Professional Documents

Culture Documents

Assessment 3 PDF

Assessment 3 PDF

Uploaded by

Aboud Hawrechz MacalilayOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assessment 3 PDF

Assessment 3 PDF

Uploaded by

Aboud Hawrechz MacalilayCopyright:

Available Formats

Dashboard / My courses /

ACC 223A /

Assessment 3 (Week 13) /

Assessment 3

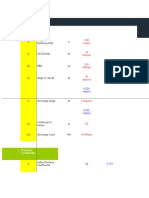

Started on Thursday, 3 June 2021, 2:52 PM

State Finished

Completed on Thursday, 3 June 2021, 3:47 PM

Time taken 55 mins 30 secs

Marks 73.00/75.00

Grade 97.33 out of 100.00

Question 1

Rabee Manufacturing Company has two departments, A and B. Department A manufactures the Part A. Department B

Correct

processes the Part A into the final goods. No inventories exist in either department at the beginning or end of 2020.

Mark 3.00 out of During the year, Department A produced 80,000 kgs. of Part A at a cost of P800,000. All the Part A's were transferred to

3.00

Department B where additional operating costs of P5 per kg. were incurred. The finished goods was sold for P3,000,000.

Determine the gross profit for Department A if the transfer price is P12 per kg.

Answer: 160,000

The correct answer is: 160,000

Question 2

The Assembly Division of Bee Company sells all of its output to the Finishing Division of the company. The only product of

Correct

the Rabee Division is Part A that are used by the Finishing Division. The retail price of the Part A is P20 per unit. Each unit

Mark 3.00 out of

completed by the Finishing Division requires four Part A's. Production quantity and cost data for 2021 are as follows:

3.00

Part A units 30,000

Direct materials P135,000

Direct labor P90,000

Factory overhead (25% is variable) P90,000

Operating expenses (20% is variable)P150,000

Compute for the transfer price for 1 unit of Part A using variable costs.

Answer: 9.25

The correct answer is: 9.25

Question 3

Global Company has two departmentss that report on a decentralized basis. Their results for 2020 were as follows:

Correct

Pencil Calculator

Mark 2.00 out of

2.00 Sales P150,000 P300,000

Income P 15,000 P 45,000

Asset base P 75,000 P150,000

Weighted average cost of capital 12% 12%

Compute for the Turnover of Pencil.

Answer: 2

The correct answer is: 2

Question 4

Rabee Manufacturing Company has two departments, A and B. Department A manufactures the Part A. Department B

Correct

processes the Part A into the final goods. No inventories exist in either department at the beginning or end of 2020.

Mark 3.00 out of

During the year, Department A produced 80,000 kgs. of Part A at a cost of P800,000. All the Part A's were transferred to

3.00

Department B where additional operating costs of P5 per kg. were incurred. The finished goods was sold for P3,000,000.

Determine the gross profit for the company as a whole if the transfer price is P12 per kg.

Answer: 1,800,000

The correct answer is: 1,800,000

Question 5

Global Company has two departmentss that report on a decentralized basis. Their results for 2020 were as follows:

Correct

Pencil Calculator

Mark 2.00 out of

2.00 Sales P150,000 P300,000

Income P 15,000 P 45,000

Asset base P 75,000 P150,000

Weighted average cost of capital 12% 12%

Compute for the Residual Income for Calculator if the desired rate of return is 20%.

Answer: 15,000

The correct answer is: 15,000

Question 6

The Part B Division of Furbee Company has just revised its actual cost data for 2020. Part B Division transfers goods to the

Correct

Finishing Division. Finishing Division can buy the same parts in the open market for P122 each. Part B division's new cost

Mark 5.00 out of

data are as follows:

5.00

Direct materials P40

Direct labor 30

Variable overhead 10

Fixed overhead 16

Variable selling expenses 6

Fixed selling and administrative expenses 12

Total costs P114

Desired return 20

Sales price P134

Current production is 200,000 units, and the Part B Division has a capacity of 300,000 units.

