Professional Documents

Culture Documents

Macro & Market Perspective - Monetary Policy

Macro & Market Perspective - Monetary Policy

Uploaded by

Little RariesOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Macro & Market Perspective - Monetary Policy

Macro & Market Perspective - Monetary Policy

Uploaded by

Little RariesCopyright:

Available Formats

Macro & Market Perspective

Topic : Monetary Policy I September 23, 2022

Catching up with the Fed

A. Higher than expected rate hike

Domestic central bank raised 7-day reverse repo rate by +50 bps to 4.25% on Sep-

22 meeting following Fed’s decision to increase borrowing cost by another +75

bps. Such policy measure was higher than consensus estimate that projected the

reference rate to be raised only by +25 bps. Furthermore, BI’s respond seemed to

be a quite surprise since the first rate hike in Aug-22 as majority of economists

agreed that domestic central bank will hold low interest rate policy a little longer.

Nevertheless, BI emphasized more on the urgency of front-loading, pre-emptive &

forward looking policy to bring back inflation at a desirable level of 2-4%. However,

we understand that the urgency for interest rate hike is increasing on the back of :

1) potentially higher than upper target of CPI; 2) outflows & continued IDR

depreciation against USD.

Key Takeaways

B. BI articulated some guidance for future interest rates

BI said that both headline & core CPI are likely to increase above its target this

• BI surprisingly raised the benchmark

policy rate by +50 bps to 4.25% on year, largely driven by subsidized fuel price adjustment taken by government. Note

Sep-22 meeting, higher than consensus that last month Pertalite & Diesel fuel price were set to increase >30%. Given the

estimate of +25 bps to 4.00%. stubbornly high global oil price & rising subsidized fuel price, headline & core CPI

will likely to increase to >6% & 4.6% respectively with the effect will last for 3

• BI emphasized that interest rate hike is months. Through the rate hike, BI expect core CPI as the main inflation gauge to

needed reflecting front-loading, pre- slowdown <4% at least by 3Q23. Furthermore, responding to IDR stability, BI said

emptive & forward looking policy to

bring back inflation at a desirable level of that recent IDR depreciation was aligned with other EM & DM currencies

2-4%. performance caused strengthening the USD index. BI projected CA balance to be at

-0.5%-+0.3% GDP for FY22E, thus expecting IDR fundamentals to remain solid.

• BI expect headline and core CPI to

increase >6% & 4.6% this year due to the C. Other policy mix to promote stability

increase in subsidized fuel prices. Indeed, BI has officially started the tightening cycle since Aug-22, yet prior to

recent interest rate hikes, BI has two other policies two promote stability namely

• BI said that recent IDR depreciation was

liquidity management and operation twist.

driven aligned with peers due to

strengthening the USD index.

• Liquidity management : BI has decided to absorb excess liquidity through

raising reserves requirement to 9%. Rising reserves requirement is estimated to

• BI also has other policy mix to promote have absorbed IDR269tn liquidity from the banking system, in-line with our

stability mainly through reserves estimate of IDR234-319tn. Furthermore, BI also ensured that liquidity to remain

requirement & policy rate hike as well as adequate and will not affect banks capability to disburse loan and participate in

operation twist. government financing.

• Operation twist : BI also conduct another monetary by selling shorter

• Given the high possibility of Fed to raise

government bonds while buying longer maturities. We noted some implications

their benchmark rate further and in order

to safeguard interest rate parity while

from the monetary policy conduct. First, higher yield for shorter maturity

anchoring as well as maintaining IDR government bonds will give more attractive valuation as investors to likely

stability, we expect 7-day reverse repo shorten their portfolio duration during interest rate hikes period. As such, could

rate to be brought to at least 5% for also favorable for foreign portfolio inflows and help to promote IDR stability.

FY22E. Second, through operation twist, government bond yield curve may flatten

indicating that high inflationary pressure is expected to be temporary. Hence

financing cost particularly for the long term could be still manageable. On the

other side, operation twist should provide better interest rate corridor for

market participants.

