Professional Documents

Culture Documents

Home Office and Branch Accounting

Home Office and Branch Accounting

Uploaded by

Rujean Salar AltejarCopyright:

Available Formats

You might also like

- VAL 010 Revalidation Procedure SampleDocument2 pagesVAL 010 Revalidation Procedure SampleSameh MostafaNo ratings yet

- Ogl260 Hilton Hotels Stakeholder AnalysisDocument2 pagesOgl260 Hilton Hotels Stakeholder Analysisapi-6296958670% (1)

- Week 5 Normal Job Order CostingDocument8 pagesWeek 5 Normal Job Order CostingRujean Salar AltejarNo ratings yet

- VI. 80% Owned-Subsidiary: Cost Model - Full Goodwill Approach Downstream and Upstream of Property, Unrealized Gain and Realized Gain On SaleDocument3 pagesVI. 80% Owned-Subsidiary: Cost Model - Full Goodwill Approach Downstream and Upstream of Property, Unrealized Gain and Realized Gain On SaleMa'arifa HussainNo ratings yet

- Inventories Problem No. 1Document4 pagesInventories Problem No. 1Ren EyNo ratings yet

- Nepomuceno, Henry James B. - Ast Quiz 5Document2 pagesNepomuceno, Henry James B. - Ast Quiz 5Mitch Tokong MinglanaNo ratings yet

- Auditing Theory and Principles Thanks GuysDocument51 pagesAuditing Theory and Principles Thanks GuysrenoNo ratings yet

- Chapter-3-Test-Bank 3eDocument46 pagesChapter-3-Test-Bank 3eMarium RazaNo ratings yet

- Roll Forward Analysis2Document4 pagesRoll Forward Analysis2CJ alandyNo ratings yet

- Chapter 19Document14 pagesChapter 19Chelsy SantosNo ratings yet

- Franchise Journal EntriesDocument2 pagesFranchise Journal Entrieskim taehyungNo ratings yet

- Acai Chapter 17 QuestionnairesDocument5 pagesAcai Chapter 17 QuestionnairesKathleenCusipagNo ratings yet

- 04 Construction ContractsDocument3 pages04 Construction ContractsJoshua HonraNo ratings yet

- AFAR02 04 Franchise AccountingDocument4 pagesAFAR02 04 Franchise AccountingNicoleNo ratings yet

- Fundamentals of Assurance Services - Docx'Document8 pagesFundamentals of Assurance Services - Docx'jhell dela cruzNo ratings yet

- Auditing Problems SOLUTION v.1 - 2018Document12 pagesAuditing Problems SOLUTION v.1 - 2018Ramainne RonquilloNo ratings yet

- LiabilitiesDocument2 pagesLiabilitiesFrederick AbellaNo ratings yet

- Chapter 15 Multiple Choices: PROB. 15-1 (AICPA)Document5 pagesChapter 15 Multiple Choices: PROB. 15-1 (AICPA)Celen OchocoNo ratings yet

- Quiz Foreign Currency Transaction, Hedging & Translation: U AnsweredDocument25 pagesQuiz Foreign Currency Transaction, Hedging & Translation: U AnsweredDenise Jane RoqueNo ratings yet

- Additional Problems On MergerDocument6 pagesAdditional Problems On MergerkakeguruiNo ratings yet

- Problem 2-8Document15 pagesProblem 2-8LisaNo ratings yet

- Revenue Recognition: Long Term ConstructionDocument3 pagesRevenue Recognition: Long Term ConstructionLee SuarezNo ratings yet

- AnswerrDocument7 pagesAnswerrLeslie Mae Vargas ZafeNo ratings yet

- Chapter 1-4 Review QuestionsDocument24 pagesChapter 1-4 Review QuestionsSophia JunelleNo ratings yet

- ACC5116 - Module 1Document6 pagesACC5116 - Module 1Carl Dhaniel Garcia SalenNo ratings yet

- Solution Chapter 8 Rev FinalDocument20 pagesSolution Chapter 8 Rev FinalJonalyn SaloNo ratings yet

- Chapter 16 - Bus Com Part 3 - Afar Part 2Document5 pagesChapter 16 - Bus Com Part 3 - Afar Part 2Emman ElagoNo ratings yet

- Module 8 LTCCDocument15 pagesModule 8 LTCCAud BalanziNo ratings yet

- Quiz 3 ProblemsDocument11 pagesQuiz 3 ProblemsRiezel PepitoNo ratings yet

- UntitledDocument9 pagesUntitledJanna Mari FriasNo ratings yet

- LTCC Quiz W AnsDocument4 pagesLTCC Quiz W AnsalyNo ratings yet

- Installment Sales and Long Term Construction ContractDocument13 pagesInstallment Sales and Long Term Construction ContractPaupauNo ratings yet

- ACCTGDocument13 pagesACCTGCabardo Maria RegilynNo ratings yet

- ACC 110 RemedialDocument11 pagesACC 110 RemedialGiner Mabale StevenNo ratings yet

- Corporate LiquidationDocument3 pagesCorporate LiquidationKrizia Mae Flores100% (1)

- Separate and Consolidated Dayag Part 6Document4 pagesSeparate and Consolidated Dayag Part 6NinaNo ratings yet

- AfarDocument3 pagesAfarLeizzamar BayadogNo ratings yet

- SAMPLEDocument3 pagesSAMPLEkrizzmaaaayNo ratings yet

- Mga Dambieee!!!!: Complete Answer Pleaseee. Thank Youuu NO. Questions Answer 1 Answer 2 If Unsure Answer 1Document12 pagesMga Dambieee!!!!: Complete Answer Pleaseee. Thank Youuu NO. Questions Answer 1 Answer 2 If Unsure Answer 1Hannah Jane UmbayNo ratings yet

- Consignment True or False: Page Rferrer/Rlaco/Atang/DejesusDocument6 pagesConsignment True or False: Page Rferrer/Rlaco/Atang/DejesusNicoleNo ratings yet

