Professional Documents

Culture Documents

Vat Review

Vat Review

Uploaded by

Vensen FuentesCopyright:

Available Formats

You might also like

- 1.1. Problems On VAT (With Answers and Solutions)Document29 pages1.1. Problems On VAT (With Answers and Solutions)Jem Valmonte88% (26)

- VAT - CPA Reviewer in Taxation - Enrico D. Tabag PDFDocument103 pagesVAT - CPA Reviewer in Taxation - Enrico D. Tabag PDFDGAENo ratings yet

- Question Bank VatDocument14 pagesQuestion Bank VatLeonard Cañamo90% (10)

- TAX - Final Pre-Board With Answer Key Batch Exodus - EncryptedDocument16 pagesTAX - Final Pre-Board With Answer Key Batch Exodus - EncryptedSophia Perez100% (1)

- BAM 208 - P2 Quiz #2Document4 pagesBAM 208 - P2 Quiz #2trishaNo ratings yet

- CombinepdfDocument129 pagesCombinepdfMary Jane G. FACERONDANo ratings yet

- Universal College of Parañaque: Value Added TaxDocument14 pagesUniversal College of Parañaque: Value Added TaxDin Rose Gonzales67% (3)

- Exercises On Value Added TaxDocument20 pagesExercises On Value Added TaxIan Jamero100% (2)

- Bustax Final ExamDocument13 pagesBustax Final Examshudaye100% (3)

- Bustamante TAX CDocument19 pagesBustamante TAX CJean Rose Tabagay BustamanteNo ratings yet

- Tax CDocument18 pagesTax Calmira garciaNo ratings yet

- HANDOUT-business TaxesDocument29 pagesHANDOUT-business TaxesGianJoshuaDayrit67% (3)

- Transfer and Business Taxation - MIDTERMDocument14 pagesTransfer and Business Taxation - MIDTERMYvette Pauline JovenNo ratings yet

- Vat-Quiz No. 1: Record As The Email To Be Included With My ResponseDocument15 pagesVat-Quiz No. 1: Record As The Email To Be Included With My Responsedorie shane sta. mariaNo ratings yet

- Business Taxation 1Document81 pagesBusiness Taxation 1Prince Isaiah Jacob100% (1)

- Subject To VAT Subject To VAT 3) Real Property Utilized For Socialized Housing VAT ExemptDocument32 pagesSubject To VAT Subject To VAT 3) Real Property Utilized For Socialized Housing VAT ExemptNikka SanzNo ratings yet

- Business Taxation Midterm Quiz 1 2 PhineeeDocument4 pagesBusiness Taxation Midterm Quiz 1 2 PhineeeKaxy PHNo ratings yet

- Value Added Tax ModuleDocument11 pagesValue Added Tax ModuleDaniella RachoNo ratings yet

- TAX2UNIT9TO12Document4 pagesTAX2UNIT9TO12Catherine Joy VasayaNo ratings yet

- Tax Review - Overview Vat and Opt (Quiz)Document4 pagesTax Review - Overview Vat and Opt (Quiz)Lovenia Magpatoc100% (7)

- Tax2 FinalsDocument8 pagesTax2 FinalsKevin Elrey Arce100% (2)

- TAXATION 2 Chapter 12 Output VAT Zero Rated SalesDocument4 pagesTAXATION 2 Chapter 12 Output VAT Zero Rated SalesKim Cristian MaañoNo ratings yet

- Multiple Choice QuestionsDocument3 pagesMultiple Choice QuestionsLUNA100% (2)

- Introduction To Business TaxesDocument32 pagesIntroduction To Business TaxesGracelle Mae Oraller100% (2)

- Final Exam in Taxation AccountingDocument5 pagesFinal Exam in Taxation AccountingMarvin CeledioNo ratings yet

- Final Exam in Tax 2Document5 pagesFinal Exam in Tax 2elminvaldezNo ratings yet

- Summatve 4 - TaxDocument8 pagesSummatve 4 - TaxkmarisseeNo ratings yet

- TaxDocument4 pagesTaxCielito AlvarezNo ratings yet

- IntroBusTax QuestsDocument9 pagesIntroBusTax QuestsTwish BarriosNo ratings yet

- Value Added Tax - : - Output VAT: Zero-Rated SalesDocument23 pagesValue Added Tax - : - Output VAT: Zero-Rated SalesAjey MendiolaNo ratings yet

