Professional Documents

Culture Documents

Transfer Rollover

Transfer Rollover

Uploaded by

Home Credit IndonesiaCopyright:

Available Formats

You might also like

- Tax Invoice For: Your Telstra BillDocument6 pagesTax Invoice For: Your Telstra Billgfdfg dfg dfNo ratings yet

- CapitalOne Statement 012016 8085 2 PDFDocument6 pagesCapitalOne Statement 012016 8085 2 PDFDeyaricDesireeFumeroVillegas100% (1)

- Account Summary - 7433311045: Collier County BenefitsDocument8 pagesAccount Summary - 7433311045: Collier County BenefitsstaciNo ratings yet

- HSBC London Corporate Refund Undertaking LetterDocument1 pageHSBC London Corporate Refund Undertaking LetterHelge Sandoy100% (3)

- Capital One Account DisclosuresDocument23 pagesCapital One Account Disclosuresisaac_maykovich100% (2)

- Direct Deposit FormDocument3 pagesDirect Deposit FormRabindra ShakyaNo ratings yet

- Cashline Form - LatestDocument3 pagesCashline Form - LatestAnonymous GxsqKv85GNo ratings yet

- Contribution FormDocument1 pageContribution FormHome Credit IndonesiaNo ratings yet

- WEX Transfer FormDocument3 pagesWEX Transfer FormGraham EvansNo ratings yet

- how-to-use-your-hsa_201612281029288126 (1)Document1 pagehow-to-use-your-hsa_201612281029288126 (1)MahendraNo ratings yet

- Account Closure Form: Health Savings Account (HSA)Document1 pageAccount Closure Form: Health Savings Account (HSA)ElaNo ratings yet

- Direct Deposit FormDocument3 pagesDirect Deposit FormSreenivas RaoNo ratings yet

- GS Bank: Deposit Account AgreementDocument19 pagesGS Bank: Deposit Account Agreementaosdghwoieh tNo ratings yet

- Generic Form Preview DocumentDocument1 pageGeneric Form Preview Documentelena.69.mxNo ratings yet

- Direct Deposit of Other Income: Please Establish Direct Deposit or Change Account Used For Direct DepositDocument1 pageDirect Deposit of Other Income: Please Establish Direct Deposit or Change Account Used For Direct DepositXquisiteNo ratings yet

- Credit Prod TransferDocument2 pagesCredit Prod Transfermatt luiNo ratings yet

- Christos Virtual Solutions - Bank InformationDocument1 pageChristos Virtual Solutions - Bank Informationshamarasharpe48No ratings yet

- Rtgs Form of Syndicate BankDocument2 pagesRtgs Form of Syndicate BankshridharNo ratings yet

- AUCardholderAgreement Debt Transfer Agreement PDFDocument5 pagesAUCardholderAgreement Debt Transfer Agreement PDFBrian Hughes100% (1)

- Medical Mutual HSA Enrollment GuideC2924GHP 1218rDocument23 pagesMedical Mutual HSA Enrollment GuideC2924GHP 1218rMayurRumalwalaNo ratings yet

- Rapid - Meta - Savings Terms and Condition Agreement - BILINGUALDocument6 pagesRapid - Meta - Savings Terms and Condition Agreement - BILINGUALBj flyerNo ratings yet

- Trustee Transfer Direct Rollover Request Form Nov2015Document2 pagesTrustee Transfer Direct Rollover Request Form Nov2015rsydbkhc98No ratings yet

- Direct Deposit FormDocument2 pagesDirect Deposit FormCamiloNo ratings yet

- Sample Funding DocumentsDocument6 pagesSample Funding Documentsfoodiejulian1994No ratings yet

- Watch Your Savings GrowDocument14 pagesWatch Your Savings GrowpratikjaiNo ratings yet

- Non Federal Direct Deposit Enrollment Request Form EnglishDocument1 pageNon Federal Direct Deposit Enrollment Request Form EnglishtobyNo ratings yet

- Bank To Bank Transfer For IRAsDocument4 pagesBank To Bank Transfer For IRAsFerdee FerdNo ratings yet

