Professional Documents

Culture Documents

Chapter 12 MindMap

Chapter 12 MindMap

Uploaded by

songs 2019 MalikCopyright:

Available Formats

You might also like

- Sample Answer To Complaint For Grave MisconductDocument12 pagesSample Answer To Complaint For Grave MisconductAbidz Bridge Rae Abad83% (6)

- Decentralized Finance (DeFi) for Beginners: DeFi and Blockchain, Borrow, Lend, Trade, Save & Invest in Peer to Peer Lending & FarmingFrom EverandDecentralized Finance (DeFi) for Beginners: DeFi and Blockchain, Borrow, Lend, Trade, Save & Invest in Peer to Peer Lending & FarmingRating: 5 out of 5 stars5/5 (1)

- The Fundamentals of CreditDocument20 pagesThe Fundamentals of CreditAlyssa Jane G. Alvarez100% (1)

- 56980bos46195mod3cp3 PDFDocument28 pages56980bos46195mod3cp3 PDFvishwa jothyNo ratings yet

- Arellano vs. CFI of SorsogonDocument8 pagesArellano vs. CFI of SorsogonMaestro LazaroNo ratings yet

- Chapter 16 MindMapDocument1 pageChapter 16 MindMapGhulam Mohyudin KharalNo ratings yet

- Test 11 SolDocument2 pagesTest 11 SolAli aliNo ratings yet

- World Bank FPS Singapore FAST Case StudyDocument30 pagesWorld Bank FPS Singapore FAST Case StudysumanNo ratings yet

- FINTECH in Myanmar PDFDocument4 pagesFINTECH in Myanmar PDFRiza Zausa CuarteroNo ratings yet

- Money Basics 2024 Jan 10Document26 pagesMoney Basics 2024 Jan 10josueburiloarteNo ratings yet

- Participant's Name: Designation: Id: Branch: Learning TemplateDocument2 pagesParticipant's Name: Designation: Id: Branch: Learning TemplateJubaida Alam JuthyNo ratings yet

- Cash and Securities MGTDocument56 pagesCash and Securities MGTkinggeorge352No ratings yet

- World Bank FPS Australia NPP Case StudyDocument45 pagesWorld Bank FPS Australia NPP Case StudyimshwetaNo ratings yet

- Means of Payment and Payment InstrumentsDocument18 pagesMeans of Payment and Payment Instrumentsrachida.elasri1979No ratings yet

- Money LaunderingDocument38 pagesMoney Launderingchinmayee khareNo ratings yet

- WEEK 8 - Treasury ManagementDocument5 pagesWEEK 8 - Treasury ManagementJerwin LomibaoNo ratings yet

- Financial Mangement Slides Lecture 1Document56 pagesFinancial Mangement Slides Lecture 1Aqash AliNo ratings yet

- Act 4 National Payment System 2021Document27 pagesAct 4 National Payment System 2021RavineshNo ratings yet

- Cashless Transaction Systems: A Study of Paradigm Shift in Indian Consumer BehaviourDocument31 pagesCashless Transaction Systems: A Study of Paradigm Shift in Indian Consumer BehaviourAman ChourasiyaNo ratings yet

- A Short Introduction To The World of CryptocurrenciesDocument15 pagesA Short Introduction To The World of Cryptocurrenciesvijay haridasNo ratings yet

- BANK FRAUD INVESTIGATION PPT FinalDocument20 pagesBANK FRAUD INVESTIGATION PPT FinalSaif ShaikhNo ratings yet

- Legal Notice No. 284 of 2020Document13 pagesLegal Notice No. 284 of 2020Sherry KalianNo ratings yet

- Accounting Ch-5 Cash & ReceivablesDocument97 pagesAccounting Ch-5 Cash & ReceivablesFeda EtefaNo ratings yet

- Ch5 Cash ControlDocument48 pagesCh5 Cash ControlRoba AbeyuNo ratings yet

- Money LaunderingDocument13 pagesMoney LaunderingTarunima TabassumNo ratings yet

- A Short Introduction To The World of Cryptocurrencies: Federal Reserve Bank of St. Louis Review January 2018Document17 pagesA Short Introduction To The World of Cryptocurrencies: Federal Reserve Bank of St. Louis Review January 2018noordin MukasaNo ratings yet