- Whether Donation Is Taxable/Nontaxable Zero Rated/VAT Exempt/VAT Taxable 2 Problems On Donation 2 Problems On VATDocument7 pagesWhether Donation Is Taxable/Nontaxable Zero Rated/VAT Exempt/VAT Taxable 2 Problems On Donation 2 Problems On VATJape PreciaNo ratings yet

- He May Be Subject To VATDocument6 pagesHe May Be Subject To VATThe makas AbababaNo ratings yet

- Consumption TaxDocument7 pagesConsumption Taxanyonghasayu30No ratings yet

- Tax-on-Individuals PhilippinesDocument21 pagesTax-on-Individuals PhilippinesMaria Regina Javier100% (2)

- Final PeriodDocument6 pagesFinal PeriodjayNo ratings yet

- Output Vat - Zero-Rated SalesDocument36 pagesOutput Vat - Zero-Rated SalesCoreen Samaniego0% (2)

- 1.2. Problems On VAT - For Tax ReviewDocument19 pages1.2. Problems On VAT - For Tax ReviewJem ValmonteNo ratings yet

- Tax Ch6 VAT BinaluyoDocument6 pagesTax Ch6 VAT Binaluyomavrhyck.21No ratings yet

- Vat Exercise UpdatedDocument5 pagesVat Exercise UpdatedChinkey FerrerNo ratings yet

- Bustax Chapter 8 PDFDocument11 pagesBustax Chapter 8 PDFPineda, Paula MarieNo ratings yet

- 93-13 - VatDocument19 pages93-13 - VatJuan Miguel UngsodNo ratings yet

- Chapter 8 Zero Rated SalesDocument39 pagesChapter 8 Zero Rated SalesCathy Marie Angela ArellanoNo ratings yet

- Modified Finals VatDocument3 pagesModified Finals VatClyden Jaile RamirezNo ratings yet

- Chapter 8Document9 pagesChapter 8nena cabañesNo ratings yet

- TAXATIONDocument11 pagesTAXATIONGail LiuNo ratings yet

- VAT Exempt SalesDocument14 pagesVAT Exempt SalesJuvanni SantosNo ratings yet

- Tax2 Quiz1 FinalsDocument9 pagesTax2 Quiz1 Finalsishinoya keishiNo ratings yet

- Business TaxDocument9 pagesBusiness TaxWere dooomedNo ratings yet

- Bus Tax Chap 2Document11 pagesBus Tax Chap 2David LijaucoNo ratings yet

- Tax2 Seatworks-03.23.2020Document2 pagesTax2 Seatworks-03.23.2020Allen Fey De JesusNo ratings yet

- LawDocument43 pagesLawMARIANo ratings yet

- Business Tax IntroductionDocument5 pagesBusiness Tax IntroductionJessica MalijanNo ratings yet

- Business TaxDocument116 pagesBusiness TaxScarlett FernandezNo ratings yet

- TBLTAX Chapter 2 Percentage Tax Exempt Sales of Goods or Properties and ServicesDocument6 pagesTBLTAX Chapter 2 Percentage Tax Exempt Sales of Goods or Properties and ServicesBeny MiraflorNo ratings yet

- CPAR 89 Final PB TAX Pages 1 21 PDFDocument21 pagesCPAR 89 Final PB TAX Pages 1 21 PDFMariz OrasaNo ratings yet

- VAT AND OPT Monthly EXAMDocument20 pagesVAT AND OPT Monthly EXAMAlexandra Nicole IsaacNo ratings yet

- Business TaxesDocument50 pagesBusiness TaxesMacatol KristineNo ratings yet

- Business TaxDocument26 pagesBusiness Taxanor.aquino.upNo ratings yet

- Chapter 4: Exempt Sales of Goods, Properties and Services Exempt SalesDocument7 pagesChapter 4: Exempt Sales of Goods, Properties and Services Exempt SalesWearIt Co.No ratings yet

- Canadian International Taxation: Income Tax Rules for ResidentsFrom EverandCanadian International Taxation: Income Tax Rules for ResidentsNo ratings yet

- Tax 2 - FMQDocument3 pagesTax 2 - FMQVensen FuentesNo ratings yet

- MS7-Accounts Receivable Additional ExercisesDocument2 pagesMS7-Accounts Receivable Additional ExercisesVensen FuentesNo ratings yet

