Professional Documents

Culture Documents

Morefields - Cost Break Up - Plot 170

Morefields - Cost Break Up - Plot 170

Uploaded by

ObnoCopyright:

Available Formats

You might also like

- Audio Information and MediaDocument2 pagesAudio Information and Mediajosefalarka75% (4)

- B.6.23 - STD SPECS - For Plum Concrete & Plum MasonaryDocument3 pagesB.6.23 - STD SPECS - For Plum Concrete & Plum MasonaryBijay Krishna Das100% (3)

- 15 - 85 Emi Holiday Plan PDFDocument2 pages15 - 85 Emi Holiday Plan PDFJasvinder SolankiNo ratings yet

- Cost Sheet For 113 - 02.2022Document2 pagesCost Sheet For 113 - 02.2022anoop.bigassetsinfraNo ratings yet

- Aeropark Price Chart - 14.03.2024Document1 pageAeropark Price Chart - 14.03.2024It's your ChannelNo ratings yet

- West Mogappair, Chennai RERA Registration No:TN.29/Building/0012/2020Document1 pageWest Mogappair, Chennai RERA Registration No:TN.29/Building/0012/2020BakiarajNo ratings yet

- PriceList - Shriram Liberty Square - 99acresDocument3 pagesPriceList - Shriram Liberty Square - 99acresKayjay2050No ratings yet

- 11WS3F - 5800Document1 page11WS3F - 5800Sunil KumarNo ratings yet

- Pilerne Reserve Villa 9 Cost SheetDocument1 pagePilerne Reserve Villa 9 Cost SheetOnshi AhujaNo ratings yet

- Bhairaav Milestone Price Sheet: Grand Total (A + B + C) 11,764,715Document1 pageBhairaav Milestone Price Sheet: Grand Total (A + B + C) 11,764,715Krishnan NadarNo ratings yet

- 4th Floor 15032 - Cost SheetDocument1 page4th Floor 15032 - Cost SheetKrishnan NadarNo ratings yet

- Pre-Possession Payment Demand NoticeDocument1 pagePre-Possession Payment Demand NoticeSunny SharmaNo ratings yet

- A Unit InformationDocument2 pagesA Unit InformationSampath RNo ratings yet

- Cost Sheet Miracle MileDocument1 pageCost Sheet Miracle Milesushil aroraNo ratings yet

- Draft: Veridian at Emerald Isle 11B 1502 549.82Document1 pageDraft: Veridian at Emerald Isle 11B 1502 549.82sachinNo ratings yet

- Master Price Sheet For Sarayu 2024 01 29 V1.6Document4 pagesMaster Price Sheet For Sarayu 2024 01 29 V1.6ankit kumarNo ratings yet

- MM - Cost SheetDocument1 pageMM - Cost SheetProperty SpecialistNo ratings yet

- 4 5893475375345830339Document5 pages4 5893475375345830339tofikkemalNo ratings yet

- 11ws3f 5800Document1 page11ws3f 5800Sunil KumarNo ratings yet

- Sarayu Villa Price Sheet-Sales TeamDocument1 pageSarayu Villa Price Sheet-Sales Teamankit kumarNo ratings yet

- 3 BR CostingDocument2 pages3 BR CostingDhruv SainiNo ratings yet

- Cost Sheet For 2 BHKDocument1 pageCost Sheet For 2 BHKBharat SharmaNo ratings yet

- C8a 103Document1 pageC8a 103Om Ezhilan UthirapathiNo ratings yet

- T30 0004 Cost Break UpDocument1 pageT30 0004 Cost Break UpR SampathNo ratings yet

- T0105B PDFDocument1 pageT0105B PDFDinesh MetkariNo ratings yet

- 100% CASH NON-RFO Lower CFDocument3 pages100% CASH NON-RFO Lower CFJ SalesNo ratings yet

- FF 131BDocument1 pageFF 131BX097No ratings yet

- Oxygen Cost Sheet 2040 Sky CityDocument10 pagesOxygen Cost Sheet 2040 Sky CityAbhi SharmaNo ratings yet

- 3 5BHKDocument2 pages3 5BHKVijayNo ratings yet

- GL-57 Provisional Cost SheetDocument2 pagesGL-57 Provisional Cost Sheetorangeideas7No ratings yet

