Professional Documents

Culture Documents

Accounting Project

Accounting Project

Uploaded by

Nour ShadyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Project

Accounting Project

Uploaded by

Nour ShadyCopyright:

Available Formats

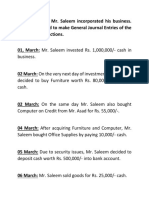

Mark established Drivers Line Company, on January 1, 2020.

It’s a

car selling company that sells cars for a period of time. During the

whole year, the company completed these transactions:

1. On January 1, Mark invested $10,000,000 on cash to start car

renting company, Drivers Line Company.

2. On January 4, Mark purchased a land paying 1,000000 on cash.

3. On January 6, He built a store for 500,000 on credit.

4. On January 7, Mark bought cars on cash 5,500,000 for 20 cars.

5. On January 12, The company purchased office equipments for

250,000 on cash.

6. On January 13, Drivers Line Company sold a car for a client with

350,000 on cash.

7. On January 16, the company paid 50,000 utilities on cash.

8. On January 18, Drivers Line company bought additional office

equipment 100,000 on credit.

9. On January 19, the company sold two cars with 600,000 On

cash and collected the money immediately.

10. The company received 350,000 cash early on a car that

should be next month to the client.

11. On January 21, the company sold a car for a client and billed

that client 300,000 for the service on credit.

12. The company rented an extra garage for 75,000 for a full

year to put the rest of the cars In it.

13. On January 24, Drivers Line company paid the assistant’s

salaries of 3,000 cash.

14. On January 25, Drivers Line company purchased additional

cars for 500,000 It paid 250,000 in cash and signed a note

payable promising to pay 250,000

15. On January 27, the company received 300,000 on cash for

the transaction created on January 21.

16. On January 28, the company paid 10,000 For an insurance

policy covering the next 12 months.

17. On January 30, the company sold a car for 300,000 On

credit.

18. The company paid the liability created on january 18

19. On February 2, Drivers Line company sold a car for 400,000

And collected the cash directly.

20. On February 3, the company paid 5,000 for an

advertisement on cash.

21. On February 5, Mark made a 20,000 Cash withdrawal from

the company for personal use.

22. On February 6, the company purchased supplies on cash for

2,000

23. On February 7, the company sold a car for a client 300,000

on credit.

24. On February 9, The company paid 2,500 For a telephone bill

on cash.

25. On February 10, Drivers Line company received 75,000 Cash

for the transaction created on February 7.

26. On February 11, Drivers Line company sold a car for a client

400,000 on cash.

27. On February 12, the company paid an assistant 10,000 cash

as wages.

28. On February 13, Drivers Line company paid 1,000 Cash for

cleaning services.

29. On February 15, Drivers Line company expanded and bought

a building to open a new branch for 400,000 cash

30. The company paid the liability in January 18.

Need: check date, money, no. 4 money not sure, no. 18 changed , no.

22 added, no. 26 changed , no. 27 changed

You might also like

- Bookkeeping ActivityDocument11 pagesBookkeeping ActivityIest HinigaranNo ratings yet

- Exercises On Journalizing (Debit and Credit)Document2 pagesExercises On Journalizing (Debit and Credit)kim100% (6)

- Case Study MoneyCareDocument1 pageCase Study MoneyCareDivesh Bhatia0% (1)

- Accountancy For Lawyers - Practice QuestionsDocument3 pagesAccountancy For Lawyers - Practice QuestionsNantege ProssielyNo ratings yet

- SAP Brazil GRC NFE OverviewDocument29 pagesSAP Brazil GRC NFE OverviewdhanahbalNo ratings yet

- Hanson CaseDocument11 pagesHanson Casegharelu10No ratings yet

- Double Entry System - Part II Tutorial 7Document3 pagesDouble Entry System - Part II Tutorial 7Waruna PrabhaswaraNo ratings yet

- Tutorial 05Document3 pagesTutorial 05Janidu KavishkaNo ratings yet

- Assignment 01 Financial AccountingDocument3 pagesAssignment 01 Financial Accountingsehrish kayaniNo ratings yet

- Test 1Document3 pagesTest 1super manNo ratings yet

- Finance - NumericalsDocument13 pagesFinance - NumericalsAbhishek Kumar DeyNo ratings yet

- Accounting Problems - 2018Document31 pagesAccounting Problems - 2018Albert Moreno100% (4)

- Home Work Problem - 27072021Document1 pageHome Work Problem - 27072021shubham hemaneNo ratings yet

- Accounting ProblemsDocument31 pagesAccounting ProblemsJanna Gunio100% (1)

- Tutorial Test 1-QuestionDocument1 pageTutorial Test 1-QuestionLe Tuong MinhNo ratings yet

- Chapter 2 Practice ExercisesDocument2 pagesChapter 2 Practice ExercisesSokrit SoeurNo ratings yet