- Hob ExercisesDocument3 pagesHob ExercisesVensen FuentesNo ratings yet

- RFBT1 Topic1 ExercisesDocument3 pagesRFBT1 Topic1 ExercisesVensen FuentesNo ratings yet

- Bsa4c G1 CH123Document24 pagesBsa4c G1 CH123Vensen FuentesNo ratings yet

- MS3 M2-ExerciseDocument6 pagesMS3 M2-ExerciseVensen FuentesNo ratings yet

- Responses ResultsDocument11 pagesResponses ResultsVensen FuentesNo ratings yet

- Chapter IV EDITEDDocument10 pagesChapter IV EDITEDVensen FuentesNo ratings yet

Vat Review

Vat Review

Uploaded by

Vensen FuentesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vat Review

Vat Review

Uploaded by

Vensen FuentesCopyright:

Available Formats

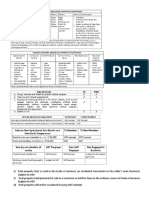

The following are exempt from vat, except

a. Sale of marinated fish

b. Sale of gold to the Bangko Sentral ng Pilipinas

c. Association dues, membership fees, and other assessments and charges ` collected by home owners

associations and condominium corporations.

d. None of the above

Which of the following shall be exempt from vat?

a. Services of banks.

b. Services of money changers and pawnshops.

c. Services of credit cooperatives

d. All of the above

Which of the following is exempt from VAT?

a. Common carriers transporting passengers by air within the Philippines

b. Common carriers transporting passengers by sea within the Philippines

c. Common carriers transporting passengers by land within the Philippines

d. Common carriers transporting cargoes by air within the Philippines

Which of the following carrier shall be subject to value-added tax?

a. Sea carrier classified as Resident Foreign Corporation, annual gross receipts is P2,000,000

b. Air carrier classified as Resident Foreign Corporation, annual gross receipts is P3,000,000

c. Sea carrier classified as Domestic Corporation, voyage is from Philippines to Japan, annual gross

receipts is P5,000,000.

d. None of the choices.

Where even if there is a business, there is no vat imposable when

I. A business is pursued by an individual where the aggregate gross sales and or receipts do not

exceed P3,000,000 during any twelve-month period.

II. Sale of real properties for low cost housing

III. Sale of real properties for socialized housing

IV. Sale of residential lot at P1,500,000 per unit and below beginning January 1, 2018

V. Sale of house and lot and other residential dwellings valued at P2,500,000 and below beginning January

I, 2018

a. I, Il and Ill only

b. Il and Ill only

c. Ill,IV and V only

d. All of the above

Where even if there is no business, vat is imposable on.

I. Importations of goods for personal use

Il. Services rendered in the Philippines by nonresident foreign persons, even isolated, shall be

considered as being rendered in the course of trade or business.

a. I only

b. Il only

c. land Il

d. None of the above

One of the following is not an activity subject to VAT:

a. Sale in retail of goods by a dealer

b. Sale of Bamboo poles by a dealer

c. Sublease of real property in the course of business

d. Importation of ordinary feeds for poultry chicken

The following are exempt from vat, except

a. Sale of 1 sack of rice

b. Sale of lechon manok

c. Sale of pet food

d. Sale of newspaper

Which of the following has an option to register under the VAT system in 2020?

I. Common carriers by air transporting passengers, the gross receipts of which do not exceed

P3,000,000.

II. Radio and/or television broadcasting companies whose annual gross receipts

of the preceding year exceeds P10,000,000.

III. Operator of cockpit, the receipts of which do not exceed P3,000,000 during the year.

IV. Seller of vat-subject services the gross receipts of which do not exceed P3,000,000.

The following data were provided by spouses' Pedro and Ana. In 2020, Pedro's gross receipts from his

practice of profession was P2,850,000 while her wife, Ana, has gross

sales of P2,200,OOO derived from her trading business. Assuming they are not vat registered, will they be

subject to vat?

a. Yes, because their aggregate gross receipts/sales exceeded the vat threshold of

b. No, because for purposes of vat threshold, husband and wife shall be considered as separate taxpayers.

c. Yes, because their gross receipts/sales are not specifically exempt from vat as provided in the Tax

Code.

d. None of the above

Which statement is wrong? Transactions considered "in the course of trade or business", and therefore

subject to the business taxes include:

a. Regular conduct or pursuit of a commercial or an economic activity by a stock private organization.

b. Regular conduct or pursuit of a commercial or an economic activity by a non-stock,non-profit private

organization.

c. Isolated services in the Philippines by non-resident foreign persons.

d. Isolated sale of goods or services.

