Professional Documents

Culture Documents

Specific Terms & Conditions For CASA-i ENG

Specific Terms & Conditions For CASA-i ENG

Uploaded by

KavinOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Specific Terms & Conditions For CASA-i ENG

Specific Terms & Conditions For CASA-i ENG

Uploaded by

KavinCopyright:

Available Formats

“Agent” refers to the Bank which will be appointed by the

SPECIFIC TERMS AND CONDITIONS FOR CURRENT ACCOUNT-i

Customer to do such acts on behalf of the Customer under the

AND SAVINGS ACCOUNT-i BASED ON TAWARRUQ

Shariah contract of Wakalah in matters pertaining to Tawarruq

(Effective Date: 14 October 2022)

in accordance to the terms herein.

This Specific Terms and Conditions is applicable to all Current Account-

“CASA-i Tawarruq” means Current Account-i or Savings

i and Savings Account-i (CASA-i) products based on the Shariah

Account-i based on the Shariah concept of Tawarruq which

concept of Tawarruq offered by the Bank. All of these products are

may be offered by the Bank from time to time including but not

governed by the applicable laws of Malaysia and Shariah principles.

limited to Basic Current Account-i, PrimeRich Current Account-

i, PrimeWin Current Account-i, Wise Savers (Basic) Savings

This Specific Terms and Conditions is read together with the General

Account-i, Cheeky Savings Account-i, Cash Rich Savings

Terms and Conditions for CASA-i. All definitions used in the said

Account-i, PrimeWin Savings Account-i and Housing

General Terms and Conditions will have the same meaning when used

Development Account-i.

in this Specific Terms and Conditions.

“Ceiling Profit” refers to the ceiling profit computed at the

The Bank and the Customer agrees and acknowledge that as at the

Ceiling Profit Rate and which constitutes the profit component

date hereof, this Specific Terms and Conditions, the underlying

of the Selling Price.

structure herein and the Commodity Trading are Shariah compliant.

Accordingly, each of the parties hereto agrees that it will not raise any

“Ceiling Profit Rate ("CPR") refers to the rate used to

dispute or issue in relation to the Shariah compliancy of these Specific

compute the Ceiling Profit of the Selling Price.

Terms and Conditions and the Commodity Trading.

“Customer” means the Bank’s customers whose application

This Specific Terms and Conditions will be additional to the Terms and

for CASA-i Tawarruq has been accepted by the Bank and such

Conditions of each type of the product/ accounts appearing in the

CASA-i Tawarruq is maintained with the Bank.

General Terms & Conditions. In the event of any discrepancy, ambiguity

or dispute in the interpretation of these Specific Terms and Condition

“Commodity” means Shariah-compliant goods and/or

and the said Terms and Conditions for each type of product/accounts

commodities (excluding ribawi items in the category of medium

appearing in the General Terms & Conditions, the said Specific Terms

of exchange such as currency, gold and silver) acceptable to

and Conditions for each product/account will prevail.

the Bank, purchased under the platform of any commodity

trader appointed by the Bank and duly approved by the Shariah

1.0 GENERAL

Advisory Committee (SAC) of the Bank which will be transacted

as the underlying asset to facilitate the Tawarruq transaction.

1.1 The CASA-i Tawarruq will be operated in accordance with the

Shariah concept of Tawarruq arrangement whereby the

“Commodity Trading” means the sale and purchase

Customer appoints the Bank under Wakalah contract, as the

transactions performed in accordance to the Shariah concept

Customer's Agent to buy Commodity from any commodity

of Tawarruq.

traders and thereafter to sell the Commodity to the Bank under

Murabahah/Musawamah contract on deferred payment.

“Daily Net Deposit ("DND") refers to end of day balance on

any single day, excluding the floats and represents the positive

Under the arrangement:

difference of the daily deposit minus daily withdrawal.

i. the Bank (as an Agent) will purchase the Commodity on

behalf of the Customer for the Purchase Price of the

“Effective Profit Rate ("EPR") refers to the actual profit rate

Commodity in the amount deposited with the Bank;

used to compute the profit accrual and profit crediting.

ii. the Bank will thereafter on its own capacity purchase the

Commodity from the Customer at the Selling Price which

“Hamish Jiddiyyah” refers to a Security Deposit ("SD")

will be paid to the Customer upon maturity;

placed to secure the undertaking to purchase an asset before

iii. the Bank may thereafter sell the Commodity to a third

execution of sale and purchase contract. Under this product,

party;

the SD will be placed by the Bank in order to secure an

undertaking to purchase the Commodity from Customer. It is

1.2 The Customer applying for the opening of the CASA-i Tawarruq

only applicable when there is any DND during the final day of

with the Bank will be bound by this Specific Terms and

the month whereby the purchase of Commodity will only be

Conditions governing the operations of the CASA-i Tawarruq in

conducted on the next day.

force from time to time.

