Professional Documents

Culture Documents

M1 14-AZ2 PENROSE Part 1 (Analysis) - Blank

M1 14-AZ2 PENROSE Part 1 (Analysis) - Blank

Uploaded by

Khushi singhal0 ratings0% found this document useful (0 votes)

8 views5 pagesThe document provides financial information for several companies, including stock prices, market capitalization, debt levels, EBITDA, net income, and valuation multiples. It also includes assumptions for a discounted cash flow model, valuing a company at $48 per share based on estimated future cash flows, a 7.1% WACC, and 2% perpetual growth rate.

Original Description:

Original Title

M1 14-AZ2 PENROSE Part 1 (Analysis)_blank.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides financial information for several companies, including stock prices, market capitalization, debt levels, EBITDA, net income, and valuation multiples. It also includes assumptions for a discounted cash flow model, valuing a company at $48 per share based on estimated future cash flows, a 7.1% WACC, and 2% perpetual growth rate.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

8 views5 pagesM1 14-AZ2 PENROSE Part 1 (Analysis) - Blank

M1 14-AZ2 PENROSE Part 1 (Analysis) - Blank

Uploaded by

Khushi singhalThe document provides financial information for several companies, including stock prices, market capitalization, debt levels, EBITDA, net income, and valuation multiples. It also includes assumptions for a discounted cash flow model, valuing a company at $48 per share based on estimated future cash flows, a 7.1% WACC, and 2% perpetual growth rate.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 5

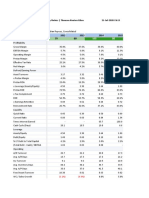

Shares

Outstanding Market Net Debt

Stock Price (millions) Cap Debt Cash /Mkt Cap

Arkos 33.60 5.1 171 28.9 1.4 16%

B&S 16.44 3.2 53 26.0 15.4 20%

Johnson 25.88 2.4 62 12.4 2.6 16%

Kennedy Tools 24.78 8.5 211 56.0 13.6 20%

Todd 4.90 29.2 143 16.7 2.8 10%

Duncan 57.00 1.21 69 10.6 9.5 2%

EBITDA EBITDA EV/EBITDA EV/EBITDA Net Income Net Income P/E

EV FY 2014A FY 2015E 2014A 2015E FY 2014A FY 2015E 2014A

198.9 15.2 14.6 13.1x 13.6x 2.3 2.4 74.5x

63.2 9.8 8.1 6.4x 7.8x 0.9 1.0 58.5x

71.9 10.7 10.0 6.7x 7.2x 1.2 1.2 51.8x

253.0 22.5 21.3 11.2x 11.9x 3.4 3.6 62.0x

157.0 10.4 9.0 15.1x 17.4x 2.7 2.8 53.0x

70.1 5.1 5.2 53.6x 60.3x 1.5 1.6 74.3x

43.4258808 48.887802

P/E

2015E

71.4x

52.6x

51.8x

58.5x

51.1x

75.5x

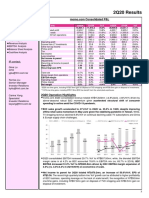

ASSUMPTIONS Year 0 1 2 3

Sales growth rate 2% Sales 55.3 56.4 57.5 58.7

COGS/Sales 65% COGS 37.9 36.7 37.4 38.1

SGA/Sales 22% SGA 12.3 12.4 12.7 12.9

Depreciation/Sales 3.1% Depreciation 1.7 1.7 1.8 1.8

CAPX/Sales 4.2% EBIT 3.4 5.6 5.7 5.8

Tax rate 28% EBIT(1-t) 2.4 4.0 4.1 4.2

NWC/Sales 40% Depreciation 1.7 1.8 1.8

CAPX 2.4 2.4 2.5

WACC 7.1% Inventory 18.0

Perpetual growth (g) 2% +A/R 6.6

-A/P 1.2

=NWC 23.4 22.6 23.0 23.5

DNWC (0.8) 0.5 0.5

FCF 4.2 3.0 3.1

Terminal value

Discount factor 1.00 1.07 1.15 1.23

PV of FCFs 4.0 2.6 2.5

PV(FCF) 11.5

Sensitivity analysis: WACC/perpetual growth PV(TV) 47.7

48.0 0.0% 1.0% 2.0% 3.0% 4.0% Enterprise value 59.2

5.5% Cash 9.5

6.5% Debt 10.6

7.1% Equity value 58.1

8.0% # shares (million) 1.21

8.5% Value per share 48.0

4 Explanation

59.9

### from FY14 I/S + growth assumption

38.9 from FY14 I/S + % sales assumption

13.2 from FY14 I/S + % sales assumption

1.9

### from % sales assumption

5.9 = Sales − COGS − SGA − Depreciation

4.3 from tax rate assumption

1.9 as above

2.5 from % sales assumption

from FY14 B/S

from FY14 B/S

from FY14 B/S

23.9

### from % sales assumption

0.5 year-to-year increase in NWC

3.1 =(1-t)EBIT+Dep − CAPX − DNWC

62.8 =(1+g)FCF2018/(WACC-g)

