Professional Documents

Culture Documents

Star Net Plus

Star Net Plus

Uploaded by

Kishore KCopyright:

Available Formats

You might also like

- Clinical Teaching Plan OBDocument7 pagesClinical Teaching Plan OBMyrtle Yvonne Ragub80% (5)

- Steelman, Graling - 2013 - Top 10 Patient Safety Issues What More Can We DoDocument23 pagesSteelman, Graling - 2013 - Top 10 Patient Safety Issues What More Can We DoElNo ratings yet

- Linear Programming ApplicationDocument12 pagesLinear Programming ApplicationSyurga Fathonah100% (3)

- DH Ratnagiri Quality ManualDocument71 pagesDH Ratnagiri Quality ManualPrabhat Kumar100% (2)

- Star Comprehensive Insurance PolicyDocument20 pagesStar Comprehensive Insurance PolicyJanakiramaiah YarlagaddaNo ratings yet

- The Oriental Insurance Company LimitedDocument33 pagesThe Oriental Insurance Company LimitedSharma AmanNo ratings yet

- VARISTHA Mediclaim For Senior Citizens Policy PDFDocument15 pagesVARISTHA Mediclaim For Senior Citizens Policy PDFSudhirNo ratings yet

- Prospectus - Star Special Care: Star Health and Allied Insurance Company LimitedDocument4 pagesProspectus - Star Special Care: Star Health and Allied Insurance Company LimitedGopi223No ratings yet

- The Oriental Insurance Company LimitedDocument9 pagesThe Oriental Insurance Company LimitedkmrezNo ratings yet

- STU Policy WordingsDocument35 pagesSTU Policy WordingsSandeep NRNo ratings yet

- Tata R-Comprehensive-Prospectus-New-1Document27 pagesTata R-Comprehensive-Prospectus-New-1vasanth8555No ratings yet

- Star Comprehensive Prospectus New 1Document27 pagesStar Comprehensive Prospectus New 1Arushi SinghNo ratings yet

- Prospectus - : Star Health and Allied Insurance Company LimitedDocument19 pagesProspectus - : Star Health and Allied Insurance Company LimitedudhayNo ratings yet

- FHO Prospectus PDFDocument20 pagesFHO Prospectus PDFVidhyaRIyengarNo ratings yet

- Family Health Optima Insurance PlanDocument16 pagesFamily Health Optima Insurance PlanAmit GargNo ratings yet

- Mediclaim Insurance Policy (Group) Policy WordingsDocument29 pagesMediclaim Insurance Policy (Group) Policy WordingsSaransh SharmaNo ratings yet

- SHAHLIP21580V052021_2020-2021Document27 pagesSHAHLIP21580V052021_2020-2021arvindsuri888No ratings yet

- Health - Individual Mediclaim Policy PDFDocument25 pagesHealth - Individual Mediclaim Policy PDFAlakh BhattNo ratings yet

- Diabetes Safe Insurance PolicyDocument11 pagesDiabetes Safe Insurance PolicyJyothika JayashriNo ratings yet

- Oichlgp449v022021 2020-2021Document29 pagesOichlgp449v022021 2020-2021shikharektaNo ratings yet

- Mediclaim Insurance Policy - IndividualDocument8 pagesMediclaim Insurance Policy - IndividualjnaguNo ratings yet

- 06 Senior Citizen PolicyDocument26 pages06 Senior Citizen PolicyJaimson FrancisNo ratings yet

- Prospectus Yuva Bharat Health PolicyDocument28 pagesProspectus Yuva Bharat Health PolicyS PNo ratings yet

- Mediclaim Policy (2007) : The New India Assurance Co. LTDDocument15 pagesMediclaim Policy (2007) : The New India Assurance Co. LTDAnil Kumar ChauhanNo ratings yet

- Adobe2017 Policy PDFDocument13 pagesAdobe2017 Policy PDFJithuNo ratings yet

- SBI General Arogya Plus Policy ProspectusDocument19 pagesSBI General Arogya Plus Policy Prospectusyashmpanchal333No ratings yet

- Health Guard: Gold PlanDocument32 pagesHealth Guard: Gold Planhiteshmohakar15No ratings yet

- Women Care Insurance Policy ProspectusDocument17 pagesWomen Care Insurance Policy ProspectusSOODHIR DEVGHARKARNo ratings yet

- AB Arogyadan Group Health Insurance SchemeDocument15 pagesAB Arogyadan Group Health Insurance SchemedrchiNo ratings yet

- HFF-2015 Pol PDFDocument31 pagesHFF-2015 Pol PDFAmit RajNo ratings yet

- Extra Care PolicyDocument13 pagesExtra Care PolicyManoj ChepeNo ratings yet

- Prospectus Yuva Bharat Health PolicyDocument29 pagesProspectus Yuva Bharat Health PolicyAlen KarbiaNo ratings yet

- Oriental Insurance-Happy Family Floater Policy-ProspectusDocument12 pagesOriental Insurance-Happy Family Floater Policy-Prospectusdpsharma1978No ratings yet

- TermsDocument11 pagesTermstusharNo ratings yet

- NEW INDIA Family Flaoter Mediclaim PolicyDocument14 pagesNEW INDIA Family Flaoter Mediclaim Policyjoydeep_d3232No ratings yet

- GHI IDC ESC - 2020-21 - FinalDocument34 pagesGHI IDC ESC - 2020-21 - FinalShobha KrishnanNo ratings yet

- Policy InfomationDocument2 pagesPolicy InfomationNirav PathakNo ratings yet

- Group Mediclaim Scheme For RetireesDocument9 pagesGroup Mediclaim Scheme For RetireesAnal GuhaNo ratings yet

- Tob Imed May2022Document6 pagesTob Imed May2022technoglobalroadNo ratings yet

- Senior Citizen ConcessionDocument19 pagesSenior Citizen ConcessionGanga PrasadNo ratings yet

- B-623, Gate No. 7, Green Field, Surajkund Mall Road, Faridabad, Haryana - 121003Document16 pagesB-623, Gate No. 7, Green Field, Surajkund Mall Road, Faridabad, Haryana - 121003Neeraj KatnaNo ratings yet

- Induction Manual 1688120103Document24 pagesInduction Manual 1688120103Radhe shamNo ratings yet

- Prospectus Senior Citizen Mediclaim PolicyDocument24 pagesProspectus Senior Citizen Mediclaim PolicyManasNo ratings yet

- BMI MediPlan 100 Planisalud Rider R7 11 21 1contratoDocument9 pagesBMI MediPlan 100 Planisalud Rider R7 11 21 1contratoivantv2014No ratings yet

- The Oriental Insurance Company Limited,: Mediclaim Insurance Policy (Group)Document14 pagesThe Oriental Insurance Company Limited,: Mediclaim Insurance Policy (Group)Amit RajNo ratings yet

- Group Mediclaim Policy 06052015 PDFDocument14 pagesGroup Mediclaim Policy 06052015 PDFAmit RajNo ratings yet

- Individual Medical Policy For Dependents - Dmed: Table of BenefitsDocument6 pagesIndividual Medical Policy For Dependents - Dmed: Table of Benefitsrahul sNo ratings yet

- The Health Insurance SpecialistDocument8 pagesThe Health Insurance SpecialistsaranyaNo ratings yet

- Bajhlip21127v032021 2020-2021Document26 pagesBajhlip21127v032021 2020-2021aakash.shandilya.cscNo ratings yet

- Family Health Optima Insurance PlanDocument16 pagesFamily Health Optima Insurance PlanvedavathiNo ratings yet

- Ghi Idc Parents 2020-21 FinalDocument31 pagesGhi Idc Parents 2020-21 FinalABHISHEKGOYANNo ratings yet

- Easy Health Insurance Customer Information Sheet With Policy Wordings (Standard Plan)Document12 pagesEasy Health Insurance Customer Information Sheet With Policy Wordings (Standard Plan)yogeshpartheNo ratings yet

- Product Summary FOR Group Hospital & Surgical InsuranceDocument4 pagesProduct Summary FOR Group Hospital & Surgical InsuranceDaniel OngNo ratings yet

- BAGIC Group Mediclaim - BrochureDocument38 pagesBAGIC Group Mediclaim - BrochureVisakh MahadevanNo ratings yet

