Professional Documents

Culture Documents

Installment Sale PDF

Installment Sale PDF

Uploaded by

Sanilyn Domingo0 ratings0% found this document useful (0 votes)

21 views33 pagesOriginal Title

installment sale.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

21 views33 pagesInstallment Sale PDF

Installment Sale PDF

Uploaded by

Sanilyn DomingoCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 33

Chapter 6

INSTALLMENT SALES

Introduction

Generally, the

nition. And among the

exceptions to

fallment method. Under

‘made, because the

1d period of time may

‘pability of collection

oi of sae isthe point of revenue recat

Point of sale realization concept is the ins

{his method, income ig recognized when collections. are

sacgtainty of collecting accounts to be receive over an extend

Suggest the postponement of revenue recognition until the pre

can be reasonably estimated.

GROSS PROFIT RECOGNITION ON INSTALLMENT SALES

Insallment sales may be regarded as calling for special treatment whereby gross

Profit is elated tothe pride in which te installment receivables are collected rather

{ean 10 the Periods in which the receivable are created. The inflow of cash

(Collections) rather than the time of sale become the criterion for revenue recognition.

Accounting for installment method or installment basis could be best illustrated by

Providing for the recognition of gross profit in proportion to collections. Under this

method, collections are regarded as both return of cost and reelization of profit in the

ratio in which these two factors are found inthe original sales price.

In applying the installment method in the accounts, the difference between the

contract sales price and the cost of goods sold is recorded as deferred gross profit.

This balance is recognized as revenue periodically in the proportion that the cash

collections of the period bear to sales price. Stated differently, the original gross

rofit percentage on the sales is applied to periodic collections in arriving at the

amounts to be recognized as revenue. At the end of each period a deferred gross

ee rude hen eerie at ee

Lt mm

sted based on the data provides

cots profit By the installer one: Normally, it may be computed by dividing Me

oer i eit apa, gon prot ae may ao be come

isi yor by dividing the deena) the installment accounts receivable

ved able (end) ferred gross profit (end) by the installment accounts

Ks

geatized Gross Profit

‘The installment ueniad of accounting recognizes profits at the point of collections,

shus realized profit is based on amount collected. Ordinarily, realized gross Profit

‘fay be computed by multiplying the gross profit fate by the amount collected. It

‘ould be pointed out that in case of defaulted contract, collections should be net of

Shy unpaid balance on Mefulted contract. However, if this formula is not applicable,

wolized gr0Ss profit may be computed by determining the difference between the

[jeferred gross profit (before adjustment) and deferred gross profit (after adjustment).

peferred Gross Profit

As stated earlier, the installment method of accounting recognizes profits at the point

ofcallection. If realized profit is based on amount collected, the deferred gross profit

js based on unpaid balance. The deferral of gross profit is, in effect, the deferral of

sales revenue accompanied by the deferral of cost of goods sold relaied to such sales

revenue. To compute the deferred gross profit at the beginning of a period (before

‘uiustment), installment accounts receivable at the beginning of the period should be

multiplied by the related gross profit rate; and the deferred gross profit at the end of

the period (afer adjustment) is equal to installment accounts receivable multiplied by

pre site chew an verona wun ora aetna

‘nan Sige on velo en Se one etd

lifference between the cost of go« het sales, the total installment sales lesy

cayenne en fede ot

Defaults and Repossessions

the gain or 1oss on repossession. As in the ease OF Boods

acquired by trade-in, the repos: urticle should be recorded at an that will

Permit a normal gross profit on its resale.

Interest on Installment Contracts

‘a charge for interest on the balance due,

ith the installment payment that reduces

| Although is included in the pe

nly that portion of a payment which reduces the principal

t contract receivable should be considered in computing the

balance of the in:

realized gross profit.

Lc cc

y ote Sales

x

mone

ue TiPLe CHOICE QUESTIONS

”

op. 1 CAICPAY

x08

«hr collection is critical event for income recognition in the

ca eo Cost recovery Then

mettt. method

: ‘No a

b Yes Yo.

£ No va

é Yes ie

pros. 6-2 (AICPA)

; is

‘rhe installment method of recognizing profit for accounting ‘purposes

scceptable if =

° Collections in the year of sale do not exceed 30% of the total sales price:

b.