1.32

### =1/(1+WACC)t + WACC assumption

2.4 =Discount Factor × FCF

= sum of PV of each FCF

= PV of terminal value

=PV(FCF)+PV(TV)

from FY14 B/S

from FY14 B/S

= Enterprise Value + Cash − Debt

from case

= equity value/number of shares

You might also like

- Peng Plasma Solutions Tables PDFDocument12 pagesPeng Plasma Solutions Tables PDFDanielle WalkerNo ratings yet

- 6 Holly Fashion Case StudyDocument3 pages6 Holly Fashion Case StudyCaramalau Mirela-Georgiana0% (1)

- FIN4040 Rosetta Stone Valuation SheetDocument6 pagesFIN4040 Rosetta Stone Valuation SheetMaira Ahmad0% (1)

- A Value Investment Strategy That Combines Security Selection and Market Timing SignalsDocument16 pagesA Value Investment Strategy That Combines Security Selection and Market Timing SignalsVarun KumarNo ratings yet

- April 6 16 Webinar Stock Study Session Mark DavDocument57 pagesApril 6 16 Webinar Stock Study Session Mark Davetuz89% (18)

- Soumya Lokhande 1353 - Manmouth CaseDocument13 pagesSoumya Lokhande 1353 - Manmouth CasednesudhudhNo ratings yet

- Werner - Financial Model - Final VersionDocument2 pagesWerner - Financial Model - Final VersionAmit JainNo ratings yet

- Appendix 1 Conservative Approach: (In FFR Million)Document6 pagesAppendix 1 Conservative Approach: (In FFR Million)Sarvagya JhaNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Final Sheet DCF - With SynergiesDocument4 pagesFinal Sheet DCF - With SynergiesAngsuman BhanjdeoNo ratings yet

- %sales Discount %yoy 18.5% 22.5% 1.8%Document2 pages%sales Discount %yoy 18.5% 22.5% 1.8%Linh NguyenNo ratings yet

- News Release INDY Result 6M22Document7 pagesNews Release INDY Result 6M22Rama Usaha MandiriNo ratings yet

- Monmouth Inc Figures in Million $Document3 pagesMonmouth Inc Figures in Million $amanNo ratings yet

- Analisis FinancieroDocument124 pagesAnalisis FinancieroJesús VelázquezNo ratings yet

- Gymboree LBO Model ComDocument7 pagesGymboree LBO Model ComrolandsudhofNo ratings yet

- Masonite Corp DCF Analysis FinalDocument5 pagesMasonite Corp DCF Analysis FinaladiNo ratings yet

- Monmouth VfinalDocument6 pagesMonmouth VfinalAjax100% (1)

- Purchases / Average Payables Revenue / Average Total AssetsDocument7 pagesPurchases / Average Payables Revenue / Average Total AssetstannuNo ratings yet

- DCF PDFDocument2 pagesDCF PDFMd Rasel Uddin ACMANo ratings yet

- Fundamental Sheet Bharat RasayanDocument28 pagesFundamental Sheet Bharat RasayanVishal WaghNo ratings yet

- Discounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No FormulasDocument2 pagesDiscounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No Formulasrito2005No ratings yet

- 2007 Annual ReportDocument152 pages2007 Annual Reportpcelica77No ratings yet

- MFL 1 Cfin2Document17 pagesMFL 1 Cfin2Siddharth SureshNo ratings yet

- Y-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesDocument45 pagesY-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesSHIKHA CHAUHANNo ratings yet

- Rosetta Stone IPODocument5 pagesRosetta Stone IPOFatima Ansari d/o Muhammad AshrafNo ratings yet

- MW SolutionDocument19 pagesMW SolutionDhiren GalaNo ratings yet

- Momo Operating Report 2Q20Document5 pagesMomo Operating Report 2Q20Wong Kai WenNo ratings yet

