Professional Documents

Culture Documents

MOCK Test SOLUTION

MOCK Test SOLUTION

Uploaded by

Ncebakazi DawedeCopyright:

Available Formats

You might also like

- Ebook American Corrections 13Th Edition Todd R Clear Online PDF All ChapterDocument69 pagesEbook American Corrections 13Th Edition Todd R Clear Online PDF All Chaptersonya.martinez866100% (11)

- Big Bucks From Big SignsDocument7 pagesBig Bucks From Big SignsFrank Rolfe67% (3)

- Interlocking Bricks Project ReportDocument20 pagesInterlocking Bricks Project ReportSHRUTI AGRAWAL100% (2)

- Part 2 PreludeDocument51 pagesPart 2 PreludeTraian ProdanovNo ratings yet

- SvSAN OverviewDocument11 pagesSvSAN OverviewIvo MayerNo ratings yet

- Presentation On FacebookDocument39 pagesPresentation On FacebookShaswat SinghNo ratings yet

- Life Extension: A Practical Scientific Approach - The Life Extension Weight Loss Program - Pearson, Durk Shaw, SandyDocument392 pagesLife Extension: A Practical Scientific Approach - The Life Extension Weight Loss Program - Pearson, Durk Shaw, Sandypdf ebook free download100% (4)

- Price Adjustment Statement1Document13 pagesPrice Adjustment Statement1Abhinav BhardwajNo ratings yet

- NABARDDocument1 pageNABARDNitin PatelNo ratings yet

- Financial Statement of FY 2022-23Document60 pagesFinancial Statement of FY 2022-23utkarsh.srivastav1403No ratings yet

- BGS - Mba18 GP12 Vizhinjam International Seaport Ltd. FinmodelDocument43 pagesBGS - Mba18 GP12 Vizhinjam International Seaport Ltd. FinmodelPANKAJNo ratings yet

- Table 9-2: Phase-1 Port Development Cost Estimate SummaryDocument43 pagesTable 9-2: Phase-1 Port Development Cost Estimate SummaryPANKAJNo ratings yet

- Ratio Analysis SumsDocument8 pagesRatio Analysis Sumshabibi 101No ratings yet

- Sub Contractor Interim Payment CertificateDocument7 pagesSub Contractor Interim Payment CertificateUditha AnuruddthaNo ratings yet

- FM Paper1Document4 pagesFM Paper1majinkya61No ratings yet

- Project Escalation Adjustment: Project Sub Contractor Supplier Date Period EndingDocument1 pageProject Escalation Adjustment: Project Sub Contractor Supplier Date Period EndingUditha AnuruddthaNo ratings yet

- 3 PDFDocument1 page3 PDFUditha AnuruddthaNo ratings yet

- Leases Robles Empleo Solution Manual - CompressDocument18 pagesLeases Robles Empleo Solution Manual - Compresschnxxi iiNo ratings yet

- Lagrimas, Sarah Nicole S. - LeasesDocument9 pagesLagrimas, Sarah Nicole S. - LeasesSarah Nicole S. LagrimasNo ratings yet

- E BillDocument1 pageE BillManglesh SinghNo ratings yet

- YASHODHA PRINT & PACK - BALANCE SHEET 2023 FinalDocument10 pagesYASHODHA PRINT & PACK - BALANCE SHEET 2023 FinalsaroharashikaNo ratings yet

- Class Example 1, 3, 6 (Solutions)Document8 pagesClass Example 1, 3, 6 (Solutions)Given RefilweNo ratings yet

- 9706 Accounting: MARK SCHEME For The May/June 2008 Question PaperDocument8 pages9706 Accounting: MARK SCHEME For The May/June 2008 Question PaperShona MaheshwariNo ratings yet

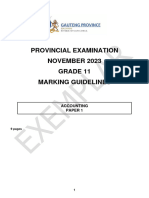

- 2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Possible AnswerDocument9 pages2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Possible AnswerChantelle IsaksNo ratings yet

- Project/Estimate Detail Report (GST)Document9 pagesProject/Estimate Detail Report (GST)Subhash DhakarNo ratings yet

- BTS Asst Details Cat C FY 2022-23Document5 pagesBTS Asst Details Cat C FY 2022-23kanishkasrivastava7No ratings yet

- Financial AnalysisDocument4 pagesFinancial AnalysisMorshedDenarAlamMannaNo ratings yet

