Professional Documents

Culture Documents

Task 4

Task 4

Uploaded by

sahilCopyright:

Available Formats

You might also like

- Capital Markets Institutions, Instruments, and Risk Management Fifth EditionDocument20 pagesCapital Markets Institutions, Instruments, and Risk Management Fifth EditionFrancis0% (2)

- The Four Functions of ForceDocument5 pagesThe Four Functions of ForceDeywisson Ronaldo De SouzaNo ratings yet

- British Gases Business EthicsDocument16 pagesBritish Gases Business EthicsLewis MutembeiNo ratings yet

- Operators Telco Cloud - White Paper: 1. Executive SummaryDocument9 pagesOperators Telco Cloud - White Paper: 1. Executive SummaryOdysseas PyrovolakisNo ratings yet

- Banking and InsuranceDocument20 pagesBanking and Insurancebeena antuNo ratings yet

- 4 o Feiticeiro Das Trevas2Document54 pages4 o Feiticeiro Das Trevas2Lucas Emanuel LopesNo ratings yet

- Introduction To Law and The Legal System Study GuideDocument3 pagesIntroduction To Law and The Legal System Study GuideMelanieNo ratings yet

- Humayra Anjumee JebaDocument2 pagesHumayra Anjumee JebaAbu Saleah100% (1)

- Batool AirportPrivatizationPakistan 2018Document22 pagesBatool AirportPrivatizationPakistan 2018sammalik1996No ratings yet

- Median XL Readme - Read This FirstDocument5 pagesMedian XL Readme - Read This FirstNguyễn Trung ThànhNo ratings yet

- Finacle 10 - Train The Trainer Guide India Post Payments BankDocument50 pagesFinacle 10 - Train The Trainer Guide India Post Payments BankDevendra GhodkeNo ratings yet

- All Risk InsuranceDocument9 pagesAll Risk InsurancePrajjwal SinghNo ratings yet

- Customer's Declaration: Assessment of Suitability and Appropriateness For Sale of Third Party ProductsDocument16 pagesCustomer's Declaration: Assessment of Suitability and Appropriateness For Sale of Third Party ProductsPanchu SwainNo ratings yet

- Agriculture Padhai Online ClassesDocument18 pagesAgriculture Padhai Online ClassesYogita SharmaNo ratings yet

- Welch Allyn PDFDocument15 pagesWelch Allyn PDFsrikanth PosaNo ratings yet

- Greece - ESM MoU, Draft 11/8/2015 (English)Document29 pagesGreece - ESM MoU, Draft 11/8/2015 (English)Yannis Koutsomitis100% (1)

- Powet Plant Control and Instrumentation: Lecture NotesDocument57 pagesPowet Plant Control and Instrumentation: Lecture Notessvvsnraju100% (1)

- Case StudyDocument34 pagesCase Studyharshita sethiNo ratings yet

- Business StudiesDocument8 pagesBusiness StudiesSonali Chaudhuri 17100% (1)

- MGFP Brochure V05Document13 pagesMGFP Brochure V05sarthakNo ratings yet

- SeatDocument10 pagesSeatHéctorNo ratings yet

- Docu82227 - VxRail Support Matrix PDFDocument18 pagesDocu82227 - VxRail Support Matrix PDFsoleilharryNo ratings yet

- Fleet Repairs & Maintenance Audit-Final ReportDocument7 pagesFleet Repairs & Maintenance Audit-Final Reportnorintan ahmadNo ratings yet

- Mok ShookDocument220 pagesMok Shookmykoda-1No ratings yet

- Presale L2wshi07067006Document1 pagePresale L2wshi07067006pavan mNo ratings yet

- Kotak Mahindra Life Insurance Company LimitedDocument208 pagesKotak Mahindra Life Insurance Company Limitedgulatisrishti15No ratings yet

- Aishwarya Viva - PPT ProjectDocument71 pagesAishwarya Viva - PPT Projectaishwarya damleNo ratings yet

- FASH181 Answer 5Document4 pagesFASH181 Answer 5Go CheckNo ratings yet

- Bronze Medallion (BM) Theory Questions (Assessment Task 1)Document23 pagesBronze Medallion (BM) Theory Questions (Assessment Task 1)idontlikeebooksNo ratings yet

- DoPT OM 10.04.1989 PDFDocument43 pagesDoPT OM 10.04.1989 PDFTarun RaoNo ratings yet

- Malaysian Aerospace Industry Blueprint 2030 V 12Document47 pagesMalaysian Aerospace Industry Blueprint 2030 V 12misterchestNo ratings yet

- Trusted Digital Identity: BuildingDocument12 pagesTrusted Digital Identity: BuildingVítor CastroNo ratings yet

- SC 370740 DWDocument1 pageSC 370740 DWmiguelNo ratings yet

- Traditional Learning Vs Digital Learning: A Paradigm Shift.: AbstractDocument17 pagesTraditional Learning Vs Digital Learning: A Paradigm Shift.: AbstractRuta PadhyeNo ratings yet