- News Release INDY Result 3M22Document7 pagesNews Release INDY Result 3M22M Rizky PermanaNo ratings yet

- 2008 Annual Financial ReportDocument268 pages2008 Annual Financial Reportpcelica77No ratings yet

- Himatsingka Seida LTD.: Ratio Analysis SheetDocument1 pageHimatsingka Seida LTD.: Ratio Analysis SheetNeetesh DohareNo ratings yet

- Βequity = Βasset (1+ (1-Tc) X B/S) : Asset Beta 0.71 0.63 0.8 Average 0.725 Tax 40%Document10 pagesΒequity = Βasset (1+ (1-Tc) X B/S) : Asset Beta 0.71 0.63 0.8 Average 0.725 Tax 40%AkashNachraniNo ratings yet

- 2008 Annual ReportDocument224 pages2008 Annual Reportpcelica77No ratings yet

- Doddy Bicara InvestasiDocument38 pagesDoddy Bicara InvestasiNur Cholik Widyan SaNo ratings yet

- Keppel Pacific Oak US REIT Financial StatementsDocument155 pagesKeppel Pacific Oak US REIT Financial StatementsAakashNo ratings yet

- Industry Median 2018 2017 2016 2015 2014 2013 2012Document10 pagesIndustry Median 2018 2017 2016 2015 2014 2013 2012AnuragNo ratings yet

- Key Ratio Analysis: Profitability RatiosDocument27 pagesKey Ratio Analysis: Profitability RatioskritikaNo ratings yet

- Hoàng Lê Hải Yến-Internal AuditDocument3 pagesHoàng Lê Hải Yến-Internal AuditHoàng Lê Hải YếnNo ratings yet

- Cottle Taylor Student - Group Assignment - F15Document3 pagesCottle Taylor Student - Group Assignment - F15Amit MishraNo ratings yet

- Samsung Electronics: Earnings Release Q2 2016Document8 pagesSamsung Electronics: Earnings Release Q2 2016Syed Mohd AliNo ratings yet

- Atherine S OnfectioneryDocument3 pagesAtherine S OnfectioneryVanshika SinghNo ratings yet

- Tutorial On How To Use The DCF Model. Good Luck!: DateDocument9 pagesTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghNo ratings yet

- Colgate Palmolive ModelDocument51 pagesColgate Palmolive ModelAde FajarNo ratings yet

- Comparative Analysis With Key Retail Sector OrganizationsDocument3 pagesComparative Analysis With Key Retail Sector OrganizationsMuhammad ImranNo ratings yet

- Sarawak Plantation 100827 RN2Q10Document2 pagesSarawak Plantation 100827 RN2Q10limml63No ratings yet

- 2 CMIncomeDocument1 page2 CMIncomeShelbyNo ratings yet

- CL EducateDocument7 pagesCL EducateRicha SinghNo ratings yet

- Earnings Highlight - DANGSUGAR PLC 9M 2016Document1 pageEarnings Highlight - DANGSUGAR PLC 9M 2016LawNo ratings yet

- (In $ Million) : WHX Corporation (WHX)Document3 pages(In $ Million) : WHX Corporation (WHX)Amit JainNo ratings yet

- Cummins India Financial ModelDocument52 pagesCummins India Financial ModelJitendra YadavNo ratings yet

- Data Patterns Income&CashFlow - 4 Years - 19052020Document8 pagesData Patterns Income&CashFlow - 4 Years - 19052020Sundararaghavan RNo ratings yet

- Adnan TestDocument10 pagesAdnan TestAisar UddinNo ratings yet

- Breaking Events: Building MaterialsDocument5 pagesBreaking Events: Building Materialsapi-26443191No ratings yet

- 2007 Annual Financial ReportDocument198 pages2007 Annual Financial Reportpcelica77No ratings yet

- Airbus ValoDocument19 pagesAirbus ValobendidisalaheddineNo ratings yet

- Pakistan State Oil Company Limited (Pso)Document6 pagesPakistan State Oil Company Limited (Pso)Maaz HanifNo ratings yet

- Financial Analysis: ITC Ltd. Ticker: ITC: Prepared By: EdualphaDocument13 pagesFinancial Analysis: ITC Ltd. Ticker: ITC: Prepared By: EdualphaParas LodayaNo ratings yet

- Also Annual Report Gb2022 enDocument198 pagesAlso Annual Report Gb2022 enmihirbhojani603No ratings yet