“Maturity Date” refers to 31st December of that year upon

1.3 This Specific Terms and Conditions is also intended to be read

which the Sale Transaction is executed.

together with pamphlets, brochures or any other relevant Terms

and Conditions issued by the Bank which may be imposed from

“Murabahah” refers to a sale and purchase of a Commodity

time to time that are applicable to the particular CASA-i

where the acquisition/purchase cost and the mark-up are

Tawarruq opened by the Customer.

disclosed to the purchaser.

2.0 MALAYSIA DEPOSIT INSURANCE CORPORATION

“Musawamah” refers to a sale and purchase of a Commodity

(“PIDM”)

where the acquisition/purchase cost is not disclosed to the

purchaser.

2.1 This product is protected by Malaysia Deposit Insurance

Corporation (“PIDM”) up to RM250, 000 for each depositor and “Purchase Price” refers to the amount equivalent to the DND

is subject to the latest version of guidelines issues by PIDM and and/or Total Outstanding Balance which will be used to

includes any statutory amendment or re-enactment thereof. purchase the Commodity on the Trading Day

3.0 DEFINITIONS “Purchase Transaction” refers to when Customer purchases

the Commodity (via the Bank acting as the Customer's Agent)

In this Specific Terms and Conditions, the following words will from any commodity trader at the Purchase Price.

have the meanings stated thereto:

“Profit Crediting Day” refers to the day when total accrued

“Actual Profit” refers to the accrued profit computed at the profit for a particular period will be credited into the Customer’s

Effective Profit Rate which is credited into the CASA-i Tawarruq CASA-i Tawarruq being partial settlement of the Selling Price.

on periodic basis as part of the settlement of the Selling Price.

“Rebate ("Ibra") represents the “waiver on rights of claim”

accorded by a person to another person that has an obligation

SPECIFIC TERMS AND CONDITIONS

SAVINGS ACCOUNT-i AND CURRENT ACCOUNT-i – Effective 14 October 2022 Page 1 of 3

v1.6

which is due to him. selling of Commodity for purposes of rectifying inaccurate

Commodity Trading performed, that may have resulted in the

“Remaining Days” refers to the remaining number of days Commodity Trading to become void or cancelled and thereafter

from the current date up to the Maturity Date of the Selling rectified with a new Commodity Trading

Price.

4.4 The Customer will be entitled to request and take physical

“Sale Transaction” is when the Customer sells the Commodity delivery of the Commodity. In the event the Customer were to

(via the Bank acting as his/her agent) to the Bank at the Selling exercise such right to take physical delivery, all costs and

Price. expenses in respect thereof will be borne by the Customer.

“Selling Price” means the sum payable by the Bank to acquire 4.5 The Customer indemnifies the Bank against all losses, actions,

the Commodity from the Customer on Murabahah basis which proceedings, damage, costs and expenses whatsoever claimed

comprise of the Purchase Price of the Commodity and the profit. by any party and/or incurred or sustained by the Bank as a result

of the purchase of Commodity under any transaction hereunder

“Tawarruq” consists of two sale and purchase contracts where as an Agent of the Customer and/or in the event of breach by

the first involves the sale of an asset to a purchaser on a the Customer of any of his obligations in this Specific Terms and

deferred basis and the subsequent sale involves sale of the Conditions. The indemnity given will survive termination of this

asset to a third party on a spot and cash basis. Under this Specific Terms and Conditions and any sum payable under it

product, the Customer will purchase the Commodity at will not be subject to any deduction either by way of set off

Purchase Price from any commodity trader and thereafter, sell counter claim or otherwise.

the Commodity to the Bank at Selling Price on the basis of

Murabahah/ Musawamah which will be paid to the Customer at 4.6 The Customer will not revoke the appointment of the Bank as

the Maturity Date (after taking into consideration any rebates, if Agent as long as the CASA-i Tawarruq remains available. The

any). The Bank will thereafter sell the Commodity to a third party appointment of the Bank as Agent of the Customer will cease

on a cash and spot basis. upon closure of the CASA-i Tawarruq;

“Tawarruq Notice” refers to yearly statement consist of all 4.7 The Bank will not be obliged to enter into any transaction or

information of Commodity trading transaction sent by the Bank follow any instruction by the Customer, if the entering into such

to the Customer. transaction, may cause the Bank or its affiliates to breach of any

applicable law, policy, rule or regulation in Malaysia.