D. Expecting more rate hikes to come

Going forward, we see BI will further raise the benchmark rate to safeguard interest

rate parity as Fed position themselves against market expectation. Downside risks

stemming the US economy from aggressive rate hikes have caused market

participants to expect rate cut next year, yet FOMC participants see it differently as

they weigh on stability than growth. Note that based on FOMC summary of

economic projection for Sep-22, the committee saw FFR to be at 3.9-4.6% for

FY22E implying another 75-150 bps rate hikes in the rest two meeting and at 3.9-

4.6% for FY23F. All in all, after considering the domestic inflation & IDR stability

Tirta Widi Gilang Citradi

outlook as well as Fed’s guidance, we projected 7-day reverse repo rate to be

Economist & Fixed Income Analyst

brought to at least 5% for FY22E.

tirta.citradi@mncgroup.com

MNCS Research Division Page 1

Macro & Market Perspective

Topic : Monetary Policy I September 23, 2022

Exhibit 1. BI tried to catch up with the Fed Exhibit 2. Domestic real rate has been consistently declining

FFR 7-day reverse repo Spread Avg

7.00 3.00

6.00 2.50

5.00

2.00

4.00

1.50

(%)

(%)

3.00

1.00

2.00

1.00 0.50

0.00 0.00

Sep-17 Sep-18 Sep-19 Sep-20 Sep-21 Sep-22 Apr-16 Apr-17 Apr-18 Apr-19 Apr-20 Apr-21 Apr-22

Sources : Bloomberg, MNCS Research Sources : Bank Indonesia, Statistics Indonesia, MNCS Research

Exhibit 3. Net portfolio flows vs IDR depreciation against USD Exhibit 4. Government bond yield curve

15,200 40

20

15,000

0

Monthly Average USD/IDR

Portfolio Flows (IDR Tn)

14,800

-20

14,600 -40

14,400 -60

-80

14,200

-100

14,000

-120

13,800 -140

Aug-20 Feb-21 Aug-21 Feb-22 Aug-22

Sources : IDX, DMO, MNCS Research Sources : Bloomberg, MNCS Research

MNCS Research Division Page 2

Macro & Market Perspective

Topic : Monetary Policy I September 23, 2022

MNC Research Industry Ratings Guidance

OVERWEIGHT: Stock's total return is estimated to be above the average total

return of our industry coverage universe over next 6-12 months

NEUTRAL: Stock's total return is estimated to be in line with the average total

return of our industry coverage universe over next 6-12 months

UNDERWEIGHT: Stock's total return is estimated to be below the average total

return of our industry coverage universe over next 6-12 months

MNC Research Investment Ratings Guidance

BUY : Share price may exceed 10% over the next 12 months

HOLD : Share price may fall within the range of +/- 10% of the next 12 months

SELL : Share price may fall by more than 10% over the next 12 months

Not Rated : Stock is not within regular research coverage

PT MNC SEKURITAS

MNC Financial Center Lt. 14 – 16

Jl. Kebon Sirih No. 21 - 27, Jakarta Pusat 10340

Telp : (021) 2980 3111

Fax : (021) 3983 6899

Call Center : 1500 899

Disclaimer

This research report has been issued by PT MNC Sekuritas, It may not be reproduced or further distributed or published, in whole or in part, for any

purpose. PT MNC Sekuritas has based this document on information obtained from sources it believes to be reliable but which it has not

independently verified; PT MNC Sekuritas makes no guarantee, representation or warranty and accepts no responsibility to liability as to its accuracy

or completeness. Expression of opinion herein are those of the research department only and are subject to change without notice. This document is

not and should not be construed as an offer or the solicitation of an offer to purchase or subscribe or sell any investment. PT MNC Sekuritas and its

affiliates and/or their offices, director and employees may own or have positions in any investment mentioned herein or any investment related

thereto and may from time to time add to or dispose of any such investment. PT MNC Sekuritas and its affiliates may act as market maker or have

assumed an underwriting position in the securities of companies discusses herein (or investment related thereto) and may sell them to or buy them

from customers on a principal basis and may also perform or seek to perform investment banking or underwriting services for or relating to those

companies.

MNCS Research Division Page 3

You might also like

- The Study of Global Political Economy John Ravenhill Chapter 1Document27 pagesThe Study of Global Political Economy John Ravenhill Chapter 1Shreeya VatsaNo ratings yet

- Monetary Policy Review - December 2023Document3 pagesMonetary Policy Review - December 2023samyukthasr36No ratings yet

- Rbi Monetary Policy Review Further Cuts LikelyDocument6 pagesRbi Monetary Policy Review Further Cuts LikelyTaransh ANo ratings yet

- Review of Monetary Policy Statement H2'24 by EBLSLDocument7 pagesReview of Monetary Policy Statement H2'24 by EBLSLAnika Nawar ChowdhuryNo ratings yet

