Professional Documents

Culture Documents

Average Net Profit

Average Net Profit

Uploaded by

GITIKA ARORA0 ratings0% found this document useful (0 votes)

10 views1 pageThis document calculates average net profit for the years 2019-20, 2020-21, and 2021-22. It lists items that are added to or subtracted from net profit after tax to determine the final net profit figure. Credits added include allowed credits like profit on sale of immovable property. Credits disallowed include premiums on shares/debentures issued/sold and profit on sale of forfeited shares. Expenses allowed are usual working charges, director's remuneration, bonuses, taxes, interest payments, repairs, depreciation, and bad debts. Expenses disallowed include income tax and capital losses on sale of an undertaking. The net profit for each year is shown as 0, indicating the calculation has

Original Description:

Original Title

Average Net Profit.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document calculates average net profit for the years 2019-20, 2020-21, and 2021-22. It lists items that are added to or subtracted from net profit after tax to determine the final net profit figure. Credits added include allowed credits like profit on sale of immovable property. Credits disallowed include premiums on shares/debentures issued/sold and profit on sale of forfeited shares. Expenses allowed are usual working charges, director's remuneration, bonuses, taxes, interest payments, repairs, depreciation, and bad debts. Expenses disallowed include income tax and capital losses on sale of an undertaking. The net profit for each year is shown as 0, indicating the calculation has

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

10 views1 pageAverage Net Profit

Average Net Profit

Uploaded by

GITIKA ARORAThis document calculates average net profit for the years 2019-20, 2020-21, and 2021-22. It lists items that are added to or subtracted from net profit after tax to determine the final net profit figure. Credits added include allowed credits like profit on sale of immovable property. Credits disallowed include premiums on shares/debentures issued/sold and profit on sale of forfeited shares. Expenses allowed are usual working charges, director's remuneration, bonuses, taxes, interest payments, repairs, depreciation, and bad debts. Expenses disallowed include income tax and capital losses on sale of an undertaking. The net profit for each year is shown as 0, indicating the calculation has

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 1

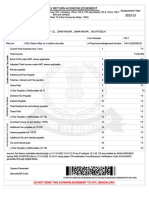

Calculation of Average Net Profit

2019-20 2020-21 2021-22

Particulars Amount Amount Amount

Net profit after tax*

Add : Allowed Credits

1 Profit on sale of immovable property

( Original Cost – WDV )

Less: Credits Disallowed

1 Premium on shares or debentures- issued/sold

2 Profit on sale of forfeited shares

Profit on sale of immovable property/FA- Capital Nature-

3 Wholly/partly

Profits of capital nature- sale of undertaking- as a whole

Surplus in P&L on measurement of asset or liability at fair

4 value/Revaluation Reserves

Less: Expenses Allowed

1 All the usual Working Charges

2 Director’s Remuneration

3 Bonus or Commission paid to Staff

4 Tax on excess or abnormal profits

5 Tax on business profits imposed for special reasons- notified by CG

6 Interest on Debentures

Interest on Loans/mortgages/advances-secured by charge on

7 fixed/floating assets

8 Interest on unsecured Loans and Advances

Expenses on repairs- movable/immovable property ( other than

9 Capital Expenditure)

10 Contributions made under section 181 ( Bonafide Charitable Trusts )

11 Depreciation to the extent section 123 schedule II

12 Prior period items

Legal liability for compensation or damages including liability from

13 breach of contract

14 Insurance Expenses on pt no 12

15 Bad debts written off/adjusted during the year

Add: Expenses Disallowed

1 Income Tax

Compensations, damages or payments made voluntarily for pt no

2 12 above

Capital Loss on sale of undertaking or part thereof ( Not include

3 losses on sale of asset )

Expenditure in P&L on measurement of asset or liability at fair

4 value/Revaluation reserves

Net Profit 0 0 0

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Assignment 1 - 2021 - 2022Document4 pagesAssignment 1 - 2021 - 2022Assya El MoukademNo ratings yet

- Main ObjectsDocument1 pageMain ObjectsGITIKA ARORA100% (1)