“Termination Date” refers to the date the Customer terminated

the CASA-i Tawarruq and withdraws the entire outstanding 4.8 The appointment as an Agent shall be terminated upon full

balance. withdrawal whereby, the Sale Price shall be accelerated and the

Bank shall pay the outstanding Sale Price i.e. deposit amount

“Total Outstanding Balance” refers to the prior year and any accrued profit (if applicable), taking into consideration

outstanding balance as at 31st December that will be used for the applicable rebate, if any, to the Customer on the Termination

the computation of the Selling Price at each new year. Date.

“Trading Day” refers to the days where Commodity Trading is 5.0 COMMODITY TRADING TRANSACTION

executed from Monday to Sunday and on which the commodity

trading platform is open for trading. 5.1 As the Customer's Agent, the Bank will enter into the Purchase

Transaction as determined by the Bank as follows:

“Wakalah” means an agency contract in which a party i. The Bank will enter into a Tawarruq transaction on the

mandates another party as the Customer's Agent to perform a Trading Day which falls on the next day following the

particular task in matters that may be delegated voluntarily or deposit placement date, subject to the DND amount; and

with imposition of fee. ii. The Bank will enter into a Tawarruq transaction on the

Trading Day which falls on the next day of each newyear

“Wa’d” means a promise or undertaking, refers to expression on the Total Outstanding Balance.

of commitment given by one party to another to perform certain

action(s) in future. 5.2 If the Trading Day is later than the date the Purchase Price is

deposited to the Bank, the Purchase Price will be treated as

4.0 APPOINTMENT AS AN AGENT Qard (loan) to the Bank prior to the Purchase Transaction. In

this regard, the Customer consents for the Bank to deal with the

4.1 Based on the concept of Wakalah, the Customer (acting as the Purchase Price.

“principal”) agrees to appoint the Bank (acting as the “Agent”)

and the Bank agrees to accept the appointment as an Agent of 5.3 In connection with each Purchase Transaction, the Bank (as the

the Customer for the Purchase Transaction and Sale “Commodity Purchaser”) will provide a promise (Wa’d) to the

Transaction of the Commodity (“Commodity Trading”) in Customer and agree to purchase the Commodity from the

accordance with this Specific Terms and Conditions. The Bank Customer upon completion of the Purchase Transaction.

will only act as the Customer’s Agent and will not assume, or be

deemed to have assumed, any additional obligations to, or to 5.4 The Selling Price will be computed based on the following

have any special relationship with the Customer other than formula:

those that is envisioned in this Specific Terms and Conditions.

Selling Price = Purchase Price + Ceiling Profit

4.2 As the Customer's Agent, the Bank will, during the tenure or any

renewal thereof, have the following powers and authority:- 5.5 The Selling Price will be deferred to two cash flow streams:

i. to do and execute all acts with respect to the purchase of i. Principal portion i.e. deposit amount will be paid on the

the Commodity on a cash and spot basis through Maturity Date i.e. December 31st (and subsequent years);

purchase agreement, certificate and other instrument

and to negotiate with commodity trader on behalf of the ii. Actual Profit will be paid at every month. The actual profit

Customer in relation thereto; and rate will be based on the EPRas per the formula below:

ii. to sell the Commodity on deferred payment to the Bank

at cost plus profit on behalf of the Customer and to do Actual Profit = End of Day Balance x EPR x No. of Days /

and execute all acts in relation thereto. 365 or 366

4.3 The Bank will look after the best interest of the Customer and 5.6 The Ceiling Profit will be computed based on the following

acts in good faith in performing its obligations in buying and formula:-

selling of Commodity. This includes performing buying and

SPECIFIC TERMS AND CONDITIONS

SAVINGS ACCOUNT-i AND CURRENT ACCOUNT-i – Effective 14 October 2022 Page 2 of 3

v1.6

Ceiling Profit = Purchase Price x CPR x Remaining Days / provided by the Bank.