‘An unrealized profit account is credited. .

©. Collection of the sales price is not reasonably assured. =

4. The method is consistently used for all sales of similar merchandise.

PROB. 6-3 (AICPA)

PROB. 6-4 (AICPA)

Under the cost recovery method of revenue recogni

Income is recognized on a proportionate basi

sale of the product,

%. Income is recognized when the cash received from the sale of the

roduet is greater than the cost of the product.

Income is recognized immediately.

d. None of these, |

‘as cash is received on the

PROB. 6-5 (AICPA)

Chris Co. sells equipment on installment contracts. Which of the following

statements best justifies Chris’ use of the cost recovery method of revenue

Tecognition to account for these installment sales?

‘The sales contract provides that ttle to the equipmient passes to the buyer

only when all payments have been made.

b. No cash payments are due until one year from the date of sale.

©. Sales are subject to a high rate of return.

4. There is no reasonable basis for estimating collectbility.

PROB. 6 - 6 (AICPA)

Winner Co. is engaged in extensive exploration for water in Utah. If, upon

discovery of water, Winner does not recognize any revenue from water sales

Luntil the sales exceed the costs of exploration, the basis of revenue recognition

being employed is the

a. Production basis

b. Cash (or collection) basi

et

, 6 ntti Sle

nat is the balanes of an installment ws ex the eal?

what aye ofthe oF gia ales price tote receivable 6 months after

Tes than 75% ofthe orginal sales pice

‘The present valu ae

o Te © ofthe remaining monthly payments discowr'

4. Less than the present valu i —

Lees ed at 126 eof the remaining monthly PY

prop. 6-8 (AICPA)

con January 2, 2009, Colt Co, sold land that cost P600.000 for 800,000.

On ving a note beating interest at 10%, The note will be paid in three annual

rerallments of P321,700 starting on December 31, 2009. Beraie collection of

the note is very uncertain, Colt will use the cost recovery ‘method. How fmuch

tevenne fom his sale should Cl recognize in 20097

a

bv. 6,000

c. 8,000

d. 20,000

PROB. 6-9 (AICPA)

Several of Pitt, Inc.'s customers are having cash flow problense, Information

pertaining {© these customers for the years ended March 31, 2009 and 2010

follows:

2009 2010

py To,000 ~-+15,000

3,000 9,000

Cost of sales

PROB. 6-10(AICPA)

‘The following information pertains wo sl fra estate by South Co. 0 Nord,

Co.on December 31,200:

Carving amount 4,000,009

Salt ee ‘enon

Purchase money mortgage 5400000 6,000,009

‘The morgage is payable in sine arn! inallmens of 600,000 beginning

December 31, 2010, ps interest of 10% The December 31,2010 installment

‘was paid schooled, tgeter with atest of PS40,00, South uses the cost

‘eovery method w scout forte sal. What mount of income should Sout,

‘ognize in 2010 rm the rel ete sles ts fnancing?

= 140.000

& —7aa000

$40,000

‘ °

PROB. 6-11 (AICPA)

Hil Company beg ope o ay I, 20, sn pple Be

tine melon Daal 0D ae oe

Installment accounts receivable, 123108

Instalimenteler sano

(Con of gods sod, as percentage of et po

‘Using the instalment metbod, Hil’

a 360,00 alized gross profit fr 2009 would be

& 240.00

© 200,00

& 140,000

sort aa Sl we

viet ims

prop. 6-12 (AICPA)

Lugs Co. wich en penn ry ws

sa od cate a ane Pct sae

is

Sleiman

a sae

ernie ote “=

em

Gross profit on sales. oe a Cd

eG er) 20 atten trt el

cote

a ae

oad

a ee

Dae Ss

ee. me

i se 8

PROB. 6-13 (RPCPA)

“The books of Pijakan Company show te following balances on December 31,

2009

Accounts eeivable 313,750

sorta OR

neaeoanrtnin

|

ep

Pe a

po

oan 2008, a

alee on an inlet basin 208 wee made at 30% above cost 2009,

Sales on an pupae pa wes P1300 relating to installment sles

Batt

How ouch is the net income on instalment ses?

