Professional Documents

Culture Documents

Consumer Price Index

Consumer Price Index

Uploaded by

Deborah ChiramboCopyright:

Available Formats

You might also like

- GWPI Luzon Tables November 2016Document3 pagesGWPI Luzon Tables November 2016Hector Andrei NicolasNo ratings yet

- Data On Sri Lanka Money Policy by CBSLDocument7 pagesData On Sri Lanka Money Policy by CBSLNishantha FernandoNo ratings yet

- SolarDocument11 pagesSolarCarlos Tadeo CapistranNo ratings yet

- Appendix (A) : Data Set of The ModelDocument22 pagesAppendix (A) : Data Set of The Modelahmeda zayedNo ratings yet

- US Corporate Bond Issuance: All Data Are Subject To RevisionDocument5 pagesUS Corporate Bond Issuance: All Data Are Subject To RevisionÂn TrầnNo ratings yet

- Consumer Price Index (February 2019 100)Document8 pagesConsumer Price Index (February 2019 100)rzvendiya-1No ratings yet

- Ejercicio Van - TirDocument8 pagesEjercicio Van - Tirluis alberto quispe vasquezNo ratings yet

- 53113CA Storage & Warehouse Leasing in Canada Industry ReportDocument44 pages53113CA Storage & Warehouse Leasing in Canada Industry ReportDaniel CruzNo ratings yet

- Aditya Birla Fashion & Retail Ltd. - 20 QTRDocument4 pagesAditya Birla Fashion & Retail Ltd. - 20 QTREldhose Paul RajNo ratings yet

- CPI For Bottom 30% Tables First Quarter 2018Document25 pagesCPI For Bottom 30% Tables First Quarter 2018Ian EstalillaNo ratings yet

- 2021 Statistics Bulletin - Public FinanceDocument16 pages2021 Statistics Bulletin - Public FinanceIbeh CosmasNo ratings yet

- Dataset: Patents by TechnologyDocument3 pagesDataset: Patents by TechnologyThanh Huyền NguyễnNo ratings yet

- SK 121201Document29 pagesSK 121201BoomdayNo ratings yet

- 72221BCA Coffee & Snack Shops in Canada Industry ReportDocument50 pages72221BCA Coffee & Snack Shops in Canada Industry ReportJoeNo ratings yet

- Book1 2Document10 pagesBook1 2Aakash SinghalNo ratings yet

- Blended Consumer Price Index (Jul 2020 100)Document3 pagesBlended Consumer Price Index (Jul 2020 100)rzvendiya-1No ratings yet

- PVGIS-5 MonthlyRadiation 10.603 14.328 Undefined 2005-2020 PDFDocument1 pagePVGIS-5 MonthlyRadiation 10.603 14.328 Undefined 2005-2020 PDFFidelesNo ratings yet

- Tourism Statistics 202401Document5 pagesTourism Statistics 202401notary.sinchanphalkunNo ratings yet

- Tourism Statistics: Kingdom of CambodiaDocument8 pagesTourism Statistics: Kingdom of CambodiaAubrey LabardaNo ratings yet

- Chap5 Money Annual 07 AanexDocument20 pagesChap5 Money Annual 07 AanexowltbigNo ratings yet

- Table 1: Principal Statistics of The Labour Force, Terengganu, 1982-2009Document16 pagesTable 1: Principal Statistics of The Labour Force, Terengganu, 1982-2009Abdul ManafNo ratings yet

- Tourism Statistics 2015Document5 pagesTourism Statistics 2015Wen-Hsuan HsiaoNo ratings yet

- Blended - CPI - Sept - 21Document20 pagesBlended - CPI - Sept - 21rzvendiya-1No ratings yet

- Melting Material Usage: Reporting Date: 07/05/2022Document1 pageMelting Material Usage: Reporting Date: 07/05/2022David GNo ratings yet

- 04 - Internet & Mobile BankingDocument1 page04 - Internet & Mobile BankingJaleany T C KhunNo ratings yet

- Ptsa2000 2021 2Document4 pagesPtsa2000 2021 2Dranreb PaleroNo ratings yet

- InternetreferencetablesDocument173 pagesInternetreferencetablesAna StanNo ratings yet

- JSW Energy Valuation 2022Document40 pagesJSW Energy Valuation 2022ShresthNo ratings yet