- Family Health Optima Insurance Plan Prospectus - Family Health Optima Insurance PlanDocument11 pagesFamily Health Optima Insurance Plan Prospectus - Family Health Optima Insurance PlanDhanush Kumar RamanNo ratings yet

- Senior Citizen Policy - 0Document14 pagesSenior Citizen Policy - 0nywd806033No ratings yet

- Family Health Care Gold BrochureDocument15 pagesFamily Health Care Gold BrochureYASH JAISINGNo ratings yet

- Health Guard Policy Wordings PrintDocument32 pagesHealth Guard Policy Wordings PrintAlexNo ratings yet

- Prospectus New India Asha Kiran PolicyDocument17 pagesProspectus New India Asha Kiran PolicySHYLAJA DNo ratings yet

- Family Health Optima Insurance PlanDocument16 pagesFamily Health Optima Insurance Planujjal deyNo ratings yet

- Medical Insurance Eligibility Verification - The Comprehensive GuideFrom EverandMedical Insurance Eligibility Verification - The Comprehensive GuideNo ratings yet

- Newman's Billing and Coding Technicians Study GuideFrom EverandNewman's Billing and Coding Technicians Study GuideRating: 4.5 out of 5 stars4.5/5 (2)

- Ses 12Document1 pageSes 12Kishore KNo ratings yet

- ICTC Staff Information For Web Site PDFDocument33 pagesICTC Staff Information For Web Site PDFKishore KNo ratings yet

- Kuhnke IA Series Relay DatasheetDocument4 pagesKuhnke IA Series Relay DatasheetKishore KNo ratings yet

- Jones-Bio Rotary 2018 2019Document1 pageJones-Bio Rotary 2018 2019Kishore KNo ratings yet

- ICICI Pru Iprotect SmartDocument19 pagesICICI Pru Iprotect SmartKishore KNo ratings yet

- Ats KPT ProjectDocument46 pagesAts KPT ProjectKishore KNo ratings yet

- 070123-PAI & AAI General Guidelines PDFDocument4 pages070123-PAI & AAI General Guidelines PDFKishore KNo ratings yet

- Price Bid Format Volume II of Nit 1603792343 PDFDocument14 pagesPrice Bid Format Volume II of Nit 1603792343 PDFKishore KNo ratings yet

- FormsDocument14 pagesFormsKishore KNo ratings yet

- Karnataka Govt Evening Polytechnic MangaluruDocument9 pagesKarnataka Govt Evening Polytechnic MangaluruKishore KNo ratings yet

- CCMD TenderDoc8Document109 pagesCCMD TenderDoc8Kishore KNo ratings yet

- Presentation Generator Protection 1514868547 258691Document14 pagesPresentation Generator Protection 1514868547 258691Kishore KNo ratings yet

- ProjectDocument25 pagesProjectKishore KNo ratings yet

- Karnataka Govt. Evening PolytechnicDocument14 pagesKarnataka Govt. Evening PolytechnicKishore KNo ratings yet

- 7.inplant TrainingDocument7 pages7.inplant TrainingKishore KNo ratings yet

- Report On Inplant Training Format For Preparation of Training Report (Four Weeks/Six Weeks/ Six Months)Document3 pagesReport On Inplant Training Format For Preparation of Training Report (Four Weeks/Six Weeks/ Six Months)Kishore KNo ratings yet

- HanumanthDocument1 pageHanumanthKishore KNo ratings yet

- CULTUREDocument2 pagesCULTUREWilliam CiferNo ratings yet

- Discharge PlanningDocument6 pagesDischarge PlanningHamdah GirlsNo ratings yet

- University Foundation: College of NursingDocument2 pagesUniversity Foundation: College of NursingDyanne BautistaNo ratings yet

- How-To Guide: Prevent Adverse Drug Events by Implementing Medication ReconciliationDocument40 pagesHow-To Guide: Prevent Adverse Drug Events by Implementing Medication ReconciliationJorge Arturo Porras BermúdezNo ratings yet

- Community PsychiatryDocument45 pagesCommunity PsychiatrySarvess MuniandyNo ratings yet

- Service Wise Clarification: 1. Charitable and Religious Activity Related ServicesDocument10 pagesService Wise Clarification: 1. Charitable and Religious Activity Related ServicesPrasanthNo ratings yet

- 1.overview of JCI 2017Document18 pages1.overview of JCI 2017Nesti AgustNo ratings yet

- Primary Hospital PDFDocument189 pagesPrimary Hospital PDFMulugeta FentawNo ratings yet

- ANNEX E and Familiarization of The FormDocument36 pagesANNEX E and Familiarization of The FormRiqueza KingNo ratings yet

- Accurate Measurement of Weight and Height 1: Weighing PatientsDocument3 pagesAccurate Measurement of Weight and Height 1: Weighing PatientsConvalescent Nursing HomeNo ratings yet

- Policy Arogya Sanjeevani Policy V 1 Final 0204 WebDocument10 pagesPolicy Arogya Sanjeevani Policy V 1 Final 0204 WebHiiNo ratings yet

- Oop - Om ADocument17 pagesOop - Om AMeghraj ShindeNo ratings yet

- CLINICAL REPORT (Autosaved)Document18 pagesCLINICAL REPORT (Autosaved)Kate BumatayNo ratings yet

- Pre-Authorization Form (PAF) : Pa NumberDocument1 pagePre-Authorization Form (PAF) : Pa NumberAmna QamarNo ratings yet

- Senior Citizens Red Carpet Health Insurance Policy PDFDocument8 pagesSenior Citizens Red Carpet Health Insurance Policy PDFrohit22221No ratings yet

- Seminar ON Role of Research, Leadership and Management in NursingDocument22 pagesSeminar ON Role of Research, Leadership and Management in Nursingannu panchal100% (1)

- Full Download Health Assessment and Physical Examination 5th Edition Estes Test BankDocument36 pagesFull Download Health Assessment and Physical Examination 5th Edition Estes Test Bankzoism.waygoose.3fuhqv100% (38)

- RRT PPT With Changes Staff 12 30 13Document22 pagesRRT PPT With Changes Staff 12 30 13Dhaya DhayaNo ratings yet

- 24 CFP Clinical Guideline 10 - Chemical RestraintDocument20 pages24 CFP Clinical Guideline 10 - Chemical RestraintFernando Feliz ChristianNo ratings yet

- Career GuidanceDocument19 pagesCareer GuidanceAbdul JalilNo ratings yet

- University of Birmingham: Implementing Clinical Governance in Iranian HospitalsDocument9 pagesUniversity of Birmingham: Implementing Clinical Governance in Iranian HospitalssunnyNo ratings yet

- NURS FPX 6016 Assessment 2 Quality Improvement Initiative EvaluationDocument6 pagesNURS FPX 6016 Assessment 2 Quality Improvement Initiative Evaluationfarwaamjad771No ratings yet

- Hospital Management System PDFDocument19 pagesHospital Management System PDFKeerthana keerthanaNo ratings yet

- Clinical Leadership Fellows Yearbook 2012 - NHS Leadership AcademyDocument47 pagesClinical Leadership Fellows Yearbook 2012 - NHS Leadership AcademyNHS Leadership Academy0% (2)

- WHO Mental Health 1949 1961 EngDocument50 pagesWHO Mental Health 1949 1961 EngShamitha ShettyNo ratings yet

- Bioetica y Decisiones Eticas en Pediatría CL BulletinDocument60 pagesBioetica y Decisiones Eticas en Pediatría CL Bulletinvainilla.333No ratings yet

Star Net Plus

Star Net Plus

Uploaded by

Kishore KOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Star Net Plus

Star Net Plus

Uploaded by

Kishore KCopyright:

Available Formats

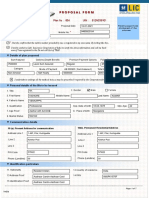

Star Health and Allied Insurance Co. Ltd.