- RBI Policy Review: Turning Hawkish: Normalization of Policy Corridor and Introduction of SDFDocument5 pagesRBI Policy Review: Turning Hawkish: Normalization of Policy Corridor and Introduction of SDFswapnaNo ratings yet

- Indopremier MacroInsight 23 Jun 2023 Unchanged BI Rate Aimed atDocument3 pagesIndopremier MacroInsight 23 Jun 2023 Unchanged BI Rate Aimed atbotoy26No ratings yet

- ICICIdirect MonthlyMFReportDocument12 pagesICICIdirect MonthlyMFReportSagar KulkarniNo ratings yet

- Bfsi by AxisDocument14 pagesBfsi by AxisJANARTHAN SANKARANNo ratings yet

- Gic Weekly 080124Document14 pagesGic Weekly 080124eldime06No ratings yet

- Axis Top Picks Jun 2022Document90 pagesAxis Top Picks Jun 2022Ankit GoelNo ratings yet

- Mutual Fund Review: Equity MarketDocument11 pagesMutual Fund Review: Equity MarketNadim ReghiwaleNo ratings yet

- Perspective On The Monetary Policy' by Rajani Sinha, Chief Economist & National Director - Research, Knight Frank IndiaDocument3 pagesPerspective On The Monetary Policy' by Rajani Sinha, Chief Economist & National Director - Research, Knight Frank IndiaNaveen BhaiNo ratings yet

- Calibrated Normalisation: Monetary PolicyDocument4 pagesCalibrated Normalisation: Monetary Policyvikash singhNo ratings yet

- BSP MonetaryPolicySummary August2022 QuizDocument2 pagesBSP MonetaryPolicySummary August2022 Quizcjpadin09No ratings yet

- SG IndiaDocument6 pagesSG IndiaAjay KastureNo ratings yet

- Monetary Policy Review 301007Document3 pagesMonetary Policy Review 301007pranjal92pandeyNo ratings yet

- MCIRFEBRUARY1311Document4 pagesMCIRFEBRUARY1311rohangundpatil096No ratings yet

- Monetary Policy Review No.7 2022Document7 pagesMonetary Policy Review No.7 2022Adaderana OnlineNo ratings yet

- Gathering Speed - Update On The Monetary Policy - June 2022Document5 pagesGathering Speed - Update On The Monetary Policy - June 2022Huzefa BharmalNo ratings yet

- UOB Global Economics & Markets Research 2021Document1 pageUOB Global Economics & Markets Research 2021Freddy Daniel NababanNo ratings yet

- Fixed Income Weekly Update - 20th May-24th May 2024Document1 pageFixed Income Weekly Update - 20th May-24th May 2024YasahNo ratings yet

- Brochure - Group 9 (Influence of RBI)Document8 pagesBrochure - Group 9 (Influence of RBI)Sugandha Gajanan GhadiNo ratings yet

- AXIS No 23Document14 pagesAXIS No 23Rushil KhajanchiNo ratings yet

- March 2021Document15 pagesMarch 2021RajugupatiNo ratings yet

- 8th April Monetary PolicyDocument3 pages8th April Monetary PolicyNeeleshNo ratings yet

- BFSI Q2FY22 - Earnings Preview - 08102021 Final (1) (1) - 08-10-2021 - 09Document13 pagesBFSI Q2FY22 - Earnings Preview - 08102021 Final (1) (1) - 08-10-2021 - 09slohariNo ratings yet

- IIFL - Banks - 4QFY24 Preview - 20240410Document19 pagesIIFL - Banks - 4QFY24 Preview - 20240410Ezzt YasserNo ratings yet

- Wa0059.Document19 pagesWa0059.Aryan NandwaniNo ratings yet

- Economic Outlook ": Empowering The Indonesian Economy For Stronger Recovery"Document23 pagesEconomic Outlook ": Empowering The Indonesian Economy For Stronger Recovery"fadjaradNo ratings yet

- UOB Economic Outlook 2022 - Global Economics & Markets ResearchDocument18 pagesUOB Economic Outlook 2022 - Global Economics & Markets ResearchWagimin SendjajaNo ratings yet

- Westpack JUN 14 Weekly CommentaryDocument7 pagesWestpack JUN 14 Weekly CommentaryMiir ViirNo ratings yet

- FY 10 Monetary ReviewDocument4 pagesFY 10 Monetary ReviewVivek SarinNo ratings yet

