Professional Documents

Culture Documents

Anomalies in Finance - What Are They and What Are They Good For

Anomalies in Finance - What Are They and What Are They Good For

Uploaded by

Trần Mai HươngOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Anomalies in Finance - What Are They and What Are They Good For

Anomalies in Finance - What Are They and What Are They Good For

Uploaded by

Trần Mai HươngCopyright:

Available Formats

International Review of Financial Analysis 10 (2001) 407 429

Anomalies in finance What are they and what are they good for?

George M. Frankfurtera,*, Elton G. McGounb,1

a

Lloyd F. Collete Professor Emeritus, Louisiana State University, Destin, FL, 32550, USA b Department of Management, Bucknell University, Lewisburg, PA 17837, USA

Abstract In the natural sciences, anomalies contribute significantly to the development of new and ultimately more successful theories. The role of anomalies in financial economics, however, has been quite different. Although at the beginning, the word was used to show deviations from the Efficient Markets Hypothesis (EMH)/Capital Asset Pricing Model (CAPM) paradigm, lately, it has been applied to a new literature that is also more accurately called Behavioral Finance (BF). This paper argues that this misuse and misapplication of the word anomaly is not a simple coincidence. It is rather a sophisticated and accordant effort to imply that although there are some unresolved deviations from the norm, the reigning paradigm is irreplaceable, and its validity needs no empirical proof. In fact, an alternative paradigm such as BF is not only insignificant but also unnecessary and even impossible. D 2001 Elsevier Science Inc. All rights reserved.

JEL classification: G00 Keywords: Anomaly; Methodology; Behavioral finance; Financial economics

1. Introduction The word anomaly has gained both prominence and broadening use in that branch of economics that is commonly referred to as financial, having become the standard label for a flourishing and ever-expanding literature. Specifically, the word refers to a compendium of

* Corresponding author. Tel.: +1-850-654-5250; fax: +1-850-654-5250. E-mail addresses: pitypalaty@netscape.net (G.M. Frankfurter), mcgoun@bucknell.edu (E.G. McGoun). 1 Tel.: + 1-570-577-3732; fax: + 1-570-577-1338. 1057-5219/01/$ see front matter D 2001 Elsevier Science Inc. All rights reserved. PII: S 1 0 5 7 - 5 2 1 9 ( 0 1 ) 0 0 0 6 1 - 8

408

G.M. Frankfurter, E.G. McGoun / International Review of Financial Analysis 10 (2001) 407429

studies that shows evidence contrary to the empirical validity of the Efficient Markets Hypothesis (EMH, subsequently) of Fama (1965, 1970) and/or the Capital Asset Pricing Model (CAPM, subsequently) of Black (1972), Lintner (1965), Sharpe (1964), and others. In a recent paper, Fama (1998) implies that what is known today as Behavioral Finance (BF, subsequently) is, in fact, the anomalies literature. The objective of this paper is to show that this misuse and misapplication of the word anomaly is not a simple coincidence. It is rather a sophisticated and accordant effort to imply that although there are some unresolved deviations from the norm, the EMH/CAPM combination is irreplaceable, and its validity needs no empirical proof. In fact, an alternative paradigm such as BF is not only insignificant but also unnecessary and even impossible. Fama (1998) does not stop short of arguing that only an alternative proven with much more binding rigor can replace the EMH as a paradigm. If this claim is taken seriously, then, anomalies or not, the EMH is for all practical purposes immunized against any possibility of rejection. This is so, because the existence of the EMH has itself never been proven with any rigor, it having had to make do with circumstantial and indirect statistical evidence. Famas (1998) paper is a landmark with respect to another consideration as well. This is the first time that the advocates of the EMH/CAPM2 have found it necessary to defend so rigorously their paradigm against another paradigm that shows more promise of coping with the continuing onslaught of anomalous results, in essence, against what they call BF. In earlier defenses of the EMH such as Ball (1996), anomalies were recognized but not taken too seriously.3 The way we see it, the anomaly imbroglio has two dimensions: 1. Whether there is any significance to finances current misuse of the term other than misunderstanding the underlying philosophy of science. 2. What the role of anomalies ought to be in the growth of scientific knowledge and in the understanding of the financial world. These two dimensions may not be totally independent of each other, which raises the question of how researchers should deal with a situation that might, in fact, be more harmful than one would imagine at first look. Consistent with the objective stated above, then, the following section deals with the general thesis of what anomalies are in the philosophy of science, specifically in the sociology of science approach of Thomas Kuhn, who introduced the term in its philosophical sense. In the natural sciences, anomalies contribute significantly to the development of new and ultimately more successful theories. Although the disinclination to accept new theories is never trivial, eventually, usually with the help of better instruments of measurement, resentment is overcome via the triumph of empirical evidence over ideology.

Fama argues that the two are inseparably linked together. In this paper, Ball argues that he was the first to find an anomaly in the finance paradigm and to use the term as Kuhn (1970) used it. We will not consider the first claim here, but the second will be addressed in the history of the use of the term in Section 3.

3 2

G.M. Frankfurter, E.G. McGoun / International Review of Financial Analysis 10 (2001) 407429

409

The role of anomalies in financial economics, however, has been quite different. In Section 3, we document and evaluate the use of the word in the contemporary finance literature. Although at the beginning, the word was used to show deviations from the EMH/ CAPM paradigm, lately, it has been applied to a new literature that is also more accurately called BF. BF is work that questions some of the key behavioral assumptions of traditional (also known as modern) finance. One consequence of this challenge is a rejection of the EMH/CAPM. Although the methods of analysis of BF so far have remained the same as those of modern finance, and its empirical domain is the same price/volume data, which modern finance has mined for years, its findings jeopardize the ruling paradigm and perhaps provide an opening toward a new way of thinking about financial phenomena. Section 4 of the paper is about how observed phenomena become anomalies in financial economics and what role they are playing in the process of discovery (search for truth). We will argue that for an empirical finding to become an unexplainable occurrence in finance; that is, an anomaly, it has to go against the grain of the explicit and implicit axioms and assumptions that together constitute the framework of the paradigm in which the phenomenon is recognized. This fact has two important consequences: 1. It immunizes the broadly accepted paradigm from being replaced. 2. More importantly, it circumscribes the ontology (what is to be known) of the field within rigid boundaries. The second point constitutes an almost insurmountable roadblock in the development of new and more comprehensive theories, because it sets out fairly specifically the phenomena that are worth studying. In Section 5, we offer our conclusions and express our hope that, somehow, the profession is going to reconsider its ways of thinking and talking about itself.

2. What are anomalies? The word anomaly has been associated with scientific and technological matters from the very beginning of its use. Of its two general definitions, the first in The Oxford English Dictionary (1989) is unevenness, inequality, of condition, motion, etc. (first used in this sense in 1581: The excess whereby the Semidiameter of the Ringe or Cornice of the Head dooth exceed the Cornice of the Coyle [of cannon] I call the Anomalye.). The second general definition is irregularity, deviation from the common order, exceptional condition or circumstance (first used in this sense in 1664: To admire Natures Anomaly . . . in the number of Eyes, which she has given to several Animals), and more specifically in the natural sciences, deviation from the natural order (first used in this sense in 1646: They confound the generation of perfect animals with imperfect . . . and erect anomalies, disturbing the lawes of Nature.). All other definitions in the dictionary apply to specific disciplines, the word being used in grammar (1612), astronomy (1669), music (1830), meteorology (1853), and geography (1924).

410

G.M. Frankfurter, E.G. McGoun / International Review of Financial Analysis 10 (2001) 407429

The use of the word anomaly in financial economics literally focuses on the second definition; that is, an irregularity, a deviation from the common or natural order, or an exceptional condition. Of course, we must ask what it is that is regular, common, natural, or unexceptional by which we identify an anomaly. In his famous work, The Structure of Scientific Revolutions, Thomas Kuhn (1970) supplies us with one answer:

Discovery commences with the awareness of anomaly, i.e., with the recognition that nature has somehow violated the paradigm-induced expectations that govern normal science. It then continues with a more or less extended exploration of the area of anomaly. And it closes only when the paradigm theory has been adjusted so that the anomalous has become the expected (Kuhn, 1970, p. 52).