Statement 1: Nonstock and nonprofit private organizations which sell exclusively to their

members in the regular conduct or pursuit of commercial or economic activity are exempt

from value-added tax.

Statement 2: Government entities engaged in commercial or economic activity are generally exempt from

value-added tax

a. Both statements are correct.

b. Both statements are incorrect.

c. Only the first statement is correct.

d. Only the second state statement is correct,

The term "in the course of trade or business" does not include

a. Regular conduct or pursuit of a commercial or economic activity.

b. Incidental business transactions.

c, Transactions by any person, regardless of whether or not the person engaged there in is a non-stock,

non-profit private organization (irrespective of the disposition of its net income and whether or not it sells

exclusively to members) or government entity.

d. None of the above

The following shall be exempt from VAT

Sale of canned pineapple

Sale of gold to the Bangko Sentral ng Pilipinas

Sale of canned sardines

None of the above

Which of the following is subject to VAT?

Services of banks

Services of a pawnshop

Services of a lending cooperative to members

Services of a lending company

Which of the following is NOT exempt to VAT?

Sale of vegetables in its original state

Sale of fruits in its original state

Sale of copra

Sale of olive oil

None of the above

Which of the following transactions is exempt from VAT?

Medical services such as dental and veterinary services rendered by professionals

Legal services

Services arising from employee-employer relationship

Services rendered by domestic air transport companies.

None of the above

Which of the following is exempt from VAT?

Non-life insurance companies

Transportation contractors on their transport of goods or cargoes

Gross receipts of television broadcasting companies whose annual gross receipts of the preceding

year does not exceed P10,000,000

Sale of raw materials or packaging materials to an export-oriented enterprise whose export sales

exceed seventy percent (70%) of total annual production

None of the above

TRUE / FALSE

Agricultural and marine food products are shall be considered in their original state even if they have

undergone the simple processes of preparation or preservation for the market, such as freezing, drying,

salting, broiling, roasting, smoking or stripping.

Sale of drugs and medicines of pharmacy run by the hospital to outpatients are subject to VAT.

The importation of the residents and non-resident citizen of their personal and household effects upon

returning from abroad and coming to resettle in the Philippines is subject to zero percent Vat

Lease of a residential unit with a monthly rental of 12,000 is exempt for VAT purposes.

Transport of passengers by international carriers is exempt to VAT.

Sale of palay by a farmer is exempt from value added tax.

Sale of canned sardines is subject to value added tax.

Sale of cooked fish in a restaurant is subject to value added tax.

Pawnshops are exempt from value added tax.

Life insurance is not subject to value added tax.

A value added tax exempt transaction has no output tax and cannot claim input tax credit.

Polished and/or husked rice, corn grits, raw cane sugar and molasses, ordinary salt, and copra shall

be considered in their original state, hence, subject to VAT.

Sale of flowers, in its original state is exempt from VAT.

Export sale is exempt to VAT if made by the VAT registered person.

A sale made by a zero rated of goods by a VAT registered person is a taxable transaction for VAT

purposes, but shall not result in any input tax.

Sale of raw materials or packaging materials to export-oriented enterprise whose export sales exceed

70% of total annual production is not subject to VAT.

Importation of seedlings of a mahogany tree is exempt for VAT purposes.

Services rendered by regional or area operating headquarters established in the Philippines by

multinational corporations which act as supervisory, communications and coordinating centers for their

affiliates, subsidiaries or branches in the Asia-Pacific Region and earn or derive income from the

Philippines is exempt to VAT.

Sale of rice by a trader is subject to value added tax.

A value added tax zero-rated transaction has no output tax and cannot claim input tax credit.

Services rendered by a contractor for an exporter whose export sales are 60% of annual productions

are subject to value added tax.

Sale of raw materials to an exporter whose export sales are 75% of annual production is exempt from

value added tax.

