Professional Documents

Culture Documents

An Evaluation of The Challenges Facing Tra On Revenue Collection in Tanzania A Case of Kariakoo Tax Region

An Evaluation of The Challenges Facing Tra On Revenue Collection in Tanzania A Case of Kariakoo Tax Region

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

An Evaluation of The Challenges Facing Tra On Revenue Collection in Tanzania A Case of Kariakoo Tax Region

An Evaluation of The Challenges Facing Tra On Revenue Collection in Tanzania A Case of Kariakoo Tax Region

Copyright:

Available Formats

Volume 8, Issue 4, April – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

An Evaluation of the Challenges Facing Tra on

Revenue Collection in Tanzania: A Case of Kariakoo

Tax Region

Robson Mohamed

The Open University of Tanzania

Abstract:- World’s Entire Government, As Well As Countries, Must Intensify Its Tax Revenue Collection. In

Tanzania, Need Financial On Behalf Of Numerous Tanzania, Revenue Collection Is Assessed And Controlled

Progress Activities. Revenue Collection Has Above The By Tanzania Revenue Authority, Which Came Into

Years Remained The Foremost Foundation Of Financial Operation In 1996 After Being Established By Act Of

For The Governments To Realize Their Expenditure Parliament No. 11 Of 1995.2

Requirements. The Tanzania Revenue Authority Is The

Government Agency With The Authority To Make An Since 1996 To 2023, The Government Of Tanzania

Assessment And Collection Of Taxes In Tanzania. For Has Comprehended Various Sources And Ways Which

Many Years, The Government Reports Show That, Including But Not Limit Enacted Tax Laws And Policies,

Tanzania Revenue Authority Has Failed Completed The Introduction Of Vat, A Task Force, And Efd’s Machines,

Collection Goals For Domestic Taxes Per Financial For The Intention Of Amassed Revenue Collection In

Year. This Has Made The Government To Majorly Tanzania. Regardless Of Above Government Efforts, Tra

Depend On Financial Transfers Which Is Insufficient To Still Regularly Reports On The Number Of Challenges

Afford Financing Development Projects. This Article Leading Failure To Complete The Collection Goals For

Centred To An Evaluation Of The Challenges Facing Domestic Taxes.3 Therefore, This Article Centred To An

Tanzania Revenue Authority (Tra) On Revenue Evaluation Of The Challenges Facing Tanzania Revenue

Collection In Tanzania. In This Study, The Most Of The Authority In Revenue Collection In Tanzania. Specifically,

Issues On The Challenges Facing Tra On Revenue The Article Evaluates Tax Laws And Policies Governing

Collection Was Addressed And Analyses. In This Tanzania Revenue Authority Processes, Practice And The

Regard, The Author Finds That Non-Voluntary Tax Relationship With Its Essential Values In Rising Revenue

Compliance, Tax Assessment Objection, Administrative Collections And Upholding Tax Compliance.

Inefficiencies, Political Interference, And Corruption

Are Amongst The Challenges Facing Tra On Revenue In This Article, The Most Of Issues On Challenges

Collection In Tanzania. This Article Contends That In Facing Tra In Revenue Collection Was Addressed And

Order To Improve Tax Compliance, The Tanzania Analyses. The Data Was Collected From The First Hand

Revenue Authority Must Become Conversant With The Observations, Interviews, Questionnaires And Documents

Laws Controlling Taxes And Uphold Their Basic From 2020 To 2023 In Demand To Estimate A Current

Principles. The Research Also Recommends That Tax Tanzania Taxation Model. At The End Of This Article

Regulations Be Changed To Make Them Far More User- Outbuildings Light On Another Researchers’ Evolvement.

Friendly For Taxpayers To Encourage Compliance.

Establishing The Link Between Culture And Voluntary Every Nation Including Tanzania Needs Financial For

Tax Compliance Will Likely Require More Study. Its National Development Activities. Revenue Collection

Has Above The Years Remained The Foremost Foundation

Keywords: An Evaluation, Challenges, Tanzania Revenue Of Fund For The Governments To Realize Their

Authority, Revenue Collection. Expenditure Requirements. The Tanzania Revenue

Authority Is The Government Agency With The Authority

I. INTRODUCTION To Control Taxation System In Tanzania.4 For Many Years,

The Government Reports Show That, Tanzania Revenue

This Article Is About An Evaluation Of The Authority (Tra) Has Failure Completed The Revenue

Challenges Facing Tanzania Revenue Authority On Collection Expectation For The Domestic Taxes. This Has

Revenue Collection In Tanzania. Revenue Collection Plays Made The Country To Majorly Depend On Financial

An Important Role In Fiscal Decentralization In Every

Country.1 Thus, Tanzania, Like Other Low-Income 2

Tanzania revenue authority act, no 11 of 1995 R.E 2019

3

Clive, G. (2011). Enhancing Transparency in Tax

1

Casey, P., & Castro, P. (2012). Electronic Fiscal Devices, Administration in Madagascar and Tanzania.

An Empirical Study of Their Impact on Taxpayer International Journal of Belfer Centre for Science and

Compliance and Administrative Efficiency. Geneva.: IMF International Affairs, 12-15.

4

Working Papers. Ibid

IJISRT23APR2304 www.ijisrt.com 2215

Volume 8, Issue 4, April – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Transfers Which Is Insufficient To Afford Financing Kibuta,5 The Author Gave The Reasons For

Development Projects. Therefore, The Article Sought To Opposition To The Assessment Some Thought. In Her

Make An Evaluation On The Number Of Challenges Argument, She Points Out That The Grounds For Tax

Leading Tra Failure To Completed Revenue Collection Assessment Objections Include Important Issues Like

Expectation For The Domestic Revenue Or Taxes. Improper Application Of Laws And Procedures, Delivery

Of The Assessment Outside Of The Legal Window, Errors

The Aim Of This Study Is To Evaluate The Challenges In The Calculation Of The Tax Due, Improper Support For

Facing Tanzania Revenue Authority (Tra) In Revenue The Assessment, And The Assessment's Omission Of Tax

Collection In Tanzania. Recognising These Challenges Will Already Paid In Relation To The Same Liability.