Therefore, an anomaly exists in opposition to a paradigm, which Kuhn elsewhere in his essay introduces thus:

In this essay, normal science means research firmly based upon one or more past scientific achievements, achievements that some particular scientific community acknowledges for a time as supplying the foundation for its further practice . . .. Achievements that share these two characteristics4 I shall henceforth refer to as paradigms, a term that relates closely to normal science (Kuhn, 1970, p. 10).

A few observations are in order here. First, Kuhn does not introduce the term anomaly until p. 52 of his essay, and when he does, he does not enclose it within single quotations as he does with the terms normal science and paradigm when he introduces them. This implies that he has simply chosen what he feels is the appropriate word to say what he means to say and does not intend to give it any new or special meaning. As we have seen from The Oxford English Dictionary, his use of anomaly is perfectly consistent with the meanings it has had for over 400 years, and before using the word anomaly, he refers to fundamental novelties of fact, new and unsuspected phenomena, and surprises, which are apparently synonymous terms and phrases. Also interesting is Kuhns distinction between anomalies and puzzles, another word that is not introduced in single quotation marks.

Puzzles are, in the entirely standard meaning here employed, that special category of problems that can serve to test ingenuity or skill in solution . . .. It is no criterion of goodness in a puzzle that its outcome be intrinsically interesting or important . . .. Though intrinsic value is no criterion for a puzzle, the assured existence of a solution is . . .. A paradigm can, for that matter, even insulate the community from those socially important problems that are not reducible to the puzzle form, because they cannot be stated in terms of the conceptual and instrumental tools the paradigm supplies (Kuhn, 1970, p. 36).

According to Kuhn, the two characteristics are:

[1] Their achievement was sufficiently unprecedented to attract an enduring group of adherents away from competing modes of scientific activity. [2] Simultaneously, it was sufficiently open-ended to leave all sorts of problems for the redefined group of practitioners to resolve (Kuhn, 1970, p. 10).

G.M. Frankfurter, E.G. McGoun / International Review of Financial Analysis 10 (2001) 407429

411

It is during puzzle solving that anomalies appear, thereby potentially precipitating a crisis, although it is interesting that in making this important point, Kuhn does not use the word anomaly.

Because it demands large-scale paradigm destruction and major shifts in the problems and techniques of normal science, the emergence of new theories is generally preceded by a period of pronounced professional insecurity. As one might expect, that insecurity is generated by the persistent failure of the puzzles of normal science to come out as they should (Kuhn, 1970, p. 67).

In another article written at the same time as The Structure of Scientific Revolutions, Kuhn (1977a) makes a point concerning anomalies that is missing from the more famous work.

Whatever the level of genius available to observe them, anomalies do not emerge from the normal course of scientific research until both instruments and concepts have developed to make their emergence likely and to make the anomaly which results recognizable as a violation of expectations. [Continuing in a footnote] . . . the conditions which make the emergence of anomaly likely and those which make anomaly recognizable are to a very great extent the same (Kuhn, 1977a, p. 173).

This makes it sound as if anomalies are not just contrary results that appear in the course of normal Popperian attempts at empirical falsification of a theory, hypothesis, or model, during which testing disconfirming evidence may be unwelcome but hardly unexpected. Rather, they are indeed fundamental novelties of fact, new and unsuspected phenomena, and surprises that pop up later when new data permit new tests. And thereafter they persist.

Anomalies, by definition, exist only with respect to firmly established expectations. Experiments can create a crisis by consistently going wrong only for a group that has previously experienced everythings seeming to go right (Kuhn, 1977b, p. 221).

The usual response to anomalies is, not unsurprisingly, denial.

Let us then assume that crises are a necessary precondition for the emergence of novel theories and ask next how scientists respond to their existence. Part of the answer, as obvious as it is important, can be discovered by noting first what scientists never do when confronted by even severe and prolonged anomalies. Though they may begin to lose faith and then to consider alternatives, they do not renounce the paradigm that has led them into crisis. They do not, that is, treat anomalies as counter-instances, though in the vocabulary of philosophy of science that is what they are (Kuhn, 1970, p. 77).

Not all anomalies, however, precipitate crises that lead to significant changes in the paradigm. However, anomalies do demand that some sort of action eventually be taken to address them, and they often point out the most fruitful directions for future research (Kuhn, 1977b).

During the course of his career, every natural scientist again and again notices and passes by qualitative and quantitative anomalies that just conceivably might, if pursued, have resulted in fundamental discovery . . .. But anomalies are not always dismissed, and of course they should not be . . .. [The] discrepancy will probably vanish through an adjustment of theory or apparatus; as we have seen, few anomalies resist persistent effort for very long. But it may

412

G.M. Frankfurter, E.G. McGoun / International Review of Financial Analysis 10 (2001) 407429

resist, and, if it does, we may have the beginning of a crisis or abnormal situation (Kuhn, 1977b, p. 202).

The quotations from Kuhn we have selected for this paper express our best understanding of what he means by the term anomaly. We must admit, however, that Kuhn is not at all clear on when an experiment has uncovered an anomaly and when it has simply not turned out as a scientist thought it should turn out. This is a very important question that he never explicitly resolves. Are all experimental results that are contrary to theoretical expectations anomalies, or are anomalies something special, which begin to turn up when previously successful theories begin to be tested with better instruments and/or better data? For the most part, Kuhn reserves the word anomaly for something special, but in the preceding quotation and in the following quotation, he does seem to say that all discrepancies in experimental results are anomalies.

How, then, to return to the initial question, do scientists respond to the awareness of an anomaly in the fit between theory and nature? What has just been said indicates that even a discrepancy unaccountably larger than that experienced in other applications of the theory need not draw any very profound response. There are always some discrepancies. Even the most stubborn ones usually respond at last to normal practices. Very often scientists are willing to wait, particularly if there are many problems available in other parts of the field (Kuhn, 1970, p. 81).

Assuming that not all discrepancies are really anomalies, it can never be immediately clear which unexpected results or discrepancies are, in fact, anomalies and which are not. Lakatos (1970) and Lightman and Gingerich (1991) even argue that at least certain anomalies are not recognized as such until they have been explained by a new theory or within a new paradigm.5 This is certainly consistent with Kuhn, whose use of the word largely implies that anomalies must in some way be detrimental to the current paradigm or else they would simply be unsolved puzzles within it. Recall that according to Kuhn, the first response of scientists is to deny anomalies and not treat them as counter-instances, though in the vocabulary of philosophy of science that is what they are. What this means is that calling a fundamental novelty of fact, a new and unsuspected phenomenon, or a surprise an anomaly, with full knowledge of what the term means in the philosophy of science, is in effect an admission that the current paradigm at least needs serious attention if not to be replaced entirely with another. As we have already noted, Kuhn is not perfectly clear on how to identify an anomaly, so we cannot blame anyone for not knowing exactly how and when to use the term. Lakatos (1970) even criticizes the extreme point of view of those who he refers to as naive falsificationists:

They do not believe that there is a relevant difference between anomalies and crucial counterevidence. For them, anomaly is a dishonest euphemism for counterevidence (Lakatos 1970, p. 120).

The lethal nature of some others can be recognized immediately without a new paradigm.

G.M. Frankfurter, E.G. McGoun / International Review of Financial Analysis 10 (2001) 407429

413

What this all seems to mean is that experiments can go wrong (yield unexpected results in light of the theory being tested) for three reasons: (1) there is some sort of discrepancy, which can be resolved within the current theory/paradigm with better experimental procedures; (2) there is an anomaly or counter-instance, which will at least require a significant reworking of the theory/paradigm; (3) there is a sufficiently serious anomaly or crucial counter-instance, which will require abandonment and replacement of the theory/paradigm. One last aspect of Kuhn that finance has frequently drawn upon to sustain the EMH/ CAPM is his view concerning this abandonment and replacement of a paradigm.

Once a first paradigm through which to view nature has been found, there is no such thing as research in the absence of any paradigm. To reject one paradigm without simultaneously substituting another is to reject science itself (Kuhn, 1970, p. 79).

We must keep in mind, however, that, here, Kuhn is speaking descriptively and not prescriptively. The reason we have to replace a theory or paradigm with another is not because science necessarily progresses with a succession of better and better theories or paradigms, but because it is not possible to do science without one.