- Img - 2134 2Document4 pagesImg - 2134 2Jasvinder SolankiNo ratings yet

- West 17aDocument2 pagesWest 17aHomestuffs TradingsNo ratings yet

- Chintels Metropolis, Sector-108 Gurgaon: Price List & Payment PlansDocument7 pagesChintels Metropolis, Sector-108 Gurgaon: Price List & Payment Plansgupta promotersNo ratings yet

- Auro Regent Price Sheet Phase 1Document1 pageAuro Regent Price Sheet Phase 1Kommawar Shiva kumarNo ratings yet

- Code 111Document5 pagesCode 111anoop.bigassetsinfraNo ratings yet

- 201 & 202 - Cost SheetDocument1 page201 & 202 - Cost SheetKrishnan NadarNo ratings yet

- Townsquare Pricelist NewDocument1 pageTownsquare Pricelist NewkhuddusNo ratings yet

- Cost Sheet For Parag Sir Near PVRDocument1 pageCost Sheet For Parag Sir Near PVRgautam bajajNo ratings yet

- Certificate of Payment No-1 From Mendifra Foundation (Dr. Tsegay)Document32 pagesCertificate of Payment No-1 From Mendifra Foundation (Dr. Tsegay)hanoseNo ratings yet

- Certificate of Payment No-1 From Mendifra Foundation (Dr. Tsegay)Document34 pagesCertificate of Payment No-1 From Mendifra Foundation (Dr. Tsegay)hanoseNo ratings yet

- Sale Consideration (Agreement Value) - A: NoteDocument1 pageSale Consideration (Agreement Value) - A: Note8884430182durgaNo ratings yet

- Computation Sheet: ImportantDocument1 pageComputation Sheet: ImportantJ SalesNo ratings yet

- Shriram 107 South East Launch Price Sheet-20:70:10 Payment Plan Valid From 26th February 2022 To 28th February 2022Document2 pagesShriram 107 South East Launch Price Sheet-20:70:10 Payment Plan Valid From 26th February 2022 To 28th February 2022Sandip shrivastavaNo ratings yet

- Unit Details Sale ConsiderationDocument1 pageUnit Details Sale ConsiderationcubadesignstudNo ratings yet

- 30% Upfront Installment Payment Plan: Note:-Service Tax & All Other Charges As ApplicableDocument4 pages30% Upfront Installment Payment Plan: Note:-Service Tax & All Other Charges As ApplicableDhruv SainiNo ratings yet

- 113 Non RentalDocument8 pages113 Non RentalParveen YådâvNo ratings yet

- 2BHK GFGDocument1 page2BHK GFGADESHNo ratings yet

- Invoice 1044 IF23040832744824 5cb1bfa15db10001c150f6ddDocument1 pageInvoice 1044 IF23040832744824 5cb1bfa15db10001c150f6ddAnurag jainNo ratings yet

- slab 2-1504Document1 pageslab 2-1504Bharat SharmaNo ratings yet

- Meterbill 112350Document1 pageMeterbill 112350navdeepdecentNo ratings yet

- Updated Concorde Amber Price Sheet 2016Document1 pageUpdated Concorde Amber Price Sheet 2016Mudit SrivastavaNo ratings yet

- Seawood L and T CostsheetDocument1 pageSeawood L and T Costsheetmasud.khanNo ratings yet

- East 14aDocument2 pagesEast 14aHomestuffs TradingsNo ratings yet

- Vaswani Menlo Park - Price Chart - Sep 22Document1 pageVaswani Menlo Park - Price Chart - Sep 22priyabrat.77No ratings yet

- Divine Space Price Sheet MasterDocument4 pagesDivine Space Price Sheet MasterSharukh KhanNo ratings yet

- RKC KosmosDocument2 pagesRKC Kosmosamritam yadavNo ratings yet

- Invoice 1044 IF2303223222971Document1 pageInvoice 1044 IF2303223222971Sivaramakrishna YvvNo ratings yet

- 3bhk New SourcingDocument1 page3bhk New Sourcingkailas aherNo ratings yet

- Sale Consideration (Agreement Value) - A: NoteDocument1 pageSale Consideration (Agreement Value) - A: Note8884430182durgaNo ratings yet