- Datas 22-23Document76 pagesDatas 22-23gkkmailzNo ratings yet

- Acce 312 Formal Test 2 MemorandumDocument6 pagesAcce 312 Formal Test 2 MemorandumPETER MABASSONo ratings yet

- 2 BHK L (824 Sq. FT) City Facing Cost Sheet - Godrej NurtureDocument1 page2 BHK L (824 Sq. FT) City Facing Cost Sheet - Godrej NurtureAvinash ChavanNo ratings yet

- AssignmentDocument6 pagesAssignmentAnkita KumariNo ratings yet

- Siran Revised TSDocument327 pagesSiran Revised TSAwais Ahmad Khan KhalilNo ratings yet

- Income Taxes - Crax LTD MemoDocument8 pagesIncome Taxes - Crax LTD Memoandiswa zuluNo ratings yet

- 1700378027.9185524 - Bdcom 2023-2024 Q1Document13 pages1700378027.9185524 - Bdcom 2023-2024 Q1Anwar Hossain ReponNo ratings yet

- Jawaban CH 21 Leasing (Fix)Document7 pagesJawaban CH 21 Leasing (Fix)abd storeNo ratings yet

- 2BHK GFGDocument1 page2BHK GFGADESHNo ratings yet

- Dated Z." .49: Jharkhand Unja Utpadan Nigam LTDDocument3 pagesDated Z." .49: Jharkhand Unja Utpadan Nigam LTDom prakashNo ratings yet

- Final Bill & Its EnclosuresDocument17 pagesFinal Bill & Its EnclosuresmanikandanNo ratings yet

- BTS Asst Details Cat B FY 2022-23Document5 pagesBTS Asst Details Cat B FY 2022-23kanishkasrivastava7No ratings yet

- EFRESHDocument14 pagesEFRESHAnjiReddy DurgampudiNo ratings yet

- ExamDocument3 pagesExamMIN THANTNo ratings yet

- BS AmazeDocument1 pageBS AmazeNanu9711 JaiswalNo ratings yet

- Yadadri Bhuvanagiri - Bommalaramaram - ZPHS Maryala - 36200701109 - P200701109 - 20231109 - 000006 - Green Chalk BoardsDocument2 pagesYadadri Bhuvanagiri - Bommalaramaram - ZPHS Maryala - 36200701109 - P200701109 - 20231109 - 000006 - Green Chalk BoardsdurgaprasadNo ratings yet

- Design & Engineering: 3 RAB:25 1 3 RAB:25 1 3 RAB:25 1 True True True RAB:25 True True RAB:25 True True RAB:25 True TrueDocument1 pageDesign & Engineering: 3 RAB:25 1 3 RAB:25 1 3 RAB:25 1 True True True RAB:25 True True RAB:25 True True RAB:25 True TrueRinjumon RinjuNo ratings yet

- MFRS 117 Leases Problem and SolutionsDocument10 pagesMFRS 117 Leases Problem and SolutionsEnnes Yaya100% (2)

- PHE (Public Health Sindh)Document63 pagesPHE (Public Health Sindh)irfanzai456No ratings yet

- COS RA Bill-03Document32 pagesCOS RA Bill-03amanNo ratings yet

- Out Come RPL 22052024Document24 pagesOut Come RPL 22052024ronitvermaphotosNo ratings yet

- View Duplicate BillDocument1 pageView Duplicate BillRajiv RanjanNo ratings yet

- Vazron Industtries Private Limited PDFDocument2 pagesVazron Industtries Private Limited PDFrupesh pandaNo ratings yet

- DPR Format Construction Work RoadDocument54 pagesDPR Format Construction Work RoadNeeraj DuaNo ratings yet

- English Detailed Public Notice - 1547Document8 pagesEnglish Detailed Public Notice - 1547Ss LaptopNo ratings yet

- Faf Tutorial 3 Ifrs 16Document4 pagesFaf Tutorial 3 Ifrs 16嘉慧No ratings yet

- VPLPL Ar 2022 23Document38 pagesVPLPL Ar 2022 23msgopinath18No ratings yet

- Faf Tutorial 3 Ifrs 16Document4 pagesFaf Tutorial 3 Ifrs 16嘉慧No ratings yet

- Notice of Valuation: Prime Cost SumDocument2 pagesNotice of Valuation: Prime Cost SumasyrafmuhddNo ratings yet