You might also like

- 1.1. Problems On VAT (With Answers and Solutions)Document29 pages1.1. Problems On VAT (With Answers and Solutions)Jem Valmonte88% (26)

- VAT - CPA Reviewer in Taxation - Enrico D. Tabag PDFDocument103 pagesVAT - CPA Reviewer in Taxation - Enrico D. Tabag PDFDGAENo ratings yet

- Question Bank VatDocument14 pagesQuestion Bank VatLeonard Cañamo90% (10)

- TAX - Final Pre-Board With Answer Key Batch Exodus - EncryptedDocument16 pagesTAX - Final Pre-Board With Answer Key Batch Exodus - EncryptedSophia Perez100% (1)

- BAM 208 - P2 Quiz #2Document4 pagesBAM 208 - P2 Quiz #2trishaNo ratings yet

- CombinepdfDocument129 pagesCombinepdfMary Jane G. FACERONDANo ratings yet

- Universal College of Parañaque: Value Added TaxDocument14 pagesUniversal College of Parañaque: Value Added TaxDin Rose Gonzales67% (3)

- Exercises On Value Added TaxDocument20 pagesExercises On Value Added TaxIan Jamero100% (2)

- Bustax Final ExamDocument13 pagesBustax Final Examshudaye100% (3)

- Bustamante TAX CDocument19 pagesBustamante TAX CJean Rose Tabagay BustamanteNo ratings yet

- Tax CDocument18 pagesTax Calmira garciaNo ratings yet

- HANDOUT-business TaxesDocument29 pagesHANDOUT-business TaxesGianJoshuaDayrit67% (3)

- Transfer and Business Taxation - MIDTERMDocument14 pagesTransfer and Business Taxation - MIDTERMYvette Pauline JovenNo ratings yet

- Vat-Quiz No. 1: Record As The Email To Be Included With My ResponseDocument15 pagesVat-Quiz No. 1: Record As The Email To Be Included With My Responsedorie shane sta. mariaNo ratings yet

- Business Taxation 1Document81 pagesBusiness Taxation 1Prince Isaiah Jacob100% (1)

- Subject To VAT Subject To VAT 3) Real Property Utilized For Socialized Housing VAT ExemptDocument32 pagesSubject To VAT Subject To VAT 3) Real Property Utilized For Socialized Housing VAT ExemptNikka SanzNo ratings yet

- Business Taxation Midterm Quiz 1 2 PhineeeDocument4 pagesBusiness Taxation Midterm Quiz 1 2 PhineeeKaxy PHNo ratings yet

- Value Added Tax ModuleDocument11 pagesValue Added Tax ModuleDaniella RachoNo ratings yet

- TAX2UNIT9TO12Document4 pagesTAX2UNIT9TO12Catherine Joy VasayaNo ratings yet

- Tax Review - Overview Vat and Opt (Quiz)Document4 pagesTax Review - Overview Vat and Opt (Quiz)Lovenia Magpatoc100% (7)

- Tax2 FinalsDocument8 pagesTax2 FinalsKevin Elrey Arce100% (2)

- TAXATION 2 Chapter 12 Output VAT Zero Rated SalesDocument4 pagesTAXATION 2 Chapter 12 Output VAT Zero Rated SalesKim Cristian MaañoNo ratings yet

- Multiple Choice QuestionsDocument3 pagesMultiple Choice QuestionsLUNA100% (2)

- Introduction To Business TaxesDocument32 pagesIntroduction To Business TaxesGracelle Mae Oraller100% (2)

- Final Exam in Taxation AccountingDocument5 pagesFinal Exam in Taxation AccountingMarvin CeledioNo ratings yet

- Final Exam in Tax 2Document5 pagesFinal Exam in Tax 2elminvaldezNo ratings yet

- Summatve 4 - TaxDocument8 pagesSummatve 4 - TaxkmarisseeNo ratings yet

- TaxDocument4 pagesTaxCielito AlvarezNo ratings yet

- IntroBusTax QuestsDocument9 pagesIntroBusTax QuestsTwish BarriosNo ratings yet

- Value Added Tax - : - Output VAT: Zero-Rated SalesDocument23 pagesValue Added Tax - : - Output VAT: Zero-Rated SalesAjey MendiolaNo ratings yet

- Whether Donation Is Taxable/Nontaxable Zero Rated/VAT Exempt/VAT Taxable 2 Problems On Donation 2 Problems On VATDocument7 pagesWhether Donation Is Taxable/Nontaxable Zero Rated/VAT Exempt/VAT Taxable 2 Problems On Donation 2 Problems On VATJape PreciaNo ratings yet

- He May Be Subject To VATDocument6 pagesHe May Be Subject To VATThe makas AbababaNo ratings yet

- Consumption TaxDocument7 pagesConsumption Taxanyonghasayu30No ratings yet

- Tax-on-Individuals PhilippinesDocument21 pagesTax-on-Individuals PhilippinesMaria Regina Javier100% (2)