365 or 366

9.2 The Customer may also request for an ad hoc notice at any of

5.7 Following the Maturity Date, the Bank will roll-over the Total the Bank’s branches, via e-mail or fax subject to the Bank's

Outstanding Balance under the Customer’s CASA-i Tawarruq prevailing applicable charges.

and enter into a new Commodity Trading for a tenure that

matures on 31st December of the following year. 9.3 Where the Bank has to rely on and make verbal confirmation

with the Customer or the authorised signatory(ies) via

6.0 HAMISH JIDDIYYAH (SECURITY DEPOSIT) telephone, the Customer agrees that the Bank is authorised to

effect, rely and act on such telephone confirmation/ instruction

6.1 Hamish Jiddiyyah is the security deposit amount which the Bank which the Bank reasonably believes to have originated from the

will credit into the Customer’s CASA-i Tawarruq on the Profit Customer in the event the request is submitted by a third party

Crediting Day. or received via e-mail or fax.

6.2 Hamish Jiddiyyah is granted as an assurance from the Bank to

the Customer to purchase the Commodity from the Customer

on

[End]

the respective Trading Day.

6.3 Security Deposit is derived based on the following formula:

Security Deposit = DND x EPR x n / 365 or 366

Where;

n = number of days prior to the Commodity Trading that

consequently occurs prior to Profit Crediting Day.

6.4 The Hamish Jiddiyyah will not be utilised by the Customer prior

to the Commodity Trading.

6.5 Upon completion of the Commodity Trading, the Hamish

Jiddiyyah will be offset against Actual Profit.

6.6 The Hamish Jiddiyyah will be returned to the Bank in the event

the Purchase Transaction does not take place. However, the

Bank may waive its right on the Hamish Jiddiyyah on specific

circumstances such as closing of CASA-i Tawarruq prior to

Commodity Trading.

7.0 REBATE (IBRA’)

7.1 The Customer will consent to grant rebate under the concept of

Ibra’ subject to the occurrence of certain events including but

not limited to:-

i. withdrawal of funds prior to Maturity Date;

ii. upon termination of the CASA-i Tawarruq prior to

Maturity Date;

iii. difference between CPR and EPR at the Maturity Date,

given the profit component of the Selling Price computed

using CPR is in excess of the aggregate profit during the

year computed using EPR based on the following

formula:

Rebate = Total Ceiling Profit - Total Accrued Profit Payable

7.2 The Customer agrees that the Bank’s determination of any profit

amount payable to the Customer under the CASA-i Tawarruq

save for obvious error will be final, conclusive and binding

against the Customer.

8.0 PROFIT RATE

8.1 The profit rate of the CASA-i Tawarruq will be subjected to the

prevailing EPR for respective products or campaigns which will

be made known to the Customer upon opening of the account

and will be determined by the Bank from time to time.

8.2 The profit rate will be credited on monthly basis.

9.0 TAWARRUQ NOTICE

9.1 Customer will receive Tawarruq Notice on yearly basis, which

detailing the Tawarruq transactions i.e. Purchase Price, Selling

Price, total profit, total profit credited, total rebate and etc. for

the period by post at the correspondence address last

registered with the Bank or any other mediums or Services as

SPECIFIC TERMS AND CONDITIONS

SAVINGS ACCOUNT-i AND CURRENT ACCOUNT-i – Effective 14 October 2022 Page 3 of 3

v1.6

You might also like

- Shares Sale AgreementDocument14 pagesShares Sale AgreementIan Ling100% (1)

- Economics - FE Review Problems and Solutions 2012Document154 pagesEconomics - FE Review Problems and Solutions 2012Blake Reeves50% (2)

- Tokeny Solutions ONBOARDDocument2 pagesTokeny Solutions ONBOARDJosephine BonjourNo ratings yet

- Best Stochastic Trading StrategyDocument5 pagesBest Stochastic Trading StrategyBadrun Ibrahim75% (4)

- Project Report On Credit Risk ManagementDocument56 pagesProject Report On Credit Risk ManagementGayatriThotakura80% (30)