What is the highest price the Finishing Division should pay for the units?

Answer: 122

The correct answer is: 122

Question 7 Global Company has two departmentss that report on a decentralized basis. Their results for 2020 were as follows:

Correct

Pencil Calculator

Mark 2.00 out of

Sales P150,000 P300,000

2.00

Income P 15,000 P 45,000

Asset base P 75,000 P150,000

Weighted average cost of capital 12% 12%

Compute for the Return on Investment of Pencil.

Answer: 20%

The correct answer is: 20%

Question 8

Global Company has two departmentss that report on a decentralized basis. Their results for 2020 were as follows:

Correct

Pencil Calculator

Mark 2.00 out of

2.00 Sales P150,000 P300,000

Income P 15,000 P 45,000

Asset base P 75,000 P150,000

Weighted average cost of capital 12% 12%

Compute for the EVA of Calculator.

Answer: 27,000

The correct answer is: 27,000

Question 9 Jerbee Incorporated sells a product for P400 per unit. The market share of the product is twenty two percent of the units

Correct sold. The marketing manager feels that the market share can be increased to 28 percent of the units sold with a reduction

Mark 3.00 out of in price to P340. The product is currently earning a profit of P64 per unit. The president of Jerbee Inc feels that his

3.00 company needs to maintain the same profit level per unit. The market share consists of P4,000,000 (10,000 units).

How many units does Jerbee Incorporated currently sell of the product?

Answer: 2,200

The correct answer is: 2,200

Question 10 Rabee Manufacturing Company has two departments, A and B. Department A manufactures the Part A. Department B

Correct processes the Part A into the final goods. No inventories exist in either department at the beginning or end of 2020.

Mark 3.00 out of During the year, Department A produced 80,000 kgs. of Part A at a cost of P800,000. All the Part A's were transferred to

3.00 Department B where additional operating costs of P5 per kg. were incurred. The finished goods was sold for P3,000,000.

Determine the gross profit for Department A if the transfer price is P8 per kg.

Answer: (160,000)

The correct answer is: (160,000)

Question 11

The Assembly Division of Bee Company sells all of its output to the Finishing Division of the company. The only product of

Correct

the Rabee Division is Part A that are used by the Finishing Division. The retail price of the Part A is P20 per unit. Each unit

Mark 3.00 out of

completed by the Finishing Division requires four Part A's. Production quantity and cost data for 2021 are as follows:

3.00

Part A units 30,000

Direct materials P135,000

Direct labor P90,000

Factory overhead (25% is variable) P90,000

Operating expenses (20% is variable)P150,000

Compute for the transfer price for 1 unit of Part A using full cost plus 10 percent markup.

Answer: 17.05

The correct answer is: 17.05

Question 12 The Assembly Division of Bee Company sells all of its output to the Finishing Division of the company. The only product of

Correct the Rabee Division is Part A that are used by the Finishing Division. The retail price of the Part A is P20 per unit. Each unit

Mark 3.00 out of completed by the Finishing Division requires four Part A's. Production quantity and cost data for 2021 are as follows:

3.00

Part A units 30,000

Direct materials P135,000

Direct labor P90,000

Factory overhead (25% is variable) P90,000

Operating expenses (20% is variable)P150,000

Compute for the transfer price for 1 unit of Part A using market price

Answer: 20

The correct answer is: 20

Question 13

Rabee Manufacturing Company has two departments, A and B. Department A manufactures the Part A. Department B

Correct

processes the Part A into the final goods. No inventories exist in either department at the beginning or end of 2020.

Mark 3.00 out of

During the year, Department A produced 80,000 kgs. of Part A at a cost of P800,000. All the Part A's were transferred to

3.00

Department B where additional operating costs of P5 per kg. were incurred. The finished goods was sold for P3,000,000.

Determine the gross profit for the company as a whole if the transfer price is P8 per kg.