- Pinnacle in House CPA Review Tuition Fee UpdatedDocument1 pagePinnacle in House CPA Review Tuition Fee UpdatedRaRa SantiagoNo ratings yet

- Acctg 17nd-Final Exam BDocument14 pagesAcctg 17nd-Final Exam BKristinelle AragoNo ratings yet

- Part I: Theory of AccountsDocument6 pagesPart I: Theory of AccountsJanna Mari FriasNo ratings yet

- Buscom Quiz 2 MidtermDocument2 pagesBuscom Quiz 2 MidtermRafael Capunpon VallejosNo ratings yet

- Business Combination and Consolidated FS Part 1Document6 pagesBusiness Combination and Consolidated FS Part 1markNo ratings yet

- Chapter 16 Solution ManualDocument22 pagesChapter 16 Solution ManualTri MahathirNo ratings yet

- Business CombinationDocument7 pagesBusiness CombinationAlarich CatayocNo ratings yet

- NKNKDocument18 pagesNKNKSophia PerezNo ratings yet

- ACTExamsDocument36 pagesACTExamsKaguraNo ratings yet

- Solution Chapter 9Document15 pagesSolution Chapter 9BobslaneLlenos0% (2)

- Cpa Review School of The Philippines: (P1,832,400-P598,400-P19,200-P180,000-P65,000-P73,000-P178,200)Document10 pagesCpa Review School of The Philippines: (P1,832,400-P598,400-P19,200-P180,000-P65,000-P73,000-P178,200)RIZA LUMAADNo ratings yet

- Assignment On Installment SalesDocument12 pagesAssignment On Installment SalesTricia Nicole Dimaano100% (1)

- Sample Probles For Corpo Liquidation Part 2Document1 pageSample Probles For Corpo Liquidation Part 2Kezia GuevarraNo ratings yet

- ACCO 30043: Quiz Number 1 (Introduction To Assurance and Audit Services)Document16 pagesACCO 30043: Quiz Number 1 (Introduction To Assurance and Audit Services)pat lanceNo ratings yet

- Cash & Cash EquivalentsDocument5 pagesCash & Cash EquivalentsJenna BanganNo ratings yet

- Pre Week NewDocument30 pagesPre Week NewAnonymous wDganZNo ratings yet

- Tax 1Document2 pagesTax 1Che CheNo ratings yet

- Construction Contracts-My NotesDocument3 pagesConstruction Contracts-My Notesjhaeus enajNo ratings yet

- AFAR 03 Partnership DissolutionDocument4 pagesAFAR 03 Partnership DissolutionDerick jorgeNo ratings yet

- Prelim Exam Aud AnswersDocument5 pagesPrelim Exam Aud Answerslois martinNo ratings yet

- Home Office and Branch AccountingDocument14 pagesHome Office and Branch AccountingRujean Salar AltejarNo ratings yet

- 21900511 - 이성민 - Chapter 2-1 Homework AssignmentDocument1 page21900511 - 이성민 - Chapter 2-1 Homework Assignment이성민학부생No ratings yet

- MODULE 2 JOINT ARRANGEMENTS ASSIGNMENT AAC2 Mar 2023 - Copy-1Document3 pagesMODULE 2 JOINT ARRANGEMENTS ASSIGNMENT AAC2 Mar 2023 - Copy-1Lorifel Antonette Laoreno TejeroNo ratings yet

- Statement 2023 OctDocument2 pagesStatement 2023 Octbabyshark9030No ratings yet

- HOBA Special ProbDocument14 pagesHOBA Special ProbRujean Salar AltejarNo ratings yet

- Revised Titletheoretical Framework SopDocument7 pagesRevised Titletheoretical Framework SopRujean Salar AltejarNo ratings yet

- Chapter 1 - COMMUNICATION PROCESSES, PRINCIPLES, AND ETHICSDocument7 pagesChapter 1 - COMMUNICATION PROCESSES, PRINCIPLES, AND ETHICSRujean Salar AltejarNo ratings yet

- Chapter 1 StratManDocument32 pagesChapter 1 StratManRujean Salar AltejarNo ratings yet

- Chapter 4 StratManDocument41 pagesChapter 4 StratManRujean Salar AltejarNo ratings yet

- Chapter 2 StratManDocument48 pagesChapter 2 StratManRujean Salar AltejarNo ratings yet

- Chapter 10 Test BankDocument48 pagesChapter 10 Test BankRujean Salar AltejarNo ratings yet

- Chapter 11 Test BankDocument46 pagesChapter 11 Test BankRujean Salar Altejar100% (1)

- Chapter 3 StratmanDocument24 pagesChapter 3 StratmanRujean Salar AltejarNo ratings yet

- Chapter 16 Test BankDocument25 pagesChapter 16 Test BankRujean Salar AltejarNo ratings yet

- Midterm Exam Afar1Document13 pagesMidterm Exam Afar1Rujean Salar AltejarNo ratings yet

- Quiz 1 Afar 1Document13 pagesQuiz 1 Afar 1Rujean Salar AltejarNo ratings yet

- Quiz 2 Afar 1Document11 pagesQuiz 2 Afar 1Rujean Salar AltejarNo ratings yet

- Tax 2 - Unit 2. Chapter 1.Document3 pagesTax 2 - Unit 2. Chapter 1.Rujean Salar AltejarNo ratings yet

- Practice Set Short Term Budgeting PDFDocument12 pagesPractice Set Short Term Budgeting PDFRujean Salar AltejarNo ratings yet

- HOBA - Finals QuizDocument13 pagesHOBA - Finals QuizRujean Salar AltejarNo ratings yet

- Partnership FormationDocument9 pagesPartnership FormationRujean Salar AltejarNo ratings yet

- CORPORATE INCOME TAX (Answer Key)Document5 pagesCORPORATE INCOME TAX (Answer Key)Rujean Salar AltejarNo ratings yet

- Corporate Liquidation Problem SolvingDocument21 pagesCorporate Liquidation Problem SolvingRujean Salar AltejarNo ratings yet