- Superhero Corporation Inc: Financial Statements For The Year Ended 31 December 2009Document9 pagesSuperhero Corporation Inc: Financial Statements For The Year Ended 31 December 2009shazNo ratings yet

- Dividend and Managerial Remuneration Adjustments-1Document3 pagesDividend and Managerial Remuneration Adjustments-1Shwetta GogawaleNo ratings yet

- Tax NotesDocument12 pagesTax Notesjames9morrisonNo ratings yet

- Indirect MethodDocument34 pagesIndirect MethodHacker SKNo ratings yet

- TAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)Document7 pagesTAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)YashNo ratings yet

- Week 9, CT Losses, 2022-23 - TutorDocument32 pagesWeek 9, CT Losses, 2022-23 - Tutorarpita aroraNo ratings yet

- Team Green - Task 1 - Drafting of Financial Documents and Conducting of A Financial AnalysisDocument14 pagesTeam Green - Task 1 - Drafting of Financial Documents and Conducting of A Financial AnalysisRoche ChenNo ratings yet

- Financial Statements of CompaniesDocument16 pagesFinancial Statements of CompaniesKiran ChristyNo ratings yet

- Income Tax Reporting: DR Jacek Welc: Jacek - Welc@ue - Wroc.plDocument49 pagesIncome Tax Reporting: DR Jacek Welc: Jacek - Welc@ue - Wroc.plaNo ratings yet

- Tutorial 8-CIT3-2024 - AnswerDocument15 pagesTutorial 8-CIT3-2024 - Answercaduong0109No ratings yet

- Tempest Accounting and AnalysisDocument10 pagesTempest Accounting and AnalysisSIXIAN JIANGNo ratings yet

- CPA Regulation (Reg) Notes 2013Document7 pagesCPA Regulation (Reg) Notes 2013amichalek0820100% (3)

- Tax Advance IndexDocument38 pagesTax Advance IndexLan TranNo ratings yet

- Eflatoun Company: Financial Statements For The Year Ended 31 December 2009Document10 pagesEflatoun Company: Financial Statements For The Year Ended 31 December 2009shazNo ratings yet

- ICAEW Principles of Taxation CH 11-13Document30 pagesICAEW Principles of Taxation CH 11-13ITALIANO hohNo ratings yet

- SHOAIBDocument2 pagesSHOAIBshaikhNo ratings yet

- Tax Accounting: Tax On Profit of Juridical PersonsDocument42 pagesTax Accounting: Tax On Profit of Juridical PersonsBasma MohamedNo ratings yet

- Tax Accounting: Tax On Profit of Juridical PersonsDocument42 pagesTax Accounting: Tax On Profit of Juridical PersonsBasma MohamedNo ratings yet

- Module 1 - PGBPDocument50 pagesModule 1 - PGBPAarushi GuptaNo ratings yet

- Fingyaan PNLDocument32 pagesFingyaan PNLDeep PadhNo ratings yet

- Week 9 Various Taxes Part ADocument64 pagesWeek 9 Various Taxes Part Alindokuhlentuli75No ratings yet

- Chapter 12 PT 2Document4 pagesChapter 12 PT 2abinaNo ratings yet

- Pres Ratios DataDocument24 pagesPres Ratios Datasamarth chawlaNo ratings yet

- Module 7 - Business Combinations SummaryDocument5 pagesModule 7 - Business Combinations Summaryboikarabelo.lesapoNo ratings yet

- Represents The Deemed Realised Gain As Per Norms Specified by The AuthorityDocument14 pagesRepresents The Deemed Realised Gain As Per Norms Specified by The AuthoritylulughoshNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument2 pagesIndian Income Tax Return Acknowledgement 2022-23: Assessment Yeardattam venkateswarluNo ratings yet

- IB BM Paper 1-MSDocument13 pagesIB BM Paper 1-MSDANIYA GENERALNo ratings yet

- Statement of Income and ExpenditureDocument2 pagesStatement of Income and Expenditureyogendra kumarNo ratings yet

- Company Name: (In Rs CRS) (In Rs CRS)Document9 pagesCompany Name: (In Rs CRS) (In Rs CRS)DineshNo ratings yet

- Tax Note No. 6 (Tax On Commercial - Part1)Document10 pagesTax Note No. 6 (Tax On Commercial - Part1)Eman AbasiryNo ratings yet

