Professional Documents

Culture Documents

Answers 1

Answers 1

Uploaded by

Max WolfOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answers 1

Answers 1

Uploaded by

Max WolfCopyright:

Available Formats

BFF3751 Derivatives 1

Tutorial 1 Answers

Question 1

When we have an exposure to a particular asset (be it stocks, bonds, exchange rates,

commodities, etc), movement in prices can be favourable or unfavourable. For most assets, it

is extremely difficult to predict future movements. Exchange rate movements, for example, are

pretty much a 50:50 chance of going up or down. The random walk hypothesis for stock prices

implies a similar thing. Businesses operate in a very uncertain world.

There are two main ways of approaching this exposure:

• Hedging: take the attitude that I am not prepared to gamble on correctly predicting price

movements … not prepared to risk making a loss. Therefore, I prefer to remove all

uncertainty by ‘locking-in’ a certain value (be it an exchange rate at which you transact, an

interest rate at which you borrow, a price at which you buy or sell, etc).

• Speculating: is the exact opposite to hedging. You don't lock-in; you basically take a

gamble that you can correctly predict price movements. In doing so, you are fully exposed

to price movements. If you guess right, you gain; if you guess wrong, you lose.

The majority of our focus in BFF3751 will be on using derivative securities to hedge various

risk exposures. Of course, if you understand how derivatives work, you can easily use them to

speculate. A few tutorial questions will do this (including Q2, Q3 and Q4 of Tutorial 1).

a) A business like Qantas buys a lot of jet fuel and is hugely exposed to the risk of fuel prices

rising. If fuel prices rise, that hurts Qantas. If fuel prices fall, that’s good for Qantas. A long

forward contract allows the purchase of oil at the pre-specified price. This gives Qantas

some certainty over what fuel will cost by locking in a purchase price. Answer: hedging.

b) Cattle farmers worry about falling prices for live cattle. Often, they enter short futures

contracts to lock in the sale price and protect against falling cattle prices. However, this

farmer has decided not to do this – effectively, s/he is gambling that prices won’t fall. It

might sound odd, but to do nothing in this case is in fact speculation. If cattle prices rise,

that’s good for the farmer. If cattle prices fall, that bad for the farmer. Such a scenario is

usually a clear indication that they are not hedged.

Fifteen to twenty years ago, there were a number of high-profile cases where company

directors were found to be negligent for ‘doing nothing’ about risk management. They

refused to enter derivative positions to manage significant exchange-rate and interest-rate

exposures.

BFF3751 Tutorial 1 Philip Gray 2020 1

c) Entering long futures positions to buy electricity is obviously a hedging activity. Electricity

prices can change very quickly due to extreme weather conditions, generator outages, etc.

if the electiricty price rises, that hurts the retailer. If electricity price falls, that’s good for

the retailer. Entering long electricity futures contracts locks in the price at which the

wholesaler can purchase electricity and therefore protects against rising prices. A: hedging.

d) It makes sense that Cadbury has been using long futures contracts written on cocoa. Since

they purchase large amounts of cocoa to make their products, they are exposed to rising

prices of their key ingredient. However, the decision of senior execs to close out the hedge

(by entering short cocoa futures) is essentially speculation. They are gambling that, when

it comes time to purchase cocoa, prices will be lower than the delivery price written into

the futures contract. If prices do fall, management look wise; however, if prices continue

to rise, they look foolish. The fact that the final outcome is sensitive to what happens with

the price of cocoa is a sure sign of a speculative move.

e) We saw in Lecture 1 that short forward/futures positions make money when the price of

the underlying assets falls. Our fund manager will indeed make money on a short SPI200

position if the market drops. Of course, had the market risen, she would have lost lots of

money with a short SPI200 position. Again, this is a sure sign of speculation.