Help To Reform And Improve The Revenue Collection

System In Tanzania, At The End The Country To Majorly Further, Researcher Point Out That, The Reasons For

Autonomous On Financial Transfers Which Is Sufficient To Objection Can Also Include Technical Points Such As The

Afford Financing Development Plans. Tax Assessment Was Not Served Upon The Respondent

Properly, The Tax Assessment Is Through On The Wrong

The General Objective Of The Article Is To Evaluate Taxpayer Or Wrong Entity. Therefore, According To The

The Challenges Facing Tra On Revenue Collection In Research, All Of Those Are Among The Challenges Facing

Tanzania While The Specific Objectives Are To Identify Tra In Accomplishment Their Responsibility. Her Research

The Revenue Collection Legal Framework In Tanzania, Was Creates A Gap From What Will Expecting Address

Explore The Practice On Revenue Collection In Tanzania, And Analyses From This Research; The Author Was Based

And Recommend Strategies To Control The Challenges On On Tax Dispute Resolution On The Point Of Objection To

Revenue Collection. This Work Was Expected Useful To The Tax Assessment.

The Management Such As Government, Institutions And

General Public As Well. Additionally, This Research Is Germino,6 The Person Who Studies Tax Avoidance.

Give Theoretically Knowledge To The Tax Management On He Claimed That One Of The Challenges The Tanzania

Their Responsibilities, The Article Is Deliver Useful Revenue Authority Faces In Obtaining Income Is Tax

Theoretical Knowledge On Motives Behind For Challenges Avoidance. Tanzania Is One Of The Active Regions Where

Facing Tanzania Revenue Authority In Revenue Collection, Tax Evasion Has Been Frequently Recorded, It Should Be

This Article Is Help Tra Officers And Taxpayers To Added. He Asserts That The Tanzanian Government Has

Comprehending The Bad Side Of Corruption And Tax Been Concentrating On Managing And Earning Money

Avoidance, And The Article Findings Is An Advantage To From A Variety Of Scarce Resources, Such As Taxes On

The Other Researchers And General Public As Well. Fuel, Cigarettes, And Buildings. Exact Research Was

Needed To Evaluate The Accountability For Revenue

An Evaluation Of The Challenges Facing Tra In Collection. He Came To The Conclusion That Tax Evasion

Revenue Collection In Tanzania Is Not A New Phenomenon In Tanzania Was Caused By Corruption's Impact On Tax

To Be Researched. There Many Literatures That Have Been Revenue Collection And By Staff Ethics' Disparate Impact

Written As Far As An Evaluation Of The Challenges Facing On Education. The Study Was Carried Out In The Temeke

Tra In Revenue Collection Is Concerned. However, Little Tax Region, Hereafter There Is A Need To Conduct Study

Have Written On The Aspect Of An Evaluation Of The From Kariakoo Tax Region Where It Is Core Of The

Challenges Facing Tra In Revenue Collection. Regardless Business Activities In Tanzania.

Of The Facts Those Literature Address The Aspect Of An

Evaluation Of The Challenges Facing Tra In Revenue

Collection, The Methodology Consideration, Case Study, II. METHODOLOGY CONSIDERATION

And Limitation For Which They Have Been Written Are

Different From What This Article Shall Concentration. This The Article Was Conducted Kariakoo Tax Region,

Particular Article Was Involved An Evaluation Of The Ilala District, And Dar Es Salaam City In Tanzania. The

Challenges Facing Tra In Revenue Collection; A Case Tanzania Revenue Authority (Tra) Staff And Taxpayers

Study Of Kariakoo Tax Region. Were Considered As Part Of Analysis From Which The

Sample Was Design. The Study Working Empirical Lawful

Further, Several Other Papers Have Examined Evaluation, Doctrinal Legal Method And Proportional Study

Different Zone Of Revenue Collection. These Papers Used To Evaluate The Challenges Facing Tra In Revenue

Dissimilar Approaches And Means, Even If Some Of Which Collection In Tanzania. A Methodical Evaluation Approach

Have Been Accepted By This Article. Nevertheless, These Was Used To Study The Current Literature Review, And

Papers Unsuccessful To Demonstrate Practical Aspect On Awareness On The Matter In Order To Realise Current

Revenue Collection And Its Challenges, Which Is The

Intention Of This Article. Also, Some Of These Papers Used

Descriptive Figures Like Occurrence Delivery To Analyse

Data. Nevertheless, Papers Do Not Show The Taxation 5

Kibuta, O, Tax Dispute Resolution, Mkuki na Nyota

System And The Connection Between Tanzania Revenue

Authority And Taxpayers, Which Is Necessary When One Publishers Ltd, Dar es Salaam, 2015 p.37 &38.

6

Evaluate The Challenges Facing Tra On Revenue Germino ,S., ‘Assessment of Tax Evasion Practice in

Collection. Tanzania: The case Temeke Municipal, MSc. PSCM

dissertation, Mzumbe University. Tanzania, 2014.