- CM CASA TNCDocument18 pagesCM CASA TNCAzharNo ratings yet

- Musharakah Bai' Muajjal (Credit Sale) : Musharakah (Joint Venture) Is AnDocument4 pagesMusharakah Bai' Muajjal (Credit Sale) : Musharakah (Joint Venture) Is AnNoha DbnNo ratings yet

- PDS SMART Mortgage Flexi TawarruqDocument8 pagesPDS SMART Mortgage Flexi TawarruqNUR AQILAH NUBAHARINo ratings yet

- Islamic Finance PresentationDocument21 pagesIslamic Finance PresentationZINEB YDIRNo ratings yet

- Islamic-Banking-Products-vs-Conventional-Banking-ProductsDocument6 pagesIslamic-Banking-Products-vs-Conventional-Banking-Productsdontsnd888No ratings yet

- Maf653 MindmapDocument1 pageMaf653 MindmapAniisa AthirahNo ratings yet

- Uib2612 1730 Lecture 2Document62 pagesUib2612 1730 Lecture 2huiminlim0626No ratings yet

- Islamic Banking and Financial Services (Haneef, Iman & Umar)Document23 pagesIslamic Banking and Financial Services (Haneef, Iman & Umar)Akmal HaziqNo ratings yet

- General Terms & Conditions For CASA-i ENGDocument7 pagesGeneral Terms & Conditions For CASA-i ENGKavinNo ratings yet

- Contract MuamalatDocument16 pagesContract MuamalatHarizul RafiqNo ratings yet

- CHAPTER 7 APPLICATION of FUNDS Financing Facilities and The Underlying Shariah Concepts Editing PDFDocument122 pagesCHAPTER 7 APPLICATION of FUNDS Financing Facilities and The Underlying Shariah Concepts Editing PDFNURADILAH AHMAD SHAIFUDDINNo ratings yet

- Islamic Banking and Conventional BankingDocument4 pagesIslamic Banking and Conventional BankingSajjad AliNo ratings yet

- Chapter 2 - Islamic Contract in The International Trade FinancingDocument19 pagesChapter 2 - Islamic Contract in The International Trade FinancingAisyah AnuarNo ratings yet

- Difference Between Conventional and Islamic Products AssetDocument9 pagesDifference Between Conventional and Islamic Products AssetTahir DestaNo ratings yet

- Week 4 Topic 1 Aqad and Sources of FundsDocument41 pagesWeek 4 Topic 1 Aqad and Sources of Funds2 Ashlih Al TsabatNo ratings yet

- Session 2 - Non Financial Contracts in Islamic Banking & FinanceDocument37 pagesSession 2 - Non Financial Contracts in Islamic Banking & FinanceMohamed Abdi LikkeNo ratings yet

- Sells Certain Specific Goods (Permissible Under Shariah and Law of The Country), To The Buyer atDocument4 pagesSells Certain Specific Goods (Permissible Under Shariah and Law of The Country), To The Buyer atUzair SheikhNo ratings yet

- Tawarruq Bank IslamDocument8 pagesTawarruq Bank IslamZulaihaAmariaNo ratings yet

- sbp-MurabahaAgreement Doc 1 MMFADocument7 pagessbp-MurabahaAgreement Doc 1 MMFAnadeemuzairNo ratings yet

- Bank Baagi HasilDocument33 pagesBank Baagi HasilBahtiar AfandiNo ratings yet

- Musharakah Mutanaqisah As An Islamic Financing Alternative To BBADocument3 pagesMusharakah Mutanaqisah As An Islamic Financing Alternative To BBAhakimi1568No ratings yet

- General Terms and Conditions of Orders To Buy and Sell SecuritiesDocument5 pagesGeneral Terms and Conditions of Orders To Buy and Sell SecuritiesDavid 01No ratings yet

- Ibt TawarruqDocument1 pageIbt TawarruqMin SugarNo ratings yet

- Al-Wadeah Principal and It's Feature Al-Wadeah Principal and It's FeatureDocument8 pagesAl-Wadeah Principal and It's Feature Al-Wadeah Principal and It's Featurevivekananda RoyNo ratings yet

- 2017 Mitsubishi Mirage 97704Document6 pages2017 Mitsubishi Mirage 97704Van OpenianoNo ratings yet

- Investment SideDocument52 pagesInvestment Sideayman FergeionNo ratings yet

- Introduction To Sale of Goods Act & Contract ACT: by J.Michael Sammanasu JIMDocument34 pagesIntroduction To Sale of Goods Act & Contract ACT: by J.Michael Sammanasu JIMRakesh VarunNo ratings yet