. . . once it has achieved the status of paradigm, a scientific theory is declared invalid only if an alternate candidate is available to take its place. No process yet disclosed by the historical study of scientific development at all resembles the methodological stereotype of falsification by direct comparison with nature . . .. The decision to reject one paradigm is always simultaneously the decision to accept another, and the judgement leading to that decision involves the comparison of both paradigms with nature and with each other (Kuhn, 1970, p. 77).

We must also keep in mind that according to Lakatos (1970), it is naive falsificationists who assert that:

. . . in spite of hundreds of known anomalies we do not regard [a specific theory] as falsified (that is, eliminated) until we have a better one (Lakatos, 1970, p. 121).

This perfectly, and very succinctly, captures Famas (1998) argument that until BF proves itself to be better than the EMH/CAPM, it does not matter how many anomalies are discovered.

3. What are anomalies in finance? 3.1. History The efficient markets literature originated in the 1950s, developed in the 1960s, and was fully articulated as the EMH in 1970 in a famous article by Eugene Fama (1970).6 During the

6 Frankfurter and McGoun (1999) briefly survey this history with an emphasis on the use of the word efficiency.

414

G.M. Frankfurter, E.G. McGoun / International Review of Financial Analysis 10 (2001) 407429

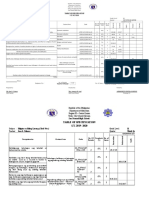

Table 1 Occurrences of words and phrases in titles and abstracts from the Economic Literature Index 1969 1999 of the American Economic Association January 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 1979 1978 1977 1976 1975 1974 1973 5 6 8 6 7 9 7 7 6 7 2 5 2 1 0 0 0 0 0 0 0 0 0 0 0 0 Weekend 0 4 4 2 4 3 5 3 3 5 8 2 1 2 3 0 1 0 1 0 0 0 0 0 0 0 Small firm 3 3 5 2 2 1 5 3 3 1 2 4 0 2 1 2 0 1 0 0 0 0 0 0 0 0 Total effects 8 13 17 10 13 13 17 13 12 13 12 11 3 5 4 2 1 1 1 0 0 0 0 0 0 0 Anomalies 15 9 16 13 12 12 12 6 6 0 4 2 6 0 1 1 0 0 0 0 2 0 0 1 0 1

1970s, the EMH was tested, using the CAPM to specify what returns should have been if the market were efficient, necessarily making such tests joint tests of both theories. A number of systematic deviations from theoretical expectations were discovered; that is, there appeared to be predictable opportunities for earning abnormal returns using rather simple trading strategies. This literature was the subject of a special issue in 1978 of the Journal of Financial Economics, in which these deviations were labeled anomalies. This marked the first significant use of the word in finance. Table 1 includes the results of a search for variations of the word anomaly in titles and abstracts in the Economic Literature Index 19691999 of the American Economic Association. According to this database, its first use in finance was in 1975 in an article by Gentry (1975) Capital Market Line Theory, Insurance Company Portfolio Performance, and Empirical Anomalies in the Quarterly Review of Economics and Business.7 Gentry, however, does not use the term in a Kuhnian sense in reference to findings which differ

7

The first use in 1973 that the literature search produced was in article published in Italian (Lotti, 1973).

G.M. Frankfurter, E.G. McGoun / International Review of Financial Analysis 10 (2001) 407429

415

from those predicted by finance theory. Rather, he uses it to refer to differences between market data and the assumptions upon which finance theory is based.8

Although the test results were positive, several anomalies emerged between the actual attributes of the data and the assumed attributes derived from market line theory (Gentry, 1975, p. 14).

Balls (1978) article in that special issue of the Journal of Financial Economics does indeed appear to have been the first to make substantial use of the word anomaly in finance in a Kuhnian sense.9 In fact, Ball makes an explicit reference to Kuhn:

It seems that the researchers position qua scientist is quite clear. There is nothing that can be done to directly verify the claims, because the perfect model of the determination of securities expected returns in equilibrium, of course, is not available. There is nothing that necessarily should be done because, as argued by Kuhn (1969 sic10), no area of normal science can justify chasing all anomaly at the expense of more fruitful research. The one proviso is that, if the anomaly is judged to be sufficiently large to hinder normal research, then it must be resolved (Ball, 1978, p. 117).

This is an accurate literal interpretation of Kuhn, but a quite inaccurate one of his spirit. It is worth repeating here a short quotation from Kuhn that we discussed in the preceding section.

Anomalies, by definition, exist only with respect to firmly established expectations. Experiments can create a crisis by consistently going wrong only for a group that has previously experienced everythings seeming to go right (Kuhn, 1977b, p. 221).

Bear in mind that the CAPM appeared in 1964 and the EMH in 1970, and that joint tests of the two were first conducted in earnest in the 1970s. At the time that Balls article was published, there was no body of empirical literature supporting everythings seeming to go right. Ball and others may have indeed had firmly established expectations in 1978 concerning the CAPM and EMH, but they could only have been ideological beliefs. By no means were they scientific results. In his introduction to the special issue, the editor, Michael Jensen (1978) views the matter slightly differently than Ball, at least early in his article.

Yet, in a manner remarkable similar to that described by Thomas Kuhn in his book, The Structure of Scientific Revolutions, we seem to be entering a stage where widely scattered and as yet incohesive evidence is arising which seems to be inconsistent with the theory. As better data become available (e.g. daily stock price data) and as our econometric sophistication increases, we are beginning to find inconsistencies that our cruder data and techniques missed in the past. It is evidence which we will not be able to ignore.

8 In Section 4, we assert that such differences are the source of anomalies, but they are not the anomalies themselves. 9 We know of at least one preceding article (Boness & Frankfurter, 1977), however, which did make use of the word anomaly in a Kuhnian sense within the article without referring to Kuhn explicitly. 10 Most scholars refer to the second expanded edition of Kuhns The Structure of Scientific Revolutions published in 1970. The first edition was published in 1962. Balls date of 1969 is incorrect.

416

G.M. Frankfurter, E.G. McGoun / International Review of Financial Analysis 10 (2001) 407429

The purpose of this special issue of the Journal of Financial Economics is to bring together a number of these scattered pieces of anomalous evidence regarding Market Efficiency. As Ball (1978) points out in his survey article: taken individually many scattered pieces of evidence on the reaction of stock prices to earnings announcements which are inconsistent with the theory dont amount to much. Yet viewed as a whole, these pieces of evidence begin to stack up in a manner which make a much stronger case for the necessity to carefully review both our acceptance of the efficient market theory and our methodological procedures. It is my hope that bringing the studies contained in this volume together in one place will help to highlight and hasten the progress of what I believe is a coming mini-revolution in the field. Focusing the attention of scholars throughout the world on these disturbing pieces of evidence will, I hope, result in the resolution of the questions they raise . . . The eventual resolution of these anomalies will result in more precise and more general theories of market efficiency and equilibrium models of the determination of asset prices under uncertainty (Jensen, 1978, p. 95).

Like Ball, Jensen implies that there is substantial body of past findings in support of the EMH that may not really have been there. Unlike Ball, however, he describes the current anomalies as evidence that we will not be able to ignore and as disturbing harbingers of a coming mini-revolution. However, this may be more a matter of marketing this issue of the journal than of his own convictions. At the conclusion of his article, he describes something that hardly qualifies as a Kuhnian revolution, even a mini one.

Unlike much of the inefficiency literature of the past, each and every one of these studies is a carefully done scientific piece. Each of the authors displays in varying degrees a commonly held allegiance to the Efficient Market Hypothesis witness the general reluctance to reject the notion of market efficiency. Viewed as a whole, however, the studies provide a powerful stimulus and serve to highlight the fact that there are inadequacies in our current state of knowledge. My reaction to this is one of excitement and enthusiasm. I have little doubt that in the next several years we will document further anomalies and begin to sort out and understand their causes. The result will not be an abandonment of the efficiency concept, nor of asset pricing models. Five years from now, however, we will as a profession have a much better understanding of these concepts than we now possess, and we will have a much more fundamental understanding of the world around us (Jensen, 1978, p. 100).