- PrecipitacionDocument175 pagesPrecipitacionPaco UtreraNo ratings yet

- Dec 2021 enDocument21 pagesDec 2021 enMohammed ShbairNo ratings yet

- Cambodia Tourism Statistics 2017Document5 pagesCambodia Tourism Statistics 2017Thông NguyễnNo ratings yet

- IUnits ChartDocument1 pageIUnits ChartThomas EntersNo ratings yet

- Year 2019Document5 pagesYear 2019Master SearNo ratings yet

- Annual Inflation Rate 2022Document1 pageAnnual Inflation Rate 2022yared mekonnenNo ratings yet

- Datos Pronosticados Del Profesor (Albania)Document12 pagesDatos Pronosticados Del Profesor (Albania)JORGE DANIEL CALDERON DIZNo ratings yet

- Blast HoleDocument1 pageBlast HoleAnonymous UXEtI80kNo ratings yet

- Year 2018-1Document5 pagesYear 2018-1Vũ Ngọc BíchNo ratings yet

- Economic Survey of India 2022 - 2023 - TableDocument145 pagesEconomic Survey of India 2022 - 2023 - Tablemerawi6699No ratings yet

- Daily Activity 23 03 2023 13 17 15Document5 pagesDaily Activity 23 03 2023 13 17 15LINDA ROMANNo ratings yet

- 2-Sanur Yuzde DegismeDocument1 page2-Sanur Yuzde DegismeSoner KoçakNo ratings yet

- KWH NovemberDocument10 pagesKWH NovemberFajar Santos MotoVlogNo ratings yet

- MET FijiDocument36 pagesMET Fijiwilliamlord8No ratings yet

- Shampoo Sales Data - Weigthed Moving Average Over 5 PeriodsDocument4 pagesShampoo Sales Data - Weigthed Moving Average Over 5 PeriodsSven A. SchnydrigNo ratings yet

- For Sugar (MMT) 69.0 122.3 174.8 176.7 For Khandsari (MMT) 10.5 13.2 10.0 11.0 For Gur (MMT) 71.6 76.6 67.3 72.5 For Seed (MMT) 20.6 28.9 30.1 35.5Document6 pagesFor Sugar (MMT) 69.0 122.3 174.8 176.7 For Khandsari (MMT) 10.5 13.2 10.0 11.0 For Gur (MMT) 71.6 76.6 67.3 72.5 For Seed (MMT) 20.6 28.9 30.1 35.5dangmilanNo ratings yet

- Weather ReportDocument1 pageWeather ReportKiran Netha'sNo ratings yet

- CURVAS IDF ConcayoDocument15 pagesCURVAS IDF ConcayoFlorentino Alberto Sanchez VilelaNo ratings yet

- Appendix 1.1: Macro-Economic Indicator: 1993-94-2004-05: ConsumptionDocument52 pagesAppendix 1.1: Macro-Economic Indicator: 1993-94-2004-05: ConsumptionromanaNo ratings yet

- Wa0034Document15 pagesWa0034SuriYati HamSanieNo ratings yet

- Perhitungan Curah Hujan RencanaDocument79 pagesPerhitungan Curah Hujan RencanaMuhammad Adli FikriNo ratings yet

- Shampoo Sales Data - Exponential SmoothingDocument4 pagesShampoo Sales Data - Exponential SmoothingSven A. SchnydrigNo ratings yet

- Molar Conductivity of Aqueous HF, HCL, HBR, and Hi ReferenceDocument1 pageMolar Conductivity of Aqueous HF, HCL, HBR, and Hi ReferenceantonioNo ratings yet

- Rib ChartDocument1 pageRib ChartAzwan ShahmeeNo ratings yet

- Sachaeffler India Ltd.Document63 pagesSachaeffler India Ltd.shivam vermaNo ratings yet

- Current Statistics: No. 39: Index Numbers of Wholesale Prices in India - by Groups and Sub-Groups (Averages)Document4 pagesCurrent Statistics: No. 39: Index Numbers of Wholesale Prices in India - by Groups and Sub-Groups (Averages)rammy24_365No ratings yet

- Production of Electric Fans in IndiaDocument32 pagesProduction of Electric Fans in Indiasushan12224No ratings yet

- Consumer Price Index - Feb15-Jan16Document331 pagesConsumer Price Index - Feb15-Jan16dpmgumtiNo ratings yet

- Uniaxial Compressive Strength Versus Point Load Index Graph: LegendDocument3 pagesUniaxial Compressive Strength Versus Point Load Index Graph: LegendsyafixNo ratings yet