- FR16 Taxation (Stud) .Document45 pagesFR16 Taxation (Stud) .duong duongNo ratings yet

- Itr 22-23 PDFDocument1 pageItr 22-23 PDFPixel computerNo ratings yet

- Adance AuditingDocument13 pagesAdance AuditingRaheen KaziNo ratings yet

- Gross Income Deductions - Lecture Handout PDFDocument4 pagesGross Income Deductions - Lecture Handout PDFKarl RendonNo ratings yet

- Income Taxes: Indian Accounting Standard (Ind AS) 12Document76 pagesIncome Taxes: Indian Accounting Standard (Ind AS) 12srinivasNo ratings yet

- Zuying. XueDocument9 pagesZuying. XueAbiot Asfiye GetanehNo ratings yet

- SESSION 3 Practice TemplateDocument7 pagesSESSION 3 Practice Templateyimin liuNo ratings yet

- Module 9 Inclusions and Exclusions From Gross IncomeDocument10 pagesModule 9 Inclusions and Exclusions From Gross IncomeKurt CyrilNo ratings yet

- Income TaxDocument85 pagesIncome TaxvicsNo ratings yet

- Statement of Cash Flow Chapter 2Document10 pagesStatement of Cash Flow Chapter 2Mary Ann PacilanNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAbhinaba SahaNo ratings yet

- Module 08 Income Tax On Partnerships Estates and TrustsDocument6 pagesModule 08 Income Tax On Partnerships Estates and TrustsZoren LegaspiNo ratings yet

- Profits and Gains of Business and ProfessionDocument41 pagesProfits and Gains of Business and ProfessionEsha BafnaNo ratings yet

- Introduction To Income Tax:: Constitution of IndiaDocument18 pagesIntroduction To Income Tax:: Constitution of IndiaSampada ShelarNo ratings yet

- Chapter 1 - Income TaxDocument30 pagesChapter 1 - Income TaxKhanh LinhNo ratings yet

- Topic TwoDocument67 pagesTopic TwoMerediths KrisKringleNo ratings yet

- Module 04 Income Tax Compliance RevisedDocument25 pagesModule 04 Income Tax Compliance RevisedSly BlueNo ratings yet

- CTAA 031 - 2023 Special DeductionsDocument20 pagesCTAA 031 - 2023 Special DeductionsZwivhuya MaimelaNo ratings yet

- Financial Mod Ch-4Document37 pagesFinancial Mod Ch-4zigale matebieNo ratings yet

- Accounts Super Revision Marathon Notes Part 2Document157 pagesAccounts Super Revision Marathon Notes Part 2gaxovi4187No ratings yet

- Module 04 - Income Tax ComplianceDocument21 pagesModule 04 - Income Tax ComplianceMark Emil BaritNo ratings yet

- Accounting of Taxation in Accordance With ITO 1984 (IAS-12)Document35 pagesAccounting of Taxation in Accordance With ITO 1984 (IAS-12)Gazi Md. Ifthakhar HossainNo ratings yet

- LM09 Analysis of Income Taxes IFT NotesDocument12 pagesLM09 Analysis of Income Taxes IFT NotesjagjitbhaimbbsNo ratings yet

- Tax Note 22.dotDocument10 pagesTax Note 22.dotdawitesayas0No ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPdeepajagadishgowda532003No ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Acquisition AgreementDocument4 pagesAcquisition AgreementGITIKA ARORANo ratings yet

- Schedule VII PDFDocument2 pagesSchedule VII PDFGITIKA ARORANo ratings yet

- 1Document4 pages1GITIKA ARORANo ratings yet

- Supplemental Agreement On Admission Cum Retirement ofDocument3 pagesSupplemental Agreement On Admission Cum Retirement ofGITIKA ARORANo ratings yet

- Annexure 2 DIN RequirementsDocument2 pagesAnnexure 2 DIN RequirementsGITIKA ARORANo ratings yet

- Documents and Information Required For Incorporation of A Company PDFDocument1 pageDocuments and Information Required For Incorporation of A Company PDFGITIKA ARORANo ratings yet