Professional Documents

Culture Documents

JKNKJ

JKNKJ

Uploaded by

Atharv MarneOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

JKNKJ

JKNKJ

Uploaded by

Atharv MarneCopyright:

Available Formats

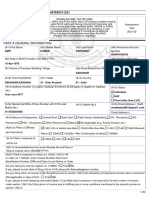

INDIAN INCOME TAX RETURN Assessment Year

ITR-1

FORM

[For Individuals having Income from Salaries, One House Property, Other Sources (Interest etc.) and having

SAHAJ total income upto Rs.50 lakh ] 2 0 2 3 - 2 4

(Refer instructions for eligibility)

PART A GENERAL INFORMATION

Aadhaar Number (12 digit)/Aadhaar Enrolment Id (28 digit) (If eligible for adhaar)

PAN CKUP S 3 8 7 9 M

1 2 3 4 5 6 7 8 9 0 1 2

Mobile No

9 8 9 0 3 5 5 5 1 1 Name : Anita Vijay Marne

E mail Address :

Address

pj.bhosale@yahoo.co.in xxx, xxx xxx, Pune 14

Fill only if you belong to -

Residential Status √ Resident Non Resident Resident but not Ordinary Resident √ Govt PSU Other

Return filed (Tick) [Please see Instruction - ] √ On or before due date-u/s 139(4), Belatede date-u/s 139(4), Revised-u/s 139(5), u/s 119(2), or, in

response to notice u/s 139(9)- Defective, 142 (1), 148 , 153A / 153 C

If Revised/Defective, then Enter Receipt No and Date of filling Original Return (DD/MM/YYYY) / /

If field in response to notice u/s 139 (9)/142(1)/148/153A/153C, enter date of such notice / /

Are you governed by Portuguse Civil Code as per section 5A? (Tick) Yes √ No (If "Yes" Fill PAN of the Spouse)

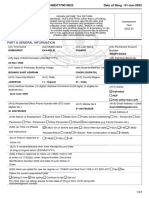

PART B - GROSS TOTAL INCOME Whole - Rupee only

B1 Income from Salary / Pension B1 1095948

B2 Income from One House Property Self Occupied Let Out (If loss, put the figure in negative) B2 ( )

B3 Income from Other Sources B3

B4 Gross Total Income (B1+B2+B3) (If loss, put the figure in negative) B4 ( ) 1095948

PART C - DEDUCTION AND TAXABLE TOTAL INCOME (Referinstructions for Deduction limit as per Income-Tax Act)

80C 150000 80D 7030 80G 0 80TTA

Any other (Please specify section)

Total Deduction C1 157255 Taxable Total Income (B4 - C1) C2 938693

PART D - COMPUTATION OF TAX PAYABLE

D1 Tax Payable on Total Income. 100239 D2 Rebate u/s 87A 0 D3 Tax after Rebate 100239

D4 Cess on D3 4010 D5 Total Tax and Cess 104249 D6 Relief u/s 89(1) 0

D7 Interest u/s 234A D8 234B D9 234C

D10 Total Tax and Interest (D5+D7+D8+D9-D6) 104249 D11 Total Tax Paid 80000

D12 Amount Payable (D10-D11) (if D10>D11) 24249 D13 Refund (D11-D10) (if D11>D10) 0

Exempt Income : Agricultural Income Others Pls, specify

10(38) 10(34)

For reporting purpose (< Rs 5000)

PART E - OTHER INFORMATION

D10 Details of all Bank Accounts held in India at any time during the previous year (excluding dormant accounts)

IFS Code of the Account Number (of 9 digits or more as Cash deposited during 09.11.2016 to 30.12.2016 (if (Tick one account \/ for

Sl.No Name of the Bank per CBS system of the Bank) refund)

Bank aggregate cash diposits during the period > Rs 2 lakh)

I

II

III

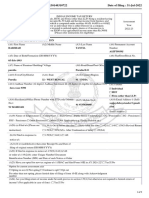

Schedule IT Details of Advance Tax and Self-Assessment Tax payments

BSR Code Date of Deposit (DD/MM/YYYY) Serial No of Challan Tax Paid

Col (1) Col (2) Col (3) Col (4)

R1 2 0

R2

R3

R4

R5

Schedule IT Details of Advance Tax and Self-Assessment Tax payments

Amount which is subject Amount claimed in the hands

Name of the Deductor Deduction / collection Tax Deducted / Amount out of (5)