- UntitledDocument80 pagesUntitledNovin neshNo ratings yet

- Statistical TableDocument100 pagesStatistical TablesmanisuzzamanNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

Consumer Price Index

Consumer Price Index

Uploaded by

Deborah ChiramboOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consumer Price Index

Consumer Price Index

Uploaded by

Deborah ChiramboCopyright:

Available Formats

Module B1 Session 6

Session 6. Consumer Price Indices – an

example of a regular statistical product

Learning objectives

At the end of this session the students will be able to

describe the CPI, and its uses

discuss some of the issues that affect the compilation and calculation of the CPI

calculate the inflation rate

find the latest national data

explain how it is compiled

Introduction

Consumer price indices (CPIs) are important indicators of how economies are performing,

especially in relation to the value of money. The indices are used in many ways by

governments, central banks, businesses, and society in general. CPIs are designed to show

the impact of changes in prices on people’s expenditure. They can have a strong influence

on interest rates, wage rates, tax thresholds and the value of contracts, among other things.

CPIs measure the change in the general level of prices charged for goods and services

bought by households and individuals for the purpose of consumption. The indices

represent the average change in prices across a wide range of consumer purchases. This is

achieved through the careful recording, every month, of the prices of a typical selection of

products in markets, shops and other outlets across the country.

Shopping basket

A good way of thinking about the CPI is to imagine a large ‘shopping basket’ full of

commodities on which people typically spend their money. The basket will include services

as well as goods (for example, bus fares). The content of the basket is kept fixed but, as

the prices of individual products vary, so does the total cost of the basket. The CPI, as a

measure of that total cost, only measures price changes. If people spend more because

they buy more goods, this does not affect the index. The amounts of the various items in

the basket are chosen to reflect their importance in the typical household budget.

Exercise 1

Make a list of important items that might be included in the shopping basket.

SADC Course in Statistics Module B1 Session 6 – Page 1

Module B1 Session 6

Scoring:

for an item that everyone thought of, no points

for an item not everyone thought of, score one point for each other

person that did not think of it

for an item not acceptable in a sensible list, minus five points!

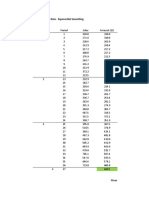

What does a consumer price index look like?

Here is an example from Malawi:

SADC Course in Statistics Module B1 Session 6 – Page 2

Module B1 Session 6

The consumer price index (national)

Beverage Clothing & Household Misc- Inflation

Food &Tobacco Footwear Housing operation Transport ellaneous All Items Rate (%)