- FREIA 1102 W Bundled CSIDocument1 pageFREIA 1102 W Bundled CSIben conrad ChavezNo ratings yet

- Main Contract 1,525,617.40 Supplementary Cont. Rebate % TotalDocument44 pagesMain Contract 1,525,617.40 Supplementary Cont. Rebate % TotalFeyedu shemsuNo ratings yet

- Iklan Transtv - Ani, Adel, Vinda - Kelas ADocument9 pagesIklan Transtv - Ani, Adel, Vinda - Kelas ANur JamilaNo ratings yet

- Agile TestingDocument5 pagesAgile TestingAman YadavNo ratings yet

- City Center Unifier Deployment PDFDocument35 pagesCity Center Unifier Deployment PDFSachin PatilNo ratings yet

- Protocols For Public-Key CryptosystemsDocument13 pagesProtocols For Public-Key CryptosystemsIvo LemosNo ratings yet

- MTCNA Lab Guide INTRA 1st Edition - Id.en PDFDocument87 pagesMTCNA Lab Guide INTRA 1st Edition - Id.en PDFreyandyNo ratings yet

- Written RequestDocument2 pagesWritten Requestcarvazro100% (1)

- EXOS Quick Guide - Cheat SheetDocument19 pagesEXOS Quick Guide - Cheat Sheetmaverick2689No ratings yet

- (Human Behavior and Environment 8) Carol M. Werner, Irwin Altman, Diana Oxley (Auth.), Irwin Altman, Carol M. Werner (Eds.) - Home Environments-Springer US (1985)Document355 pages(Human Behavior and Environment 8) Carol M. Werner, Irwin Altman, Diana Oxley (Auth.), Irwin Altman, Carol M. Werner (Eds.) - Home Environments-Springer US (1985)Carlos Roberto JúniorNo ratings yet

- Certificate ASHWINIDocument4 pagesCertificate ASHWINIbloodspray167No ratings yet

- Particle Filter TutorialDocument8 pagesParticle Filter TutorialTanmay NathNo ratings yet

- Cost FM Sample PaperDocument6 pagesCost FM Sample PapercacmacsNo ratings yet

- 8DIO Claire Oboe Virtuoso ManualDocument10 pages8DIO Claire Oboe Virtuoso ManualNiskaNo ratings yet

- Thrift Banks ActDocument25 pagesThrift Banks ActMadelle Pineda100% (1)

- Occupational StructureDocument3 pagesOccupational StructureEmirul FairuzNo ratings yet

- Quick Reference Guide: 65 Degree 1800 MHZ Dual Polarized 90 Degree 1800 MHZ Dual PolarizedDocument20 pagesQuick Reference Guide: 65 Degree 1800 MHZ Dual Polarized 90 Degree 1800 MHZ Dual PolarizedРоманКочневNo ratings yet

- Presentation - Pragati MaidanDocument22 pagesPresentation - Pragati MaidanMohamed Anas100% (4)

- Astm A 1011 2005Document8 pagesAstm A 1011 2005gao yanminNo ratings yet

- Revisit of Harriott's Method For Process ControlDocument3 pagesRevisit of Harriott's Method For Process ControlkiddhoNo ratings yet

- Basic First Aid Handbook v2Document47 pagesBasic First Aid Handbook v2maeveley9dayne9chuaNo ratings yet

- Person To PersonDocument126 pagesPerson To PersonYalmi AdiNo ratings yet

- Testing ChecklistDocument3 pagesTesting ChecklistAnurag YadavNo ratings yet

- Commerce EMDocument344 pagesCommerce EMSTAR E WORLDNo ratings yet

- 10 Best JobsitesDocument14 pages10 Best JobsitesHemansu PathakNo ratings yet

- Piping Stress AnalysisDocument10 pagesPiping Stress AnalysisM Alim Ur Rahman100% (1)

- SoftOne BlackBook ENG Ver.3.3 PDFDocument540 pagesSoftOne BlackBook ENG Ver.3.3 PDFLiviu BuliganNo ratings yet

- Title DefenseDocument3 pagesTitle DefenseLiezl Sabado100% (1)

- Analysis of StructureDocument4 pagesAnalysis of StructureCarlson CaliwanNo ratings yet