Answer: 1,800,000

The correct answer is: 1,800,000

Question 14

Global Company has two departmentss that report on a decentralized basis. Their results for 2020 were as follows:

Correct

Pencil Calculator

Mark 2.00 out of

2.00 Sales P150,000 P300,000

Income P 15,000 P 45,000

Asset base P 75,000 P150,000

Weighted average cost of capital 12% 12%

Compute for the EVA of Pencil.

Answer: 6,000

The correct answer is: 6,000

Question 15

Rabee Manufacturing Company has two departments, A and B. Department A manufactures the Part A. Department B

Correct

processes the Part A into the final goods. No inventories exist in either department at the beginning or end of 2020.

Mark 3.00 out of

During the year, Department A produced 80,000 kgs. of Part A at a cost of P800,000. All the Part A's were transferred to

3.00

Department B where additional operating costs of P5 per kg. were incurred. The finished goods was sold for P3,000,000.

Determine the gross profit for Department B if the transfer price is P12 per kg.

Answer: 1,640,000

The correct answer is: 1,640,000

Question 16

Global Company has two departmentss that report on a decentralized basis. Their results for 2020 were as follows:

Correct

Pencil Calculator

Mark 2.00 out of

2.00 Sales P150,000 P300,000

Income P 15,000 P 45,000

Asset base P 75,000 P150,000

Weighted average cost of capital 12% 12%

Compute for the Residual Income for Pencil if the desired rate of return is 20%.

Answer: 0

The correct answer is: 0

Question 17

The Assembly Division of Bee Company sells all of its output to the Finishing Division of the company. The only product of

Correct

the Rabee Division is Part A that are used by the Finishing Division. The retail price of the Part A is P20 per unit. Each unit

Mark 3.00 out of

completed by the Finishing Division requires four Part A's. Production quantity and cost data for 2021 are as follows:

3.00

Part A units 30,000

Direct materials P135,000

Direct labor P90,000

Factory overhead (25% is variable) P90,000

Operating expenses (20% is variable)P150,000

Compute for the transfer price for 1 unit of Part A using variable product costs plus a fixed fee of 20 percent.

Answer: 9.90

The correct answer is: 9.90

Question 18

Jerbee Incorporated sells a product for P400 per unit. The market share of the product is twenty two percent of the units

Correct

sold. The marketing manager feels that the market share can be increased to 28 percent of the units sold with a reduction

Mark 3.00 out of in price to P340. The product is currently earning a profit of P64 per unit. The president of Jerbee Inc feels that his

3.00

company needs to maintain the same profit level per unit. The market share consists of P4,000,000 (10,000 units).

What is the target cost per unit?

Answer: 276

The correct answer is: 276

Question 19

Global Company has two departmentss that report on a decentralized basis. Their results for 2020 were as follows:

Incorrect

Pencil Calculator

Mark 0.00 out of

2.00 Sales P150,000 P300,000

Income P 15,000 P 45,000

Asset base P 75,000 P150,000

Weighted average cost of capital 12% 12%

Compute for the EVA of Calculator.

Answer: 27,000

The correct answer is: 2

Question 20

The Assembly Division of Bee Company sells all of its output to the Finishing Division of the company. The only product of

Correct

the Rabee Division is Part A that are used by the Finishing Division. The retail price of the Part A is P20 per unit. Each unit

Mark 3.00 out of

completed by the Finishing Division requires four Part A's. Production quantity and cost data for 2021 are as follows:

3.00

Part A units 30,000

Direct materials P135,000

Direct labor P90,000

Factory overhead (25% is variable) P90,000

Operating expenses (20% is variable)P150,000

Compute for the transfer price for 1 unit of Part A using full cost plus 20 percent markup.

Answer: 12.60

The correct answer is: 12.60

Question 21

Global Company has two departmentss that report on a decentralized basis. Their results for 2020 were as follows:

Correct

Pencil Calculator

Mark 2.00 out of

2.00 Sales P150,000 P300,000

Income P 15,000 P 45,000

Asset base P 75,000 P150,000

Weighted average cost of capital 12% 12%

Compute for the Return on Investment of Calculator.