Weight 58.1 5.9 8.5 12.1 4.1 5.1 6.2 100

2000 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0

2001 117.6 131.0 130.5 132.9 129.3 129.5 122.1 122.7 22.7

2002 136.4 136.7 152.7 156.6 143.8 143.9 134.4 140.8 14.8

2003 143.6 165.8 166.8 180.0 172.9 172.1 148.3 154.3 9.6

2004 154.4 196.5 179.5 211.7 218.3 202.8 169.1 172.0 11.5

2005 181.0 240.6 192.8 236.9 269.0 230.1 182.6 198.5 15.4

2006 209.1 273.5 208.8 266.9 313.5 261.6 197.5 226.1 13.9

2006 Jan 216.4 262.2 201.2 257.5 308.1 251.4 188.7 226.6 16.7

Feb 228.7 262.7 205.4 259.8 308.5 251.7 189.7 234.5 17.1

Mar 227.7 264.0 205.4 260.4 309.6 251.7 193.4 234.4 16.6

Apr 220.0 265.0 205.6 259.9 309.6 252.0 193.6 229.9 16.1

May 211.8 266.8 207.0 260.6 310.1 255.1 195.3 225.8 15.8

June 198.3 267.3 207.4 261.4 310.3 256.3 196.3 218.2 15.3

July 193.7 268.4 208.1 266.6 312.1 258.2 197.7 216.6 14.9

Aug 184.2 273.3 208.4 268.0 312.7 261.6 198.5 211.8 12.0

Sep 199.0 285.0 213.4 274.4 318.5 274.7 202.7 223.5 11.6

Oct 200.9 285.4 213.6 274.9 318.6 275.3 203.1 224.7 11.0

Nov 210.3 288.0 215.0 277.0 321.9 275.8 205.1 230.9 10.5

Dec 218.3 293.8 215.0 282.1 321.9 275.8 205.6 236.6 10.1

2007 Jan 237.4 296.3 216.0 283.6 323.6 278.5 206.4 248.4 9.6

Feb 249.4 296.6 218.2 284.1 329.5 281.2 207.6 256.0 9.2

Mar 246.5 297.2 218.5 285.0 330.3 281.9 207.7 254.6 8.6

Apr 237.3 297.3 218.8 284.5 330.6 282.0 207.9 249.2 8.4

May 227.0 297.7 219.3 285.5 331.2 283.4 209.1 243.7 7.9

June 211.8 298.6 219.3 284.8 332.9 284.3 209.4 234.9 7.7

Notes: 1. Annual figures are calculated using the average of the monthly indices for the year compared to the average for the previous year

Source: http://www.nso.malawi.net/

The overall CPI is shown in the last-but-one column of this table. It is often known as the

“all items” index. The “inflation rate” is shown in the last column, and shows the

percentage change in the CPI compared with the same period a year earlier.

The overall inflation rate for June 2007 is calculated as follows

take the CPI figure for June 2007 (234.9)

divide this by the CPI figure for June 2006 (218.2, result 1.077)

subtract 1 (0.077) and express the result as a percentage (7.7%).

The previous columns show seven main categories of goods and services which

households buy. So you can work out the inflation rate for each category.

Exercise 2

A) Calculate the percentage changes between June 2006 and June 2007 for each category

Category per cent

Food

SADC Course in Statistics Module B1 Session 6 – Page 3

Module B1 Session 6

Beverage &Tobacco

Clothing & Footwear

Housing

Household operation

Transport

Miscellaneous

All Items 7.7%

B) Calculate the overall percentage change in prices between March 2007 and June 2007

Questions for discussion

In which category did prices increase the most between June 2006 and June 2007?

The inflation rate was lower in June 2007 (7.7%) than it was in June 2006. Does

this mean prices are going down?

In which complete year did prices increase the least overall?

What does a negative percentage change mean?

Which category is mainly responsible for the fall in prices between March and June

Could the CPI ever be less than 100 in any period?

Could the CPI ever be zero?

SADC Course in Statistics Module B1 Session 6 – Page 4

Module B1 Session 6

How is the CPI compiled?

Collecting the prices

Once the items in the shopping basket have been selected, the prices of the items are

collected every month from a number of markets, shops and other outlets, usually in urban

centres, throughout the country. The price of some products (such as the cost of a mobile

phone call) may be obtained centrally.

This is an example of a form used in Zimbabwe to collect the prices of fresh fruit and

vegetables in supermarkets. It provides for three visits to the outlet during the month.

Section 4 Geo Code

Name of outlet………….……….……………..……………...…………..…………Outlet code

Physical address……………………………………..……………….……………………………..……….…………………………………

Fresh fruits and vegetables (Supermarkets) Contact person…………..…………………..….………

Item Item name Item Description

Code & Specification Price Pcode Price Pcode Price Pcode

10611 Apples Per kg

10612 Bananas Per kg

10613 Mangoes Per kg

10614 Oranges Per kg

10615 Pine apples Per kg

10711 Green beans Per kg

10712 Cabbages Per kg

10713 Okra Per kg

10714 Carrots Per kg

10715 Onions Per kg

10716 Rape/Covo/Chomoulier Per kg

10717 Tomatoes Per kg

10718 Cucumber Per kg

10719 Potatoes Per 2kg

Name (Print)……………………………………………………………………………………Date …………………………………………….

Name (Print)……………………………………………………………………………………Date …………………………………………….

Name (Print)……………………………………………………………………………………Date …………………………………………….

It is important that the index calculations are based on ‘like for like’ comparisons of prices

for each of the items in the basket. In other words, the price of the very same item should

be obtained each time. This is often easier said than done.

It is no good getting the price of a bar of soap weighing 200 grams one month and then

getting the price of a bar of soap weighing 100 grams the next month. And soap can vary

in quality, so it must be the very same product each time. When it comes to markets, even

the time of day or day of the week can have an important influence on the price. These

variations should be avoided as far as possible, as they reduce the accuracy of the index.

SADC Course in Statistics Module B1 Session 6 – Page 5

Module B1 Session 6

However, inevitably, some brands or varieties of particular products may cease to be

available and new ones take over. This is particularly common among products such as

clothing or electronic goods.