- Partnership OperationsDocument20 pagesPartnership OperationsRujean Salar AltejarNo ratings yet

- HOBA Special ProbDocument19 pagesHOBA Special ProbRujean Salar AltejarNo ratings yet

- Home Office and Branch AccountingDocument14 pagesHome Office and Branch AccountingRujean Salar AltejarNo ratings yet

- Chapter 20Document24 pagesChapter 20Rujean Salar AltejarNo ratings yet

- MAS 5 Short TermDocument10 pagesMAS 5 Short TermRujean Salar AltejarNo ratings yet

- Partnership LiquidationDocument18 pagesPartnership LiquidationRujean Salar AltejarNo ratings yet

- Labor: Controlling and Accounting For Costs: Multiple ChoiceDocument21 pagesLabor: Controlling and Accounting For Costs: Multiple ChoiceRujean Salar AltejarNo ratings yet

- Partnership DissolutionDocument19 pagesPartnership DissolutionRujean Salar Altejar100% (1)

- Tax 2 - Unit 2. Chapter 2.Document7 pagesTax 2 - Unit 2. Chapter 2.Rujean Salar AltejarNo ratings yet

- Auditing Problems 2Document8 pagesAuditing Problems 2Rujean Salar AltejarNo ratings yet

- Risk Management: Learning OutcomesDocument16 pagesRisk Management: Learning OutcomesNATURE123No ratings yet

- ASMI OSHMS PR 15 Management Review ProcedureDocument8 pagesASMI OSHMS PR 15 Management Review ProcedureJHUPEL ABARIALNo ratings yet

- Performance Management Systems at Avon Moldplast LTDDocument16 pagesPerformance Management Systems at Avon Moldplast LTDSumedh BhagwatNo ratings yet

- City of Peterborough 2021 Draft Operating BudgetDocument244 pagesCity of Peterborough 2021 Draft Operating BudgetPeterborough ExaminerNo ratings yet

- Accounting ExercisesDocument3 pagesAccounting ExercisesKeitheia QuidlatNo ratings yet

- Five Key Principles For Construction Business SuccessDocument5 pagesFive Key Principles For Construction Business SuccessJavier ContrerasNo ratings yet

- Workshop BrochureDocument1 pageWorkshop Brochureshatabdi mukherjeeNo ratings yet

- Term Paper: Submitted ToDocument6 pagesTerm Paper: Submitted ToHossen ImamNo ratings yet

- Quiz 5Document2 pagesQuiz 5Misbah UllahNo ratings yet

- What If Scenario Analysis Can Supercharge Your BusinessDocument16 pagesWhat If Scenario Analysis Can Supercharge Your BusinessrindergalNo ratings yet

- Land Deals PDFDocument7 pagesLand Deals PDFAkshayShrivastavaNo ratings yet

- Introduction To Financial Accounting For Iipm: R.S.Sivaraman Chartered AccountantDocument46 pagesIntroduction To Financial Accounting For Iipm: R.S.Sivaraman Chartered AccountantaashukadelNo ratings yet

- Cost and Time Estimation 19INDocument7 pagesCost and Time Estimation 19INtimesave240No ratings yet

- Preparing, Awarding, and Managing Coating ContractsDocument24 pagesPreparing, Awarding, and Managing Coating ContractsSUBODH100% (1)

- NEW APP Format (RA-11469)Document14 pagesNEW APP Format (RA-11469)JoAnneGallowayNo ratings yet

- SiteSpecificSafetyPlan MasterDocument37 pagesSiteSpecificSafetyPlan MasterCris VilceanuNo ratings yet

- Kuis 4Document12 pagesKuis 4Sakina Nusarifa TantriNo ratings yet

- DLMS Volume1Document183 pagesDLMS Volume1Battsengel PurewdorjNo ratings yet

- MGT 212: Organizational Management: MID 2 LT 4-Organization DesignDocument40 pagesMGT 212: Organizational Management: MID 2 LT 4-Organization DesignShadhin DaDaNo ratings yet

- Ockham Techonolgies AnalysisDocument2 pagesOckham Techonolgies AnalysisAlexNo ratings yet

- MAU Company ProfileDocument26 pagesMAU Company ProfileLauw Tjun Nji100% (1)

- Labsii 209 Bara 2010Document10 pagesLabsii 209 Bara 2010megersa usmanNo ratings yet

- v5 0 Cpim Exam Preview Manual PDFDocument6 pagesv5 0 Cpim Exam Preview Manual PDFKamalapati BeheraNo ratings yet

- Promoting Entrepreneurship in The PhilippinesDocument24 pagesPromoting Entrepreneurship in The PhilippinesZZZZNo ratings yet

- aUDIT 1Document10 pagesaUDIT 1princeNo ratings yet

- GROUP PROJECT Cost Behaviour Relevant Cost and Incremental Analysis EMBA27JBDocument3 pagesGROUP PROJECT Cost Behaviour Relevant Cost and Incremental Analysis EMBA27JBAina Syazwana ZulkefliNo ratings yet

- Strategic Planning - Gap AnalysisDocument44 pagesStrategic Planning - Gap AnalysisRubenNo ratings yet

Home Office and Branch Accounting

Home Office and Branch Accounting

Uploaded by

Rujean Salar AltejarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Home Office and Branch Accounting

Home Office and Branch Accounting

Uploaded by

Rujean Salar AltejarCopyright:

Available Formats

Home Office and Branch Accounting

RECIPROCAL NON RECIPROCAL

Transactions between the H.O. and the Branch Transactions with third parties

Reciprocal accounts

H.O. Books Branch Books

Branch Current ≠ Home Office Current

1. Timing

Investment Account 2. Errors Capital Account

3. Branch income

Debited everytime Credited everytime

the HO transfers the branch receives CASH xx

assets to the branch assets to the H.O. AR xx

Exp xx

Pro forma entries: Cash xx

H.O. Books Branch Books H.O. Books Branch Books

Branch Current xx Cash xx BC 120,000 SFHO 120,000

Cash xx HOC xx STB 100,000 HOC 120,000

UP 20,000

BC @ BP xx SFHO xx AR 100,800

STB @ Cost xx HOC xx Sales 100,800

AFO/UP xx

Expenses 5,000

Cash xx HOC xx Cash 5,000

BC xx AR xx

Sales 100,800

BC xx Expense xx SFHO - End 36,000

Cash xx HOC xx SFHO- Beg. 120,000

Expenses 5,000

BC xx IES xx I/ES 11,800

Branch Income xx HOC xx

BC 11,800 I/ES 11,800

AFO/UP xx Branch Income 11,800 HOC 11,800

Branch Income xx

UP 14,000

Branch Income 14,000 EI @ Billed Price 36,000

EI @ cost 30,000

Unrealized Profit

6,000 End Beg -

14,000 Realized Profit Current Shipments 20,000

Return shipments

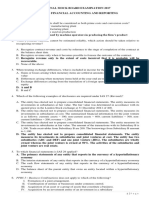

Problem 1 H.O. Books Br. Books

Branch Home Office

Current Current

Yolanda Garment Company operates a branch in Tacloban City. At the end of the year, the Unadj. 150,000 117,420

branch account in the books of the home office at Manila, shows a balance of P150,000. The

following information are ascertained: (1) 37,500

(2) 10,500

(3) - 4,500

1. The home office has billed the branch the amount of P37,500, for the merchandise, which was (4) - 1,080

in transit on December 31. (5) 25,000 25,000

Adj. 179,920 179,920

2. A home office accounts receivable for P10,500 was collected by the branch. Said collection was Entries:

not reported to the home office by the branch. (1) SFHO 37,500

HOC 37,500

3. Supplies of P4,500 was returned by the branch to the home office but the home office has not (2) BC 10,500

yet reflected in its records the receipt of the supplies. AR 10,500

(3) Supplies 4,500

4. The branch made profit of P10,100 for the month of December but the home office BC 4,500

erroneously recorded it as P11,180. (4) Branch Income 1,080

BC 1,080

5. The branch has not received the cash in the amount of P25,000 sent by home office on (5) Cash 25,000

December 31. This was charged to General Expense account. HOC 25,000

All transactions are presumed to have been properly recorded. BC 25,000

What is the balance of the Home Office account on the books of the branch as of December 31, G.E. 25,000

before adjustments?

G.E. 25,000

Cash 25,000

Problem 2

BC 25,000

Cash 25,000

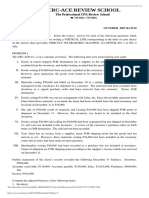

The Maynilad Corporation decided to open a branch in Cebu. Shipments of merchandise to the

branch totaled P540,000 which included a 20% mark-up on cost. All accounting records are to be

kept at the home office.

1. Ending Inventory at cost

The branch submitted the following report summarizing its operations for the period ended

December 31, 2020: 20% from outside parties @ cost 60,000

300,000

80% from HO @billed price 240,000 200,000

Sales on account 740,000 260,000

Sales on cash basis 220,000 2. True net income

Collections of account 600,000

Expenses paid 380,000 Sales 960,000 Sales 960,000

Expenses unpaid 120,000 Cost of sales: Cost of sales:

Purchase of merchandise for cash 260,000 BI - BI -

Inventory on Hand, December 31; 80% from H.O. 300,000 Pur. 260,000 Pur. 260,000

Remittance to home office 550,000 SFHO 540,000 SFHO 450,000

TGAFS 800,000 TGAFS 710,000

1. How much is the ending inventory at cost? Less: EI 300,000 500,000 Less: EI 260,000 450,000

Gross Profit 460,000 Gross Profit 510,000

2. The branch operations insofar as the home office is concerned resulted in a net income of?

OPEX 500,000 OPEX 500,000

Unrealized Profit Net Income - Branch - 40,000 True Net Income 10,000

40,000 End Beg - Add: Adj. - Realized Profit 50,000

50,000 Realized Current 90,000 True Net Income 10,000

Problem 3 Return

SFHO @ BP 360,000 Unrealized Profit

The following information came from the books and records of Philam Corporation and its STB @ Cost 240,000 18,000 End Beg 16,000

branch. The balances are as of December 31, 2020, the fourth year of the corporation's existence. UP - Current 120,000 118,000 Realized Current 120,000

Home office Branch Return

Dr.(Cr.) Dr. (Cr.) Mark up rate 50% 136,000

Sales (P850,000)

Shipments to branch (P240,000) 1. Beginning Inventory from outsiders

Shipments from home office 360,000

Purchases 180,000 Outsiders 24,000 @ cost

72,000

Expenses 160,000 SFHO 48,000 @BP 32,000 @ cost

Inventory, January 1, 2020 72,000

Unrealized profit in branch inventory (136,000) 2. Correct net income

Sales 850,000 Sales 850,000

There are no shipments in transit between the home office and the branch. Both Shipments Cost of sales: Cost of sales:

accounts are properly recorded. The closing inventory at billed prices includes merchandise

acquired from the home office in the amount of P54,000 and P30,000 acquired from vendors for a BI 72,000 BI 56,000

total of P84,000. Pur. 180,000 Pur. 180,000

36,000 30,000 66,000 EI@cost SFHO 360,000 SFHO 240,000

TGAFS 612,000 TGAFS 476,000

1. How much of the beginning inventory of the branch was acquired from outsiders? Less: EI 84,000 528,000 Less: EI 66,000 410,000

2. How much is the correct net income of the branch? Gross Profit 322,000 Gross Profit 440,000

OPEX 160,000 OPEX 160,000

3. What is the entry to adjust the net income of the branch on the home office books? Net Income - Branch 162,000 True Net Income 280,000

UP 118,000 Add: Adj. - Realized Profit 118,000

Branch Income 118,000 True Net Income 280,000

Problem 4

Unrealized Profit

24,000 End Beg. 20,000

The income statement submitted by the San Carlos City branch to the Home Office for the month

of December, 2020 is shown below. After reflecting the necessary adjustments, the true net 96,000 Realized Current 100,000

income of the branch was ascertained to be P156,000. Returns

Sales ₱ 600,000

Cost of sales:

Inventory, December 1 ₱ 80,000 Inventory, Dec. 1 -HO 70,000

Shipments from home office 350,000 SFHO 350,000

Local purchases 30,000 TGAFS 420,000

Total available for sale ₱ 460,000 EI -HO 84,000 336,000

Inventory, December 31 100,000 360,000 Realized Profit 96,000

Gross margin ₱ 240,000 True Cost of Sales 240,000

Operating expenses 180,000

Net income ₱ 60,000 Mark up rate based on Cost 40%

The branch inventories were:

Dec. 1, 2020 Dec. 31, 2020

Merchandise from home office ₱ 70,000 ₱ 84,000

Local purchases 10,000 16,000

Total ₱ 80,000 ₱ 100,000

1. The billing price based on cost imposed by the home office to the branch is 140%

2. The balance of allowance for overvaluation of branch on December 31, 2020 after adjustment

Problem 5

1. Beginning Inventory from outside vendors:

The following information came from the books and records of Philip Corporation and its branch.

The balances are as of December 31, 2020, the fourth year of the corporation's existence. From outside 6,000 @cost

36,000

Home office Branch From HO 30,000 @BP 20,000 @cost

Dr. (Cr.) Dr. (Cr.)

Unrealized Profit

Sales (P320,000) 7,000 End Beg. 10,000

Shipments to branch (P80,000) 43,000 Realized Current 40,000

Shipments from home office 120,000 - Return

Purchases 50,000 50,000 50,000

Expenses 80,000

Inventory, January 1, 2020 36,000

Unrealized profit in branch inventory (50,000)

Sales 320,000 Sales 320,000

Cost of sales: Cost of sales:

There are no shipments in transit between the home office and the branch. Both shipments BI 36,000 BI 26,000

accounts are properly recorded. The closing inventory at billed prices includes merchandise

acquired from the home office in the amount of P21,000 and P9,000 acquired from vendors for a Pur. 50,000 Pur. 50,000

total of P30,000. SFHO 120,000 SFHO 80,000

TGAFS 206,000 TGAFS 156,000

Required: Determine the following: Less: EI 30,000 176,000 Less: EI 23,000 133,000

Gross Profit 144,000 Gross Profit 187,000

1. Beginning inventory acquired from outsiders. 6,000 OPEX 80,000 OPEX 80,000

2. Correct cost of beginning inventory. 26,000 Net Income - Branch 64,000 True Net Income 107,000

3. Realized profit from inventory shipments. 43,000 Add: Adj. - Realized Profit 43,000

4. Correct net income of branch. 107,000 True Net Income 107,000

5. Correct ending inventory. 23,000

6. Allowance balance at the end. 7,000

Problem 6

1. EI of Tecware Products Corporation @ cost

Tecware Products Corporation has two branches, Baguio and Davao, to which merchandise is

billed at 20% above cost. Partial trial balance accounts of the three entities at December 31, 2020 HO 700,000

are summarized as follows: Baguio Branch 175,000

Davao Branch 225,000

Home office Baguio Branch Davao Branch EI @ Cost 1,100,000

Inventory ₱ 800,000 ₱ 180,000 ₱ 240,000

Baguio branch 450,000 Shipments to Davao 400,000

Davao branch 420,000 Multiply by: 120% x 120%

Shipments from home office 600,000 360,000 Debit to BC 480,000

Purchases 1,600,000

Expenses 900,000 250,000 200,000 Shipments to DAVAO at BP 480,000 Total ending inventory - DAVAO @ BP

Home office 450,000 300,000 Shipments recorde by DAVAO 360,000 150,000

Loading - Baguio branch 130,000 Shipments in transit 120,000 120,000

Loading - Davao branch 120,000 270,000

Sales 1,950,000 900,000 750,000 HO DAVAO BRANCH

Shipments to Baguio branch 500,000

Shipments to Davao branch 400,000 BC 480,000 SFHO 360,000

STB - DAVAO 400,000 HOC 360,000

Physical inventories on hand at December 31, 2020 were as follows: UP 80,000

Home office ₱ 700,000 at cost

Baguio branch 210,000 at billed prices 2. Combined Net Income

Davao branch 150,000 at billed prices HOME OFFICE BAGUIO & DAVAO

Sales 1,950,000 Sales 1,650,000

1. The ending inventory of Tecware Products Corporation must be Cost of sales: Cost of sales:

2. The combined net income of home office and branches for 2020 must be BI 800,000 BI @ cost 350,000

3. Correct net income of branches for 2020 must be Pur. 1,600,000 Pur. -

TGAFS&FS 2,400,000 SFHO @ cost 900,000

Less: STB 900,000 TGAFS 1,250,000

Less: EI 700,000 800,000 Less: EI @ cost 400,000 850,000

Gross Profit 1,150,000 Gross Profit 800,000

OPEX 900,000 OPEX 450,000

Net Income 250,000 True Net Income 350,000

COMBINED NET INCOME 600,000

3. True Net Income of the Branches 350,000

Problem 7

Branch 1 Branch 5 Home Office

SFHO 160,000 Branch Current - Br. 1

The M Company maintains branches that market the products that it produces. Merchandise is HOC 160,000 STB - Br. 1

billed to the branches at 25% above costs, with the branches paying freight charges from the

home office to the branch. On November 15, Branch No. 1 ships part of its stock to Branch No. 5 Unrealized Profit

upon authorization by the home office. Originally, Branch No. 1 had been billed for this Freight 35,000

merchandise at P160,000 and had paid freight charges of P35,000 on the shipment from the Cash 35,000

home office. Branch No. 5, upon receiving the merchandise, pays freight charges of P25,000 on

the shipment from Branch No. 1. If the shipment had been made from the home office directly to