1,000

11300

© 16000

& 10250

PROB. 6-14 (RPCPA)

‘A company uss the installment method of accounting fo recognize income, ang

Pertinent data areas flows

2007 2008 2009

Installment sles 300.00 375.000" 360,000

Cost of ales miso 285000 252,000,

Balance of goss

Profit at yearend:

2007 52,00 15.000 -

2008 4000 9,000

2009 72,000

‘The balance of the receivable on December 31,2009 i

2270000

b m300

© 279000

4 3¢0.000

PROB. 6-15 (AICPA) |

Tat Comm which began buss on January I, 208, aproprialy ues the

installment sales method of accounting. The folowing data ae availble for

December 31, 2008 nd 2009

mm

Balance of deferred gross profit on : ae

—— |

oon

20 arn)

(Gross profit on sales 0% an

sr nan Se

coop nts

Th inn un bane ot Decne, 2098

b.

a

‘PROB. 6-16(AICPA)

Dolce Co, which began operations on Jamsry 1, 2008, appropriately wees the

installment method of ccomting record revenues. The following information i

available forthe yer ended December 31,2008 and 2009:

2008 2009

7,000,900 2,000,000

sate

Se roti eae oe ma

sp ‘soo gaa

i ‘on

0%

res prope

wnat amount of ilies cout

December, 208, be set?

1238.00

monn +

SLi.

100

rectivable should Dolee report in Jt

PROB. 6:17 (AICPA) a

vce Corp. ese insist method of reporting The folowing data

atered for itt ens foros:

2007___2008__ 2009

Big hs as

veto ee

see ee

3 PO alent receivable, Det. 31

Balne finalise Frog 435,000, 60,000

atin Bae

Eee se

2009 inlet sales

|

: itm cnet

1209, «cao dtc ning, he mechani

‘te of i300 rsp Te en mace 207 ad pi

Son i fsa 20.

‘What ie th tl ein gros profit in 20087

412300

183,750,

34300

363750

sth amount of gin ot) en eposesion in 2007?

7500)

(30)

000

3,000

PROB. 6.18 (RPCPA

‘The Cental Pains Subdivision sls eset! subdivision Ios in inlet

‘Te following infomation was ken foe the scouning recurs of Cental

Phin Subaiviion att Deseber 31, 205

Installment accounts receivable, 1109 1735000

Testament account receivable, 123109 40.000

Usain gros profi 1109 335,50

Insalment sles, sa000

ow much ish realied pros pofitin 2097

2” "27500.

B s39730

309250

PROB. 6:19(AICPA)

oso cr. hich began ston ney 1, 209, appropri wes te

Instn le metod ef accountng fo con a peng pene The

‘Sowing dar ola or 0

Installs ecb, 125

Installment ses e299) 12300" oon

Cr rien ss 09

Ck inns eo, wat wt be Rosa's deed os

profit at Dece ?

oan o00|

% sno00

© soo00

rr)

PROB, 620/AICPA)

arr Co, began operations Huy 1, 2009 and appropriately wer He

‘Sealine meted of soung Te flowing nermaten pertains 1 Ka

pean foe 208

Insane sles 00000

Costef insane es ‘sue

(Genta and adnate expenses ee

Collections ca stale ss 004

“te balance inthe defer ro profit coun at December 31, 2009 shoul Be

2120000

1000

© 20000

4 320000

PROB. 621 (RPCPA)

“te Bownot nc, boeing tte st of he clea ea 200, wt

‘matin etd of ning

400.000

insane Peed

Invemory, Deven 31,200 ey

CET cimcrine expen nme

Gener eeebl Dcenbe 31,2009

ar tet

Bo

© ‘96000

4 000

PROB. 623 (RPceAy

‘ross margin on cst 623%

‘Unread gro profit 192000

(Cash collections inlding dow payments 360,00

PROB, 623,AICPA)

Lane Co, which began operations ca amuse 1,200, appropriately ses the

insallneat method of actuating. Te folowing information peas Lane's

‘operation or the ent 2008

PROB. 624(AICPA)

PROB. 625(RPCPA)

‘These dt pein

+ Dawe py

1s receivable athe end of Year 3

PROB. 6-26 (Adapted)

is ave bea od nd accounted or bythe instalment meth are

"poses and retumed to iver, they shouldbe ecard oe

ofthe inslimen receivable et aucited def pose

He eposesed merchandise a book

tee

ae

~ ht tg ae

R08. 628 (RPCPA)