When particular products do disappear, care is needed to ensure that replacements are of

broadly comparable quality so that price comparisons are not distorted. If this is not

possible, special procedures have to be used to take account of the change in quality.

Weighting

We spend more on some things than others, so we would expect a ten per cent increase in

the price of cereal products (such as maize meal) to have a much bigger impact on the CPI

than a similar rise in the price of shoes, say, which we buy only occasionally. For this

reason the components of the index are ‘weighted’. These weights are not to be confused

with how much items weigh in kilograms. They are based on expenditures measured in

terms of money. The weighting ensures that the CPI reflects the importance of the various

items in the average shopping basket.

While the precise methods may vary from country to country, the weights for the CPI are

mainly derived from surveys of household expenditure. In this kind of survey, which

usually lasts a whole year, a sample is selected of several thousand households from all over

the country. Enumerators record the spending of the household members over a period of

two weeks or a month. Details may also be recorded of major purchases made within the

previous twelve months.

Calculating the index

The first task is to enter the data into the computer processing system and to check that

the recorded changes in prices are within expected limits. (In some countries, this is done

in the field, using hand-held computers.) Errors can easily occur for a number of reasons.

Some errors may not affect the results much, but others can have a big effect, making the

CPI misleading. Care is needed to identify and correct them. On the other hand,

sometimes prices may actually change in an unexpected way, so it is important that such eal

changes are reflected in the CPI.

After the prices for a particular item have been entered and checked, the processing can

begin. Prices of the individual goods and services in the index are compared to their levels

in an earlier (base) period. The results are elementary indicators called ‘price relatives’.

These are the building blocks used to produce the index, but may also be useful in their

own right.

The price relatives are then combined using a special mathematical formula involving the

weights described above. The formula is used to produce indices for groups of products

(such as the seven major categories used in Malawi) as well as the “all items” index that

measures the overall average price change.

Presenting the results

SADC Course in Statistics Module B1 Session 6 – Page 6

Module B1 Session 6

Finally, CPIs have to be published, so that users can use them! Some important users want

to know as soon as possible what the latest figures are. Most countries follow

internationally accepted best practice by releasing the results on a specific day each month.

The date is published in advance, so that users know when to expect the figures to become

available.

The figures are usually presented in the form of a “press release” or similar document.

This document will usually contain some description in words of the latest figures as well

as a table and perhaps a chart. The same information should be available on the website of

the National Statistics Office.

Further information

Information about the methods used in your particular country should be available. If you

cannot find them locally, try the IMF’s GDDS (or SDDS) website:

http://dsbb.imf.org/Applications/web/gdds/gddshome/

or, more specifically,

http://dsbb.imf.org/Applications/web/gdds/gddscategorycountrypage/?strcat=PCPI0&s

trcatname=Consumer%20price%20index

Coverage and related issues

The coverage of the CPI in SADC countries may differ to some extent. In some cases the

index will be country wide, covering rural as well as urban areas. In others, it may cover

selected urban centres only (or even just the capital city). It could be very expensive to

collect prices in rural areas as well as in urban centres. But, although the level of prices in

rural areas may differ from those in urban areas, research suggests it is reasonable to

suppose that the movement or change in prices will be very similar in neighbouring areas.

However, the expenditure patterns of people living in rural areas are likely to be quite

different from those of urban people, so it makes a difference which are included in the

weighting. Another issue is whether the weights should include the value of food that

people grow for themselves as well as what they buy.

Some countries may produce separate indices for specific populations (eg rural and urban),

and some may do so for the different regions of the country. Economists wishing to

analyse the trends and sources of inflation may be interested in indices that exclude certain

items, such as food, that fluctuate in a different way, so some countries publish special

indices of this kind.

Exercise 3

SADC Course in Statistics Module B1 Session 6 – Page 7

Module B1 Session 6

Obtain a copy of the latest CPI statistics for your country. Also get hold of a description

of the methods used to compile it.

I am a local businessman with access to the internet. I review the pay of my staff at this

time of year. I want to know by what percentage should I increase their pay so that they

can buy as much now with their wages as they could a year ago?

Write me a brief letter telling me (a) the answer to my question (b) how I can find the

answer easily for myself and (c) where I can find a short description of the methods used to

compile the CPI.

