Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

15 views2022 Budegt of Recovery of Naira

2022 Budegt of Recovery of Naira

Uploaded by

Ibrahim OlaideNaira

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 2023 Appropriation BillDocument14 pages2023 Appropriation BillIbrahim OlaideNo ratings yet

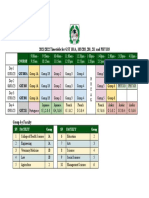

- 2021-2022 CBT Timetable and GroupDocument1 page2021-2022 CBT Timetable and GroupIbrahim OlaideNo ratings yet

- Professional Store Manager Resume (1) - 2 PDFDocument1 pageProfessional Store Manager Resume (1) - 2 PDFIbrahim OlaideNo ratings yet

- ClearanceformDocument3 pagesClearanceformIbrahim OlaideNo ratings yet

- Business Plan Questions-3Document3 pagesBusiness Plan Questions-3Ibrahim OlaideNo ratings yet

2022 Budegt of Recovery of Naira

2022 Budegt of Recovery of Naira

Uploaded by

Ibrahim Olaide0 ratings0% found this document useful (0 votes)

15 views4 pagesNaira

Original Title

2022 Budegt of Recovery of naira

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNaira

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

15 views4 pages2022 Budegt of Recovery of Naira

2022 Budegt of Recovery of Naira

Uploaded by

Ibrahim OlaideNaira

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 4

Pe eae cee apa erttoy

SSeS RSS uc ere BNE CBSE UL

WPI) CDG at

BUDGE’

ee erard

Pee nase

pace of ec

ee

prosperity and deliver on

Sree anos

Se cory

Per Barrel

1 er

Teo o eke en

ENDROSU NEN AUD

Mr. President laid the FGN 2021 Budget Proposal on

October 8, 2020. The National Assembly (NASS) passed

the Bill by December 21, and Mr President signed into

Jaw on December’, 2020,

‘This underscores the Administration’s firm

‘commitment to sustain the return to a predictable

January ~ December fiscal year, as well enact annual

Finance Acts to facilitate the implementation of the

budget.

A supplementary budget of N982.73bn was also passed

bby the NASS on the 7th of uly, 2021, and Mr. President

assented toit on the 26th of fly, 2021 bringing the total

appropriated expenditurefor 2021 toN14.57 trilion.

Daily oi

Production Exchange

Rate

N410.15

t per US Dollar

Million Barrels

per day

Africa

Pee ee ed

Perret 0 ow

to high domestic consumption. Real GDP

eee peiots

Pee ee ee TS

Rete renee ene ety

Prue re aon

to expand by 3.4% in 2021 and 4

pea

ee ee ae ott

ero

eer

ey.

The Nigerian economy lapsed intorecessionin 52020,

after two successive quarters of negative GDP growth,

bbut quickly emerged from the recession with a positive

0.11% GDP growth in Q42020.

2 5.01 growth, largely due to the effective

mplementation of government's Economic

Sustainability Planand the easing of COVID-19 induced

The growth was mainly driven by the non-oll sector,

which rose by 6.74% YoY, masking the deterioration in

oilGDPby-12.65% YoY,

GOP Growth

4.20%

Inflation

13.00%!

Nigeria

Soe ee

‘year growth in the second quarter of 2021

Se

SO eset

oe eas

Oren al

co

See en

GDP growth forecast to 2.5% and 2.6% in

eters

‘Where the Money Coming from

‘The projected aggregate revenue available

to fund the 2022 budget of N1O.13 trillion

is 24.8% higher than the 2021 projection of

8.12 trillion.

‘To promote fiscal transparency,

accountability & comprehensiveness,

allocations to TETFUND and the budgets of

60 GOEs are integrated in the FGN’s 2022

Budget proposal.

In aggregate, 54.9% of projected revenues

is to come from oil-related sources while

65.1% is to be earned from non-oil sources.

‘The 2022 Aggregate FGN Expenditure

(inclusive of GOEs and project-tied Loans)

is projected to be N16.39 tn, which is 12.5%

higher than the 2021 Budget.

Recurrent (nion-debt) spending, estimated

to amount to N6.83tn, is 41.7% of total

expenditute, and 18.5% higher than the

2021 Budget.

Aggregate Capital Expenditure of N3.3Stn

is 32.7% of total expenditure. This provision

is inclusive of Capital component of

Statutory Transfers, GOEs Capital &

Project-tied loans expenditures.