- Mahogany Bullet Payment Plan Dec 2018Document1 pageMahogany Bullet Payment Plan Dec 2018prajjal111No ratings yet

- BS NormallyDocument11 pagesBS Normallyvishwakarmaash75No ratings yet

- Rangpur Foundry LimitedDocument10 pagesRangpur Foundry Limitedanup dasNo ratings yet

- Authority: Roads & Buildings Department, NH Division, Rajkot, GujaratDocument16 pagesAuthority: Roads & Buildings Department, NH Division, Rajkot, GujaratRajeev RanjanNo ratings yet

- Enviromental Monitoring Report - Feb-2024Document25 pagesEnviromental Monitoring Report - Feb-2024Sameer BhanushaliNo ratings yet

- GR 11 Accounting P1 (English 2023 Possible AnswerDocument9 pagesGR 11 Accounting P1 (English 2023 Possible Answert86663375No ratings yet

- RA 06 - Rohan Square - Certified-1Document5 pagesRA 06 - Rohan Square - Certified-1Pon Malai KrishNo ratings yet

- Jawaban Sesi 3 Ujikom Pt. BoombasstikDocument12 pagesJawaban Sesi 3 Ujikom Pt. BoombasstikNada Nadya100% (1)

- Ref Cost Database 2019Document22 pagesRef Cost Database 2019N.a. M. TandayagNo ratings yet

- Performance-Based Road Maintenance Contracts in the CAREC RegionFrom EverandPerformance-Based Road Maintenance Contracts in the CAREC RegionNo ratings yet

- Cargo Handling 5Document21 pagesCargo Handling 5LilCent MmanuelNo ratings yet

- General FOB CIF Contract-02 - 3 - 2020 PDFDocument11 pagesGeneral FOB CIF Contract-02 - 3 - 2020 PDFKhánh Linh Mai Trần100% (1)

- Child and Families.Document6 pagesChild and Families.CNo ratings yet

- Wesleyan University-Philippines: Basic Education Department PahintulotDocument1 pageWesleyan University-Philippines: Basic Education Department Pahintulotthyme 02No ratings yet

- VERSINI 2018 - A Distributed Modelling Approach To Assess The Use of Blue and GreenInfrastructures To Ful L Stormwater Management RequirementsDocument4 pagesVERSINI 2018 - A Distributed Modelling Approach To Assess The Use of Blue and GreenInfrastructures To Ful L Stormwater Management RequirementscoutohahaNo ratings yet

- 2.1 Marketing Objectives and PlansDocument35 pages2.1 Marketing Objectives and Plansdftkgkx9bvNo ratings yet

- BeforeDocument23 pagesBeforeEklavya yadavNo ratings yet

- Microchips Small and DemandedDocument4 pagesMicrochips Small and DemandedxellosdexNo ratings yet

- Co vs. CADocument3 pagesCo vs. CAJaysonNo ratings yet

- Portrait So The Events Had To Be Sketchy With The Aim ofDocument8 pagesPortrait So The Events Had To Be Sketchy With The Aim ofvademecumdevallyNo ratings yet

- STD 5 The Village Saint AnalysisDocument3 pagesSTD 5 The Village Saint AnalysisAdnan HusainNo ratings yet

- CHALLENGES IN TRANSLATING CHINESE CLASSICAL NOVEL 《魔道祖师》 (MODAOZUSHI) INTO ENGLISHDocument16 pagesCHALLENGES IN TRANSLATING CHINESE CLASSICAL NOVEL 《魔道祖师》 (MODAOZUSHI) INTO ENGLISHtang qiao erNo ratings yet

- KROES Design MethodologyDocument16 pagesKROES Design MethodologydariosandroneNo ratings yet

- Artificial Intelligence in 2019 Presentation by Chandravadan RautDocument72 pagesArtificial Intelligence in 2019 Presentation by Chandravadan RautChandravadan Raut100% (1)

- ECA Job DescriptionDocument2 pagesECA Job DescriptionJinesh80% (5)

- Maynilad Assoc V MayniladDocument13 pagesMaynilad Assoc V MayniladEmaleth LasherNo ratings yet

- Inguinal HerniaDocument2 pagesInguinal HerniaTaraKyleUyNo ratings yet

- Disertation Proposal NDocument9 pagesDisertation Proposal Nnabam jirmaNo ratings yet