TAN of the Deductor to tax deduction / of spouse if section 5A is

/ Collector year collected claimed this year

collection applicable

Col (1) Col (2) Col (3) Col (4) Col (5) Col (6) Col (7)

Pune Municipal

T1 0 Corporation

938693 2021-22 104249 0 0

T2

T3

VERIFICATION

I Anita Vijay Marne son / daughter of 0

Stamp Receipt No., Seal, Date & solemnly declare that to the best of my knowledge and belief, the information given in the return is correct and

Sign of Receiving Official complete and in accordance with the provisions of the Income-Tax Acr, 1961

Date : - - 2 0 Sign

You might also like

- ITR Form-1 (Sahaj)Document1 pageITR Form-1 (Sahaj)NDTVNo ratings yet

- New Itr Forms NotifiedDocument2 pagesNew Itr Forms NotifiedmahenderreddybNo ratings yet

- Itr1 PreviewDocument7 pagesItr1 PreviewGst IndiaNo ratings yet

- itr1_previewDocument9 pagesitr1_previewsubrata dasNo ratings yet

- Form PDF 338831280310722Document6 pagesForm PDF 338831280310722Sumit SainiNo ratings yet

- Form_pdf_223455830170524Document9 pagesForm_pdf_223455830170524Amit BohraNo ratings yet

- Form PDF 494190400281221Document8 pagesForm PDF 494190400281221Suprava MishraNo ratings yet

- Form PDF 421656360251221Document10 pagesForm PDF 421656360251221aworlda75No ratings yet

- Itr1 PreviewDocument8 pagesItr1 Previewsufihossain7No ratings yet

- Form PDF 395323140241221Document8 pagesForm PDF 395323140241221sharathnaikNo ratings yet

- Rktarai DetailDocument9 pagesRktarai DetailDeepak SwainNo ratings yet

- Itr1 PreviewDocument8 pagesItr1 PreviewSanthosh DamaNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Vikas CheedellaNo ratings yet

- Itr1 PreviewDocument7 pagesItr1 PreviewPowerNo ratings yet

- Form PDF 164388980230523Document7 pagesForm PDF 164388980230523venkatramaiah_sudarsanNo ratings yet

- Form PDF 910494870311222Document9 pagesForm PDF 910494870311222Navin DongreNo ratings yet

- Form PDF 689751510220622Document6 pagesForm PDF 689751510220622Asif EbrahimNo ratings yet

- ComputationDocument10 pagesComputationRaghav SharmaNo ratings yet

- Form PDF 898493730311222Document7 pagesForm PDF 898493730311222RAMESH WAGHMARENo ratings yet

- Form PDF 432385000170822Document9 pagesForm PDF 432385000170822Khan kingNo ratings yet

- Form_pdf_343006470310722Document6 pagesForm_pdf_343006470310722Rammohanreddy RajidiNo ratings yet

- Form PDF 820116700251122Document6 pagesForm PDF 820116700251122Anonymous PzLXgCmNo ratings yet

- Form PDF 360019890310722Document9 pagesForm PDF 360019890310722Sumit SainiNo ratings yet

- Form3 2008 09Document9 pagesForm3 2008 09api-3850174No ratings yet

- Form PDF 344472690310722Document11 pagesForm PDF 344472690310722NandhakumarNo ratings yet

- Form PDF 340519100221221AVTPC0987CDocument8 pagesForm PDF 340519100221221AVTPC0987Csmadvocate049No ratings yet

- Form PDF 240143980290722Document7 pagesForm PDF 240143980290722RebornNo ratings yet

- Sugam: (Please See Instruction)Document10 pagesSugam: (Please See Instruction)SUBHASH CHANDRANo ratings yet

- Form PDF 713457630311221Document8 pagesForm PDF 713457630311221slowmotionmeeNo ratings yet

- Form3 2007 08Document9 pagesForm3 2007 08api-3850174No ratings yet

- Itr2022 23Document7 pagesItr2022 23Debabrata pahariNo ratings yet

- Itr1 PreviewDocument7 pagesItr1 PreviewRSC NabardNo ratings yet

- Form PDF 645857770010622Document9 pagesForm PDF 645857770010622GURU KRUPANo ratings yet