Branch No. 5, the freight cost to Branch No. 5 would have been P40,000. HOC 195,000 SFHO 160,000 BC - Br. 5

SFHO 160,000 HOC 160,000 Freight

Required: Prepare the journal entries necessary to record the above information on the books of Freight 35,000 BC - Br. 1

Branch No. 1, Branch No. 5 and Home Office. Freight 40,000

Cash 25,000

Inter Branch Transfers: HOC 15,000

1. Transferring Branch is as if returning the asset to the H.O.

2. Recipient is as if receiving the asset from the H.O.

3. HO makes a clearing entry by debiting the receiving branch and crediting the transferring branch.

4. Excess freight is charged to H.O.

Home Office

Branch Current - Br. 1 160,000

STB - Br. 1 128,000

Unrealized Profit 32,000

175,000

20,000

BC - Br. 1 195,000

You might also like

- VAL 010 Revalidation Procedure SampleDocument2 pagesVAL 010 Revalidation Procedure SampleSameh MostafaNo ratings yet

- Ogl260 Hilton Hotels Stakeholder AnalysisDocument2 pagesOgl260 Hilton Hotels Stakeholder Analysisapi-6296958670% (1)

- Week 5 Normal Job Order CostingDocument8 pagesWeek 5 Normal Job Order CostingRujean Salar AltejarNo ratings yet

- VI. 80% Owned-Subsidiary: Cost Model - Full Goodwill Approach Downstream and Upstream of Property, Unrealized Gain and Realized Gain On SaleDocument3 pagesVI. 80% Owned-Subsidiary: Cost Model - Full Goodwill Approach Downstream and Upstream of Property, Unrealized Gain and Realized Gain On SaleMa'arifa HussainNo ratings yet

- Inventories Problem No. 1Document4 pagesInventories Problem No. 1Ren EyNo ratings yet

- Nepomuceno, Henry James B. - Ast Quiz 5Document2 pagesNepomuceno, Henry James B. - Ast Quiz 5Mitch Tokong MinglanaNo ratings yet

- Auditing Theory and Principles Thanks GuysDocument51 pagesAuditing Theory and Principles Thanks GuysrenoNo ratings yet

- Chapter-3-Test-Bank 3eDocument46 pagesChapter-3-Test-Bank 3eMarium RazaNo ratings yet

- Roll Forward Analysis2Document4 pagesRoll Forward Analysis2CJ alandyNo ratings yet

- Chapter 19Document14 pagesChapter 19Chelsy SantosNo ratings yet

- Franchise Journal EntriesDocument2 pagesFranchise Journal Entrieskim taehyungNo ratings yet

- Acai Chapter 17 QuestionnairesDocument5 pagesAcai Chapter 17 QuestionnairesKathleenCusipagNo ratings yet

- 04 Construction ContractsDocument3 pages04 Construction ContractsJoshua HonraNo ratings yet

- AFAR02 04 Franchise AccountingDocument4 pagesAFAR02 04 Franchise AccountingNicoleNo ratings yet

- Fundamentals of Assurance Services - Docx'Document8 pagesFundamentals of Assurance Services - Docx'jhell dela cruzNo ratings yet

- Auditing Problems SOLUTION v.1 - 2018Document12 pagesAuditing Problems SOLUTION v.1 - 2018Ramainne RonquilloNo ratings yet

- LiabilitiesDocument2 pagesLiabilitiesFrederick AbellaNo ratings yet

- Chapter 15 Multiple Choices: PROB. 15-1 (AICPA)Document5 pagesChapter 15 Multiple Choices: PROB. 15-1 (AICPA)Celen OchocoNo ratings yet

- Quiz Foreign Currency Transaction, Hedging & Translation: U AnsweredDocument25 pagesQuiz Foreign Currency Transaction, Hedging & Translation: U AnsweredDenise Jane RoqueNo ratings yet

- Additional Problems On MergerDocument6 pagesAdditional Problems On MergerkakeguruiNo ratings yet

- Problem 2-8Document15 pagesProblem 2-8LisaNo ratings yet

- Revenue Recognition: Long Term ConstructionDocument3 pagesRevenue Recognition: Long Term ConstructionLee SuarezNo ratings yet

- AnswerrDocument7 pagesAnswerrLeslie Mae Vargas ZafeNo ratings yet

- Chapter 1-4 Review QuestionsDocument24 pagesChapter 1-4 Review QuestionsSophia JunelleNo ratings yet

- ACC5116 - Module 1Document6 pagesACC5116 - Module 1Carl Dhaniel Garcia SalenNo ratings yet

- Solution Chapter 8 Rev FinalDocument20 pagesSolution Chapter 8 Rev FinalJonalyn SaloNo ratings yet

- Chapter 16 - Bus Com Part 3 - Afar Part 2Document5 pagesChapter 16 - Bus Com Part 3 - Afar Part 2Emman ElagoNo ratings yet

- Module 8 LTCCDocument15 pagesModule 8 LTCCAud BalanziNo ratings yet

- Quiz 3 ProblemsDocument11 pagesQuiz 3 ProblemsRiezel PepitoNo ratings yet

- UntitledDocument9 pagesUntitledJanna Mari FriasNo ratings yet

- LTCC Quiz W AnsDocument4 pagesLTCC Quiz W AnsalyNo ratings yet

- Installment Sales and Long Term Construction ContractDocument13 pagesInstallment Sales and Long Term Construction ContractPaupauNo ratings yet

- ACCTGDocument13 pagesACCTGCabardo Maria RegilynNo ratings yet

- ACC 110 RemedialDocument11 pagesACC 110 RemedialGiner Mabale StevenNo ratings yet

- Corporate LiquidationDocument3 pagesCorporate LiquidationKrizia Mae Flores100% (1)

- Separate and Consolidated Dayag Part 6Document4 pagesSeparate and Consolidated Dayag Part 6NinaNo ratings yet

