - MBA 2019-21 - Sem-IIYash RampuriaNo ratings yet

- Breakeven Point Total Cost Total Sales Formula: Breakeven Point Fixed Cost ÷ Contribution Margin (Price - Variable Cost)Document10 pagesBreakeven Point Total Cost Total Sales Formula: Breakeven Point Fixed Cost ÷ Contribution Margin (Price - Variable Cost)Alyssa Grace Feliciano VicenteNo ratings yet

- Lesson 3 Profit or LossDocument28 pagesLesson 3 Profit or Lossgatdula.hannahlulu.burgosNo ratings yet

- FABM2 Module 5 - FS AnalysisDocument11 pagesFABM2 Module 5 - FS AnalysisKimberly Abella CabreraNo ratings yet

- C. If Selling Price in Year 1 Remains at $10 Per Unit, How Many Units Must Be Sold in Year 1 For The Operating Profit To Be $200,000?Document1 pageC. If Selling Price in Year 1 Remains at $10 Per Unit, How Many Units Must Be Sold in Year 1 For The Operating Profit To Be $200,000?Nitesh AgrawalNo ratings yet

- Given:: Problem 6 - 21: Prepare & Reconcile Variable Costing StatementsDocument13 pagesGiven:: Problem 6 - 21: Prepare & Reconcile Variable Costing StatementsimjiyaNo ratings yet

- Analysis of Financial StatementsDocument17 pagesAnalysis of Financial StatementsMarvin AlmariaNo ratings yet

- Exercise 6Document4 pagesExercise 6Tania MaharaniNo ratings yet

- Example Cash BudgetDocument6 pagesExample Cash BudgetMark RamosNo ratings yet

- MANACC - NotesW - Answers - BEP - The Master BudgetDocument6 pagesMANACC - NotesW - Answers - BEP - The Master Budgetldeguzman210000000953No ratings yet

- Income Tax On Individuals (Part 3)Document13 pagesIncome Tax On Individuals (Part 3)Jamielene TanNo ratings yet

- Financial Management: Operating Leverage & Financial LeverageDocument70 pagesFinancial Management: Operating Leverage & Financial LeverageHarnitNo ratings yet

- Chapter 4: Accounting For Revenues and Reporting Financial PerformanceDocument21 pagesChapter 4: Accounting For Revenues and Reporting Financial PerformanceLinh HoangNo ratings yet

- Profit and Loss StatementDocument4 pagesProfit and Loss Statementsofia mantolinoNo ratings yet

- Interim Financial Reporting NotesDocument3 pagesInterim Financial Reporting NotesRogin Erica AdolfoNo ratings yet

- Lesson 3statement of Changes in EquityDocument11 pagesLesson 3statement of Changes in EquityMarquez, Lynn Andrea L.No ratings yet

- Cost and Management AccountingDocument9 pagesCost and Management AccountingMayur AgarwalNo ratings yet

- ACC101 Cost Accounting. Review For LT1 K.MontejoDocument2 pagesACC101 Cost Accounting. Review For LT1 K.MontejonicoleNo ratings yet

- A. $800,000 B. $600,000 C. $440,000 D. $200,000Document15 pagesA. $800,000 B. $600,000 C. $440,000 D. $200,000sino akoNo ratings yet

- Lesson 2 Statement of Comprehensive IncomeDocument23 pagesLesson 2 Statement of Comprehensive IncomePaulette Sarno80% (5)

- Review Problem: CVP Relationships: RequiredDocument6 pagesReview Problem: CVP Relationships: RequiredMaika J. PudaderaNo ratings yet

- VCMQ1Document11 pagesVCMQ1Daniella Dhanice CanoNo ratings yet

- Tutorial 5 - CHAPTER 9 - QDocument13 pagesTutorial 5 - CHAPTER 9 - QThuỳ PhạmNo ratings yet

- Kuis UTS Genap 21-22 ACCDocument3 pagesKuis UTS Genap 21-22 ACCNatasya FlorenciaNo ratings yet