- Final Project FA BSAF-2.0Document5 pagesFinal Project FA BSAF-2.0Uzair QayyumNo ratings yet

- G. Exercise 1Document1 pageG. Exercise 1Natasyah AbdullahNo ratings yet

- Advance Journal EntriesDocument1 pageAdvance Journal EntriesJanhabi deNo ratings yet

- Accounting Equation Problems and SolutionDocument7 pagesAccounting Equation Problems and SolutionNilrose EscartinNo ratings yet

- Afn Tutorial 5Document4 pagesAfn Tutorial 5annie christNo ratings yet

- School Maintenance IncDocument1 pageSchool Maintenance IncMarissa ClementNo ratings yet

- Accouting PracticeDocument1 pageAccouting PracticeSOTTO, MCKIM A.No ratings yet

- Accounting ProjectDocument5 pagesAccounting ProjectEdwin KimoriNo ratings yet

- Accounting Equation and General JournalDocument3 pagesAccounting Equation and General JournalWaqar AhmadNo ratings yet

- Journal EntryDocument1 pageJournal EntryFransiel B. AkistoyNo ratings yet

- Double Entry ExerciseDocument1 pageDouble Entry ExerciseL MyNo ratings yet

- ACC Project 1Document8 pagesACC Project 1Mikaela LensleyNo ratings yet

- Assignment 01Document1 pageAssignment 01Muddassir NasirNo ratings yet

- Cases Karkraft & Valley TransportersDocument2 pagesCases Karkraft & Valley TransportersAvirup ChatterjeeNo ratings yet

- Accounting Concepts CaseletsDocument2 pagesAccounting Concepts CaseletsStorm ShadowNo ratings yet

- Accountancy ProjectDocument10 pagesAccountancy ProjectAham GamingNo ratings yet

- AssignmentDocument3 pagesAssignmentoblazer shadowNo ratings yet

- As NADDD Final RequiremnetDocument1 pageAs NADDD Final Requiremnetnono.lharryNo ratings yet

- Notes 20231111073718Document1 pageNotes 20231111073718Fadhilah Jalil (Lilaj halihdaf)No ratings yet

- Assignment Soution 1Document9 pagesAssignment Soution 1divya kalyaniNo ratings yet

- Assign. S1 2122....Document2 pagesAssign. S1 2122....إسماعيل البلوشيNo ratings yet

- General Journal PracticeDocument5 pagesGeneral Journal PracticeAhmedNo ratings yet

- Session # 3 - Accounting CaseletsDocument2 pagesSession # 3 - Accounting CaseletsMandapalli SatishNo ratings yet

- Depreciation Questions.Document2 pagesDepreciation Questions.doshifamily.raahilNo ratings yet

- Accounting EquationDocument1 pageAccounting EquationFelicia Shan SugataNo ratings yet

- E1 Accounting Entries PracticeDocument1 pageE1 Accounting Entries PracticeHuzaifanadeemNo ratings yet

- MT FreshDocument5 pagesMT FreshMechergui RamiNo ratings yet

- 11th Com DepreciationDocument4 pages11th Com DepreciationObaid KhanNo ratings yet

- Assignment No. 01 FAPDocument4 pagesAssignment No. 01 FAPUmar FaridNo ratings yet

- Exercises On Accounting EquationDocument4 pagesExercises On Accounting EquationNeelu AggrawalNo ratings yet

- Lab Practical Question in Computerised AccountingDocument2 pagesLab Practical Question in Computerised Accountingnani11k3No ratings yet

- Nguyễn Đinh Long Giang HS153006 Individual AssignmentDocument14 pagesNguyễn Đinh Long Giang HS153006 Individual AssignmentNguyen Hoang Nam (K15 HL)No ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Journal entries - QuestionsDocument11 pagesJournal entries - Questionsdilipupadhyay1979No ratings yet

- Journal EntryDocument1 pageJournal EntryPrabhleen KaurNo ratings yet

- Gurjeets Journal EntriesDocument1 pageGurjeets Journal EntriesJordanBetelNo ratings yet

- Prelim - Accounting For Non AccountantsDocument1 pagePrelim - Accounting For Non AccountantsJason YaraNo ratings yet

- Lecture 2 Transaction Analysis QuestionDocument1 pageLecture 2 Transaction Analysis QuestionHương ĐỗNo ratings yet

- Common Stock Cash Note Payable Cash Cash Services Cash Note Payable Services A/P Services A/R A/P A/R Cash CashDocument3 pagesCommon Stock Cash Note Payable Cash Cash Services Cash Note Payable Services A/P Services A/R A/P A/R Cash CashĐàm Quang Thanh TúNo ratings yet

- Bake and Bite Inc.Document1 pageBake and Bite Inc.Simaran MalikNo ratings yet

- Holden Graham Started The Graham Co A New Business That: Unlock Answers Here Solutiondone - OnlineDocument1 pageHolden Graham Started The Graham Co A New Business That: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- POA Questions 3Document4 pagesPOA Questions 3HAFSA -No ratings yet

- Accounting Bs 1st New Practice QuestionsDocument14 pagesAccounting Bs 1st New Practice QuestionsJahanzaib ButtNo ratings yet

- CH 03 Alt ProbDocument8 pagesCH 03 Alt ProbMuhammad Usman25% (4)

- APL Laundry and Linen Private LimitedDocument3 pagesAPL Laundry and Linen Private LimitedAnurag SharmaNo ratings yet

- Clearsight Monitor - Professional Services Industry UpdateDocument9 pagesClearsight Monitor - Professional Services Industry UpdateClearsight AdvisorsNo ratings yet

- Brand ValuationDocument37 pagesBrand Valuationmohit.almal100% (2)

- Performance Governance System: PNP P.A.T.R.O.L. Plan 2030Document158 pagesPerformance Governance System: PNP P.A.T.R.O.L. Plan 2030arnelmartin120689No ratings yet

- I. 1. Acquisition Method: Non-Controlling Interest Consolidated StatementDocument14 pagesI. 1. Acquisition Method: Non-Controlling Interest Consolidated StatementCookies And CreamNo ratings yet

- Bonus Shares, Right Shares PDFDocument30 pagesBonus Shares, Right Shares PDFNaga ChandraNo ratings yet

- Defining Principles Based StandardsDocument5 pagesDefining Principles Based StandardsZeeshanSameenNo ratings yet

- Submitted To: Submitted By:: Marketing PlanDocument8 pagesSubmitted To: Submitted By:: Marketing PlanZeeshan AhmadNo ratings yet

- Solution Manual For Fundamentals of Taxation 2019 Edition 12th by CruzDocument31 pagesSolution Manual For Fundamentals of Taxation 2019 Edition 12th by CruzSherryBakerdawz100% (40)

- Project Excution and Control FourDocument40 pagesProject Excution and Control FourMohammad AbdullahNo ratings yet

- Acc 112 TG#09Document8 pagesAcc 112 TG#09Carren joy MendozaNo ratings yet

- IAS 16 NotesDocument2 pagesIAS 16 Notesshoaib jamshedNo ratings yet

- Stevenson 13e Chapter 13Document40 pagesStevenson 13e Chapter 13Jerwin MarasiganNo ratings yet

- P1 Day1 RM2020Document5 pagesP1 Day1 RM2020P De GuzmanNo ratings yet

- Lect 1 - Introduction On Course and Technopreneurship ViewDocument34 pagesLect 1 - Introduction On Course and Technopreneurship ViewmawargunNo ratings yet

- Project Management - Initiating ProjectsDocument40 pagesProject Management - Initiating ProjectsKaushika Rajapaksha PereraNo ratings yet

- Industrial Automation1Document15 pagesIndustrial Automation1anon_91668243No ratings yet

- Walmat Case Study-M IsasmendiDocument10 pagesWalmat Case Study-M IsasmendiCairis CairisNo ratings yet

- FMI Annual Report 2018 2019 PDFDocument140 pagesFMI Annual Report 2018 2019 PDFHtet KhaingNo ratings yet

- Factors Affecting The Profitability of Small Scale Food InustriesDocument9 pagesFactors Affecting The Profitability of Small Scale Food InustriesDeo N. Sarol0% (1)

- 11th Edition Bernard W. Taylor IIIDocument10 pages11th Edition Bernard W. Taylor IIIArdhika IriantoNo ratings yet

- Overall NSA - ICANDocument33 pagesOverall NSA - ICANDristi SaudNo ratings yet

- Explain Diversifiable Risk and Non-Diversifiable Risk in Financial Markets?Document2 pagesExplain Diversifiable Risk and Non-Diversifiable Risk in Financial Markets?fnajwa55No ratings yet

- Ambit PDFDocument70 pagesAmbit PDFshahavNo ratings yet

- Qa 1Document6 pagesQa 1AISECT PMKK SalemNo ratings yet

- ACC 304 Week 3 Homework - Chapter 10Document8 pagesACC 304 Week 3 Homework - Chapter 10Leree0% (1)

- QUICK GUIDE Amadeus Ticketing EntriesDocument50 pagesQUICK GUIDE Amadeus Ticketing EntriestkirstenleighNo ratings yet

- Benchmark V Kalanick and Uber PDF Uber (Company) Board of DirectorsDocument1 pageBenchmark V Kalanick and Uber PDF Uber (Company) Board of Directorsjs8462774No ratings yet

- Cost ReductionDocument40 pagesCost ReductionXMBA 24 ITM Vashi100% (2)