Policy Wordings

STAR HEALTH AND ALLIED INSURANCE COMPANY LIMITED

Health Regd. & Corporate Office: 1, New Tank Street, Valluvar Kottam High Road, Nungambakkam,

Personal & Caring Insurance

The Health Insurance Specialist Chennai - 600 034. « Phone : 044 - 28288800 « Email : support@starhealth.in

Website : www.starhealth.in « CIN : U66010TN2005PLC056649 « IRDAI Regn. No. : 129

Kind Attention : Policyholder

Please check whether the details given by you about the insured persons in the proposal form (a copy of which was provided at the time

of issuance of cover for the first time) are incorporated correctly in the policy schedule. If you find any discrepancy, please inform us

within 15 days from the date of receipt of the policy, failing which the details relating to the person/s covered would be taken as correct.

So also the coverage details may also be gone through and in the absence of any communication from you within 15 days from the date

of receipt of this policy, it would be construed that the policy issued is correct and the claims if any arise under the policy will be dealt

with based on proposal / policy details.

STAR HEALTH AND ALLIED INSURANCE COMPANY LIMITED

Health Regd. & Corporate Office: 1, New Tank Street, Valluvar Kottam High Road, Nungambakkam,

Personal & Caring Insurance

The Health Insurance Specialist Chennai - 600 034. « Phone : 044 - 28288800 « Email : support@starhealth.in

Website : www.starhealth.in « CIN : U66010TN2005PLC056649 « IRDAI Regn. No. : 129

STAR NET PLUS

Unique Identification No.: IRDA/NL-HLT/SHAI/P-H/V.I/106/13-14

The Proposal, declaration and other documents if any given by the proposer forms the C) Surgeon, Anaesthetist, Medical Practitioner, Consultants, Specialist Fees.

basis of this policy of insurance D) Anaesthesia, Blood, Oxygen, Operation Theatre charges, Surgical Appliances,

In consideration of the premium paid in full and subject to the terms and conditions as set out in the Medicines and Drugs, Diagnostic Materials and X-ray, Dialysis Chemotherapy,

Schedule with all its Parts, the Company by this Policy agrees as under :- Radiotherapy, cost of Pacemaker and similar expenses.

1. COVERAGE E) Emergency ambulance charges up-to a sum of Rs. 750/- per hospitalisation and overall

limit of Rs. 1,500/- per policy period for transportation of the insured person by private

Section I – HIV Cover Section

ambulance service when this is needed for medical reasons to go to hospital for

The insured person shall contract the covered disease / illness/ accidental injuries as defined treatment provided such hospitalisation claim is admissible as per the Policy.

herein, the Company will pay to the Insured the limit mentioned in the Schedule as a lump sum.

F) Relevant Pre-Hospitalization medical expenses incurred for a period not exceeding

In the event of any claim becoming admissible under this insurance, the Company will pay to the 30 days prior to the date of Hospitalisation, on the disease/illness, injury sustained

Insured as follows:- following an admissible claim under the policy

The lump-sum amount as specified in the Policy Schedule for the covered disease / illness / G) A Sum equivalent to 7% of the hospitalisation expenses incurred comprising of Nursing

accidental injuries, subject to terms, conditions, limitations and exclusions mentioned therein, if charges, Surgeon/consultant fees, Diagnostic charges, Medicines and Drugs only

the Insured Person is declared as having reached the stage of AIDS (if the cd4 count falls below subject to a maximum of Rs. 5,000/- per occurrence towards Post Hospitalisation

150) as defined herein and the same is diagnosed and certified by a team of doctors appointed / Medical expenses wherever recommended by the attending Medical Practioner.

nominated by the Company after conducting appropriate test(s) and during the Period of

Where package rates are charged by the hospitals the Post-Hospitalisation benefit will be

Insurance and if all of the following conditions are satisfied.

calculated after taking the room and boarding charges at 2% of the Sum Insured per day.

The stage of AIDS experienced by the Insured Person is the first incidence; and

Expenses on Hospitalization for minimum period of 24 hours are admissible. However, this time

The signs or symptoms experienced by the Insured Person commenced more than 90 days limit will not apply for Dialysis, Chemotherapy, Radiotherapy, Cataract surgery, Dental Surgery,

(ninety days) following the Commencement Date of the policy. Lithotripsy (Kidney stone removal) Tonsillectomy, Cutting and Draining of Abscess, Liver

The Insured Person subjects himself/herself to examination by the panel doctor of the Company

and AIDS is confirmed by the panel doctor. Health

Aspiration, Pleural Effusion Aspiration, Colonoscopy, Sclerotheraphy, taken in the Hospital /

Nursing Home and the Insured is discharged on the same day.

Personal & Caring

Only one lump sum payment shall be provided during the Insured Person's lifetime regardless of

the number of treatments undergone by the Insured Person. The cover for the respective

individual will be automatically terminated after the lump sum payment is made as above and the

Insurance

The amount payable respect of the following treatment is up-to the limit mentioned there-against:

Cataract surgery - Rs.20000/- in respect of one eye and Rs.30000/- in the entire policy period

Lithotripsy (Kidney stone removal) - Rs. 20000/-

cover for the respective person shall not be renewed.

Section II – Medical Section The Health Insurance Specialist Tonsillectomy

Cutting and Draining of Abscess

- Rs. 7500/-

- Rs. 1500/-

If during the period stated in the Schedule if the insured person shall contract any disease or suffer

from any illness or sustain any bodily injury through accident and if such disease or injury shall Liver Aspiration - Rs. 2000/-

require such insured Person, upon the advice of the duly Qualified Physician / Medical Specialist / Pleural Effusion Aspiration - Rs. 2000/-

Medical Practitioner or of duly Qualified Surgeon to incur Hospitalization expenses for medical / Sclerotheraphy - Rs. 5000/-

surgical treatment at any Nursing Home / Hospital in India as herein defined as an inpatient, the Provided the waiver of the minimum period of 24 hours hospitalisation is limited to the above noted

Company will pay to the Insured Person the amount of such expenses as are reasonably and treatments only.

necessarily incurred up-to the limits indicated but not exceeding the sum insured in aggregate in Note: -Company's liability in respect of all claims admitted during the period of insurance

any one period stated in the schedule hereto. shall not exceed the Sum insured per person mentioned (under Section II – Medical

1.0 In the event of any claims becoming admissible under this Scheme, the Company will pay to Section) in the Schedule.

the Insured Person or the estate of the Insured Person.

2. DEFINITIONS

2.0 The amount of such expenses as would fall under different heads up to the limits mentioned,

and as are reasonably and necessarily incurred thereof by or on behalf of such Insured Accident / Accidental – means a sudden, unforeseen and involuntary event caused by external,

Person, but not exceeding the Sum insured in aggregate mentioned in the schedule hereto. visible and violent means.

A) Room, Boarding Expenses as provided by the Hospital / Nursing Home at 2% of the AIDS means Acquired Immuno Deficiency Syndrome where the CD4 count of the HIV infected

sum insured. person goes below 150 and this (AIDS) has to be confirmed in conjunction with other relevant tests

and parameters.

B) Nursing expenses.

STAR NET PLUS Unique Identification No.: IRDA/NL-HLT/SHAI/P-H/V.I/106/13-14 1 of 4

Star Health and Allied Insurance Co. Ltd. Policy Wordings

Any one Illness means continuous period of illness and it includes relapse within 45 days from charges being made by others of similar standing in the locality where the charge is incurred when

the date of last consultation with the Hospital/Nursing Home where treatment has been taken. furnishing like or comparable treatment, services or supplies to individuals of the same sex and of

Occurrence of the same illness after a lapse of 45 days as stated above will be considered as fresh comparable age, for a similar disease, illness, medical condition or injury.

illness for the purpose of this policy. Room Rent means the amount charged by a hospital for the occupancy of a bed on per day (24

Company means Star Health and Allied Insurance Company Limited hrs) basis and shall include associated medical expenses

Condition Precedent shall mean a policy term or condition upon which the Insurer's liability under Surgical Operation means manual and / or operative procedure (s) required for treatment of an

the policy is conditional upon illness or injury, correction of deformities and defects, diagnosis and cure of diseases, relief of

Congenital Internal means congenital anomaly which is not in the visible and accessible parts of suffering or prolongation of life, performed in a hospital or day care centre by a medical practitioner

the body. SPECIAL CONDITIONS : UNDER SECTION 1

Congenital External means congenital anomaly which is in the visible and accessible parts of the The eligibility of a claim under the policy must be confirmed by a registered medical practitioner as

body. defined herein and must be supported by clinical and laboratory evidence acceptable to the

Diagnosis means Diagnosis by a registered medical practitioner, supported by clinical, Company.

radiological, histo-pathological and laboratory evidence and also surgical evidence wherever Insurance under this policy shall cease upon payment of the compensation as provided herein

applicable, acceptable to the Company. and no further payment will be made for any consequent disease or dependent disease.