IJISRT23APR2304 www.ijisrt.com 2216

Volume 8, Issue 4, April – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Details.7 The Methods Were Joint To Take Visions For IV. CONCLUSION AND

Evaluation Of Data Using The Normative Practical Aspect. RECOMMENDATIONS

An Information Of Legal Issues And Contributory

Attractiveness Was Arrived At Complete Combined Legal Conclusion

Research Methods. The Results Of This Article Demonstrate How Widely

Dispersed The Problems Confronting Tanzania Revenue

In Additional On Doctrinal Technique, Empirical Authority Revenue Collection In Tanzania Are. The

Analysis Is Utilized To Determine How The Law Affects Findings’ Summary Reveals That The Research’s Major

Tanzania Revenue Authority And Taxpayers As A Whole. And Particular Goals Were Successfully Attained. The

This Technique Assisted In Determining The Impact Of Tax Study’s Major Goals Are To Evaluate The Challenges

Law As It Is Applied By Tanzania Revenue Authority (Tra) Facing Tanzania Revenue Authority On Revenue Collection

And How It Interacts With Taxpayers’ Fundamental Belief. In Tanzania Through A Case Study Of The Kariakoo Tax

Field Observations In Kariakoo And In Person Interviews Region. More Specifically, It Wants To Know What Kinds

With Taxpayers Were Used To Gather The Empirical Data. Of Taxes The Kariakoo Tax Region Collects, What

An Information Gathered Using An Empirical Technique Challenges It Encounters On Collecting Taxes, And What

Was Assessed In Light Of Legislative Provision, And Solutions It Has Found. Numerous Issues, Including But

Recommendations And Conclusions Were Made. Not Limit To Tax Evasion And Lack Of Transparency,

Have Had A Significant Negative Impact On Tanzania’s

III. RESULTS AND DISCUSION Ability To Collect Taxes. The Fact That There Are Many

Instances Of Tax Evasion, There Is A Lack Of Openness,

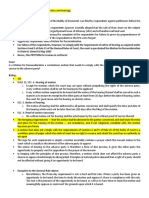

The Article Interviewed 270 Respondents Whereby 30 And There Is A High Degree Of Corruption In Tanzania

Respondents Are Tanzania Revenue Authority Staffs, And Should Worry The Government And The Tax System.

240 Are Taxpayers. The Results Got From the

Questionnaire, Or Interview Are Shows On The Table As The Challenges Faced By Tanzania Revenue Authority

The Following; (Tra) In Tanzanian Revenue Collection Can Be Attributed

To A Number Of Factors, Including A Lack Of Employee

Type of Number of Agreed Disagreed Motivation, Tax Education, And Tax Payment Sensitization.

Challenge Respondents The Tax Payment Sensitization Is Not The Best Way To

Political Pressure 270 75% 25% Solve The Problems Since Some Individuals Would Still

Corruption 270 78% 22% Try To Avoid Paying Taxes Even If They Were Aware Of

Tax Evasion And 270 80% 20% The Benefits. As A Result, The Fundamental Problem

Avoidance Should Entirely Lie In Just And Comprehensive Tax

Lack Of 270 20% 80% Legislation. The Three Components, Which Have Their

Awareness From Roots In The Taxation Cannons, Must Be Reflected In A

Taxpayers Noble Tax System.

Lack Of Skills 270 75% 25%

From Authority First, Taxation Aims To Raise Revenue For The Public

Tax Assessment 270 85% 15% Service Where By The Cost Of Collection And

Objection Administration Should Not Exceed 5% Of The Amount

Tax Exemption 270 28% 72% Revenue Collected, Second That People Must Pay

Lack Of Working 270 40% 60% According To Their Ability And The Last Tax Should Not

Equipment’s Be Discriminatory In Any Aspect, Where All Taxpayers

Lack Of 270 35% 65% Bear A Proportionally Equal Burden In Taxes.8 The Strong

Motivated Staff Means To Advance Revenue Collection In Tanzania Is To

Bring Accountability And Transparency Of Public Funds,

Heavy Punishment, Sufficiency Of Taxation System And

Those Result Mean That A Large Part Of The

The Quality Of Service In Return For Taxes.

Challenges Facing Tanzania Revenue Authority In Revenue

Collection Are Corruption, Skills And Expertise In Some Of

Lastly, Record For Taxpayers Or Tax Management At

The Tax Areas, Tax Assessment Objection, Political

Wholly Stages Of Rule Would Be Punctually Onscreen To

Pressure, Tax Avoidance And Evasion. Tax Exemption And

Safeguard That The Scheme Of Statistics Storing Processing

Lack Of Awareness From Taxpayers Are Slight Challenges

And Recovery Is Well-Organized.9

Facing Tra In Revenue Collection.

8

Simon, O., Equality before the law; presidential tax

7

Francis, M. (2018). Tax Dispute Settlement Procedures in liabilities; effects of exemptions on voluntarily

Tanzania - GRIN" at compliance, LLM Dissertation, The Open University of

https://www.grin.com/document/438898, (accessed Tanzania, Dar es salaam, 2016.

9

26/9/2018) Rup, K., The East African Tax System, Mkuki na Nyota

Publishers Ltd, Dar es Salaam, 2015, p. 65.

IJISRT23APR2304 www.ijisrt.com 2217

Volume 8, Issue 4, April – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Recommendations Particularly For Small Company Owners, On The

The Suggestions Mentioned Below Can Serve A Significance Of Taxes. Additionally, Encourage

Starting Point For Conversations That Can Result In The Administrative Effectiveness By Offering Better Tools Like

Construction Of A Long Lasting, Tax Friendly System That Laptops, Transportation Options, Etc.