AUNS.61tn, debt service is 22% of total

expenditure, and 35.6% of total revenues.

Provision to retire maturing bonds to local

contractors / suppliers of N292.7 bn is 1.79%

of total expenditure. This provision isin line

with the FGN’s commitment to offset

accumulated arrears of contractual

tm obligations dating back over a decade.

ws independent revenues over the

Sty independent evens tom 207.

die This lets performance of

“ “+ Atthe current run rate, we ae

hhave always considered our

rojo mre but weave

| (REST)

N16.39tn

Proposed Budget

resin

wegen ‘aga

gs ae

wgsoen

Dea

N1816tn

Maeno N6.829tn

aes ‘Sorbent

expendice

N2.132tn

ine

1N924,31bn

cc o-n4.g92tn

Sources NB.531tn sxpeullue

ot RehiedRevenoe

N10.132tn

N16.391tn

party eset

Char revenue soures sud Dividends, Marae & Mining, Electron Monay

“Trantor Levy, Spocal Accounts Draw Down, Demeste Recoveries, rans &

ener Funding, Education ox

Cran

6

‘We resort to borrowing to

finance our fiscal gaps.

However, we believe that the

debt level ofthe Federal

Government is stil within

sustainable limits

&

Having witnessed two economic

recessions we have had to spend

‘our way out of recession, which

necessitated a resort to growing

the publicdebt.

&

ur target over the medium

term is to grow our Revenue-

to-GDP ratio from about 8

percent currently to 15percent

by 2025. At that level of

revenues, the Debt-Service-to-

Revenue ratio will cease to be

worrying,

s Debt Sustainability

&

Borrowings are for Investments

in Infrastructure and Human

Capital Development, and

speci strategic projects

fanded via debt can be verified

publicly.

&

Itis unlikely that our recovery

from each of the two recessions

would have grown as fst

‘without the sustained

government expenditure funded

Frac

6

Overall, we do not have a debt

sustainability problem, but a

revenue challenge which we

will tackle to ensure our debts

remain sustainable,

&

We use the loans to finance critical development projects and

programmes aimed at improving our economic environment and

ensuring effective delivery ofpublieservices our people.

+ The underiying drivers of the 2022 fiscal projections, such as oll

An Overview of the Deficit, Financing & Critical Ratios price benchmark, oil production volume, exchange rate, GDP

growth, and inflation rate remain unchanged as inthe previously

‘spproved 2022-24 MTEPS&EFSP.

oglu dete + However, there have been key changes inthe medim-term sal

“Budget dct tobe ‘ew fiscal terms in the Petroleum Industry Act PIA) 2021, as wellas

a a premised on hybrid of fanuary-Tane (based on current fiscal regime)

le aeal tera and luly-December (based on PIA fiscal regime), while 2028 and

ee eentctien Proceeds = 2024arenow fullybasedon the PIA.

‘Thekey impacts areas follows:

+ Gross Federation Revenue projection decreased by N34157 billion,

fromN@.870 trilionto NB 528 trilion,

+ Deductions for Federally-funded upstream project costs and 13%

Derivation, decreased by N335.3 billion and N810.25 million

respectively

+ Net Federation Oil and Gas revenue projection thus declined by NSA2

bilion from N6.S40 trilion oN6.S3Strillion

Despite the decline in Federation Account revenue, the FGN's Retained

Revenue is projected to increase from NA.36 trilion to N10.13 trillion

{inclusive of GOES), largely based on

+ Aprojected increase in the retained revenues of Government Owned-

Enterprises (GOES) by NB37.76bilion,

+ MDAsinternally Generated Revenue by N697.6bilion

+ ‘Theintroduction of Education Tax of N306 billion and Dividend of 3

billion rom the Bankoflndustey asrevenuelines;and

+ BGN share of ol price royalty of N96. billion whichis expected to be

transferred tothe Nigerian Sovereign Investment Authority based

‘heprovisionsofthe PLA

tere

Weer)