Disclosure to information norm mean the policy shall be void and all premium paid hereon shall Payment of claims will be made to the Insured whose discharge shall be final and binding. It is for

be forfeited to the Company, in the event of misrepresentation, mis-description or non-disclosure the Insured to decide to pass on the benefit of a claim to the claimant either by way of treatment or

of any material fact. cash in lieu thereof.

Day Care Treatment means medical treatment, and/or surgical procedure which is: Waiting Period- No claim for compensation will become payable if illness/disease/condition

- undertaken under General or Local Anesthesia in a hospital/day care centre in less than 24 specified in the policy incepts or manifests during the first 90 days of the inception of the policy. In

hrs because of technological advancement, and the event of renewal with the Company this 90 days limit shall not apply.

- which would have otherwise required a hospitalization of more than 24 hours. 3. EXCLUSIONS:

Treatment normally taken on an out-patient basis is not included in the scope of this definition Exclusions under Section I :

Grace Period means the specified period of time immediately following the premium due date 1. The Company shall not be liable to make any payments under this Policy in respect of any

during which a payment can be made to renew or continue a policy in force without loss of expenses what so ever incurred by any Insured person in connection with or in respect of

continuity benefits such as waiting periods and coverage of pre-existing diseases. Coverage is not expenses towards the treatment of HIV.

available for the period for which no premium is received. 2. All medical conditions which are Pre Existing when the cover incepts for the first time

HIV means Human Immuno Virus. including the stage of AIDS except HIV which is specifically covered.

Hospital/ Nursing Home means any institution established for in-patient care and day care 3. AIDS confirmed during the first 90 days from the commencement date of the policy.

treatment of illness and/or injuries and which has been registered as a hospital with the local Exclusions under Section II :

authorities under the Clinical Establishments (Registration and Regulation) Act, 2010 or under the

1. Pre Existing Diseases as defined in the policy until 48 consecutive months of continuous

enactments specified under the Schedule of Section 56(1) of the said Act or complies with all

coverage have elapsed, since inception of the first policy with any Indian Insurer. However

minimum criteria as under:

the limit of the Company's liability in respect of claim for pre-existing diseases under such

a. Has qualified nursing staff under its employment round the clock; portability shall be limited to the sum insured under first policy with any Indian Insurance

b. Has at least 10 in-patient beds in towns having a population of less than 10,00,000 and at Company

least 15 in-patient beds in all other places; 2. Any disease contracted by the Insured Person during the first 30 days from the

c. Has qualified medical practitioner(s) in charge round the clock; commencement date of the policy. This condition shall not however apply in case of the

d. Has a fully equipped operation theatre of its own where surgical procedures are carried out; Insured Person having been covered under this scheme or group insurance scheme with

e. Maintains daily records of patients and makes these accessible to the insurance company's any of the Indian Insurance companies for a continuous period of preceding 12 months

authorized personnel. without any break.

In-Patient means an Insured Person who is admitted to Hospital and stays there for a minimum 3. Exclusion of medical expenses incurred for treatment of Tuberculosis and Gastro-Enteritis.

period of 24 hours for the sole purpose of receiving treatment. 4. During the First two Years of continuous operation of Insurance cover, the expenses on

Insured means Government or Non Governmental Organisation or Agencies active in the field of treatment of Cataract, Hysterectomy for Menorrhagia or Fibromyoma, Knee replacement

serving the cause of people with HIV / AIDS which has proposed this policy and who remits the Surgery (other than caused by an accident), Joint Replacement Surgery(other than caused

premium with service tax, as applicable, to the Company under this policy. by an accident), Prolapse of intervertibral disc(other than caused by accident), Varicose

veins and Varicose ulcers.

Insured person means the name of persons shown in the schedule of the Policy.

5. During the first year of operation of the Insurance cover the expenses on treatment of

Medical Practitioner is a person who holds a valid registration from the Medical Council of any

diseases such as Benign Prostate Hypertrophy, Hernia, Hydrocele, Congenital Internal

State or Medical Council of India or Council for Indian Medicine or for Homeopathy set up by the

disease / defect, Fistula in anus, Piles, Sinusitis and related disorders, Gallstones and renal

Government of India or a State Government and is there by entitled to practice medicine within its

stones removal are not payable.

jurisdiction; and is acting within the scope and jurisdiction of licence.

If these diseases are Pre- Existing at the time of proposal they will be covered subject to the

Network Hospital means all such hospitals, day care centers or other providers that the

exclusion for Pre-Existing Disease as above

Company has mutually agreed with, to provide services like cashless access to policyholders. The

list is available with the Company and subject to amendment from time to time. 6. The amount of claim indicated in the schedule to be borne by the Insured Person.

Non Network Hospital means any hospital, day care centre or other provider that is not part of the 7. Injury/ Disease directly or indirectly caused by or arising from or attributable to War, Invasion,

network Act of Foreign Enemy, Warlike operations (whether war be declared or not).

Pre-Insurance medical test means the clinical and laboratorial tests including CD4 test and/or 8. Circumcision unless necessary for treatment of a disease not excluded hereunder or as may

HIV Viral Load Test or any other test as may be required, conducted on the Insured persons, to be necessitated due to an accident, vaccination (except for post-bite treatment)or

establish HIV infection and also to rule out the stage of AIDS. inoculation or change of life or cosmic or aesthetic treatment of any description, plastic

surgery other than as may be necessitated due to an accident or as a part of any illness.

Pre-Existing Disease /Condition means any condition, ailment or injury or related condition (s)

for which the insured had signs or symptoms ,and/or were diagnosed, and/or received medical 9. Cost of spectacles and contact lens, hearing aids, walkers, crutches wheel chairs and such

advice /treatment within 48 months prior to the Insured's first policy with any Indian Insurer. other aids.

Pre Hospitalization means Medical Expenses incurred immediately before the Insured Person is 10. Dental treatment or surgery of any kind unless necessitated due to accidental injuries and

Hospitalised, provided that : requiring hospitalization.

i. Such Medical Expenses are incurred for the same condition for which the Insured Person's 11. Convalescence, general debility, Run-down condition or rest cure, congenital external

Hospitalization was required, and disease or defects or anomalies, sterility, venereal disease, intentional self injury and use of

intoxicating drugs/alcohol.

ii. The In-patient Hospitalization claim for such Hospitalization is admissible by the Insurance

Company 12. Charges incurred at Hospital or Nursing Home primarily for Diagnostic, X-ray or laboratory

Examinations not consistent with or incidental to the diagnosis and treatment of the positive

Post Hospitalization means Medical Expenses incurred immediately after the insured person is

existence or presence of any ailment, sickness or injury, for which confinement is required at

discharged from the hospital provided that:

hospital / nursing home.

i. Such Medical Expenses are incurred for the same condition for which the insured person's

13. Expenses on vitamins and tonics unless forming part of treatment for injury or disease as

hospitalization was required and

certified by the attending Physician.

ii. The inpatient hospitalization claim for such hospitalization is admissible by the insurance

14. Injury or Disease directly or indirectly caused by or contributed to by nuclear weapons/

company.

materials.

Qualified Nurse is a person who holds a valid registration from the Nursing Council of India or the

15. Treatment arising from or traceable to pregnancy, childbirth, miscarriage, abortion or

Nursing Council of any state In India.

complications of any of these including caesarean section.(other than ectopic pregnancy)

Reasonable and Customary charges means a charge for medical care which shall be

16. Naturopathy Treatment.

considered reasonable and customary to the extent that it does not exceed the general level of

STAR NET PLUS Unique Identification No.: IRDA/NL-HLT/SHAI/P-H/V.I/106/13-14 2 of 4

Star Health and Allied Insurance Co. Ltd. Policy Wordings

17. Hospital registration charges, record charges, telephone charges and such other similar 5. All claims under this policy shall be payable in Indian currency.

charges. 6. All medical/surgical treatments under this policy shall have to be taken in India.