Note the marked ideological biases in this passage. According to Jensen, the previous studies challenging market efficiency were not carefully done scientific pieces, but those in this volume, done by those who have an allegiance to the EMH and a general reluctance to reject it, are. On the one hand, this may mean that we ought to trust the inefficiency findings of EMH supporters more than those of EMH critics, who obviously have their own ideological axes to grind. On the other hand, however, it may be implying that only EMH supporters are capable of doing top-notch scientific work, and only inferior researchers would not have a prior belief in the EMH. In the final paragraph, what Jensen predicts is definitely not a Kuhnian revolution of any sort; that is, that the result of research into these anomalies will be a greater understanding

G.M. Frankfurter, E.G. McGoun / International Review of Financial Analysis 10 (2001) 407429

417

of efficiency and asset pricing models. In other words, at the end of five years of research, markets will still be able to be characterized as efficient in some way or other, and we will still have mathematical asset pricing models to describe their behavior. Thus, this issue of the journal is not really about anomalies at all, but about what Kuhn called puzzles. Notice from Table 1 that the word anomaly virtually disappeared from finance again for several years after this special issue.11 For a time, the more neutral word effect was much more common. The table lists the appearance of three of the more prominent effectsthe January Effect, the Weekend Effect, and the Small Firm Effect. Anomaly was more or less revived in 1986 with an article published by Kleidon (1986) in the Journal of Business, an article which was originally presented at the 1985 Conference on Behavioral Foundations of Economic Theory at the University of Chicago and included in a 1987 compilation of the proceedings of this conference (Hogarth & Reder, 1987). Kleidon brings up Kuhn at the very beginning of his article, the main purpose of which is to assess the variance bounds literature. First, he quotes Kuhn concerning the important issue we addressed in Section 2; that is, when an observed anomaly is a serious counter-instance that precipitates a crisis that leads to a paradigmatic revolution and when it is a more minor issue. Kleidons comment following his quotation from Kuhn12 makes it clear that he considers the anomalies addressed in the variance bounds literature to be unimportant. Moreover, these are not even real anomalies, but seeming anomalies.

. . . it is likely that we will always be contending with anomalies recently generated by empirical research. Many of these will be dispelled by more refined observation, but, as in the past, some will persist and cause revisions of relevant theory. At any given time, researchers are forced to decide whether a seeming anomaly is of the formertransitorykind or presents an opportunity for viable reconstruction of theory. In financial economics, such a seeming anomaly has been generated by some recent research that challenges an underlying model, namely, that stock prices can be regarded as the present value of rationally forecasted future cash flows (Kleidon, 1987, p. 286).

11 The 1983 reference was in the Journal of Public Economics (Hamilton, 1983) and in 1984 in the Accounting Review (Foster, Olsen, & Shevlin, 1984). Neither of these is a finance journal, although the latter article concerns a finance topic. The literature search did not turn up all articles explicitly concerning anomalies in finance, however, since we know of at least two others published during this period (Keim, 1983; Reinganum, 1981). 12 This quotation is from p. 81 of The Structure of Scientific Revolutions, a portion of which we quoted in Section 2. Later in the paper, Kleidon paraphrases the question in his own words to introduce his own discussion of the subject with regard to finance and economics,

If it is true that the profession will always be faced with some anomalous differences between theory and data, when does an anomaly cease being regarded as a challenging puzzle to be solved within the current framework, to become regarded as evidence that some fundamental change in worldview is desirable? The issue revolves around the benchmark that is used to measure successful reconciliation of data with theory since what is anomalous from one viewpoint may be self-evident from another. This section examines and suggests, first, that some kinds of anomalies are more likely to lead to serious changes in the behavioral foundations of economics than others and, second, that not all subfields or models in economics are equally susceptible to changes of this nature (Kleidon, 1987, p. 304).

418

G.M. Frankfurter, E.G. McGoun / International Review of Financial Analysis 10 (2001) 407429

In fact, what Kleidon is calling an anomaly would probably not be an anomaly at all by Kuhns definition. Seeming anomaly may be a technically accurate term for what are really discrepancies, but still a misleading one. What is especially interesting and significant in Kleidons article is that after having disparaged the evidence suggesting irrational behavior in stock market pricing, he spends considerable time addressing whether the behavioral foundations of finance and economics ought to be changed or not. He turns once again to Kuhn to structure his argument.

Kuhn (1970, p. 84) suggests that, historically, there have been three responses to significant anomalies (which in his terminology produce a crisis for the affected discipline). First, what initially appeared to be anomalous may be subsequently explained within the original disciplinary framework. Second, the problem may be regarded as insoluble with the current state of knowledge and left for future generations. Third, and most relevant here, the disciplinary foundations may change so that, within the new framework, the anomaly is explained (Kleidon, 1987, p. 306).

It is worth emphasizing Kleidons parenthetical material. Kuhn would probably argue that all anomalies are significant by definition, and that if they can be explained within the original disciplinary framework, they would never be anomalies. What happens is that anomalies are initially mistaken for discrepancies and not vice versa. Following this, Kleidon (1987) specifies his criteria for a new theory. It is one that explains the original anomaly; does not destroy too much of what was known under the previous theory; provides promise for future work; and meets the same standards of explanatory rigor to which the old theory is being subjected (i.e., it does not have equally serious anomalies of its own). With respect to these criteria, he argues that the variance bounds literature has, first, failed to firmly establish that there is an anomaly and then, second, failed to meet the standards of the economic profession, which has come to expect certain standards of compatibility with assumptions found successful in other applications (such as rational expectations), specificity of modeling and prediction, and past and future empirical success (Kleidon, 1987, p. 310). Finally, it is worth quoting substantially from Kleidons conclusion, as it is has remained finances typical response to what critics regard as empirical refutation of its theories and as it includes the use of appropriate descriptive language to disparage the behavioral alternative.

The analysis in this paper suggests that the case for radical change of behavioral assumptions underlying economic models based on the results of variance bounds tests may be easily overstated. There are serious questions concerning whether the phenomenon of excess volatility exists in the first place and, if it did, whether abandonment of assumptions of rational expectations in favor of assumptions of mass psychology and fads as primary determinants of price changes is the best avenue for current research.

G.M. Frankfurter, E.G. McGoun / International Review of Financial Analysis 10 (2001) 407429

419

. . . It is still too early to tell which, if any, of these puzzles will prove incorrigible within the current framework of financial economics and consequently call the disciplinary foundations into serious question. What is clear at this stage, however, is that none of them is sufficiently well formulated to allow it to take the role of a critical experiment discussed earlier. In short, whether or not their existence eventually leads to a significantly different disciplinary framework, they do not provide a blueprint for such change (Kleidon, 1987, p. 313).

4. Discussion This sections history of finances use of the term anomalies in the sense that Kuhn introduced it into the sociology of science has necessarily been brief. However, it should be sufficient to show how it has come to have its current connotations in the discipline. The special issue of the Journal of Financial Economics in 1978, referred to above, appears to have firmly associated the word very specifically with evidence contradictory to the EMH and the CAPM. In addition, the Conference on Behavioral Foundations of Economic Theory at the University of Chicago in 1985 appears then to have firmly associated the word specifically with BF as the alternative to them. So in 1998, Fama, who was not uncoincidentally a session chair at the 1985 conference, publishes an article in the Journal of Financial Economics, again not uncoincidentally, in which BF is the anomalies literature. The extended, albeit still quite abbreviated discussion of anomalies thus far, quoting liberally from Kuhn (1970), does provide us with the essential background for evaluating the current use of the term anomaly in finance. Kuhns is likely to be one of the two methodological works that finance professors have read, or at least heard of,13 and as we have seen, their use of the term can usually be directly or indirectly attributable to him. Additionally, as Kuhn was among the first to try to elucidate how the process of science actually works, as opposed to how it is supposed to work, he provides a basis for evaluating whether what is happening in finance is normal or whether the process has been perverted in some way. Kuhn does not represent himself as having written the definitive description of how a scientific revolution is effected.

In addition, the view of science to be developed here suggests the potential fruitfulness of a number of new sorts of research, both historical and sociological. For example, the manner in which anomalies, or violations of expectation, attract the increasing attention of a scientific community needs detailed study, as does the emergence of the crises that may be induced by repeated failure to make an anomaly conform (Kuhn, 1970, p. ix).14

Thus, we certainly cannot call upon Kuhn as the definitive authority to assert that the EMH/CAPM has lived with its anomalies for far too long without having been abandoned, which it may certainly seem has occurred.

The other is Friedman (1953). Note here that by not preceding the word violations with the qualifying adjective repeated, Kuhn once again comes close to confounding the words anomaly and discrepancy.