Education Sector: 1.290bn Health Sector: 820.2bn

iis (@) (zs VR}

N875.93bn N108.10bn {'N306.00bm) N711.28bn _NS4.87bn

Amount ‘Amount Transfers to Federal Ministry cay Transfer to

“Ministry of for Education Trust (Re & Counterpart Healthcare

ppinisty of Universal Basic Fund (TETFUND) cen Funding for Provision

sotagencia Education for infrastructure oe Donor Supported Fund (BHCPF)

(Recurrent & Commission projects in expenditure, Programmes, 1% of CRF

Capital (UBEC) Tertiary including Hazard Including Global

meagre

the tay Police Coulusiveof PSR Proson), Seen

Intelligence & Para-Miltary Transport, Water Resources, IEE

Capita expenditure)

Initiatives improve FGN revenues

Revenue generation remains the major fiscal constraint

of the Federal Government.

The systemic resource mobilization problem has been

compounded by recent economic recessions.

Several measures are being instituted under the

Administration's Strategic Revenue Growth Initiatives to,

improve government revenue and entrench fiscal

prudence with emphasis on achieving value for money.

These measures include

Improving the tax administration framework including

tax filing and payment compliance improvements.

Other measures:

+ Evaluation of the process and policy effectiveness of

Fiscal Incentives, including:

+ Review of Sectors eligible for Pioneer Tax Holiday

Incentives under the Industrial Development Income

TaxRelief Act (IDITRA’);

+ Dimensioning the cost of tax waivers/concessions, and

evaluating their policy effectiveness.

+ Setting annual ceilings on Tax Expenditures to better

manage their impact on already constrained

government revenues.

+ Ensuring that MDAs appropriately account for and remit

their internally-generated revenue

‘+ Identifying and plugging existing revenue leakages to

enhance tax compliance and reduce tax evasion;

+ Leveraging technology and automation; and

‘+ Plugging fiscal drainers like subsidies

To further enhance Independent Revenue collection,

Government aims to optimize the operational efficiencies

and revenue generation focus of GOEs

Introduction of new and further increases in existing pro

heath taxes for example, excise on carbonated drinks

GOs’ revenue performance / remittance will be enhanced

through

Effective implementation of the enhanced Performance

Management Framework, including possible sanctions

should they default on their targets;

Tighter Expenditure control including enforcing of Finance

Act 2020 provision limiting GOEs cost-to-revenue ratio to

maximum of 50%;

Regular independent monitoring and reporting of revenue

and expenditure performance of GOEs by both the Budget

Office of the Federation and the Office of the Accountant

General ofthe Federation.

Finance Bill, 2021 will contain measures to further

advance the SRGI.

‘The 2022 Budget is expected to further accelerate the recovery of our economy.

We are optimistic of attaining more inclusive GDP growth as we focus on achieving our objective of massive job

eee en ocean

Early passage of the 2022 Budget for implementation from January 1 will significantly contribute towards

Det eee ee as

a racaeacattan suger teeter eat

ee Cae ee eRe iat eet erro occa

In addition to the Strategic Revenue Growth Initiatives (SRGI), we are leveraging technology and automation, plugging

Coen ee Ca acetic nen oe eae

ee Cog OO Gi)

Peete team ur eecerotnag cs

5 jensioning cost of tax waivers and promoting policy dialogue and transparency around tax waiver regimes

Pee re one eee seen ce

See aU a Cr aa ec

Ciay

‘Achieving government's budget objectives require bold, decisive and urgent actions, Government is determined to act

perce

However, Government remains mindful of the need to provide safety nets to cus!

De eee eee as

The goal of fiscal interventions will be to keep the economy active through carefully calibrated regulatory/policy

Pete cor i as Gotan tet Oe ere ramets iets rnc ns

Er eaten ec

Alistofsome key projects included in the 2022 Budget is attached as an Appendixto the presentation,

Peete eect

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 2023 Appropriation BillDocument14 pages2023 Appropriation BillIbrahim OlaideNo ratings yet

- 2021-2022 CBT Timetable and GroupDocument1 page2021-2022 CBT Timetable and GroupIbrahim OlaideNo ratings yet

- Professional Store Manager Resume (1) - 2 PDFDocument1 pageProfessional Store Manager Resume (1) - 2 PDFIbrahim OlaideNo ratings yet

- ClearanceformDocument3 pagesClearanceformIbrahim OlaideNo ratings yet

- Business Plan Questions-3Document3 pagesBusiness Plan Questions-3Ibrahim OlaideNo ratings yet