18. Expenses incurred on Lasik Laser or Refractive Error Correction treatment. 7. If the claim event falls within two policy periods, the claims shall be paid taking into

19. Expenses incurred on weight control services including surgical procedures for treatment of consideration the available sum insured in the two policy periods, including the

obesity, medical treatment for weight control/loss programs. deductibles for each policy period. Such eligible claim amount to be payable to the insured

20. Expenses incurred for treatment of diseases/illness/accidental injuries by systems of shall be reduced to the extent of premium to be received for the renewal/due date of premium

medicines other than Allopathic shall be restricted to 25% of the sum insured. of health insurance policy, if not received earlier.

21. OTHER EXCLUDED EXPENSES AS DETAILED IN THE WEBSITE WWW.STARHEALTH.IN. 8. Package Charges: The Company's liability in respect of package charges will be restricted

to 80% of such amount. (Package charges refer to charges that are not advertised in the

4. CONDITIONS:

Schedule of the Hospital) Where Package rates are charged the Post-Hospitalisation benefit

Conditions under Section I will be calculated after taking the room and boarding charges at 2% of the sum insured per

1. This policy is available for all persons irrespective of age. However, the Company can day.

decline cover to any persons subsequent to pre-insurance medical tests. Conditions common to Section I and Section II

2. The renewals shall be automatic provided the renewal premium is paid before expiry of the 1. The premium payable under this policy shall be payable in advance. No receipt of premium

current policy. The yearly renewal premiums may vary over the period as and when this shall be valid except on the official form of the company signed by a duly authorized official of

policy product is reviewed and amended with the clearance of the Statutory Authorities. the company. The due payment of premium and the observance of fulfilment of the terms,

3. Pre-insurance medical tests are a pre-condition for all persons also who are included for the provision, conditions and endorsements of this policy by the Insured, in so far as they relate

first time under this insurance, at the time of renewal of the policy. Insurer can decline cover to anything to be done or complied with by the Insured, shall be a condition precedent to any

for any person or persons based on the outcome of such tests. liability of the Company to make any payment under this policy. No waiver of any terms,

4. The Insured shall obtain and furnish the Company with all documents upon which a claim is provisions, conditions, and endorsements of this policy shall be valid unless made in writing

based and shall also give the Company such additional information and assistance as the and signed by an authorized official of the Company.

Company may require in dealing with the claim. 2. Upon the happening of any event, which may give rise to a claim under this policy, notice with

5. The findings of such medical team shall be final and binding in deciding the admissibility of a full particulars shall be sent to the Company within 3days from the date of the incidence

claim. giving rise to a valid claim under the policy.

6. Automatic Termination: This policy shall terminate in respect of the relevant Insured person Note: Wavier of this condition may be considered in extreme cases of hardship where it is

immediately on the earlier of the following events: proved to the satisfaction of the company that under the circumstances in which the insured

was placed it was not possible form him or any other person to give such notice or file claim

a Upon the death of the relevant Insured person

within the prescribed time limit.

a Upon payment of benefit under the policy in respect of the relevant Insured person.

3. A team of medical practitioners as defined herein shall be allowed to examine the Insured

7. Limitation: It is also further expressly agreed and declared that if the Company shall disclaim person and conduct the required tests in case of an alleged condition giving rise to a claim,

liability to the Insured for any claim hereunder and such claim shall not, within three years when and as often as the same may reasonably be required on behalf of the Company at

from the date of such disclaimer have been made the subject matter of a suit in a Court of company's cost.

Law, then the claim shall for all purposes be deemed to have been abandoned and shall not

4. The Company shall not be liable to make any payment under the policy in respect of any

thereafter be recoverable hereunder.

claim if such claim is in any manner fraudulent or supported by any fraudulent means or

8. Payment of Claim: All claims under this policy shall be payable in Indian currency. device, misrepresentation whether by the Insured person or by any other person acting on

Conditions under Section II his behalf.

1. Claim must be filed within 15 days from the date of discharge from the Hospital. This is a 5. Cancellation: The Company may cancel this policy on grounds of misrepresentation, fraud,

condition precedent to admission of liability under the policy. However the company will moral hazard, non disclosure of material fact as declared in proposal form / at the time of

examine and relax the time limit mentioned in these conditions depending upon the merits of claim, or non-co-operation by the insured person, by sending the insured 30 days notice by

the case registered letter at the insured person's last known address. The insured may at any time

2. The Insured Person shall obtain and furnish the Company with all original bills, receipts and cancel this policy and in such event the Company shall allow refund after retaining premium

other documents upon which a claim is based and shall also give the Company such at Company's short period rate only (table given below) provided no claim has occurred up to

additional information and assistance as the Company may require in dealing with the the date of cancellation

claim.

Documents to be submitted in support of claim are – PERIOD ON RISK RATE OF PREMIUM TO BE RETAINED

For reimbursement claims Up to one-month ⅓ rd of annual premium

a. Duly completed claim form, and Up to three months ½ of annual premium

b. Pre -admission investigations and treatment papers Up to six months ¾ th of annual premium

c. Discharge summary from the hospital in original Exceeding six months Full annual premium

d. Cash receipts from hospital, chemists

e. Cash receipts and reports for tests done 6. Policy Dispute: Any dispute concerning the interpretation of the terms, conditions,

f. Receipts from doctors, surgeons, anesthetist limitations and/or exclusions contained herein is understood and agreed to by both the

Insured and the Company to be subject to Indian Law. All matters arising hereunder shall be

g. Certificate from the attending doctor regarding the diagnosis.

determined in accordance with the law and practice of such Court.

For Cashless Treatment:

7. Renewal: The policy will be renewed except on grounds of misrepresentation / fraud

Prescriptions and receipts for Pre and Post-hospitalization committed, non-disclosure of material facts as declared in the proposal form.

Note: The Company reserves the right to call for additional documents wherever required A grace period of 30 days from the date of expiry of the policy is available for renewal. If

In case of delay in payment of any claim that has been admitted as payable under the Policy renewal is made within this 30 days period the continuity of benefits will be allowed. However

terms and conditions, beyond the time period as prescribed under IRDA (Protection of the actual period of cover will start only from the date of payment of premium. In other words

Policyholders Regulation), 2002, the Company shall be liable to pay interest at a rate which is no protection is available between the policy expiry date and the date of payment of premium

2% above the bank rate prevalent at the beginning of the financial year in which the claim is for renewal.

approved by the Company. For the purpose of this clause, 'bank rate' shall mean the existing In the event of this policy being withdrawn / modified with revised terms and/or premium with

bank rate as notified by Reserve Bank of India, unless the extent regulation requires the prior approval of the Competent Authority, the insured will be intimated three months in

payment based on some other prescribed interest rate. advance and accommodated in any other equivalent health insurance policy offered by the

3. Automatic Termination: This insurance in relation to each relevant person shall terminate Company, if requested for by the Insured Person, at the relevant point of time.

immediately on the earlier of the following events: 8. Notices: Any notice, direction or instruction given under this policy shall be in writing and

a Upon the death of the Insured Person delivered by hand, post, or facsimile/email to Star Health and Allied Insurance Company

a Upon exhaustion of the sum insured in respect of such person Limited, No 1, New Tank Street, Valluvar Kottam High Road, Nungambakkam, Chennai-

4. It is clearly agreed and understood that no difference or dispute shall be referable to 600034. Toll Free Fax No.: 1800-425-5522, Toll Free No.:1800-425-2255 / 1800-102-4477,

arbitration, as hereinbefore provided, if the Company has disputed or not accepted liability E-Mail : support@starhealth.in.

under or in respect of this Policy. It is hereby expressly stipulated and declared that it shall be Notice and instructions will be deemed served 7 days after posting or immediately upon

a condition precedent to any right of action or suit upon this Policy that the award by such receipt in the case of hand delivery, facsimile or e-mail

arbitrator/ arbitrators of the amount of the loss or damage shall be first obtained. It is also 9. Customer Service: If at any time the Insured requires any clarification or assistance, the

further expressly agreed and declared that if the Company shall disclaim liability to the Insured may contact the offices of the Company at the address specified, during normal

Insured for any claim hereunder and such claim shall not, within three years from the date of business hours.

such disclaimer have been made the subject matter of a suit in a Court of Law, then the claim 10. Grievances: In case the Insured Person is aggrieved in any way, the Insured may contact

shall for all purposes be deemed to have been abandoned and shall not thereafter be the Company and Company at the specified address, during normal business hours.

recoverable hereunder.