14 13

420

G.M. Frankfurter, E.G. McGoun / International Review of Financial Analysis 10 (2001) 407429

As we have stated, most of the so-called anomalies concerning the EMH/CAPM have been known to finance from the very beginning of their testing, and in all fairness, actions have been taken to adjust the EMH/CAPM to address disconfirming evidence. So far, however, most articles concerning the issue, of which Fama (1998) is certainly an exemplar, look more like displays of mathematical virtuosity, patched up patterns of trial-and-error,15 or deliberate attempts at immunization than like the serious attention to fundamentals that is called for. For the most part, finance has belied Kuhns contention that: No crisis is, however, so hard to suppress as one that derives from a quantitative anomaly that has resisted all the usual efforts at reconciliation (Kuhn, 1970, p. 209). Perhaps this is a reflection of the fact that however hard the social sciences such as economics and finance attempt to emulate the natural sciences, their inability to subject most phenomena to controlled experimentation necessarily introduces a significant qualitative component into any quantitative work. Finance, for example, can often make no prediction stronger than that the price of something will rise under certain circumstances, as opposed to remaining unchanged or fallinga prediction that is, in fact, qualitative, although in testing the prediction, price will be quantitatively measured. As Kuhn goes on to note:

By their very nature, qualitative anomalies usually suggest ad hoc modifications of theory that will disguise them, and once these modifications have been suggested there is little way of telling whether they are good enough. An established quantitative anomaly, in contrast, usually suggests nothing except trouble (Kuhn, 1970, p. 209).

There are, however, aspects of finances use of the term anomaly that are clearly perverse. One is its limited use. Anomaly is a generic term that applies to any fundamental novelty of fact, new and unsuspected phenomenon, or surprise with regard to any theory, hypothesis, or model. Yet, the term is used exclusively in finance with reference to the EMH/CAPM. It is therefore not surprising that anomaly has become synonymous with BF, which is at present the only quasiofficially acknowledged alternative to the EMH/CAPM. Thus, BF is not just an attempt to explain the anomalies which testing the EMH/CAPM has generated, it has, in some sense, become an anomaly, in the literal sense of the word itself. For BF to be called the anomalies literature is not the same as to call it a literature that among other things is concerned with a certain set of anomalies concerning a specific piece of the modern finance paradigm. A more important perverse aspect of finances use of the term anomaly lies in the implication inherent in the word that a paradigmatic revolution, or at least substantial revision of the current paradigm, is necessary. One cannot, therefore, call a set of observations anomalies for decades without necessarily recognizing the failure of the current paradigm, as is, to explain them, not only for the time being, but permanently. So to attempt so rigorously to salvage the EMH/CAPM pretty much intact in the face of an anomaly literature is either an admittedly meaningless task or a consequence of ignorance of the underlying philosophy.

15

This description is used by Lakatos (1970).

G.M. Frankfurter, E.G. McGoun / International Review of Financial Analysis 10 (2001) 407429

421

Even if mainstream finance does not accept BF as a better alternative, it ought to be sincerely searching for one, even if it is only a modification of the current one, and this no longer seems to be happening. As finance researchers are probably not knowingly wasting their time engaged in a futile activity, it is more likely that they are methodologically (not methodically) unaware of what is going on. But then just why is it that they use this particular word anomaly so inappropriately? One reason is perhaps to make it appear as if finance has given some thought to its methodology, and not simply to its methods. However, the real reason may lie in the nonKuhnian senses of the word. Recall that an anomaly is an irregularity, deviation from the common order, exceptional condition or circumstance or a deviation from the natural order. If one looks at what is regular, common, natural, or unexceptional not as the current scientific paradigm, but as something that is a part of what might be called the natural order of things, then anomaly becomes a pejorative term applied to something not just inconsistent with a paradigm, but with a deeper underlying ideology. It follows that by referring to what the EMH/CAPM proponents find inconvenient as anomalies is a means of marginalizing or trivializing them; and calling BF the anomaly literature is a means of discrediting it. Lakatos (1970) supplies us with another explanation for the attention, which anomalies are receiving in finance in the form of an anomaly literature.

Which problems scientists working in powerful research programmes rationally choose is determined by the positive heuristic of the programme rather than by the psychologically worrying (or technologically urgent) anomalies. The anomalies are listed but shoved aside in the hope that they will turn, in due course, into corroborations of the programme. Only those scientists have to rivet their attention on anomalies who are either engaged in trial-and-error exercises or who work in a degenerating phase of a research programme when the positive heuristic has ran out of steam (Lakatos, 1970, p. 137).

In other words, the EMH/CAPM research is not moving forward, having no important or even interesting puzzles it looks as if it can solve. Instead, to keep itself occupied, it has turned around and taken on BF, which is nipping at its heels. This concludes our discussion of what the word anomaly means in a general sense and in Kuhns sociology of science sense, our review of the history of its use in finance, and our speculation about what its use may mean in finance. These issues all make up the first dimension of the anomaly imbroglio, as we described it in the Introduction. Now, we turn to the second dimension concerning what it is that finance considers being anomalies and what their roles ought to be in the growth of scientific knowledge and understanding of the financial world.

5. Where do anomalies in finance come from? What makes an empirical finding or disputation an anomaly? There must be some sort of powerful paradigm, in a Kuhnian sense or otherwise, which defines what is considered an irregularity, deviation from the common order, exceptional condition or circumstance. That

422

G.M. Frankfurter, E.G. McGoun / International Review of Financial Analysis 10 (2001) 407429

is, there must be a strong structure, ideological, religious, or other, that defines regularity, common order, normal conditions, or expected circumstance. In a meta-science such as economics, financial, or otherwise, this structure is an assemblage of axioms. De facto, axioms are just a set of assumptions that originally had a degree of verity much weaker than true axioms but which somehow became deeply entrenched in the field. Because of this entrenchment, no one questions the verisimilitude of these conjectures any longer. Thus, the word axiom is commonly defined and used as a universal, or self-evident truth, a maxim. Axioms then become the foundations of theories and thus circumvent any need to prove whether the axioms themselves are veritable. In reality, many of the axioms upon which an economic doctrine is built are nothing more than hypotheses, deriving from some basic understanding of the state of the world as perceived by the creators and propagators of a particular paradigm or as adopted by them as a matter of convenience for further theory building. In essence, most of the axioms that we take for granted are self-serving. Albert Jay Nocks observation, It is an economic axiom as old as the hills that goods and services can be paid for only with goods and services, is an example of the efforts of many economists to portray human behavior as selfish and motivated only by rewards directly translatable into monetary units, or barter. The commonly accepted rationale of economic behavior in financial economics is grounded on the paradigm of expected utility of wealth developed by Von Neuman and Morgenstern (1967) (VM, subsequently) on the foundations of the theory toward risk taking in games of chance by the Bernoullis.16 The VM paradigm is called axiomatic, because the risk-return space mapping of investment behavior of economic agents is the consequence of six axioms. Although this set of axioms had been reproduced in countless places, in the interest of convenience we briefly summarize them as they appear in Frankfurter and Phillips (1995, p. 7).

6. The Von Neumann and Morgenstern axioms Axiom 1: Comparability For any pair of investment opportunities, A and B, one of the following must be true: the investor prefers A to B, B to A, or is indifferent between A and B. Axiom 2: Transitivity If A is preferred to B, and B is preferred to C, than A is preferred to C. Axiom 3: Continuity If investment outcome A is preferred to B, and B to C, then there is some probability P such that the investor would be indifferent between the certain event B and the uncertain event { PA + (1 P)C}.

16

See Bernoulli (1954) and the summary in Maistrov (1974).