- Operating Budget DiscussionDocument3 pagesOperating Budget DiscussionDavin DavinNo ratings yet

- Fabm 2: LEARNING ACTIVITIES - Statement of Comprehensive Income (SCI)Document2 pagesFabm 2: LEARNING ACTIVITIES - Statement of Comprehensive Income (SCI)Cameron VelascoNo ratings yet

- Managerial Accounting AssignmentsDocument3 pagesManagerial Accounting Assignmentslovely reyesNo ratings yet

- Income Statement QuestionsDocument2 pagesIncome Statement QuestionsMarc Eric RedondoNo ratings yet

- ADM2341 CH 8 Capstone QDocument2 pagesADM2341 CH 8 Capstone QjuiceNo ratings yet

- Practice Problems-Income Tax AccountingDocument3 pagesPractice Problems-Income Tax Accountingjsonnchun75% (4)

- Module 2 ARS PCC - CVP, Absorption and VariableDocument3 pagesModule 2 ARS PCC - CVP, Absorption and VariableVia Jean LacsieNo ratings yet

- Fundamentals of Accountancy, Business, and Management 2Document31 pagesFundamentals of Accountancy, Business, and Management 2Honey ShenNo ratings yet

- ExploreDocument4 pagesExploreNorlyn RunesNo ratings yet

- Individual Taxation Assignment 2 - 1868900521Document2 pagesIndividual Taxation Assignment 2 - 1868900521Jaylyn BacolonNo ratings yet

- Operating F C LeverageDocument22 pagesOperating F C LeverageVageeshNo ratings yet

- Cost and Management Dec 23 AssignmentDocument7 pagesCost and Management Dec 23 Assignmentsureshgovekar98No ratings yet

- Tugas Akmen (Nurfuadi - A031181511)Document2 pagesTugas Akmen (Nurfuadi - A031181511)Budiman BudiNo ratings yet

- Cost Behavior ExerciseDocument3 pagesCost Behavior ExerciseIftekhar Uddin M.D EisaNo ratings yet

- Quiz 4 CADocument8 pagesQuiz 4 CAbasilnaeem7No ratings yet

- Activity Sheets in Fundamentals of Accountanc2Document5 pagesActivity Sheets in Fundamentals of Accountanc2Irish NicolasNo ratings yet

- TO DO - Illustrations (Product Costing and Segment Reporting)Document2 pagesTO DO - Illustrations (Product Costing and Segment Reporting)Lovely De CastroNo ratings yet

- Lagura - Ass04 Statement of Comprehensive IncomeDocument7 pagesLagura - Ass04 Statement of Comprehensive IncomeShane LaguraNo ratings yet

- Statement of Comprehensive IncomeDocument2 pagesStatement of Comprehensive IncomeRandom AcNo ratings yet

- Cost-Volume-Profit (CVP) Analysis Is Used To Determine How Changes in Costs and VolumeDocument19 pagesCost-Volume-Profit (CVP) Analysis Is Used To Determine How Changes in Costs and Volumelaur33nNo ratings yet

- Practice Problems For The Final - 2 - UpdatedDocument8 pagesPractice Problems For The Final - 2 - Updatedmaroo566100% (1)

- Iclean Company Income Statements For 3 Years Ended December 2017, 2018 & 2019Document2 pagesIclean Company Income Statements For 3 Years Ended December 2017, 2018 & 2019Jamie YingNo ratings yet

- EFIN542 U09 T01 PowerPointDocument26 pagesEFIN542 U09 T01 PowerPointcustomsgyanNo ratings yet

- Lec 3 After Mid TermDocument11 pagesLec 3 After Mid TermsherygafaarNo ratings yet

- Midterm QuizDocument4 pagesMidterm QuizAllan Jay CabreraNo ratings yet

- Guide to Management Accounting CCC (Cash Conversion Cycle) for managersFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for managersNo ratings yet