Grievance Department, Star Health and Allied Insurance Company Limited, No1, New

STAR NET PLUS Unique Identification No.: IRDA/NL-HLT/SHAI/P-H/V.I/106/13-14 3 of 4

Star Health and Allied Insurance Co. Ltd. Policy Wordings

Tank Street, Valluvar Kottam High Road, Nungambakkam, Chennai 600034, Phone: 044- c. any dispute on the legal construction of the policies in so far as such disputes relate to

28243921 during normal business hours. or Send e-mail to grievances@starhealth.in. claims;

Senior Citizens may Call 044-28243923. d. delay in settlement of claims;

In the event of the following grievances: e. Non-issuance of any insurance document to customer after receipt of the premium.

a. any partial or total repudiation of claims by the Company the insured person may approach the Insurance Ombudsman at the address given below,

b. any dispute in regard to premium paid or payable in terms of the policy; within whose jurisdiction the branch or office of Star Health and Allied Insurance Company

Limited or the residential address or place of the policy holder is located.

LIST OF OMBUDSMAN OFFICE DETAILS

6th Floor, Jeevan Prakash Bldg., Tilak Marg, Fatima Akhtar Court, 4th Floor, 453, Anna Janak Vihar Complex, 2nd Floor, 6, Malviya 6th Floor, Jeevan Bhawan, Phase-II, Nawal

Relief Road, Ahmedabad - 380001. Salai, Teynampet, CHENNAI – 600 018. Nagar, Opp. Airtel Office, Near New Market, Kishore Road, Hazratganj, Lucknow -

Phone: 079 - 25501201-02-05-06 Tel.: 044 - 24333668 / 24335284, Fax: 044 - Bhopal – 462003. Fax: 0755 -2769203, Tel.: 226001. Tel.: 0522 - 2231330 / 2231331,

Email ID : bimalokpal.ahmedabad@ecoi.co.in 24333664. 0755 - 2769201 / 2769202. Fax: 0522 -2231310

Website : www.ecoi.co.in Email:bimalokpal.chennai@ecoi.co.in Email: bimalokpal.bhopal@ecoi.co.in Email:bimalokpal.lucknow@ecoi.co.in

JURISDICTION : Gujarat, Dadra & Nagar JURISDICTION : Tamil Nadu, Pondicherry JURISDICTION : Madhya Pradesh, JURISDICTION : Districts of

Haveli, Daman and Diu. Town and Karaikal Chattisgarh. Uttar Pradesh : Laitpur, Jhansi, Mahoba,

Hamirpur, Banda, Chitrakoot, Allahabad,

Jeevan Nidhi – II Bldg., Gr. Floor, Bhawani 1st Floor,Kalpana Arcade Building, Bazar 62, Forest park, Bhubneshwar – 751 009. Mirzapur, Sonbhabdra, Fatehpur,

Singh Marg,Jaipur - 302 005. Tel.: 0141 - Samiti Road, Bahadurpur, Patna - 800 006. Tel.: 0674 - 2596461 / 2596455, Pratapgarh, Jaunpur,Varanasi, Gazipur,

2740363 Tel.: 0612-2680952 Fax: 0674 -2596429 Jalaun, Kanpur, Lucknow, Unnao, Sitapur,

Email:Bimalokpal.jaipur@ecoi.co.in Email:bimalokpal.patna@ecoi.co.in Email: bimalokpal.bhubaneswar@ecoi.co.in Lakhimpur, Bahraich, Barabanki,

JURISDICTION : Rajasthan. JURISDICTION : Bihar,Jharkhand. JURISDICTION : Orissa. Raebareli, Sravasti, Gonda, Faizabad,

Amethi, Kaushambi, Balrampur, Basti,

Ambedkar nagar, Sultanpur, Maharajgang,

3rd Floor, Jeevan Seva Annexe, S. V. Road, Jeevan Nivesh, 5th Floor, Nr. Panbazar over Jeevan Darshan Bldg., 3rd Floor, C.T.S.

Santkabir nagar, Azamgarh, Kushinagar,

Santacruz (W), Mumbai - 400 054. bridge, S.S. Road, Guwahati – 781 001 No.s. 195 to 198, N.C. Kelkar Road, Narayan

Gorkhpur, Deoria, Mau, Ghazipur,

Tel.: 022 -26106552 / 26106960, Fax: 022 - (ASSAM). Tel.: 0361 - 2132204 / 2132205, Peth, Pune – 411 030. Tel.: 020-41312555

26106052 Fax: 0361 -2732937 Email:bimalokpal.pune@ecoi.co.in Chandauli, Ballia, Sidharathnagar.

Email:bimalokpal.mumbai@ecoi.co.in Email:bimalokpal.guwahati@ecoi.co.in JURISDICTION : Maharashtra, Area of Navi 2nd Floor, Pulinat Bldg., Opp. Cochin

JURISDICTION : Goa, Mumbai JURISDICTION : Assam, Meghalaya, Mumbai and Thane excluding Mumbai Shipyard, M. G. Road,Ernakulam - 682 015.

Metropolitan Region excluding Navi Manipur, Mizoram, Arunachal Pradesh, Metropolitan Region. Tel.: 0484 - 2358759 / 2359338, Fax: 0484 -

Mumbai & Thane. Nagaland and Tripura. 2359336

S.C.O. No. 101, 102 & 103, 2nd Floor, Batra Email:bimalokpal.ernakulam@ecoi.co.in

Jeevan Soudha Building, PID No. 57-27-N-19 Bhagwan Sahai Palace, 4th Floor, Main Building, Sector 17–D, Chandigarh–160 017. JURISDICTION : Kerala, Lakshadweep,

Ground Floor, 19/19, 24th Main Road, JP Road, Naya Bans, Sector 15, Distt: Gautam Tel.: 0172 - 2706196 / 2706468, Mahe - a part of Pondicherry.

Nagar, Ist Phase, Bengaluru – 560 078. Buddh Nagar, U.P-201301. Fax: 0172 -2708274

Tel. : 080 - 26652048 / 26652049 Tel.: 0120 - 2514250 / 2514252 / 2514253 Email: bimalokpal.chandigarh@ecoi.co.in

Email : bimalokpal.bengaluru@ecoi.co.in Email:bimalokpal.noida@ecoi.co.in 2/2 A, Universal Insurance Building, Asaf Ali

JURISDICTION : Punjab, Road, New Delhi – 110 002.

JURISDICTION : Karnataka. JURISDICTION : State of Uttaranchal and Haryana,Himachal Pradesh, Jammu & Tel.: 011 - 23232481 / 23213504

the following Districts of Uttar Pradesh: Kashmir, Chandigarh. Email:bimalokpal.delhi@ecoi.co.in

6-2-46, 1st floor, "Moin Court", Lane Opp. Agra, Aligarh, Bagpat, Bareilly, Bijnor,

Saleem Function Palace, A. C. Guards, Budaun, Bulandshehar, Etah, Kanooj, JURISDICTION : Delhi.

Hindustan Bldg. Annexe, 4th Floor, 4, C.R.

Lakdi-Ka-Pool, Hyderabad - 500 004. Mainpuri, Mathura, Meerut, Moradabad, Avenue, KOLKATA - 700 072.

Tel.: 040 - 65504123 / 23312122, Fax: 040 - Muzaffar nagar, Oraiyya, Pilibhit, Etawah, Tel.: 033 - 22124339 / 22124340,

23376599 Farrukhabad, Firozbad, Gautambodha Fax : 033 -22124341.

Email:bimalokpal.hyderabad@ecoi.co.in nagar, Ghaziabad, Hardoi, Shahjahanpur, Email:bimalokpal.kolkata@ecoi.co.in

JURISDICTION : Andhra pradesh, Hapur, Shamli, Rampur, Kashganj, Health

Sambhal, Amroha, Hathras, Kanshiram JURISDICTION : West Bengal,Sikkim, Personal & Caring Insurance

Telangana, Yanam and part of Territory of Andaman & Nicobar Islands.