G.M. Frankfurter, E.G. McGoun / International Review of Financial Analysis 10 (2001) 407429

423

Axiom 4: Independence If an investor is indifferent between the certain outcomes A and B, and C is any other certain outcome, then he is also indifferent between the uncertain events { PA + (1 P)C} and { PB + (1 P)C}. Axiom 5: Interchangeability If an investor is indifferent between two uncorrelated risky income streams, then the securities that produce them are interchangeable in any investment strategysimple or complex. Axiom 6: Risk Aversion If securities A and B offer the same positive rate of return, R = X, with probabilities Pa and Pb, respectively, and otherwise R = 0 with probabilities (1 Pa) and (1 Pb), respectively, then A is preferred to B if Pa > Pb. Moreover, ones relative preference for A in this case is a (possibly complex) monotonic function of the relative certainty coefficient Pa/Pb (Von Neuman & Morgenstern, 1967, p. 7). Until the emergence of BF, and of the prospect theory of Kahnman and Tversky (1979) upon which BF is built, no one in finance questioned, seriously, the veracity of the VM axioms. In fact, the tome of modern finance, in excess of 60,000 scientific papers both published and presented before learned societies, is exclusively based on the VM axioms.17 Yet, all six of them are highly questionable as a mode of behavior, their implication being that investors are totally keen, penetrating and rational in calculating the numbers that are required for investment decision making. This, of course, is a mere fiction that flies in the face of a multitude of psychological studies showing human behavior to be otherwise. The emergence of what is termed today BF is a direct consequence of the realization of the sophistry of the VM axioms. Why then is there such strong adherence to these axioms18 by the practitioners of the orthodox financial economics? The answer is very simple: the axioms are the sine qua non for comprehensive model building. What is more disturbing than the explicitly stated axioms that serve as the foundation of accepted dogma (which, after all, are open to criticism if one can find a publication outlet supportive of such rebuke) are those axioms that are never explicitly stated. These comprise that set of universal truths that forms the foundations of research in which the growth of scientific knowledge of a discipline is grounded. Of the two sets of axioms, which we might

17 These axioms may be true or false as applied to a particular investor. However, to the extent that investors do calculate and are willing to acknowledge the existence of risk, the VM axioms are restrictive only with regard to the continuity assumption, which is inconsistent with Roys (1952) safety-first argument. It is hard to see how one can have Stochastic Dominance without satisfying (Axioms 1, 2, 4, and 5). Axioms 6 is explicitly assumed by Markowitz (1952), and his portfolio expectation and variance operators follow from Axioms 3. However, this, of course, is the normative model. Sharpes (1963) derivation is based on the Markowitz results, plus equilibrium restrictions that, except for the borrowing and lending have no other purpose but to make the homogeneous expectations assumption in Sharpe (1964) plausible. 18 Bear in mind that as we have stated, these are, in fact, no more than highly questionable assumptions.

424

G.M. Frankfurter, E.G. McGoun / International Review of Financial Analysis 10 (2001) 407429

call the seen and not seen, the more perilous is the latter. This is because refutation of the dogma is contingent on the validity of the unseen axioms. Since they are not seen, they are cloaked in taboo and thus shielded from questioning. Let us cite just five among the most influential of these unwritten truths. Although there are quite possibly more than these five, we think that these are the most harmful and the least conducive to the development of a new methodology of financial economics. (I) The term financial economics by and of itself. On the surface, this term seems to be a rather innocuous label for theoretical work in the field of finance, which is performed by those who are regularly called financial economists (although we have never heard of a practitioner being labeled a financial economist, instead of a financial analyst). Inherent in the label, however, is the notion that finance and economics are one and the same; or rather, that the only underlying logic of finance and the behavior of individuals, firms, nonprofit organizations, and other micro units, either alone or together, is described and prescribed by the same logic or paradigm upon which economic theory rests. We are not clear on when the term was first used in a professional paper, as our efforts to pinpoint its debut in the literature have so far been fruitless. Regardless, the term has enjoyed broad use since the first appearance of the journal that bears that name. One must be hopelessly naive not to suspect that the title of the journal, the term, and the school of thought that promote the underlying notion are closely tied. Yet, anyone who is even superficially familiar with the finance process in organizations and the financial behavior of individuals knows that decisions are often made on the basis of considerations totally contrary to economic logic that Miller (1977) in his presidential address to the American Finance Association called heuristic. More important, and highly questionable, is the notion that from the analysis of massive electronic data one can infer the motivations of individuals and firmsa notion that is anchored in the use of the term. (II) The axiom that a complicated mathematical problem can be disaggregated into its simple parts, which, in turn, can be solved individually and separately and then reaggregated to provide a solution to the complex problem. In other words, that the sum of the parts is equal to the whole. This view brings to mind the analogy that by putting two semiliterate persons together, one could obtain one literate person. Who would accept this idea? Why then do we behave as if this is the natural order of things in our theoretical developments? (III) The axiom that cultural processes such as rituals, customs, and habits can be modeled mathematically. Ernest Gellners (1993) review of In Search of a Better World: Lectures and Essays of Thirty Years by Karl R. Popper observes:

The whole point about what anthropologists call culture is that it is not optional as between various cultures. An activity inherently polluting in one society is neutral in another; an act that constitutes a solemn statusconferring ritual in one society means nothing in another; and so on. Anthropologists are concerned with describing and explaining the manner in which diverse societies construct worlds that are felt, internally, to be binding and obligatory but are, from the vantage point of intercultural space, nothing of the kind (Gellner, 1993, p. 37).

G.M. Frankfurter, E.G. McGoun / International Review of Financial Analysis 10 (2001) 407429

425

One paragraph later, Gellner argues that Popper and Wittgenstein reach a curious similarity:

. . . cultures, though variable and optional, came to constitute the only possible, but adequate, validation of our practices. This lumping together of utterly optional rituals . . . with interculturally cogent procedures (mathematics) is absurd and indefensible (Gellner, 1993, p. 38).

If one is to accept this argument as an axiom (and we are not saying that one necessarily should, although its logic in describing human behavior is quite convincing), then much of the agency theory and postagency theory literature, especially that of the market-forcorporate-control kind, must be deemed borderline absurd. Yet, we seem to prefer the mathematical explanation of social phenomena, and the more complex the explanation, the better. Our relentless quest for intricate mathematical models (to imitate physics) turns into a sort of academic joust, in which one seeks to confirm ones claim to knighthood. (IV) The axiom, that by proving one thing, we also disprove its opposite. Simply put, this is the gospel that fuels the immense (and still burgeoning) literature of event studies. By proving that randomly selected shocks do not, statistically, show up as events, we let loose several generations of researchers on the same database, who have been arguing most of the time that what does measure on a statistical scale as an event is indeed a universal occurrence. (V) The axiom that unrealistic assumptions that lead to (economically) rational conclusions can be useful in building theories (what one may call the Friedman doctrine). This says that the alternative of more realistic assumptions (assumptions that correspond to observable facts) but which do not lead to the development of theories consistent with the logic of the homo economicus and/or which are not presentable in mathematical terms is worthless. For the sake of this universal truth, we are willing to consider a limitless volume of literature that seems to generate itself for its own perpetuation, thus serving the fame and fortune of its promoters. This occurs without the slightest effort to apply some if not all the Popperian or any other philosophy of science criteria for what contributes to the growth of scientific knowledge.19 This axiom has been the basis of a mushrooming literature in which the assumption of homogeneous expectations of investors plays a cardinal role, though no academics (and certainly not finance professionals) would accept the idea that this is indeed observable human behavior. Not only do we have no understanding how expectations are formed, but also we have no mechanism to convert individual expectations into something that is communal.20 Kuhns (1970) theory is cleverly used by the few who make the pretense to care about issues of methodology to serve the purpose of the status quo. The argument that a revolution eventually will come might be consistent with historical facts, but it disregards the social and other costs incurred during the period needed for such reformation of thinking to occur. Even if the axioms that are seen are seriously challenged, what is unseen is more powerful and

19

The only exception is in Fama (1998) where one principle of Lakatos is cleverly used, out of context (see above) to immunize the EMH/CAPM against all possible refutation. 20 See Frankfurter and McGoun (1996, pp. 35 44) for a detailed critique of the Friedman Doctrine.