BFF3751 Tutorial 1 Philip Gray 2020 2

Question 2

We have seen in Lecture 1 that the short gold forward position profits when the price of the

underlying commodity falls and makes a loss when the price of the underlying commodity

rises. The lecture notes displayed the payoff diagram for a short forward position. It was a

downward sloping line – the further the price rises (falls), the more the short forward position

loses (profits). This question merely asks you to re-produce this payoff diagram calculating the

profit/loss for a range of gold prices.

Two key things to note about the calculations:

• The question is assuming that the size of the contract is 1,000 ounces of gold. That is,

the forward contract is for the delivery of 1,000 ounces of gold. So all calculations

below multiply by 1,000 ounces.

• Our initial position was to enter a short forward contract. We will close this out in

December by entering an offsetting long forward contract. The table gives a range of

possible prices for gold in December 2020. The calculations implicitly assume that the

forward price available to us when we go long to close out equals the December spot

price for gold. It is a fact that, on the expiry date of the contract, the quoted forward

price must equal the spot price of the underlying asset (i.e., gold). If this does not

happen, there is a trivial arbitrage opportunity available (see Q6 of Tutorial 1).

Opening trade: Short forward to sell 1,000 ounces of gold in Dec-2020:

1,000 × 1975 =USD 1,975,000

Closing trade: Long forward to buy 1,000 ounces of gold in Dec-2020:

1,000 × 1,625 =USD 1,625,000

Profit = 1,975,000 – 1,625,000 = +350,000

Calculate profit or loss if Dec-2020 gold price is:

1400 1500 1625 1700 1800 2000 2200 2300 2400

Profit or loss on

+575k +475k +350k +275k +175k -25k -225k -325k -425k

short gold forward

BFF3751 Tutorial 1 Philip Gray 2020 3

Profit Diagram for Short Forward Position

1.5

Our forward contract has a

delivery price (F) = 1975

A short forward position profits

when Dec-2020 gold price is

0.5 below F = 1975

1000 1500 2000 2500 3000

Profit or Loss

Dec-2020 Gold Price (per ounce)

-0.5

A short forward position loses

-1 when Dec-2020 gold price is

above F = 1975

-1.5

6

10

BFF3751 Tutorial 1 Philip Gray 2020 4

Question 3

a) By entering a long futures contract, we have an obligation to buy the underlying asset at

the contract price (F) on the specified delivery date. In this case, we are long ten FCOJ

futures contracts. Futures contracts are highly standardised. Each FCOJ contract covers

15,000 pounds of orange juice solids. 1 Since we have ten contracts, we are obliged to

purchase 150,000 pounds of orange juice in September 2020 at a fixed price of 200 cents

per pound. Therefore, the purchase will cost us: 150,000 × $2 = $300,000.

We went long because we are speculating that orange juice prices will rise. We hope they

will be something much higher than 200 cents. For example, we would love the price to

rise to say 300 cents. We have a contract that allows us to buy orange juice at 200c and we

could then sell it for 300c.

The danger is that the predicted price rise does not eventuate. If orange juice price falls to

say 150c, we are obliged to buy OJ at 200c per pound and it will only be worth 150c. In

other words, the danger with a long position is that prices will fall.

b) The FCOJ futures traded on the ICE can be physically delivered. That is, if we did not close

out the contract before expiry, we would have to take delivery of 150,000 pounds of orange

juice – not something a trader really wants to do! The vast majority of futures contracts are

not physically delivered. Rather, the trader closes out by entering an equal and opposite

position.

In our case, we can close out any time we want between now and September 2020. The

question says that, once price hits 230c, we close out and take the profit.

Opening trade: Long ten Sep-20 FCOJ contracts: 10 × 15,000 × 200 USD 300,000

Closing trade: Short ten Sep-20 FCOJ contracts: 10 × 15,000 × 230 USD 345,000

Profit USD 45,000

Calculate profit or loss if Sep-20 FCOJ futures price is:

100 125 150 175 200 225 250 275 300

Profit or loss on ten

-150k -112.5k -75k -37.5k nil +37.5k +75k +112.5k +150k

long FCOJ futures

1

I don’t really know what orange juice ‘solids’ are. And I don’t really need to. As a trader, I have no intention of

ever physically taking delivery or receiving orange juice. Once the price moves in my favoured direction, I will

simply close out the position and take the profit.