- Week Ended September 21, 2012: Icici Amc Idfc Amc Icici BankDocument4 pagesWeek Ended September 21, 2012: Icici Amc Idfc Amc Icici BankBonthala BadrNo ratings yet

- RBI Monetary Policy Statement - Must Read For The Class Now and TodayDocument4 pagesRBI Monetary Policy Statement - Must Read For The Class Now and TodayAnanya SharmaNo ratings yet

- Performance of Debt Markt: An Article ReviewDocument11 pagesPerformance of Debt Markt: An Article ReviewNida SubhaniNo ratings yet

- Credit Policy Review - May 2020Document5 pagesCredit Policy Review - May 2020Sanjay SharmaNo ratings yet

- Spark CapitalDocument57 pagesSpark CapitalNaushil ShahNo ratings yet

- Pakistan's Monetary Policy of 2022Document14 pagesPakistan's Monetary Policy of 2022Gohar KhalidNo ratings yet

- Ed - 11-08-2023Document1 pageEd - 11-08-2023Avinash Chandra RanaNo ratings yet

- FinSights - RBI Monetary Policy Statement Dec 2020Document2 pagesFinSights - RBI Monetary Policy Statement Dec 2020speedenquiryNo ratings yet

- MPR Quarter III 2022Document20 pagesMPR Quarter III 2022Muhammad HasyimNo ratings yet

- RBI 25bp HIkeDocument1 pageRBI 25bp HIkeadithyaNo ratings yet

- Bullish Under The Hood December Policy TakeawaysDocument3 pagesBullish Under The Hood December Policy Takeawaysvishal_lal89No ratings yet

- Task 7 ESSAYDocument1 pageTask 7 ESSAYDanielle UgayNo ratings yet

- NH-2022-Indonesia Market-Outlook-Final PDFDocument82 pagesNH-2022-Indonesia Market-Outlook-Final PDFUdan RMNo ratings yet

- Icici Prudential Mutual Fund Rbi Second Quarter Review of Monetary Policy 2010-11Document4 pagesIcici Prudential Mutual Fund Rbi Second Quarter Review of Monetary Policy 2010-11Vinit KumarNo ratings yet

- Aryan Chaudhary BE PSDA 2Document4 pagesAryan Chaudhary BE PSDA 2Anuj VermaNo ratings yet

- Credence Capital - MPC Aug 2022Document1 pageCredence Capital - MPC Aug 2022Sandeep TiwariNo ratings yet

- Key Highlights:: Inflationary Pressures Overrides Downside Risks To GrowthDocument6 pagesKey Highlights:: Inflationary Pressures Overrides Downside Risks To Growthsamyak_jain_8No ratings yet

- Annual Report Investments FY23 CPDocument4 pagesAnnual Report Investments FY23 CPVipul MangalathNo ratings yet

- Mortgage Rate ForecastDocument2 pagesMortgage Rate ForecastIgorNo ratings yet

- Interest Rate Cut 11-06Document2 pagesInterest Rate Cut 11-06ijaz AhmadNo ratings yet

- Credit Policy 5 Reasons Why RBI Is Unlikely To ActDocument2 pagesCredit Policy 5 Reasons Why RBI Is Unlikely To ActShwetabh SrivastavaNo ratings yet

- Schroders Outlook 2022 Macro Market Outlook FinalDocument24 pagesSchroders Outlook 2022 Macro Market Outlook FinalOkinawan P.SNo ratings yet

- 0RBIBULLETIN2D1CE48Document200 pages0RBIBULLETIN2D1CE48sp78gxmfkrNo ratings yet

- BFSI Q4FY24 - Earnings Preview - 090424 - 09-04-2024 - 11Document15 pagesBFSI Q4FY24 - Earnings Preview - 090424 - 09-04-2024 - 11Haardik GandhiNo ratings yet

- Monetary PolicyDocument2 pagesMonetary PolicyFuture Leaders of the PhilippinesNo ratings yet

- End of Cheap Deposits: Implications For Banks' Deposit Betas, Asset Growth, and FundingDocument9 pagesEnd of Cheap Deposits: Implications For Banks' Deposit Betas, Asset Growth, and FundingMinzhe LiNo ratings yet

- Mirae Macro Update 23 Jun 2023 June Policy Rate Decision, RemainDocument5 pagesMirae Macro Update 23 Jun 2023 June Policy Rate Decision, Remainbotoy26No ratings yet