- Critical Reading Is A Technique Which Involves Analyzing The Claims Presented in TheDocument12 pagesCritical Reading Is A Technique Which Involves Analyzing The Claims Presented in TheLa Vern O.No ratings yet

- Antazo Vs DobladaDocument6 pagesAntazo Vs DobladaCel C. CaintaNo ratings yet

- Streptococci: General Characteristics of StreptococciDocument13 pagesStreptococci: General Characteristics of Streptococcidevesh.hsNo ratings yet

- Pre-Partition Freedom Movement of India (Comprehensive Notes)Document27 pagesPre-Partition Freedom Movement of India (Comprehensive Notes)Ali NawazNo ratings yet

- Call Out CultureDocument6 pagesCall Out CultureEugene ToribioNo ratings yet

- Business Cult Ual Intelligence Quotient A Five Country StudyDocument15 pagesBusiness Cult Ual Intelligence Quotient A Five Country StudyAndrew Sauer PA-C DMScNo ratings yet

MOCK Test SOLUTION

MOCK Test SOLUTION

Uploaded by

Ncebakazi DawedeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MOCK Test SOLUTION

MOCK Test SOLUTION

Uploaded by

Ncebakazi DawedeCopyright:

Available Formats

Page 2 of 6

QUESTION 1 SUGGESTED SOLUTION AND MARK PLAN

MARKS

POS ACT

a) Journal entries

DR CR

R R

Right of use asset 708 563 2

Bank (1 207 + 36 876) 38 083 1½

Lease liability (W1) 670 480 ½

Interest expense (W1) 75 764 ½

Bank 182 783 ½

Lease liability (Balancing) 107 019 ½+½

Depreciation (708 563/6) 118 094 1

Accumulated depreciation: Right of use asset 118 094 ½

Provision for data recovery costs 328 000 ½

Bank 305 000 ½

Data recovery expense (685 000 - (230 000 + 127 000 + 305 000)) 23 000 ½+½

Cloud backup expense 40 000 ½

Bank 40 000 ½

a) 10½ 0

b) Disclosure of lease: AddToCart (Pty) Limited (Lessee)

ADDTOCART (PTY) LIMITED

(EXTRACT) NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 APRIL 2021

15. Lease note

15.1. Right of use asset

R

Acquisition of leased asset (refer to a) 708 563 ½

Depreciation (708 563 / 6) (118 094) 1

Carrying amount at 30 April 2021 590 469 ½

15.2 Maturity analysis of future lease payments

R

- in 2022 182 783

- in 2023 182 783

1

- in 2024 182 783

- in 2025 182 783

Total future lease payments 731 132

Future finance costs (Balancing) (167 671) ½

Net lease liability (W1) 563 461 ½

15.3 Other expenses related to leases

R

Finance costs - lease of Crafter Van (W1) 75 764 ½

Format ½

b) 5 0

RGV201 Mock Test 2 : May 2023

Page 3 of 6

QUESTION 1 (CONTINUED) SUGGESTED SOLUTION AND MARK PLAN

MARKS

POS ACT

WORKINGS

W1 Lease of Crafter Van

n = 5; PMT = (182 783); FV = 0; I = 11.3%; 2

COMP PV = 670 480

Date Interest Payment Balance

1 May 20 670 480 ½

30 Apr 21 75 764 (182 783) 563 461 1

Workings 3½ 0

a) 10½ 0

b) 5 0

QUESTION 1 19 0

RGV201 Mock Test 2 : May 2023

Page 4 of 6

QUESTION 2 SUGGESTED SOLUTION AND MARK PLAN

MARKS

POS ACT

a) TikTik Matter

To: The Accountant of Futuratech Limited

Regarding: The TikTik matter

The issue at hand is whether the court case relating to the TikTik app should be recognised as a

provision, disclosed as a contingent liability or ignored, in the financial statements of Futuratech

Limited for the year ended 30 April 2021. ½

In order for a provision to be recognised the definition of a liability needs to be met:

A liability is a :

Present obligation: exists if it more likely than not. ½

As the legal advisors are of the opinion that this case will not be successful, the present obligation

cannot be considered to be more likely than not. ½

There has been legal action instituted against Futuratech but the court is still deciding whether or

not Futuratech has an obligation. Therefore there is no current legal or constructive obligation at

year-end. ½

A present obligation does not exist at 30 April 2021. ½

As the result of a past event: violation of privacy protection laws, this occurred before the year-end. ½

½

From which the outflow of benefits is probable: As the legal advisors are of the opinion that this ½

case will not be successful, the outflow of benefits cannot be considered to be more likely than not.

½

The definition is not met therefore a provision cannot be recognised in the 2021 financial year. 1

Consideration should be given to whether a contingent liability exists: ½

Possible obligation: As the legal advisors are of the opinion that this case will not be successful, the ½

present obligation cannot be considered to be more likely than not.

Only a possible obligation appears to exist at 30 April 2021 reporting date.

As the result of a past event: as above ½

Whose existence will only be confirmed by the occurrence or non-occurrence of an uncertain future

event not wholly within the control of the entity: whether the legal action taken will result in a ½

successful case for the claimants is not within the control of Futuratech Limited. ½

The legal representatives stated that as there are no similar cases on this specific matter, it is not

entirely unlikely that the case might succeed. As the court case cannot be predicted with certainty,

the obligation cannot be considered remote. ½

The contingent liability definition is met and thus a contingent liability should be disclosed in the

annual financial statements of Futuratech Limited at 30 April 2021. 1

Disclosure should include a description of the nature and an estimate of the financial impact if

available. 1

a) Limited to 6 0

RGV201 Mock Test 2 : May 2023

Page 5 of 6

QUESTION 2 (CONTINUED) SUGGESTED SOLUTION AND MARK PLAN

MARKS

POS ACT

b) Change in estimate and Change in Accounting Policy

FUTURATECH LIMITED

(EXTRACT) NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 APRIL 2021

10. Change in estimate

During the year management revised the estimate on their tablets. The useful life of a equipment was

re-estimated to a total useful life of three years from an original five years. ½

The effect on profit R

- decrease in current year (10 800-21 600) (10 800) 1

- increase in future years ((10 800 x 3) - 21 600) 10 800 1

12. Change in accounting policy

During the year the company changed its accounting policy for inventory valuation from weighted

average to FIFO. The change was made to achieve fairer presentation. 1

The effect of the change in policy is as follows:

2021 2020

R R

Statement of profit or loss

Decrease in cost of sales (W2) (100 000) (35 000) 1

Increase in profit for the year 100 000 35 000 ½

Statement of financial position

Increase in inventory (W2) 120 000 20 000 1

Increase/(Decrease) in retained earnings at beginning

20 000 (15 000) 1

of year

Increase in retained earnings at end of year (W2) 120 000 20 000 ½

Format 1

8½ 0

RGV201 Mock Test 2 : May 2023

Page 6 of 6

QUESTION 2 (CONTINUED) SUGGESTED SOLUTION AND MARK PLAN

MARKS

POS ACT

0

WORKINGS

W1 Change in estimate

Original depreciation: (54 000) / 5 10 800 ½

Carrying amount at change in estimate: (54 000 - 10 800) 43 200 ½

New depreciation: (43 200 / 2) 21 600 1

W2 Change in accounting policy

2021 2020 2019

R R R

Cost of sales -100 000 -35 000 15 000 1½

Opening Inventory 20 000 -15 000 0 ½

Closing Inventory 120 000 20 000 -15 000 1½

Profit for the year 100 000 35 000 -15 000 ½

Retained Earnings 120 000 20 000 -15 000 1½

Workings 7½ 0

a) 6 0

b) 8½ 0

QUESTION 2 22 0

RGV201 Mock Test 2 : May 2023

You might also like

- Ebook American Corrections 13Th Edition Todd R Clear Online PDF All ChapterDocument69 pagesEbook American Corrections 13Th Edition Todd R Clear Online PDF All Chaptersonya.martinez866100% (11)

- Big Bucks From Big SignsDocument7 pagesBig Bucks From Big SignsFrank Rolfe67% (3)

- Interlocking Bricks Project ReportDocument20 pagesInterlocking Bricks Project ReportSHRUTI AGRAWAL100% (2)

- Part 2 PreludeDocument51 pagesPart 2 PreludeTraian ProdanovNo ratings yet

- SvSAN OverviewDocument11 pagesSvSAN OverviewIvo MayerNo ratings yet

- Presentation On FacebookDocument39 pagesPresentation On FacebookShaswat SinghNo ratings yet

- Life Extension: A Practical Scientific Approach - The Life Extension Weight Loss Program - Pearson, Durk Shaw, SandyDocument392 pagesLife Extension: A Practical Scientific Approach - The Life Extension Weight Loss Program - Pearson, Durk Shaw, Sandypdf ebook free download100% (4)

- Price Adjustment Statement1Document13 pagesPrice Adjustment Statement1Abhinav BhardwajNo ratings yet

- NABARDDocument1 pageNABARDNitin PatelNo ratings yet

- Financial Statement of FY 2022-23Document60 pagesFinancial Statement of FY 2022-23utkarsh.srivastav1403No ratings yet

- BGS - Mba18 GP12 Vizhinjam International Seaport Ltd. FinmodelDocument43 pagesBGS - Mba18 GP12 Vizhinjam International Seaport Ltd. FinmodelPANKAJNo ratings yet

- Table 9-2: Phase-1 Port Development Cost Estimate SummaryDocument43 pagesTable 9-2: Phase-1 Port Development Cost Estimate SummaryPANKAJNo ratings yet

- Ratio Analysis SumsDocument8 pagesRatio Analysis Sumshabibi 101No ratings yet

- Sub Contractor Interim Payment CertificateDocument7 pagesSub Contractor Interim Payment CertificateUditha AnuruddthaNo ratings yet

- FM Paper1Document4 pagesFM Paper1majinkya61No ratings yet

- Project Escalation Adjustment: Project Sub Contractor Supplier Date Period EndingDocument1 pageProject Escalation Adjustment: Project Sub Contractor Supplier Date Period EndingUditha AnuruddthaNo ratings yet

- 3 PDFDocument1 page3 PDFUditha AnuruddthaNo ratings yet

- Leases Robles Empleo Solution Manual - CompressDocument18 pagesLeases Robles Empleo Solution Manual - Compresschnxxi iiNo ratings yet

- Lagrimas, Sarah Nicole S. - LeasesDocument9 pagesLagrimas, Sarah Nicole S. - LeasesSarah Nicole S. LagrimasNo ratings yet

- E BillDocument1 pageE BillManglesh SinghNo ratings yet

- YASHODHA PRINT & PACK - BALANCE SHEET 2023 FinalDocument10 pagesYASHODHA PRINT & PACK - BALANCE SHEET 2023 FinalsaroharashikaNo ratings yet

- Class Example 1, 3, 6 (Solutions)Document8 pagesClass Example 1, 3, 6 (Solutions)Given RefilweNo ratings yet

- 9706 Accounting: MARK SCHEME For The May/June 2008 Question PaperDocument8 pages9706 Accounting: MARK SCHEME For The May/June 2008 Question PaperShona MaheshwariNo ratings yet

- 2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Possible AnswerDocument9 pages2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Possible AnswerChantelle IsaksNo ratings yet

- Project/Estimate Detail Report (GST)Document9 pagesProject/Estimate Detail Report (GST)Subhash DhakarNo ratings yet

- BTS Asst Details Cat C FY 2022-23Document5 pagesBTS Asst Details Cat C FY 2022-23kanishkasrivastava7No ratings yet

- Financial AnalysisDocument4 pagesFinancial AnalysisMorshedDenarAlamMannaNo ratings yet

- Datas 22-23Document76 pagesDatas 22-23gkkmailzNo ratings yet

- Acce 312 Formal Test 2 MemorandumDocument6 pagesAcce 312 Formal Test 2 MemorandumPETER MABASSONo ratings yet

- 2 BHK L (824 Sq. FT) City Facing Cost Sheet - Godrej NurtureDocument1 page2 BHK L (824 Sq. FT) City Facing Cost Sheet - Godrej NurtureAvinash ChavanNo ratings yet

- AssignmentDocument6 pagesAssignmentAnkita KumariNo ratings yet

- Siran Revised TSDocument327 pagesSiran Revised TSAwais Ahmad Khan KhalilNo ratings yet

- Income Taxes - Crax LTD MemoDocument8 pagesIncome Taxes - Crax LTD Memoandiswa zuluNo ratings yet

- 1700378027.9185524 - Bdcom 2023-2024 Q1Document13 pages1700378027.9185524 - Bdcom 2023-2024 Q1Anwar Hossain ReponNo ratings yet

- Jawaban CH 21 Leasing (Fix)Document7 pagesJawaban CH 21 Leasing (Fix)abd storeNo ratings yet

- 2BHK GFGDocument1 page2BHK GFGADESHNo ratings yet

- Dated Z." .49: Jharkhand Unja Utpadan Nigam LTDDocument3 pagesDated Z." .49: Jharkhand Unja Utpadan Nigam LTDom prakashNo ratings yet

- Final Bill & Its EnclosuresDocument17 pagesFinal Bill & Its EnclosuresmanikandanNo ratings yet

- BTS Asst Details Cat B FY 2022-23Document5 pagesBTS Asst Details Cat B FY 2022-23kanishkasrivastava7No ratings yet

- EFRESHDocument14 pagesEFRESHAnjiReddy DurgampudiNo ratings yet

- ExamDocument3 pagesExamMIN THANTNo ratings yet

- BS AmazeDocument1 pageBS AmazeNanu9711 JaiswalNo ratings yet

- Yadadri Bhuvanagiri - Bommalaramaram - ZPHS Maryala - 36200701109 - P200701109 - 20231109 - 000006 - Green Chalk BoardsDocument2 pagesYadadri Bhuvanagiri - Bommalaramaram - ZPHS Maryala - 36200701109 - P200701109 - 20231109 - 000006 - Green Chalk BoardsdurgaprasadNo ratings yet

- Design & Engineering: 3 RAB:25 1 3 RAB:25 1 3 RAB:25 1 True True True RAB:25 True True RAB:25 True True RAB:25 True TrueDocument1 pageDesign & Engineering: 3 RAB:25 1 3 RAB:25 1 3 RAB:25 1 True True True RAB:25 True True RAB:25 True True RAB:25 True TrueRinjumon RinjuNo ratings yet

- MFRS 117 Leases Problem and SolutionsDocument10 pagesMFRS 117 Leases Problem and SolutionsEnnes Yaya100% (2)

- PHE (Public Health Sindh)Document63 pagesPHE (Public Health Sindh)irfanzai456No ratings yet

- COS RA Bill-03Document32 pagesCOS RA Bill-03amanNo ratings yet

- Out Come RPL 22052024Document24 pagesOut Come RPL 22052024ronitvermaphotosNo ratings yet

- View Duplicate BillDocument1 pageView Duplicate BillRajiv RanjanNo ratings yet

- Vazron Industtries Private Limited PDFDocument2 pagesVazron Industtries Private Limited PDFrupesh pandaNo ratings yet

- DPR Format Construction Work RoadDocument54 pagesDPR Format Construction Work RoadNeeraj DuaNo ratings yet

- English Detailed Public Notice - 1547Document8 pagesEnglish Detailed Public Notice - 1547Ss LaptopNo ratings yet

- Faf Tutorial 3 Ifrs 16Document4 pagesFaf Tutorial 3 Ifrs 16嘉慧No ratings yet

- VPLPL Ar 2022 23Document38 pagesVPLPL Ar 2022 23msgopinath18No ratings yet

- Faf Tutorial 3 Ifrs 16Document4 pagesFaf Tutorial 3 Ifrs 16嘉慧No ratings yet

- Notice of Valuation: Prime Cost SumDocument2 pagesNotice of Valuation: Prime Cost SumasyrafmuhddNo ratings yet

- Mahogany Bullet Payment Plan Dec 2018Document1 pageMahogany Bullet Payment Plan Dec 2018prajjal111No ratings yet

- BS NormallyDocument11 pagesBS Normallyvishwakarmaash75No ratings yet

- Rangpur Foundry LimitedDocument10 pagesRangpur Foundry Limitedanup dasNo ratings yet

- Authority: Roads & Buildings Department, NH Division, Rajkot, GujaratDocument16 pagesAuthority: Roads & Buildings Department, NH Division, Rajkot, GujaratRajeev RanjanNo ratings yet

- Enviromental Monitoring Report - Feb-2024Document25 pagesEnviromental Monitoring Report - Feb-2024Sameer BhanushaliNo ratings yet

- GR 11 Accounting P1 (English 2023 Possible AnswerDocument9 pagesGR 11 Accounting P1 (English 2023 Possible Answert86663375No ratings yet