- Indepth Ifrs7 Ifrs13 Disclosures 201405Document52 pagesIndepth Ifrs7 Ifrs13 Disclosures 201405Nuwani ManasingheNo ratings yet

- Track Shipment Status - Consignment Status - DTDC IndiaDocument1 pageTrack Shipment Status - Consignment Status - DTDC IndiaAjay Chowdary Ajay ChowdaryNo ratings yet

- 007-012477-001 SAS Token Guide OTP Hardware Token RevEDocument14 pages007-012477-001 SAS Token Guide OTP Hardware Token RevEBarons ArismatNo ratings yet

- CCNA 200-120 Questions: INTRODUCTIONDocument117 pagesCCNA 200-120 Questions: INTRODUCTIONPaul MayombweNo ratings yet

- 8198 ICICIPrudential BalancedAdvantageFund ProductNoteDocument3 pages8198 ICICIPrudential BalancedAdvantageFund ProductNoteKiranmayi UppalaNo ratings yet

- File 1Document1 pageFile 1Harsh SinghalNo ratings yet

- Detailed Technology Profile PDFDocument54 pagesDetailed Technology Profile PDFAlfred Joseph ZuluetaNo ratings yet

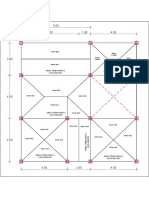

- Areas Tributarias (Ch-Ofi)Document1 pageAreas Tributarias (Ch-Ofi)lizandro gonzalez cisnerosNo ratings yet

- New Hire TrainingDocument37 pagesNew Hire TrainingEdward MarquezNo ratings yet

- AdministrationGuide PDFDocument316 pagesAdministrationGuide PDFPercy SolizNo ratings yet

- Labor CodeDocument3 pagesLabor CodeMarielle Louise FerrerNo ratings yet

- Energy Efficiency in HospitalsDocument103 pagesEnergy Efficiency in Hospitalsclement levisNo ratings yet

- Document OnlineForm ASMEPluswithtakafuloptionProductTrainingSlides22April2015Document83 pagesDocument OnlineForm ASMEPluswithtakafuloptionProductTrainingSlides22April2015wan marzukiNo ratings yet

- Singapore Case Note - Enforceability of Settlement Agreements - Kluwer Mediation BlogDocument7 pagesSingapore Case Note - Enforceability of Settlement Agreements - Kluwer Mediation BlogKevin AlarcónNo ratings yet

- Reliance Industries Limited - 12Document6 pagesReliance Industries Limited - 12Amish GangarNo ratings yet

- MD Nastran R3 Explicit Nonlinear (SOL 700) User's GuideDocument602 pagesMD Nastran R3 Explicit Nonlinear (SOL 700) User's GuideDonNo ratings yet

- Ipru Pension 10 Year X 2 LacDocument5 pagesIpru Pension 10 Year X 2 LacHK Option LearnNo ratings yet

- Economics Unit 1 NotesDocument40 pagesEconomics Unit 1 NotesZawad ZarifNo ratings yet

- HD2018 Operation Manual V1.0.1Document44 pagesHD2018 Operation Manual V1.0.1Rajneesh SainiNo ratings yet

- Acme CV Valve LiteratureDocument8 pagesAcme CV Valve LiteratureBhuvanaNo ratings yet

- Jilla B. Alvarado P.E. 3 Answer SheetsDocument4 pagesJilla B. Alvarado P.E. 3 Answer SheetsWhencell Ann RomblonNo ratings yet

- pdf24 MergedDocument43 pagespdf24 MergedJoel WilliamNo ratings yet

- Havells MilestonesDocument9 pagesHavells MilestonesRajeevNo ratings yet

- DLF Split Raises Questions: 50 P/unit Incentive For Wind Power ProducersDocument1 pageDLF Split Raises Questions: 50 P/unit Incentive For Wind Power ProducerssbravalNo ratings yet

- MSC 1-Circ 1432Document12 pagesMSC 1-Circ 1432waliagauravNo ratings yet

- Sample PDF of STD 12th Board Question With Solutions PCMB Sampel ContentDocument20 pagesSample PDF of STD 12th Board Question With Solutions PCMB Sampel ContentSujata ChavanNo ratings yet

- 6-3. Corporation Tax - LossDocument26 pages6-3. Corporation Tax - LossDharshan KumarNo ratings yet

- A Interim Report 1Document28 pagesA Interim Report 1Mayank MahajanNo ratings yet

- Insurance Promotion - IIDocument12 pagesInsurance Promotion - IIAditi JainNo ratings yet

- An Analysis of Contempt of Court - A Challenge To Rule of LawDocument19 pagesAn Analysis of Contempt of Court - A Challenge To Rule of LawsahilNo ratings yet

- Internship Final ReportDocument10 pagesInternship Final ReportsahilNo ratings yet