- Itr1 PreviewDocument7 pagesItr1 PreviewRg RrgNo ratings yet

- Form PDF 671841130150622Document6 pagesForm PDF 671841130150622RajeshKannaSundrapandianNo ratings yet

- Self Upgrade Data 2Document8 pagesSelf Upgrade Data 20gts7 GamerszNo ratings yet

- Form PDF 429324390030921Document9 pagesForm PDF 429324390030921Good NamNo ratings yet

- NCC Form PDFDocument7 pagesNCC Form PDFmudgalansh942544No ratings yet

- Form PDF 658202480080622Document6 pagesForm PDF 658202480080622Chandrasekhar NandigamNo ratings yet

- Form PDF 958500510240722Document6 pagesForm PDF 958500510240722Hks HksNo ratings yet

- Itr1 PreviewDocument7 pagesItr1 PreviewPriyanshuNo ratings yet

- Form PDF 231443680220524Document9 pagesForm PDF 231443680220524rohangundpatil096No ratings yet

- Asha Itr 4Document11 pagesAsha Itr 4Niraj JaiswalNo ratings yet

- Form PDF 614955380220723Document9 pagesForm PDF 614955380220723Chandra PrakashNo ratings yet

- Form PDF 345858330310722Document10 pagesForm PDF 345858330310722narasimhahanNo ratings yet

- Form PDF 492690920160723Document9 pagesForm PDF 4926909201607234th zenz starNo ratings yet

- Form PDF 465757040271221Document8 pagesForm PDF 465757040271221cfaprep040No ratings yet

- Itr4 PreviewDocument11 pagesItr4 PreviewSathishkumar RNo ratings yet

- Form PDF 230861000130623Document6 pagesForm PDF 230861000130623Sunil AccountsNo ratings yet

- Form PDF 383130140310722 PDFDocument9 pagesForm PDF 383130140310722 PDFsandeep kuamr ChoubeyNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Dipannita DasNo ratings yet

- Form PDF 165223390030424Document9 pagesForm PDF 165223390030424officialmosessahotaNo ratings yet

- Itr1 PreviewDocument7 pagesItr1 PreviewRg RrgNo ratings yet

- Indian Income Tax Return Assessment Year 2021 - 22: SugamDocument9 pagesIndian Income Tax Return Assessment Year 2021 - 22: SugamAvnish BhasinNo ratings yet

- Form_pdf_289607030300722Document7 pagesForm_pdf_289607030300722crawat433No ratings yet

- Form PDF 237268260290722Document9 pagesForm PDF 237268260290722cfaprep040No ratings yet

- Form PDF 172586610110424Document9 pagesForm PDF 172586610110424Niraj JaiswalNo ratings yet

- Form PDF 992301420310723Document10 pagesForm PDF 992301420310723tax advisorNo ratings yet

- Acoustic Characteristics of Noise Absorbing Barriers: Gleb Nazarov, Dmitry Nepryakhin, and Alexandr KomkinDocument9 pagesAcoustic Characteristics of Noise Absorbing Barriers: Gleb Nazarov, Dmitry Nepryakhin, and Alexandr KomkinAtharv MarneNo ratings yet

- SITESELECTIONCRITERIAFORNUCLEARPOWERPLANTSUSPVerma ISEG2008 FINALDocument17 pagesSITESELECTIONCRITERIAFORNUCLEARPOWERPLANTSUSPVerma ISEG2008 FINALAtharv MarneNo ratings yet

- Akustiikkapaivat 2019 s346Document10 pagesAkustiikkapaivat 2019 s346Atharv MarneNo ratings yet

- Final MED - All - Syllabus - 180s - With Co Po PDFDocument189 pagesFinal MED - All - Syllabus - 180s - With Co Po PDFAtharv MarneNo ratings yet

- Steam CondenserDocument16 pagesSteam CondenserAtharv MarneNo ratings yet

- Basics of Income Tax-2Document3 pagesBasics of Income Tax-2kiranmayeeNo ratings yet

- (I) (B) (Ii) (D) (Iii) (D) (Iv) (C) (V) (A) (Vi) (C) (Vii) (A) (Viii) (D) (Ix) (C) (X) (C)Document8 pages(I) (B) (Ii) (D) (Iii) (D) (Iv) (C) (V) (A) (Vi) (C) (Vii) (A) (Viii) (D) (Ix) (C) (X) (C)santosh palNo ratings yet