- (LN) Orc Eroica - Volume 01 (YP)Document282 pages(LN) Orc Eroica - Volume 01 (YP)FBINo ratings yet

Morefields - Cost Break Up - Plot 170

Morefields - Cost Break Up - Plot 170

Uploaded by

ObnoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Morefields - Cost Break Up - Plot 170

Morefields - Cost Break Up - Plot 170

Uploaded by

ObnoCopyright:

Available Formats

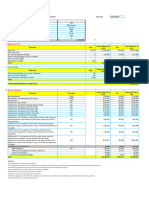

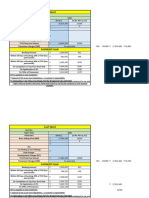

COST BREAKUP

RERA Approval no – PRM/KA/RERA/1251/308/PR/181022/002103

Plot Number - 170

Mr. & Mrs.

`

Section –A

Land Area (Sq.Ft) 3999.34

Land Area (Sqm) 371.55

Price Per Sq.Ft 3,750

Premium Location Charges (Applicable for Corner Plot Facing)

Total Agreement Value 1,49,97,517.00

Applicable Stamp Duty @ 5.15% 7,72,372.00

Applicable Stamp Duty @ 0.50% 74,988.00

Applicable Stamp Duty @ 1.00% 1,49,975.00

Total Cost of the Plot (A) 1,59,94,852.00

Section - B

Infra Structure Development Charges (Rs.200/- per sft) 7,99,868.00

GST @ 18% 1,43,977.00

Total Charges (B) 9,43,845.00

Section - C

Maintenance Charges @ Rs 1.50/- Sq.ft per month for 5 years 3,59,940.00

Other Charges 50,000.00

GST @ 18% 73,790.00

Total Charges (C) 4,83,730.00

Grand Total (A+B+C) 1,74,22,427.00

Payment Summary

On Booking Rs.1,00,000/- 100000.00

On Agreement - 15 days from the booking date (20% of the Agreement Value) 2899503.00

On Registration - Within 45 Days from the booking date (Balance amount including deposits and charges) 14422924.00

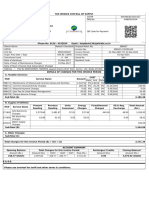

Disclaimer

• The above Costing is excluding the applicable premium.

• 1 Square Meter is equal to 10.7639 Square Feet.

• All Payments shall be made by Cheque/DD payable at Bangalore, Favoring Entity.

• Kindly issue a Cheque/DD in Favour of "Manyata Developers Pvt. Ltd." towards all the payable amounts to Manyata Developers Pvt. Ltd.

• It is Mandatory that purchasers use their respective accounts to make all transfers starting with the booking amount, the payment schedule and all other charges

mentioned above.

• Please submit a copy of PAN Card, Proof of Address and a Passport Size Photograph of self along with the Booking Application Form.

• Any changes in the details of Applicant/Co Applicant, should be communicated to the company within 7 working days of signing the document.

• Taxes have been computed based on the current rate applicable. All additional taxes/levies/cesses or any other statutory charges which may be imposed by the

authorities from time to time shall be payable by the Purchaser.

• Applicable Stamp Duty to be paid directly to the Sub Registrar's Office at rates prevailing at that time by the buyer in the form of DD/Online Payment/way as per

the requirement.

• IMPORTANT - TDS on property purchase : The Income Tax Act, 1961 requires a purchaser of an immovable property (other than Rural Agricultural Land) worth

Rs.50 Lakhs or more to deduct and pay with holding tax at the rate of 1.00% from the consideration payable to the Seller. He/She is required to quote his or her

PAN and Sellers PAN while making the payment. The Purchaser's are requested to comply with the law and issue us the FORM 16B. FORM 16B if the TDS

certificate to be issued by the Purchaser to the Seller in respect of the taxes deducted and deposited into the Government Account. Further details on this may be

found at https://www.tin-nsdl.com/TDS/TDS-FAQ.php. The purchaser are solely responsible for this compliance.

• Additional Charges /Deposits such as Charges towards providing Power, Water and Sewerage Connection, Maintenance Charges, Club Membership and Service

Charges will be payable by the Applicant as per demand raised by the Seller as per applicable timelines.

• Any disputes arising between both the parties shall be governed by the laws of India and subject to exclusive Jurisdiction of Courts in Bangalore, India .

You might also like

- Audio Information and MediaDocument2 pagesAudio Information and Mediajosefalarka75% (4)

- B.6.23 - STD SPECS - For Plum Concrete & Plum MasonaryDocument3 pagesB.6.23 - STD SPECS - For Plum Concrete & Plum MasonaryBijay Krishna Das100% (3)

- 15 - 85 Emi Holiday Plan PDFDocument2 pages15 - 85 Emi Holiday Plan PDFJasvinder SolankiNo ratings yet

- Cost Sheet For 113 - 02.2022Document2 pagesCost Sheet For 113 - 02.2022anoop.bigassetsinfraNo ratings yet

- Aeropark Price Chart - 14.03.2024Document1 pageAeropark Price Chart - 14.03.2024It's your ChannelNo ratings yet

- West Mogappair, Chennai RERA Registration No:TN.29/Building/0012/2020Document1 pageWest Mogappair, Chennai RERA Registration No:TN.29/Building/0012/2020BakiarajNo ratings yet

- PriceList - Shriram Liberty Square - 99acresDocument3 pagesPriceList - Shriram Liberty Square - 99acresKayjay2050No ratings yet

- 11WS3F - 5800Document1 page11WS3F - 5800Sunil KumarNo ratings yet

- Pilerne Reserve Villa 9 Cost SheetDocument1 pagePilerne Reserve Villa 9 Cost SheetOnshi AhujaNo ratings yet

- Bhairaav Milestone Price Sheet: Grand Total (A + B + C) 11,764,715Document1 pageBhairaav Milestone Price Sheet: Grand Total (A + B + C) 11,764,715Krishnan NadarNo ratings yet

- 4th Floor 15032 - Cost SheetDocument1 page4th Floor 15032 - Cost SheetKrishnan NadarNo ratings yet

- Pre-Possession Payment Demand NoticeDocument1 pagePre-Possession Payment Demand NoticeSunny SharmaNo ratings yet

- A Unit InformationDocument2 pagesA Unit InformationSampath RNo ratings yet

- Cost Sheet Miracle MileDocument1 pageCost Sheet Miracle Milesushil aroraNo ratings yet

- Draft: Veridian at Emerald Isle 11B 1502 549.82Document1 pageDraft: Veridian at Emerald Isle 11B 1502 549.82sachinNo ratings yet

- Master Price Sheet For Sarayu 2024 01 29 V1.6Document4 pagesMaster Price Sheet For Sarayu 2024 01 29 V1.6ankit kumarNo ratings yet

- MM - Cost SheetDocument1 pageMM - Cost SheetProperty SpecialistNo ratings yet

- 4 5893475375345830339Document5 pages4 5893475375345830339tofikkemalNo ratings yet

- 11ws3f 5800Document1 page11ws3f 5800Sunil KumarNo ratings yet

- Sarayu Villa Price Sheet-Sales TeamDocument1 pageSarayu Villa Price Sheet-Sales Teamankit kumarNo ratings yet

- 3 BR CostingDocument2 pages3 BR CostingDhruv SainiNo ratings yet

- Cost Sheet For 2 BHKDocument1 pageCost Sheet For 2 BHKBharat SharmaNo ratings yet

- C8a 103Document1 pageC8a 103Om Ezhilan UthirapathiNo ratings yet

- T30 0004 Cost Break UpDocument1 pageT30 0004 Cost Break UpR SampathNo ratings yet

- T0105B PDFDocument1 pageT0105B PDFDinesh MetkariNo ratings yet

- 100% CASH NON-RFO Lower CFDocument3 pages100% CASH NON-RFO Lower CFJ SalesNo ratings yet

- FF 131BDocument1 pageFF 131BX097No ratings yet

- Oxygen Cost Sheet 2040 Sky CityDocument10 pagesOxygen Cost Sheet 2040 Sky CityAbhi SharmaNo ratings yet

- 3 5BHKDocument2 pages3 5BHKVijayNo ratings yet

- GL-57 Provisional Cost SheetDocument2 pagesGL-57 Provisional Cost Sheetorangeideas7No ratings yet

- Img - 2134 2Document4 pagesImg - 2134 2Jasvinder SolankiNo ratings yet

- West 17aDocument2 pagesWest 17aHomestuffs TradingsNo ratings yet

- Chintels Metropolis, Sector-108 Gurgaon: Price List & Payment PlansDocument7 pagesChintels Metropolis, Sector-108 Gurgaon: Price List & Payment Plansgupta promotersNo ratings yet

- Auro Regent Price Sheet Phase 1Document1 pageAuro Regent Price Sheet Phase 1Kommawar Shiva kumarNo ratings yet

- Code 111Document5 pagesCode 111anoop.bigassetsinfraNo ratings yet

- 201 & 202 - Cost SheetDocument1 page201 & 202 - Cost SheetKrishnan NadarNo ratings yet

- Townsquare Pricelist NewDocument1 pageTownsquare Pricelist NewkhuddusNo ratings yet

- Cost Sheet For Parag Sir Near PVRDocument1 pageCost Sheet For Parag Sir Near PVRgautam bajajNo ratings yet

- Certificate of Payment No-1 From Mendifra Foundation (Dr. Tsegay)Document32 pagesCertificate of Payment No-1 From Mendifra Foundation (Dr. Tsegay)hanoseNo ratings yet

- Certificate of Payment No-1 From Mendifra Foundation (Dr. Tsegay)Document34 pagesCertificate of Payment No-1 From Mendifra Foundation (Dr. Tsegay)hanoseNo ratings yet

- Sale Consideration (Agreement Value) - A: NoteDocument1 pageSale Consideration (Agreement Value) - A: Note8884430182durgaNo ratings yet

- Computation Sheet: ImportantDocument1 pageComputation Sheet: ImportantJ SalesNo ratings yet

- Shriram 107 South East Launch Price Sheet-20:70:10 Payment Plan Valid From 26th February 2022 To 28th February 2022Document2 pagesShriram 107 South East Launch Price Sheet-20:70:10 Payment Plan Valid From 26th February 2022 To 28th February 2022Sandip shrivastavaNo ratings yet

- Unit Details Sale ConsiderationDocument1 pageUnit Details Sale ConsiderationcubadesignstudNo ratings yet

- 30% Upfront Installment Payment Plan: Note:-Service Tax & All Other Charges As ApplicableDocument4 pages30% Upfront Installment Payment Plan: Note:-Service Tax & All Other Charges As ApplicableDhruv SainiNo ratings yet

- 113 Non RentalDocument8 pages113 Non RentalParveen YådâvNo ratings yet

- 2BHK GFGDocument1 page2BHK GFGADESHNo ratings yet

- Invoice 1044 IF23040832744824 5cb1bfa15db10001c150f6ddDocument1 pageInvoice 1044 IF23040832744824 5cb1bfa15db10001c150f6ddAnurag jainNo ratings yet

- slab 2-1504Document1 pageslab 2-1504Bharat SharmaNo ratings yet

- Meterbill 112350Document1 pageMeterbill 112350navdeepdecentNo ratings yet

- Updated Concorde Amber Price Sheet 2016Document1 pageUpdated Concorde Amber Price Sheet 2016Mudit SrivastavaNo ratings yet

- Seawood L and T CostsheetDocument1 pageSeawood L and T Costsheetmasud.khanNo ratings yet

- East 14aDocument2 pagesEast 14aHomestuffs TradingsNo ratings yet

- Vaswani Menlo Park - Price Chart - Sep 22Document1 pageVaswani Menlo Park - Price Chart - Sep 22priyabrat.77No ratings yet

- Divine Space Price Sheet MasterDocument4 pagesDivine Space Price Sheet MasterSharukh KhanNo ratings yet

- RKC KosmosDocument2 pagesRKC Kosmosamritam yadavNo ratings yet

- Invoice 1044 IF2303223222971Document1 pageInvoice 1044 IF2303223222971Sivaramakrishna YvvNo ratings yet

- 3bhk New SourcingDocument1 page3bhk New Sourcingkailas aherNo ratings yet

- Sale Consideration (Agreement Value) - A: NoteDocument1 pageSale Consideration (Agreement Value) - A: Note8884430182durgaNo ratings yet

- FREIA 1102 W Bundled CSIDocument1 pageFREIA 1102 W Bundled CSIben conrad ChavezNo ratings yet