- Final PeriodDocument6 pagesFinal PeriodjayNo ratings yet

- Output Vat - Zero-Rated SalesDocument36 pagesOutput Vat - Zero-Rated SalesCoreen Samaniego0% (2)

- 1.2. Problems On VAT - For Tax ReviewDocument19 pages1.2. Problems On VAT - For Tax ReviewJem ValmonteNo ratings yet

- Tax Ch6 VAT BinaluyoDocument6 pagesTax Ch6 VAT Binaluyomavrhyck.21No ratings yet

- Vat Exercise UpdatedDocument5 pagesVat Exercise UpdatedChinkey FerrerNo ratings yet

- Bustax Chapter 8 PDFDocument11 pagesBustax Chapter 8 PDFPineda, Paula MarieNo ratings yet

- 93-13 - VatDocument19 pages93-13 - VatJuan Miguel UngsodNo ratings yet

- Chapter 8 Zero Rated SalesDocument39 pagesChapter 8 Zero Rated SalesCathy Marie Angela ArellanoNo ratings yet

- Modified Finals VatDocument3 pagesModified Finals VatClyden Jaile RamirezNo ratings yet

- Chapter 8Document9 pagesChapter 8nena cabañesNo ratings yet

- TAXATIONDocument11 pagesTAXATIONGail LiuNo ratings yet

- VAT Exempt SalesDocument14 pagesVAT Exempt SalesJuvanni SantosNo ratings yet

- Tax2 Quiz1 FinalsDocument9 pagesTax2 Quiz1 Finalsishinoya keishiNo ratings yet

- Business TaxDocument9 pagesBusiness TaxWere dooomedNo ratings yet

- Bus Tax Chap 2Document11 pagesBus Tax Chap 2David LijaucoNo ratings yet

- Tax2 Seatworks-03.23.2020Document2 pagesTax2 Seatworks-03.23.2020Allen Fey De JesusNo ratings yet

- LawDocument43 pagesLawMARIANo ratings yet

- Business Tax IntroductionDocument5 pagesBusiness Tax IntroductionJessica MalijanNo ratings yet

- Business TaxDocument116 pagesBusiness TaxScarlett FernandezNo ratings yet

- TBLTAX Chapter 2 Percentage Tax Exempt Sales of Goods or Properties and ServicesDocument6 pagesTBLTAX Chapter 2 Percentage Tax Exempt Sales of Goods or Properties and ServicesBeny MiraflorNo ratings yet

- CPAR 89 Final PB TAX Pages 1 21 PDFDocument21 pagesCPAR 89 Final PB TAX Pages 1 21 PDFMariz OrasaNo ratings yet

- VAT AND OPT Monthly EXAMDocument20 pagesVAT AND OPT Monthly EXAMAlexandra Nicole IsaacNo ratings yet

- Business TaxesDocument50 pagesBusiness TaxesMacatol KristineNo ratings yet

- Business TaxDocument26 pagesBusiness Taxanor.aquino.upNo ratings yet

- Chapter 4: Exempt Sales of Goods, Properties and Services Exempt SalesDocument7 pagesChapter 4: Exempt Sales of Goods, Properties and Services Exempt SalesWearIt Co.No ratings yet

- Canadian International Taxation: Income Tax Rules for ResidentsFrom EverandCanadian International Taxation: Income Tax Rules for ResidentsNo ratings yet

- Tax 2 - FMQDocument3 pagesTax 2 - FMQVensen FuentesNo ratings yet

- MS7-Accounts Receivable Additional ExercisesDocument2 pagesMS7-Accounts Receivable Additional ExercisesVensen FuentesNo ratings yet

- Hob ExercisesDocument3 pagesHob ExercisesVensen FuentesNo ratings yet

- RFBT1 Topic1 ExercisesDocument3 pagesRFBT1 Topic1 ExercisesVensen FuentesNo ratings yet

- Bsa4c G1 CH123Document24 pagesBsa4c G1 CH123Vensen FuentesNo ratings yet

- MS3 M2-ExerciseDocument6 pagesMS3 M2-ExerciseVensen FuentesNo ratings yet

- Responses ResultsDocument11 pagesResponses ResultsVensen FuentesNo ratings yet

- Chapter IV EDITEDDocument10 pagesChapter IV EDITEDVensen FuentesNo ratings yet