- There Are No Certainties or Guarantees in LifeDocument6 pagesThere Are No Certainties or Guarantees in LifesahilNo ratings yet

- CONTEMPT OF COURT ArticleDocument3 pagesCONTEMPT OF COURT ArticlesahilNo ratings yet

- LIST OF PLATINUM IN INTRANET (Data Generated As of 18-05-2020 01'09PM)Document854 pagesLIST OF PLATINUM IN INTRANET (Data Generated As of 18-05-2020 01'09PM)Christelle Fatima CreaylaNo ratings yet

- TAIFEX Nifty 50 Futures Contract Specifications: Item Description Underlying Index Ticker SymbolDocument2 pagesTAIFEX Nifty 50 Futures Contract Specifications: Item Description Underlying Index Ticker SymbolVenkataNo ratings yet

- Philosophy of Islamic Banking and FinanceDocument9 pagesPhilosophy of Islamic Banking and FinanceNabeela ShahNo ratings yet

- Form of Contract 12.11.2022Document2 pagesForm of Contract 12.11.2022raghav joshiNo ratings yet

- Sample Contract of LoanDocument2 pagesSample Contract of LoanEd Armand VentoleroNo ratings yet

- McDonalds Franchise Disclosure DocumentDocument2 pagesMcDonalds Franchise Disclosure DocumentNilesh GuptaNo ratings yet

- RFBT Preweek B94 - Questionnaire - AnswersDocument25 pagesRFBT Preweek B94 - Questionnaire - AnswersSilver LilyNo ratings yet

- Tax Consequences For REMIC and REMIC Investors-For Loan ModsDocument13 pagesTax Consequences For REMIC and REMIC Investors-For Loan Mods83jjmackNo ratings yet

- 1 Chapter 1 Partnership FormationDocument16 pages1 Chapter 1 Partnership FormationJymldy EnclnNo ratings yet

- Learning Resource 8 Lesson 1Document7 pagesLearning Resource 8 Lesson 1Vianca Marella SamonteNo ratings yet

- Bankruptcy Law PrimerDocument101 pagesBankruptcy Law PrimerJoe23232232100% (2)

- Memorial For RespondentDocument28 pagesMemorial For RespondentKunwarbir Singh lohatNo ratings yet

- PLEDGE (Sec. 172-179) 1. Concept and Definition:: in Lallan Prasad v. Rahmat AliDocument5 pagesPLEDGE (Sec. 172-179) 1. Concept and Definition:: in Lallan Prasad v. Rahmat AliKrishna AhujaNo ratings yet

- CA Notes Bill of Exchange and Promissory Notes PDFDocument28 pagesCA Notes Bill of Exchange and Promissory Notes PDFBijay Aryan DhakalNo ratings yet

- Intraday GVK StocksDocument9 pagesIntraday GVK Stockssri sriNo ratings yet

- R45 P2 T6 Gregory Ch9 Intermediation v5 PDFDocument24 pagesR45 P2 T6 Gregory Ch9 Intermediation v5 PDFOsama Shaheen100% (1)

- Corporate Accounting IMP QuestionsDocument6 pagesCorporate Accounting IMP QuestionsMayank RajeNo ratings yet

- Lecturer 2 Financial Distress and DissolutionDocument10 pagesLecturer 2 Financial Distress and DissolutionGoitse LithekoNo ratings yet

- EEI Master Netting Agreement FaqDocument3 pagesEEI Master Netting Agreement FaqOSRNo ratings yet

- Master Distributor Stock Components: Bulletin HY14-2700/USDocument72 pagesMaster Distributor Stock Components: Bulletin HY14-2700/USYuriPasenkoNo ratings yet

- Bam 242 Regulatory Framework and Business TransactionsDocument38 pagesBam 242 Regulatory Framework and Business TransactionsMary PatalinghugNo ratings yet

- Partnership Laws: Legal Aspects of Business Prof. Mehek KapoorDocument14 pagesPartnership Laws: Legal Aspects of Business Prof. Mehek KapoorAman jaiNo ratings yet

- Home InsuranceDocument3 pagesHome InsuranceAiman hanifNo ratings yet

- The Recto and Maceda LawDocument3 pagesThe Recto and Maceda Lawjovani emaNo ratings yet

- 3 Articles of IncorporationDocument5 pages3 Articles of IncorporationPrincess de GuzmanNo ratings yet

- A Study of Open Interest in Nifty Future PDFDocument7 pagesA Study of Open Interest in Nifty Future PDFRaghuraman ThaiyarNo ratings yet

- Legal Aspects of Business (LAB) : Post Graduate Programme in Management (PGPM)Document24 pagesLegal Aspects of Business (LAB) : Post Graduate Programme in Management (PGPM)Aman PratikNo ratings yet

Task 4

Task 4

Uploaded by

sahilOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Task 4

Task 4

Uploaded by

sahilCopyright:

Available Formats

TERM LIFE INSURANCE

Term life insurance, sometimes known as term assurance, is a type of life insurance that offers

protection for a specific term, or finite amount of time, at a predetermined rate of payments.

The client must choose between forgoing coverage or maybe obtaining further coverage with

different payments or conditions after that time period has passed since coverage at the prior

rate of premiums is no longer guaranteed. The beneficiary will get the death benefit if the life

insured passes away within the period. On a basis of coverage amount per premium for a

particular time period, term insurance is often the least expensive way to buy a significant

death benefit.

Frequently Asked Questions

1. What distinguishes term insurance from life insurance?

A term insurance plan does not include maturity benefits and only entitles the policy

holder's nominee(s) to the sum assured in the case of the policy holder's passing during

the plan term, as opposed to a life insurance policy that does.

2. Do term insurance policies offer maturity proceeds? i

The clause for return of premium, which permits the policy holder to get the paid

premiums in the event of plan maturity, is included by many insurance companies

nowadays. However, this raises the payable premiums.

3. Are "Act of God" covered by term insurance plans?

Death related to an Act of God is not excluded unless specifically stated in the policy

document's exclusions.

4. Can I change the duration of Term Cover after the policy is issued?

No it cannot be changed once the policy has been issued.

5. How does smoking affect one's decision while selecting a term insurance plan? ii

Term insurance is a type of life insurance, and risk evaluations are what insurance firms

rely on. The insurers will charge you a greater premium if your chance of contracting a

critical disease is higher. You will have to pay a higher premium if you smoke than a non-

smoker policyholder.

6. Given that I already have life insurance via my company, why should I get a separate

insurance policy?

It may be advantageous if your employer provides life insurance for its employees. For

the protection of your family, you need a bigger sum assured because these coverage

are frequently insufficient. Additionally, after you leave your company, your employer's

insurance coverage ends.

7. What distinguishes accidental insurance from term insurance?

Only if the insured dies in an accident will the accidental insurance offer a death reward.

The term insurance coverage provides protection against all types of demise.

8. What would transpire if the policyholder had two different term policies?

If a policyholder has two different term policies, the second insurer must be informed

about the first policy and must acknowledge the first insurer.

9. Can I switch my Term Plan to some other type of insurance later?iii

As one ages the needs also change, several term plans do come with the option to port

your plan to Whole life cover. It entirely depends on the terms and conditions of the

insurance provider.

10. What is meant by term insurance riders?

Term insurance riders are additions or attachments placed to a term insurance plan

that provide the policyholder with extra coverage and increase the usefulness of the

policy. In addition to the death benefit that is granted by the term insurance policy,

riders offer a number of other advantages.

ENDOWMENT POLICY

An endowment policy is essentially a life insurance policy that, in addition to protecting the

insured's life, aids the policyholder in saving regularly over a certain length of time in order to

be eligible for a lump sum payment at policy maturity, should they live through the policy term.

This maturity amount can be used to cover a variety of expenses, including retirement, a child's

schooling and/or marriage, or a home purchase. A life insurance endowment policy pays the

entire sum assured to the beneficiaries in the event that the insured dies during the policy term

or, in the event that the insured survives the period, to the policy holder at maturity of the

policy.

Frequently Asked Questions

1. What Riders Are Available Under An Endowment Plan?

The riders included in endowment plans are rider for Accidental Death Benefit, rider

for Benefits of Permanent Disability, rider for Benefit for Critical Illness, rider for

Benefits for Life Guardian, and Accidental Illness in accordance with the Guardian

Benefit Rider, the remaining premiums are paid on the policyholder's behalf in the

event of accidental disability.

2. Are endowment plans a risk free insurance option?iv

Since endowment plans are unaffected by market conditions, they do not deal with

risk. It can be a suitable choice if you want complete security over your investment

capital. This feature guarantees risk-free returns, so it may be evaluated based on

your risk tolerance.

3. Who Can Participate in Endowment Plans?

Between the ages of 55 and 60, a person may apply for endowment plan insurance

coverage. Apart from this endowment plans are accessible to a wide range of people

beginning at age five or even younger.

4. Can Endowment Plans Benefit From Tax Breaks?v

If you want to reduce your tax liability, this is a smart option. Under section 80C of the

Income Tax Act, an investment made in an endowment plan is eligible for a tax

deduction of up to Rs 1.5 lakh. Additionally, under section 10(10D) of the Income Tax

Act, all gains made from it are tax-free. This will guarantee a smooth money

transaction in an emergency situation or during a currency shortage.

5. What Common Exclusions Are Included in Endowment Plans?

Like other insurance plans, endowment plans have a number of situations in which

the company is not required to pay for coverage. Any claim made under an

endowment plan that arises directly or indirectly from any of the following is generally

excluded, attempted or actual self-harm, involvement in unlawful activity, being drunk

or using drugs or alcohol to get high (exceptions apply), participating in dangerous

sports or activities and participating in any riots or other public unrest or Aviation Risk.

6. Can You Invest Long Term in Endowment Plans?

An excellent risk-free investment option for long-term savers is endowment

programmes. Popular endowment plans are used to build a future savings fund. The

regular deposits of premiums encourage long-term saving practices.

7. Are there Maturity Benefits in Endowment Plans?

According to the maturity benefits offered by an endowment plan, the policyholder

will get the lump sum payoff if they live past the maturity term. This feature sets an

endowment plan apart from others and ensures the security of the policyholder.

8. What is meant by Reversionary Bonus in Endowment plan?

Reversionary Bonus is money that is added to the balance owed with profit at

maturity or death. After being declared, a reversionary bonus cannot be withdrawn,

regardless of whether the insurance matures or the covered person passes away.

9. What is meant by Terminal Bonus in Endowment plan?

When an insurance policy reaches its maturity date or an insured person passes away,

the insurance company may choose to add a discretionary sum to the payout. Typical

time periods for this are 10 or 15 years, it is acknowledged as Terminal Bonus.

10. What is the tenure of Endowment Plans?vi

An endowment policy can last anywhere between 10 and 20 years. The five to ten-

year premium payment period. At the age of 18, you can get a term insurance policy.

The age at which someone reaches full adulthood is 75. As a result, 55 is the oldest

age at which a person may get a 20-year term insurance plan.

WHOLE LIFE INSURANCE

Whole life insurance, usually referred to as conventional life insurance, offers continuous death

benefit protection for the duration of the insured's life. Whole life insurance has a savings

component in which cash value may buildup in addition to paying a death benefit. A fixed rate

of tax-deferred interest is accrued. One sort of permanent life insurance is whole life policies.

Other terms include universal life, indexed universal life, and variable universal life. The first

sort of life insurance was whole life, but since there are many different kinds of permanent life,

whole life does not necessarily equate to permanent life insurance.

Frequently Asked Questions

1. The agent told me when I purchased my life insurance policy that it would be "paid

off" after ten years, yet ten years have passed and I am still receiving bills. Why?vii

There may be guaranteed interest rates and/or dividends the insurance company will

pay on your premiums according to the terms of your contract (insurance policy).

However, before your premiums "pay up" your policy, they must generate extremely

large revenues. Items that are promised in the contract must be backed by the

company. The promise of "paid up" life insurance is prohibited when it is based on

unreliable values. Your state's insurance department might be able to help if you have

proof that the agent made this promise. Any writing containing the promise would be

considered documentation, including a casual handwritten note or similar statement by

an agent.

2. Who can obtain a life insurance coverage on me?

An insurance policy on your life can only be purchased by someone who has a "insurable

interest." It follows that a stranger cannot purchase an insurance to cover your life.

Members of your immediate family are typically included in those with an insurable

interest. Your employer or business partner may occasionally have an insurable interest.

Institutions or individuals who end up being your biggest creditors may also qualify for

insurable interest.

3. When the insurance coverage is entirely paid up, what happens to the cash value?

The insurance provider intends to pay your premiums until you pass away using the cash

value. There might not be enough money left over to cover premiums if you subtract

cash value. The insurance company may demand that you resume making premium

payments or lower the death benefit so that it is compatible with the remaining cash

value.

4. I used to have a paid-up policy, but now I'm informed that I don't. What should I do?

You might have authorized the use of your paid-up policy's cash worth to fund a larger

policy by signing documents. Call the insurance provider if you're unsure or can't

remember.

5. What is a participatory policy?

You could benefit from having that type of insurance. You have the opportunity to

"participate" in the profits of the business. In reality, a life insurance dividend is a partial

repayment of your premium. A corporation may issue dividends at the end of a given

year if it has received more premium money than is required to cover death claims and

keep the insurance pool in good standing.

6. What is the cash value of my policy?

Check out your insurance. It includes a table of cash values that ought to include the

solution. If you're still unsure about the cash worth, call your representative.

7. What happens to my insurance policy's cash value if I pass away?

The insurance provider will pay the death benefit after your passing. Your beneficiaries

may not receive more than the stated death benefit, regardless of the amount of cash

value you may have had in the policy at the time of your death. Your outstanding loans

(plus interest) will be deducted from your death benefit.

8. Are funeral expenses covered by life insurance?

Yes, Funeral and final expense insurance, a type of life insurance, does, in fact, pay for

funeral costs (final expenses).

9. Which types of life insurance have cash values?viii

Term life insurance normally does not offer monetary value, but permanent life

insurance, such as Whole Life and Universal Life, can. A loan for a policy is an additional

option. The only term life insurance that comes close to having cash value is term life

insurance with Return of Premium (money-back guarantee).

10. What's the complete life insurance application procedure like?

The application procedure differs from insurance company to insurance company.

However, the majority of application procedures need you to submit an online or paper

application. A few days after the application is received, an insurance company

representative will visit you. Your height, weight, and urine sample are checked first.

The insurance provider looks into your family history, prescription drug use, and medical

history behind the scenes. They will give you a rating once they have all of these details,

either accepting or rejecting it.

i

www.hdfclife.com

ii

www.exidelife.in

iii

www.coverfox.com

iv

www.insurancedhekho.com

v

www.economictimes.indiatimes.com

vi

www.canarahsbclife.com

vii

www.insureuonline.com

viii

www.annuityexpertadvice.com

You might also like

- Capital Markets Institutions, Instruments, and Risk Management Fifth EditionDocument20 pagesCapital Markets Institutions, Instruments, and Risk Management Fifth EditionFrancis0% (2)

- The Four Functions of ForceDocument5 pagesThe Four Functions of ForceDeywisson Ronaldo De SouzaNo ratings yet

- British Gases Business EthicsDocument16 pagesBritish Gases Business EthicsLewis MutembeiNo ratings yet

- Operators Telco Cloud - White Paper: 1. Executive SummaryDocument9 pagesOperators Telco Cloud - White Paper: 1. Executive SummaryOdysseas PyrovolakisNo ratings yet

- Banking and InsuranceDocument20 pagesBanking and Insurancebeena antuNo ratings yet

- 4 o Feiticeiro Das Trevas2Document54 pages4 o Feiticeiro Das Trevas2Lucas Emanuel LopesNo ratings yet

- Introduction To Law and The Legal System Study GuideDocument3 pagesIntroduction To Law and The Legal System Study GuideMelanieNo ratings yet

- Humayra Anjumee JebaDocument2 pagesHumayra Anjumee JebaAbu Saleah100% (1)

- Batool AirportPrivatizationPakistan 2018Document22 pagesBatool AirportPrivatizationPakistan 2018sammalik1996No ratings yet

- Median XL Readme - Read This FirstDocument5 pagesMedian XL Readme - Read This FirstNguyễn Trung ThànhNo ratings yet

- Finacle 10 - Train The Trainer Guide India Post Payments BankDocument50 pagesFinacle 10 - Train The Trainer Guide India Post Payments BankDevendra GhodkeNo ratings yet

- All Risk InsuranceDocument9 pagesAll Risk InsurancePrajjwal SinghNo ratings yet

- Customer's Declaration: Assessment of Suitability and Appropriateness For Sale of Third Party ProductsDocument16 pagesCustomer's Declaration: Assessment of Suitability and Appropriateness For Sale of Third Party ProductsPanchu SwainNo ratings yet

- Agriculture Padhai Online ClassesDocument18 pagesAgriculture Padhai Online ClassesYogita SharmaNo ratings yet

- Welch Allyn PDFDocument15 pagesWelch Allyn PDFsrikanth PosaNo ratings yet

- Greece - ESM MoU, Draft 11/8/2015 (English)Document29 pagesGreece - ESM MoU, Draft 11/8/2015 (English)Yannis Koutsomitis100% (1)

- Powet Plant Control and Instrumentation: Lecture NotesDocument57 pagesPowet Plant Control and Instrumentation: Lecture Notessvvsnraju100% (1)

- Case StudyDocument34 pagesCase Studyharshita sethiNo ratings yet

- Business StudiesDocument8 pagesBusiness StudiesSonali Chaudhuri 17100% (1)

- MGFP Brochure V05Document13 pagesMGFP Brochure V05sarthakNo ratings yet

- SeatDocument10 pagesSeatHéctorNo ratings yet

- Docu82227 - VxRail Support Matrix PDFDocument18 pagesDocu82227 - VxRail Support Matrix PDFsoleilharryNo ratings yet

- Fleet Repairs & Maintenance Audit-Final ReportDocument7 pagesFleet Repairs & Maintenance Audit-Final Reportnorintan ahmadNo ratings yet

- Mok ShookDocument220 pagesMok Shookmykoda-1No ratings yet

- Presale L2wshi07067006Document1 pagePresale L2wshi07067006pavan mNo ratings yet

- Kotak Mahindra Life Insurance Company LimitedDocument208 pagesKotak Mahindra Life Insurance Company Limitedgulatisrishti15No ratings yet

- Aishwarya Viva - PPT ProjectDocument71 pagesAishwarya Viva - PPT Projectaishwarya damleNo ratings yet

- FASH181 Answer 5Document4 pagesFASH181 Answer 5Go CheckNo ratings yet

- Bronze Medallion (BM) Theory Questions (Assessment Task 1)Document23 pagesBronze Medallion (BM) Theory Questions (Assessment Task 1)idontlikeebooksNo ratings yet

- DoPT OM 10.04.1989 PDFDocument43 pagesDoPT OM 10.04.1989 PDFTarun RaoNo ratings yet

- Malaysian Aerospace Industry Blueprint 2030 V 12Document47 pagesMalaysian Aerospace Industry Blueprint 2030 V 12misterchestNo ratings yet

- Trusted Digital Identity: BuildingDocument12 pagesTrusted Digital Identity: BuildingVítor CastroNo ratings yet

- SC 370740 DWDocument1 pageSC 370740 DWmiguelNo ratings yet

- Traditional Learning Vs Digital Learning: A Paradigm Shift.: AbstractDocument17 pagesTraditional Learning Vs Digital Learning: A Paradigm Shift.: AbstractRuta PadhyeNo ratings yet

- Indepth Ifrs7 Ifrs13 Disclosures 201405Document52 pagesIndepth Ifrs7 Ifrs13 Disclosures 201405Nuwani ManasingheNo ratings yet

- Track Shipment Status - Consignment Status - DTDC IndiaDocument1 pageTrack Shipment Status - Consignment Status - DTDC IndiaAjay Chowdary Ajay ChowdaryNo ratings yet

- 007-012477-001 SAS Token Guide OTP Hardware Token RevEDocument14 pages007-012477-001 SAS Token Guide OTP Hardware Token RevEBarons ArismatNo ratings yet

- CCNA 200-120 Questions: INTRODUCTIONDocument117 pagesCCNA 200-120 Questions: INTRODUCTIONPaul MayombweNo ratings yet

- 8198 ICICIPrudential BalancedAdvantageFund ProductNoteDocument3 pages8198 ICICIPrudential BalancedAdvantageFund ProductNoteKiranmayi UppalaNo ratings yet

- File 1Document1 pageFile 1Harsh SinghalNo ratings yet

- Detailed Technology Profile PDFDocument54 pagesDetailed Technology Profile PDFAlfred Joseph ZuluetaNo ratings yet

- Areas Tributarias (Ch-Ofi)Document1 pageAreas Tributarias (Ch-Ofi)lizandro gonzalez cisnerosNo ratings yet

- New Hire TrainingDocument37 pagesNew Hire TrainingEdward MarquezNo ratings yet

- AdministrationGuide PDFDocument316 pagesAdministrationGuide PDFPercy SolizNo ratings yet

- Labor CodeDocument3 pagesLabor CodeMarielle Louise FerrerNo ratings yet

- Energy Efficiency in HospitalsDocument103 pagesEnergy Efficiency in Hospitalsclement levisNo ratings yet

- Document OnlineForm ASMEPluswithtakafuloptionProductTrainingSlides22April2015Document83 pagesDocument OnlineForm ASMEPluswithtakafuloptionProductTrainingSlides22April2015wan marzukiNo ratings yet

- Singapore Case Note - Enforceability of Settlement Agreements - Kluwer Mediation BlogDocument7 pagesSingapore Case Note - Enforceability of Settlement Agreements - Kluwer Mediation BlogKevin AlarcónNo ratings yet

- Reliance Industries Limited - 12Document6 pagesReliance Industries Limited - 12Amish GangarNo ratings yet

- MD Nastran R3 Explicit Nonlinear (SOL 700) User's GuideDocument602 pagesMD Nastran R3 Explicit Nonlinear (SOL 700) User's GuideDonNo ratings yet

- Ipru Pension 10 Year X 2 LacDocument5 pagesIpru Pension 10 Year X 2 LacHK Option LearnNo ratings yet

- Economics Unit 1 NotesDocument40 pagesEconomics Unit 1 NotesZawad ZarifNo ratings yet

- HD2018 Operation Manual V1.0.1Document44 pagesHD2018 Operation Manual V1.0.1Rajneesh SainiNo ratings yet

- Acme CV Valve LiteratureDocument8 pagesAcme CV Valve LiteratureBhuvanaNo ratings yet

- Jilla B. Alvarado P.E. 3 Answer SheetsDocument4 pagesJilla B. Alvarado P.E. 3 Answer SheetsWhencell Ann RomblonNo ratings yet

- pdf24 MergedDocument43 pagespdf24 MergedJoel WilliamNo ratings yet

- Havells MilestonesDocument9 pagesHavells MilestonesRajeevNo ratings yet

- DLF Split Raises Questions: 50 P/unit Incentive For Wind Power ProducersDocument1 pageDLF Split Raises Questions: 50 P/unit Incentive For Wind Power ProducerssbravalNo ratings yet

- MSC 1-Circ 1432Document12 pagesMSC 1-Circ 1432waliagauravNo ratings yet

- Sample PDF of STD 12th Board Question With Solutions PCMB Sampel ContentDocument20 pagesSample PDF of STD 12th Board Question With Solutions PCMB Sampel ContentSujata ChavanNo ratings yet

- 6-3. Corporation Tax - LossDocument26 pages6-3. Corporation Tax - LossDharshan KumarNo ratings yet

- A Interim Report 1Document28 pagesA Interim Report 1Mayank MahajanNo ratings yet

- Insurance Promotion - IIDocument12 pagesInsurance Promotion - IIAditi JainNo ratings yet

- An Analysis of Contempt of Court - A Challenge To Rule of LawDocument19 pagesAn Analysis of Contempt of Court - A Challenge To Rule of LawsahilNo ratings yet