- Main Contract 1,525,617.40 Supplementary Cont. Rebate % TotalDocument44 pagesMain Contract 1,525,617.40 Supplementary Cont. Rebate % TotalFeyedu shemsuNo ratings yet

- Iklan Transtv - Ani, Adel, Vinda - Kelas ADocument9 pagesIklan Transtv - Ani, Adel, Vinda - Kelas ANur JamilaNo ratings yet

- Agile TestingDocument5 pagesAgile TestingAman YadavNo ratings yet

- City Center Unifier Deployment PDFDocument35 pagesCity Center Unifier Deployment PDFSachin PatilNo ratings yet

- Protocols For Public-Key CryptosystemsDocument13 pagesProtocols For Public-Key CryptosystemsIvo LemosNo ratings yet

- MTCNA Lab Guide INTRA 1st Edition - Id.en PDFDocument87 pagesMTCNA Lab Guide INTRA 1st Edition - Id.en PDFreyandyNo ratings yet

- Written RequestDocument2 pagesWritten Requestcarvazro100% (1)

- EXOS Quick Guide - Cheat SheetDocument19 pagesEXOS Quick Guide - Cheat Sheetmaverick2689No ratings yet

- (Human Behavior and Environment 8) Carol M. Werner, Irwin Altman, Diana Oxley (Auth.), Irwin Altman, Carol M. Werner (Eds.) - Home Environments-Springer US (1985)Document355 pages(Human Behavior and Environment 8) Carol M. Werner, Irwin Altman, Diana Oxley (Auth.), Irwin Altman, Carol M. Werner (Eds.) - Home Environments-Springer US (1985)Carlos Roberto JúniorNo ratings yet

- Certificate ASHWINIDocument4 pagesCertificate ASHWINIbloodspray167No ratings yet

- Particle Filter TutorialDocument8 pagesParticle Filter TutorialTanmay NathNo ratings yet

- Cost FM Sample PaperDocument6 pagesCost FM Sample PapercacmacsNo ratings yet

- 8DIO Claire Oboe Virtuoso ManualDocument10 pages8DIO Claire Oboe Virtuoso ManualNiskaNo ratings yet

- Thrift Banks ActDocument25 pagesThrift Banks ActMadelle Pineda100% (1)

- Occupational StructureDocument3 pagesOccupational StructureEmirul FairuzNo ratings yet

- Quick Reference Guide: 65 Degree 1800 MHZ Dual Polarized 90 Degree 1800 MHZ Dual PolarizedDocument20 pagesQuick Reference Guide: 65 Degree 1800 MHZ Dual Polarized 90 Degree 1800 MHZ Dual PolarizedРоманКочневNo ratings yet

- Presentation - Pragati MaidanDocument22 pagesPresentation - Pragati MaidanMohamed Anas100% (4)

- Astm A 1011 2005Document8 pagesAstm A 1011 2005gao yanminNo ratings yet

- Revisit of Harriott's Method For Process ControlDocument3 pagesRevisit of Harriott's Method For Process ControlkiddhoNo ratings yet

- Basic First Aid Handbook v2Document47 pagesBasic First Aid Handbook v2maeveley9dayne9chuaNo ratings yet

- Person To PersonDocument126 pagesPerson To PersonYalmi AdiNo ratings yet

- Testing ChecklistDocument3 pagesTesting ChecklistAnurag YadavNo ratings yet

- Commerce EMDocument344 pagesCommerce EMSTAR E WORLDNo ratings yet

- 10 Best JobsitesDocument14 pages10 Best JobsitesHemansu PathakNo ratings yet

- Piping Stress AnalysisDocument10 pagesPiping Stress AnalysisM Alim Ur Rahman100% (1)

- SoftOne BlackBook ENG Ver.3.3 PDFDocument540 pagesSoftOne BlackBook ENG Ver.3.3 PDFLiviu BuliganNo ratings yet

- Title DefenseDocument3 pagesTitle DefenseLiezl Sabado100% (1)

- Analysis of StructureDocument4 pagesAnalysis of StructureCarlson CaliwanNo ratings yet

- (LN) Orc Eroica - Volume 01 (YP)Document282 pages(LN) Orc Eroica - Volume 01 (YP)FBINo ratings yet