- 1Q21 Core Operating Performance Beats Estimates: International Container Terminal Services IncDocument8 pages1Q21 Core Operating Performance Beats Estimates: International Container Terminal Services IncJajahinaNo ratings yet

- Problem 4 Unlevered Beta TaxDocument8 pagesProblem 4 Unlevered Beta TaxThuy Tran TrangNo ratings yet

- 0.134 0.1082 Step 1 Cash Flow PV Factor: Problem 21-2Document5 pages0.134 0.1082 Step 1 Cash Flow PV Factor: Problem 21-2alvinNo ratings yet

- ADRODocument1 pageADROfajarNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Book BuildingDocument7 pagesBook BuildingshivathilakNo ratings yet

- Short Adxcellence Power Trend Strategies Charles SchaapDocument85 pagesShort Adxcellence Power Trend Strategies Charles SchaapMedical Skg100% (1)

- Special: Trading Ideas: David AranzabalDocument41 pagesSpecial: Trading Ideas: David AranzabalJelenaNo ratings yet

- New Project ReportDocument70 pagesNew Project ReporthardikNo ratings yet

- Bvps and EpsDocument30 pagesBvps and EpsRenzo Melliza100% (1)

- Ba 5012 Security Analysis and Portfolio Management Unit 1 Part ADocument7 pagesBa 5012 Security Analysis and Portfolio Management Unit 1 Part AHarihara PuthiranNo ratings yet

- Government Securities Market in IndiaDocument66 pagesGovernment Securities Market in Indiasanketgharat83% (12)

- Old Mutual PortfolioDocument12 pagesOld Mutual PortfolioshabsuNo ratings yet

- A Summary of The Transactions Affecting The Stockholders Equity ofDocument1 pageA Summary of The Transactions Affecting The Stockholders Equity ofAmit PandeyNo ratings yet

- Buyback PPTDocument16 pagesBuyback PPTSubham MundhraNo ratings yet

- Jurnal Ananda Indra, Rustam Hidayat DLLDocument10 pagesJurnal Ananda Indra, Rustam Hidayat DLLIlham Rajid RNo ratings yet

- Investing in Equities: Topic 6Document58 pagesInvesting in Equities: Topic 6bulacanhomesiteNo ratings yet

- English HKSI LE Paper 8 Pass Paper Question Bank (QB)Document10 pagesEnglish HKSI LE Paper 8 Pass Paper Question Bank (QB)Tsz Ngong KoNo ratings yet

- Test Bank For Fundamentals of Investments Valuation and Management 9th Edition Bradford Jordan Thomas Miller Steve DolvinDocument48 pagesTest Bank For Fundamentals of Investments Valuation and Management 9th Edition Bradford Jordan Thomas Miller Steve Dolvinchrisrasmussenezsinofwdr100% (35)

- Investment BKM 5th EditonDocument21 pagesInvestment BKM 5th EditonKonstantin BezuhanovNo ratings yet

- Tugas KonsolidasiDocument10 pagesTugas KonsolidasiFajar Rahadi NugrohoNo ratings yet

- Nism 9Document19 pagesNism 9newbie1947No ratings yet

- Stock Market Extra QDocument2 pagesStock Market Extra QNick OoiNo ratings yet

- Study and Review of Mutual Funds PDFDocument6 pagesStudy and Review of Mutual Funds PDFVenkateswaran SNo ratings yet

- Chapter 03 - How Securities Are TradedDocument8 pagesChapter 03 - How Securities Are TradedSarahNo ratings yet

- Fundamental AnalysisDocument73 pagesFundamental Analysispearlksr100% (1)

- The RE Formula Is As Follows:: ProfitsDocument4 pagesThe RE Formula Is As Follows:: Profitserica lamsenNo ratings yet

- Final Report - Aashita SabharwalDocument41 pagesFinal Report - Aashita SabharwalAashita Sabharwal100% (1)

- Cor1306 Wang JiweiDocument5 pagesCor1306 Wang JiweiNicholas KuekNo ratings yet

- Presentation - HDFC Dividend Yield FundDocument27 pagesPresentation - HDFC Dividend Yield FundRitesh ChatterjeeNo ratings yet

- Solution - Assignment - 8 2Document4 pagesSolution - Assignment - 8 2irinasarjveladze19No ratings yet

- Code Search Assignment 1Document6 pagesCode Search Assignment 1Jackie BeadmanNo ratings yet

- Auditing (Problems) Book Value Per ShareDocument12 pagesAuditing (Problems) Book Value Per ShareJasper Bryan BlagoNo ratings yet