The uneatze gos profit or inlet sls mae ding Yeu 2, ”

ofthe cad of Yer none

. 0 of December i, 2

A

a

PROB. 626

bes sold and accouned for by the insfaliment method are

sed and retamed oven, they shouldbe recorded

208 commonly used Yo report defaults and repossessions is

‘Provide no bass forthe eposeacd as

ery recognizing ons

"abv, recoding pia ot

Ne reposescd merchant at book valu, recording no gain or

4. None ofthese,

ek __enpr tate te

‘Tye os on repossession made on 4 2008 ae Wa

8

et sales are recorded at contr price. Any

ntact are being charged Yo wncolectbie

ed merchandise were cede Yo uneolecte

‘Sccouis expense Inte re ecogaised nthe prod cane Fors Ht ear

© Thelosson reposition made on 20898 W#

© 126230

4 pnwernctgiven

PROB. 629(AICPA)

‘halinents.

a

apr ate Se

a

ROB. 637 (RPCPA)

PROB. 635 (AICPA)

tomer Realy bough

fam, Lot A ws bo

PROB. 636¢a1cPa)

Baker Co. i el

Baker appropriately

over 30 yeas Baker’ rss

Balers two year f pe

Sate

(Cash colecione

car: ba

PROB. 639(AICPA)

What i the

PROB. 6-46

Init int

oun

nt met of evens cognition. Te ellos

le forte yor ended Decor 3 .

Che

Tea

Heoteon

ol

‘SOLUTIONS AND EXPLANATIONS

PROB. 641 Sugzested anrver()

he tnstalinent method i sed whon cole of te sles rice isnot

(Furonaiy assured Hower when te cea of caletio 50 reat

‘at ven thee of thet method special, he th cut

‘Sigh method maybe ed ng no veal ean

ulecbicy would provide a grat enough uneriint 10 6 HE cost

recovery met

PROB. 6-2 Suppesed amor (o)

per, the profi onsale in the orinary cure of busines i considered

‘0 be realted ate tn fsa iene bh te ale pice

‘wl be collected. Tha if collet of the nae ce ot ease

‘ited. the installa mth hl Ba

PROD.6-3 Sugeve ansmer(b)

‘he istalinot method of accountings cd when there ie igh degre of

scoring rearing the colette sal pce Unde ts mote,

sale evens ad the related eo of gods sod are rcoted Inthe

nad of heal Hever, he ert pref ered oe prod fe

PROB.6—4 Suageedannver (i)

Linder te cs recovery method, got profi dered and ecg enly

"hen the cman eceparexesd th cot of te tse

PROB.6S. Sigsenedonmer

Oninariy, revenses should be accu for when a wangcion i

‘molt ith porprtepravin fr uncalecil aceut Hoses

‘hn this no tonal as fr etna the degre of elegy

‘iter he saline metodo he at ony mod maybe

OE

geeememeesy lw

co recovery thd.

ot ofthe em mld POM oly er collections exceeded the

PROB.6-6 Sespeed aren

Under the ost recovry tho, no proto any tps recognzed util he

ile chal ai tre ced cn cae

PROB. 67 Seagenel ance)

‘The bone fo lente eae suas he apa ance of

rcp. Th difirece bree the gos reac and the paid

‘rnc te inert. Thro he Salnce of the nate eal 1 he

reset ae of rence payments cote te cnt ret

PROB.6-8 Sezpsed omer) 0

Under he ot recovery method mo prof of any pe eg unt ihe

multe recps pcan eres) xeed he cst of he se sO

he cst of POO. nate rnd 200), no ea of evere

Som

sou 6+ Semen

ehieamaseron ae

sn 72,000

=e

seereaee 28 ap

See =

ex easy mato nts pri ony ar clecons ee he

ae hen Re pil o ay ben covered. Seen!

ete orca ene as relied ers rai

PROB. 610, Segpeedonver (0) FO

asin, the est recovery method recog srt ont tr collections

he at often eat wh fl cst BERN CONTE Ay

‘Beemer any P2009 of th P4000 hs BN eee

has, come hae rend

PROB. 611 Segenad exer) 160000

arene 0000

inet scm ecb, 123

200 cottons ae.