Answer: 30%

The correct answer is: 30%

Question 22

Global Company has two departmentss that report on a decentralized basis. Their results for 2020 were as follows:

Correct

Pencil Calculator

Mark 2.00 out of

2.00 Sales P150,000 P300,000

Income P 15,000 P 45,000

Asset base P 75,000 P150,000

Weighted average cost of capital 12% 12%

Compute for the margin of Pencil Division.

Answer: 10%

The correct answer is: 10%

Question 23 The Part B Division of Furbee Company has just revised its actual cost data for 2020. Part B Division transfers goods to the

Correct Finishing Division. Finishing Division can buy the same parts in the open market for P122 each. Part B division's new cost

Mark 5.00 out of data are as follows:

5.00

Direct materials P40

Direct labor 30

Variable overhead 10

Fixed overhead 16

Variable selling expenses 6

Fixed selling and administrative expenses 12

Total costs P114

Desired return 20

Sales price P134

Current production is 200,000 units, and the Part B Division has a capacity of 300,000 units.

What is the lowest price the Part B Division should charge for the internal transfers of its goods?

Answer: 86

The correct answer is: 86

Question 24

Jerbee Incorporated sells a product for P400 per unit. The market share of the product is twenty two percent of the units

Correct

sold. The marketing manager feels that the market share can be increased to 28 percent of the units sold with a reduction

Mark 3.00 out of

in price to P340. The product is currently earning a profit of P64 per unit. The president of Jerbee Inc feels that his

3.00

company needs to maintain the same profit level per unit. The market share consists of P4,000,000 (10,000 units).

What is the original cost per unit?

Answer: 336

The correct answer is: 336

Question 25

Jerbee Incorporated sells a product for P400 per unit. The market share of the product is twenty two percent of the units

Correct

sold. The marketing manager feels that the market share can be increased to 28 percent of the units sold with a reduction

Mark 3.00 out of

in price to P340. The product is currently earning a profit of P64 per unit. The president of Jerbee Inc feels that his

3.00

company needs to maintain the same profit level per unit. The market share consists of P4,000,000 (10,000 units).

What is the target price per unit?

Answer: 340

The correct answer is: 340

Question 26

Global Company has two departmentss that report on a decentralized basis. Their results for 2020 were as follows:

Correct

Pencil Calculator

Mark 2.00 out of

2.00 Sales P150,000 P300,000

Income P 15,000 P 45,000

Asset base P 75,000 P150,000

Weighted average cost of capital 12% 12%

Compute for the margin of Calculator Division.

Answer: 15%

The correct answer is: 15%

Question 27

Rabee Manufacturing Company has two departments, A and B. Department A manufactures the Part A. Department B

Correct

processes the Part A into the final goods. No inventories exist in either department at the beginning or end of 2020.

Mark 3.00 out of During the year, Department A produced 80,000 kgs. of Part A at a cost of P800,000. All the Part A's were transferred to

3.00

Department B where additional operating costs of P5 per kg. were incurred. The finished goods was sold for P3,000,000.

Determine the gross profit for Department B if the transfer price is P8 per kg.

Answer: 1,960,000

The correct answer is: 1,960,000

◄ Answers to Strategic Cost Management Assignment

Jump to... Activity-Based Management PDF ►

You might also like

- Ashrae 15-2022 (Packaged Standard 34-2022)Document5 pagesAshrae 15-2022 (Packaged Standard 34-2022)rpercorNo ratings yet

- Managing Successful Projects with PRINCE2 2009 EditionFrom EverandManaging Successful Projects with PRINCE2 2009 EditionRating: 4 out of 5 stars4/5 (3)

- Results For Item 2Document26 pagesResults For Item 2Kath LeynesNo ratings yet

- CPAR87 Final PB - AFARDocument15 pagesCPAR87 Final PB - AFARLJ AggabaoNo ratings yet

- Handout ManAcc2 PDFDocument16 pagesHandout ManAcc2 PDFmobylay0% (1)