- MIM01 Basics - MIM - BEADocument21 pagesMIM01 Basics - MIM - BEAkuloskiNo ratings yet

- Crypto CurrencyDocument9 pagesCrypto CurrencyMD SAIFUL ISLAMNo ratings yet

- PAS 7 - Statement of Cash Flows: Operating Activities Investing Activities Financing ActivitiesDocument1 pagePAS 7 - Statement of Cash Flows: Operating Activities Investing Activities Financing ActivitiesDora the ExplorerNo ratings yet

- Swift - Bae - Report - Follow-The MoneyDocument28 pagesSwift - Bae - Report - Follow-The Moneysadsada12e12312No ratings yet

- AML and KYCDocument20 pagesAML and KYCphanidhar varanasiNo ratings yet

- E Money PDFDocument41 pagesE Money PDFCPMMNo ratings yet

- E Money PDFDocument41 pagesE Money PDFCPMMNo ratings yet

- Credit Risk and Security Documentation For Agri OfficersDocument192 pagesCredit Risk and Security Documentation For Agri OfficersAdnan Adil HussainNo ratings yet

- ENG Orientering Om Blockchain Som InfrastrukturDocument10 pagesENG Orientering Om Blockchain Som InfrastrukturViolin_ManNo ratings yet

- Financial Accounting, 4eDocument55 pagesFinancial Accounting, 4eEka Aliyah FauziNo ratings yet

- Chapter 7 ReviewDocument15 pagesChapter 7 ReviewMs ShoaibNo ratings yet

- Money Laundering: By-Chintan Gutka Himanshu Kapadia Harshael Sawant Olivia D'Mello Ritesh Sapre Ashwin SharmaDocument15 pagesMoney Laundering: By-Chintan Gutka Himanshu Kapadia Harshael Sawant Olivia D'Mello Ritesh Sapre Ashwin SharmaHarshael SawantNo ratings yet

- WhatsApp PayDocument10 pagesWhatsApp PaySardar Gurvinder singhNo ratings yet

- The Revenue Cycle:: Cash Receipts System FlowchartDocument4 pagesThe Revenue Cycle:: Cash Receipts System FlowchartShyrine EjemNo ratings yet

- Objective:-: To Know About Following ApplicationsDocument8 pagesObjective:-: To Know About Following ApplicationsNasser AlsowyanNo ratings yet

- Industry Perspectives On Best Practices 1689569356Document29 pagesIndustry Perspectives On Best Practices 1689569356Ramiro Humberto Nova JaimesNo ratings yet

- Advanced Anti-Money Laundering: Combatting Terrorism Financing & Fraud AwarenessDocument145 pagesAdvanced Anti-Money Laundering: Combatting Terrorism Financing & Fraud AwarenessnidhinambuNo ratings yet

- MAFS - Moduel-B - Payment SystemDocument31 pagesMAFS - Moduel-B - Payment SystemtopxifplNo ratings yet

- Anti Money Laundering AMLPolicyDocument9 pagesAnti Money Laundering AMLPolicyAkash GhodkeNo ratings yet

- Cashless Transaction Systems: A Study of Paradigm Shift in Indian Consumer BehaviourDocument31 pagesCashless Transaction Systems: A Study of Paradigm Shift in Indian Consumer BehaviourUDayNo ratings yet

- Banking Concepts: Sanjay Dhamija Sdhamija@mdi - Ac.inDocument158 pagesBanking Concepts: Sanjay Dhamija Sdhamija@mdi - Ac.inPuneet JainNo ratings yet

- ACAMS CAMS6 EN C Flashcards Printable v1.15Document51 pagesACAMS CAMS6 EN C Flashcards Printable v1.15abhishekrai11111990No ratings yet

- Prevention of Money Laundering Terrorism FinancingDocument51 pagesPrevention of Money Laundering Terrorism FinancingdiviananaslinNo ratings yet

- Pakistan RAAST Case StudyDocument42 pagesPakistan RAAST Case Studymedihil774No ratings yet

- Non-Cash Payment Transaction Processing in Indonesia 184 PDFDocument14 pagesNon-Cash Payment Transaction Processing in Indonesia 184 PDFSuci RulianyNo ratings yet

- Code of Banking Practice Hong KongDocument59 pagesCode of Banking Practice Hong KongAgustino BatistaNo ratings yet