- Term Descriptions: Glossary of TermsDocument2 pagesTerm Descriptions: Glossary of TermsabdellaNo ratings yet

- PDS - BridgingF-i v1.5 080720 ENGDocument2 pagesPDS - BridgingF-i v1.5 080720 ENGFairuz MohdNo ratings yet

- Fundamentals of Islamic Finance and Banking: Chapter 8: SalamDocument12 pagesFundamentals of Islamic Finance and Banking: Chapter 8: SalamIsmail Ahmad ZahidNo ratings yet

- Product Disclosure Sheet: 680329-V) Incorporated in MalaysiaDocument4 pagesProduct Disclosure Sheet: 680329-V) Incorporated in MalaysiaSyuhada BazliNo ratings yet

- Gambar Pds HiwalahDocument4 pagesGambar Pds HiwalahSyuhada BazliNo ratings yet

- Sagicor Bank Account Terms and Conditions July 27 2020Document9 pagesSagicor Bank Account Terms and Conditions July 27 2020Maxwell R. SmithNo ratings yet

- Islamic Banking and Finance A#5Document6 pagesIslamic Banking and Finance A#5Abdul Wahid KhanNo ratings yet

- Pdic From PPT With Side NotesDocument5 pagesPdic From PPT With Side NotesPiolo Serrano100% (1)

- Credit Financing in Islamic Financial in PDFDocument2 pagesCredit Financing in Islamic Financial in PDFasadfNo ratings yet

- Aleya - Ba1194c - Motor Vehicle Financing&personal FinancingDocument26 pagesAleya - Ba1194c - Motor Vehicle Financing&personal FinancingzahierulNo ratings yet

- Difference Between Bai-Murabaha & Bai-MuajjalDocument6 pagesDifference Between Bai-Murabaha & Bai-MuajjalMD. ANWAR UL HAQUE100% (11)

- PAPT Document - RefinancingDocument16 pagesPAPT Document - RefinancingAlex YiuNo ratings yet

- Deposit and Investment ProductsDocument35 pagesDeposit and Investment ProductsNurulhikmah RoslanNo ratings yet

- Al-Bai Bithaman Ajil The Shari'ah and Legal Issues On Its Application As A Financing Facility: The Malaysian ExperienceDocument22 pagesAl-Bai Bithaman Ajil The Shari'ah and Legal Issues On Its Application As A Financing Facility: The Malaysian ExperienceFaizalAhamadNo ratings yet

- Response To Feedback Received: Wadi'ahDocument2 pagesResponse To Feedback Received: Wadi'ahJaleany T C KhunNo ratings yet

- Islamic Accounting P 2Document60 pagesIslamic Accounting P 2Abdelnasir HaiderNo ratings yet

- AlAwfar Terms ConditionsDocument15 pagesAlAwfar Terms ConditionsNabihah MansorNo ratings yet

- Islamic Banking: Presented by Lakshmi and ShameemDocument21 pagesIslamic Banking: Presented by Lakshmi and ShameemvidyaposhakNo ratings yet

- Terms Ranked From LEAST RISK To MOST RISK For The SellerDocument17 pagesTerms Ranked From LEAST RISK To MOST RISK For The Sellerkamalarora117No ratings yet

- C7-Islamic Trade Financing InstrumentsDocument5 pagesC7-Islamic Trade Financing Instrumentsnurainilmi2001No ratings yet

- 1651056046yes tsDocument7 pages1651056046yes tsSomesh IngaleNo ratings yet

- Supporting Shariah Concepts: Shariah Resolutions in Islamic FinanceDocument20 pagesSupporting Shariah Concepts: Shariah Resolutions in Islamic FinanceMohd Afif bin Ab RazakNo ratings yet

- PDS-Credit-Card-i-Tawarruq-Visa-Platinum_and_Visa_InfiniteDocument3 pagesPDS-Credit-Card-i-Tawarruq-Visa-Platinum_and_Visa_Infinitenuruljannah.yusrimajuNo ratings yet

- Islamic Banking and Finance Hourly IIDocument3 pagesIslamic Banking and Finance Hourly IIKiran HasnaniNo ratings yet

- Bank Guarantee BrochureDocument46 pagesBank Guarantee BrochureVictoria Adhitya0% (1)

- Murabaha FinanceDocument36 pagesMurabaha FinancesaadriazNo ratings yet

- Conventional Bank: This Ideal of Economic Bank May Be A Establishment That Accepts DepositsDocument11 pagesConventional Bank: This Ideal of Economic Bank May Be A Establishment That Accepts DepositsRasheed M IsholaNo ratings yet

- Differences Between Conventional Bank and Islamic BankDocument102 pagesDifferences Between Conventional Bank and Islamic Bankmuluneh paulosNo ratings yet

- Escrow AgreementDocument49 pagesEscrow AgreementkarthikeyanwebtelNo ratings yet

- Hussain & Mehboob WCR 5Document3 pagesHussain & Mehboob WCR 5ismail hzNo ratings yet

- Revealed From A Top Realtor: The Fastest Way To Sell Properties Like Crazy In Real Estate - Even If You Are A Complete NewbieFrom EverandRevealed From A Top Realtor: The Fastest Way To Sell Properties Like Crazy In Real Estate - Even If You Are A Complete NewbieNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- 0001Document1 page0001KavinNo ratings yet

- 05 SFB SS316 M8 X 35MM P21680Document7 pages05 SFB SS316 M8 X 35MM P21680KavinNo ratings yet

- 02-3 Sec B - WQTDocument2 pages02-3 Sec B - WQTKavinNo ratings yet

- P21349 Aerogas D.ODocument2 pagesP21349 Aerogas D.OKavinNo ratings yet

- 06 SFB SS316 M8 Spring Washer P21680Document7 pages06 SFB SS316 M8 Spring Washer P21680KavinNo ratings yet

- 0004Document1 page0004KavinNo ratings yet

- Iso 9001 - 2008Document1 pageIso 9001 - 2008KavinNo ratings yet

- 0003Document1 page0003KavinNo ratings yet

- GLND Way of Working - Process & ToolsDocument1 pageGLND Way of Working - Process & ToolsKavinNo ratings yet

- Api 2C 2D - JCDDocument2 pagesApi 2C 2D - JCDKavinNo ratings yet

- Introduction To Pipeline EngineeringDocument1 pageIntroduction To Pipeline EngineeringKavinNo ratings yet

- 0002Document1 page0002KavinNo ratings yet

- MSOG EXCEL LEVEL I & IIDocument1 pageMSOG EXCEL LEVEL I & IIKavinNo ratings yet

- 01 CV - Kavin Updated 10-10-2022 REV 00Document26 pages01 CV - Kavin Updated 10-10-2022 REV 00KavinNo ratings yet

- Section 1 - Shell HSSE and Social PerformanceDocument1 pageSection 1 - Shell HSSE and Social PerformanceKavinNo ratings yet

- 01 Gen-M6st1-Gen-Cgu-004506.00-M6s1-Awv-Nww-Me-Reg-800700-00Document2 pages01 Gen-M6st1-Gen-Cgu-004506.00-M6s1-Awv-Nww-Me-Reg-800700-00KavinNo ratings yet

- Belimo NF..A - S2 SF..A - S2 Installation-InstructionsDocument2 pagesBelimo NF..A - S2 SF..A - S2 Installation-InstructionsKavinNo ratings yet

- Section 3 - Shell Global Quality Policy, Objectives and PracticesDocument1 pageSection 3 - Shell Global Quality Policy, Objectives and PracticesKavinNo ratings yet

- Section 5 - Shell FLAWLESS PROJECT DELIVERYDocument1 pageSection 5 - Shell FLAWLESS PROJECT DELIVERYKavinNo ratings yet

- GLND Way of Working - Commercial AwarenessDocument1 pageGLND Way of Working - Commercial AwarenessKavinNo ratings yet

- Section 4 - Shell Technical StandardsDocument1 pageSection 4 - Shell Technical StandardsKavinNo ratings yet

- Section 2 - Shell-General Business Principles & Code of ConductDocument1 pageSection 2 - Shell-General Business Principles & Code of ConductKavinNo ratings yet

- Map of A Human Being PDFDocument32 pagesMap of A Human Being PDFKavin100% (1)

- Chapter 6 Business Formation Sections 3-4Document25 pagesChapter 6 Business Formation Sections 3-4kparsons938512No ratings yet