- Internship Final ReportDocument10 pagesInternship Final ReportsahilNo ratings yet

- There Are No Certainties or Guarantees in LifeDocument6 pagesThere Are No Certainties or Guarantees in LifesahilNo ratings yet

- CONTEMPT OF COURT ArticleDocument3 pagesCONTEMPT OF COURT ArticlesahilNo ratings yet

- LIST OF PLATINUM IN INTRANET (Data Generated As of 18-05-2020 01'09PM)Document854 pagesLIST OF PLATINUM IN INTRANET (Data Generated As of 18-05-2020 01'09PM)Christelle Fatima CreaylaNo ratings yet

- TAIFEX Nifty 50 Futures Contract Specifications: Item Description Underlying Index Ticker SymbolDocument2 pagesTAIFEX Nifty 50 Futures Contract Specifications: Item Description Underlying Index Ticker SymbolVenkataNo ratings yet

- Philosophy of Islamic Banking and FinanceDocument9 pagesPhilosophy of Islamic Banking and FinanceNabeela ShahNo ratings yet

- Form of Contract 12.11.2022Document2 pagesForm of Contract 12.11.2022raghav joshiNo ratings yet

- Sample Contract of LoanDocument2 pagesSample Contract of LoanEd Armand VentoleroNo ratings yet

- McDonalds Franchise Disclosure DocumentDocument2 pagesMcDonalds Franchise Disclosure DocumentNilesh GuptaNo ratings yet

- RFBT Preweek B94 - Questionnaire - AnswersDocument25 pagesRFBT Preweek B94 - Questionnaire - AnswersSilver LilyNo ratings yet

- Tax Consequences For REMIC and REMIC Investors-For Loan ModsDocument13 pagesTax Consequences For REMIC and REMIC Investors-For Loan Mods83jjmackNo ratings yet

- 1 Chapter 1 Partnership FormationDocument16 pages1 Chapter 1 Partnership FormationJymldy EnclnNo ratings yet

- Learning Resource 8 Lesson 1Document7 pagesLearning Resource 8 Lesson 1Vianca Marella SamonteNo ratings yet

- Bankruptcy Law PrimerDocument101 pagesBankruptcy Law PrimerJoe23232232100% (2)

- Memorial For RespondentDocument28 pagesMemorial For RespondentKunwarbir Singh lohatNo ratings yet

- PLEDGE (Sec. 172-179) 1. Concept and Definition:: in Lallan Prasad v. Rahmat AliDocument5 pagesPLEDGE (Sec. 172-179) 1. Concept and Definition:: in Lallan Prasad v. Rahmat AliKrishna AhujaNo ratings yet

- CA Notes Bill of Exchange and Promissory Notes PDFDocument28 pagesCA Notes Bill of Exchange and Promissory Notes PDFBijay Aryan DhakalNo ratings yet

- Intraday GVK StocksDocument9 pagesIntraday GVK Stockssri sriNo ratings yet

- R45 P2 T6 Gregory Ch9 Intermediation v5 PDFDocument24 pagesR45 P2 T6 Gregory Ch9 Intermediation v5 PDFOsama Shaheen100% (1)

- Corporate Accounting IMP QuestionsDocument6 pagesCorporate Accounting IMP QuestionsMayank RajeNo ratings yet

- Lecturer 2 Financial Distress and DissolutionDocument10 pagesLecturer 2 Financial Distress and DissolutionGoitse LithekoNo ratings yet

- EEI Master Netting Agreement FaqDocument3 pagesEEI Master Netting Agreement FaqOSRNo ratings yet

- Master Distributor Stock Components: Bulletin HY14-2700/USDocument72 pagesMaster Distributor Stock Components: Bulletin HY14-2700/USYuriPasenkoNo ratings yet

- Bam 242 Regulatory Framework and Business TransactionsDocument38 pagesBam 242 Regulatory Framework and Business TransactionsMary PatalinghugNo ratings yet

- Partnership Laws: Legal Aspects of Business Prof. Mehek KapoorDocument14 pagesPartnership Laws: Legal Aspects of Business Prof. Mehek KapoorAman jaiNo ratings yet

- Home InsuranceDocument3 pagesHome InsuranceAiman hanifNo ratings yet

- The Recto and Maceda LawDocument3 pagesThe Recto and Maceda Lawjovani emaNo ratings yet

- 3 Articles of IncorporationDocument5 pages3 Articles of IncorporationPrincess de GuzmanNo ratings yet

- A Study of Open Interest in Nifty Future PDFDocument7 pagesA Study of Open Interest in Nifty Future PDFRaghuraman ThaiyarNo ratings yet

- Legal Aspects of Business (LAB) : Post Graduate Programme in Management (PGPM)Document24 pagesLegal Aspects of Business (LAB) : Post Graduate Programme in Management (PGPM)Aman PratikNo ratings yet