- The Payment System and Instruments of PaymentDocument15 pagesThe Payment System and Instruments of PaymentMedina KNo ratings yet

- PhilPaSS PDFDocument31 pagesPhilPaSS PDFaguilar_chrisNo ratings yet

- Chapter 7 Internal Control Over Cash Trang STDocument35 pagesChapter 7 Internal Control Over Cash Trang STCFAB K62 Kiểm toánNo ratings yet

- Offline Marathon November 23Document8 pagesOffline Marathon November 23Alex FernandoNo ratings yet

- Chapter 7 Internal Control Over CashDocument39 pagesChapter 7 Internal Control Over Cashtrangalc123No ratings yet

- Lecture Notes Lectures 1 6 Financial Institutions and Markets 7th EditionDocument60 pagesLecture Notes Lectures 1 6 Financial Institutions and Markets 7th EditionLi NguyenNo ratings yet

- Peer-To-Peer Payments: Surveying A Rapidly Changing LandscapeDocument20 pagesPeer-To-Peer Payments: Surveying A Rapidly Changing Landscapesrx devNo ratings yet

- Cryptocurrency (Chandni Adwani)Document7 pagesCryptocurrency (Chandni Adwani)Ravin ArvinNo ratings yet

- Banking Terminologies PDFDocument4 pagesBanking Terminologies PDFAditya AnandNo ratings yet

- CH 5 Cash and ReceivblesDocument92 pagesCH 5 Cash and ReceivblesYohanna SisayNo ratings yet

- Test 3 SolDocument2 pagesTest 3 Solsongs 2019 MalikNo ratings yet

- Lecture 27 PDFDocument1 pageLecture 27 PDFsongs 2019 MalikNo ratings yet

- ICAP Study Text Chap-4 (Solutions)Document3 pagesICAP Study Text Chap-4 (Solutions)songs 2019 MalikNo ratings yet

- ICAP Study Text Chap-4 (Questions)Document3 pagesICAP Study Text Chap-4 (Questions)songs 2019 MalikNo ratings yet

- Chapter 09 MindMapDocument1 pageChapter 09 MindMapsongs 2019 MalikNo ratings yet

- Chapter 10 MindMap PDFDocument2 pagesChapter 10 MindMap PDFsongs 2019 MalikNo ratings yet

- Chapter 07 MindMap PDFDocument1 pageChapter 07 MindMap PDFsongs 2019 MalikNo ratings yet

- Chapter 02 MindMapDocument1 pageChapter 02 MindMapsongs 2019 MalikNo ratings yet

- Kapisanan NG Mga Kawani NG Energy Regulatory Board v. Commissioner Fe Barin, G.R. No. 150974, June 29, 2007Document1 pageKapisanan NG Mga Kawani NG Energy Regulatory Board v. Commissioner Fe Barin, G.R. No. 150974, June 29, 2007Ynah TantugNo ratings yet

- G.R. No. 179462Document5 pagesG.R. No. 179462Graile Dela CruzNo ratings yet

- Second Division (G.R. Nos. 233443-44, November 28, 2018)Document7 pagesSecond Division (G.R. Nos. 233443-44, November 28, 2018)Linalyn LeeNo ratings yet

- Toaz - Info TC 71 RPDF PRDocument30 pagesToaz - Info TC 71 RPDF PRAmogh Taskar100% (1)

- Terry Frisking: The Law, Field Examples and AnalysisDocument6 pagesTerry Frisking: The Law, Field Examples and AnalysisAWhNo ratings yet

- Local Rules For The Superior Court County of El Dorado: Effective July 1, 2021Document173 pagesLocal Rules For The Superior Court County of El Dorado: Effective July 1, 2021Leo ReyesNo ratings yet

- Samson Vs RestriveraDocument2 pagesSamson Vs RestriveraElyn ApiadoNo ratings yet

- Executive Summary - Belgium: Economic Context and Drivers of Better RegulationDocument29 pagesExecutive Summary - Belgium: Economic Context and Drivers of Better RegulationBoban MilacicNo ratings yet

- Recent Amendments in ConstitutionDocument8 pagesRecent Amendments in ConstitutionNikita MauryaNo ratings yet

- 2013 06 PDFDocument395 pages2013 06 PDFBernard Masipha0% (1)