Might Potentially Broaden The Tax Base And Encourage

More Individuals To Pay Taxes. The Research Has Made A Recommendation to Taxpayers

Number Of Suggestions, Including The Following For The The Taxpayers Are Once Again Advised To Consider

Central Government, The Tanzania Revenue Authority The State Attentiveness In Addition Uphold The Primacy

(Tra), Taxpayers, And To The General Public. And Positivism Of The Law. The Majority Of Taxpayers

Unnecessarily Violate Their Duties By Claiming Fictitious

Recommendation to Central Government Income, Engaging In Unlawful Activity, And Encouraging

It Is Advised That Taxation Be A Constitutional Matter A Culture Of Tax Avoidance. A Few Dishonest Taxpayers

And That All Unfavourable Laws And Policies Related To In The Kariakoo Tax Region Are On The Front Lines Of

Taxation Be Examined In Order To Create A Sufficient Teaching Foreign Investors, Particularly Chinese Ones,

Taxation System. When Taxation Is A Constitutional How To Avoid Taxes Or Create Fictitious Receipts. They

Matter, It Ensures, Among The Things, Equality, Certainty, Are Attempting To Develop A Culture Among Taxpayers

Convenience, And Economic Rights. That Supports Tax Avoidance. The Taxpayers Are

Encouraged To Take Social Action To Ensure That Their

Also, The Central Government Has Mandate To Broad Returns Are Filed, Submitted, And Actual Payments Are

Cast Laws That Will Guide The Administration Of Tax, Made On Time. In This Section, Social Intervention Is

Particularly The Tanzania Revenue Authority. In That, If Crucial To Supporting One Another And Fostering A

Taxation System Is Clear And Responsibility, There Are Cultural Climate That Upholds The Idea Of Paying Taxes

Accountability And Transparency Of Public Funds, Strict Among Taxpayers.

On Corruption And Provides The Quality Of Service To The

People In Return For Taxes It Will Definitely The Best Recommendation to the General Public

Ways To Curb The Challenges Facing Tanzania Revenue Here, It Is Advised That The General Public Support

Authority On Revenue Collection In Tanzania. Lack Of Government Programs Aimed At Address In Problems. One

Accountability And Transparency Of Public Funds, Of The piece Of Advice To The Community Is To Noise

Corruption Scandals And Poor Basic Needs And Services, Every Action Of Levy Fraud, Corruption, Or Associated

Citizen May Not Willing To Pay Taxes. Tax Malpractice To The Appropriate Authorities.

Additionally, By Requiring Genuine Efd’s When Buying

Recommendation to Tanzania Revenue Authority Commodities, The Taxpayers Will Be Reminded of their

It Has Been Advised That Tanzania Revenue Authority Responsibility To Have A Plan To Deal With Problems.

(Tra) Avoid Applying Separate Local Governments With Another Recommendation To The General Public Is That

Varying Tax Administration Standard. While The Same Anyone Conducting Business Without Being Registered As

Goods Are Sold Without Receipts In Other Local A Taxpayer, As Well As Anyone Who Has Already Been

Governments, It Is Completely Forbidden To Sell Any Issued A Street Hawkers Smart Card But Whose Capital

Commodities In The Kariakoo Tax Region. While All Local Investment Is Outside The Allowed Maximum Amount, Is

Governments Operations Continue As Usual, The Usage Of Stimulated To Record Their Trade With The Tra In Order

Efd Machines In Kariakoo Tax Region Appears To Be To Ratify Their Operation And Comply With Tax Laws.

Illegal.

REFERENCES

Consider The Fact That These Taxpayers For Kariakoo

Tax Region Are From These Local Government; When [1]. Casey, P., & Castro, P. (2012). Electronic Fiscal

They Assess The Situation, They Certainly Lose Motivation. Devices, An Empirical Study Of Their Impact On

It Is Also Advised To Adhere To And Behave In Taxpayer Compliance And Administrative Efficiency.

Accordance With The Tanzania Revenue Authority And Geneva.: Imf Working Papers.

Other Tax Rules. [2]. Clive, G. (2011). Enhancing Transparency In Tax

Administration In Madagascar And Tanzania.

Officials In The Tanzania Revenue Authority (Tra) International Journal Of Belfer Centre For Science

Are Required To Act In The National Interest Rather Than And International Affairs, 12-15.

Their Own Interests Or Profits. Unmoral Actions Of Tax [3]. Kibuta, O, Tax Dispute Resolution, Mkuki Na Nyota

Collectors, Such As Unjust Tax Assessments, Corruption, Publishers Ltd, Dar Es Salaam, 2015

Excessive Fines And Penalties, Uncompetitive Tax Rates, [4]. Germino ,S., ‘Assessment of Tax Evasion Practice In

And The Use Of Excessive Force During Tax Collection, Tanzania: The Case Temeke Municipal, Msc. Pscm

Have A Detrimental Impact On Taxpayers. Additionally, Dissertation, Mzumbe University. Tanzania, 2014.

Tanzania Revenue Authority (Tra) Employees Should [5]. Francis, M. (2018). Tax Dispute Settlement

Conduct Technical Staff Training On Accounting, Tax Procedures In Tanzania - Grin" At

Legislation And Business Exchange Trips With Other Https://Www.Grin.Com/Document/438898,

Nations To Expose Participants To Real World Business (Accessed 26/9/2018)

Situations, And Taxpayer Sensitization And Education,

IJISRT23APR2304 www.ijisrt.com 2218

Volume 8, Issue 4, April – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

[6]. Simon, O., Equality Before The Law; Presidential

Tax Liabilities; Effects Of Exemptions On

Voluntarily Compliance, Llm Dissertation, The Open

University Of Tanzania, Dar Es Salaam, 2016.

[7]. Rup, K., The East African Tax System, Mkuki Na

Nyota Publishers Ltd, Dar Es Salaam, 2015

[8]. Chamshama, D. (2015). Influence Of Electronic

Fiscal Devices (Efds) On Value Added Tax (Vat)

Collection; Case Of Vat Registered Traders In

Morogoro Municipality,Tanzania. Morogoro.:

Unpublished: Dissertation Submitted For The Award

Of Master Degree In Business Admnistration;

Mzumbe University.

