Professional Documents

Culture Documents

R17 Acepa6021b 20-21

R17 Acepa6021b 20-21

Uploaded by

rajeshre2Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

R17 Acepa6021b 20-21

R17 Acepa6021b 20-21

Uploaded by

rajeshre2Copyright:

Available Formats

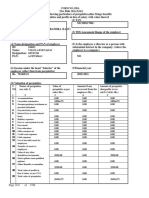

Emp ID : 5465

FORM NO.12BA

[See Rule 26A(2)(b)]

Statement showing particulars of perquisites, other fringe benefits or

amenities and profits in lieu of salary with value thereof

1. Name and address of the employer : Trivandrum

KL

2. TAN : TVDN00182A

3. TDS Assessment Range of the employer :

4. Name, designation and PAN of employee : A Ponnambalam

Assistant General Manager

ACEPA6021B

5. Is the employee a director or a person with substantial interest in the : N

company (where the employer is a company)

6. Income under the head "Salaries" of the employee : 31,79,372.00

(Other than from perquisites)

7. Financial Year : 2019 - 2020

8. Valuation of Perquisites :

S.No Nature of perquisite (see rule 3) Value of perquisite as Amount, if any recovered Amount of perquisite

per rules from employee chargeable to tax

(Rs.) (Rs.) Col (3) – Col (4)

(Rs.)

1 Accommodation 0.00 0.00 0.00

2 Cars/Other Automotive 1,32,233.00 0.00 1,32,233.00

3 Sweeper, Gardeners, Watchman Or Personal Attendant 57,000.00 0.00 57,000.00

4 Gas, Electricity, Water 0.00 0.00 0.00

5 Interest Free Or Concessional Loans 37,961.00 0.00 37,961.00

6 Holiday Expenses 0.00 0.00 0.00

7 Free Or Concessional Travel 0.00 0.00 0.00

8 Free Meals 0.00 0.00 0.00

9 Free Education 75,000.00 0.00 75,000.00

10 Gifts, Vouchers Etc. 0.00 0.00 0.00

11 Credit Card Expenses 0.00 0.00 0.00

12 Club Expenses 0.00 0.00 0.00

13 Use Of Movable Assets By Employees 0.00 0.00 0.00

14 Transfer Of Assets To Employees 2,40,000.00 0.00 240,000.00

15 Value Of Any Other Benefit/Amenity/Service/Privilege

0.00 0.00 0.00

(Employer Paid tax)

16 Stock Options (Non Qualified Options) 0.00 0.00 0.00

17 Other Benefits Or Amenities 1,07,683.00 0.00 1,07,683.00

18 Total Value Of Perquisites 6,49,877.00 0.00 6,49,877.00

19 Total Value Of Profits In Lieu Of Salary as per 17(3) 0.00 0.00 0.00

9. Details of Tax

a) Tax deducted from salary of the employee u/s 192(1) : 7,20,804.00

b) Tax paid by employer on behalf of the employee u/s 192(1A) : 12,986.00

c) Total tax paid : 7,33,790.00

d) Date of payment into Government treasury : As per Form 16

DECLARATION BY EMPLOYER

I, Rahul N Damani, son/daughter of Narendra Chunilal Damani working as Assistant General Manager do hereby declare on behalf of (name of the employer)

that the information given above is based on the books of account, documents and other relevant records or information available with us and the details of value

of each such perquisite are in accordance with section 17 and rules framed thereunder and that such information is true and correct.

Place Head Office - Mumbai Signature of the person responsible for deduction of tax

Date 15-06-2020 Full Name Rahul N Damani

Designation Assistant General Manager

Page 1 of 1

You might also like

- PW37196 34541005Document2 pagesPW37196 34541005rajan singhNo ratings yet

- DellDocument1 pageDellNaresh Kumar Yadav (nari)No ratings yet

- Bus and Coach Station Design GuideDocument35 pagesBus and Coach Station Design GuidemeshNo ratings yet

- F12ba 1005009 2016Document2 pagesF12ba 1005009 2016Nikhil121314No ratings yet

- 12BADocument1 page12BAmanas022No ratings yet

- Annexure To Form 16 - TCSDocument3 pagesAnnexure To Form 16 - TCSRupini RavichandranNo ratings yet

- Form No.12Ba: Savan Gurudas Anvekar Development Manager AAOPA9108A NODocument3 pagesForm No.12Ba: Savan Gurudas Anvekar Development Manager AAOPA9108A NOsavan anvekarNo ratings yet

- 2 (F) Amount of Any Other Exemption Under Section 10: Annexure To Form 16 Part BDocument3 pages2 (F) Amount of Any Other Exemption Under Section 10: Annexure To Form 16 Part BAnonymous IIj5AONo ratings yet

- Annexure To Form 16 Part B (2019)Document3 pagesAnnexure To Form 16 Part B (2019)Dharmendra ParmarNo ratings yet

- Place Mumbai: Annexure To Form 16 Part BDocument3 pagesPlace Mumbai: Annexure To Form 16 Part BVikram RaiNo ratings yet

- 2020 - Form16 - PART B AnnexureDocument3 pages2020 - Form16 - PART B AnnexureUtkarsh KadamNo ratings yet

- FY2022 23 Annexure To Form16Document3 pagesFY2022 23 Annexure To Form16Joydip MukhopadhyayNo ratings yet

- Annexure To Form 16 - TCS - 20202021Document3 pagesAnnexure To Form 16 - TCS - 20202021Kritansh BindalNo ratings yet

- Place Mumbai: Annexure To Form 16 Part BDocument3 pagesPlace Mumbai: Annexure To Form 16 Part BsivaNo ratings yet

- Bob Form12baDocument1 pageBob Form12baruchi561No ratings yet

- Ay2021-22 12baDocument2 pagesAy2021-22 12bazaffsanNo ratings yet

- Annexure To Form 16Document3 pagesAnnexure To Form 16mohitverma.840No ratings yet

- Akcpm0324m 12ba 2023-24Document2 pagesAkcpm0324m 12ba 2023-24Indra Nath MishraNo ratings yet

- Invetech Lighting PVT LTD Form 16Document5 pagesInvetech Lighting PVT LTD Form 16Saikiran SharonNo ratings yet

- Confidential PayslipDocument1 pageConfidential PayslipNiteesh KumarNo ratings yet

- Payslip TS11702.Document1 pagePayslip TS11702.Sandy MNo ratings yet

- Payslip Alight ConsultantsDocument1 pagePayslip Alight ConsultantsLalit JainNo ratings yet

- 2023-24 12baDocument3 pages2023-24 12baiammouliNo ratings yet

- LG PayslipDocument1 pageLG PayslipDipendra TOMARNo ratings yet

- Payslip Saksham Jain 03-2024Document1 pagePayslip Saksham Jain 03-2024sakshamjain4567No ratings yet

- Employee Details Payment & Working Days Details Location Details Nilu KumariDocument1 pageEmployee Details Payment & Working Days Details Location Details Nilu KumariRohit raagNo ratings yet

- Payslip Feb 2024Document1 pagePayslip Feb 2024lonely mudasirNo ratings yet

- Lalit Payslip LGDocument1 pageLalit Payslip LGLalit JainNo ratings yet

- Employee Details Payment & Working Days Details Location Details Nitu SinghDocument1 pageEmployee Details Payment & Working Days Details Location Details Nitu SinghRohit raagNo ratings yet

- Payslip Sep2023Document2 pagesPayslip Sep2023ALINo ratings yet

- Form No. 12ba: Declaration by EmployerDocument1 pageForm No. 12ba: Declaration by EmployerVaibhav Sharad DhandeNo ratings yet

- Employee Details Payment & Working Days Details Location Details Neha KumariDocument1 pageEmployee Details Payment & Working Days Details Location Details Neha KumariRohit raagNo ratings yet

- GLOBAL DILDAR Payslip KotakDocument1 pageGLOBAL DILDAR Payslip KotakAnkit GuptaNo ratings yet

- Shrine Lifesciences Private Limited: Earnings Deductions Amount AmountDocument1 pageShrine Lifesciences Private Limited: Earnings Deductions Amount Amountralesh694No ratings yet

- Punam Devi: Adhikar Micro Finance (P) LTDDocument1 pagePunam Devi: Adhikar Micro Finance (P) LTDPUNAM DEVINo ratings yet

- British American Tobacco Bangladesh: Internal Credit Risk Scoring SystemDocument4 pagesBritish American Tobacco Bangladesh: Internal Credit Risk Scoring SystemSadia HossainNo ratings yet

- PaySlips Format 6Document2 pagesPaySlips Format 6achievingsquad4lifeNo ratings yet

- Employee DataDocument2 pagesEmployee DataJitender singhNo ratings yet

- Mylan Laboratories Limited: Payslip For The Month of APRIL 2017Document1 pageMylan Laboratories Limited: Payslip For The Month of APRIL 2017vediyappanNo ratings yet

- Account Usage and Recharge Statement From 02-Dec-2021 To 08-Dec-2021Document2 pagesAccount Usage and Recharge Statement From 02-Dec-2021 To 08-Dec-2021Kartik Jain ASCO, NoidaNo ratings yet

- Account Usage and Recharge Statement From 01-Apr-2019 To 30-Apr-2019Document3 pagesAccount Usage and Recharge Statement From 01-Apr-2019 To 30-Apr-2019Yash MittalNo ratings yet

- Salary Slip - Dec - 2023Document1 pageSalary Slip - Dec - 2023lonely mudasirNo ratings yet

- 5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Document1 page5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Shreyash SahayNo ratings yet

- SRL Limited: Payslip For The Month of JANUARY 2019Document1 pageSRL Limited: Payslip For The Month of JANUARY 2019Giri PriyaNo ratings yet

- Retbhhafg 4 Saxsanxw 5 R 10215585111939843733012110549Document1 pageRetbhhafg 4 Saxsanxw 5 R 10215585111939843733012110549SHWETANo ratings yet

- My - Statement - 17 Oct, 2018 - 15 Nov, 2018 - 6302470395Document17 pagesMy - Statement - 17 Oct, 2018 - 15 Nov, 2018 - 6302470395bharath sambojuNo ratings yet

- No.1, Thiruvellore High Road, Puduchathram (Po), Thirumazhisai (Via), Chennai, Tamil Nadu, India Pin - 600124 PHONE: 044-39106210Document1 pageNo.1, Thiruvellore High Road, Puduchathram (Po), Thirumazhisai (Via), Chennai, Tamil Nadu, India Pin - 600124 PHONE: 044-39106210amitNo ratings yet

- Payslip Aug2021Document1 pagePayslip Aug2021Umesh BabuNo ratings yet

- Shriram - UpendraDocument2 pagesShriram - Upendravishv DeepakNo ratings yet

- I B Payslips 90975Document1 pageI B Payslips 90975Kushagra Pratap SinghNo ratings yet

- Payslip Nov 2023Document1 pagePayslip Nov 2023lonely mudasirNo ratings yet

- Account Usage and Recharge Statement From 16-May-2021 To 14-Jun-2021Document9 pagesAccount Usage and Recharge Statement From 16-May-2021 To 14-Jun-2021Lorrenzo Public SchoolNo ratings yet

- Inr014298 53291001Document2 pagesInr014298 53291001NARASIMHS MURTHYNo ratings yet

- Pay Slip May Indian Bhushan NathDocument1 pagePay Slip May Indian Bhushan Nathralesh694No ratings yet

- 22 GST Council MeetDocument2 pages22 GST Council Meetkumar45caNo ratings yet

- Andluru Naga Muneswar Reddy Payslip Aug 2022Document1 pageAndluru Naga Muneswar Reddy Payslip Aug 2022ykeerthisharanNo ratings yet

- Salary Slip MainDocument1 pageSalary Slip MainVineetBaliyan100% (1)

- Employee Pay SlipDocument1 pageEmployee Pay Slippriyankapriyanka90856No ratings yet

- Cartradeexchange Solutions Private LimitedDocument2 pagesCartradeexchange Solutions Private LimitedAJEET KUMARNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Tax Invoice: Order ID Order Date Invoice Date POSDocument1 pageTax Invoice: Order ID Order Date Invoice Date POSrajeshre2No ratings yet

- CRR-Analysis EcmDocument3 pagesCRR-Analysis Ecmrajeshre2No ratings yet

- Banking Ombudsman - RCBDocument4 pagesBanking Ombudsman - RCBrajeshre2No ratings yet

- PrintD 2 HDocument1 pagePrintD 2 Hrajeshre2No ratings yet

- MCS AcknowlegementDocument2 pagesMCS Acknowlegementrajeshre2No ratings yet

- N Gad999Document1 pageN Gad999rajeshre2No ratings yet

- Final Exam Review QuestionsDocument3 pagesFinal Exam Review QuestionsYanni PoonNo ratings yet

- Temporary Staffing Agencies and Services Via Accent StaffingDocument2 pagesTemporary Staffing Agencies and Services Via Accent StaffingAccent StaffingNo ratings yet

- Humanistic Theories of NsgorganizationsDocument15 pagesHumanistic Theories of NsgorganizationsYnaffit Alteza UntalNo ratings yet

- GSIS and Limited Portability Law CasesDocument38 pagesGSIS and Limited Portability Law CasesMarrie SantiagoNo ratings yet

- Human Resources Assistant Resume TemplateDocument2 pagesHuman Resources Assistant Resume TemplateDaniel WondimuNo ratings yet

- Poster On Over Tourism in Hilton HotelsDocument12 pagesPoster On Over Tourism in Hilton HotelsnaaaNo ratings yet

- CHAPTER II ThesisDocument10 pagesCHAPTER II ThesisChanyeol ParkNo ratings yet

- International Business and Emerging Economy Firms: Volume I: Universal Issues and The Chinese Perspective 1st Ed. 2020 Edition Marin A. MarinovDocument68 pagesInternational Business and Emerging Economy Firms: Volume I: Universal Issues and The Chinese Perspective 1st Ed. 2020 Edition Marin A. Marinovtimothy.parrott698100% (6)

- Addendum13 07 2018Document10 pagesAddendum13 07 2018Saad SuhailNo ratings yet

- Application To Purchase A House and Lot Package/Housing Unit Under The Government Employees Housing ProgramDocument2 pagesApplication To Purchase A House and Lot Package/Housing Unit Under The Government Employees Housing ProgramCrislyne ItaliaNo ratings yet

- Employee - Any Person Who Performs Services For An Employer in Which Either or Both MentalDocument3 pagesEmployee - Any Person Who Performs Services For An Employer in Which Either or Both MentalBerch MelendezNo ratings yet

- Sample Employee Appraisal ReportsDocument13 pagesSample Employee Appraisal Reportsztanga7@yahoo.comNo ratings yet

- PAL vs. Pascua Et Al., GR No. 143258, Aug. 15, 2003Document1 pagePAL vs. Pascua Et Al., GR No. 143258, Aug. 15, 2003Vincent Quiña PigaNo ratings yet

- Critical Review of Culture and Leadership of TescoDocument4 pagesCritical Review of Culture and Leadership of TescoAzfer Firoz100% (2)

- Library Opening HrsDocument2 pagesLibrary Opening HrsTonye EmeledohNo ratings yet

- Urban Decay and RenewalDocument3 pagesUrban Decay and RenewalSofiaNo ratings yet

- Introduction To Flexible Work Arrangement (FWA)Document26 pagesIntroduction To Flexible Work Arrangement (FWA)Fatin AfifaNo ratings yet

- School Supervisor: Job Description, Duties and Requirements: Essential InformationDocument2 pagesSchool Supervisor: Job Description, Duties and Requirements: Essential Informationyan thiNo ratings yet

- Baguio Central University Sto. Niño Jesus Medical Center: No. 28 Lower P. Burgos, Baguio City 2600Document19 pagesBaguio Central University Sto. Niño Jesus Medical Center: No. 28 Lower P. Burgos, Baguio City 2600Shehada Marcos BondadNo ratings yet

- Resume DMDocument5 pagesResume DMDeepa MoreNo ratings yet

- LABOR STANDARDS Case Digest Compiled 8 0 Probationary EmployeesDocument50 pagesLABOR STANDARDS Case Digest Compiled 8 0 Probationary EmployeesBrian DuelaNo ratings yet

- Pilipino Telepone Vs PILTEADocument7 pagesPilipino Telepone Vs PILTEAJohnday MartirezNo ratings yet

- BUSINESS PLAN GROUP 4 TAKOMILK FinalDocument47 pagesBUSINESS PLAN GROUP 4 TAKOMILK FinalShaira Mae BocaligNo ratings yet

- Unit 1 The Emerging Role of HRDocument13 pagesUnit 1 The Emerging Role of HRhalaomarNo ratings yet

- ALP Consulting - SAP StaffingDocument12 pagesALP Consulting - SAP StaffingAnindya SharmaNo ratings yet

- Kes Sek 20 Award 18276Document28 pagesKes Sek 20 Award 18276Salam Salam Solidarity (fauzi ibrahim)No ratings yet

- Effect of Stakeholder Power On The Employee Information Disclosure of Nigerian Listed Firms: A Panel StudyDocument16 pagesEffect of Stakeholder Power On The Employee Information Disclosure of Nigerian Listed Firms: A Panel StudyEditor IJTSRDNo ratings yet

- Siemens Gamesa General Hse Requirements For Contractors enDocument46 pagesSiemens Gamesa General Hse Requirements For Contractors enrichard nagassarNo ratings yet

- War On Worker's RightsDocument24 pagesWar On Worker's RightsJoshua J. IsraelNo ratings yet