Pondicherry. nagar, Saharanpur. The Health Insurance Specialist

11. Important Note:

The Policy Schedule and any Endorsement are to be read together and any word or expression to which a specific meaning has been attached in any one of them shall bear such meaning

wherever it appears.

The terms conditions and exceptions that appear in the Policy or in any Endorsement are part of the contract and must be complied with. Failure to comply may result in the claim being denied.

The attention of the policy holder is drawn to our website www.starhealth.in for Antifraud policy of the company for necessary compliance by all stake holders.

POL / NET / V.4 / 2018 - 19

Health

Personal & Caring Insurance

The Health Insurance Specialist

STAR NET PLUS Unique Identification No.: IRDA/NL-HLT/SHAI/P-H/V.I/106/13-14 4 of 4

You might also like

- Clinical Teaching Plan OBDocument7 pagesClinical Teaching Plan OBMyrtle Yvonne Ragub80% (5)

- Steelman, Graling - 2013 - Top 10 Patient Safety Issues What More Can We DoDocument23 pagesSteelman, Graling - 2013 - Top 10 Patient Safety Issues What More Can We DoElNo ratings yet

- Linear Programming ApplicationDocument12 pagesLinear Programming ApplicationSyurga Fathonah100% (3)

- DH Ratnagiri Quality ManualDocument71 pagesDH Ratnagiri Quality ManualPrabhat Kumar100% (2)

- Star Comprehensive Insurance PolicyDocument20 pagesStar Comprehensive Insurance PolicyJanakiramaiah YarlagaddaNo ratings yet

- The Oriental Insurance Company LimitedDocument33 pagesThe Oriental Insurance Company LimitedSharma AmanNo ratings yet

- VARISTHA Mediclaim For Senior Citizens Policy PDFDocument15 pagesVARISTHA Mediclaim For Senior Citizens Policy PDFSudhirNo ratings yet

- Prospectus - Star Special Care: Star Health and Allied Insurance Company LimitedDocument4 pagesProspectus - Star Special Care: Star Health and Allied Insurance Company LimitedGopi223No ratings yet

- The Oriental Insurance Company LimitedDocument9 pagesThe Oriental Insurance Company LimitedkmrezNo ratings yet

- STU Policy WordingsDocument35 pagesSTU Policy WordingsSandeep NRNo ratings yet

- Tata R-Comprehensive-Prospectus-New-1Document27 pagesTata R-Comprehensive-Prospectus-New-1vasanth8555No ratings yet

- Star Comprehensive Prospectus New 1Document27 pagesStar Comprehensive Prospectus New 1Arushi SinghNo ratings yet

- Prospectus - : Star Health and Allied Insurance Company LimitedDocument19 pagesProspectus - : Star Health and Allied Insurance Company LimitedudhayNo ratings yet

- FHO Prospectus PDFDocument20 pagesFHO Prospectus PDFVidhyaRIyengarNo ratings yet

- Family Health Optima Insurance PlanDocument16 pagesFamily Health Optima Insurance PlanAmit GargNo ratings yet

- Mediclaim Insurance Policy (Group) Policy WordingsDocument29 pagesMediclaim Insurance Policy (Group) Policy WordingsSaransh SharmaNo ratings yet

- SHAHLIP21580V052021_2020-2021Document27 pagesSHAHLIP21580V052021_2020-2021arvindsuri888No ratings yet

- Health - Individual Mediclaim Policy PDFDocument25 pagesHealth - Individual Mediclaim Policy PDFAlakh BhattNo ratings yet

- Diabetes Safe Insurance PolicyDocument11 pagesDiabetes Safe Insurance PolicyJyothika JayashriNo ratings yet

- Oichlgp449v022021 2020-2021Document29 pagesOichlgp449v022021 2020-2021shikharektaNo ratings yet

- Mediclaim Insurance Policy - IndividualDocument8 pagesMediclaim Insurance Policy - IndividualjnaguNo ratings yet

- 06 Senior Citizen PolicyDocument26 pages06 Senior Citizen PolicyJaimson FrancisNo ratings yet

- Prospectus Yuva Bharat Health PolicyDocument28 pagesProspectus Yuva Bharat Health PolicyS PNo ratings yet

- Mediclaim Policy (2007) : The New India Assurance Co. LTDDocument15 pagesMediclaim Policy (2007) : The New India Assurance Co. LTDAnil Kumar ChauhanNo ratings yet

- Adobe2017 Policy PDFDocument13 pagesAdobe2017 Policy PDFJithuNo ratings yet

- SBI General Arogya Plus Policy ProspectusDocument19 pagesSBI General Arogya Plus Policy Prospectusyashmpanchal333No ratings yet

- Health Guard: Gold PlanDocument32 pagesHealth Guard: Gold Planhiteshmohakar15No ratings yet

- Women Care Insurance Policy ProspectusDocument17 pagesWomen Care Insurance Policy ProspectusSOODHIR DEVGHARKARNo ratings yet

- AB Arogyadan Group Health Insurance SchemeDocument15 pagesAB Arogyadan Group Health Insurance SchemedrchiNo ratings yet

- HFF-2015 Pol PDFDocument31 pagesHFF-2015 Pol PDFAmit RajNo ratings yet

- Extra Care PolicyDocument13 pagesExtra Care PolicyManoj ChepeNo ratings yet

- Prospectus Yuva Bharat Health PolicyDocument29 pagesProspectus Yuva Bharat Health PolicyAlen KarbiaNo ratings yet

- Oriental Insurance-Happy Family Floater Policy-ProspectusDocument12 pagesOriental Insurance-Happy Family Floater Policy-Prospectusdpsharma1978No ratings yet

- TermsDocument11 pagesTermstusharNo ratings yet

- NEW INDIA Family Flaoter Mediclaim PolicyDocument14 pagesNEW INDIA Family Flaoter Mediclaim Policyjoydeep_d3232No ratings yet

- GHI IDC ESC - 2020-21 - FinalDocument34 pagesGHI IDC ESC - 2020-21 - FinalShobha KrishnanNo ratings yet

- Policy InfomationDocument2 pagesPolicy InfomationNirav PathakNo ratings yet

- Group Mediclaim Scheme For RetireesDocument9 pagesGroup Mediclaim Scheme For RetireesAnal GuhaNo ratings yet

- Tob Imed May2022Document6 pagesTob Imed May2022technoglobalroadNo ratings yet

- Senior Citizen ConcessionDocument19 pagesSenior Citizen ConcessionGanga PrasadNo ratings yet

- B-623, Gate No. 7, Green Field, Surajkund Mall Road, Faridabad, Haryana - 121003Document16 pagesB-623, Gate No. 7, Green Field, Surajkund Mall Road, Faridabad, Haryana - 121003Neeraj KatnaNo ratings yet

- Induction Manual 1688120103Document24 pagesInduction Manual 1688120103Radhe shamNo ratings yet

- Prospectus Senior Citizen Mediclaim PolicyDocument24 pagesProspectus Senior Citizen Mediclaim PolicyManasNo ratings yet

- BMI MediPlan 100 Planisalud Rider R7 11 21 1contratoDocument9 pagesBMI MediPlan 100 Planisalud Rider R7 11 21 1contratoivantv2014No ratings yet

- The Oriental Insurance Company Limited,: Mediclaim Insurance Policy (Group)Document14 pagesThe Oriental Insurance Company Limited,: Mediclaim Insurance Policy (Group)Amit RajNo ratings yet

- Group Mediclaim Policy 06052015 PDFDocument14 pagesGroup Mediclaim Policy 06052015 PDFAmit RajNo ratings yet

- Individual Medical Policy For Dependents - Dmed: Table of BenefitsDocument6 pagesIndividual Medical Policy For Dependents - Dmed: Table of Benefitsrahul sNo ratings yet

- The Health Insurance SpecialistDocument8 pagesThe Health Insurance SpecialistsaranyaNo ratings yet

- Bajhlip21127v032021 2020-2021Document26 pagesBajhlip21127v032021 2020-2021aakash.shandilya.cscNo ratings yet

- Family Health Optima Insurance PlanDocument16 pagesFamily Health Optima Insurance PlanvedavathiNo ratings yet

- Ghi Idc Parents 2020-21 FinalDocument31 pagesGhi Idc Parents 2020-21 FinalABHISHEKGOYANNo ratings yet

- Easy Health Insurance Customer Information Sheet With Policy Wordings (Standard Plan)Document12 pagesEasy Health Insurance Customer Information Sheet With Policy Wordings (Standard Plan)yogeshpartheNo ratings yet

- Product Summary FOR Group Hospital & Surgical InsuranceDocument4 pagesProduct Summary FOR Group Hospital & Surgical InsuranceDaniel OngNo ratings yet

- BAGIC Group Mediclaim - BrochureDocument38 pagesBAGIC Group Mediclaim - BrochureVisakh MahadevanNo ratings yet

- Family Health Optima Insurance Plan Prospectus - Family Health Optima Insurance PlanDocument11 pagesFamily Health Optima Insurance Plan Prospectus - Family Health Optima Insurance PlanDhanush Kumar RamanNo ratings yet

- Senior Citizen Policy - 0Document14 pagesSenior Citizen Policy - 0nywd806033No ratings yet

- Family Health Care Gold BrochureDocument15 pagesFamily Health Care Gold BrochureYASH JAISINGNo ratings yet

- Health Guard Policy Wordings PrintDocument32 pagesHealth Guard Policy Wordings PrintAlexNo ratings yet

- Prospectus New India Asha Kiran PolicyDocument17 pagesProspectus New India Asha Kiran PolicySHYLAJA DNo ratings yet

- Family Health Optima Insurance PlanDocument16 pagesFamily Health Optima Insurance Planujjal deyNo ratings yet

- Medical Insurance Eligibility Verification - The Comprehensive GuideFrom EverandMedical Insurance Eligibility Verification - The Comprehensive GuideNo ratings yet

- Newman's Billing and Coding Technicians Study GuideFrom EverandNewman's Billing and Coding Technicians Study GuideRating: 4.5 out of 5 stars4.5/5 (2)

- Ses 12Document1 pageSes 12Kishore KNo ratings yet

- ICTC Staff Information For Web Site PDFDocument33 pagesICTC Staff Information For Web Site PDFKishore KNo ratings yet

- Kuhnke IA Series Relay DatasheetDocument4 pagesKuhnke IA Series Relay DatasheetKishore KNo ratings yet

- Jones-Bio Rotary 2018 2019Document1 pageJones-Bio Rotary 2018 2019Kishore KNo ratings yet

- ICICI Pru Iprotect SmartDocument19 pagesICICI Pru Iprotect SmartKishore KNo ratings yet

- Ats KPT ProjectDocument46 pagesAts KPT ProjectKishore KNo ratings yet

- 070123-PAI & AAI General Guidelines PDFDocument4 pages070123-PAI & AAI General Guidelines PDFKishore KNo ratings yet

- Price Bid Format Volume II of Nit 1603792343 PDFDocument14 pagesPrice Bid Format Volume II of Nit 1603792343 PDFKishore KNo ratings yet

- FormsDocument14 pagesFormsKishore KNo ratings yet

- Karnataka Govt Evening Polytechnic MangaluruDocument9 pagesKarnataka Govt Evening Polytechnic MangaluruKishore KNo ratings yet

- CCMD TenderDoc8Document109 pagesCCMD TenderDoc8Kishore KNo ratings yet

- Presentation Generator Protection 1514868547 258691Document14 pagesPresentation Generator Protection 1514868547 258691Kishore KNo ratings yet

- ProjectDocument25 pagesProjectKishore KNo ratings yet

- Karnataka Govt. Evening PolytechnicDocument14 pagesKarnataka Govt. Evening PolytechnicKishore KNo ratings yet

- 7.inplant TrainingDocument7 pages7.inplant TrainingKishore KNo ratings yet

- Report On Inplant Training Format For Preparation of Training Report (Four Weeks/Six Weeks/ Six Months)Document3 pagesReport On Inplant Training Format For Preparation of Training Report (Four Weeks/Six Weeks/ Six Months)Kishore KNo ratings yet

- HanumanthDocument1 pageHanumanthKishore KNo ratings yet

- CULTUREDocument2 pagesCULTUREWilliam CiferNo ratings yet

- Discharge PlanningDocument6 pagesDischarge PlanningHamdah GirlsNo ratings yet

- University Foundation: College of NursingDocument2 pagesUniversity Foundation: College of NursingDyanne BautistaNo ratings yet

- How-To Guide: Prevent Adverse Drug Events by Implementing Medication ReconciliationDocument40 pagesHow-To Guide: Prevent Adverse Drug Events by Implementing Medication ReconciliationJorge Arturo Porras BermúdezNo ratings yet

- Community PsychiatryDocument45 pagesCommunity PsychiatrySarvess MuniandyNo ratings yet

- Service Wise Clarification: 1. Charitable and Religious Activity Related ServicesDocument10 pagesService Wise Clarification: 1. Charitable and Religious Activity Related ServicesPrasanthNo ratings yet

- 1.overview of JCI 2017Document18 pages1.overview of JCI 2017Nesti AgustNo ratings yet

- Primary Hospital PDFDocument189 pagesPrimary Hospital PDFMulugeta FentawNo ratings yet

- ANNEX E and Familiarization of The FormDocument36 pagesANNEX E and Familiarization of The FormRiqueza KingNo ratings yet

- Accurate Measurement of Weight and Height 1: Weighing PatientsDocument3 pagesAccurate Measurement of Weight and Height 1: Weighing PatientsConvalescent Nursing HomeNo ratings yet

- Policy Arogya Sanjeevani Policy V 1 Final 0204 WebDocument10 pagesPolicy Arogya Sanjeevani Policy V 1 Final 0204 WebHiiNo ratings yet

- Oop - Om ADocument17 pagesOop - Om AMeghraj ShindeNo ratings yet

- CLINICAL REPORT (Autosaved)Document18 pagesCLINICAL REPORT (Autosaved)Kate BumatayNo ratings yet

- Pre-Authorization Form (PAF) : Pa NumberDocument1 pagePre-Authorization Form (PAF) : Pa NumberAmna QamarNo ratings yet

- Senior Citizens Red Carpet Health Insurance Policy PDFDocument8 pagesSenior Citizens Red Carpet Health Insurance Policy PDFrohit22221No ratings yet

- Seminar ON Role of Research, Leadership and Management in NursingDocument22 pagesSeminar ON Role of Research, Leadership and Management in Nursingannu panchal100% (1)

- Full Download Health Assessment and Physical Examination 5th Edition Estes Test BankDocument36 pagesFull Download Health Assessment and Physical Examination 5th Edition Estes Test Bankzoism.waygoose.3fuhqv100% (38)

- RRT PPT With Changes Staff 12 30 13Document22 pagesRRT PPT With Changes Staff 12 30 13Dhaya DhayaNo ratings yet

- 24 CFP Clinical Guideline 10 - Chemical RestraintDocument20 pages24 CFP Clinical Guideline 10 - Chemical RestraintFernando Feliz ChristianNo ratings yet

- Career GuidanceDocument19 pagesCareer GuidanceAbdul JalilNo ratings yet

- University of Birmingham: Implementing Clinical Governance in Iranian HospitalsDocument9 pagesUniversity of Birmingham: Implementing Clinical Governance in Iranian HospitalssunnyNo ratings yet

- NURS FPX 6016 Assessment 2 Quality Improvement Initiative EvaluationDocument6 pagesNURS FPX 6016 Assessment 2 Quality Improvement Initiative Evaluationfarwaamjad771No ratings yet

- Hospital Management System PDFDocument19 pagesHospital Management System PDFKeerthana keerthanaNo ratings yet

- Clinical Leadership Fellows Yearbook 2012 - NHS Leadership AcademyDocument47 pagesClinical Leadership Fellows Yearbook 2012 - NHS Leadership AcademyNHS Leadership Academy0% (2)

- WHO Mental Health 1949 1961 EngDocument50 pagesWHO Mental Health 1949 1961 EngShamitha ShettyNo ratings yet

- Bioetica y Decisiones Eticas en Pediatría CL BulletinDocument60 pagesBioetica y Decisiones Eticas en Pediatría CL Bulletinvainilla.333No ratings yet