[9]. Devos, K. (2014). Factors Influencing Individual

Taxpayer Compliance Behaviour. Hardcover.Gebre,

W. (2006). Tax Accounting System Of Ethiopia, 2nd

Edition.Ethiopia.

[10]. David, K., The Tanzanian Tax Law, Dar Es Salaam;

Karl Max Publishers, 2019.

[11]. Kibuta, O., Tax Dispute Resolution, Mkuki Na Nyota

Publishers Ltd, Dar Es Salaam, 2015.

[12]. Mpunguliana, R., The Theory And Practice Of

Taxation In Tanzania, Tanzania Printing Services,

Dar Es Salaam, 2000.

[13]. Tra. (2020). Tax Collection Reports. Dar Es Salaam:

Tanzania Revenue Authority.

[14]. Tra. (2022). Annual Report 2021-2022. Dar Es

Salaam.: Tanzania Revenue Authority.

[15]. Urt. (2022). Population Distribution By

Administrative Units; 2022 Population And Housing

Census. Dar Es Salaam.: National Bureau Of

Statistics.

IJISRT23APR2304 www.ijisrt.com 2219

You might also like

- Research Paper EDocument12 pagesResearch Paper EAbhishekGautamNo ratings yet

- Tax KDocument9 pagesTax KJoel ChikomaNo ratings yet

- Chapter One 1.0 Introduction and Background 1.1 Overview of The StudyDocument36 pagesChapter One 1.0 Introduction and Background 1.1 Overview of The StudyAnonymous wVISEAh1BNo ratings yet

- Tax Evasion BaafDocument31 pagesTax Evasion BaafMARCO PETERNo ratings yet

- Eunice Chapter One To Five 2Document45 pagesEunice Chapter One To Five 2Oko IsaacNo ratings yet

- Genzeb 2 On TaxDocument15 pagesGenzeb 2 On TaxAbu DadiNo ratings yet

- Challenges of Business Income Tax AdministrationDocument14 pagesChallenges of Business Income Tax AdministrationZed AlemayehuNo ratings yet

- Eunice Chapter One-Three CorrectedDocument34 pagesEunice Chapter One-Three CorrectedOko IsaacNo ratings yet

- ECSU - Proposal Thesis INSTITUTE - OF - TAX - AND - CUSTOMS - ADMINISTRATDocument39 pagesECSU - Proposal Thesis INSTITUTE - OF - TAX - AND - CUSTOMS - ADMINISTRATGadaa TDhNo ratings yet

- Effect of Tax Administration On Revenue Generation in Nigeria: Evidence From Benue State Tax Administration (2015-2018)Document22 pagesEffect of Tax Administration On Revenue Generation in Nigeria: Evidence From Benue State Tax Administration (2015-2018)Bhagya ChowdaryNo ratings yet

- Chapter One 1.0 1.1 Background of StudyDocument42 pagesChapter One 1.0 1.1 Background of StudyOko IsaacNo ratings yet

- SIKIKA Tax System Report EngDocument40 pagesSIKIKA Tax System Report EngprincegeorgeyonaNo ratings yet

- Csae2015 1093 2Document19 pagesCsae2015 1093 2Ishmael OneyaNo ratings yet

- ajol-file-journals_235_articles_225988_submission_proof_225988-2797-551044-1-10-20220601Document22 pagesajol-file-journals_235_articles_225988_submission_proof_225988-2797-551044-1-10-20220601Amandus LuhaziNo ratings yet

- Researchcub 213 11Document3 pagesResearchcub 213 11Emi-Aware TechnologyNo ratings yet

- The Impact of ICT On Taxation: The Case of Large Taxpayer Department of Tanzania Revenue AuthorityDocument11 pagesThe Impact of ICT On Taxation: The Case of Large Taxpayer Department of Tanzania Revenue AuthorityAlly HarjiNo ratings yet

- Literature Review On Personal Income Tax in NigeriaDocument7 pagesLiterature Review On Personal Income Tax in NigeriabeemwvrfgNo ratings yet

- Efficiency of Tax Revenue Administration in Africa: Stellenbosch Economic Working Papers: WP02/2021Document52 pagesEfficiency of Tax Revenue Administration in Africa: Stellenbosch Economic Working Papers: WP02/2021JAG CompartirNo ratings yet

- An Investigation of Factors Leading Low Tax Collection Among Informal Businesses in Dar Es Salaam City Council Fabian Respy (DR Pastory)Document19 pagesAn Investigation of Factors Leading Low Tax Collection Among Informal Businesses in Dar Es Salaam City Council Fabian Respy (DR Pastory)pastorysimioNo ratings yet

- DeterminantsDocument13 pagesDeterminantsAubrrryNo ratings yet

- Scoping Study On Internally Generated Revenue of Nigerian States Trends Challenges and OptionsDocument41 pagesScoping Study On Internally Generated Revenue of Nigerian States Trends Challenges and OptionsDebo Sodipo100% (1)

- Assesment of Impact of Taxation On Revenue Generation in Local GovernmentDocument72 pagesAssesment of Impact of Taxation On Revenue Generation in Local GovernmentAFOLABI AZEEZ OLUWASEGUNNo ratings yet

- Problems of Tax Collection in GhanaDocument61 pagesProblems of Tax Collection in GhanaMichael Oppong100% (7)

- Tax Audit, InvestigationDocument20 pagesTax Audit, InvestigationRaga VenthiniNo ratings yet

- ABSTRACTDocument30 pagesABSTRACTkelvin ruruNo ratings yet

- Comparative Analysis of Value Added Tax Revenue Among Different Sector in NigeriaDocument52 pagesComparative Analysis of Value Added Tax Revenue Among Different Sector in NigeriaSabanettNo ratings yet

- Drivers of Tax Payer's Motivation and Tax Compliance Level: The Nigeria ExperienceDocument8 pagesDrivers of Tax Payer's Motivation and Tax Compliance Level: The Nigeria ExperienceInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Backcock Chapter OneDocument6 pagesBackcock Chapter OneDon-ibeh PrinceNo ratings yet

- Determinants of Tax Compliance Among SmaDocument13 pagesDeterminants of Tax Compliance Among SmaDAVID AMPEMNo ratings yet

- Research Paper On Tax System in PakistanDocument6 pagesResearch Paper On Tax System in Pakistanafeavbrpd100% (2)

- A Project ProposalDocument8 pagesA Project ProposalPasang TamangNo ratings yet

- The Impact of Tax Audit and Investigation On Revenue Generation in NigeriaDocument7 pagesThe Impact of Tax Audit and Investigation On Revenue Generation in NigeriaAkingbesote VictoriaNo ratings yet

- The Polytechnic, Ibadan: Kayode Oladipupo OlayemiDocument38 pagesThe Polytechnic, Ibadan: Kayode Oladipupo OlayemiSuleiman Abubakar AuduNo ratings yet

- MeleseDocument40 pagesMeleseዳግማዊ ጌታነህ ግዛው ባይህNo ratings yet

- Tax Administration NegiriaDocument10 pagesTax Administration NegiriaBhagya ChowdaryNo ratings yet

- Effect of E Taxation On Revenue Generation in Anambra StateDocument10 pagesEffect of E Taxation On Revenue Generation in Anambra StateEditor IJTSRDNo ratings yet

- Tax Practitioners: Advocates of Compliance or Avoidance?: Conference PaperDocument23 pagesTax Practitioners: Advocates of Compliance or Avoidance?: Conference PaperKristy Dela CernaNo ratings yet

- Queen's Collage Department of Business Administration: Addis Ababa, Ethiopia July 19/2021Document33 pagesQueen's Collage Department of Business Administration: Addis Ababa, Ethiopia July 19/2021abduNo ratings yet

- Thesis On Taxation in EthiopiaDocument6 pagesThesis On Taxation in Ethiopialaurajohnsonphoenix100% (2)

- The Perceptions of Taxpayers On The Adoption of Electronic Fiscal Devices EFDs in Revenue Collection in Tanzania The Case of DodomaDocument17 pagesThe Perceptions of Taxpayers On The Adoption of Electronic Fiscal Devices EFDs in Revenue Collection in Tanzania The Case of Dodomaabdulswamadu0No ratings yet

- Tax Administration and TaxDocument8 pagesTax Administration and TaxIbrahim Olasunkanmi AbduLateefNo ratings yet

- 4 5841655718746262213Document38 pages4 5841655718746262213Abera AsefaNo ratings yet

- Tax Evasion CHPT 1-5Document38 pagesTax Evasion CHPT 1-5KAYODE OLADIPUPO100% (5)

- 519 986 1 SMDocument17 pages519 986 1 SMvenipin416No ratings yet

- Tax Evasion1Document39 pagesTax Evasion1helenjessy2002No ratings yet

- Impact of Semi-Autonomous Revenue Authority On Tax Revenue and Buoyancy - Evidence From PakistanDocument11 pagesImpact of Semi-Autonomous Revenue Authority On Tax Revenue and Buoyancy - Evidence From Pakistanvenipin416No ratings yet

- Cat 1-1Document11 pagesCat 1-1Erick MburuNo ratings yet

- 4134-Research Results-11496-1-10-20190121 2Document17 pages4134-Research Results-11496-1-10-20190121 2Sri SetianiNo ratings yet

- Assessmentsof Value Added Tax Administrationin Guraghe Zone Revenue AuthorityDocument14 pagesAssessmentsof Value Added Tax Administrationin Guraghe Zone Revenue AuthorityMinase tamiruNo ratings yet

- Maximizing Tax Revenue: The Predictive Power of Competent Account Representatives and The Role of Taxpayer Compliance As The ModeratorDocument8 pagesMaximizing Tax Revenue: The Predictive Power of Competent Account Representatives and The Role of Taxpayer Compliance As The ModeratorInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Role of An Efficient and Effective Tax System in The 1-2Document34 pagesThe Role of An Efficient and Effective Tax System in The 1-2EmmanuelNo ratings yet

- Mbeya University of Science and TechnologyDocument6 pagesMbeya University of Science and TechnologyProf. SchleidenNo ratings yet

- Effect of Tax Avoidance and Tax EvasionDocument13 pagesEffect of Tax Avoidance and Tax EvasionChe DivineNo ratings yet

- How Successful Is Presumptive Tax in Bringing Informal Operators Into The Tax Net in Zimbabwe? A Study of Transport Operators in BulawayoDocument10 pagesHow Successful Is Presumptive Tax in Bringing Informal Operators Into The Tax Net in Zimbabwe? A Study of Transport Operators in BulawayoInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- ATR 3 - 1 - 82-92 - WordDocument11 pagesATR 3 - 1 - 82-92 - WordAkingbesote VictoriaNo ratings yet

- MAKNET Policy Brief No 1Document6 pagesMAKNET Policy Brief No 1Martha KhungwaNo ratings yet

- Tax Awareness Taxpayers Perceptions and AttitudesDocument17 pagesTax Awareness Taxpayers Perceptions and AttitudesSoleil RiegoNo ratings yet

- Ghana: Tax Administration Reforms (1985-1993)Document20 pagesGhana: Tax Administration Reforms (1985-1993)Seth VondeeNo ratings yet

- Policy Brief TaxDocument24 pagesPolicy Brief Taxstunner_1994No ratings yet

- Indonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaFrom EverandIndonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaNo ratings yet

- A Rare Complication: Cardiac Arrest and Pulmonary Embolism in Polyarteritis NodosaDocument5 pagesA Rare Complication: Cardiac Arrest and Pulmonary Embolism in Polyarteritis NodosaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Forecasting PM10 Concentrations Using Artificial Neural Network in Imphal CityDocument10 pagesForecasting PM10 Concentrations Using Artificial Neural Network in Imphal CityInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Comprehensive Review on the Therapeutic Potential of PectinDocument6 pagesA Comprehensive Review on the Therapeutic Potential of PectinInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Quality Control to Reduce Appearance Defects at PT. Musical InstrumentDocument11 pagesQuality Control to Reduce Appearance Defects at PT. Musical InstrumentInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Analysis of Carton Packaging Quality Control Using Statistical Quality Control Methods at PT XYZDocument10 pagesAnalysis of Carton Packaging Quality Control Using Statistical Quality Control Methods at PT XYZInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Application of the Economic Order Quantity (EOQ) Method on the Supply of Chemical Materials in the Laboratory of PT. Fajar Surya Wisesa TbkDocument15 pagesApplication of the Economic Order Quantity (EOQ) Method on the Supply of Chemical Materials in the Laboratory of PT. Fajar Surya Wisesa TbkInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Proof of Concept Using BLE to Optimize Patients Turnaround Time (PTAT) in Health CareDocument14 pagesA Proof of Concept Using BLE to Optimize Patients Turnaround Time (PTAT) in Health CareInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Application of Project Management using CPM (Critical Path Method) and Pert (Project Evaluation and Review Technique) in the Nava House Bekasi Cluster Housing Development ProjectDocument12 pagesApplication of Project Management using CPM (Critical Path Method) and Pert (Project Evaluation and Review Technique) in the Nava House Bekasi Cluster Housing Development ProjectInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Impact of Integrated Border Security System on Human Trafficking in Bangladesh: The Mediating Effect of the Use of Advanced TechnologyDocument12 pagesThe Impact of Integrated Border Security System on Human Trafficking in Bangladesh: The Mediating Effect of the Use of Advanced TechnologyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Entrepreneurial Adult Education as a Catalyst for Youth Employability in Disadvantaged AreasDocument9 pagesEntrepreneurial Adult Education as a Catalyst for Youth Employability in Disadvantaged AreasInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Developing Digital Fluency in Early Education: Narratives of Elementary School TeachersDocument11 pagesDeveloping Digital Fluency in Early Education: Narratives of Elementary School TeachersInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Quizlet's Usefulness for Vocabulary Learning: Perceptions of High-Level and Low-Level Chinese College EFL LearnersDocument5 pagesQuizlet's Usefulness for Vocabulary Learning: Perceptions of High-Level and Low-Level Chinese College EFL LearnersInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Synthetic and Natural Vitamin C Modulation of Leaded Paint-Induced Nephrotoxicity of Automobile Painters in Ile-Ife, Nigeria.Document21 pagesSynthetic and Natural Vitamin C Modulation of Leaded Paint-Induced Nephrotoxicity of Automobile Painters in Ile-Ife, Nigeria.International Journal of Innovative Science and Research TechnologyNo ratings yet

- Visitor Perception Related to the Quality of Service in Todo Tourism VillageDocument10 pagesVisitor Perception Related to the Quality of Service in Todo Tourism VillageInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Enhancing Estimating the Charge Level in Electric Vehicles: Leveraging Force Fluctuation and Regenerative Braking DataDocument6 pagesEnhancing Estimating the Charge Level in Electric Vehicles: Leveraging Force Fluctuation and Regenerative Braking DataInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Intrusion Detection System with Ensemble Machine Learning Approaches using VotingClassifierDocument4 pagesIntrusion Detection System with Ensemble Machine Learning Approaches using VotingClassifierInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Naturopathic Approaches to Relieving Constipation: Effective Natural Treatments and TherapiesDocument10 pagesNaturopathic Approaches to Relieving Constipation: Effective Natural Treatments and TherapiesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Health Care - An Android Application Implementation and Analyzing user Experience Using PythonDocument7 pagesHealth Care - An Android Application Implementation and Analyzing user Experience Using PythonInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Crop Monitoring System with Water Moisture Levels Using ControllerDocument8 pagesCrop Monitoring System with Water Moisture Levels Using ControllerInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A New Model of Rating to Evaluate Start-ups in Emerging Indian MarketDocument7 pagesA New Model of Rating to Evaluate Start-ups in Emerging Indian MarketInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Gravity Investigations Applied to the Geological Framework Study of the Mambasa Territory in Democratic Republic of CongoDocument9 pagesGravity Investigations Applied to the Geological Framework Study of the Mambasa Territory in Democratic Republic of CongoInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Optimizing Bio-Implant Materials for Femur Bone Replacement:A Multi-Criteria Analysis and Finite Element StudyDocument5 pagesOptimizing Bio-Implant Materials for Femur Bone Replacement:A Multi-Criteria Analysis and Finite Element StudyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Design and Implementation of Software-Defined ReceiverDocument8 pagesDesign and Implementation of Software-Defined ReceiverInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Inclusive Leadership in the South African Police Service (SAPS)Document26 pagesInclusive Leadership in the South African Police Service (SAPS)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Year Wise Analysis and Prediction of Gold RatesDocument8 pagesYear Wise Analysis and Prediction of Gold RatesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Fahfi/Mochaina Illegal Gambling Activities and its Average Turnover within Limpopo ProvinceDocument8 pagesFahfi/Mochaina Illegal Gambling Activities and its Average Turnover within Limpopo ProvinceInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Government's Role in DMO-based Urban Tourism in Kayutangan area of Malang cityDocument8 pagesThe Government's Role in DMO-based Urban Tourism in Kayutangan area of Malang cityInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Effectiveness of Organizing Crossing Transport Services in the Maritime Area of Riau Islands ProvinceDocument10 pagesEffectiveness of Organizing Crossing Transport Services in the Maritime Area of Riau Islands ProvinceInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Income Diversification of Rural Households in Bangladesh (2022-23)Document5 pagesIncome Diversification of Rural Households in Bangladesh (2022-23)International Journal of Innovative Science and Research TechnologyNo ratings yet

- A Study to Assess the Effectiveness of Bronchial Hygiene Therapy (BHT) on Clinical Parameters among Mechanically Ventilated Patients in Selected Hospitals at ErodeDocument7 pagesA Study to Assess the Effectiveness of Bronchial Hygiene Therapy (BHT) on Clinical Parameters among Mechanically Ventilated Patients in Selected Hospitals at ErodeInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Balanay, Jr. V MartinezDocument2 pagesBalanay, Jr. V MartinezKristine Garcia100% (1)

- G.R. No. 175507Document12 pagesG.R. No. 175507mehNo ratings yet

- Checklist For DPT 3 ReturnDocument1 pageChecklist For DPT 3 ReturnAbhinay KumarNo ratings yet

- Justifying (Art. 11) Exempting (Art. 12) Mitigating (Art. 13) Aggravating (Art. 14) Alternative (Art. 15) Absolutory CausesDocument2 pagesJustifying (Art. 11) Exempting (Art. 12) Mitigating (Art. 13) Aggravating (Art. 14) Alternative (Art. 15) Absolutory CausesJasmin SolivenNo ratings yet

- Phil - Foreign Service Act of 1991 R.A 7157Document27 pagesPhil - Foreign Service Act of 1991 R.A 7157Jason Brian E. AvelinoNo ratings yet

- 2017 UPBOC Taxation Law PDFDocument288 pages2017 UPBOC Taxation Law PDFGrace Robes HicbanNo ratings yet

- JurisdictionDocument21 pagesJurisdictionPIYUSH SHARMA0% (1)

- WESTERN BICUTAN v. MILITARY SHRINE POLIDocument1 pageWESTERN BICUTAN v. MILITARY SHRINE POLILDNo ratings yet

- Chua v. Executive JudgeDocument4 pagesChua v. Executive Judgejaine0305No ratings yet

- 2k - Pil Case DigestsDocument295 pages2k - Pil Case Digestsroi dizon100% (1)

- 03 PDFDocument313 pages03 PDFKennethSerpidoNo ratings yet

- Senate Bill 93Document5 pagesSenate Bill 93Lindsey BasyeNo ratings yet

- Transpo UploadDocument3 pagesTranspo UploadJuan Carlo CastanedaNo ratings yet

- Briefing Memo On Maine Targeted Case Management Appeal To Federal Decision To Pay Back $29.7 For Medicaid Fraud in Child WelfareDocument2 pagesBriefing Memo On Maine Targeted Case Management Appeal To Federal Decision To Pay Back $29.7 For Medicaid Fraud in Child WelfareBeverly TranNo ratings yet

- Absolute Monarchy To Constitutional Monarchy Flow Chart 1Document2 pagesAbsolute Monarchy To Constitutional Monarchy Flow Chart 1api-247406019No ratings yet

- CARPER LAD Form No. 3 Notice of CoverageDocument2 pagesCARPER LAD Form No. 3 Notice of CoverageEmil Cervantes100% (1)

- Alameda County Sheriff's Office Opposition To Plaintiffs' Emergency Petition For An Order To Show CauseDocument48 pagesAlameda County Sheriff's Office Opposition To Plaintiffs' Emergency Petition For An Order To Show CauseElizabeth Nolan Brown100% (1)

- Bañez vs. Bañez, 374 SCRA 340, January 23, 2002Document11 pagesBañez vs. Bañez, 374 SCRA 340, January 23, 2002TNVTRLNo ratings yet

- FABM2 Q2 FinalsDocument3 pagesFABM2 Q2 FinalsZeus Malicdem100% (1)

- Shukla Anvika and Shukla Rishabh - PresentationDocument10 pagesShukla Anvika and Shukla Rishabh - PresentationHappy TVNo ratings yet

- History of Global PoliticsDocument13 pagesHistory of Global PoliticsJosent Marie FranciscoNo ratings yet

- Civ Pro Digest Dec 11Document20 pagesCiv Pro Digest Dec 11Charmila SiplonNo ratings yet

- Beginners Guide Political MicrotargetingDocument49 pagesBeginners Guide Political MicrotargetingSurendra NaikNo ratings yet

- Chapter 07: Legal-Ethical Aspects of Nursing Test Bank Multiple ChoiceDocument16 pagesChapter 07: Legal-Ethical Aspects of Nursing Test Bank Multiple Choicemishaal malikNo ratings yet

- Reply in Support of Cross-Motion For Summary Judgment, Federal DefendantsDocument19 pagesReply in Support of Cross-Motion For Summary Judgment, Federal DefendantsEquallyAmericanNo ratings yet

- Ceruila Vs DelantarDocument7 pagesCeruila Vs DelantarGhee MoralesNo ratings yet

- Islamic Republic of Afghanistan Visa Application Form: Personal DetailsDocument2 pagesIslamic Republic of Afghanistan Visa Application Form: Personal DetailsMasay SaiqalNo ratings yet

- Certificate of Compliance: Certificate's Holder: Zhejiang Grizzlies Material Technolgy Co., LTDDocument1 pageCertificate of Compliance: Certificate's Holder: Zhejiang Grizzlies Material Technolgy Co., LTDDavid ValeroNo ratings yet

- Arbitrator Cannot Go Beyond Point of ReferenceDocument4 pagesArbitrator Cannot Go Beyond Point of Referencesneh guptaNo ratings yet