- Ayp3-39-10 Police Operations August 2021Document286 pagesAyp3-39-10 Police Operations August 2021gnarlmasterNo ratings yet

- 12 Angry Men - Extended QuotesDocument11 pages12 Angry Men - Extended Quotesapi-355906173No ratings yet

- Ls 104 Criminal Procedure and Practice: Teaching NotesDocument14 pagesLs 104 Criminal Procedure and Practice: Teaching NotesKashindye LucasNo ratings yet

- Use of Force Policy 06Document3 pagesUse of Force Policy 06citizeninv1No ratings yet

- Position, Appointment & Powers of Directors Under Companies Act, 2013 - Taxguru - inDocument6 pagesPosition, Appointment & Powers of Directors Under Companies Act, 2013 - Taxguru - inamrit singhNo ratings yet

- MODULE FinalsDocument20 pagesMODULE FinalsCalixtro Sunshine OreniaNo ratings yet

- Grace Poe Vs ComelecDocument35 pagesGrace Poe Vs ComelecPrincess MenisisNo ratings yet

- GR No 170141 Japan Airlines V SimanganDocument18 pagesGR No 170141 Japan Airlines V SimanganruelNo ratings yet

- Module 5 in Crim Law.2nd SemDocument45 pagesModule 5 in Crim Law.2nd SemNicoleNo ratings yet

- Hickman V Kent or Romney Marsh Sheepbreeders' Association (1915)Document4 pagesHickman V Kent or Romney Marsh Sheepbreeders' Association (1915)Bharath SimhaReddyNaiduNo ratings yet

- Chapter S95 Interstate Compact On The Placement of ChildrenDocument13 pagesChapter S95 Interstate Compact On The Placement of ChildrenTheplaymaker508No ratings yet

- Demurrer Civil CaseDocument10 pagesDemurrer Civil CaseMICHAEL SALINASNo ratings yet

- Assignment 2 TAXES, TAX LAWS AND TAX ADMIN ANSWER KEYDocument2 pagesAssignment 2 TAXES, TAX LAWS AND TAX ADMIN ANSWER KEYRonna Mae DungogNo ratings yet

- Crimpro DigestDocument6 pagesCrimpro DigestZeke GarciaNo ratings yet

- Republic of The PhilippinesDocument4 pagesRepublic of The PhilippinesCarl CatacutanNo ratings yet

- Atty. Enrique Dela Cruz "Buko" Notes Important Areas in SuccessionDocument11 pagesAtty. Enrique Dela Cruz "Buko" Notes Important Areas in Successionrobertoii_suarezNo ratings yet

- Elizondo CaseDocument2 pagesElizondo CaseFrank A. Cusumano, Jr.No ratings yet

- Cleveland City Council Passes Ordinance For Body Camera and Dash Camera ReleaseDocument4 pagesCleveland City Council Passes Ordinance For Body Camera and Dash Camera ReleaseWKYC.comNo ratings yet

Chapter 12 MindMap

Chapter 12 MindMap

Uploaded by

songs 2019 MalikOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 12 MindMap

Chapter 12 MindMap

Uploaded by

songs 2019 MalikCopyright:

Available Formats

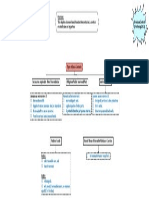

Overview:

CAF 04: Business Laws This chapter discusses :

Chapter 12: Anti-Money Laundering & Electronic Payments Money Laundering: Offence and Punishment Premium Content

Secret Sheet for Quick Revision Designated Payment System (DPS): Arrangements and Revocation (For Spring 2022)

(For students of Muhammad Asif, FCA) Definition of Electronic Money and Electronic Fund Transfer.

Part 1: Anti-Money Laundering

LO 1: Introduction LO 2: Offence and Evidence LO 3: Punishment

Financial Institutions: Role of Financial Institutions: When is a person guilty of offence of money laundering: Evidence of offence of money laundering: For Individuals: (i.e. natural person) For Legal Persons: (i.e. company)

Persons doing activities of: To monitor customers’ transactions If he knows that a property is proceeds of crime and still: Knowledge inferred from factual circumstances. Imprisonment 1 to 10 Years Fine upto Rs. 100 million.