426

G.M. Frankfurter, E.G. McGoun / International Review of Financial Analysis 10 (2001) 407429

more inhibiting to change. Consequently, R.H. Coases (1992) seemingly optimistic contention that:

. . . a scholar must be content with the knowledge that what is false in what he says will soon be exposed and, for what is true he can count on ultimately seeing it accepted . . . (Coase, 1992, p. 719)

is clouded by his own ill-disguised skepticism: . . . if only he lives long enough. It is not difficult to see that the assumptions Sharpe (1964) and others make when they develop their CAPMs, and Famas (1965, 1970) when he created the EMH, would have never been possible without the foundation laid by the VM axioms. Just to mention such follies as the idea of homogeneous expectations and good estimates of intrinsic values with respect to the CAPM and EMH, respectively, would be sufficient to deem both irrational.21 In both theoretical and empirical work, in addition to assumptions piled on top of the axioms, there are two more problems that compound the delusion of the paradigm: 1. Some previously acknowledged assumptions upon which the new work is based, which may or may not be valid, are taken for granted and are not even mentioned. 2. The assumptions of the statistical model used to validate or reject a null hypothesis are not seriously considered or adhered to.22 Now comes any new frame of work that is basically a serious and well-deserved questioning of the axioms and indirectly of all the work of the orthodoxy. Whether it is empirical evidence about the incorrectness of the paradigm or a newly created theory such as BF, the way to proceed in the interest of growth in scientific knowledge is to let the competing rationales run their course in parallel. Instead, the promoters of accepted dogma, the guardians of the faith, try everything to discredit the emerging new way of thinking. Accordingly, reducing evidence and theory to the level of an anomaly, or just a dustbin of anomalous results, takes the fight against progress into an intellectual level that discourages new minds to join the fray. The power of language is mightier than the sword, and the elite of the old religion is very comfortable with manipulating it. It has been efficiently used for decades now.

7. Conclusion In his comments on Kleidons (1987) article, which we discussed extensively in Section 3, Robert Shiller (1987) makes the following statement:

Perhaps what we need is not something so dramatic as a scientific revolution so much as a little softening of the dogmatic adherence to the efficient markets viewpoint among people in

As the story is told in several places, Sharpes (1964) paper was originally rejected by The Journal of Finances editor on the grounds that the assumption of homogeneous expectation was called by the reviewer of the paper preposterous, and the editor fully concurred with the reviewer. 22 The most glaring is disregarding the requirement of normality of the data, which can rarely if ever be verified.

21

G.M. Frankfurter, E.G. McGoun / International Review of Financial Analysis 10 (2001) 407429

427

academe. If you look in finance journals, you will find a nearly total absence of any mention of the possibility that fashions or fads may be at work. Those who bring up such a possibility are viewed as if they were bringing up astrology or extrasensory perception. I find that, as a consequence, many people in academic finance show little indication of having thought much about how fashions or fads might affect financial markets (Shiller, 1987, p. 317).

To this, we would add that what finance really needs is a healthy infusion of the very sort of science that it portrays itself as practicing. First, it ought to be more attentive to its philosophy. It should be clear from the numerous quotations from Kuhn in this paper that he is not very precise about just what an anomaly is. However, it should be equally clear from our discussion in this paper that where finance has made reference to Kuhn, it has clearly done so in its own interests. It uses the word anomaly in what is on the whole its general sense in order to disparage what ought to be taken as serious evidence against the EMH and CAPM, and it borrows Kuhns more dismissive comments on anomalies to give the semblance of philosophical respectability to what it is doing. Second, finance ought to be more attentive to its language in general. Although it purports to be objective, it clearly uses words that are subtly dismissive of alternatives to its most cherished theories. Even finances critics contribute to their own downfall. It is not surprising that Kleidon should contrast rational expectations with mass psychology and fads. However, if Shiller expects BF ever to be taken seriously, it cannot continue to be described as advocating the relevance of fashions and fads. Of course, it is hard to imagine a term for markets that could possibly compete with efficiency, now that that term has been adopted for what previously had been not nearly so attractively referred to as a random walk. The case of the word anomaly in many ways encapsulates the current status of research in finance. Traditional finance has immunized itself from criticism by ensuring that its novices in doctoral programs receive a limited education in its own bastardized version of the philosophy of science and by clothing itself in terms that are so attractive and its opposition in terms that are so disparaging. Real progress in finance can only be achieved when such matters are recognized for what they are and critically examined.

References

Ball, R. (1978). Anomalies in relationships between securities yields and yield surrogates. Journal of Financial Economics, 6, 103 126. Ball, R. (1996). The theory of stock market efficiency: accomplishments and limitations. Journal of Financial Education, 22, 1 13. Bernoulli, D. (1954). Exposition of a new theory on the measurement of risk. Econometrica, 22, 23 36. Black, F. (1972). Capital market equilibrium with restricted borrowing. Journal of Business, 45, 444 455. Boness, A. J., & Frankfurter, G. M. (1977). Evidence of non-homogeneity of capital costs within risk-classes. Journal of Finance, 32, 755 766.

428

G.M. Frankfurter, E.G. McGoun / International Review of Financial Analysis 10 (2001) 407429

Coase, R. H. (1992). The institutional structure of production. American Economic Review, 82, 713 719. Fama, E. F. (1965). The behavior of stock market prices. Journal of Business, 38, 34 105. Fama, E. F. (1970). Efficient capital markets: a review of theory and empirical work. Journal of Finance, 25, 383 417. Fama, E. F. (1998). Market efficiency, long-term returns, and behavioral finance. Journal of Financial Economics, 49, 283 306. Foster, G., Olsen, C., & Shevlin, T. (1984). Earnings releases, anomalies, and the behavior of security returns. Accounting Review, 59, 574 603. Frankfurter, G. M., & McGoun, E. G. (1996). Toward finance with meaning the methodology of finance: what it is and what it can be. Greenwich, CT: JAI Press. Frankfurter, G. M., & McGoun, E. G. (1999). Ideology and the theory of financial economics. Journal of Economic Behavior and Organization, 39, 159 177. Frankfurter, G. M., & Phillips, E. H. (1995). Forty years of normative portfolio theory: issues, controversies and misconceptions. Greenwich, CT: JAI Press. Friedman, M. (1953). The methodology of positive economics. In: Essays in positive economics ( pp. 3 43). Chicago: University of Chicago Press. Gellner, E. (1993). The rational mystic. New Republic, 208, 35 38. Gentry, J. A. (1975). Capital market line theory, insurance company portfolio performance and empirical anomalies. Quarterly Review of Economics and Business, 15, 7 16. Hamilton, B. W. (1983). The flypaper effect and other anomalies. Journal of Public Economics, 22, 347 361. Hogarth, R. M., & Reder, M. W. (Eds.) (1987). Rational choice: the contrast between economics and psychology. Chicago: University of Chicago Press. Jensen, M. C. (1978). Some anomalous evidence regarding market efficiency. Journal of Financial Economics, 6, 95 101. Kahneman, D., & Tversky, A. (1979). Prospect theory: an analysis of decisions under risk. Econometrica, 47, 263 291. Keim, D. B. (1983). Size-related anomalies and stock market seasonality: further empirical evidence. Journal of Financial Economics, 12, 13 32. Kleidon, A. W. (1987). Anomalies in financial economics: blueprint for change? In: R. M. Hogarth, & M. W. Reder (Eds.), Rational choice: the contrast between economics and psychology ( pp. 285 315). Chicago, IL: University of Chicago Press. Kuhn, T. S. (1970). The structure of scientific revolutions. Chicago: The University of Chicago Press. Kuhn, T. S. (1977a). The function of measurement in modern physical science. The essential tension ( pp. 165 177). Chicago: University of Chicago Press. Kuhn, T. S. (1977b). The historical structure of scientific discovery. In: The essential tension ( pp. 178 224). Chicago: University of Chicago Press. Lakatos, I. (1970). Falsification and the methodology of scientific research programmes. In I. Lakatos & A. Musgrave (Eds.), Criticism and the growth of knowledge. Cambridge, UK: Cambridge University Press. Lightman, A., & Gingerich, O. (1991). When do anomalies begin? Science, 255, 690 695. Lintner, J. (1965). The valuation of risk assets and the selection of risky investments in stock portfolios and capital budgets. Review of Economics and Statistics, 47, 13 37. Lotti, E. (1973). LEccendenza Industriale: Analisi e Calcola DellIncidenza Delle Anomalie del Processo Produttivo SullEccendenza Industriale. LImpresa, 15, 245 251. Maistrov, L. E. (1974). Probability theory: a historical sketch. New York: Academic Press. Markowitz, H. M. (1952). Portfolio selection. Journal of Finance, 7, 77 91. Miller, M. H. (1977). Debt and taxes. Journal of Finance, 32, 261 275. Reinganum, M. R. (1981). Misspecification of capital asset pricing: empirical anomalies based on earnings yields and market values. Journal of Financial Economics, 9, 19 46. Roy, A. D. (1952). Safety first and the holding of assets. Econometrica, 20, 431 449. Sharpe, W. F. (1963). A simplified model for portfolio analysis. Management Science, 9, 277 293.