- Bank Authorization (BA) FormDocument4 pagesBank Authorization (BA) FormAilec FinancesNo ratings yet

- SSS - Online and Offline TransactionsDocument1 pageSSS - Online and Offline Transactionsgarciacruz0510No ratings yet

- Express AccountOpeningDocument7 pagesExpress AccountOpeningSheraz AbbasNo ratings yet

- Liquidity Account OpenformDocument20 pagesLiquidity Account OpenformClement DavidNo ratings yet

- Abd Direct Deposit InfoDocument2 pagesAbd Direct Deposit Infobrysonblair23No ratings yet

- Allied Bank App FormDocument2 pagesAllied Bank App FormChristian LarkinNo ratings yet

- Health Savings Account (Hsa) : Fifth ThirdDocument2 pagesHealth Savings Account (Hsa) : Fifth ThirdMuhammad Akmal HossainNo ratings yet

- KeyBank Rollover FormDocument1 pageKeyBank Rollover FormmicheleNo ratings yet

- Direct Deposit FormDocument1 pageDirect Deposit FormLatonya DodsonNo ratings yet

- HSA SunAdvantageHSA Guide May07Document8 pagesHSA SunAdvantageHSA Guide May07jaxNo ratings yet

- Asaan AccountopeningDocument7 pagesAsaan AccountopeningAbdullah IbrahimNo ratings yet

- IRA Contribution and RolloverDocument4 pagesIRA Contribution and Rolloverja leeNo ratings yet

- Thomas 05.31.23Document32 pagesThomas 05.31.23Deuntae ThomasNo ratings yet

- Primary Account Holder Joint Account Holder 1 Joint Account Holder 2Document1 pagePrimary Account Holder Joint Account Holder 1 Joint Account Holder 2Varun NagpalNo ratings yet

- DormantDocument1 pageDormantbabujiNo ratings yet

- HSBC Add-On Credit Card Application: Primary Credit Cardholder DetailsDocument2 pagesHSBC Add-On Credit Card Application: Primary Credit Cardholder DetailsPrabudh BansalNo ratings yet

- Salary Transfer Letter: (Leave Blank If Account To Be Opened)Document1 pageSalary Transfer Letter: (Leave Blank If Account To Be Opened)bossbobNo ratings yet

- Introduction EbcDocument5 pagesIntroduction EbckmkesavanNo ratings yet

- Ready Cash Availment Form 1.5% - IBDocument1 pageReady Cash Availment Form 1.5% - IBWynmar Kevyn MarquezNo ratings yet

- ACH+FORM_ (1)Document1 pageACH+FORM_ (1)juneduval680No ratings yet

- Reply To Email Via:: Payment Amount: 3.CRORE, 6.LAKHSDocument1 pageReply To Email Via:: Payment Amount: 3.CRORE, 6.LAKHSPranayWaghmareNo ratings yet

- Request Letter For Bank DraftDocument8 pagesRequest Letter For Bank Draftc2nwx0f3100% (1)

- Direct Deposit Enrollment & Changes: SECTION 1: Annuitant InformationDocument3 pagesDirect Deposit Enrollment & Changes: SECTION 1: Annuitant InformationdesireeNo ratings yet

- Citizenship Charter of DBDocument13 pagesCitizenship Charter of DBPrathyusha KothaNo ratings yet

- Dir DepDocument1 pageDir Depfazlah8106No ratings yet

- APP24588Document2 pagesAPP24588ArifNo ratings yet

- Retail BankingDocument71 pagesRetail Bankingswati_rathourNo ratings yet

- Schwab Bank Electronic Funds Transfer Enrollment FormDocument7 pagesSchwab Bank Electronic Funds Transfer Enrollment FormcadeadmanNo ratings yet

- Balance Transfer Application Form: (Please Use Capital Letters To Fill The Application)Document1 pageBalance Transfer Application Form: (Please Use Capital Letters To Fill The Application)Ali Khan AKNo ratings yet

- HK GRCC Platinum - Transfer-In App FormDocument1 pageHK GRCC Platinum - Transfer-In App FormpercysmithNo ratings yet

- Security Bank ADA Enrollment FormDocument1 pageSecurity Bank ADA Enrollment FormNoknik OllirecNo ratings yet