- Quick TestDocument7 pagesQuick TestLittle RariesNo ratings yet

- Jawaban CaseDocument4 pagesJawaban CaseLittle RariesNo ratings yet

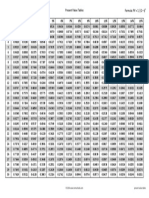

- Tabel PV of 1Document1 pageTabel PV of 1Little RariesNo ratings yet

- Tabel PV AnnuityDocument1 pageTabel PV AnnuityLittle RariesNo ratings yet

- Tealicious Class ScheduleDocument1 pageTealicious Class ScheduleLittle RariesNo ratings yet

- Own Mahmood PresiDocument3 pagesOwn Mahmood PresiOwn AbbadiNo ratings yet

- Ecom525 SyllabusDocument2 pagesEcom525 Syllabusastitvaawasthi33No ratings yet

- The Time Value of Money: ExampleDocument4 pagesThe Time Value of Money: ExampleMoneca MillerNo ratings yet

- Final 1 - Chapter 1-2Document30 pagesFinal 1 - Chapter 1-2jonalyn arellanoNo ratings yet

- HUSS Study Guide - GIIS MUN 2022Document37 pagesHUSS Study Guide - GIIS MUN 2022Kashish AroraNo ratings yet

- Problämes ch05Document6 pagesProblämes ch05jessicalaurent1999No ratings yet

- Assignment: Name of Assignment: International Trade How OurDocument9 pagesAssignment: Name of Assignment: International Trade How OurAmeen IslamNo ratings yet

- Chapter-2 Central Bank and Its Functions: An Institution Such As National Bank of EthiopiaDocument44 pagesChapter-2 Central Bank and Its Functions: An Institution Such As National Bank of Ethiopiasabit hussenNo ratings yet

- Instruction: Write The Letter of The Correct AnswerDocument4 pagesInstruction: Write The Letter of The Correct Answerzanderhero30No ratings yet

- Chapter 2 - Data of MacroeconomicsDocument23 pagesChapter 2 - Data of MacroeconomicsBenny TanNo ratings yet

- Economic Factors: Demand-Consumer-Goods - AspDocument3 pagesEconomic Factors: Demand-Consumer-Goods - AspMary Joy Villaflor HepanaNo ratings yet

- A Slowing Malaysian Economy: The Circular Flow of IncomeDocument7 pagesA Slowing Malaysian Economy: The Circular Flow of IncomeMuhammad FaizanNo ratings yet

- Macroeconomics Notes Unit 3Document30 pagesMacroeconomics Notes Unit 3Eshaan GuruNo ratings yet

- Risk Management - Tutorial 4Document7 pagesRisk Management - Tutorial 4chziNo ratings yet

- PRACTICEDocument4 pagesPRACTICEtotoroc4tNo ratings yet

- Impact of Inflation Research InstitutionalDocument6 pagesImpact of Inflation Research InstitutionalVamie SamasNo ratings yet

- Macro Economics Exercise 1Document2 pagesMacro Economics Exercise 1Daisy MistyNo ratings yet

- Economic SurveyDocument11 pagesEconomic SurveycfzbscjdghNo ratings yet

- Kathleen Brooks On ForexDocument36 pagesKathleen Brooks On ForexLawalNo ratings yet

- Business Cycle and Stabilisation PolicyDocument19 pagesBusiness Cycle and Stabilisation PolicyKrunal PatelNo ratings yet

- Ch. 22 & 23 - As-AD Analysis - PostedDocument35 pagesCh. 22 & 23 - As-AD Analysis - PostedEslam HendawiNo ratings yet

- ProductivityDocument2 pagesProductivityLina SimbolonNo ratings yet

- National Income AccountingDocument25 pagesNational Income AccountingAnuska ThapaNo ratings yet

- CPI and Inflation Practice Problems - 1Document4 pagesCPI and Inflation Practice Problems - 1lixvanterNo ratings yet

- Brave New World by Ritesh JainDocument5 pagesBrave New World by Ritesh JainDeveshNo ratings yet

- Moody's - Government of ArgentinaDocument28 pagesMoody's - Government of ArgentinaCronista.com100% (1)

- Chapter OneDocument33 pagesChapter OneTesfahun GetachewNo ratings yet

- The Australian EconomyDocument35 pagesThe Australian Economybiangbiang bangNo ratings yet

- 2.1exchange Rate Parity Currency ForecastingDocument30 pages2.1exchange Rate Parity Currency ForecastingFATIN NADJWA MAZLANNo ratings yet