BFF3751 Tutorial 1 Philip Gray 2020 5

10

5 Payoff Diagram for ten Long FCOJ Futures

Our futures contracts have a

delivery price F = 200c

1 Long position profits

when Sep-20 FCOJ price

is above F = 200c

0

Profit/Loss

Long position loses

when Sep-20 FCOJ

-1 price is below F = 200c

-2

-3

0 0.5 1 1.5 2 2.5 3 3.5 4

Sep-20 FCOJ Price (per pound)

BFF3751 Tutorial 1 Philip Gray 2020 6

Question 4

The convention is to quote an exchange rate as AUD 1.00 buys X foreign dollars (this is referred

to as an indirect quote). For example, AUD 1.00 = CHF 0.74. However, it simplifies the

intuition if we view the foreign currency as just another commodity. Q: How much does it cost

to buy one Swiss franc? A: AUD 1.3514. 2 This is a direct quotation (e.g., CHF 1.00 = AUD

1.3514 . This practice also makes it much easier to understand the jargon of currencies

‘strengthening’ and ‘weakening’.

a) If the CHF strengthens, it becomes more expensive to buy. Buying CHF 1.00 will cost

more than AUD 1.3514. For example, the cost of one CHF might be AUD 1.40. In such

a case, the quoted exchange rate after strengthening is thus 1/1.40 = 0.7143.

So you can see why the indirect quoting convention is counter-intuitive. CHF quotes

have gone from 0.7400 down to 0.7143, yet this is in fact a strengthening of the CHF.

In contrast, if we use direct quotes, it is intuitive that the cost of a CHF going from

1.3514 up to 1.4000 is a strengthening.

b) The way to make money on anything is to sell at a higher price than that at which you

bought (i.e., buy low, sell high). If we are speculating that the CHF will strengthen,

part (a) showed that this means the cost of the CHF will rise. So we want a long position

in the CHF. Long positions make money when the price of the underlying asset rises.

Even ignoring the availability of a forward contract, we could speculate by taking a

long position in CHF (i.e., just buy some Swiss francs today at cost of AUD 1.3514).

We hold the CHF, hope they strengthen, then sell them at the higher price (i.e., convert

them back to AUD).

However, the question wants us to speculate using the forward contract. Again, we

would take a long forward contract on CHF at the six-month rate of 0.7450. Entering

a long forward contract at 0.7450 gives us the right to buy Swiss francs in six months’

time at a fixed price of AUD 1.3423.

To profit from this speculation, we not only need the CHF to strengthen, but to

strengthen beyond the quoted forward rate of 0.7450. This happens in part (d) and we

do in fact profit.

2

These answers will round the exchange rates to four decimal places. Students may get slightly different answers

if they use different rounding. I suggest that 4 dps is sufficient. Using just 2 dps can lead to quite large rounding

errors.

BFF3751 Tutorial 1 Philip Gray 2020 7

c) The spot exchange rate at 31 December maturity is 0.80. This represents a weakening

of the CHF (thus, our calculation below must show a loss). The quoted forward rate for

delivery on 31 Dec must also be 0.80 (else trivial arbitrage opportunity – see Tutorial 1

Question 6). So the ‘price’ of a CHF is 1.2500. We close out by shorting CHF 60,000

at this low price.

(in July) Enter long forward contract:

CHF 60,000 × 1.3423 AUD 80,538

(in Dec) Close out by shorting forward contract

CHF 60,000 × 1.2500 AUD 75,000

Loss AUD (5,538)

Note: when we enter this long forward contract in July, no money changes hands. It is

just a contract which has a notional value of $A80,538. Likewise, when we close out

by shorting the contract, we do not receive the notional value of $A75,000. The only

cashflow is us handing over $5,538.

d) If the spot exchange rate on 31 December is 0.70, the CHF has strengthened

considerably. This what we were hoping for when we entered a long forward on Swiss

Francs. The price of a CHF is AUD 1.4286.