Matty by os roi on ale (100%) “io

Read gos pot, 209 ia

Se emai tf me hn

Set Set oe eer ar

a Saree tanec

me acai feany a carmmaeyee

Eo Rancho ate per ane

ig ar nade ies Canteens

leet en at ea

me eesti ne

wi ce ea

PROB, 612 Sigpesedanover() 00000 24,000

Insttiet a 560000 40%)

1400000

‘a etal son ea 125109

(asso

Maki ee pat a ae Om

est pr pt 200) Her

omersctmioti

recognition. This Ute with reason princi tat font

Italien sles, roma copied are oot of clon.

ther is posi of eelation of the cnr nd substantial olen

ts may Be inured When gros pref i regarded a comtngen! oe

cxlleton of eas, hres stronger np fr ts egtion ov the ene

‘lection period.

There, prot clecon, which regarded as representing, bth ©

recovery ofc and reatn of grasp mast be maiplicd 627

Profit ate on sleds the eed ros profit forthe period:

‘Due 1 yearend eny 10 adit the dafered gross prof for purposes °f

erat ts ltr tren

eerie iah tie ea ere

See epee aed

Eek ang wacaieramaronst

=

secu bee

Tess defared pes ptt erste!)

208 sles (1625030130)

38000

a0

oo als os

(6000838 1313313) mso0, 26280

Rete pos ot 9

Tess eapnss ling tient es ie

Noses te

‘he cnputon often poiforg ven paid ot coed

Sse amma ating ees ro rete:

caer econ rand he met rs

a re es fella res as Pf

Ce ea abort gram aro teen fh ered oe

ct a ch Banc. Tar th

ee de aed nora bore adisment ond he

Meter aja ted we ee

PROB, 614 Sepgenedonoer (0) F275

209.

Inmet es FRONT. SHOR

Soectaer™ —_SBamioen. _ 22007

copa Seen). toot se

Inte fonts 020) 13

Sito gesesme Gow 20a

Se

1 ppg he line muta he ecu te diferece beeen

thi rc ond i oof aire aia A os

Prot Ts tance ep tren persica b proarion

fet he cath colin of te pad or es Pe, Seed

iar te et a Sande

‘teen eek perod fre gro fbn rama tefl,

nd" gut tothe grat pot peerage ped 1 te Blanc of

‘linen echetc afte dee

PROB. 618 Suspend anmer (P1500

Folia! senate

2008 sas (120000 30%).

209 sales (4000 00) 1.07000

Intent acount esa, 12009

iepcmeepaetret stiri vate at

S7aie ate me

ett om pa pen ato i

Riera as

Ena

PROB. 616 Sxgseuedanter(6)P.708000

es cotton tome

‘0s see

{100 +90 any 30

Hoo ae

‘aon0n 40%)

‘Toalintlinet ass

Reseible 123108

si coi wth he rome lets nce, if

‘Scion the rsp rand ih

‘SmputedBy aig res prot percent

‘ection ing porta, odie te acu

an.

toon, 10.000

tment aes nr

vost with he omc

‘rom

howd

nti ire led rs prot at agen por wis

ciel ye rept pos Pt

Feral ot of @ sien de

Pema ect i aa ri aS oy

"ate

Sales, Terre the linn oro.

009 shea be Po (0.00 * 1300.00

Ron. 617

"Sage ame) P4500

eset rae, 123108

Tellme eae [2319

Foutectis

Tossa lee

cher word 8 prope

coc asthe aint eee

2500

December 3

Bet Se

sme 05000

Sion Teepe TOD

m. ee

Br, ae

tion bal a the

ts revenue recog

onl aun of nainent

‘peolleced, Ths amount

et wth the ectable mailed

ne eed Tt, the tll $88 Profit

EE —_—

elected 2008 regards of he yr ofa, se amet of PH4.306

(1704.00 350) mpd re

Siegler (0) 780

teed ‘50

Ta

Y the entone dents or an tatnnt ctr! and m0 fcr

{lc an me llr may ipo he meando

fe og de

{be pte mera irc ae le han the

Areca efi hee te aes tn

‘Srrpocctn vt road Contrch Ye eke spa oe

‘pated mrcane mor ane secede art

‘opie cone tment a at sn tO fo

‘here! pein tet se

Peon 618

See er (0 9.20

epee 0) 735000

att a 2109 ‘a

api ye ra a ne "