- Lucifer LitanyDocument1 pageLucifer LitanySpyros SoapNo ratings yet

- Ga HistoryDocument11 pagesGa HistoryjoshcottNo ratings yet

- BWT Septron Line 31-61 Rev01!08!05-18 Opm enDocument56 pagesBWT Septron Line 31-61 Rev01!08!05-18 Opm enDavide Grioni100% (1)

- Siren BS1 - Rev-E PDFDocument2 pagesSiren BS1 - Rev-E PDFConstantin Gurzu0% (1)

- 1.3 Responsibility Accounting Problems AnswersDocument5 pages1.3 Responsibility Accounting Problems AnswersAsnarizah PakinsonNo ratings yet

- 1.3 Responsibility Accounting Problems AnswersDocument5 pages1.3 Responsibility Accounting Problems AnswersAsnarizah PakinsonNo ratings yet

- 3 Mas Answer KeyDocument25 pages3 Mas Answer KeyAngelie0% (1)

- 3 - Discussion - Joint Products and ByproductsDocument2 pages3 - Discussion - Joint Products and ByproductsCharles TuazonNo ratings yet

- Answer Key Long Quiz - CVP AnalysisDocument10 pagesAnswer Key Long Quiz - CVP AnalysistanginamotalagaNo ratings yet

- Major Quiz #2Document10 pagesMajor Quiz #2jsus22No ratings yet

- Reviewer Strat CostDocument20 pagesReviewer Strat CostMiriam Ubaldo DanielNo ratings yet

- 0505 MAS PreweekDocument46 pages0505 MAS PreweekJulius Antonio GopitaNo ratings yet

- AFAR Preboards MergedDocument112 pagesAFAR Preboards Mergedpajarillagavincent15No ratings yet

- Final Preboard - AFAR-with AnswersDocument12 pagesFinal Preboard - AFAR-with AnswersLuiNo ratings yet

- ReviewerDocument6 pagesReviewerSamuel FerolinoNo ratings yet

- Equired Answer Each of The Following Questions IndependentlyDocument2 pagesEquired Answer Each of The Following Questions IndependentlyJan Christopher CabadingNo ratings yet

- AFAR Self Test - 9003Document6 pagesAFAR Self Test - 9003King MercadoNo ratings yet

- Advanced Financial Accounting and Reporting Preweek LectureDocument19 pagesAdvanced Financial Accounting and Reporting Preweek LectureVanessa Anne Acuña DavisNo ratings yet

- Ma1 Sfe KaDocument6 pagesMa1 Sfe KaMarc MagbalonNo ratings yet

- Problem A. PORT HYIR Manufacturing Company Using Process Costing To Account For ItsDocument3 pagesProblem A. PORT HYIR Manufacturing Company Using Process Costing To Account For ItsMay RamosNo ratings yet

- Strategic Cost Management Midterm Examination SY 2021-2022 FIRST SEMESTERDocument4 pagesStrategic Cost Management Midterm Examination SY 2021-2022 FIRST SEMESTERMixx MineNo ratings yet

- Afar 93 PW Selftest 1Document19 pagesAfar 93 PW Selftest 1Harold Dan AcebedoNo ratings yet

- Easy Round 1 Point Each Theory - 10 Seconds Problem - 15 SecondsDocument10 pagesEasy Round 1 Point Each Theory - 10 Seconds Problem - 15 Secondsby ScribdNo ratings yet

- Additional Data For The Period Were ProvidedDocument3 pagesAdditional Data For The Period Were Providedmoncarla lagon100% (1)

- Cost Accounting - 2 2020Document5 pagesCost Accounting - 2 2020Shone Philips ThomasNo ratings yet

- Multiple Choice Questions - PROBLEMS Provide Your Solutions: Commented (1) : BDocument2 pagesMultiple Choice Questions - PROBLEMS Provide Your Solutions: Commented (1) : BSittie Sarah BangonNo ratings yet

- Break Even Analysis PDFDocument5 pagesBreak Even Analysis PDFJohnpaul Maranan de GuzmanNo ratings yet