- AfarDocument3 pagesAfarLeizzamar BayadogNo ratings yet

- SAMPLEDocument3 pagesSAMPLEkrizzmaaaayNo ratings yet

- Mga Dambieee!!!!: Complete Answer Pleaseee. Thank Youuu NO. Questions Answer 1 Answer 2 If Unsure Answer 1Document12 pagesMga Dambieee!!!!: Complete Answer Pleaseee. Thank Youuu NO. Questions Answer 1 Answer 2 If Unsure Answer 1Hannah Jane UmbayNo ratings yet

- Consignment True or False: Page Rferrer/Rlaco/Atang/DejesusDocument6 pagesConsignment True or False: Page Rferrer/Rlaco/Atang/DejesusNicoleNo ratings yet

- Pinnacle in House CPA Review Tuition Fee UpdatedDocument1 pagePinnacle in House CPA Review Tuition Fee UpdatedRaRa SantiagoNo ratings yet

- Acctg 17nd-Final Exam BDocument14 pagesAcctg 17nd-Final Exam BKristinelle AragoNo ratings yet

- Part I: Theory of AccountsDocument6 pagesPart I: Theory of AccountsJanna Mari FriasNo ratings yet

- Buscom Quiz 2 MidtermDocument2 pagesBuscom Quiz 2 MidtermRafael Capunpon VallejosNo ratings yet

- Business Combination and Consolidated FS Part 1Document6 pagesBusiness Combination and Consolidated FS Part 1markNo ratings yet

- Chapter 16 Solution ManualDocument22 pagesChapter 16 Solution ManualTri MahathirNo ratings yet

- Business CombinationDocument7 pagesBusiness CombinationAlarich CatayocNo ratings yet

- NKNKDocument18 pagesNKNKSophia PerezNo ratings yet

- ACTExamsDocument36 pagesACTExamsKaguraNo ratings yet

- Solution Chapter 9Document15 pagesSolution Chapter 9BobslaneLlenos0% (2)

- Cpa Review School of The Philippines: (P1,832,400-P598,400-P19,200-P180,000-P65,000-P73,000-P178,200)Document10 pagesCpa Review School of The Philippines: (P1,832,400-P598,400-P19,200-P180,000-P65,000-P73,000-P178,200)RIZA LUMAADNo ratings yet

- Assignment On Installment SalesDocument12 pagesAssignment On Installment SalesTricia Nicole Dimaano100% (1)

- Sample Probles For Corpo Liquidation Part 2Document1 pageSample Probles For Corpo Liquidation Part 2Kezia GuevarraNo ratings yet

- ACCO 30043: Quiz Number 1 (Introduction To Assurance and Audit Services)Document16 pagesACCO 30043: Quiz Number 1 (Introduction To Assurance and Audit Services)pat lanceNo ratings yet

- Cash & Cash EquivalentsDocument5 pagesCash & Cash EquivalentsJenna BanganNo ratings yet

- Pre Week NewDocument30 pagesPre Week NewAnonymous wDganZNo ratings yet

- Tax 1Document2 pagesTax 1Che CheNo ratings yet

- Construction Contracts-My NotesDocument3 pagesConstruction Contracts-My Notesjhaeus enajNo ratings yet

- AFAR 03 Partnership DissolutionDocument4 pagesAFAR 03 Partnership DissolutionDerick jorgeNo ratings yet

- Prelim Exam Aud AnswersDocument5 pagesPrelim Exam Aud Answerslois martinNo ratings yet

- Home Office and Branch AccountingDocument14 pagesHome Office and Branch AccountingRujean Salar AltejarNo ratings yet

- 21900511 - 이성민 - Chapter 2-1 Homework AssignmentDocument1 page21900511 - 이성민 - Chapter 2-1 Homework Assignment이성민학부생No ratings yet

- MODULE 2 JOINT ARRANGEMENTS ASSIGNMENT AAC2 Mar 2023 - Copy-1Document3 pagesMODULE 2 JOINT ARRANGEMENTS ASSIGNMENT AAC2 Mar 2023 - Copy-1Lorifel Antonette Laoreno TejeroNo ratings yet

- Statement 2023 OctDocument2 pagesStatement 2023 Octbabyshark9030No ratings yet

- HOBA Special ProbDocument14 pagesHOBA Special ProbRujean Salar AltejarNo ratings yet

- Revised Titletheoretical Framework SopDocument7 pagesRevised Titletheoretical Framework SopRujean Salar AltejarNo ratings yet

- Chapter 1 - COMMUNICATION PROCESSES, PRINCIPLES, AND ETHICSDocument7 pagesChapter 1 - COMMUNICATION PROCESSES, PRINCIPLES, AND ETHICSRujean Salar AltejarNo ratings yet

- Chapter 1 StratManDocument32 pagesChapter 1 StratManRujean Salar AltejarNo ratings yet

- Chapter 4 StratManDocument41 pagesChapter 4 StratManRujean Salar AltejarNo ratings yet

- Chapter 2 StratManDocument48 pagesChapter 2 StratManRujean Salar AltejarNo ratings yet

- Chapter 10 Test BankDocument48 pagesChapter 10 Test BankRujean Salar AltejarNo ratings yet

- Chapter 11 Test BankDocument46 pagesChapter 11 Test BankRujean Salar Altejar100% (1)

- Chapter 3 StratmanDocument24 pagesChapter 3 StratmanRujean Salar AltejarNo ratings yet

- Chapter 16 Test BankDocument25 pagesChapter 16 Test BankRujean Salar AltejarNo ratings yet

- Midterm Exam Afar1Document13 pagesMidterm Exam Afar1Rujean Salar AltejarNo ratings yet

- Quiz 1 Afar 1Document13 pagesQuiz 1 Afar 1Rujean Salar AltejarNo ratings yet

- Quiz 2 Afar 1Document11 pagesQuiz 2 Afar 1Rujean Salar AltejarNo ratings yet

- Tax 2 - Unit 2. Chapter 1.Document3 pagesTax 2 - Unit 2. Chapter 1.Rujean Salar AltejarNo ratings yet