‘aintsa ss ig

Reaaa pos pet 2009 st

sno of eh pri fred at a pa

igen refractor e

ee seat pnt fea he po ona

‘ini cmt fot ee ef oe

“ene face

is

pt te

PROB. 619 Spel xeer() 89000

Inte cn ibe 123109 op

ity ye ptr ‘oe

Deter go e099 088

asin we the asics hd of acum deferens oft

‘Mle that oni th ba endear pale

‘ai pcg sped ke of ne eae

PROM, 630 Spat aver 2000

tie le, 209 sw0.000

(mclaren et ‘ro

Inti ena 129108 oo.

Mat pte as

‘i ss00) sno) ite

ete wos pt 123109, =e

‘cco abl 123109

yy ems pam es

rare

eed 0 psi 123.09 aa

Yami te a lei seu recon principle, ad gross

epte cota rig the pro, te ered gross profit

ens eld he fe nd of ours th

reef mdr privat ons

PROB, 621 Sept ner) PDREND

2000

RON. 622 Spat er

Diy te

soma ees

| SS oem

epi waarmee

‘Se hao ter

ROB, 623 gpd our) OND

Intima soni, 12310 won

Mig gps

aan i a

at po a 200 Siet

ie era ea ote

ener be hd et ene le poe of

ean ae ac cl facta wh pf ay he

noe ring espa pt i re

ent a Se el be

Mogul chl orang ert epee la pe

PROM 624 Sere ner F580

Stes omy m8)

tia

We sao (0800)

atin au cai 5109 SG OMY

aii epson ee

Peteede pet astm a

1 rend rot cons apt wate,

on te ple

‘arate ets a

Sa ats a eno ar

er rh i i tm,

iii apace oe

Sopahomarnie

2 Sagem oF

soso

ar

treme ma

ieyceaere Bae

sya gp ina mii et

sep led rare el eae ee

Fe me a ma of ek

‘ta ot

TET sae ahve compos

Shae onwer(o P09

Use dowmpayac (0)

etic yr ale x80)

ayy opt

ei po tate of Yer?

Peart harrier

funcre ioe:

Spt omer NO

te Sir sor

Ber) ais, __cmson

eee swe — Tae

"Yat 2s 0

Mersin gua _omxo

eed Yor) ina z

Sie es ice exc ht a ie gt

Sener aalRa a

ota

Spear L165

sinters nantes.) _ AB

lily y bom pn se Toi

Une gs pin of Yew} a

sn the sai gr profi a teen of Yoo 3

(Sota porto fates dir 7

nd of Yoo ermine yop BT

Shia

pron tbat ae .

see i rt ha

Cea a ey

SASS oe

cae

PROR.62T Seed one)

os in cna and epaseson of te

Pe ot Siro anyon Boks of te seer tat repo the

i hit dae in

vege if ae he at of repr

Sonne

a Shep ane PAILS

tate abl 208 ale, 29108 2900000

orice Smile, 120009 1.00000

‘rales Tos. 00

Erde cont 7950.00

also 208 735000

Serine ron les (54.000 120,000)

onde olen, 208 sale. Brest

sania 8500

sa sso

cio

oan nd pe

‘ulna nen ler ce ea a

mse: oc as farsa eae

ion pp aha

fo

ere temanes e

elo rer te from heal tof one or roe

eeninte tema Se

“apend oower ne

an eel etaie 30

Lacuna 5085) eas

tenon

S

Sears ett

eit roe

oe cataract re

eee ee eas

eaeieticioes stares,

Sassi crane 8

(028 Sgt mn) 7250000

Catena pre 200000

yoy open

“(ego oy 800) suum

esi ps pr 2010 ‘tot

0000

denier etal ef econ, oom aes

sa a ee cee ot of reaton, Bele

rr ceed tg te grt prof ro setae

‘ht ro aos ue te roe

prove fora charge for nares te

ale wth he boner!