(in July) Enter long forward contract

CHF 60,000 × 1.3423 AUD 80,538

(in Dec) Close out by shorting forward contract

CHF 60,000 × 1.4286 AUD 85,716

Gain AUD 5,178

BFF3751 Tutorial 1 Philip Gray 2020 8

Question 5

nb: all of these answers round the exchange rate to 4 decimal places. If students carry more

dps, their answer may differ just a little.

a) This part illustrates the danger of remaining exposed to exchange-rate movements (i.e.,

being unhedged). The AUD has weakened relative to the Euro between August and

December. Back in August, one Euro cost AUD 1.4706. Now, one Euro costs AUD 2.0000.

So the EUR10,000 needed for your holiday cost you a lot more. At the spot rate of 0.50,

buying EUR 10,000 will cost AUD 20,000. Ouch!

b) If we purchase EUR 10,000 at today’s spot rate of 0.6800, it will cost us AUD 14,706. If

the exchange rate did weaken to something like 0.50 in part a, we would be very glad we

bought the Euros early. But this strategy isn’t ideal, in that we need to have access to AUD

14,706 today and thus miss out on the potential interest we could have earned.

c) By using a forward contract, we can lock in today the price at which we can buy Euros in

December, thus removing any risk of exchange-rate movements. And doing this is better

than (b) because we don’t need to have any cash now. Since we intend to buy Euros in

December, we would enter a long forward contract written on Euros. As soon as we do this,

we know for certain that, in December, the EUR 10,000 will cost us AUD 14,656. And

another good thing about this long forward contract is that we don’t need any cash now.

We merely need to have AUD 14,656 in December to meet our commitment under the

forward contract.

d) To buy EUR 10,000 at today’s spot rate of 0.6800, we need AUD 14,706. So we can borrow

AUD 14,706 from a local bank, convert them into Euros today at the spot exchange rate,

all ready for our vacation. Four months later, we repay the loan balance of AUD 14,804

(=14,706 × exp(0.02 × 4/12)).

e) If we borrow AUD 14,560 today and use it to buy Euros at the spot rate of 0.6800, this

produces EUR 9,901 (14,560 × 0.68). Next, we deposit these Euros into our European bank

account to earn interest at 3% p.a. continuously compounded. In four months’ time, this

account has grown to EUR 10,000 (9901 × exp(0.03 × 4/12)). So that’s our target spending

money for the vacation! Back home, our loan of AUD 14,560 has grown to AUD 14,657

(14,560 × exp(0.02 × 4/12)). So this is the effective cost of the holiday.

Note that the vacation cost in part e is identical to the vacation cost when a forward

contract was utilised in part c (with $1 rounding difference). In Lecture 3, we will see the

same logic being used to establish the fair price for currency forward contracts (i.e.,

factoring in the spot exchange rate and the interest rates in the two countries). This is how

banks determine forward rates.

BFF3751 Tutorial 1 Philip Gray 2020 9

Question 6

On the expiry date of forward contract, if the quoted forward price does not match the spot

price on that day, there is an arbitrage opportunity. In other words, anyone who recognises the

mis-pricing can implement some simple transactions to make a certain (or riskless) profit.

For example, consider a forward contract on gold with delivery in October. Assume that one

hour before the October contract expires, the spot price of gold is $1900/ounce and the forward

is quoted at $1910/ounce. If this happens, the forward is overpriced. We could implement the

following trades to capture the arbitrage profit:

• Take a short forward contract on the October-maturity gold. Why short? At $1910, the

forward contract is overpriced. When something is overpriced, we would want to sell it.

The short forward means I have a commitment to sell one ounce of gold (in one hour's time)

and I will receive the delivery price of $1910.

• I also immediately purchase the one ounce of gold on the spot market for $1900. This will

enable me to meet my commitments.

• In one hour's time, the forward contract matures. I physically deliver the gold to satisfy my

commitment under the short forward. I receive the contracted forward price of $1910. And

I have made $10 arbitrage profit.

And, of course, I wouldn't do this for just one ounce of gold. I'd do it for as many ounces as

possible. There are plenty of smart arbitrageurs out there who would quickly jump on this

mispriced forward contract and trade heavily until the forward contract was correctly priced.

Similarly, if the forward contract was quoted at $1895 very close to maturity, I'd do the

opposite. Effectively, the forward contract is underpriced:

• Enter long forward contract on gold. Why long? At $1895, the forward is underpriced.

When something is underpriced, we like to buy it. The long forward means I have a

commitment to purchase gold in one hour's time at price $1895.

• Short-sell one ounce of gold at the spot price of $1900. In simple terms, short selling means

someone ‘loans’ you some gold, you sell it today on the spot market and pocket the $1900.

Of course, at some point in the future, you must repay the gold to them.

• In one hour, I honour my commitment under the forward contract to buy one ounce of gold

for $1895. I use the gold to settle my short-sale debt.

Note that this question is concerned with the convergence of the spot and forward price exactly

at expiry. At any time before expiry, we expect they will be different. More on this next week.

Note also that the ability of arbitrageurs to implement these trades depends, in some cases, on

the ability to short sell the underlying asset. This is not always possible for every asset.

BFF3751 Tutorial 1 Philip Gray 2020 10

You might also like

- Principles of Corporate Finance 12Th Edition Brealey Solutions Manual Full Chapter PDFDocument35 pagesPrinciples of Corporate Finance 12Th Edition Brealey Solutions Manual Full Chapter PDFgephyreashammyql0100% (14)

- hw2 2015 Bpes SolutionsDocument7 pageshw2 2015 Bpes SolutionsDaryl Khoo Tiong Jinn100% (1)

- Here's The HAMMER You Need To Win A Mortgage DisputeDocument6 pagesHere's The HAMMER You Need To Win A Mortgage DisputeBob Hurt100% (2)

- Asc 303 Group AssignmentDocument20 pagesAsc 303 Group AssignmentSHARIFAH NUR AFIQAH BINTI SYED HISAN SABRYNo ratings yet

- Solnik & McLeavey - Global Investment 6th EdDocument5 pagesSolnik & McLeavey - Global Investment 6th Edhotmail13No ratings yet

- Appendix B Solutions To Concept ChecksDocument31 pagesAppendix B Solutions To Concept Checkshellochinp100% (1)

- How to Trade Cfds Profitably: A Trader's Guide to Successful Cfd TradingFrom EverandHow to Trade Cfds Profitably: A Trader's Guide to Successful Cfd TradingNo ratings yet

- Acc. No.: Boulton's Toy EmporiumDocument5 pagesAcc. No.: Boulton's Toy EmporiumMisty TranquilNo ratings yet

- BFF3751 Derivatives 1 Tutorial 1 Required Reading: Hull Chapter 1 Hull Chapter 2Document9 pagesBFF3751 Derivatives 1 Tutorial 1 Required Reading: Hull Chapter 1 Hull Chapter 2Fira SyawaliaNo ratings yet

- Tutorial 10 - SolutionsDocument5 pagesTutorial 10 - Solutionstrang snoopyNo ratings yet

- BB - 3 - Futures & Options - Hull - Chap - 3Document31 pagesBB - 3 - Futures & Options - Hull - Chap - 3Ibrahim KhatatbehNo ratings yet

- FIN4003 Lecture 03Document24 pagesFIN4003 Lecture 03jason leeNo ratings yet

- Tutorial 1Document24 pagesTutorial 1Fira SyawaliaNo ratings yet

- Brief - Hedge ImplementationDocument5 pagesBrief - Hedge ImplementationAnil GowdaNo ratings yet