- 11 11Document2 pages11 11SankalpNo ratings yet

- Module 2 - Banking Transaction DocumentsDocument13 pagesModule 2 - Banking Transaction DocumentsAshwinNo ratings yet

- Pakistan Telecommunication Employees Trust: Account Verification FormDocument2 pagesPakistan Telecommunication Employees Trust: Account Verification FormMubasher AliNo ratings yet

- Chennai Metro WaterDocument1 pageChennai Metro WaterlkjdfkallNo ratings yet

- Invoice - 1375765446 - I0129P2306166110 - Jun - Aug 2023Document1 pageInvoice - 1375765446 - I0129P2306166110 - Jun - Aug 2023koushik DuttaNo ratings yet

- 11072004Document2 pages11072004Ma. Vershiela De GuzmanNo ratings yet

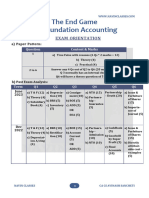

- Dec 23 - CA Foundation Acc Marathon NotesDocument37 pagesDec 23 - CA Foundation Acc Marathon Notesnasiransar26No ratings yet

- Credit Card BrochureDocument13 pagesCredit Card BrochureA Man GamesNo ratings yet

- Accounts Receivable Collection PolicyDocument9 pagesAccounts Receivable Collection PolicyEuneze Lucas100% (1)

- Emergency Leave Letter-1Document3 pagesEmergency Leave Letter-1militarybase773365No ratings yet

- History of Allied Bank of Pakistan: Univeristy of The PunjabDocument72 pagesHistory of Allied Bank of Pakistan: Univeristy of The PunjabAmbreen SheikhNo ratings yet

- Bank Reconciliation Theory & ProblemsDocument9 pagesBank Reconciliation Theory & ProblemsSalvador DapatNo ratings yet

- Bannking OperationnDocument61 pagesBannking OperationnDS SdNo ratings yet

- Raizabcanillas: Page1of3 Fd228Pinesparkbalili 9 4 8 9 - 2 4 8 5 - 8 9 Latrinidad Benguetla 2 6 0 1Document4 pagesRaizabcanillas: Page1of3 Fd228Pinesparkbalili 9 4 8 9 - 2 4 8 5 - 8 9 Latrinidad Benguetla 2 6 0 1RAIZA CANILLASNo ratings yet

- Standard Fees ChargesDocument1 pageStandard Fees ChargesShirleyNo ratings yet

- Develop Understanding of Debt and Consumer CreditDocument5 pagesDevelop Understanding of Debt and Consumer CreditJemal SeidNo ratings yet

- Trial Balance Examples1Document9 pagesTrial Balance Examples1John WickNo ratings yet

- Account Opening Form NR IndividualDocument2 pagesAccount Opening Form NR IndividualGraham EvansNo ratings yet

- Broadband Bill AprilDocument1 pageBroadband Bill AprilkarthikNo ratings yet

- $1,943,217, Equifax 2017.11.01Document1 page$1,943,217, Equifax 2017.11.01larry-612445No ratings yet

- Invoice: Summary of Charges / Payments Current Bill AnalysisDocument7 pagesInvoice: Summary of Charges / Payments Current Bill AnalysisJo AngNo ratings yet

- "A Study On Consumer Perception TOWARDS Paytm": AbstractDocument12 pages"A Study On Consumer Perception TOWARDS Paytm": Abstractmukesh kumarNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsMae Richelle D. DacaraNo ratings yet

- Prepaid Presentation APEXDocument23 pagesPrepaid Presentation APEXRajkot academyNo ratings yet

- Fee Information Document: General Account ServicesDocument7 pagesFee Information Document: General Account Servicesdaryl30011996No ratings yet

- Internship Report Chap 3Document9 pagesInternship Report Chap 3Faizan MalikNo ratings yet

- SoC Retail Deposits 08 11 2022Document6 pagesSoC Retail Deposits 08 11 2022Dihan AbdullahNo ratings yet

- Theories and Problem Solving AKDocument19 pagesTheories and Problem Solving AKJob CastonesNo ratings yet

- Group 1 Chapter 1 3 Quali Research - Docx REVISEDDocument40 pagesGroup 1 Chapter 1 3 Quali Research - Docx REVISEDLeo EspinoNo ratings yet

Transfer Rollover

Transfer Rollover

Uploaded by

Home Credit IndonesiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Transfer Rollover

Transfer Rollover

Uploaded by

Home Credit IndonesiaCopyright:

Available Formats

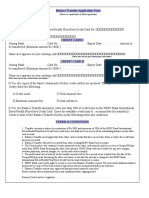

Health Savings Account Direct Transfer Request Form

Complete this form to authorize HSA Bank to receive a transfer of assets directly from a

Health Savings Account (HSA) or Medical Savings Account (Archer MSA) into your HSA at

HSA Bank.

IMPORTANT: Mail your completed form to the Trustee or Custodian who is currently holding your assets and will be transferring

funds to your HSA at HSA Bank.

• Please be sure your account at HSA Bank is open and active prior to submitting this form. If you don’t have an open account at

HSA Bank, funds will be returned to the prior Custodian.

• For an HSA Rollover involving a check, complete the Health Savings Account Rollover Request Form, available on the Member

Website.

• For an IRA to HSA Transfer, complete the IRA to HSA Transfer Form, available on the Member Website.

• Note: Transfers may take 4 to 6 weeks depending on the transferring Trustee/Custodian’s processing time.

All fields are required.

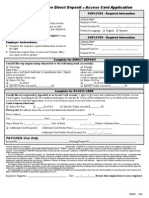

PART 1: ACCOUNTHOLDER INFORMATION

First Name: Middle Initial: Last Name:

Street Address: City: State: Zip Code:

Daytime Phone Number: Email Address:

HSA Bank Account Number:

(8 or 12 digits from your Welcome Kit or Member Website (Accounts tab). The account number is NOT the same as your debit

card number.)

Full 9‐digit Social Security Number:

‐ ‐

PART 2: REQUEST TYPE

This form is being submitted to my current Trustee/Custodian to request a Trustee‐to‐Trustee Transfer. I currently have HSA

funds with my current Trustee/Custodian and want to transfer the funds directly to HSA Bank.

Account Number at Current Trustee/Custodian:

PART 3: TRANSFER INSTRUCTIONS

Transfer the entire account balance.

Partial Transfer. Please transfer $ to HSA Bank and DO NOT close my account with your organization.

RULES AND CONDITIONS APPLICABLE TO TRANSFERS

Eligibility for HSA Transfer:

You may only transfer funds into an HSA from an HSA, Archer MSA, or IRA. You may only transfer funds if you are: 1) the

accountholder of both the receiving and transferring HSA, Archer MSA, or IRA; 2) the surviving spouse of a deceased

accountholder; or 3) the former spouse of the accountholder who is receiving an interest in the HSA, Archer MSA, or IRA pursuant

to a divorce or separation agreement.

INSTRUCTIONS FOR THE CUSTODIAN

Make check payable to “HSA Bank For the Benefit Of [Owner’s Name]” and mail check, along with this fully completed form, to:

HSA Bank, P.O. Box 251, Sheboygan, WI 53082. Include full social security number or full HSA Bank account number.

PART 4: SIGNATURES

I have read and understand the rules and conditions on the bottom of this form and I have met the requirements for making the

designated transaction. Due to the important tax consequences of the designated transaction I have been advised to see a tax

professional. All information provided by me is true and correct and may be relied on by the Trustee or Custodian. I assume full

responsibility for this transaction and will not hold HSA Bank liable for any adverse consequences that may result.

Accountholder Signature: Date:

Provided that the HSA Bank HSA is opened and in good order, HSA Bank agrees to serve as the Custodian for the HSA of the above‐

named individual. As Custodian, HSA Bank agrees to accept the transferred assets, which should clearly identify the individual

whose HSA is to be credited.

Authorized Signature of Accepting HSA Custodian:

© 2022 HSA Bank. HSA Bank is a division of Webster Bank, N.A., Member FDIC. Form_Health_Savings_Account _Direct_Transfer_010522

Plan Administrative Services and Benefit Services are administered by Webster Servicing LLC.

You might also like

- Tax Invoice For: Your Telstra BillDocument6 pagesTax Invoice For: Your Telstra Billgfdfg dfg dfNo ratings yet

- CapitalOne Statement 012016 8085 2 PDFDocument6 pagesCapitalOne Statement 012016 8085 2 PDFDeyaricDesireeFumeroVillegas100% (1)

- Account Summary - 7433311045: Collier County BenefitsDocument8 pagesAccount Summary - 7433311045: Collier County BenefitsstaciNo ratings yet

- HSBC London Corporate Refund Undertaking LetterDocument1 pageHSBC London Corporate Refund Undertaking LetterHelge Sandoy100% (3)

- Capital One Account DisclosuresDocument23 pagesCapital One Account Disclosuresisaac_maykovich100% (2)

- Direct Deposit FormDocument3 pagesDirect Deposit FormRabindra ShakyaNo ratings yet

- Cashline Form - LatestDocument3 pagesCashline Form - LatestAnonymous GxsqKv85GNo ratings yet

- Contribution FormDocument1 pageContribution FormHome Credit IndonesiaNo ratings yet

- WEX Transfer FormDocument3 pagesWEX Transfer FormGraham EvansNo ratings yet

- how-to-use-your-hsa_201612281029288126 (1)Document1 pagehow-to-use-your-hsa_201612281029288126 (1)MahendraNo ratings yet

- Account Closure Form: Health Savings Account (HSA)Document1 pageAccount Closure Form: Health Savings Account (HSA)ElaNo ratings yet

- Direct Deposit FormDocument3 pagesDirect Deposit FormSreenivas RaoNo ratings yet

- GS Bank: Deposit Account AgreementDocument19 pagesGS Bank: Deposit Account Agreementaosdghwoieh tNo ratings yet

- Generic Form Preview DocumentDocument1 pageGeneric Form Preview Documentelena.69.mxNo ratings yet

- Direct Deposit of Other Income: Please Establish Direct Deposit or Change Account Used For Direct DepositDocument1 pageDirect Deposit of Other Income: Please Establish Direct Deposit or Change Account Used For Direct DepositXquisiteNo ratings yet

- Credit Prod TransferDocument2 pagesCredit Prod Transfermatt luiNo ratings yet

- Christos Virtual Solutions - Bank InformationDocument1 pageChristos Virtual Solutions - Bank Informationshamarasharpe48No ratings yet

- Rtgs Form of Syndicate BankDocument2 pagesRtgs Form of Syndicate BankshridharNo ratings yet

- AUCardholderAgreement Debt Transfer Agreement PDFDocument5 pagesAUCardholderAgreement Debt Transfer Agreement PDFBrian Hughes100% (1)

- Medical Mutual HSA Enrollment GuideC2924GHP 1218rDocument23 pagesMedical Mutual HSA Enrollment GuideC2924GHP 1218rMayurRumalwalaNo ratings yet

- Rapid - Meta - Savings Terms and Condition Agreement - BILINGUALDocument6 pagesRapid - Meta - Savings Terms and Condition Agreement - BILINGUALBj flyerNo ratings yet

- Trustee Transfer Direct Rollover Request Form Nov2015Document2 pagesTrustee Transfer Direct Rollover Request Form Nov2015rsydbkhc98No ratings yet

- Direct Deposit FormDocument2 pagesDirect Deposit FormCamiloNo ratings yet

- Sample Funding DocumentsDocument6 pagesSample Funding Documentsfoodiejulian1994No ratings yet

- Watch Your Savings GrowDocument14 pagesWatch Your Savings GrowpratikjaiNo ratings yet

- Non Federal Direct Deposit Enrollment Request Form EnglishDocument1 pageNon Federal Direct Deposit Enrollment Request Form EnglishtobyNo ratings yet

- Bank To Bank Transfer For IRAsDocument4 pagesBank To Bank Transfer For IRAsFerdee FerdNo ratings yet

- Bank Authorization (BA) FormDocument4 pagesBank Authorization (BA) FormAilec FinancesNo ratings yet

- SSS - Online and Offline TransactionsDocument1 pageSSS - Online and Offline Transactionsgarciacruz0510No ratings yet

- Express AccountOpeningDocument7 pagesExpress AccountOpeningSheraz AbbasNo ratings yet

- Liquidity Account OpenformDocument20 pagesLiquidity Account OpenformClement DavidNo ratings yet

- Abd Direct Deposit InfoDocument2 pagesAbd Direct Deposit Infobrysonblair23No ratings yet

- Allied Bank App FormDocument2 pagesAllied Bank App FormChristian LarkinNo ratings yet

- Health Savings Account (Hsa) : Fifth ThirdDocument2 pagesHealth Savings Account (Hsa) : Fifth ThirdMuhammad Akmal HossainNo ratings yet

- KeyBank Rollover FormDocument1 pageKeyBank Rollover FormmicheleNo ratings yet

- Direct Deposit FormDocument1 pageDirect Deposit FormLatonya DodsonNo ratings yet

- HSA SunAdvantageHSA Guide May07Document8 pagesHSA SunAdvantageHSA Guide May07jaxNo ratings yet

- Asaan AccountopeningDocument7 pagesAsaan AccountopeningAbdullah IbrahimNo ratings yet

- IRA Contribution and RolloverDocument4 pagesIRA Contribution and Rolloverja leeNo ratings yet

- Thomas 05.31.23Document32 pagesThomas 05.31.23Deuntae ThomasNo ratings yet

- Primary Account Holder Joint Account Holder 1 Joint Account Holder 2Document1 pagePrimary Account Holder Joint Account Holder 1 Joint Account Holder 2Varun NagpalNo ratings yet

- DormantDocument1 pageDormantbabujiNo ratings yet

- HSBC Add-On Credit Card Application: Primary Credit Cardholder DetailsDocument2 pagesHSBC Add-On Credit Card Application: Primary Credit Cardholder DetailsPrabudh BansalNo ratings yet

- Salary Transfer Letter: (Leave Blank If Account To Be Opened)Document1 pageSalary Transfer Letter: (Leave Blank If Account To Be Opened)bossbobNo ratings yet

- Introduction EbcDocument5 pagesIntroduction EbckmkesavanNo ratings yet

- Ready Cash Availment Form 1.5% - IBDocument1 pageReady Cash Availment Form 1.5% - IBWynmar Kevyn MarquezNo ratings yet

- ACH+FORM_ (1)Document1 pageACH+FORM_ (1)juneduval680No ratings yet

- Reply To Email Via:: Payment Amount: 3.CRORE, 6.LAKHSDocument1 pageReply To Email Via:: Payment Amount: 3.CRORE, 6.LAKHSPranayWaghmareNo ratings yet

- Request Letter For Bank DraftDocument8 pagesRequest Letter For Bank Draftc2nwx0f3100% (1)

- Direct Deposit Enrollment & Changes: SECTION 1: Annuitant InformationDocument3 pagesDirect Deposit Enrollment & Changes: SECTION 1: Annuitant InformationdesireeNo ratings yet

- Citizenship Charter of DBDocument13 pagesCitizenship Charter of DBPrathyusha KothaNo ratings yet

- Dir DepDocument1 pageDir Depfazlah8106No ratings yet

- APP24588Document2 pagesAPP24588ArifNo ratings yet

- Retail BankingDocument71 pagesRetail Bankingswati_rathourNo ratings yet

- Schwab Bank Electronic Funds Transfer Enrollment FormDocument7 pagesSchwab Bank Electronic Funds Transfer Enrollment FormcadeadmanNo ratings yet

- Balance Transfer Application Form: (Please Use Capital Letters To Fill The Application)Document1 pageBalance Transfer Application Form: (Please Use Capital Letters To Fill The Application)Ali Khan AKNo ratings yet

- HK GRCC Platinum - Transfer-In App FormDocument1 pageHK GRCC Platinum - Transfer-In App FormpercysmithNo ratings yet

- Security Bank ADA Enrollment FormDocument1 pageSecurity Bank ADA Enrollment FormNoknik OllirecNo ratings yet

- 11 11Document2 pages11 11SankalpNo ratings yet

- Module 2 - Banking Transaction DocumentsDocument13 pagesModule 2 - Banking Transaction DocumentsAshwinNo ratings yet

- Pakistan Telecommunication Employees Trust: Account Verification FormDocument2 pagesPakistan Telecommunication Employees Trust: Account Verification FormMubasher AliNo ratings yet

- Chennai Metro WaterDocument1 pageChennai Metro WaterlkjdfkallNo ratings yet

- Invoice - 1375765446 - I0129P2306166110 - Jun - Aug 2023Document1 pageInvoice - 1375765446 - I0129P2306166110 - Jun - Aug 2023koushik DuttaNo ratings yet

- 11072004Document2 pages11072004Ma. Vershiela De GuzmanNo ratings yet

- Dec 23 - CA Foundation Acc Marathon NotesDocument37 pagesDec 23 - CA Foundation Acc Marathon Notesnasiransar26No ratings yet

- Credit Card BrochureDocument13 pagesCredit Card BrochureA Man GamesNo ratings yet

- Accounts Receivable Collection PolicyDocument9 pagesAccounts Receivable Collection PolicyEuneze Lucas100% (1)

- Emergency Leave Letter-1Document3 pagesEmergency Leave Letter-1militarybase773365No ratings yet

- History of Allied Bank of Pakistan: Univeristy of The PunjabDocument72 pagesHistory of Allied Bank of Pakistan: Univeristy of The PunjabAmbreen SheikhNo ratings yet

- Bank Reconciliation Theory & ProblemsDocument9 pagesBank Reconciliation Theory & ProblemsSalvador DapatNo ratings yet

- Bannking OperationnDocument61 pagesBannking OperationnDS SdNo ratings yet

- Raizabcanillas: Page1of3 Fd228Pinesparkbalili 9 4 8 9 - 2 4 8 5 - 8 9 Latrinidad Benguetla 2 6 0 1Document4 pagesRaizabcanillas: Page1of3 Fd228Pinesparkbalili 9 4 8 9 - 2 4 8 5 - 8 9 Latrinidad Benguetla 2 6 0 1RAIZA CANILLASNo ratings yet

- Standard Fees ChargesDocument1 pageStandard Fees ChargesShirleyNo ratings yet

- Develop Understanding of Debt and Consumer CreditDocument5 pagesDevelop Understanding of Debt and Consumer CreditJemal SeidNo ratings yet

- Trial Balance Examples1Document9 pagesTrial Balance Examples1John WickNo ratings yet

- Account Opening Form NR IndividualDocument2 pagesAccount Opening Form NR IndividualGraham EvansNo ratings yet

- Broadband Bill AprilDocument1 pageBroadband Bill AprilkarthikNo ratings yet

- $1,943,217, Equifax 2017.11.01Document1 page$1,943,217, Equifax 2017.11.01larry-612445No ratings yet

- Invoice: Summary of Charges / Payments Current Bill AnalysisDocument7 pagesInvoice: Summary of Charges / Payments Current Bill AnalysisJo AngNo ratings yet

- "A Study On Consumer Perception TOWARDS Paytm": AbstractDocument12 pages"A Study On Consumer Perception TOWARDS Paytm": Abstractmukesh kumarNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsMae Richelle D. DacaraNo ratings yet

- Prepaid Presentation APEXDocument23 pagesPrepaid Presentation APEXRajkot academyNo ratings yet

- Fee Information Document: General Account ServicesDocument7 pagesFee Information Document: General Account Servicesdaryl30011996No ratings yet

- Internship Report Chap 3Document9 pagesInternship Report Chap 3Faizan MalikNo ratings yet

- SoC Retail Deposits 08 11 2022Document6 pagesSoC Retail Deposits 08 11 2022Dihan AbdullahNo ratings yet

- Theories and Problem Solving AKDocument19 pagesTheories and Problem Solving AKJob CastonesNo ratings yet

- Group 1 Chapter 1 3 Quali Research - Docx REVISEDDocument40 pagesGroup 1 Chapter 1 3 Quali Research - Docx REVISEDLeo EspinoNo ratings yet