SADC Course in Statistics Module B1 Session 6 – Page 8

You might also like

- GWPI Luzon Tables November 2016Document3 pagesGWPI Luzon Tables November 2016Hector Andrei NicolasNo ratings yet

- Data On Sri Lanka Money Policy by CBSLDocument7 pagesData On Sri Lanka Money Policy by CBSLNishantha FernandoNo ratings yet

- SolarDocument11 pagesSolarCarlos Tadeo CapistranNo ratings yet

- Appendix (A) : Data Set of The ModelDocument22 pagesAppendix (A) : Data Set of The Modelahmeda zayedNo ratings yet

- US Corporate Bond Issuance: All Data Are Subject To RevisionDocument5 pagesUS Corporate Bond Issuance: All Data Are Subject To RevisionÂn TrầnNo ratings yet

- Consumer Price Index (February 2019 100)Document8 pagesConsumer Price Index (February 2019 100)rzvendiya-1No ratings yet

- Ejercicio Van - TirDocument8 pagesEjercicio Van - Tirluis alberto quispe vasquezNo ratings yet

- 53113CA Storage & Warehouse Leasing in Canada Industry ReportDocument44 pages53113CA Storage & Warehouse Leasing in Canada Industry ReportDaniel CruzNo ratings yet

- Aditya Birla Fashion & Retail Ltd. - 20 QTRDocument4 pagesAditya Birla Fashion & Retail Ltd. - 20 QTREldhose Paul RajNo ratings yet

- CPI For Bottom 30% Tables First Quarter 2018Document25 pagesCPI For Bottom 30% Tables First Quarter 2018Ian EstalillaNo ratings yet

- 2021 Statistics Bulletin - Public FinanceDocument16 pages2021 Statistics Bulletin - Public FinanceIbeh CosmasNo ratings yet

- Dataset: Patents by TechnologyDocument3 pagesDataset: Patents by TechnologyThanh Huyền NguyễnNo ratings yet

- SK 121201Document29 pagesSK 121201BoomdayNo ratings yet

- 72221BCA Coffee & Snack Shops in Canada Industry ReportDocument50 pages72221BCA Coffee & Snack Shops in Canada Industry ReportJoeNo ratings yet

- Book1 2Document10 pagesBook1 2Aakash SinghalNo ratings yet

- Blended Consumer Price Index (Jul 2020 100)Document3 pagesBlended Consumer Price Index (Jul 2020 100)rzvendiya-1No ratings yet

- PVGIS-5 MonthlyRadiation 10.603 14.328 Undefined 2005-2020 PDFDocument1 pagePVGIS-5 MonthlyRadiation 10.603 14.328 Undefined 2005-2020 PDFFidelesNo ratings yet

- Tourism Statistics 202401Document5 pagesTourism Statistics 202401notary.sinchanphalkunNo ratings yet

- Tourism Statistics: Kingdom of CambodiaDocument8 pagesTourism Statistics: Kingdom of CambodiaAubrey LabardaNo ratings yet

- Chap5 Money Annual 07 AanexDocument20 pagesChap5 Money Annual 07 AanexowltbigNo ratings yet

- Table 1: Principal Statistics of The Labour Force, Terengganu, 1982-2009Document16 pagesTable 1: Principal Statistics of The Labour Force, Terengganu, 1982-2009Abdul ManafNo ratings yet

- Tourism Statistics 2015Document5 pagesTourism Statistics 2015Wen-Hsuan HsiaoNo ratings yet

- Blended - CPI - Sept - 21Document20 pagesBlended - CPI - Sept - 21rzvendiya-1No ratings yet

- Melting Material Usage: Reporting Date: 07/05/2022Document1 pageMelting Material Usage: Reporting Date: 07/05/2022David GNo ratings yet

- 04 - Internet & Mobile BankingDocument1 page04 - Internet & Mobile BankingJaleany T C KhunNo ratings yet

- Ptsa2000 2021 2Document4 pagesPtsa2000 2021 2Dranreb PaleroNo ratings yet

- InternetreferencetablesDocument173 pagesInternetreferencetablesAna StanNo ratings yet

- JSW Energy Valuation 2022Document40 pagesJSW Energy Valuation 2022ShresthNo ratings yet

- PrecipitacionDocument175 pagesPrecipitacionPaco UtreraNo ratings yet

- Dec 2021 enDocument21 pagesDec 2021 enMohammed ShbairNo ratings yet

- Cambodia Tourism Statistics 2017Document5 pagesCambodia Tourism Statistics 2017Thông NguyễnNo ratings yet