ain our

vee ade tt

fei

Aenean dna

se cease pi nt

tn ot nse re end rps ft a ly

Bay oe fe a pe

‘cu ee sna ag wh ke

‘ttt pr enon an

Sse noe 880

=e ea

‘etl gat fre how

lessee aa “a

isu oie

ey tame aoe

eae ea

Pl =

Colletons, 2009 sales in 2009 Sie

Se

oS -

ae

pec een

eal Sr raul sae (spit of sale: whe tat for means

sales poi 6, nore

Sh ap

sd for regular sles fromthe ttl cost ald for purposes of

‘mie espa nc

Serdar

an rpm rnd

Leeceton so Bas

Ari te es of snes ade 8 bt

‘Sab ene aa ont al port forma

ee mnt

teat led re re oo

SOREL a tere wend co

on 63 Sse 9D

Sarees sa

eed 3s

tect wane ae

nde he stint mod of acouine y ama elie

‘er mn 9 ce ln

rt ie he os Poe

Ty tarred

omen sto be isan od ric ho soon og

‘ore obi pr sr a a,

So pene meee seri mtn

someon tee gi

eet Sree ee pr

4 fone rcs te eis

a Tc a te

“4. nein rebscton a he principal bance

re rot pope pd erg!

non. 638

apne nner 3%

Soi

Tn

cnn

ce te a1

a

leona

om mt =

Pa mee = 47292. =

etre ti rio ete Hof

sta a5 80 na

hatin a a 8 pce

i

— ey

Sager 4

nae ne ie sai000

‘tec a0

aa =a

Noni oles ane

segs! Bans

Seow

Shami sen00

in mtn orcs pent re fra ara tee,

SP ne mie ene arty pale he

PRS il eee er per eth

‘pop hap oe ech tit,

‘Sslareame on nid cae 9 POSH

Sx er PMN 98

coh od

Pact poram ping pcp on on

"ie See nse eS) 3026448

sepa in elo eae

"sau mes =

‘eatser in pitatethpie

aii soft) i

ep 30" Basse

~ ——_t i

Snes he nderng ra econ pe fot elite Pale even and epets he re incomes

Sateen rte Pe a seg rm re ie

cllecad u's normal ene, read gros rot tual fo fot (este rf provider thrall nreaes are added and 3 Sot

ios i rl apd ie a A a dedcied except the changes in some item lik eer

ee ee aa name

eee Sr ent ge eae

es * emer on

Nara 209, 23109 216000 i 28109 ws1a32

a ce 1 28 |

Buca @ Ce ia twig 8

isanet or CE a ee

[seen a eee a

come nner i. ise Shetemsepinint aa

pot 2 a Cop hr

(034772! 315.932) 422835 enme aie

ee | es Termes, SUS ae

posi a one as

mim coe,

St er lyr ere cere neaeioneieo St

pence Em she cent eed yo 08 +

rae | abate aos

soos er mae

wu

anodes a8)

a

‘ei ing pr ofthe eed Thee

sued ps ei 2007

‘wo ao» clot ae ny

"P0400 euler 2009

sorrel me

bs recording rectipt of note, Note Re

‘owt cif ts eRe ad be shat bpd ate ta anit

u acca paanteteee | 1 hd pe er nd 309 a, Tay, ied

ee nl caf pic

eae Seman bing mes ee ees pi

7 ary mort cc ceo eke ee

Ron. 632 Sgn er (0 P10

aT

fo on

| ies iho

| — aor

cc

en cota Rate 308.000

“tsasot8seF 50) 30) sn,

okenete =

i frp f cmp he ered rs oh ee 0

| ‘Nt rent rf he a we

Fah a Seam neengeas ter ree,

‘Ft inl we nen pes eon eon

‘peptic agin ol ee

‘om eon Sarin he mast he

tw pl med el ts ad

PROG Supe sre 18000

oot 270.000

Lona 5S

Tetrion Te

at an

ott ph inant =e

td be elt Der =

ieee

te rn of acing med epg ree

2 fm fn rrr he aed ee

ete wat Seen

Serine ™ te

PROBES Sap ome 29500

oo

‘ro ot s00 182900)

Dar sg Age

Corte a

mae eae e900

‘amet ae ptt Dee 31,2009 200859.