1. Deposits, and Lending. To report large transactions. 1. Acquire, converts, possess, use or transfer such property. Fine upto Rs. 25 million. Individual liability for director,

2. Leasing. 2. Conceals the true nature, origin, location, ownership, movement of such property. Forfeiture of property officer or employees involved.

3. Insurance. 3. Holds or possess such property on behalf of any other person.

4. Money Transfers. 4. Aids, or counsels to commit above acts.

5. Managing means of payments.

6. Business trading in Forex, Mutual

funds, Money market instruments etc.

Part 2: Electronic Payments

LO 4: Designated Payment System (DPS) LO 5: Electronic Fund Transfer (EFT)

Payment System: Electronic Fund Transfer:

System used to settle financial transactions through transfer of money. Transfer of funds, other than by paper instrument (without direct

intervention of bank staff).

Designation of Payment System:

State Bank designates, after inspection of premises, equipment etc. “Electronic Fund” or “Electronic Money”:

Financial Institution, who is authorized to operate a DPS is called “Operator”. Money transferred through electronic device.

Money stored in an electronic device or payment instrument.

Operational Arrangements:

Operate shall make:

1. Criteria.

2. Rights and liabilities of Operator and Participant.

3. Measures to ensure operational reliability and contingency arrangements.

4. Procedures for management of credit, liquidity and settlement risk.

Revocation of Designated Payment System (DPS):

State Bank may revoke if:

1. DPS ceases to operate effectively.

2. Operator submitted false information to SBP.

3. Operator is in winding up.

4. violation of T&C.

5. It is in public interest.

Designation can be suspended (without notice), or revoked (with notice).

You might also like

- Sample Answer To Complaint For Grave MisconductDocument12 pagesSample Answer To Complaint For Grave MisconductAbidz Bridge Rae Abad83% (6)

- Decentralized Finance (DeFi) for Beginners: DeFi and Blockchain, Borrow, Lend, Trade, Save & Invest in Peer to Peer Lending & FarmingFrom EverandDecentralized Finance (DeFi) for Beginners: DeFi and Blockchain, Borrow, Lend, Trade, Save & Invest in Peer to Peer Lending & FarmingRating: 5 out of 5 stars5/5 (1)

- The Fundamentals of CreditDocument20 pagesThe Fundamentals of CreditAlyssa Jane G. Alvarez100% (1)

- 56980bos46195mod3cp3 PDFDocument28 pages56980bos46195mod3cp3 PDFvishwa jothyNo ratings yet

- Arellano vs. CFI of SorsogonDocument8 pagesArellano vs. CFI of SorsogonMaestro LazaroNo ratings yet

- Chapter 16 MindMapDocument1 pageChapter 16 MindMapGhulam Mohyudin KharalNo ratings yet

- Test 11 SolDocument2 pagesTest 11 SolAli aliNo ratings yet

- World Bank FPS Singapore FAST Case StudyDocument30 pagesWorld Bank FPS Singapore FAST Case StudysumanNo ratings yet

- FINTECH in Myanmar PDFDocument4 pagesFINTECH in Myanmar PDFRiza Zausa CuarteroNo ratings yet

- Money Basics 2024 Jan 10Document26 pagesMoney Basics 2024 Jan 10josueburiloarteNo ratings yet

- Participant's Name: Designation: Id: Branch: Learning TemplateDocument2 pagesParticipant's Name: Designation: Id: Branch: Learning TemplateJubaida Alam JuthyNo ratings yet

- Cash and Securities MGTDocument56 pagesCash and Securities MGTkinggeorge352No ratings yet

- World Bank FPS Australia NPP Case StudyDocument45 pagesWorld Bank FPS Australia NPP Case StudyimshwetaNo ratings yet

- Means of Payment and Payment InstrumentsDocument18 pagesMeans of Payment and Payment Instrumentsrachida.elasri1979No ratings yet

- Money LaunderingDocument38 pagesMoney Launderingchinmayee khareNo ratings yet

- WEEK 8 - Treasury ManagementDocument5 pagesWEEK 8 - Treasury ManagementJerwin LomibaoNo ratings yet

- Financial Mangement Slides Lecture 1Document56 pagesFinancial Mangement Slides Lecture 1Aqash AliNo ratings yet

- Act 4 National Payment System 2021Document27 pagesAct 4 National Payment System 2021RavineshNo ratings yet