- IUnits ChartDocument1 pageIUnits ChartThomas EntersNo ratings yet

- Year 2019Document5 pagesYear 2019Master SearNo ratings yet

- Annual Inflation Rate 2022Document1 pageAnnual Inflation Rate 2022yared mekonnenNo ratings yet

- Datos Pronosticados Del Profesor (Albania)Document12 pagesDatos Pronosticados Del Profesor (Albania)JORGE DANIEL CALDERON DIZNo ratings yet

- Blast HoleDocument1 pageBlast HoleAnonymous UXEtI80kNo ratings yet

- Year 2018-1Document5 pagesYear 2018-1Vũ Ngọc BíchNo ratings yet

- Economic Survey of India 2022 - 2023 - TableDocument145 pagesEconomic Survey of India 2022 - 2023 - Tablemerawi6699No ratings yet

- Daily Activity 23 03 2023 13 17 15Document5 pagesDaily Activity 23 03 2023 13 17 15LINDA ROMANNo ratings yet

- 2-Sanur Yuzde DegismeDocument1 page2-Sanur Yuzde DegismeSoner KoçakNo ratings yet

- KWH NovemberDocument10 pagesKWH NovemberFajar Santos MotoVlogNo ratings yet

- MET FijiDocument36 pagesMET Fijiwilliamlord8No ratings yet

- Shampoo Sales Data - Weigthed Moving Average Over 5 PeriodsDocument4 pagesShampoo Sales Data - Weigthed Moving Average Over 5 PeriodsSven A. SchnydrigNo ratings yet

- For Sugar (MMT) 69.0 122.3 174.8 176.7 For Khandsari (MMT) 10.5 13.2 10.0 11.0 For Gur (MMT) 71.6 76.6 67.3 72.5 For Seed (MMT) 20.6 28.9 30.1 35.5Document6 pagesFor Sugar (MMT) 69.0 122.3 174.8 176.7 For Khandsari (MMT) 10.5 13.2 10.0 11.0 For Gur (MMT) 71.6 76.6 67.3 72.5 For Seed (MMT) 20.6 28.9 30.1 35.5dangmilanNo ratings yet

- Weather ReportDocument1 pageWeather ReportKiran Netha'sNo ratings yet

- CURVAS IDF ConcayoDocument15 pagesCURVAS IDF ConcayoFlorentino Alberto Sanchez VilelaNo ratings yet

- Appendix 1.1: Macro-Economic Indicator: 1993-94-2004-05: ConsumptionDocument52 pagesAppendix 1.1: Macro-Economic Indicator: 1993-94-2004-05: ConsumptionromanaNo ratings yet

- Wa0034Document15 pagesWa0034SuriYati HamSanieNo ratings yet

- Perhitungan Curah Hujan RencanaDocument79 pagesPerhitungan Curah Hujan RencanaMuhammad Adli FikriNo ratings yet

- Shampoo Sales Data - Exponential SmoothingDocument4 pagesShampoo Sales Data - Exponential SmoothingSven A. SchnydrigNo ratings yet

- Molar Conductivity of Aqueous HF, HCL, HBR, and Hi ReferenceDocument1 pageMolar Conductivity of Aqueous HF, HCL, HBR, and Hi ReferenceantonioNo ratings yet

- Rib ChartDocument1 pageRib ChartAzwan ShahmeeNo ratings yet

- Sachaeffler India Ltd.Document63 pagesSachaeffler India Ltd.shivam vermaNo ratings yet

- Current Statistics: No. 39: Index Numbers of Wholesale Prices in India - by Groups and Sub-Groups (Averages)Document4 pagesCurrent Statistics: No. 39: Index Numbers of Wholesale Prices in India - by Groups and Sub-Groups (Averages)rammy24_365No ratings yet

- Production of Electric Fans in IndiaDocument32 pagesProduction of Electric Fans in Indiasushan12224No ratings yet

- Consumer Price Index - Feb15-Jan16Document331 pagesConsumer Price Index - Feb15-Jan16dpmgumtiNo ratings yet

- Uniaxial Compressive Strength Versus Point Load Index Graph: LegendDocument3 pagesUniaxial Compressive Strength Versus Point Load Index Graph: LegendsyafixNo ratings yet

- UntitledDocument80 pagesUntitledNovin neshNo ratings yet

- Statistical TableDocument100 pagesStatistical TablesmanisuzzamanNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet