Professional Documents

Culture Documents

New Regime Vs Old Regime AY 2024-25 - CA Sai Pratap Kopparapu

New Regime Vs Old Regime AY 2024-25 - CA Sai Pratap Kopparapu

Uploaded by

viswa081Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Regime Vs Old Regime AY 2024-25 - CA Sai Pratap Kopparapu

New Regime Vs Old Regime AY 2024-25 - CA Sai Pratap Kopparapu

Uploaded by

viswa081Copyright:

Available Formats

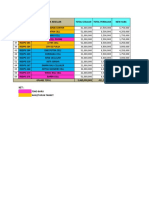

NEW TAX REGIME Vs OLD TAX REGIME

TOTAL INCOME CA SAI PRATAP KOPPARAPU Ph.No. 9000786310

Income

Tax Regime 7,00,000 7,50,000 8,00,000 9,00,000 10,00,000 11,00,000 12,00,000 13,50,000 15,00,000 17,00,000 20,00,000 25,00,000 30,00,000 40,00,000 50,00,000

(80C, 80D, HRA Etc., OTHER THAN INTEREST ON HOME LOAN)

Deductions

New Regime 0 31,200 36,400 46,800 62,400 78,000 93,600 1,24,800 1,56,000 2,18,400 3,12,000 4,68,000 6,24,000 9,36,000 12,48,000

0 Old Regime 54,600 65,000 75,400 96,200 1,17,000 1,48,200 1,79,400 2,26,200 2,73,000 3,35,400 4,29,000 5,85,000 7,41,000 10,53,000 13,65,000

New Regime 0 0 36,400 46,800 62,400 78,000 93,600 1,24,800 1,56,000 2,18,400 3,12,000 4,68,000 6,24,000 9,36,000 12,48,000

50,000 Old Regime 44,200 54,600 65,000 85,800 1,06,600 1,32,600 1,63,800 2,10,600 2,57,400 3,19,800 4,13,400 5,69,400 7,25,400 10,37,400 13,49,400

New Regime 0 0 36,400 46,800 62,400 78,000 93,600 1,24,800 1,56,000 2,18,400 3,12,000 4,68,000 6,24,000 9,36,000 12,48,000

1,00,000 Old Regime 33,800 44,200 54,600 75,400 96,200 1,17,000 1,48,200 1,95,000 2,41,800 3,04,200 3,97,800 5,53,800 7,09,800 10,21,800 13,33,800

New Regime 0 0 36,400 46,800 62,400 78,000 93,600 1,24,800 1,56,000 2,18,400 3,12,000 4,68,000 6,24,000 9,36,000 12,48,000

1,62,500 Old Regime 20,800 31,200 41,600 62,400 83,200 1,04,000 1,28,700 1,75,500 2,22,300 2,84,700 3,78,300 5,34,300 6,90,300 10,02,300 13,14,300

New Regime 0 0 36,400 46,800 62,400 78,000 93,600 1,24,800 1,56,000 2,18,400 3,12,000 4,68,000 6,24,000 9,36,000 12,48,000

1,87,500 Old Regime 15,600 26,000 36,400 57,200 78,000 98,800 1,20,900 1,67,700 2,14,500 2,76,900 3,70,500 5,26,500 6,82,500 9,94,500 13,06,500

New Regime 0 0 36,400 46,800 62,400 78,000 93,600 1,24,800 1,56,000 2,18,400 3,12,000 4,68,000 6,24,000 9,36,000 12,48,000

2,37,500 Old Regime 0 15,600 26,000 46,800 67,600 88,400 1,09,200 1,52,100 1,98,900 2,61,300 3,54,900 5,10,900 6,66,900 9,78,900 12,90,900

New Regime 0 0 36,400 46,800 62,400 78,000 93,600 1,24,800 1,56,000 2,18,400 3,12,000 4,68,000 6,24,000 9,36,000 12,48,000

2,62,500 Old Regime 0 0 20,800 41,600 62,400 83,200 1,04,000 1,44,300 1,91,100 2,53,500 3,47,100 5,03,100 6,59,100 9,71,100 12,83,100

New Regime 0 0 36,400 46,800 62,400 78,000 93,600 1,24,800 1,56,000 2,18,400 3,12,000 4,68,000 6,24,000 9,36,000 12,48,000

2,87,500 Old Regime 0 0 15,600 36,400 57,200 78,000 98,800 1,36,500 1,83,300 2,45,700 3,39,300 4,95,300 6,51,300 9,63,300 12,75,300

DEDUCTIONS & EXEMPTIONS

New Regime 0 0 36,400 46,800 62,400 78,000 93,600 1,24,800 1,56,000 2,18,400 3,12,000 4,68,000 6,24,000 9,36,000 12,48,000

3,12,500 Old Regime 0 0 0 31,200 52,000 72,800 93,600 1,28,700 1,75,500 2,37,900 3,31,500 4,87,500 6,43,500 9,55,500 12,67,500

New Regime 0 0 36,400 46,800 62,400 78,000 93,600 1,24,800 1,56,000 2,18,400 3,12,000 4,68,000 6,24,000 9,36,000 12,48,000

3,25,000 Old Regime 0 0 0 28,600 49,400 70,200 91,000 1,24,800 1,71,600 2,34,000 3,27,600 4,83,600 6,39,600 9,51,600 12,63,600

New Regime 0 0 36,400 46,800 62,400 78,000 93,600 1,24,800 1,56,000 2,18,400 3,12,000 4,68,000 6,24,000 9,36,000 12,48,000

3,75,000 Old Regime 0 0 0 18,200 39,000 59,800 80,600 1,11,800 1,56,000 2,18,400 3,12,000 4,68,000 6,24,000 9,36,000 12,48,000

New Regime 0 0 36,400 46,800 62,400 78,000 93,600 1,24,800 1,56,000 2,18,400 3,12,000 4,68,000 6,24,000 9,36,000 12,48,000

4,00,000 Old Regime 0 0 0 0 33,800 54,600 75,400 1,06,600 1,48,200 2,10,600 3,04,200 4,60,200 6,16,200 9,28,200 12,40,200

* In the Case of Employees above Total Income will be after deducting Standard Deduction of Rs.50,000 which is available in both New and Old Tax Regime,

* In the Case of Employees, always you will have an option to choose any regime before filing of your Income Tax Returns, if you file within due date.

* Above Tax Amount is including Cess @ 4%

* Person having deductions more than 3.75 Lakhs Old Regime is beneficial and for a person having income above 15 Lakhs New Regime is beneficial till 3.75 lakhs deductions.

You might also like

- Rohm and Haas HBR Case AnalysisDocument2 pagesRohm and Haas HBR Case AnalysisSourik Syed57% (7)

- Answers To Final Exam 2005 PDFDocument10 pagesAnswers To Final Exam 2005 PDFRohit PalNo ratings yet

- Lone Pine - 4Q09 V 1Q10Document2 pagesLone Pine - 4Q09 V 1Q10Glenn BuschNo ratings yet

- ProdutosDocument256 pagesProdutosEduardo LapaNo ratings yet

- SAP FICO TestingDocument3 pagesSAP FICO TestingNaveen Kumar100% (2)

- PPE Compliance ChecklistDocument5 pagesPPE Compliance ChecklistHari Utama100% (2)

- 7 CPC Pay MatrixDocument1 page7 CPC Pay Matrixramana adepuNo ratings yet

- Income Tax ComparisionDocument1 pageIncome Tax ComparisionHometex decorNo ratings yet

- Pemberian DobutaminDocument1 pagePemberian Dobutaminandi rahmat100% (1)

- Instituto de Higiene E Medicina TropicalDocument12 pagesInstituto de Higiene E Medicina TropicalRita FerreiraNo ratings yet

- Tugas 2 IndraDocument13 pagesTugas 2 IndraAwad Mahardika IshaqNo ratings yet

- Daihatsu Juli 2023Document1 pageDaihatsu Juli 2023Yogi SuprayogoNo ratings yet

- Pppaks 2Document2 pagesPppaks 2Muhammad ThirafiNo ratings yet

- Payroll WTX Less Benefits Activity 4Document34 pagesPayroll WTX Less Benefits Activity 4Ashley Jean CosmianoNo ratings yet

- Pre Selection Et BudgetDocument2 pagesPre Selection Et BudgetKomla Edem Dieudonné AdjonyoNo ratings yet

- Tugas 3 KalkulusDocument5 pagesTugas 3 Kalkulus116 SHALWA NORENDINA AZIZNo ratings yet

- Tabela Distribuicao NormalDocument2 pagesTabela Distribuicao Normalevando_showNo ratings yet

- Aliran Seragam: Percobaan KeDocument6 pagesAliran Seragam: Percobaan KePutri ChanNo ratings yet

- Universidad Autónoma Juan Misael Saracho Facultad de Ciencias Económicas Y Financieras Carrera de Administración de EmpresasDocument4 pagesUniversidad Autónoma Juan Misael Saracho Facultad de Ciencias Económicas Y Financieras Carrera de Administración de EmpresasAlvaro Quispe ToconasNo ratings yet

- Illustration of Benefits: Pioneer Life IncDocument2 pagesIllustration of Benefits: Pioneer Life IncRon CatalanNo ratings yet

- Act 3Document18 pagesAct 3Pagba, Bryan MaldonadoNo ratings yet

- ПР - 04 - Видобування деревини - 4Document8 pagesПР - 04 - Видобування деревини - 4Величко ИльяNo ratings yet

- Billing Rate: S1 Setara/bulan S2 Setara/bulanDocument4 pagesBilling Rate: S1 Setara/bulan S2 Setara/bulanArie SofanieNo ratings yet

- Vehicle Weight Table (RCW 46.44.041) : Under 6" Take The LowerDocument1 pageVehicle Weight Table (RCW 46.44.041) : Under 6" Take The LowererleosNo ratings yet

- Loan TableDocument2 pagesLoan TableaiselpesanosNo ratings yet

- NormalDocument1 pageNormalChangchang ChenNo ratings yet

- Paket Mitsubishi Xpander DP Murah: Angsuran Bayar I Angsuran Bayar I Type / Otr Sisa Addb Type / Otr Sisa AddbDocument1 pagePaket Mitsubishi Xpander DP Murah: Angsuran Bayar I Angsuran Bayar I Type / Otr Sisa Addb Type / Otr Sisa AddbWilly KrayandyaNo ratings yet

- Rpublish Paket Daihatsu Astra 5 September 2022Document4 pagesRpublish Paket Daihatsu Astra 5 September 2022Dimas AryaNo ratings yet

- Tabla de La Distribución Normal N (0,1)Document2 pagesTabla de La Distribución Normal N (0,1)markoNo ratings yet

- REPORT #GOLDHUNTDocument80 pagesREPORT #GOLDHUNTMuzlim Skuzu IcHigoNo ratings yet

- Pricelist Corral @malibu As of Feb, 3Rd 2020 DP 1X: Dalam Ribuan Rupiah (,000)Document14 pagesPricelist Corral @malibu As of Feb, 3Rd 2020 DP 1X: Dalam Ribuan Rupiah (,000)AlvianNo ratings yet

- Stock Barang 2010Document297 pagesStock Barang 2010afif alawiNo ratings yet

- Unlock 10 Week 2Document15 pagesUnlock 10 Week 2sidnan nabiNo ratings yet

- Tabela Gamma FunkcijeDocument2 pagesTabela Gamma FunkcijeProfil FaksNo ratings yet

- Payroll-2 2Document4 pagesPayroll-2 22301108731No ratings yet

- Flayer Paket Rejeki SMD Toyota Sept 2023Document3 pagesFlayer Paket Rejeki SMD Toyota Sept 2023edikusnadi5481No ratings yet

- Excel SheetDocument7 pagesExcel SheetahautNo ratings yet

- Lampiran: Tabel Fungsi Temperatur Dan KetinggianDocument8 pagesLampiran: Tabel Fungsi Temperatur Dan KetinggianUli ZahratiNo ratings yet

- Paket Daihatsu New NormalDocument4 pagesPaket Daihatsu New NormaldekyNo ratings yet

- Practica EconometriaDocument44 pagesPractica Econometriakenny.jdlsNo ratings yet

- Stok Barang Saprotan Bumdes Berkah Alam Desa CiguhaDocument3 pagesStok Barang Saprotan Bumdes Berkah Alam Desa Ciguhanusantara sukanagaraNo ratings yet

- MCOM21Document7 pagesMCOM21Abhishek SmartyNo ratings yet

- Alnum IterasiDocument9 pagesAlnum IterasiCindy SitorusNo ratings yet

- Ejercicios PrestamosDocument16 pagesEjercicios PrestamosIsabel Luna JesúsNo ratings yet

- DFSK HargaDocument1 pageDFSK HargaDimas AryaNo ratings yet

- HydrographDocument27 pagesHydrographFaisal RehmanNo ratings yet

- Wardah 04Document4 pagesWardah 04Faisal BasriNo ratings yet

- Rekapitulasi Bulanan Puskesmas Jatirokeh Feb-18Document4 pagesRekapitulasi Bulanan Puskesmas Jatirokeh Feb-18puskesmas jatirokehNo ratings yet

- Bagh Ring Road Project: Calculation of Soil SpringsDocument1 pageBagh Ring Road Project: Calculation of Soil Springsazam1uNo ratings yet

- Bagh Ring Road Project: Calculation of Soil SpringsDocument1 pageBagh Ring Road Project: Calculation of Soil Springsazam1uNo ratings yet

- New Microsoft Excel WorksheetDocument132 pagesNew Microsoft Excel WorksheetAkshay gargNo ratings yet

- Cadenas de Acero RedondoDocument145 pagesCadenas de Acero RedondoRandolph LoayzaNo ratings yet

- Tabla de Distribución Norma Ándar ST E LDocument3 pagesTabla de Distribución Norma Ándar ST E LSofía Simpértigue CubillosNo ratings yet

- Shrinivas Nadpurohit 29062023 2242Document6 pagesShrinivas Nadpurohit 29062023 2242Shrinivas NadpurohitNo ratings yet

- PPPDocument1 pagePPPMuhammad ThirafiNo ratings yet

- Tabela de BraresDocument1 pageTabela de BraresGETULIO VICENTE VIEIRA MENEZESNo ratings yet

- Tablas EstadisticasDocument15 pagesTablas Estadisticastamara pereiraNo ratings yet

- PRGR-633 Renewable Energy Systems & Energy Efficiency in BuildingsDocument4 pagesPRGR-633 Renewable Energy Systems & Energy Efficiency in BuildingsHoda MekkaouiNo ratings yet

- Paket Daihatsu Passanger Series Mei 2024 (Daicare Sigra)Document2 pagesPaket Daihatsu Passanger Series Mei 2024 (Daicare Sigra)smartjeh informaNo ratings yet

- Acomp Vendas SupDocument2 pagesAcomp Vendas Suprodrigo.pan.biancaNo ratings yet

- Paket Daihatsu April 2021Document1 pagePaket Daihatsu April 2021wahaNo ratings yet

- TablasDocument76 pagesTablasteoNo ratings yet

- Buku Daftar KeuntunganDocument9 pagesBuku Daftar Keuntunganserminandera73No ratings yet

- Group Assignment Question BBL3614Document3 pagesGroup Assignment Question BBL3614Mohd Shafik100% (1)

- PACC/ POSH ProspectusDocument516 pagesPACC/ POSH ProspectusEugene TayNo ratings yet

- Fundamental of Financial AccountingDocument26 pagesFundamental of Financial AccountingShirish JhaNo ratings yet

- GE MatrixDocument6 pagesGE MatrixManish JhaNo ratings yet

- Embedded EWM in SAP A Functional ComparisionDocument5 pagesEmbedded EWM in SAP A Functional ComparisionRajesh SinghNo ratings yet

- Week 1 Part 2 History of Marketing & Marketing Mix For BlackboardDocument21 pagesWeek 1 Part 2 History of Marketing & Marketing Mix For BlackboardIulia NicolaNo ratings yet

- Implementation Guidelines For Third Party Agencies Under The Apprentices Act, 1961Document4 pagesImplementation Guidelines For Third Party Agencies Under The Apprentices Act, 1961Mavin Sandeep GuptaNo ratings yet

- Grab - Uber Merger: Teacher: Ms. Cheng KeeDocument4 pagesGrab - Uber Merger: Teacher: Ms. Cheng KeePatrick AdiwangsaNo ratings yet

- Amarjeet Suryawanshi CVDocument3 pagesAmarjeet Suryawanshi CVumeshjmangroliyaNo ratings yet

- Magazine Letter 2017-18Document17 pagesMagazine Letter 2017-18Marie CurieNo ratings yet

- ACCT1511 Accounting and Financial Management 1B S12015Document16 pagesACCT1511 Accounting and Financial Management 1B S12015Bob CaterwallNo ratings yet

- List IBM Udaipur RegionDocument847 pagesList IBM Udaipur RegionindusexposiumNo ratings yet

- Claim 9101687 2020 01 18 PDFDocument4 pagesClaim 9101687 2020 01 18 PDFLinda ClarkeNo ratings yet

- Quality TrainingDocument111 pagesQuality TrainingDr. Wael El-Said83% (6)

- Stock Trading ChallengeDocument9 pagesStock Trading ChallengeMiguel MartinezNo ratings yet

- Sap Otc TablesDocument6 pagesSap Otc TablesPrab Gow0% (1)

- Lopez Realty, Inc. v. Florentina FontechaDocument4 pagesLopez Realty, Inc. v. Florentina FontechabearzhugNo ratings yet

- Economic Impacts of The Padma BridgeDocument2 pagesEconomic Impacts of The Padma Bridgezahirrayhan80% (10)

- Seven Procure Presentation IntroductionDocument28 pagesSeven Procure Presentation IntroductiondikshaNo ratings yet

- ASO EbookDocument76 pagesASO EbookEdmund Ciego100% (2)

- Supply Chain Performance of Sugar Industry Using Regression AnalysisDocument8 pagesSupply Chain Performance of Sugar Industry Using Regression AnalysisVittal SBNo ratings yet

- Micro Lesson 1Document26 pagesMicro Lesson 1Micaela Cariño50% (4)

- Industry 4.0Document26 pagesIndustry 4.0Zaenal Arifin100% (1)

- ITF VS. COMELEC G.R. No. 159139. January 13, 2004Document2 pagesITF VS. COMELEC G.R. No. 159139. January 13, 2004KaiiSophieNo ratings yet

- Kashato Shirts: Chart of AccountsDocument22 pagesKashato Shirts: Chart of AccountsAnjelica MarcoNo ratings yet

- Cooper Case StudyDocument16 pagesCooper Case StudyRahul RathoreNo ratings yet