- MUMBAI - 400 001. MUMBAI 400 051. Scrip Code: 530005 Scrip Code: INDIACEMDocument228 pagesMUMBAI - 400 001. MUMBAI 400 051. Scrip Code: 530005 Scrip Code: INDIACEMNishaben DholuNo ratings yet

- Tax Planning & ManagementDocument7 pagesTax Planning & Managementoffer manNo ratings yet

- Bengal Tiger Line Pte Ltd. Vs DCIT ITAT ChennaiDocument40 pagesBengal Tiger Line Pte Ltd. Vs DCIT ITAT ChennaiArulnidhi Ramanathan SeshanNo ratings yet

- Audit Under FiscalDocument108 pagesAudit Under FiscalAjay PanwarNo ratings yet

- Income Tax BasicsDocument20 pagesIncome Tax BasicsShivajee SNo ratings yet

- Theory Questions For PracticeDocument2 pagesTheory Questions For Practice04 Sourabh BaraleNo ratings yet

- Notes On Taxation LawDocument93 pagesNotes On Taxation Lawram patilNo ratings yet

- ICICI Home Loan StatementDocument1 pageICICI Home Loan Statementgauravgupta982No ratings yet

- P-DEEDDocument7 pagesP-DEEDDilip AgrawalNo ratings yet

- Annexures CADocument21 pagesAnnexures CADeepankar SinghNo ratings yet

- Bos 58983Document20 pagesBos 58983NitzNo ratings yet

- CA Final DT Case Law Book by CA Saket GhiriaDocument78 pagesCA Final DT Case Law Book by CA Saket GhiriaNCD NAWADANo ratings yet

- Amendments in Finance Bill 2022Document20 pagesAmendments in Finance Bill 2022Prashant MunotNo ratings yet

- Test Paper - 3 CA FinalDocument3 pagesTest Paper - 3 CA FinalyeidaindschemeNo ratings yet

- Questions - Income Tax Divyastra CH 7 - PGBPDocument19 pagesQuestions - Income Tax Divyastra CH 7 - PGBPArjun ThawaniNo ratings yet

- Income From House PropertyDocument32 pagesIncome From House PropertyDrishtiNo ratings yet

- NEW DT Bullet (MCQ'S) by CA Saumil Manglani - CS Exec June 22 & Dec 22 ExamsDocument168 pagesNEW DT Bullet (MCQ'S) by CA Saumil Manglani - CS Exec June 22 & Dec 22 ExamsAkash MalikNo ratings yet

- SMT Harleen Kaur Bhatiavs Principal Commissionerof IncomDocument23 pagesSMT Harleen Kaur Bhatiavs Principal Commissionerof IncomKaran GannaNo ratings yet

- Ca Inter M24 Batch B AkDocument23 pagesCa Inter M24 Batch B Akpranaamsrivatsan46No ratings yet

- 74792bos60498 cp1Document104 pages74792bos60498 cp1Ankita DebtaNo ratings yet

- Payment of Bonus Act 1965Document9 pagesPayment of Bonus Act 1965Akhil NautiyalNo ratings yet

- BB SIR QUESTION BANK DT May 22Document216 pagesBB SIR QUESTION BANK DT May 22Srushti AgarwalNo ratings yet

- Ebook Byrd and Chens Canadian Tax Principles 2018 2019 1St Edition Byrd Test Bank Full Chapter PDFDocument68 pagesEbook Byrd and Chens Canadian Tax Principles 2018 2019 1St Edition Byrd Test Bank Full Chapter PDFShannonRussellapcx100% (16)

- Ebook PDF Canadian Income Taxation 2018 2019 by William Buckwold PDFDocument41 pagesEbook PDF Canadian Income Taxation 2018 2019 by William Buckwold PDFdaniel.blakenship846100% (51)

- InsuranceDocument54 pagesInsuranceL NNo ratings yet

- SalaryDocument80 pagesSalarykalyanikamineniNo ratings yet

- Medical Insurance Policy ParentsDocument1 pageMedical Insurance Policy Parentssivavm4No ratings yet

- Income Tax MCQ Question Bank May 2023 (130 Pages)Document130 pagesIncome Tax MCQ Question Bank May 2023 (130 Pages)PRITESH JAIN100% (3)