‘Tualatin ere

see 50

sa cee cars team’ PE

(pip wh ass cman eed Pa

PROB.638 Seeder 280

Cons 10% nips Bais

‘eel mes 0S

SUS, name ge

Z : apple frst

can stent

ig yy

iim

PHONE ed nner PSH

nt ne 208 *4gpe

‘ie cs med, 29108 ont

Mage esp poem i

a

Deol poste

dr mest ar, fre rn pata en of 8 en

ASSTESRLITEC ier cour cable mee rind

Pel eerie Wit on ulation

Foppocrmne bed oo

tan mt

Cath caters 0268 kar

sierra =

Sree ti

sect mme 338 43939 rnin

shee iter iter iter

er a

Teal — a

So ae Sie ie

ct Be ee iS

Sf Go oe ie

a Hu gs

Spee “Sect. tet Pei

Deo Mine aad Tan Sse

ae

Ace me cr tt et

Sea fem matt mene

‘omc sad fat ree ar ers,

err or oe ee

Tent

Fic eco

A Sattar gna

Cotte *

(Chiov attr

‘Fouts +10080 20

ee

caer ——

icine a

erreur

See

_ ——_t

eigen wn nme a he meee

sorbate henpansiadncoave he at pa

Pr ret thorny pene a

fata mp ray negli te

Biot was neve fo eed soo

‘ete ne of ee rn Al ny

ce eg ot om oS

2 sagen) 0

‘Gran 0

kes

be bg

lem

‘ated pce Tr 09)

aS is

|

segs eta -99

aa

nim Ds) 2) Ba

earn, 08 =

a

bared 80

Scare the 2

meetin ae

Sat cox 1B 1a

vale 8 iss

‘etree a

Vetoamagst

Seen cama ‘so ip

Smo JS.

Pisco eer a

ea ap me mera

sai eer rena

eect

pone sete -

weenie

Teen SL sae

za

PRON 640 Sapam ne 20

“oe e.

ist 0.50708

Seas oa

| ron. 64 spe nner 0

aan a0 sim

ptt ne wo

“nos rengone3 1309) co

homie) iss

mn ere ert ne eel

Serer et

RoR gaan 09

“arper ane

Scone a0

‘ioeaegay —_sn _somme, p06

mnt at

Ini se) 733900

iar sa

See an a

oe pare

ea som

Zo ee

‘sae 00 053) tag

Tae ‘Sig

Sky aan crm ‘

tel pt wae

ree ef rade i oe al ine of than ral

Peel na dn fom Bote eh

lee cape ore

Sees

PROB 6-44 Suggested answer (i) 230.000

Cashin @30000525128 id

Chang st cob 39 13/1331) ous

Imlnent baa o0 030 _ ow.

Total realized gross profit

[Note tha the insalinent method of acounving, recognizes pris ct the porno

collections, therefore he realized grass profit is based on the cme

PROB. 6-45 Sugpested answer (a) Land 2

{AS 18 sets out five criteria that needed to he met before revere the sae

‘of goods sail be recognized:

1 ihe amounn of revere ean be measured rehab:

2 The seller no longer has management involvement or effec om

the goons:

3. The significant “risks and rewards” of owners

“from the seller 10 he buyer.

44 Teisprobable that payment for the goods wl! he recesvd by: the iy

5. The coss incurred or to be incurred. in relation 0 the sransaction. can be

‘measured relia

ship ave sen transferred

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

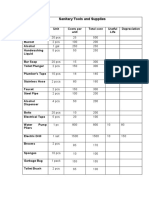

- Sanitary Tools and SuppliesDocument2 pagesSanitary Tools and SuppliesSanilyn DomingoNo ratings yet

- Forecasted Financial Position LabelDocument1 pageForecasted Financial Position LabelSanilyn DomingoNo ratings yet

- CLEAN FIRST Statement of CashflowDocument1 pageCLEAN FIRST Statement of CashflowSanilyn DomingoNo ratings yet

- Forecasted Financial Position LabelDocument1 pageForecasted Financial Position LabelSanilyn DomingoNo ratings yet

- Answer Key ACCTG 202Document3 pagesAnswer Key ACCTG 202Sanilyn DomingoNo ratings yet

- CF6 PDFDocument4 pagesCF6 PDFSanilyn DomingoNo ratings yet