- Practice Set Short Term Budgeting PDFDocument12 pagesPractice Set Short Term Budgeting PDFRujean Salar AltejarNo ratings yet

- HOBA - Finals QuizDocument13 pagesHOBA - Finals QuizRujean Salar AltejarNo ratings yet

- Partnership FormationDocument9 pagesPartnership FormationRujean Salar AltejarNo ratings yet

- CORPORATE INCOME TAX (Answer Key)Document5 pagesCORPORATE INCOME TAX (Answer Key)Rujean Salar AltejarNo ratings yet

- Corporate Liquidation Problem SolvingDocument21 pagesCorporate Liquidation Problem SolvingRujean Salar AltejarNo ratings yet

- Partnership OperationsDocument20 pagesPartnership OperationsRujean Salar AltejarNo ratings yet

- HOBA Special ProbDocument19 pagesHOBA Special ProbRujean Salar AltejarNo ratings yet

- Home Office and Branch AccountingDocument14 pagesHome Office and Branch AccountingRujean Salar AltejarNo ratings yet

- Chapter 20Document24 pagesChapter 20Rujean Salar AltejarNo ratings yet

- MAS 5 Short TermDocument10 pagesMAS 5 Short TermRujean Salar AltejarNo ratings yet

- Partnership LiquidationDocument18 pagesPartnership LiquidationRujean Salar AltejarNo ratings yet

- Labor: Controlling and Accounting For Costs: Multiple ChoiceDocument21 pagesLabor: Controlling and Accounting For Costs: Multiple ChoiceRujean Salar AltejarNo ratings yet

- Partnership DissolutionDocument19 pagesPartnership DissolutionRujean Salar Altejar100% (1)

- Tax 2 - Unit 2. Chapter 2.Document7 pagesTax 2 - Unit 2. Chapter 2.Rujean Salar AltejarNo ratings yet

- Auditing Problems 2Document8 pagesAuditing Problems 2Rujean Salar AltejarNo ratings yet

- Risk Management: Learning OutcomesDocument16 pagesRisk Management: Learning OutcomesNATURE123No ratings yet

- ASMI OSHMS PR 15 Management Review ProcedureDocument8 pagesASMI OSHMS PR 15 Management Review ProcedureJHUPEL ABARIALNo ratings yet

- Performance Management Systems at Avon Moldplast LTDDocument16 pagesPerformance Management Systems at Avon Moldplast LTDSumedh BhagwatNo ratings yet

- City of Peterborough 2021 Draft Operating BudgetDocument244 pagesCity of Peterborough 2021 Draft Operating BudgetPeterborough ExaminerNo ratings yet

- Accounting ExercisesDocument3 pagesAccounting ExercisesKeitheia QuidlatNo ratings yet

- Five Key Principles For Construction Business SuccessDocument5 pagesFive Key Principles For Construction Business SuccessJavier ContrerasNo ratings yet

- Workshop BrochureDocument1 pageWorkshop Brochureshatabdi mukherjeeNo ratings yet

- Term Paper: Submitted ToDocument6 pagesTerm Paper: Submitted ToHossen ImamNo ratings yet

- Quiz 5Document2 pagesQuiz 5Misbah UllahNo ratings yet

- What If Scenario Analysis Can Supercharge Your BusinessDocument16 pagesWhat If Scenario Analysis Can Supercharge Your BusinessrindergalNo ratings yet

- Land Deals PDFDocument7 pagesLand Deals PDFAkshayShrivastavaNo ratings yet

- Introduction To Financial Accounting For Iipm: R.S.Sivaraman Chartered AccountantDocument46 pagesIntroduction To Financial Accounting For Iipm: R.S.Sivaraman Chartered AccountantaashukadelNo ratings yet

- Cost and Time Estimation 19INDocument7 pagesCost and Time Estimation 19INtimesave240No ratings yet

- Preparing, Awarding, and Managing Coating ContractsDocument24 pagesPreparing, Awarding, and Managing Coating ContractsSUBODH100% (1)

- NEW APP Format (RA-11469)Document14 pagesNEW APP Format (RA-11469)JoAnneGallowayNo ratings yet

- SiteSpecificSafetyPlan MasterDocument37 pagesSiteSpecificSafetyPlan MasterCris VilceanuNo ratings yet

- Kuis 4Document12 pagesKuis 4Sakina Nusarifa TantriNo ratings yet

- DLMS Volume1Document183 pagesDLMS Volume1Battsengel PurewdorjNo ratings yet

- MGT 212: Organizational Management: MID 2 LT 4-Organization DesignDocument40 pagesMGT 212: Organizational Management: MID 2 LT 4-Organization DesignShadhin DaDaNo ratings yet

- Ockham Techonolgies AnalysisDocument2 pagesOckham Techonolgies AnalysisAlexNo ratings yet

- MAU Company ProfileDocument26 pagesMAU Company ProfileLauw Tjun Nji100% (1)

- Labsii 209 Bara 2010Document10 pagesLabsii 209 Bara 2010megersa usmanNo ratings yet

- v5 0 Cpim Exam Preview Manual PDFDocument6 pagesv5 0 Cpim Exam Preview Manual PDFKamalapati BeheraNo ratings yet

- Promoting Entrepreneurship in The PhilippinesDocument24 pagesPromoting Entrepreneurship in The PhilippinesZZZZNo ratings yet

- aUDIT 1Document10 pagesaUDIT 1princeNo ratings yet

- GROUP PROJECT Cost Behaviour Relevant Cost and Incremental Analysis EMBA27JBDocument3 pagesGROUP PROJECT Cost Behaviour Relevant Cost and Incremental Analysis EMBA27JBAina Syazwana ZulkefliNo ratings yet

- Strategic Planning - Gap AnalysisDocument44 pagesStrategic Planning - Gap AnalysisRubenNo ratings yet