G.M. Frankfurter, E.G. McGoun / International Review of Financial Analysis 10 (2001) 407429

429

Sharpe, W. F. (1964). Capital asset prices: a theory of market equilibrium under condition of risk. Journal of Finance, 19, 425 442. Shiller, R. J. (1987). Comments on Miller and Kleidon. In: R. M. Hogarth, & M. W. Reder (Eds.), Rational choice: the contrast between economics and psychology ( pp. 317 321). Chicago: University of Chicago Press. The Oxford English dictionary (2nd ed.). Oxford: Clarendon Press. Von Neuman, J., & Morgenstern, O. (1967). Theory of games and economic behavior (3rd ed.). Princeton, NJ: Princeton University Press.

You might also like

- Rollo - Glamorous SorceryDocument261 pagesRollo - Glamorous SorceryHeather Freysdottir100% (2)

- Eseu Goffman-StigmaDocument9 pagesEseu Goffman-StigmaAndrei Catalin FrincuNo ratings yet

- Some Problems Falsificationism in Economics : CaldwellDocument7 pagesSome Problems Falsificationism in Economics : Caldwellsad_jrNo ratings yet

- 9-Risk Perception Psychology PDFDocument9 pages9-Risk Perception Psychology PDFSobi AfzNo ratings yet

- Financial PhysicsDocument40 pagesFinancial PhysicsArmando Salas IparrazarNo ratings yet

- MC 4 Module 5-9Document16 pagesMC 4 Module 5-9Tintin TagupaNo ratings yet

- Tinbergen1982 - The-Need-for-a-SynthesisDocument7 pagesTinbergen1982 - The-Need-for-a-SynthesisGastón Andrés CiprianoNo ratings yet

- 05-24-01 Frankfurter PDFDocument13 pages05-24-01 Frankfurter PDFgraceNo ratings yet

- The Complexity Approach To EconomicsDocument31 pagesThe Complexity Approach To EconomicsclearlyInvisibleNo ratings yet

- Econophysics and The Social Sciences: Challenges and OpportunitiesDocument12 pagesEconophysics and The Social Sciences: Challenges and OpportunitiesHenrique97489573496No ratings yet

- What Has Econophysics Ever Done For Us?: ThesisDocument1 pageWhat Has Econophysics Ever Done For Us?: ThesisHenrique97489573496No ratings yet

- Rules For Scientific Research in Economics The Alpha Beta MethodDocument173 pagesRules For Scientific Research in Economics The Alpha Beta MethodJoan MirandaNo ratings yet

- SSRN Id1889318Document7 pagesSSRN Id1889318alexandrulacramioaraNo ratings yet

- Progreso en EconomiaDocument31 pagesProgreso en Economiakaterine acostaNo ratings yet

- What Has Econophysics Ever Done For Us?: ThesisDocument1 pageWhat Has Econophysics Ever Done For Us?: ThesisWilfredo Baños CruzNo ratings yet

- Behavioral Process of ExtinctionDocument11 pagesBehavioral Process of ExtinctionDivya ValatharaNo ratings yet

- Nuri - Fractional Reserve Banking As Economic Parasitism - A Scientific, Mathematical and Historical Expose, Critique and Manifesto (2002)Document62 pagesNuri - Fractional Reserve Banking As Economic Parasitism - A Scientific, Mathematical and Historical Expose, Critique and Manifesto (2002)Indianhoshi HoshiNo ratings yet

- What Would A Scientific Economics Look Like?: Peter DormanDocument7 pagesWhat Would A Scientific Economics Look Like?: Peter DormanjrodascNo ratings yet

- Da Graça Moura, M., & Martins, N. (2008) - On Some Criticisms of Critical Realism in Economics. Cambridge Journal of Economics, 32 (2), 203-218.Document16 pagesDa Graça Moura, M., & Martins, N. (2008) - On Some Criticisms of Critical Realism in Economics. Cambridge Journal of Economics, 32 (2), 203-218.lcr89No ratings yet

- Philosophy 5,6,7 FinalDocument9 pagesPhilosophy 5,6,7 Finalspongebob squarepantsNo ratings yet

- Fama On Bubbles: Tom Engsted January 2015Document11 pagesFama On Bubbles: Tom Engsted January 2015torosterudNo ratings yet

- Can Small Deviations From Rationality Make Significant Differences To Economic Equilibria?Document14 pagesCan Small Deviations From Rationality Make Significant Differences To Economic Equilibria?Alim Somethin WateverNo ratings yet

- 1 s2.0 S0014292197001311 MainDocument16 pages1 s2.0 S0014292197001311 MainAldana MarquezNo ratings yet

- The Empirical Evidence Against Utility MDocument49 pagesThe Empirical Evidence Against Utility MIonela BaltatescuNo ratings yet

- Lucas - Econometric Policy Evaluation, A CritiqueDocument28 pagesLucas - Econometric Policy Evaluation, A CritiqueFederico Perez CusseNo ratings yet

- Weston 1994Document18 pagesWeston 1994Valentina Vera CortésNo ratings yet

- The Quest For OptimalityDocument41 pagesThe Quest For Optimalityarun rajaramNo ratings yet

- Mccallum PDFDocument21 pagesMccallum PDFLaura NaviaNo ratings yet

- Log Periodic Power Laws MPRA - Paper - 47869Document36 pagesLog Periodic Power Laws MPRA - Paper - 47869Deep. L. DuquesneNo ratings yet

- Causal Factor InvestingDocument75 pagesCausal Factor Investinghai wangNo ratings yet

- Financial CrisisDocument9 pagesFinancial CrisisRachel DuhaylungsodNo ratings yet

- Predicting Asset Prices: EconomicsDocument1 pagePredicting Asset Prices: Economicsballer5556No ratings yet

- 2009 Empirical View at Primary MetaphorsDocument16 pages2009 Empirical View at Primary MetaphorsM Lorena PérezNo ratings yet

- Is There Any Law of Nature Behind The Financial Crisis of 2008?Document3 pagesIs There Any Law of Nature Behind The Financial Crisis of 2008?Yuri Tarnopolsky100% (1)

- Psychology On EconomicsDocument7 pagesPsychology On Economics88bas0202100% (1)

- An Agenda For Reforming Economic Theory: Paradigm in Monetary Economics, Cambridge University Press, 2003Document15 pagesAn Agenda For Reforming Economic Theory: Paradigm in Monetary Economics, Cambridge University Press, 2003api-26091012No ratings yet

- Ompetition As A Iscovery Rocedure: T M S. S IDocument15 pagesOmpetition As A Iscovery Rocedure: T M S. S IantitrusthallNo ratings yet

- Benoit Mandelbrot. The Inescapable Need For Fractal Tools in FinanceDocument3 pagesBenoit Mandelbrot. The Inescapable Need For Fractal Tools in Financebalin_work1949No ratings yet

- Modern Portfolio Theory, 1950 To Date: Edwin J. Elton, Martin J. GruberDocument17 pagesModern Portfolio Theory, 1950 To Date: Edwin J. Elton, Martin J. Gruberxai1lanroiboNo ratings yet

- Discussion Paper 14 - About Stock BubblesDocument19 pagesDiscussion Paper 14 - About Stock BubblesRowland PasaribuNo ratings yet

- Response To "Worrying Trends in Econophysics": Jmccauley@uh - EduDocument26 pagesResponse To "Worrying Trends in Econophysics": Jmccauley@uh - EduHenrique97489573496No ratings yet

- Victor A. BekerDocument23 pagesVictor A. BekerJshea11No ratings yet

- Frococ 1Document34 pagesFrococ 1roxjaglan000No ratings yet

- SSRN Id3104826Document5 pagesSSRN Id3104826Richard LindseyNo ratings yet

- Pesendorfer BehEconComesofAgeAReviewofAdvinBehEcon JEL06Document11 pagesPesendorfer BehEconComesofAgeAReviewofAdvinBehEcon JEL06Richarddon54No ratings yet

- Fallibility Reflexivity and The Human Uncertainty PrincipleDocument22 pagesFallibility Reflexivity and The Human Uncertainty PrincipleAdiaconiței AdrianNo ratings yet

- T W R P E: HE EAK Ationality Rinciple in ConomicsDocument25 pagesT W R P E: HE EAK Ationality Rinciple in ConomicslmunozcNo ratings yet