- FAR03 - Accounting For Property, Plant, and EquipmentDocument4 pagesFAR03 - Accounting For Property, Plant, and EquipmentDisguised owlNo ratings yet

- Rex Offer Document (Clean)Document732 pagesRex Offer Document (Clean)Invest StockNo ratings yet

- 1.0 Executive Summary:: Integrated Marketing CommunicationDocument28 pages1.0 Executive Summary:: Integrated Marketing CommunicationAnubhov Jobair100% (1)

- Hingur RampurDocument23 pagesHingur RampurJeewanti panchpalNo ratings yet

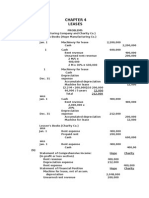

- Chapter 4 Lecture NotesDocument30 pagesChapter 4 Lecture NotesStacy SMNo ratings yet

- Trial BalanceDocument4 pagesTrial Balancepri_dulkar4679No ratings yet

- Financial Accounting 2 Chapter 4Document27 pagesFinancial Accounting 2 Chapter 4Elijah Lou ViloriaNo ratings yet

- Salient Features of The Revised Irr OF R.A. 9520Document21 pagesSalient Features of The Revised Irr OF R.A. 9520AJ NaragNo ratings yet

- Order FN5961505942 Mode of Payment: COD Carrier Name: DELHIVERY AWB Number: 195041861090113Document1 pageOrder FN5961505942 Mode of Payment: COD Carrier Name: DELHIVERY AWB Number: 195041861090113ajaymahto2550No ratings yet

- Homeless Emergency Solutions Grant ApplicationDocument17 pagesHomeless Emergency Solutions Grant ApplicationBridgeportCTNo ratings yet

- Protection of Historical Monuments and Development of Museums Taken Up Under 12th Finance Commission FundsDocument151 pagesProtection of Historical Monuments and Development of Museums Taken Up Under 12th Finance Commission FundsKeerthana SNo ratings yet

- Marriage in Iowa Law - Complete ResultsDocument109 pagesMarriage in Iowa Law - Complete ResultsDavid ShaferNo ratings yet

- Intrinsic Stock Value FCFF On JNJ StockDocument6 pagesIntrinsic Stock Value FCFF On JNJ Stockviettuan91No ratings yet

- Risk Management I Intro FOREX ExposureDocument25 pagesRisk Management I Intro FOREX ExposureFrisancho OrkoNo ratings yet

- Bep ProblemsDocument5 pagesBep ProblemsvamsibuNo ratings yet

- Gati Shakti' To Give 100-trn Infra Boost: Ola's Maiden E-Scooter Undercuts CompetitionDocument20 pagesGati Shakti' To Give 100-trn Infra Boost: Ola's Maiden E-Scooter Undercuts CompetitionRavinoor ChahalNo ratings yet

- VN Top500Document43 pagesVN Top500Vioh NguyenNo ratings yet

- PBM Scholarship Circular Form Spring 22 10032022Document5 pagesPBM Scholarship Circular Form Spring 22 10032022Rose MarryNo ratings yet

- Scenario 4 - Inter Compant TrxnsDocument2 pagesScenario 4 - Inter Compant Trxnsanishokm2992No ratings yet

- 9421 - Non-Profit OrganizationDocument4 pages9421 - Non-Profit Organizationjsmozol3434qcNo ratings yet

- Internship Details of Students For 2012-13 For Mba Sem 3Document37 pagesInternship Details of Students For 2012-13 For Mba Sem 3Jeet MehtaNo ratings yet

- OBHR 202 - W05 Exercise Compensation Management CaseDocument6 pagesOBHR 202 - W05 Exercise Compensation Management CaseDinaHengNo ratings yet

- Latihan Soal Mid Test PTMDocument5 pagesLatihan Soal Mid Test PTMChristine Novalina AritonangNo ratings yet

- IGNOU MBA Prospectus 2014Document230 pagesIGNOU MBA Prospectus 2014manas routNo ratings yet

- An Empirical Analysis On The Relationship Between Multiple Directorships and Cash Holding: A Study On The Financial Sector 2019-2020 in OmanDocument10 pagesAn Empirical Analysis On The Relationship Between Multiple Directorships and Cash Holding: A Study On The Financial Sector 2019-2020 in OmanBOHR International Journal of Business Ethics and Corporate GovernanceNo ratings yet