- Questions 2Document5 pagesQuestions 2Max WolfNo ratings yet

- Refer Chap 022 SolutionsDocument5 pagesRefer Chap 022 SolutionsRahul BhangaleNo ratings yet

- International Parity Relationships & Forecasting Exchange RatesDocument33 pagesInternational Parity Relationships & Forecasting Exchange RatesKARISHMAATA2No ratings yet

- Practice Set and Solutions #3Document6 pagesPractice Set and Solutions #3ashiq amNo ratings yet

- Hedging Strategies Using FuturesDocument37 pagesHedging Strategies Using FuturesAmeen ShaikhNo ratings yet

- Soln CH 22 Futures IntroDocument5 pagesSoln CH 22 Futures IntroSilviu TrebuianNo ratings yet

- Forex Question With and Ans Upto 30Document38 pagesForex Question With and Ans Upto 30Kavan PatelNo ratings yet

- Soln CH 23 Futures CloserDocument9 pagesSoln CH 23 Futures CloserSilviu TrebuianNo ratings yet

- Future and ForwardsDocument24 pagesFuture and ForwardsamitgtsNo ratings yet

- Fundamental Value of Stocks and BondsDocument5 pagesFundamental Value of Stocks and BondsJohnson Lozano JimenezNo ratings yet

- Tutorial 2 SolutionsDocument4 pagesTutorial 2 SolutionsIvana Second EmailNo ratings yet

- Chapter 22: Futures Markets: Problem SetsDocument8 pagesChapter 22: Futures Markets: Problem SetsMehrab Jami Aumit 1812818630No ratings yet

- Parity PPPDocument42 pagesParity PPPDeus MalimaNo ratings yet

- Chapter 11: Forward and Futures Hedging, Spread, and Target StrategiesDocument9 pagesChapter 11: Forward and Futures Hedging, Spread, and Target StrategiesNam MaiNo ratings yet

- Group 5 - Case 1Document7 pagesGroup 5 - Case 1Nirmal Kumar RoyNo ratings yet

- Chapter 3 (Hedging Strategies Using Futures)Document20 pagesChapter 3 (Hedging Strategies Using Futures)afrainhossain65No ratings yet

- BMAN20072 Week 9 Problem Set 2021 - SolutionDocument4 pagesBMAN20072 Week 9 Problem Set 2021 - SolutionAlok AgrawalNo ratings yet

- Excel 19Document6 pagesExcel 19debojyotiNo ratings yet

- ProblemSet1 PDFDocument5 pagesProblemSet1 PDFjeremy AntoninNo ratings yet

- Week 4-5 Tutorial Solutions UpdatedDocument7 pagesWeek 4-5 Tutorial Solutions UpdatedAshley ChandNo ratings yet

- Bodie Essentials of Investments 12e Ch17 SM CKDocument11 pagesBodie Essentials of Investments 12e Ch17 SM CKpavistatsNo ratings yet

- BMA 12e SM CH 26 Final PDFDocument14 pagesBMA 12e SM CH 26 Final PDFNikhil ChadhaNo ratings yet

- FINS 3616 Tutorial Questions-Week 4Document6 pagesFINS 3616 Tutorial Questions-Week 4Alex WuNo ratings yet

- Soln Er Main AP, FM Chapter Forward, Futures (Shared)Document24 pagesSoln Er Main AP, FM Chapter Forward, Futures (Shared)eshitanayyarNo ratings yet

- Mining For Short-Term Micro-ArbitrageDocument24 pagesMining For Short-Term Micro-ArbitragehlehuyNo ratings yet

- Problem Set of Session 3Document8 pagesProblem Set of Session 3Pauline CavéNo ratings yet

- Lecture 5Document9 pagesLecture 5Nhung Phuong Ha NguyenNo ratings yet

- Capital Markets and PortfolioDocument7 pagesCapital Markets and PortfolioshameempalyamNo ratings yet

- Answers To Practice Questions: Managing RiskDocument11 pagesAnswers To Practice Questions: Managing RiskTestNo ratings yet

- Financial Risk Management Complete Notes PDFDocument305 pagesFinancial Risk Management Complete Notes PDFSagar KansalNo ratings yet

- Ross 7 e CH 04Document58 pagesRoss 7 e CH 04Antora HoqueNo ratings yet

- Ch05 Part 2 Questions and Problems AnswersDocument5 pagesCh05 Part 2 Questions and Problems AnswersJemma JadeNo ratings yet

- Investment & Portfolio Management FIN730: This Is January Effect Anomaly (Like July Effect in Pakistan)Document14 pagesInvestment & Portfolio Management FIN730: This Is January Effect Anomaly (Like July Effect in Pakistan)Abdul Rauf Khan100% (3)

- FRM1 SD FRMDocument4 pagesFRM1 SD FRMSheetal DisaleNo ratings yet

- Solution of InvestmentDocument74 pagesSolution of Investmentahsanmalik2050No ratings yet

- SwapsDocument12 pagesSwapsSilenceNo ratings yet

- Bonds and Their Valuation: Key Features of Bonds Bond Valuation Measuring Yield Assessing RiskDocument49 pagesBonds and Their Valuation: Key Features of Bonds Bond Valuation Measuring Yield Assessing RiskfahadaijazNo ratings yet

- Lecture Session 8 - Currency Futures Forwards Payoff ProfilesDocument8 pagesLecture Session 8 - Currency Futures Forwards Payoff Profilesapi-19974928No ratings yet

- Stake Steak: Product Paper M A Y 2 0 2 1Document12 pagesStake Steak: Product Paper M A Y 2 0 2 1JoseNo ratings yet

- South-Western: Lecture Suggestions: 5 - 1Document7 pagesSouth-Western: Lecture Suggestions: 5 - 1Kathryn TeoNo ratings yet

- Time Value of Money: Mcgraw-Hill/Irwin Corporate Finance, 7/EDocument44 pagesTime Value of Money: Mcgraw-Hill/Irwin Corporate Finance, 7/Ehuy anh leNo ratings yet

- 03 PS4 FF - SolDocument4 pages03 PS4 FF - SolhatemNo ratings yet

- Hogwarts ThemeDocument43 pagesHogwarts ThemeLeDatNo ratings yet

- McDonald Chapter5Document11 pagesMcDonald Chapter5Tu TruongNo ratings yet

- Ross FCF 11ce Ch08Document34 pagesRoss FCF 11ce Ch08amyna abhavaniNo ratings yet

- Section A: Multiple Choice Questions - Single Option: This Section Has 70 Questions Worth 1 Mark Each (Total of 70 Marks)Document24 pagesSection A: Multiple Choice Questions - Single Option: This Section Has 70 Questions Worth 1 Mark Each (Total of 70 Marks)Kenny HoNo ratings yet

- Agricultural, Energy and Metallurgical Futures ContractsDocument68 pagesAgricultural, Energy and Metallurgical Futures ContractsCan BayirNo ratings yet

- Hedging Strategies Using FuturesDocument22 pagesHedging Strategies Using FuturesMd Rayhan UddinNo ratings yet

- The Determinants of Dividend PolicyDocument4 pagesThe Determinants of Dividend PolicyShahnewaj ShaanNo ratings yet

- Questions 2Document5 pagesQuestions 2Max WolfNo ratings yet

- Answers 4Document12 pagesAnswers 4Max WolfNo ratings yet

- Answers 2Document10 pagesAnswers 2Max WolfNo ratings yet

- Superannuation Industry Supervision Regulations 1994Document105 pagesSuperannuation Industry Supervision Regulations 1994Max WolfNo ratings yet

- smsfr2010 002Document20 pagessmsfr2010 002Max WolfNo ratings yet

- Multiple Choice QuestionsDocument18 pagesMultiple Choice Questionsnadya erlyNo ratings yet

- Adv AFARDocument145 pagesAdv AFARDvcLouisNo ratings yet

- State of The European Asset Management Industry: Adapting To A New NormalDocument15 pagesState of The European Asset Management Industry: Adapting To A New NormalJuan Manuel VeronNo ratings yet

- Daily Ex 09042013Document2 pagesDaily Ex 09042013Caleb LeeNo ratings yet

- Consolidation End Solutions Demo in SAP BPCDocument36 pagesConsolidation End Solutions Demo in SAP BPCjoesaranNo ratings yet

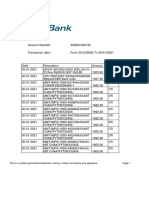

- ANZ Bank StatementDocument5 pagesANZ Bank Statement衡治洲No ratings yet

- AIS Chapter 1 Lecture NotesDocument28 pagesAIS Chapter 1 Lecture NotesNhi Ho50% (4)

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument16 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureRaju SambheNo ratings yet

- Ekotek - Alfiano Fuadi3Document50 pagesEkotek - Alfiano Fuadi3Alfiano Fuadi0% (1)

- European Union: Post Crisis Challenges and Prospects For GrowthDocument292 pagesEuropean Union: Post Crisis Challenges and Prospects For GrowtharmandoibanezNo ratings yet

- FINS 3616 Tutorial Questions-Week 7 - AnswersDocument2 pagesFINS 3616 Tutorial Questions-Week 7 - AnswersbenNo ratings yet

- 3 Adjusting Entries HandoutsDocument10 pages3 Adjusting Entries HandoutsJuan Dela CruzNo ratings yet

- 61 Fernandez Hermanos v. CIRDocument2 pages61 Fernandez Hermanos v. CIRAgus DiazNo ratings yet

- Crypto Mega Theses - MulticoinDocument12 pagesCrypto Mega Theses - MulticointempvjNo ratings yet

- BS Commerce Syllabus, UoBDocument117 pagesBS Commerce Syllabus, UoBMasood BabarNo ratings yet

- Comparative Study of Lic and Icici Pension PlanDocument67 pagesComparative Study of Lic and Icici Pension PlanNitesh Singh100% (2)

- Castillo V PascoDocument2 pagesCastillo V PascoSui50% (2)

- Nes 124 - Quiz #6Document2 pagesNes 124 - Quiz #6PatrickNo ratings yet

- The Duty of Disclosure PDFDocument8 pagesThe Duty of Disclosure PDFVusi Bhebhe83% (6)

- Account TestDocument2 pagesAccount Testajay chaudhary0% (1)

- Principles of Microeconomics 9Th Edition Sayre Test Bank Full Chapter PDFDocument67 pagesPrinciples of Microeconomics 9Th Edition Sayre Test Bank Full Chapter PDFphenicboxironicu9100% (11)

- Indian Institute of Technology: Delhi Summary Sheet Consumable StoresDocument2 pagesIndian Institute of Technology: Delhi Summary Sheet Consumable StoresSumit SinghNo ratings yet

- FA 2 Chapter 1 Control AccountsDocument19 pagesFA 2 Chapter 1 Control AccountsMhd Amin0% (1)

- HoshangABackEnd - Offer LetterDocument2 pagesHoshangABackEnd - Offer LetterShivansh GuptaNo ratings yet

- The Four Dimensions of Public Financial ManagementDocument9 pagesThe Four Dimensions of Public Financial ManagementInternational Consortium on Governmental Financial Management100% (2)

- Acca IPSAS CertificationDocument63 pagesAcca IPSAS CertificationemanOgie100% (1)

- FI S4 FunctionalitiesDocument31 pagesFI S4 FunctionalitiesNikhil KaikadeNo ratings yet