- Pract 2, March 2010Document8 pagesPract 2, March 2010jjjjjjjjjjjjjjjNo ratings yet

- CVP Analysis 2Document8 pagesCVP Analysis 2Gennelyn Grace PenaredondoNo ratings yet

- ACC20020 Management - Accounting Exam - 15-16-2Document11 pagesACC20020 Management - Accounting Exam - 15-16-2Anonymous qRU8qVNo ratings yet

- Final Exam Answers BudgetsDocument11 pagesFinal Exam Answers BudgetsScribdTranslationsNo ratings yet

- Costs and Cost ConceptsDocument4 pagesCosts and Cost ConceptsGhaill CruzNo ratings yet

- Hayogon - Lessons 4 8 and 9 - AccountingDocument19 pagesHayogon - Lessons 4 8 and 9 - AccountingRobert DomingoNo ratings yet

- 1 Cost Volume Profit AnalysisDocument4 pages1 Cost Volume Profit AnalysisGreta BassettiNo ratings yet

- Management Advisory Services - Final RoundDocument14 pagesManagement Advisory Services - Final RoundRyan Christian M. CoralNo ratings yet

- MS-1stPB 10.22Document12 pagesMS-1stPB 10.22Harold Dan Acebedo0% (1)

- Exercise Topic 4Document7 pagesExercise Topic 4jr ylvsNo ratings yet

- 08 Unit, Job & Batch CostingDocument12 pages08 Unit, Job & Batch Costingnsm2zmvnbbNo ratings yet

- Quiz-3 Cost2 BSA4Document7 pagesQuiz-3 Cost2 BSA4Jessa HerreraNo ratings yet

- Exercises CVP AnalysisDocument2 pagesExercises CVP AnalysisMeeka CalimagNo ratings yet

- Reviewer in Financial MarketDocument6 pagesReviewer in Financial MarketPheobelyn EndingNo ratings yet

- College of Business Education PR 4 Management Advisory Services Diagnostic ExamDocument6 pagesCollege of Business Education PR 4 Management Advisory Services Diagnostic ExamMendoza Ron NixonNo ratings yet

- Intermediate Acctg 1 - Inventories13Document3 pagesIntermediate Acctg 1 - Inventories13GraceNo ratings yet

- Lesson 2: Absorption and Variable Costing: Management 9 Review Questions Multiple ChoiceDocument4 pagesLesson 2: Absorption and Variable Costing: Management 9 Review Questions Multiple Choiceandrea0% (1)

- JointDocument12 pagesJointacidoleannamaeNo ratings yet

- Midterm Exam - BSAIS 2ADocument6 pagesMidterm Exam - BSAIS 2AMarilou DomingoNo ratings yet

- BBDocument3 pagesBBJoshua WacanganNo ratings yet

- KTQTDocument8 pagesKTQTKhánh ĐoanNo ratings yet

- Strat Cost QuesDocument6 pagesStrat Cost QuesJasmineNo ratings yet

- MT Exam - Strategic Cost ManagementDocument8 pagesMT Exam - Strategic Cost ManagementMarilou DomingoNo ratings yet

- Cost Accounting Midterm ExamDocument37 pagesCost Accounting Midterm Examshynebright.phNo ratings yet

- 1007 (RA, SR and TP)Document6 pages1007 (RA, SR and TP)Neil Ryan CatagaNo ratings yet

- 673 Quirino Highway, San Bartolome, Novaliches, Quezon CityDocument4 pages673 Quirino Highway, San Bartolome, Novaliches, Quezon CityRodolfo ManalacNo ratings yet

- Bcom 5 Sem Cost Accounting 1 22100106 Jan 2022Document4 pagesBcom 5 Sem Cost Accounting 1 22100106 Jan 2022Internet 223No ratings yet

- Suggested Answer of November 2019 ExamDocument21 pagesSuggested Answer of November 2019 ExamRakshitha VarshaNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- Midterm ExaminationDocument32 pagesMidterm ExaminationAboud Hawrechz MacalilayNo ratings yet

