Professional Documents

Culture Documents

Budget 2023 Live Updates New Income Tax Slabs An PDF

Budget 2023 Live Updates New Income Tax Slabs An PDF

Uploaded by

Gopinath SaiyanCopyright:

Available Formats

You might also like

- TAXDocument10 pagesTAXJeana Segumalian100% (3)

- Fiji Income Tax Cases 2006-9Document123 pagesFiji Income Tax Cases 2006-9Sara Raj67% (3)

- BLR JAI: TICKET - ConfirmedDocument3 pagesBLR JAI: TICKET - ConfirmedUdit ChauhanNo ratings yet

- Faqs Service Tax EmapyamentDocument3 pagesFaqs Service Tax EmapyamentsafepowerNo ratings yet

- Lembar JawabanDocument26 pagesLembar JawabanFajar SepdiantoNo ratings yet

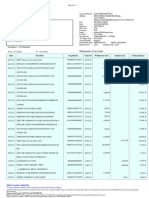

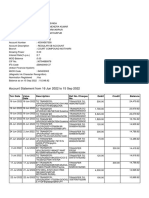

- Statement of Axis Account No:922010045406544 For The Period (From: 01-09-2022 To: 13-12-2022)Document2 pagesStatement of Axis Account No:922010045406544 For The Period (From: 01-09-2022 To: 13-12-2022)OPERATIONAL WINSTARNo ratings yet

- CC96002457276Document17 pagesCC96002457276sangramb104No ratings yet

- Canara Bank Debit CardDocument8 pagesCanara Bank Debit Cardmir musaweer aliNo ratings yet

- D. Chandra Shekhar Ghosh: Volodymyr Zelensky (UkraineDocument17 pagesD. Chandra Shekhar Ghosh: Volodymyr Zelensky (UkraineLIC ADVISOR RAJVEER DEBNo ratings yet

- CreditReport Piramal - Mahendra Payel - 2023 - 05 - 12 - 13 - 20 - 54.pdf 12-May-2023Document8 pagesCreditReport Piramal - Mahendra Payel - 2023 - 05 - 12 - 13 - 20 - 54.pdf 12-May-2023Gamer SinghNo ratings yet

- Customer Details and Policy Feature Change Request Form Version 2.0 - tcm47-60089Document2 pagesCustomer Details and Policy Feature Change Request Form Version 2.0 - tcm47-60089UserNED100% (2)

- AsdfghjklDocument2 pagesAsdfghjklAdventurous FreakNo ratings yet

- Application FormDocument5 pagesApplication FormPRADEEPNo ratings yet

- Oracle Virtual Box FromDocument81 pagesOracle Virtual Box FromDHIVYA SNo ratings yet

- Paysafe Are Payments The Key To A Bright Future For Education PlatformsDocument12 pagesPaysafe Are Payments The Key To A Bright Future For Education PlatformsJStoneNo ratings yet

- D073063472 3182563622531592 TpschedulescDocument2 pagesD073063472 3182563622531592 Tpschedulescmd. alamNo ratings yet

- For Bank Use Only For Bank Use Only: EP000124865 Sourcing Channel EP000124865 Sourcing ChannelDocument5 pagesFor Bank Use Only For Bank Use Only: EP000124865 Sourcing Channel EP000124865 Sourcing ChannelMUTHYALA NEERAJANo ratings yet

- ARCH232 Lec Notes 3Document5 pagesARCH232 Lec Notes 3Carl Justin PantaleonNo ratings yet

- ICMarketsGlobal Funding InstructionsDocument1 pageICMarketsGlobal Funding InstructionsAina RasalemaNo ratings yet

- Strategic ManagementDocument6 pagesStrategic ManagementSridip Adhikary100% (1)

- Bank Statement WPS OfficeDocument2 pagesBank Statement WPS OfficeAdventurous FreakNo ratings yet

- Money Transmitter Licensee ListDocument2 pagesMoney Transmitter Licensee ListCoin FireNo ratings yet

- Email WalMart WALMEX Memo 2005-10-15Document9 pagesEmail WalMart WALMEX Memo 2005-10-15hmagueyNo ratings yet

- R PosDocument3 pagesR PosPunit ShawNo ratings yet

- CIBIL Score & ReportDocument20 pagesCIBIL Score & ReportKumar GowdaNo ratings yet

- DuplicateDocument4 pagesDuplicateKarteek NadellaNo ratings yet

- Verizon Software Requirement SpecificationDocument253 pagesVerizon Software Requirement SpecificationcopslockNo ratings yet

- Owner 1 Label Name Owner 1 Last Name Owner 1 First Name Owner 2 Label NameDocument55 pagesOwner 1 Label Name Owner 1 Last Name Owner 1 First Name Owner 2 Label Nameapi-25893974No ratings yet

- Mono BaseDocument11 pagesMono BaseCarlos Júlio CarlosNo ratings yet

- UntitledDocument3 pagesUntitleddalpat Singh001No ratings yet

- 7 P'S of Marketing of Icici Bank 1. Product Mix A) DEPOSITS:Savings AccountDocument5 pages7 P'S of Marketing of Icici Bank 1. Product Mix A) DEPOSITS:Savings Accountpandiselvi pillaiNo ratings yet

- ExportDocument18 pagesExportdunn mckaganNo ratings yet

- Document 2Document5 pagesDocument 2rosaNo ratings yet

- Statement of Account: HDFC Bank LimitedDocument1 pageStatement of Account: HDFC Bank LimitedPraveen Kumar MNo ratings yet

- I20325522500001RPOSDocument3 pagesI20325522500001RPOSShreya SumanNo ratings yet

- Samsung CheckoutDocument2 pagesSamsung CheckoutWilliam DoveNo ratings yet

- SL ParticularsDocument18 pagesSL ParticularsRRajath ShettyNo ratings yet

- Damida OID-00269713Document3 pagesDamida OID-00269713AIMIDA WOOONo ratings yet

- Turk Profiles First BatchDocument30 pagesTurk Profiles First Batchmae valentineNo ratings yet

- EFT Detail Submission Form Word 97 Format0.1Document1 pageEFT Detail Submission Form Word 97 Format0.1nani3388No ratings yet

- MR - Pragya Kamtaprasad ShrivastavDocument1 pageMR - Pragya Kamtaprasad ShrivastavAkash Gade100% (1)

- 1486047776053IizSOQRIHRhxh8qd PDFDocument5 pages1486047776053IizSOQRIHRhxh8qd PDFsanjeev raiNo ratings yet

- ActivClient User GuideDocument78 pagesActivClient User GuideReNeGaDe124No ratings yet

- MC An5543 PinDocument9 pagesMC An5543 PinMilagros Barrenechea AldereteNo ratings yet

- Imagine A Reward: Every Time You RedeemDocument1 pageImagine A Reward: Every Time You RedeemD SathwikNo ratings yet

- Bajaj Finance Limited: Charge SlipDocument21 pagesBajaj Finance Limited: Charge Slipbibhuti bhusan routNo ratings yet

- Supermarket CodeDocument22 pagesSupermarket CodehassenNo ratings yet

- I82035522100093RPOSDocument3 pagesI82035522100093RPOSVignesh VNo ratings yet

- Jammu and Kashmir Bank LTDDocument21 pagesJammu and Kashmir Bank LTDnareshNo ratings yet

- Messages: Meter No. Read Date Size Current Prior Usage TypeDocument1 pageMessages: Meter No. Read Date Size Current Prior Usage TypeJose EspinozaNo ratings yet

- Wise Account Details Payer 35968619Document2 pagesWise Account Details Payer 35968619Toko emas AdillaNo ratings yet

- View PDFDocument13 pagesView PDFShraddha guptaNo ratings yet

- Bank DatabaseDocument2 pagesBank Databaseghaith rustomNo ratings yet

- BrownLucas 10v4Document1 pageBrownLucas 10v4Tuấn Anh Nguyễn DuyNo ratings yet

- Booking Confirmation Voucher-1Document4 pagesBooking Confirmation Voucher-1Honey PatelNo ratings yet

- CreditReport Piramal - Vikash Kumar Soni - 2023 - 05 - 10 - 11 - 40 - 05.pdf 10-May-2023 PDFDocument16 pagesCreditReport Piramal - Vikash Kumar Soni - 2023 - 05 - 10 - 11 - 40 - 05.pdf 10-May-2023 PDFGamer SinghNo ratings yet

- CreditReport Piramal - Arjun Gupta - 2023 - 03 - 10 - 21 - 25 - 06.pdf 10-Mar-2023Document3 pagesCreditReport Piramal - Arjun Gupta - 2023 - 03 - 10 - 21 - 25 - 06.pdf 10-Mar-2023Rabbul RahmanNo ratings yet

- Online Shop Order O114874644 Confirmation - VodafoneDocument8 pagesOnline Shop Order O114874644 Confirmation - VodafonebarpitNo ratings yet

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- Aruna 1 PDFDocument5 pagesAruna 1 PDFChelsi GehlotNo ratings yet

- Budget 2022 Highlights Digital Rupee To Be Issued by RBI Taxpayers Get 2 Years To Update I-T ReturnsDocument5 pagesBudget 2022 Highlights Digital Rupee To Be Issued by RBI Taxpayers Get 2 Years To Update I-T ReturnsThe FinanceeNo ratings yet

- PWC GM Folio LesothoDocument17 pagesPWC GM Folio Lesothoananta fikyaNo ratings yet

- Chapter 10 - Prior Period Errors: Problem 10-1 (IAA)Document12 pagesChapter 10 - Prior Period Errors: Problem 10-1 (IAA)Asi Cas JavNo ratings yet

- Bar 2018 - MlquDocument138 pagesBar 2018 - MlquTimmy GonzalesNo ratings yet

- Bba Semester III & IVDocument31 pagesBba Semester III & IVvarshmurhe100% (2)

- Gross Income: Quit CourseDocument45 pagesGross Income: Quit CourseFranklin Fronek Jr50% (2)

- Taxation: Témakör 2 Téma 3 1Document2 pagesTaxation: Témakör 2 Téma 3 1Mark MatyasNo ratings yet

- Case Comment On Commissioner Income Tax V. Shambhu Investment Pvt. LTDDocument8 pagesCase Comment On Commissioner Income Tax V. Shambhu Investment Pvt. LTDvaibhav katochNo ratings yet

- Module 4 - Income TaxationDocument6 pagesModule 4 - Income TaxationLumbay, Jolly MaeNo ratings yet

- Flow ChartDocument2 pagesFlow ChartKristal JuditNo ratings yet

- Tax Planning - Intro NotesDocument7 pagesTax Planning - Intro NotesBest How To StudioNo ratings yet

- Business Taxation NotesDocument2 pagesBusiness Taxation NotesSelene DimlaNo ratings yet

- PART I - 34ptsDocument8 pagesPART I - 34ptsJuleen Evette MallariNo ratings yet

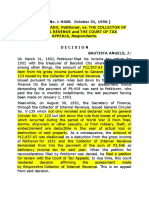

- Hilado v. CIR, G.R. No. L-9408 (October 31, 1956)Document6 pagesHilado v. CIR, G.R. No. L-9408 (October 31, 1956)Lou AquinoNo ratings yet

- TURNOVER TAX PROCLAMATION No 308 2002Document22 pagesTURNOVER TAX PROCLAMATION No 308 2002Murti DhugasaNo ratings yet

- 05 Bir - SMRDocument1 page05 Bir - SMRMelany Trazo Calvez-EvangelistaNo ratings yet

- Income TaxDocument35 pagesIncome TaxAmer Hussien ManarosNo ratings yet

- Tax Rates 2079 80 PDFDocument16 pagesTax Rates 2079 80 PDFrabin khatriNo ratings yet

- Bachelor of Science in Accounting Information System: Bulacan Polytechnic CollegeDocument9 pagesBachelor of Science in Accounting Information System: Bulacan Polytechnic CollegeReena BoliverNo ratings yet

- Income TaxationDocument124 pagesIncome TaxationGWENN JYTSY BAFLORNo ratings yet

- BBA Sagar SyllubusDocument20 pagesBBA Sagar SyllubusJessica Lewis100% (1)

- Pita Law FullDocument93 pagesPita Law Fullay odNo ratings yet

- Gbs 520:financial and Management Accounting: Bryson MumbaDocument46 pagesGbs 520:financial and Management Accounting: Bryson MumbaSANDFORD MALULUNo ratings yet

- Agrarian ReformDocument43 pagesAgrarian ReformDenarius Hardaway Solder100% (1)

- A Study On Self-Assessment Tax System Awareness in MalaysiaDocument11 pagesA Study On Self-Assessment Tax System Awareness in MalaysiaEfriani SipahutarNo ratings yet

- 05 Handout 1 PDFDocument5 pages05 Handout 1 PDFjhomar benavidezNo ratings yet

- Pennsylvania State TaxesDocument2 pagesPennsylvania State TaxesVikram rajputNo ratings yet

- Petitioner Vs Vs Respondent Pablo M. Bastes, Jr. and Rhodora J. Corcuera-Menzon Esquivas Cruz Conlu & YabutDocument16 pagesPetitioner Vs Vs Respondent Pablo M. Bastes, Jr. and Rhodora J. Corcuera-Menzon Esquivas Cruz Conlu & YabutAggy AlbotraNo ratings yet

- Part 1 - Total of 33Pts: San Beda University College of Law Taxation2 Final ExaminationDocument4 pagesPart 1 - Total of 33Pts: San Beda University College of Law Taxation2 Final ExaminationBrigette DomingoNo ratings yet

Budget 2023 Live Updates New Income Tax Slabs An PDF

Budget 2023 Live Updates New Income Tax Slabs An PDF

Uploaded by

Gopinath SaiyanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budget 2023 Live Updates New Income Tax Slabs An PDF

Budget 2023 Live Updates New Income Tax Slabs An PDF

Uploaded by

Gopinath SaiyanCopyright:

Available Formats

Budget Live New Income Tax Slabs 2023-24 Railway Budget

OPEN APP

NEWS CORONAVIRUS AUTO NEWS CITY NEWS

LIVE NOW

Budget 2023 Live Updates: New

Income Tax slabs announced; PM

Modi says Budget provides

foundation for a developed India

Budget 2023 Live Updates: Finance minister

Nirmala Sitharaman announced a number of

changes in the income tax slabs in the new tax

regime. If we include all rebates, an individual will

have to pay no tax on income up to Rs 7 lakh in the

new tax regime. An individual with annual income

of Rs 9 lakh will have to pay only Rs 45,000 as tax in

the new regime. This is only 5% of a taxpayer's

income in the new regime. There is a standard

deduction of Rs 52,500 in the new tax regime. The

FM also said that the new tax regime would be the

default regime.

New income tax slabs 2023 - 24:

Up to Rs 3 lakh income there is 0% or NIL tax

From Rs 3 lakh to Rs 6 lakh the tax rate is 5%

From Rs 6 lakh to Rs 9 lakh the tax rate is 10%

From Rs 9 lakh to Rs 12 lakh the tax rate is 15%

From Rs 12 lakh to Rs 15 lakh the tax rate is 20%

Above Rs 15 lakh the tax rate is 30%

"This is the first Budget of Amrit Kaal", with these

words finance minister Nirmala Sitharaman started

the presentation of the last full Budget of the Modi

government. The world has recognized India

economy as a bright spot, the FM said. India's

growth at 7% in current fiscal highest among major

economies. Indian economy on right track, and

heading towards a bright future, Sitharaman said in

her budget speech.

Per capita income has increased to Rs 1.97 lakh. At

the same time, India's economy has grown from

10th to 5th largest in the world in the last 9 years,

Sitharaman said in the Union Budget speech.

India Budget 2023 is being presented at a time

when the major advanced economies in the world

are crippled by a slow down and are even staring at

a possible recession. In this backdrop, the Economic

Survey still expects India’s GDP to grow between the

6-6.8% range, maintaining its tag of being the

fastest growing economy in the world. What also

bodes well for the GDP growth prospects is that the

Survey has said that India’s recovery from the shock

of the Covid-19 pandemic is complete.

Indian Railways has received a capital outlay of Rs

2.40 lakh crore for the first time ever. This is the

highest capital outlay for railways, Sitharaman said.

Finance Minister Nirmala Sitharaman announced

a huge rise in capital expenditure. The Union

Budget has hiked the outlay on capital expenditure

by 33% to Rs 10 lakh crore. This would be 3.3% of

GDP. The FM has also announced a massive

increase in PM Awaas Yojana. In her Budget speech,

Sithraman highlighted the continuation of the food

security programme for another year and

announced steps for Agri startups, fisheries and

started a programme for primitive, vulnerable, tribal

groups.

But, Sitharaman also has the crucial task of not just

maintaining the fiscal deficit target of 6.4%, but also

providing a credible road map to bring it down

further in the coming years, closer to the FRBM

target.

The Times of India | Feb 1, 2023, 14:53:32 IST

KEY EVENTS

Union Budget 2023 for startups Budg

14:53 (IST), Feb 1

Income tax live: Rebate limit hike

"Currently, those with income up to Rs 5 lakh do

not pay any income tax in both old and new tax

regimes. I propose to increase the rebate limit to

Rs 7 lakh in the new tax regime. Thus, persons in

the new tax regime, with income up to Rs 7 lakh

will not have to pay any tax," Finance Minister

Nirmala Sitharaman said.

14:48 (IST), Feb 1

India Budget 2023 live: Budget provides

foundation for a developed India

Prime Minister Narendra Modi said that this is

'Amrit Kaal's' first budget and it provides

foundation to fulfil resolve for a developed India.

14:34 (IST), Feb 1

Budget 2023 live: Digital payments in

agri sector

The Prime Minister also emphasised that

success of digital payments has to be replicated

in agriculture sector. Hence, the government has

brought a scheme for digital agriculture

infrastructure.

14:29 (IST), Feb 1

India Budget 2023 live: Several steps

taken for women in Budget, says PM

Govt has taken several steps to make the lives of

women, in rural & urban areas, easy. Women's

self-help groups will further enhance them.

Special savings scheme will be started

empowering women in households: PM Modi

ADVERTISEMENT

14:26 (IST), Feb 1

Budget 2023 live: PM Modi says Budget

is for all sectors

Praising Nirmala Sitharaman for a progressive

Union Budget 2023, Prime Minister Narendra

Modi said that the Budget caters to all sectors

alike.

14:21 (IST), Feb 1

Budget 2023 Live: Sports

"It was surprising that high performance,

grassroots athlete schemes and sports

infrastructure didn’t get a mention in the

Budget 2023-24. With India considering bidding

for the 2036 Olympics, the preparation needs to

begin now, both from infrastructure and talent

development perspective for India to step up

towards achieving its sporting and active

lifestyle ambitions," says Aman Dhall, Team

Owner, Gurgaon InCredibles at LastManStands.

14:19 (IST), Feb 1

Budget 2023 live: PM Modi says Budget

will fulfil dreams of aspirational society

The Union Budget 2023-24 will fulfil dreams of

aspirational society including poor people,

middle-class people, farmers, PM Narendra Modi

said in his address.

14:17 (IST), Feb 1

India Budget 2023 live: First budget of

'Amrit Kaal', says PM

Prime Minister Narendra Modi said that this first

Budget of 'Amrit Kaal' will build a strong

foundation for building a developed India.

ADVERTISEMENT

14:15 (IST), Feb 1

Budget 2023 Live: Budget for

'Vishwakarmas', says PM

Prime Minister Narendra Modi praised the

government for its Budget presentation and

said that it is a Budget for 'Vishwakarmas'

14:13 (IST), Feb 1

Budget 2023 Live: PM Modi

congratulates FM

Prime Minister Narendra Modi addressed the

nation after the Budget presentation and

congratulated FM SItharaman for a successful

Budget

14:07 (IST), Feb 1

Budget 2023 live: Allocation to defence

ministry

In the Union Budget presented in Parliament by

Finance Minister Nirmala Sitharaman on

Wednesday, a total of Rs 1.62 lakh crore has been

set aside for capital expenditure that includes

purchasing new weapons, aircraft, warships and

other military hardware. For 2022-23, the

budgetary allocation for capital outlay was Rs

1.52 lakh crore but the revised estimate showed

the expenditure at Rs 1.50 lakh crore. According

to 2023-24 budget documents, an allocation of

Rs 2,70,120 crore has been made for revenue

expenditure that includes expenses on payment

of salaries and maintenance of establishments.

The budgetary allocation of revenue

expenditure in 2022-23 was Rs 2,39,000 crore. In

the budget for 2023-24, the capital outlay for the

Ministry of Defence (Civil) has been pegged at Rs

8,774 crore while an amount of Rs 13,837 crore

has been set aside under capital outlay.

14:05 (IST), Feb 1

India Budget 2023 live: Deposit limit for

Senior Citizen Savings Scheme doubled

Finance Minister Nirmala Sitharaman on

Wednesday proposed to double the deposit

limit for Senior Citizen Savings Scheme to Rs 30

lakh and Monthly Income Account Scheme to

Rs 9 lakh. In her Budget Speech, the minister

also announced a new small savings scheme for

women. "The maximum deposit limit for Senior

Citizen Savings Scheme will be enhanced from

Rs 15 lakh to Rs 30 lakh," the minister said in her

87-minute long speech. She also proposed that

the maximum deposit limit for Monthly Income

Account Scheme will be enhanced from Rs 4.5

lakh to Rs 9 lakh for a single account and from

Rs 9 lakh to Rs 15 lakh for a joint account.

ADVERTISEMENT

14:01 (IST), Feb 1

Budget 2023 live: PM Modi to address

shortly

Prime Minister Narendra Modi to address shortly

on the announcements made by Nirmala

Sitharaman in Union Budget 2023

14:00 (IST), Feb 1

Income Tax Slabs 2023 Live: New Income

Tax Regime Decoded

EY Analysis: While the answer is not straight

forward and it has to be seen on a person by

person level it seems like if a person is claiming a

deduction of more than Rs 425000 then the old

regime is beneficial unless the individual earns

over 5 crores.

13:59 (IST), Feb 1

Income Tax Live: Default income tax

regime

It is also proposed that the new tax regime will

be the default tax regime and individuals will

have an option to opt for the old tax regime

13:57 (IST), Feb 1

Budget 2023 live: Luxury cars and EVs to

cost more

Fully imported luxury cars and electric vehicles

(EVs) in India will now cost more as government

raised custom duty from 60% to 70% on these

items in Budget 2023.

ADVERTISEMENT

13:54 (IST), Feb 1

Income Tax 2023: Enhanced limits for

MSMEs

The limits for micro enterprises and

professionals has been enhanced in the Union

Budget 2023 to avail benefits of presumptive

taxation and 95% of the receipts to be non-cash.

13:43 (IST), Feb 1

Income Tax 2023: Tax benefits for

startups

The government on Wednesday proposed to

extend income tax benefits to startups

incorporated till March 2024. Nirmala

Sitharaman also said that the government

proposes to increase the benefit of carrying

forward losses for startups to 10 years. "I propose

to extend the date of incorporation for income

tax benefits to startups from March 31, 2023, to

March 31, 2024. I further propose to provide the

benefit of carry forward of losses on change of

shareholding of startups from seven years of

incorporation to ten years," she announced.

Sugar cooperatives can claim payments prior to

2016-17 made to sugarcane farmers as

expenditure, the minister added. New

cooperatives that commence manufacturing

activity till March 2024 would also attract a lower

tax rate of 15 per cent, she said in the Budget

speech.

13:28 (IST), Feb 1

New Income Tax 2023: Simplification in

indirect tax - customs duty reduced

Finance minister Nirmala Sitharaman on

Wednesday announced a cut in customs duty

on the import of certain inputs for mobile phone

manufacturing. In her Budget 2023-24 speech,

she said India's mobile phone output rose from

5.8 crore units in 2014-15 to 31 crore units last

fiscal. Her announcement comes at a time when

India has aggressively positioned itself as an

electronics powerhouse to the world, as global

players look for a China plus 1 strategy.

13:20 (IST), Feb 1

New tax slab 2023: Benefits for

pensioners

For pensioners, the finance minister announced

extending the benefit of standard deduction to

new tax regime. Each salaried person with an

income of Rs. 15.5 lakh or more will benefit by Rs.

52,500. Sitharaman, while presenting the Union

Budget in Parliament, said, "A person earning Rs

9 lakh a year will now be paying just Rs 45,000

instead of Rs. 60,000 currently. Similarly, a

person earning Rs 15 lakh will now pay only 10

per cent of this as tax."

13:19 (IST), Feb 1

New tax slabs 2023: Personal income tax

rates

On personal income tax, the FM announced that

"tax for income of Rs 0-3 lakh is nil, for income

above Rs 3 lakh and up to Rs 5 lakh will be taxed

at 5 per cent, for income of above Rs 6 lakh and

up to Rs 9 lakh will be taxed at 10 per cent and

for income above Rs 12 lakh and up to Rs 15 lakh

to be taxed at 20 per cent and above 15 lakh at

Rs 30 per cent."

13:19 (IST), Feb 1

Income Tax 2023 slab: Income tax rebate

limit

Finance minister Nirmala Sitharaman on

Wednesday announced an increase in the

income tax rebate limit from Rs 5 lakh to Rs 7

lakh stating that the new tax regime will now be

the default tax regime. Sitharaman also

proposed to change the tax structure in this

regime by reducing the number of tax slabs to 5

and increasing the tax exemption limit to Rs 3

lakh.

12:59 (IST), Feb 1

New Income tax 2023: Leave

encashment limit raised

Finance minister has proposed to hike tax

exemption on leave encashment on retirement

of non-government salaried employees to Rs 25

lakh from Rs 3 lakh. "We are also making the

new income tax regime the default tax regime

however, citizens will continue to have the

option to avail the benefits of the old tax

regime," FM said.

12:45 (IST), Feb 1

New Income tax Slabs: Here is how tax

rates will look like now

There will be no tax for income up to Rs 3 lakh.

For income Rs 3-6 lakh, 5% tax will be charged;

highest tax rate of 30% on income above Rs 15

lakh under new I-T regime: FM Sitharaman

12:37 (IST), Feb 1

Budget 2023 live: Stock markets cheer

Budget 2023

The benchmark BSE sensex surged over 1,000

points to scale over 60,500-mark as investors

cheered announcements by Nirmala

Sitharaman. The broader NSE Nifty is up 258

points and trading at 17,920.

12:34 (IST), Feb 1

New Income Tax Live updates: Tax on

income over Rs 15 lakh

In the Union Budget 2023, Nirmala Sitharaman

announced that people earning over Rs 15 lakh

in a year will be subject to 30% tax.

12:32 (IST), Feb 1

Budget 2023 live: Surcharge rate reduced

The government has proposed to reduce the

highest surcharge rate from 37% to 25% under

new tax regime, FM Sitharaman said while

presenting the Budget 2023.

12:25 (IST), Feb 1

New Income Tax Slabs 2023-24: New tax

rates announced

The government has enhanced income tax

rebate limit up to Rs 7 lakh under new tax

regime, finance minister says

12:23 (IST), Feb 1

Budget 2023 live: ITR processing period

reduced

The income tax returns processing period has

been reduced by 16 days, says finance minister

12:20 (IST), Feb 1

Budget 2023 live: New I-T return forms

introduced

The government has introduced new Income

Tax return (ITR) forms for easier filing of returns:

FM Sitharaman

12:17 (IST), Feb 1

Budget 2023 Live: lower tax rate for new

cooperative societies

Benefit of lower tax rate of 15% to new

cooperative societies: FM

12:16 (IST), Feb 1

Budget 2023 Live: Made cash transfer of

Rs 2.2 lakh crore under PM-KISAN

scheme, says Sitharaman

The government made cash transfer of Rs 2.2

lakh crore under the PM-KISAN scheme, Finance

Minister Nirmala Sitharaman said on

Wednesday.Presenting the last full Budget of

the second term of the BJP-led NDA

government ahead of the general elections in

2024, she said the mission of the government is

to achieve knowledge-driven economy.

12:15 (IST), Feb 1

Cigarettes will get more expensive, says

FM

12:15 (IST), Feb 1

Budget 2023 live: Customs on kitchen

chimneys

Customs on kitchen chimneys to go down: FM

12:14 (IST), Feb 1

Union Budget 2023 Live: Center of

Excellence for Millets

The setting up of a Center of Excellence for

Millets, which have high nutritional content, will

help increase the share of gross sown area under

millets, which today stands at a mere 3% of total

gross cropped area - CRISIL Insta Analysis

12:14 (IST), Feb 1

Budget 2023 Live: Pradhan Mantri Awaas

Yojana

With allocation to the Pradhan Mantri Awaas

Yojana rising 66% to Rs 79,000 crore next fiscal,

more than 55% of the estimated gap in funding

for projects under the scheme is addressed. This

should help timely construction of urban and

rural houses - CRISIL Insta Analysis

12:14 (IST), Feb 1

India Budget 2023 Live: Scrapping

Adequate funding to scrap old government

vehicles and ambulances will be marginally

positive for SCV buses and other vehicle

categories - CRISIL Insta Analysis

12:14 (IST), Feb 1

Gold, silver and diamonds to get

expensive"

- FM Sitharaman

12:13 (IST), Feb 1

States to be allowed 3.5% of GDP as fiscal

deficit, says FM

12:13 (IST), Feb 1

Union Budget 2023 Live:

Decarbonization

"It will be interesting to see what steps the

government takes, if at all, to address more

'hard-to-abate' sectors for decarbonisation.

Replicating the recently announced Green

Hydrogen scheme to include more similar

sectors, such as steel, shipping, fertilisers, etc.,

would go a long way in establising India's

leadership in decarbonisation." - Dr. Abhinav

Akhilesh, Partner, Public Sector Consulting,

Grant Thornton Bharat

12:12 (IST), Feb 1

Union Budget 2023 Live: Renewables

Viability gap funding for battery storage,

renewable energy evacuation, green credit

policy and incentives for further growth are

strong initiatives to support green growth and

achieve net zero mission by 2070 - EY Insta

Analysis

12:11 (IST), Feb 1

Budget 2023 Live: Powers under SEZ law

Deloitte Insta Analysis:: Powers under SEZ law to

be granted to IFSC for regulation of GIFT IFSC

alongwith single window regulatory mechanism

across all tax and regulatory authorities viz.

GSTN, SEZ, SEBI etc. this is a welcome move and

will reduce loading between multiple authorities

for businesses and ease doing business.

12:11 (IST), Feb 1

FM Nirmala Sitharaman on total receipts

Total receipts or receipts other than borrowing is

Rs 24.3 lakh crore of which net tax receipts are

Rs 20.9 lakh crore. The revised estimate of the

total expenditure is Rs 41.9 lakh crore, of which

the capital expenditure is about Rs 7.3 lakh crore

12:11 (IST), Feb 1

Integrated IT portal will be set up for

reclaiming unclaimed shares and

dividends: FM

12:10 (IST), Feb 1

India Budget 2023 Live: Credit guarantee

scheme for MSMEs

QuantEco Research Insta Analysis: Revamping of

credit guarantee scheme for MSMEs with Rs

9000 cr infusion would insulate them from rising

interest rate burden

12:10 (IST), Feb 1

Union Budget 2023 Live: Digital Nation

QuantEco Research Insta Analysis: Focus on

digitalNATION continues; Use of DigiLocker and

Aadhar to establish personal identities will

smoothen current KYC hurdles

12:08 (IST), Feb 1

Budget 2023 Live: Infrastructure-capex

to support the economy

The Union Budget 2024 paves the way for yet

another year of the government using

infrastructure-capex to support the economy.

This is enhanced by the govt’s focus on green

capex transition support. Capex support from

the budget rises to 4.5% of GDP for the next

fiscal from sub-4% this fiscal and sub-3% in fiscal

2020 - CRISIL Insta Analysis

12:07 (IST), Feb 1

Budget 2023 Live: Capex crucial for the

infrastructure buildout

The 33% increase in capital investment outlay

using gross budgetary support, which has

already a strong growth this fiscal, and grants of

Rs 3.7 lakh crore are crucial for the infrastructure

buildout needed to crowd in private investments

and push India towards its $5 trillion economy

goal - CRISIL Insta Analysis

12:06 (IST), Feb 1

Budget fiscal deficit update: Revised

estimate of fiscal deficit

Revised estimate for 2022-23 fiscal deficit at 5.9%

of GDP, says FM

12:06 (IST), Feb 1

India Budget 2023 Live: Rs 35,000 crore

for energy transition

The allocation of Rs 35,000 crore for energy

transition, and viability gap funding for battery

storage are much needed steps to enable

growth in renewable energy capacity additions

and grid stability. CRISIL estimates India will

need at least 45 GW of energy storage capacity

by 2030 - CRISIL Insta Analysis

168 More Updates

See More Updates

TOP COMMENT

Nafutuu

10 seconds ago

bhakts enjoy your looting by illiterate

pmnjoy you money in mandir

Biluildings Or fooling you in name of

mandir which is ...Read more

ADD COMMENT

READ COMMENTS (180)

POPULAR FROM BUSINESS

Union Budget: World has recognised

India as bright star, Nirmala

Sitharaman says

INDIA FIGHTS COVID

8 6

"Do I need a fourth COVID Long COVID co

vaccine?" and worse

ADVERTISEMENT

VISUAL STORIES

Nutritionist- Kriti Sanon’s

approved high favourite Keerthy

blood pressure mithai: Besan Suresh's h

diet meal plan Barfi recipe sari ward

WEB-STORIES WEB-STORIES LIFE-STYLE

MORE VISUAL STORIES

VIRAL NEWS

'Seh lenge thoda': Internet 'Chuna laga diy

blows up in memes after yet regime with reb

another hike in cigarette tax lakh ignites me

MORE VIRAL NEWS

QUICK LINKS

COVID CASES TODAY BUDGET LIVE

CORONAVIRUS IN INDIA INCOME TAX SLABS

News / Business / Business / Business /

Budget 2023 Live Updates: …

BUSINESS

About us Terms of use

Privacy policy Cookie policy

Do Not Sell Data

TOP TRENDS Budget 2023 Live New Income tax

slabs

Railway Budget Budget

Highlights

Budget Speech Nirmala

Sitharaman

Horoscope Today Income Tax 2023

New Tax Regime Income tax for

women

Finance Minsiter Union Budget

Nirmala

Sitharaman

Income tax slabs Adani News

2023

Delhi Mumbai Longwalks App

Expressway

Copyright © 2023 Bennett, Coleman & Co. Ltd. All rights reserved. For

OPEN

reprint rights: Times Syndication IN APP

Service

You might also like

- TAXDocument10 pagesTAXJeana Segumalian100% (3)

- Fiji Income Tax Cases 2006-9Document123 pagesFiji Income Tax Cases 2006-9Sara Raj67% (3)

- BLR JAI: TICKET - ConfirmedDocument3 pagesBLR JAI: TICKET - ConfirmedUdit ChauhanNo ratings yet

- Faqs Service Tax EmapyamentDocument3 pagesFaqs Service Tax EmapyamentsafepowerNo ratings yet

- Lembar JawabanDocument26 pagesLembar JawabanFajar SepdiantoNo ratings yet

- Statement of Axis Account No:922010045406544 For The Period (From: 01-09-2022 To: 13-12-2022)Document2 pagesStatement of Axis Account No:922010045406544 For The Period (From: 01-09-2022 To: 13-12-2022)OPERATIONAL WINSTARNo ratings yet

- CC96002457276Document17 pagesCC96002457276sangramb104No ratings yet

- Canara Bank Debit CardDocument8 pagesCanara Bank Debit Cardmir musaweer aliNo ratings yet

- D. Chandra Shekhar Ghosh: Volodymyr Zelensky (UkraineDocument17 pagesD. Chandra Shekhar Ghosh: Volodymyr Zelensky (UkraineLIC ADVISOR RAJVEER DEBNo ratings yet

- CreditReport Piramal - Mahendra Payel - 2023 - 05 - 12 - 13 - 20 - 54.pdf 12-May-2023Document8 pagesCreditReport Piramal - Mahendra Payel - 2023 - 05 - 12 - 13 - 20 - 54.pdf 12-May-2023Gamer SinghNo ratings yet

- Customer Details and Policy Feature Change Request Form Version 2.0 - tcm47-60089Document2 pagesCustomer Details and Policy Feature Change Request Form Version 2.0 - tcm47-60089UserNED100% (2)

- AsdfghjklDocument2 pagesAsdfghjklAdventurous FreakNo ratings yet

- Application FormDocument5 pagesApplication FormPRADEEPNo ratings yet

- Oracle Virtual Box FromDocument81 pagesOracle Virtual Box FromDHIVYA SNo ratings yet

- Paysafe Are Payments The Key To A Bright Future For Education PlatformsDocument12 pagesPaysafe Are Payments The Key To A Bright Future For Education PlatformsJStoneNo ratings yet

- D073063472 3182563622531592 TpschedulescDocument2 pagesD073063472 3182563622531592 Tpschedulescmd. alamNo ratings yet

- For Bank Use Only For Bank Use Only: EP000124865 Sourcing Channel EP000124865 Sourcing ChannelDocument5 pagesFor Bank Use Only For Bank Use Only: EP000124865 Sourcing Channel EP000124865 Sourcing ChannelMUTHYALA NEERAJANo ratings yet

- ARCH232 Lec Notes 3Document5 pagesARCH232 Lec Notes 3Carl Justin PantaleonNo ratings yet

- ICMarketsGlobal Funding InstructionsDocument1 pageICMarketsGlobal Funding InstructionsAina RasalemaNo ratings yet

- Strategic ManagementDocument6 pagesStrategic ManagementSridip Adhikary100% (1)

- Bank Statement WPS OfficeDocument2 pagesBank Statement WPS OfficeAdventurous FreakNo ratings yet

- Money Transmitter Licensee ListDocument2 pagesMoney Transmitter Licensee ListCoin FireNo ratings yet

- Email WalMart WALMEX Memo 2005-10-15Document9 pagesEmail WalMart WALMEX Memo 2005-10-15hmagueyNo ratings yet

- R PosDocument3 pagesR PosPunit ShawNo ratings yet

- CIBIL Score & ReportDocument20 pagesCIBIL Score & ReportKumar GowdaNo ratings yet

- DuplicateDocument4 pagesDuplicateKarteek NadellaNo ratings yet

- Verizon Software Requirement SpecificationDocument253 pagesVerizon Software Requirement SpecificationcopslockNo ratings yet

- Owner 1 Label Name Owner 1 Last Name Owner 1 First Name Owner 2 Label NameDocument55 pagesOwner 1 Label Name Owner 1 Last Name Owner 1 First Name Owner 2 Label Nameapi-25893974No ratings yet

- Mono BaseDocument11 pagesMono BaseCarlos Júlio CarlosNo ratings yet

- UntitledDocument3 pagesUntitleddalpat Singh001No ratings yet

- 7 P'S of Marketing of Icici Bank 1. Product Mix A) DEPOSITS:Savings AccountDocument5 pages7 P'S of Marketing of Icici Bank 1. Product Mix A) DEPOSITS:Savings Accountpandiselvi pillaiNo ratings yet

- ExportDocument18 pagesExportdunn mckaganNo ratings yet

- Document 2Document5 pagesDocument 2rosaNo ratings yet

- Statement of Account: HDFC Bank LimitedDocument1 pageStatement of Account: HDFC Bank LimitedPraveen Kumar MNo ratings yet

- I20325522500001RPOSDocument3 pagesI20325522500001RPOSShreya SumanNo ratings yet

- Samsung CheckoutDocument2 pagesSamsung CheckoutWilliam DoveNo ratings yet

- SL ParticularsDocument18 pagesSL ParticularsRRajath ShettyNo ratings yet

- Damida OID-00269713Document3 pagesDamida OID-00269713AIMIDA WOOONo ratings yet

- Turk Profiles First BatchDocument30 pagesTurk Profiles First Batchmae valentineNo ratings yet

- EFT Detail Submission Form Word 97 Format0.1Document1 pageEFT Detail Submission Form Word 97 Format0.1nani3388No ratings yet

- MR - Pragya Kamtaprasad ShrivastavDocument1 pageMR - Pragya Kamtaprasad ShrivastavAkash Gade100% (1)

- 1486047776053IizSOQRIHRhxh8qd PDFDocument5 pages1486047776053IizSOQRIHRhxh8qd PDFsanjeev raiNo ratings yet

- ActivClient User GuideDocument78 pagesActivClient User GuideReNeGaDe124No ratings yet

- MC An5543 PinDocument9 pagesMC An5543 PinMilagros Barrenechea AldereteNo ratings yet

- Imagine A Reward: Every Time You RedeemDocument1 pageImagine A Reward: Every Time You RedeemD SathwikNo ratings yet

- Bajaj Finance Limited: Charge SlipDocument21 pagesBajaj Finance Limited: Charge Slipbibhuti bhusan routNo ratings yet

- Supermarket CodeDocument22 pagesSupermarket CodehassenNo ratings yet

- I82035522100093RPOSDocument3 pagesI82035522100093RPOSVignesh VNo ratings yet

- Jammu and Kashmir Bank LTDDocument21 pagesJammu and Kashmir Bank LTDnareshNo ratings yet

- Messages: Meter No. Read Date Size Current Prior Usage TypeDocument1 pageMessages: Meter No. Read Date Size Current Prior Usage TypeJose EspinozaNo ratings yet

- Wise Account Details Payer 35968619Document2 pagesWise Account Details Payer 35968619Toko emas AdillaNo ratings yet

- View PDFDocument13 pagesView PDFShraddha guptaNo ratings yet

- Bank DatabaseDocument2 pagesBank Databaseghaith rustomNo ratings yet

- BrownLucas 10v4Document1 pageBrownLucas 10v4Tuấn Anh Nguyễn DuyNo ratings yet

- Booking Confirmation Voucher-1Document4 pagesBooking Confirmation Voucher-1Honey PatelNo ratings yet

- CreditReport Piramal - Vikash Kumar Soni - 2023 - 05 - 10 - 11 - 40 - 05.pdf 10-May-2023 PDFDocument16 pagesCreditReport Piramal - Vikash Kumar Soni - 2023 - 05 - 10 - 11 - 40 - 05.pdf 10-May-2023 PDFGamer SinghNo ratings yet

- CreditReport Piramal - Arjun Gupta - 2023 - 03 - 10 - 21 - 25 - 06.pdf 10-Mar-2023Document3 pagesCreditReport Piramal - Arjun Gupta - 2023 - 03 - 10 - 21 - 25 - 06.pdf 10-Mar-2023Rabbul RahmanNo ratings yet

- Online Shop Order O114874644 Confirmation - VodafoneDocument8 pagesOnline Shop Order O114874644 Confirmation - VodafonebarpitNo ratings yet

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- Aruna 1 PDFDocument5 pagesAruna 1 PDFChelsi GehlotNo ratings yet

- Budget 2022 Highlights Digital Rupee To Be Issued by RBI Taxpayers Get 2 Years To Update I-T ReturnsDocument5 pagesBudget 2022 Highlights Digital Rupee To Be Issued by RBI Taxpayers Get 2 Years To Update I-T ReturnsThe FinanceeNo ratings yet

- PWC GM Folio LesothoDocument17 pagesPWC GM Folio Lesothoananta fikyaNo ratings yet

- Chapter 10 - Prior Period Errors: Problem 10-1 (IAA)Document12 pagesChapter 10 - Prior Period Errors: Problem 10-1 (IAA)Asi Cas JavNo ratings yet

- Bar 2018 - MlquDocument138 pagesBar 2018 - MlquTimmy GonzalesNo ratings yet

- Bba Semester III & IVDocument31 pagesBba Semester III & IVvarshmurhe100% (2)

- Gross Income: Quit CourseDocument45 pagesGross Income: Quit CourseFranklin Fronek Jr50% (2)

- Taxation: Témakör 2 Téma 3 1Document2 pagesTaxation: Témakör 2 Téma 3 1Mark MatyasNo ratings yet

- Case Comment On Commissioner Income Tax V. Shambhu Investment Pvt. LTDDocument8 pagesCase Comment On Commissioner Income Tax V. Shambhu Investment Pvt. LTDvaibhav katochNo ratings yet

- Module 4 - Income TaxationDocument6 pagesModule 4 - Income TaxationLumbay, Jolly MaeNo ratings yet

- Flow ChartDocument2 pagesFlow ChartKristal JuditNo ratings yet

- Tax Planning - Intro NotesDocument7 pagesTax Planning - Intro NotesBest How To StudioNo ratings yet

- Business Taxation NotesDocument2 pagesBusiness Taxation NotesSelene DimlaNo ratings yet

- PART I - 34ptsDocument8 pagesPART I - 34ptsJuleen Evette MallariNo ratings yet

- Hilado v. CIR, G.R. No. L-9408 (October 31, 1956)Document6 pagesHilado v. CIR, G.R. No. L-9408 (October 31, 1956)Lou AquinoNo ratings yet

- TURNOVER TAX PROCLAMATION No 308 2002Document22 pagesTURNOVER TAX PROCLAMATION No 308 2002Murti DhugasaNo ratings yet

- 05 Bir - SMRDocument1 page05 Bir - SMRMelany Trazo Calvez-EvangelistaNo ratings yet

- Income TaxDocument35 pagesIncome TaxAmer Hussien ManarosNo ratings yet

- Tax Rates 2079 80 PDFDocument16 pagesTax Rates 2079 80 PDFrabin khatriNo ratings yet

- Bachelor of Science in Accounting Information System: Bulacan Polytechnic CollegeDocument9 pagesBachelor of Science in Accounting Information System: Bulacan Polytechnic CollegeReena BoliverNo ratings yet

- Income TaxationDocument124 pagesIncome TaxationGWENN JYTSY BAFLORNo ratings yet

- BBA Sagar SyllubusDocument20 pagesBBA Sagar SyllubusJessica Lewis100% (1)

- Pita Law FullDocument93 pagesPita Law Fullay odNo ratings yet

- Gbs 520:financial and Management Accounting: Bryson MumbaDocument46 pagesGbs 520:financial and Management Accounting: Bryson MumbaSANDFORD MALULUNo ratings yet

- Agrarian ReformDocument43 pagesAgrarian ReformDenarius Hardaway Solder100% (1)

- A Study On Self-Assessment Tax System Awareness in MalaysiaDocument11 pagesA Study On Self-Assessment Tax System Awareness in MalaysiaEfriani SipahutarNo ratings yet

- 05 Handout 1 PDFDocument5 pages05 Handout 1 PDFjhomar benavidezNo ratings yet

- Pennsylvania State TaxesDocument2 pagesPennsylvania State TaxesVikram rajputNo ratings yet

- Petitioner Vs Vs Respondent Pablo M. Bastes, Jr. and Rhodora J. Corcuera-Menzon Esquivas Cruz Conlu & YabutDocument16 pagesPetitioner Vs Vs Respondent Pablo M. Bastes, Jr. and Rhodora J. Corcuera-Menzon Esquivas Cruz Conlu & YabutAggy AlbotraNo ratings yet

- Part 1 - Total of 33Pts: San Beda University College of Law Taxation2 Final ExaminationDocument4 pagesPart 1 - Total of 33Pts: San Beda University College of Law Taxation2 Final ExaminationBrigette DomingoNo ratings yet