- Cashless Transaction Systems: A Study of Paradigm Shift in Indian Consumer BehaviourDocument31 pagesCashless Transaction Systems: A Study of Paradigm Shift in Indian Consumer BehaviourAman ChourasiyaNo ratings yet

- A Short Introduction To The World of CryptocurrenciesDocument15 pagesA Short Introduction To The World of Cryptocurrenciesvijay haridasNo ratings yet

- BANK FRAUD INVESTIGATION PPT FinalDocument20 pagesBANK FRAUD INVESTIGATION PPT FinalSaif ShaikhNo ratings yet

- Legal Notice No. 284 of 2020Document13 pagesLegal Notice No. 284 of 2020Sherry KalianNo ratings yet

- Accounting Ch-5 Cash & ReceivablesDocument97 pagesAccounting Ch-5 Cash & ReceivablesFeda EtefaNo ratings yet

- Ch5 Cash ControlDocument48 pagesCh5 Cash ControlRoba AbeyuNo ratings yet

- Money LaunderingDocument13 pagesMoney LaunderingTarunima TabassumNo ratings yet

- A Short Introduction To The World of Cryptocurrencies: Federal Reserve Bank of St. Louis Review January 2018Document17 pagesA Short Introduction To The World of Cryptocurrencies: Federal Reserve Bank of St. Louis Review January 2018noordin MukasaNo ratings yet

- MIM01 Basics - MIM - BEADocument21 pagesMIM01 Basics - MIM - BEAkuloskiNo ratings yet

- Crypto CurrencyDocument9 pagesCrypto CurrencyMD SAIFUL ISLAMNo ratings yet

- PAS 7 - Statement of Cash Flows: Operating Activities Investing Activities Financing ActivitiesDocument1 pagePAS 7 - Statement of Cash Flows: Operating Activities Investing Activities Financing ActivitiesDora the ExplorerNo ratings yet

- Swift - Bae - Report - Follow-The MoneyDocument28 pagesSwift - Bae - Report - Follow-The Moneysadsada12e12312No ratings yet

- AML and KYCDocument20 pagesAML and KYCphanidhar varanasiNo ratings yet

- E Money PDFDocument41 pagesE Money PDFCPMMNo ratings yet

- E Money PDFDocument41 pagesE Money PDFCPMMNo ratings yet

- Credit Risk and Security Documentation For Agri OfficersDocument192 pagesCredit Risk and Security Documentation For Agri OfficersAdnan Adil HussainNo ratings yet

- ENG Orientering Om Blockchain Som InfrastrukturDocument10 pagesENG Orientering Om Blockchain Som InfrastrukturViolin_ManNo ratings yet

- Financial Accounting, 4eDocument55 pagesFinancial Accounting, 4eEka Aliyah FauziNo ratings yet

- Chapter 7 ReviewDocument15 pagesChapter 7 ReviewMs ShoaibNo ratings yet

- Money Laundering: By-Chintan Gutka Himanshu Kapadia Harshael Sawant Olivia D'Mello Ritesh Sapre Ashwin SharmaDocument15 pagesMoney Laundering: By-Chintan Gutka Himanshu Kapadia Harshael Sawant Olivia D'Mello Ritesh Sapre Ashwin SharmaHarshael SawantNo ratings yet

- WhatsApp PayDocument10 pagesWhatsApp PaySardar Gurvinder singhNo ratings yet

- The Revenue Cycle:: Cash Receipts System FlowchartDocument4 pagesThe Revenue Cycle:: Cash Receipts System FlowchartShyrine EjemNo ratings yet

- Objective:-: To Know About Following ApplicationsDocument8 pagesObjective:-: To Know About Following ApplicationsNasser AlsowyanNo ratings yet

- Industry Perspectives On Best Practices 1689569356Document29 pagesIndustry Perspectives On Best Practices 1689569356Ramiro Humberto Nova JaimesNo ratings yet

- Advanced Anti-Money Laundering: Combatting Terrorism Financing & Fraud AwarenessDocument145 pagesAdvanced Anti-Money Laundering: Combatting Terrorism Financing & Fraud AwarenessnidhinambuNo ratings yet

- MAFS - Moduel-B - Payment SystemDocument31 pagesMAFS - Moduel-B - Payment SystemtopxifplNo ratings yet

- Anti Money Laundering AMLPolicyDocument9 pagesAnti Money Laundering AMLPolicyAkash GhodkeNo ratings yet

- Cashless Transaction Systems: A Study of Paradigm Shift in Indian Consumer BehaviourDocument31 pagesCashless Transaction Systems: A Study of Paradigm Shift in Indian Consumer BehaviourUDayNo ratings yet

- Banking Concepts: Sanjay Dhamija Sdhamija@mdi - Ac.inDocument158 pagesBanking Concepts: Sanjay Dhamija Sdhamija@mdi - Ac.inPuneet JainNo ratings yet

- ACAMS CAMS6 EN C Flashcards Printable v1.15Document51 pagesACAMS CAMS6 EN C Flashcards Printable v1.15abhishekrai11111990No ratings yet

- Prevention of Money Laundering Terrorism FinancingDocument51 pagesPrevention of Money Laundering Terrorism FinancingdiviananaslinNo ratings yet

- Pakistan RAAST Case StudyDocument42 pagesPakistan RAAST Case Studymedihil774No ratings yet

- Non-Cash Payment Transaction Processing in Indonesia 184 PDFDocument14 pagesNon-Cash Payment Transaction Processing in Indonesia 184 PDFSuci RulianyNo ratings yet

- Code of Banking Practice Hong KongDocument59 pagesCode of Banking Practice Hong KongAgustino BatistaNo ratings yet

- The Payment System and Instruments of PaymentDocument15 pagesThe Payment System and Instruments of PaymentMedina KNo ratings yet

- PhilPaSS PDFDocument31 pagesPhilPaSS PDFaguilar_chrisNo ratings yet

- Chapter 7 Internal Control Over Cash Trang STDocument35 pagesChapter 7 Internal Control Over Cash Trang STCFAB K62 Kiểm toánNo ratings yet

- Offline Marathon November 23Document8 pagesOffline Marathon November 23Alex FernandoNo ratings yet

- Chapter 7 Internal Control Over CashDocument39 pagesChapter 7 Internal Control Over Cashtrangalc123No ratings yet

- Lecture Notes Lectures 1 6 Financial Institutions and Markets 7th EditionDocument60 pagesLecture Notes Lectures 1 6 Financial Institutions and Markets 7th EditionLi NguyenNo ratings yet

- Peer-To-Peer Payments: Surveying A Rapidly Changing LandscapeDocument20 pagesPeer-To-Peer Payments: Surveying A Rapidly Changing Landscapesrx devNo ratings yet

- Cryptocurrency (Chandni Adwani)Document7 pagesCryptocurrency (Chandni Adwani)Ravin ArvinNo ratings yet

- Banking Terminologies PDFDocument4 pagesBanking Terminologies PDFAditya AnandNo ratings yet

- CH 5 Cash and ReceivblesDocument92 pagesCH 5 Cash and ReceivblesYohanna SisayNo ratings yet

- Test 3 SolDocument2 pagesTest 3 Solsongs 2019 MalikNo ratings yet

- Lecture 27 PDFDocument1 pageLecture 27 PDFsongs 2019 MalikNo ratings yet

- ICAP Study Text Chap-4 (Solutions)Document3 pagesICAP Study Text Chap-4 (Solutions)songs 2019 MalikNo ratings yet

- ICAP Study Text Chap-4 (Questions)Document3 pagesICAP Study Text Chap-4 (Questions)songs 2019 MalikNo ratings yet

- Chapter 09 MindMapDocument1 pageChapter 09 MindMapsongs 2019 MalikNo ratings yet

- Chapter 10 MindMap PDFDocument2 pagesChapter 10 MindMap PDFsongs 2019 MalikNo ratings yet

- Chapter 07 MindMap PDFDocument1 pageChapter 07 MindMap PDFsongs 2019 MalikNo ratings yet

- Chapter 02 MindMapDocument1 pageChapter 02 MindMapsongs 2019 MalikNo ratings yet

- Kapisanan NG Mga Kawani NG Energy Regulatory Board v. Commissioner Fe Barin, G.R. No. 150974, June 29, 2007Document1 pageKapisanan NG Mga Kawani NG Energy Regulatory Board v. Commissioner Fe Barin, G.R. No. 150974, June 29, 2007Ynah TantugNo ratings yet