- RA 06 - Rohan Square - Certified-1Document5 pagesRA 06 - Rohan Square - Certified-1Pon Malai KrishNo ratings yet

- Jawaban Sesi 3 Ujikom Pt. BoombasstikDocument12 pagesJawaban Sesi 3 Ujikom Pt. BoombasstikNada Nadya100% (1)

- Ref Cost Database 2019Document22 pagesRef Cost Database 2019N.a. M. TandayagNo ratings yet

- Performance-Based Road Maintenance Contracts in the CAREC RegionFrom EverandPerformance-Based Road Maintenance Contracts in the CAREC RegionNo ratings yet

- Cargo Handling 5Document21 pagesCargo Handling 5LilCent MmanuelNo ratings yet

- General FOB CIF Contract-02 - 3 - 2020 PDFDocument11 pagesGeneral FOB CIF Contract-02 - 3 - 2020 PDFKhánh Linh Mai Trần100% (1)

- Child and Families.Document6 pagesChild and Families.CNo ratings yet

- Wesleyan University-Philippines: Basic Education Department PahintulotDocument1 pageWesleyan University-Philippines: Basic Education Department Pahintulotthyme 02No ratings yet

- VERSINI 2018 - A Distributed Modelling Approach To Assess The Use of Blue and GreenInfrastructures To Ful L Stormwater Management RequirementsDocument4 pagesVERSINI 2018 - A Distributed Modelling Approach To Assess The Use of Blue and GreenInfrastructures To Ful L Stormwater Management RequirementscoutohahaNo ratings yet

- 2.1 Marketing Objectives and PlansDocument35 pages2.1 Marketing Objectives and Plansdftkgkx9bvNo ratings yet

- BeforeDocument23 pagesBeforeEklavya yadavNo ratings yet

- Microchips Small and DemandedDocument4 pagesMicrochips Small and DemandedxellosdexNo ratings yet

- Co vs. CADocument3 pagesCo vs. CAJaysonNo ratings yet

- Portrait So The Events Had To Be Sketchy With The Aim ofDocument8 pagesPortrait So The Events Had To Be Sketchy With The Aim ofvademecumdevallyNo ratings yet

- STD 5 The Village Saint AnalysisDocument3 pagesSTD 5 The Village Saint AnalysisAdnan HusainNo ratings yet

- CHALLENGES IN TRANSLATING CHINESE CLASSICAL NOVEL 《魔道祖师》 (MODAOZUSHI) INTO ENGLISHDocument16 pagesCHALLENGES IN TRANSLATING CHINESE CLASSICAL NOVEL 《魔道祖师》 (MODAOZUSHI) INTO ENGLISHtang qiao erNo ratings yet

- KROES Design MethodologyDocument16 pagesKROES Design MethodologydariosandroneNo ratings yet

- Artificial Intelligence in 2019 Presentation by Chandravadan RautDocument72 pagesArtificial Intelligence in 2019 Presentation by Chandravadan RautChandravadan Raut100% (1)

- ECA Job DescriptionDocument2 pagesECA Job DescriptionJinesh80% (5)

- Maynilad Assoc V MayniladDocument13 pagesMaynilad Assoc V MayniladEmaleth LasherNo ratings yet

- Inguinal HerniaDocument2 pagesInguinal HerniaTaraKyleUyNo ratings yet

- Disertation Proposal NDocument9 pagesDisertation Proposal Nnabam jirmaNo ratings yet

- Critical Reading Is A Technique Which Involves Analyzing The Claims Presented in TheDocument12 pagesCritical Reading Is A Technique Which Involves Analyzing The Claims Presented in TheLa Vern O.No ratings yet

- Antazo Vs DobladaDocument6 pagesAntazo Vs DobladaCel C. CaintaNo ratings yet

- Streptococci: General Characteristics of StreptococciDocument13 pagesStreptococci: General Characteristics of Streptococcidevesh.hsNo ratings yet

- Pre-Partition Freedom Movement of India (Comprehensive Notes)Document27 pagesPre-Partition Freedom Movement of India (Comprehensive Notes)Ali NawazNo ratings yet

- Call Out CultureDocument6 pagesCall Out CultureEugene ToribioNo ratings yet

- Business Cult Ual Intelligence Quotient A Five Country StudyDocument15 pagesBusiness Cult Ual Intelligence Quotient A Five Country StudyAndrew Sauer PA-C DMScNo ratings yet