- Assessment 1Document12 pagesAssessment 1Aboud Hawrechz MacalilayNo ratings yet

- Assessment 4 PDFDocument10 pagesAssessment 4 PDFAboud Hawrechz MacalilayNo ratings yet

- Assessment 2 PDFDocument6 pagesAssessment 2 PDFAboud Hawrechz MacalilayNo ratings yet

- Screening and Assessment LDDocument63 pagesScreening and Assessment LDalhati63No ratings yet

- '21 Kona Bicycles Owner's Manual PDFDocument46 pages'21 Kona Bicycles Owner's Manual PDFInsight PeruNo ratings yet

- Western CSSFORUM MergedDocument44 pagesWestern CSSFORUM MergedRana Umar HayyatNo ratings yet

- BUET Prospectus CIVILDocument111 pagesBUET Prospectus CIVILMashrur AbidNo ratings yet

- Blasting BrochureDocument8 pagesBlasting BrochureMuhammad SyiardyNo ratings yet

- Presentation Geotextile (November 2010)Document22 pagesPresentation Geotextile (November 2010)Gizachew ZelekeNo ratings yet

- Not All Mineral Oils Are Equal Exploring The History and Tech Behind Mineral Insulating OilsDocument6 pagesNot All Mineral Oils Are Equal Exploring The History and Tech Behind Mineral Insulating OilsJicheng PiaoNo ratings yet

- Cbet Curriculum RegulationsDocument15 pagesCbet Curriculum RegulationsCharles OndiekiNo ratings yet

- Result Awaited FormDocument1 pageResult Awaited FormRoshan kumar sahu100% (1)

- English Project QuestionsDocument3 pagesEnglish Project Questionsharshitachhabria18No ratings yet

- Fortran CF DDocument160 pagesFortran CF DLahcen AkerkouchNo ratings yet

- MBD Final Exam 2019 Model Answer PDFDocument2 pagesMBD Final Exam 2019 Model Answer PDFMina ZakariaNo ratings yet

- NEW Fees Record 2010-11Document934 pagesNEW Fees Record 2010-11manojchouhan2014No ratings yet

- Johns Hopkins RFPDocument7 pagesJohns Hopkins RFPLucky 77No ratings yet

- What Is The Substation Automation System (SAS) and What You MUST Know About ItDocument24 pagesWhat Is The Substation Automation System (SAS) and What You MUST Know About Itዛላው መናNo ratings yet

- Types of TournamentDocument22 pagesTypes of TournamentROSALYNN MATANo ratings yet

- LESSON 3: Talk About Your Weekend or Holiday Plan Using VerbsDocument3 pagesLESSON 3: Talk About Your Weekend or Holiday Plan Using VerbsjoannaNo ratings yet

- Apostolic Fathers II 1917 LAKEDocument410 pagesApostolic Fathers II 1917 LAKEpolonia91No ratings yet

- Group 112-111 My Daily RoutineDocument9 pagesGroup 112-111 My Daily Routineapi-306090241No ratings yet

- Charles Spurgeon Scriptural IndexDocument59 pagesCharles Spurgeon Scriptural IndexjohndagheNo ratings yet

- I) Height of Retaining Wall H: Preliminary DataDocument10 pagesI) Height of Retaining Wall H: Preliminary DataOmPrakashNo ratings yet

- Guidelines and Fundamental Considerations For Axle BalancingDocument40 pagesGuidelines and Fundamental Considerations For Axle BalancingAnonymous PVXBGg9TNo ratings yet

- Verifier 300 LCDocument2 pagesVerifier 300 LCDarcantorNo ratings yet

- Electronics and Communication Engineering (EC) - 21.03.18Document1 pageElectronics and Communication Engineering (EC) - 21.03.18Dishani LahiriNo ratings yet

- Sep2 Meterview: Energy Measurement and ManagementDocument2 pagesSep2 Meterview: Energy Measurement and ManagementAdil HameedNo ratings yet