- G.R. No. 179462Document5 pagesG.R. No. 179462Graile Dela CruzNo ratings yet

- Second Division (G.R. Nos. 233443-44, November 28, 2018)Document7 pagesSecond Division (G.R. Nos. 233443-44, November 28, 2018)Linalyn LeeNo ratings yet

- Toaz - Info TC 71 RPDF PRDocument30 pagesToaz - Info TC 71 RPDF PRAmogh Taskar100% (1)

- Terry Frisking: The Law, Field Examples and AnalysisDocument6 pagesTerry Frisking: The Law, Field Examples and AnalysisAWhNo ratings yet

- Local Rules For The Superior Court County of El Dorado: Effective July 1, 2021Document173 pagesLocal Rules For The Superior Court County of El Dorado: Effective July 1, 2021Leo ReyesNo ratings yet

- Samson Vs RestriveraDocument2 pagesSamson Vs RestriveraElyn ApiadoNo ratings yet

- Executive Summary - Belgium: Economic Context and Drivers of Better RegulationDocument29 pagesExecutive Summary - Belgium: Economic Context and Drivers of Better RegulationBoban MilacicNo ratings yet

- Recent Amendments in ConstitutionDocument8 pagesRecent Amendments in ConstitutionNikita MauryaNo ratings yet

- 2013 06 PDFDocument395 pages2013 06 PDFBernard Masipha0% (1)

- Ayp3-39-10 Police Operations August 2021Document286 pagesAyp3-39-10 Police Operations August 2021gnarlmasterNo ratings yet

- 12 Angry Men - Extended QuotesDocument11 pages12 Angry Men - Extended Quotesapi-355906173No ratings yet

- Ls 104 Criminal Procedure and Practice: Teaching NotesDocument14 pagesLs 104 Criminal Procedure and Practice: Teaching NotesKashindye LucasNo ratings yet

- Use of Force Policy 06Document3 pagesUse of Force Policy 06citizeninv1No ratings yet

- Position, Appointment & Powers of Directors Under Companies Act, 2013 - Taxguru - inDocument6 pagesPosition, Appointment & Powers of Directors Under Companies Act, 2013 - Taxguru - inamrit singhNo ratings yet

- MODULE FinalsDocument20 pagesMODULE FinalsCalixtro Sunshine OreniaNo ratings yet

- Grace Poe Vs ComelecDocument35 pagesGrace Poe Vs ComelecPrincess MenisisNo ratings yet

- GR No 170141 Japan Airlines V SimanganDocument18 pagesGR No 170141 Japan Airlines V SimanganruelNo ratings yet

- Module 5 in Crim Law.2nd SemDocument45 pagesModule 5 in Crim Law.2nd SemNicoleNo ratings yet

- Hickman V Kent or Romney Marsh Sheepbreeders' Association (1915)Document4 pagesHickman V Kent or Romney Marsh Sheepbreeders' Association (1915)Bharath SimhaReddyNaiduNo ratings yet

- Chapter S95 Interstate Compact On The Placement of ChildrenDocument13 pagesChapter S95 Interstate Compact On The Placement of ChildrenTheplaymaker508No ratings yet

- Demurrer Civil CaseDocument10 pagesDemurrer Civil CaseMICHAEL SALINASNo ratings yet

- Assignment 2 TAXES, TAX LAWS AND TAX ADMIN ANSWER KEYDocument2 pagesAssignment 2 TAXES, TAX LAWS AND TAX ADMIN ANSWER KEYRonna Mae DungogNo ratings yet

- Crimpro DigestDocument6 pagesCrimpro DigestZeke GarciaNo ratings yet

- Republic of The PhilippinesDocument4 pagesRepublic of The PhilippinesCarl CatacutanNo ratings yet

- Atty. Enrique Dela Cruz "Buko" Notes Important Areas in SuccessionDocument11 pagesAtty. Enrique Dela Cruz "Buko" Notes Important Areas in Successionrobertoii_suarezNo ratings yet

- Elizondo CaseDocument2 pagesElizondo CaseFrank A. Cusumano, Jr.No ratings yet

- Cleveland City Council Passes Ordinance For Body Camera and Dash Camera ReleaseDocument4 pagesCleveland City Council Passes Ordinance For Body Camera and Dash Camera ReleaseWKYC.comNo ratings yet